Credicorp Bundle

How Did Credicorp Become a Financial Powerhouse?

Journey into the captivating Credicorp SWOT Analysis to understand the company's trajectory. From its roots as a Peruvian financial institution, Credicorp's story is one of strategic evolution and consistent growth. Discover how this financial giant navigated the complexities of the Latin American market to achieve its current dominance. This exploration will uncover the key moments that shaped Credicorp's rise.

Credicorp's history is deeply intertwined with the evolution of the Peruvian economy. Founded in 1889 as Banco Italiano, later known as Banco de Credito del Peru (BCP), the company's early years were marked by a commitment to providing essential financial services. Understanding the brief Credicorp history timeline reveals the strategic decisions that transformed a regional bank into a leading financial services holding company. This journey highlights Credicorp's expansion strategy and its impact on the Peruvian economy.

What is the Credicorp Founding Story?

The story of Credicorp, a leading Peruvian financial institution, begins on April 9, 1889. This marks the founding of Banco Italiano in Lima, Peru, laying the groundwork for what would become a major player in Latin America's financial sector. This early establishment reflects the vision of its founders and sets the stage for a long history of growth and adaptation.

The initial mission was to serve the needs of the burgeoning Italian community and the broader Peruvian economy. The founders aimed to establish a reliable banking system, addressing the need for accessible financial services in a developing nation. This focus on both individual and commercial financial needs was crucial from the start, shaping the institution's early business model.

Banco Italiano, the precursor to Credicorp, was founded in 1889. It was established to support the growing Italian community and the overall Peruvian economy. The bank's initial services included deposits, loans, and foreign exchange.

- The founders included Michele Fortunato Gallese, Alfredo Benavides, and Giacomo Boggio.

- Initial funding came from the founders and investments from the Italian community.

- The cultural and economic context of late 19th-century Peru supported the establishment of a financial institution.

- The bank's name, 'Banco Italiano,' reflected its founders' heritage and target clientele.

The founders of Banco Italiano, including Michele Fortunato Gallese, Alfredo Benavides, and Giacomo Boggio, were instrumental in its establishment. They brought expertise in commerce and finance, essential for navigating the financial landscape of the time. Their efforts helped build a reputable institution that would evolve over the years. The bank began with traditional commercial banking services, including deposits, loans, and foreign exchange. This foundation was critical for its future expansion and impact on the Peruvian economy. For a broader perspective on the competitive landscape, you can explore the Competitors Landscape of Credicorp.

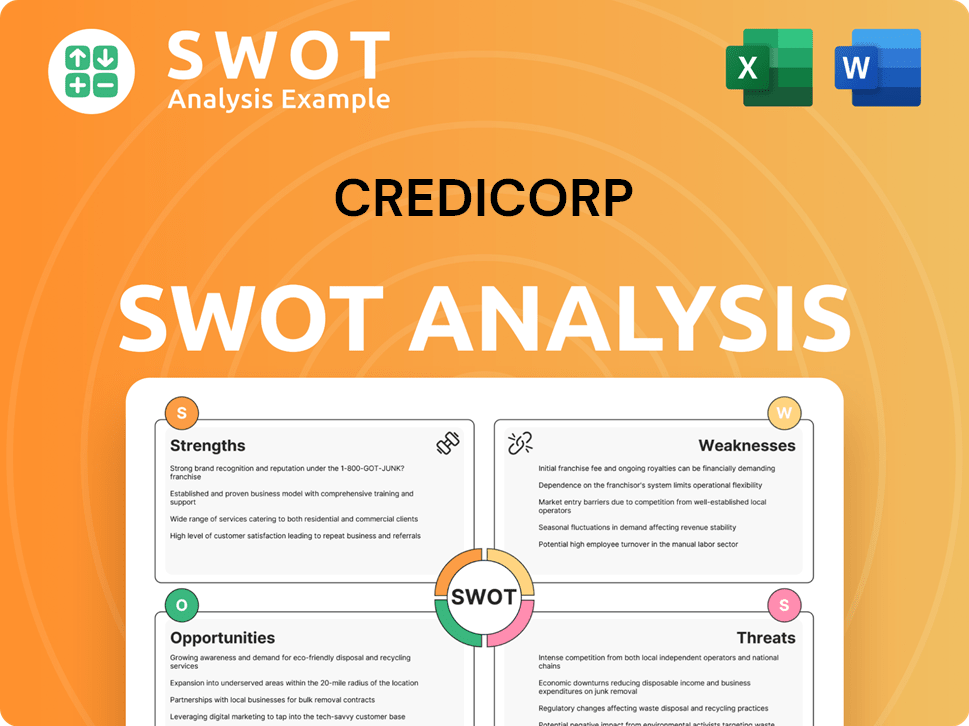

Credicorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Credicorp?

