Aon Bundle

How Did Aon Become a Global Leader?

Aon, a titan in risk, retirement, and health solutions, boasts a compelling Aon SWOT Analysis that reveals its strategic evolution. Its story began with a clear mission: to help clients navigate and mitigate risks. Founded in 1982, Aon's journey from its early days to its current global presence is a testament to its adaptability and strategic vision.

This article dives into the Aon history, exploring the Aon company's origins and the key milestones that shaped it. From humble beginnings, the Aon company has grown through strategic Aon acquisitions and innovations, becoming a prominent force in the insurance brokerage industry. Discover the Brief history Aon and its impact on global markets.

What is the Aon Founding Story?

The Aon company's story began in 1982. It was formed by merging Ryan Insurance Group and Combined International Corporation. Patrick Ryan, from Ryan Insurance Group, was key in this merger. This marked the start of a company that would become a major player in insurance and financial services.

This merger was a strategic move. It aimed to create a diversified professional services firm. The goal was to offer a broader range of services. The early 1980s saw a growing need for specialized risk management and human capital solutions. This influenced the company's direction.

The initial focus was on insurance brokerage and underwriting services. The merger combined the strengths of both companies. This allowed for a more comprehensive service offering. The name 'Aon', which means 'one' in Gaelic, was adopted in 1987. This symbolized the company's unified approach. This name change was a key step in creating a strong corporate identity. The company's early funding came from the assets of Ryan Insurance Group and Combined International Corporation. The founders saw an opportunity to consolidate expertise. Their goal was to serve a fragmented market better and become a global leader in risk and human capital solutions. Read more about the company's values in Mission, Vision & Core Values of Aon.

The merger of Ryan Insurance Group and Combined International Corporation in 1982 formed the foundation of Aon.

- Patrick Ryan's leadership was crucial in the company's formation.

- The early business model centered on insurance brokerage and underwriting.

- The name 'Aon' was adopted in 1987 to represent unity.

- Initial funding came from the assets of the merging companies.

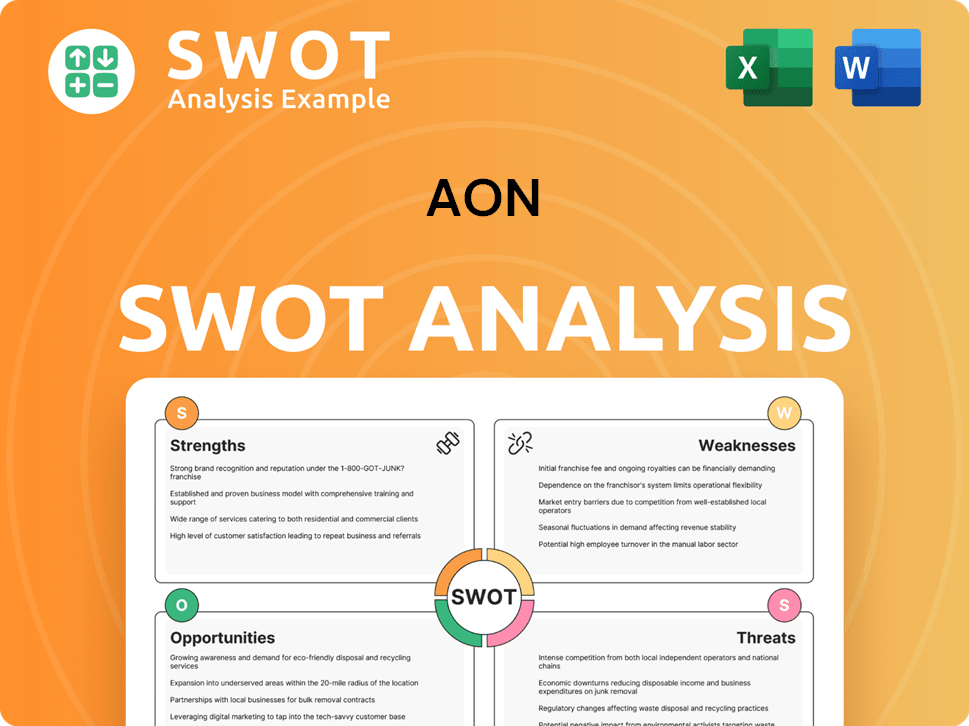

Aon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Aon?

