Denali Therapeutics Bundle

What's the Story Behind Denali Therapeutics?

Denali Therapeutics, a rising star in the biotech world, is making waves with its focus on neurodegenerative diseases. With a mission to tackle conditions like Alzheimer's and Parkinson's, the company is on a quest to revolutionize treatment. A pivotal moment is approaching as Denali gears up to potentially commercialize its therapies.

Founded in 2015, Denali's journey from a startup to a key player in Denali Therapeutics SWOT Analysis is a compelling story of innovation and perseverance. From its early history to its current market capitalization of $1.82 billion, the company has consistently pushed the boundaries of Denali drug development. This exploration delves into Denali's origins, its progress in clinical trials, and its impact on the biotech landscape, offering insights into its future as it navigates the complexities of the industry.

What is the Denali Therapeutics Founding Story?

The founding of Denali Therapeutics marks a significant moment in the biotech industry, driven by a vision to tackle neurodegenerative diseases. Established in May 2015 in South San Francisco, the company emerged from a shared commitment to address the challenges in treating conditions like Alzheimer's and Parkinson's disease.

The founders brought together expertise in neuroscience, drug development, and biotechnology leadership. Their goal was to create medicines that could effectively cross the blood-brain barrier (BBB), a major obstacle in delivering treatments to the brain. This focus has shaped Denali's approach to drug discovery and development.

Denali's early success was fueled by substantial financial backing and innovative technology. The company's approach to drug delivery, particularly its Transport Vehicle (TV) technology, has been a key factor in its strategy. This technology aims to utilize natural pathways to transport drugs across the BBB, potentially revolutionizing treatment for neurological disorders.

Denali Therapeutics was founded in May 2015 in South San Francisco, California.

- The founding team included Ryan Watts, PhD, Arthur 'Art' Levinson, PhD, and Marc Tessier-Lavigne, PhD.

- Initial focus was on overcoming the blood-brain barrier (BBB) to treat neurodegenerative diseases.

- Secured $217 million in Series A financing, one of the largest in biotech history at the time.

- Developed Transport Vehicle (TV) technology to deliver drugs across the BBB.

The founding team of Denali Therapeutics, including Ryan Watts, Art Levinson, and Marc Tessier-Lavigne, brought together a wealth of experience. Watts, formerly from Genentech, contributed expertise in neuroscience. Levinson, the former CEO of Genentech and Chairman of Apple, provided leadership experience. Tessier-Lavigne, also from Genentech and later at Stanford, added scientific leadership. This combination of talent was crucial to the company's early direction.

The company's mission, as reflected in its early actions, was to develop innovative therapies for neurodegenerative diseases. The focus on the BBB and the development of the TV technology underscored this mission. The substantial Series A funding, totaling $217 million, demonstrated investor confidence in Denali's approach. Key investors included Fidelity Biosciences, ARCH Venture Partners, and Flagship Ventures.

A pivotal moment in Denali's early history was the discovery of the transferrin receptor as a pathway for drug delivery across the BBB. This breakthrough, made by Ryan Watts and Alex Schuth at Genentech, led to the development of the TV technology. This technology uses the body's natural transport mechanisms to deliver drugs to the brain. This innovation has been central to Denali's drug discovery process and is a key factor in its approach to treating diseases like Alzheimer's and Parkinson's.

The company's early history is characterized by significant financial backing and technological innovation. The initial funding round was a major milestone, providing the resources needed to advance its research and development efforts. The focus on the BBB and the development of the TV technology set Denali apart in the biotech landscape. To understand more about the competitive landscape, you can explore the Competitors Landscape of Denali Therapeutics.