The early growth of Credicorp, originating from Banco Italiano, involved strategic adaptations and expansions. This period marked significant changes, including a name change and a broadening of its national presence. The company focused on extending its branch network and introducing new financial products. This expansion was crucial in shaping its trajectory as a diversified financial group.

In 1941, due to the political climate, Banco Italiano was renamed Banco de Crédito del Perú (BCP). This shift was a pivotal moment for the Credicorp target market, broadening its appeal across Peru. This change allowed the company to establish a stronger national identity and expand its reach.

BCP significantly expanded its branch network throughout Peru. This expansion allowed the company to reach new geographical markets within the country. By increasing its physical presence, BCP could serve a wider customer base and offer its financial products more broadly.

Early product launches included a wider array of consumer and commercial lending products. These products catered to a growing middle class and various industries in Peru. This diversification of financial offerings helped meet the increasing demand for financial solutions.

Key acquisitions and mergers played a role in Credicorp's expansion. In 1964, BCP acquired Banco Gibson, which further solidified its market position. These strategic moves helped the company to consolidate its presence and enhance its service offerings.

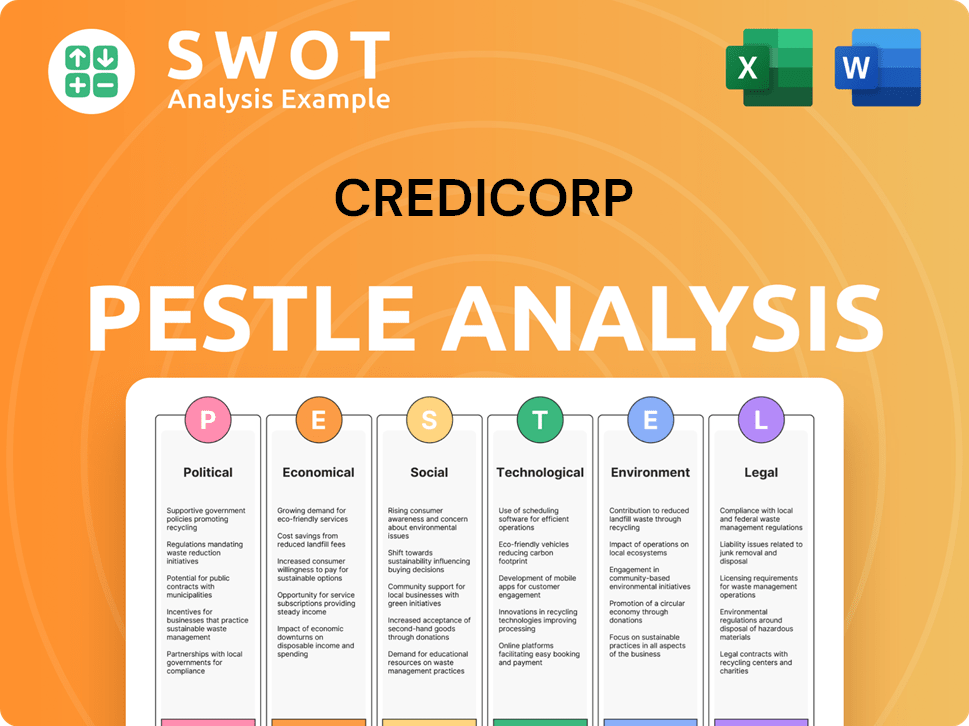

Credicorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Credicorp history?