The early growth of the Aon company, a key part of the brief history Aon, was marked by strategic acquisitions and a significant expansion of its service offerings. Formed in 1982, the company quickly broadened its geographical footprint and product categories. Key Aon acquisitions in the late 1980s and 1990s were crucial in solidifying Aon's position in the global market. These moves included expanding into new international markets, particularly in Europe and Asia, to meet the growing demand for global risk management solutions.

Aon's expansion into Europe and Asia was a strategic response to the increasing need for global risk management. By the early 2000s, Aon had established itself as one of the largest insurance brokers globally. This expansion helped Aon to better serve multinational clients and diversify its revenue streams. The company's global presence allowed it to offer tailored solutions in various regions, adapting to local market conditions.

The company's service portfolio evolved beyond traditional insurance brokerage. It included reinsurance, human capital consulting, and benefits administration. This diversification was a strategic response to the changing needs of clients and the evolving competitive landscape. Aon's ability to integrate these diverse services under one umbrella allowed it to offer more holistic solutions.

Aon's mergers and acquisitions history played a vital role in its growth. These strategic moves helped Aon to expand its market share and service offerings. The acquisitions not only broadened Aon's geographical reach but also enhanced its capabilities in risk management and human capital solutions. The company's growth strategy through acquisitions was a key factor in its success.

Leadership transitions and strategic shifts in business models during this period further shaped Aon's trajectory. The company adapted to various market conditions and capitalized on emerging opportunities. These changes allowed Aon to remain competitive and innovative in the insurance and risk management industry. Understanding the Target Market of Aon is also key to understanding its strategic growth.

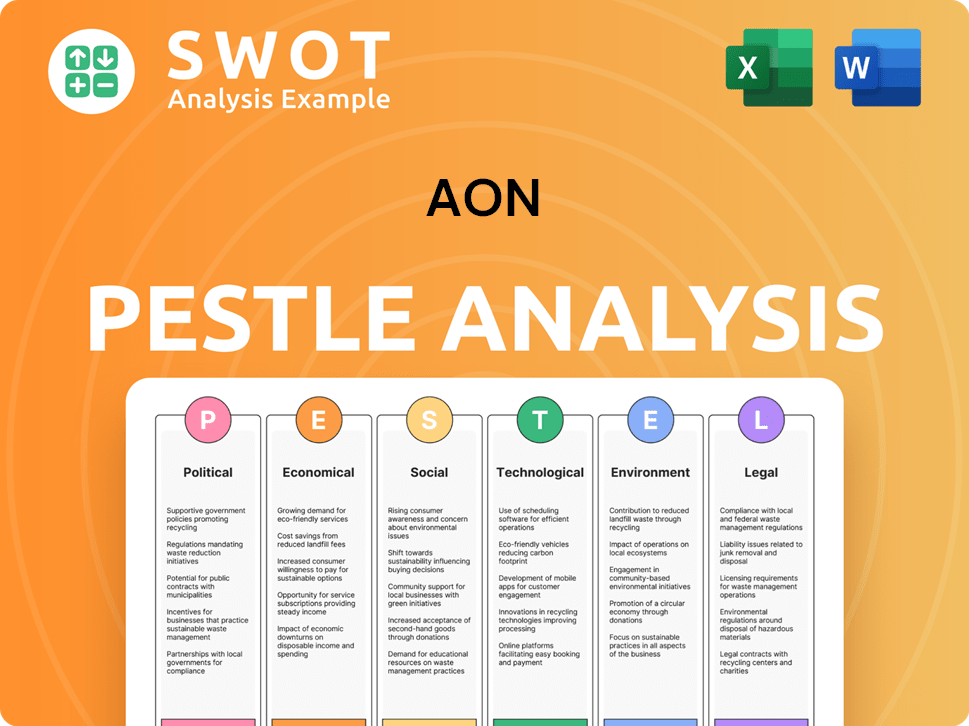

Aon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Aon history?

The Aon history is marked by significant milestones, including its global expansion and strategic acquisitions, solidifying its position as a leading professional services firm. The company's journey reflects its ability to adapt and innovate within the dynamic landscape of risk management, insurance brokerage, and human capital solutions.

| Year | Milestone |

|---|---|

| 1982 | Founded through the merger of Ryan Insurance and Combined International Corporation's insurance brokerage operations. |

| 1987 | Expanded its global footprint, establishing a presence in several international markets. |

| 1990s | Made significant |

| 2000 | Completed a merger with the consulting firm, Hewitt Associates, to enhance its human capital and consulting capabilities. |

| 2010s | Focused on streamlining operations and divesting non-core assets to concentrate on its core businesses of risk, retirement, and health solutions. |

| 2023 | Aon reported revenues of $13.4 billion, reflecting its strong market position and growth. |

The

Aon has invested heavily in data and analytics platforms to provide clients with advanced risk assessment tools. These tools help clients make more informed decisions.