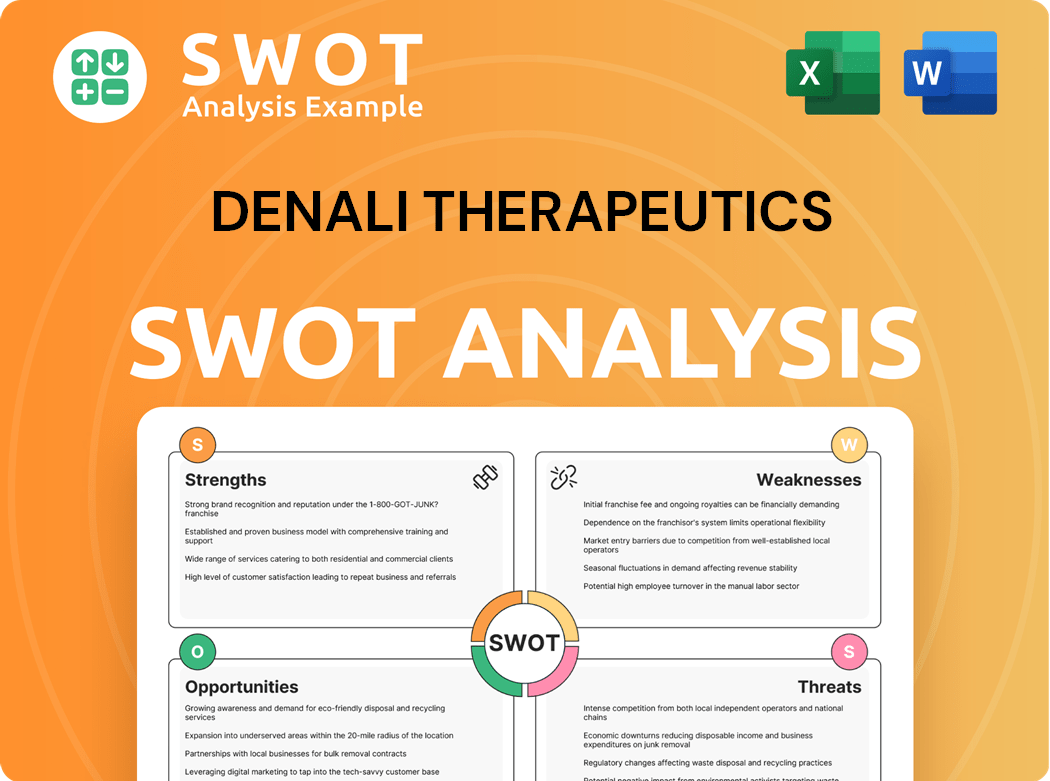

Denali Therapeutics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Denali Therapeutics?

The early growth and expansion of Denali Therapeutics, a biotech company, were marked by significant capital raises and strategic partnerships. Founded in 2015, the company quickly secured funding to fuel its research and development efforts. These early financial infusions and collaborations were crucial in shaping its trajectory in the competitive biotech landscape, particularly within the realm of Denali drug development.

Denali Therapeutics began its journey with a substantial Series A funding round, raising $217 million in 2015. This initial capital injection provided a strong foundation for the company's early operations. In 2017, the company went public through an Initial Public Offering (IPO), which generated an additional $250 million, further bolstering its financial resources and supporting the advancement of its pipeline programs. This early financial backing was critical for Denali's growth.

A key strategic decision for Denali was to concentrate on developing therapeutics capable of crossing the blood-brain barrier. This focus led to the development of its proprietary Transport Vehicle (TV) platform, designed to deliver large therapeutic molecules into the brain. The company's commitment to overcoming this challenge has been central to its mission, as highlighted in Mission, Vision & Core Values of Denali Therapeutics.

Denali formed critical partnerships with larger pharmaceutical companies to accelerate its drug development efforts. A significant collaboration with Takeda in 2018 focused on co-developing therapies for neurodegenerative diseases. Another key partnership with Biogen was established to work on Parkinson's disease programs. These alliances provided financial support, clinical expertise, and accelerated development timelines.

Denali's operational framework centered on drug discovery and development, particularly focusing on biomarker-driven development to increase the likelihood of regulatory success. As of June 30, 2024, the company reported approximately $1.35 billion in cash, cash equivalents, and marketable securities. This robust financial position has supported its ambitious research and development endeavors and expansion of its infrastructure.