The Credicorp history is marked by significant milestones that have shaped its growth and influence in the Peruvian financial landscape. These milestones showcase the evolution of the Credicorp company from its early years to its current position as a leading financial institution.

| Year | Milestone |

|---|---|

| 1889 | Banco Italiano del Perú, the precursor to Banco de Crédito del Perú (BCP), is founded. |

| 1993 | Credicorp Ltd. is established in Bermuda. |

| 1995 | Credicorp Ltd. is restructured as a holding company, integrating its financial services. |

| 2008-2009 | Credicorp demonstrates resilience during the global financial crisis, maintaining stability through diversified portfolios and conservative practices. |

| 2020-2022 | Credicorp responds to the COVID-19 pandemic with digital transformation initiatives and client support programs. |

Innovations have been central to Credicorp's strategy, particularly in digital banking. The company has consistently invested in technology to improve customer experience and operational efficiency, leading to the development of mobile banking applications and digital payment solutions. These advancements have helped Credicorp stay competitive and responsive to the evolving needs of its customers.

Credicorp has heavily invested in digital platforms, including mobile banking apps and online services, to enhance customer experience and streamline operations.

The company has developed and implemented mobile payment solutions to facilitate convenient and secure transactions for its customers.

Credicorp continually adopts new technologies to improve its service offerings and maintain a competitive edge in the market.

The Credicorp company has faced numerous challenges, including economic downturns and competition from both traditional banks and emerging fintech companies. These challenges have reinforced Credicorp's commitment to diversified revenue streams, technological advancements, and a customer-centric approach. The Peruvian financial institution has adapted by focusing on digital transformation and customer support.

Credicorp has navigated economic crises in Peru and Latin America, demonstrating resilience through strategic repositioning and risk management.

The rise of fintech companies has prompted Credicorp to innovate and adapt its business model to stay competitive.

The COVID-19 pandemic presented operational and economic challenges, which Credicorp addressed through digital transformation and client support programs.

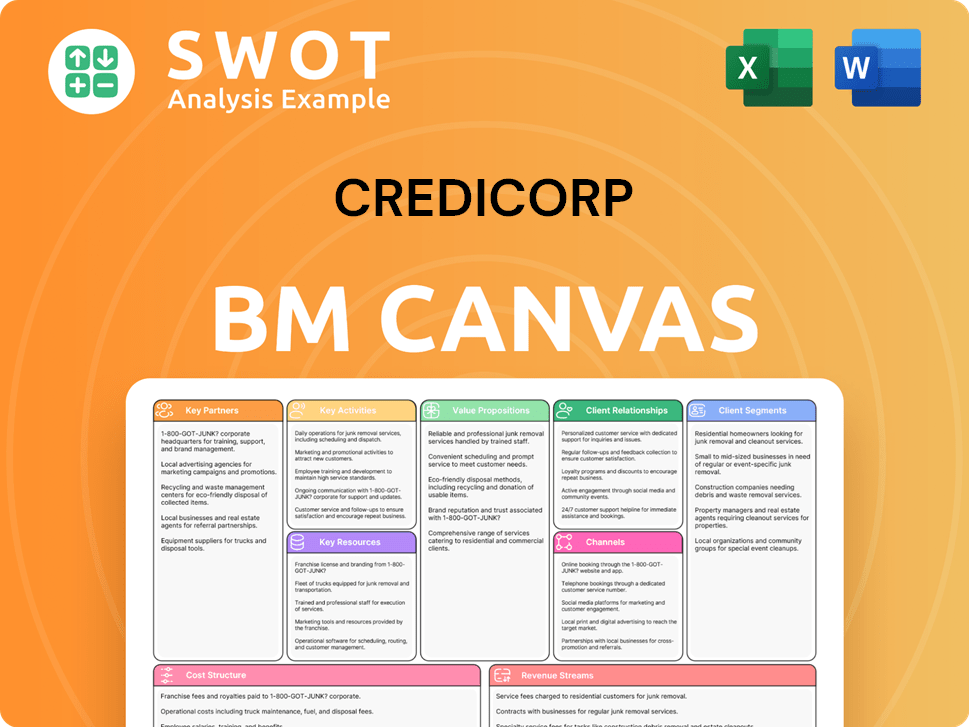

Credicorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Credicorp?