The company developed proprietary risk assessment tools and actuarial models, which have become benchmarks in the industry. These tools enable more precise risk quantification and management.

Aon has enhanced its digital platforms to improve client service and streamline operations. This includes the development of online portals for clients.

The company offers specialized consulting services in areas such as cyber risk and climate change. These services help clients address emerging risks.

Aon continues to innovate in its human capital solutions, providing services such as retirement planning and health benefits. This helps clients manage their workforce effectively.

The company integrates advanced technologies, including AI and machine learning, to improve its service offerings. This enhances the efficiency and effectiveness of its solutions.

Despite its successes, the

Economic downturns, such as the 2008 financial crisis, have presented challenges, requiring strategic adjustments. These adjustments include cost-cutting measures and a focus on core competencies.

Increased regulatory scrutiny in the insurance and financial services industries has led to increased compliance costs. The company has had to adapt to stricter requirements.

Intense competition from other global firms has required continuous innovation and differentiation. The company faces pressure to maintain its market share.

Internal restructuring efforts, including divesting non-core assets, have been necessary to streamline operations. This has helped the company focus on its core strengths.

The company has faced product failures and internal crises, which have led to restructuring and rebranding efforts. These issues have required strategic pivots.

Successfully integrating acquired companies and managing the complexities of mergers and acquisitions have been ongoing challenges. These integrations require careful planning and execution.

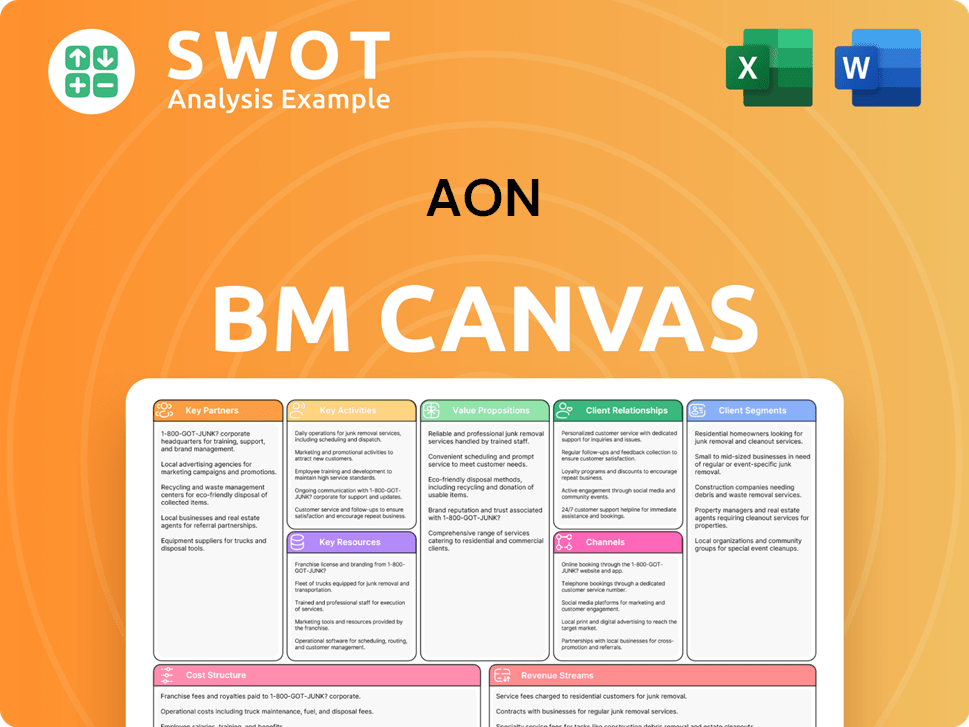

Aon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Aon?