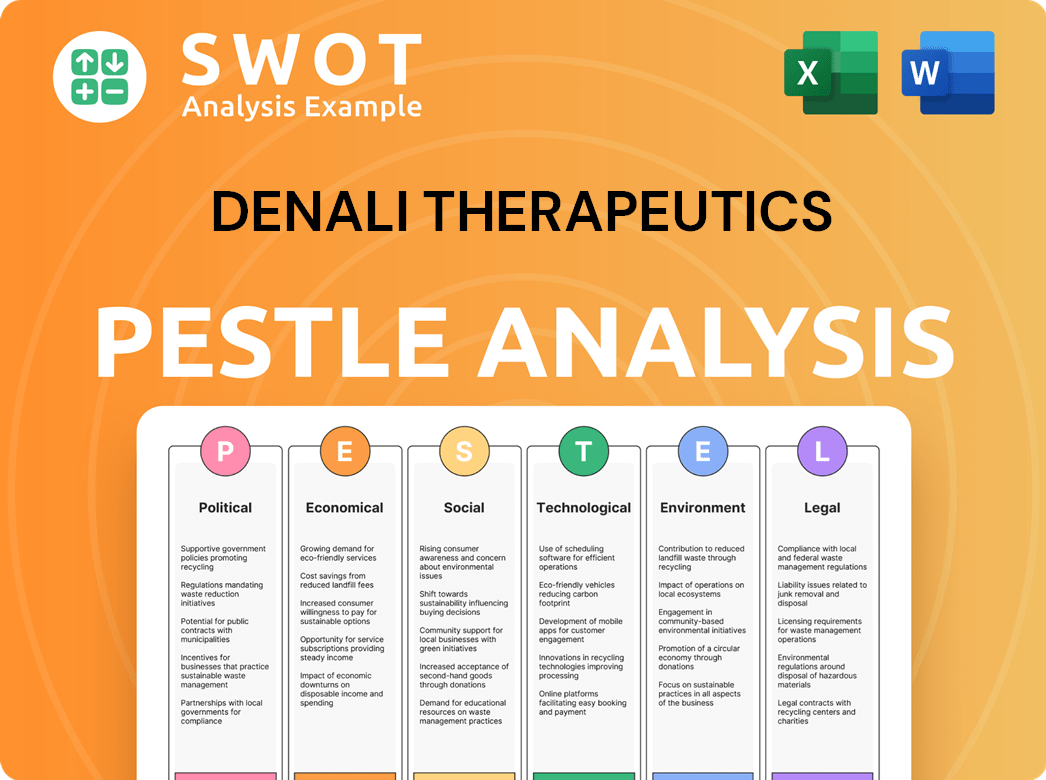

Denali Therapeutics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Denali Therapeutics history?

Denali Therapeutics has achieved several significant milestones, especially in the realm of neurodegenerative disease treatment. These accomplishments underscore its commitment to advancing therapies for challenging conditions. The company's progress reflects its dedication to innovation and its strategic approach to drug development.

| Year | Milestone |

|---|---|

| Early 2025 | FDA granted Breakthrough Therapy Designation to tividenofusp alfa (DNL310) for Hunter syndrome (MPS II). |

| May 2025 | Completion of the Biologics License Application (BLA) rolling submission for tividenofusp alfa, based on promising Phase 1/2 study data. |

A key innovation is the proprietary Transport Vehicle (TV) platform, which enables large therapeutic molecules to cross the blood-brain barrier (BBB). This technology is crucial for delivering treatments to the brain, addressing a major hurdle in neuroscience drug development. This platform has led to the development of programs like Enzyme Transport Vehicle (ETV), Oligonucleotide Transport Vehicle (OTV), and Antibody Transport Vehicle (ATV).

The TV platform is designed to overcome the blood-brain barrier, a significant obstacle in delivering drugs to the brain. This technology allows for the transport of large therapeutic molecules, opening new possibilities for treating neurodegenerative diseases.

ETV programs focus on delivering enzyme therapies across the blood-brain barrier. This approach is particularly relevant for treating metabolic disorders affecting the brain.

OTV programs aim to deliver oligonucleotide-based therapies, which can target specific genes and pathways. This approach has potential in treating various neurological diseases.

ATV programs focus on delivering antibody-based therapies across the blood-brain barrier. This technology is designed to target specific proteins and pathways involved in neurodegenerative diseases.