The Credicorp company has a rich history, evolving from its origins in 1889 as Banco Italiano to become a leading Peruvian financial institution. Over the years, it has expanded its services and geographical reach, adapting to market changes and technological advancements. Today, Credicorp is a major player in the Latin American financial sector, known for its diversified business model and commitment to innovation.

| Year | Key Event |

|---|---|

| 1889 | Banco Italiano is founded in Lima, Peru. |

| 1941 | Banco Italiano changes its name to Banco de Crédito del Perú (BCP). |

| 1964 | BCP acquires Banco Gibson, expanding its market reach. |

| 1993 | BCP becomes the first Peruvian bank to issue American Depositary Receipts (ADRs) on the New York Stock Exchange. |

| 1995 | Credicorp Ltd. is established as the holding company for BCP, Pacifico Seguros, and Credicorp Capital. |

| 2006 | Credicorp establishes Mibanco, a leading microfinance institution in Peru. |

| 2014 | Credicorp Capital expands its operations in the region through acquisitions in Chile and Colombia. |

| 2018 | Credicorp launches its digital transformation strategy, investing in fintech and innovation. |

| 2020 | Credicorp navigates the challenges of the COVID-19 pandemic, accelerating digital adoption. |

| 2023 | Credicorp continues to report strong financial results, with net income reaching over S/4.6 billion (approximately $1.2 billion USD), showcasing its resilience and growth. |

Credicorp is actively investing in digital technologies to enhance customer experience and streamline operations. This includes the development of new digital platforms and the integration of fintech solutions. The company is focused on expanding its digital banking services and improving its online and mobile banking capabilities.

Credicorp aims to strengthen its presence in Latin America, particularly in investment banking and wealth management. This involves strategic acquisitions and partnerships to broaden its market reach. The company is focused on expanding its services to cater to the growing demand in the region.

Credicorp is integrating environmental, social, and governance (ESG) factors into its operations and investment decisions. This commitment reflects a growing trend in the financial industry. The company is focusing on sustainable practices and promoting responsible investing across its portfolio.

Credicorp is committed to promoting financial inclusion across the region. This involves providing access to financial services to underserved populations and supporting economic development. The company is leveraging its microfinance institution, Mibanco, to achieve this goal.

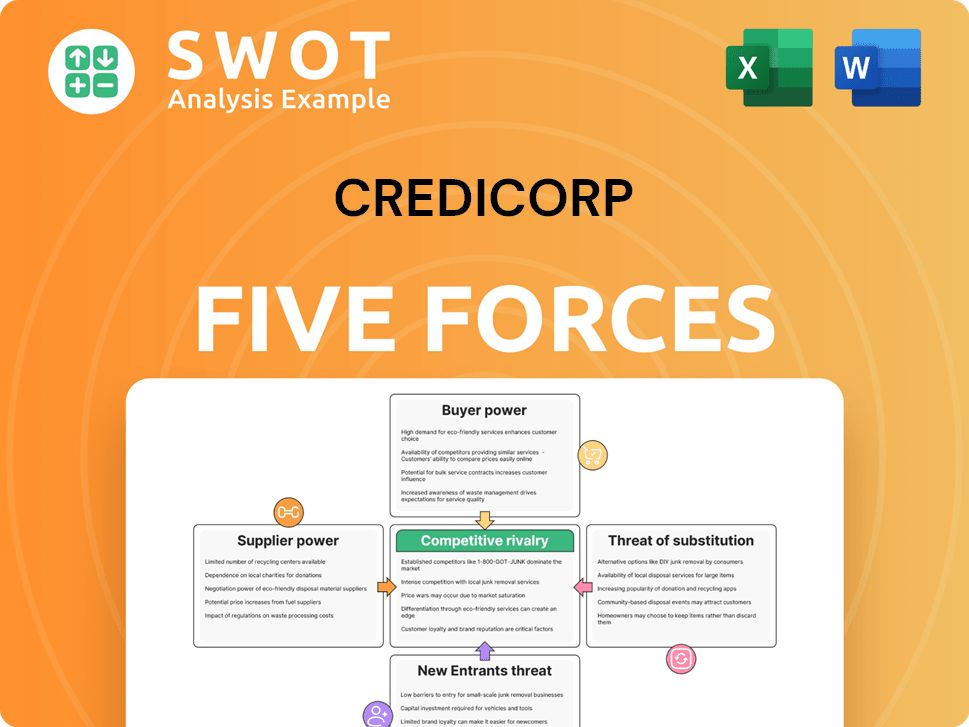

Credicorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Credicorp Company?

- What is Growth Strategy and Future Prospects of Credicorp Company?

- How Does Credicorp Company Work?

- What is Sales and Marketing Strategy of Credicorp Company?

- What is Brief History of Credicorp Company?

- Who Owns Credicorp Company?

- What is Customer Demographics and Target Market of Credicorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.