The Owners & Shareholders of Aon journey, a leading global professional services firm, began with the 1982 merger of Ryan Insurance Group and Combined International Corporation, forming its foundation. The company officially adopted the name 'Aon' in 1987, marking a unified approach. The 1990s saw significant global expansion through strategic acquisitions, solidifying its presence. In the early 2000s, Aon became a prominent global insurance broker. A restructuring in the mid-2010s streamlined operations, focusing on core services. Recently, Aon has invested in data and analytics to enhance its risk advisory services. In 2020, Aon announced its intent to acquire Willis Towers Watson, an acquisition that was later terminated. In 2024, Aon reported robust financial results, with revenue growth in its core segments.

| Year | Key Event |

|---|---|

| 1982 | Ryan Insurance Group and Combined International Corporation merged, laying the groundwork for Aon. |

| 1987 | The company officially adopted the name 'Aon', representing a unified approach. |

| 1990s | Aon expanded its global footprint through strategic acquisitions. |

| Early 2000s | Aon solidified its position as a leading global insurance broker. |

| Mid-2010s | A significant restructuring occurred to streamline operations and focus on core services. |

| 2020 | Aon announced its intent to acquire Willis Towers Watson, although the deal was later terminated. |

| 2024 | Aon reported strong financial performance with revenue growth in its core segments. |

Aon is focused on long-term strategic initiatives to empower better decisions for its clients. The company aims to integrate its commercial risk, reinsurance, retirement, and health solutions. This integrated approach aims to provide comprehensive support to clients, addressing their diverse needs. The goal is to offer holistic solutions to clients.

The company plans to continue investing in advanced analytics and digital platforms. This investment is aimed at delivering innovative solutions, particularly in emerging areas. Cyber risk and climate resilience are key areas of focus for these advanced solutions. Aon aims to stay at the forefront of technological advancements.

Industry trends, such as increasing global interconnectedness, will impact Aon's future. Evolving regulatory landscapes and the demand for specialized risk mitigation are also key factors. These trends will shape the company's trajectory. Aon is adapting to meet these challenges.

Leadership emphasizes a commitment to client value creation and leveraging data-driven insights. The focus is on addressing future challenges through these insights. Aon aims to empower clients to navigate risk effectively. The company’s future outlook is tied to these core values.

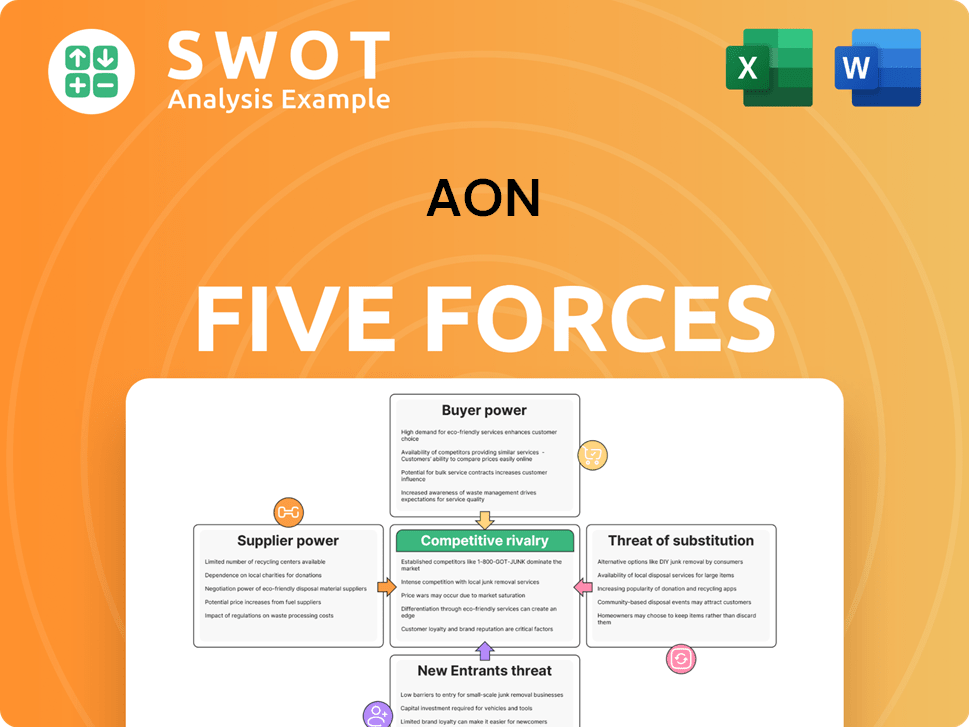

Aon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Aon Company?

- What is Growth Strategy and Future Prospects of Aon Company?

- How Does Aon Company Work?

- What is Sales and Marketing Strategy of Aon Company?

- What is Brief History of Aon Company?

- Who Owns Aon Company?

- What is Customer Demographics and Target Market of Aon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.