Despite its successes, Denali Therapeutics has faced challenges inherent in Denali drug development. For instance, the DNL343 program for Amyotrophic Lateral Sclerosis (ALS) did not meet its primary endpoint in the HEALEY ALS platform trial. These setbacks highlight the high-risk nature of clinical trials in neurodegenerative diseases. The company reported a net loss of $422.8 million for the full year 2024, and a net loss of $133.0 million for the first quarter of 2025, reflecting the significant R&D investments.

The DNL343 program for ALS did not meet its primary endpoint in a clinical trial, demonstrating the challenges in Denali Therapeutics drug development. This outcome underscores the complexities and risks associated with neurodegenerative disease research.

Denali Therapeutics reported a net loss of $422.8 million for the full year 2024 and $133.0 million for the first quarter of 2025. These losses are typical for a biotech company in the development phase, reflecting substantial investments in research and development.

Collaborations with Biogen for Parkinson's disease and Takeda for GRN-related frontotemporal dementia are crucial for sharing development risks and resources. These partnerships help in advancing the Denali Therapeutics pipeline.

Denali Therapeutics is concentrating on its most promising drug candidates to maximize the chances of success. This strategic focus is essential for efficient resource allocation and achieving key milestones.

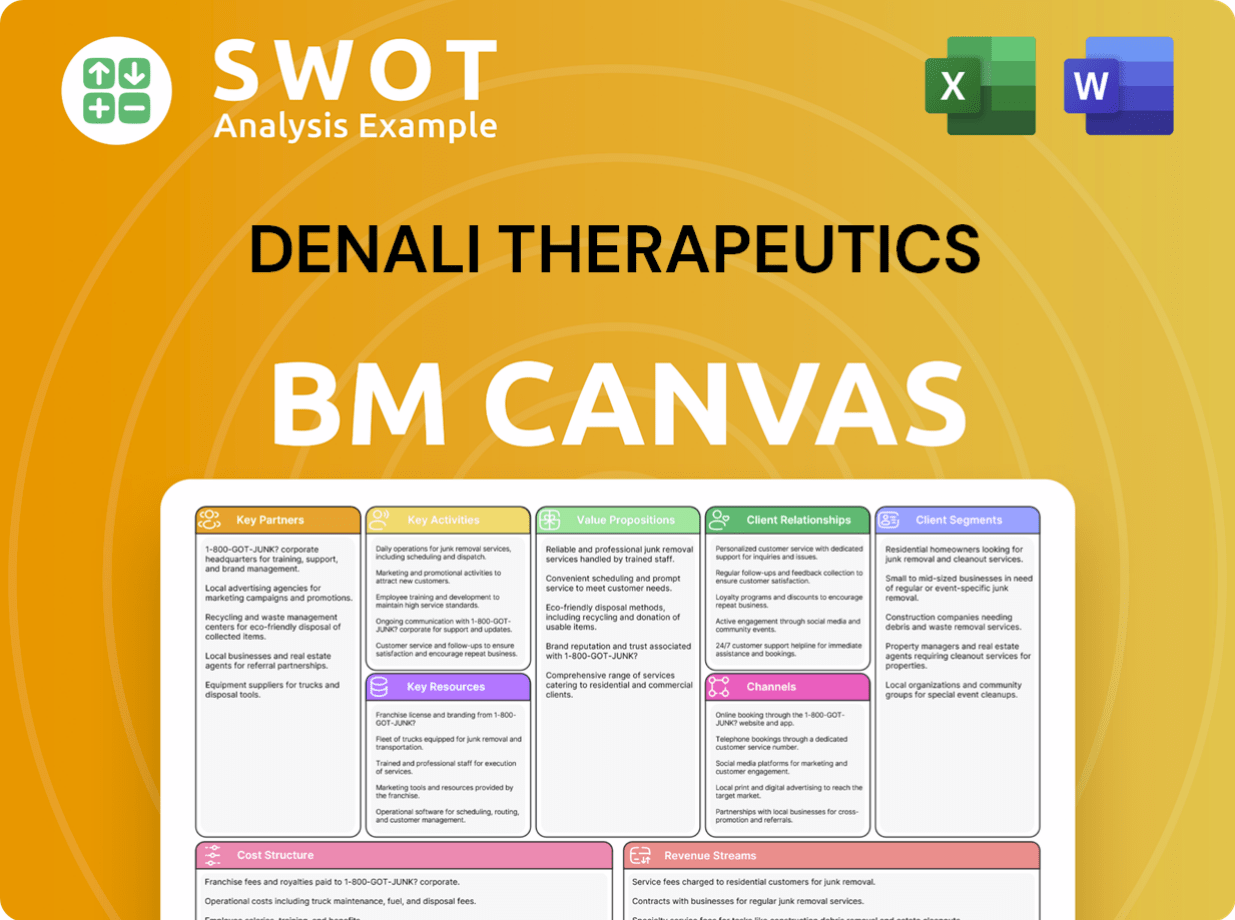

Denali Therapeutics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Denali Therapeutics?

The Denali Therapeutics journey reflects a commitment to innovation in biotechnology, marked by significant milestones in its drug development and strategic partnerships. The company, founded in 2015 with substantial Series A funding, has consistently advanced its research and clinical programs, including its IPO in 2017 and collaborations with major pharmaceutical companies. Recent years have seen critical advancements in clinical trials and regulatory interactions, positioning Denali for a pivotal transition into a commercial-stage biotech leader.

| Year | Key Event |

|---|---|

| 2015 | Denali Therapeutics founded with $217 million in Series A funding. |

| 2017 | Initial Public Offering (IPO), raising $250 million. |

| 2018 | Collaboration with Takeda for neurodegenerative disease therapies. |

| 2019 | First patient dosed in Phase 1b study of DNL151 for Parkinson's disease. |

| 2020 | Clinical trial initiation for DNL151. |

| 2023 Q2 | Collaboration revenue of $294.1 million primarily from Biogen exercising an option to license the ATV:Abeta program. |

| September 2024 | Successful meeting with FDA outlining accelerated approval path for tividenofusp alfa for Hunter syndrome. |

| December 2024 | Dosing begins in Phase 2a BEACON study for LRRK2-associated Parkinson's disease. |

| January 2025 | FDA grants Breakthrough Therapy Designation for tividenofusp alfa for Hunter syndrome. |

| March 2025 | Denali opens new 60,000-square-foot biomanufacturing facility in Salt Lake City, Utah. |

| May 2025 | Completion of Biologics License Application (BLA) rolling submission for tividenofusp alfa for Hunter syndrome. |

Denali Therapeutics is preparing for the potential U.S. commercial launch of tividenofusp alfa for Hunter syndrome in late 2025 or early 2026. The company is also seeking FDA alignment on an accelerated approval pathway for DNL126 for Sanfilippo syndrome Type A. These initiatives are key as Denali transitions into a commercial-stage biotech leader by 2026.

Denali anticipates advancing one to two additional Transport Vehicle (TV)-enabled programs into clinical trials annually over the next three years. This expansion includes programs for Pompe disease, Gaucher disease, Hurler syndrome, and diseases such as Alzheimer's disease and Parkinson's disease. This strategy underscores Denali's commitment to addressing a wide range of neurodegenerative conditions.

As of March 31, 2025, Denali has approximately $1.05 billion in cash, cash equivalents, and marketable securities, providing a cash runway into 2028. Despite a net loss of $133.0 million for Q1 2025, the company's financial position supports its strategic investments. Analysts have a positive outlook, recognizing the inherent volatility in biotech investments.

Denali’s long-term strategy remains centered on its founding vision of combating neurodegenerative diseases through scientific rigor and innovative drug delivery. The company continues to push boundaries in neuroscience, focusing on developing therapies for conditions like Alzheimer's disease and Parkinson's disease. This approach reflects Denali's commitment to improving outcomes for patients with these challenging diseases.

Denali Therapeutics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Denali Therapeutics Company?

- What is Growth Strategy and Future Prospects of Denali Therapeutics Company?

- How Does Denali Therapeutics Company Work?

- What is Sales and Marketing Strategy of Denali Therapeutics Company?

- What is Brief History of Denali Therapeutics Company?

- Who Owns Denali Therapeutics Company?

- What is Customer Demographics and Target Market of Denali Therapeutics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.