Guardian Pharmacy Bundle

How Did Guardian Pharmacy Become a National Leader?

Discover the compelling Guardian Pharmacy SWOT Analysis and the fascinating journey of Guardian Pharmacy, a significant healthcare provider in the long-term care sector. From its inception in 2004, this Pharmacy Chain has redefined pharmacy services with a unique, locally-driven approach. Explore the early days of Guardian Pharmacy and the strategic decisions that fueled its remarkable expansion.

The brief history of Guardian Pharmacy reveals a story of innovation and strategic growth. Founded with a vision to empower local teams, Guardian Pharmacy quickly moved from a single Drugstore in Phoenix, Arizona, to a nationwide network, demonstrating its commitment to personalized care. Learn about Guardian Pharmacy's company background, key milestones, and how it has impacted the community, all while examining its current status and operations.

What is the Guardian Pharmacy Founding Story?

The founding story of Guardian Pharmacy Services began in 2004. The company was established by Fred Burke, David Morris, and Kendall Forbes, industry veterans who saw an opportunity in the long-term care pharmacy sector. Their vision was to create a business model that empowered local pharmacy management teams with significant ownership and operational authority.

This decentralized approach was designed to improve efficiency and provide more personalized, community-centered care. The company's initial focus was on assisted living communities, a niche that set it apart in the industry. The model combined local operations with a national support team, allowing each pharmacy to operate independently while benefiting from centralized resources.

The first pharmacy was established in Phoenix, Arizona, where John Saliba, RPh, identified an unmet need for pharmacy services tailored to assisted living communities. The early days of Guardian Pharmacy involved capitalization from its management team and individual investors, fostering steady growth. This structure, emphasizing local autonomy and national support, addressed the complexities of long-term care pharmacy, responding to the increasing demand for specialized care in assisted living and behavioral health facilities. For more insights, you can explore the Marketing Strategy of Guardian Pharmacy.

Here's a summary of the key aspects of Guardian Pharmacy's founding:

- Founded in 2004 by Fred Burke, David Morris, and Kendall Forbes.

- Focused on empowering local pharmacy management teams.

- First pharmacy in Phoenix, Arizona, targeting assisted living communities.

- Capitalized by the management team and individual investors.

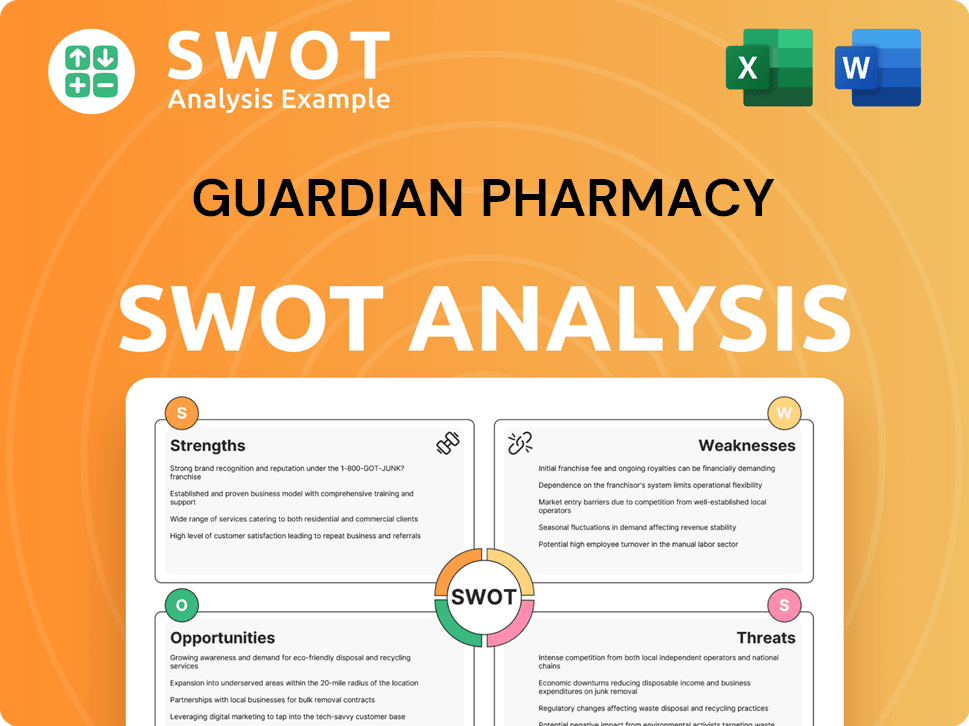

Guardian Pharmacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Guardian Pharmacy?

The early growth and expansion of Guardian Pharmacy marked a significant phase in its history. Starting from a single pharmacy in Phoenix, Arizona, in 2004, the company focused on the assisted living market. This initial focus set the stage for a unique business model that empowered local pharmacy management teams.

Guardian Pharmacy experienced substantial growth in its resident count. From December 31, 2014, when it served 52,000 residents, the number increased to 174,000 by June 30, 2024. This growth included both organic expansion, adding 77,000 residents, and acquisitions, which contributed an additional 45,000 residents.

By December 31, 2024, Guardian Pharmacy operated 51 pharmacies. These pharmacies served approximately 186,000 residents across 7,000 long-term care facilities. The company's footprint expanded to 38 states. As of March 31, 2025, the resident count further increased to 189,000, a 15% year-over-year increase.

Key acquisitions played a crucial role in Guardian Pharmacy's expansion. In 2024, the company acquired Heartland Pharmacy on April 1, 2024, and Freedom Pharmacy on November 1, 2024. The acquisition of Freedom Pharmacy marked its entry into New Jersey. In 2024, the company added nine new pharmacy locations through mergers, acquisitions, and greenfield startups.

The company's financial performance reflected its growth. Full-year 2024 revenue reached $1.228 billion, a 17% increase year-over-year. The trailing 12-month revenue as of March 31, 2025, was $1.28 billion, up 19.54% year-over-year. Guardian Pharmacy Services also successfully launched its initial public offering (IPO) in September 2024, listing its Class A common stock on the New York Stock Exchange (NYSE) under the symbol 'GRDN.'

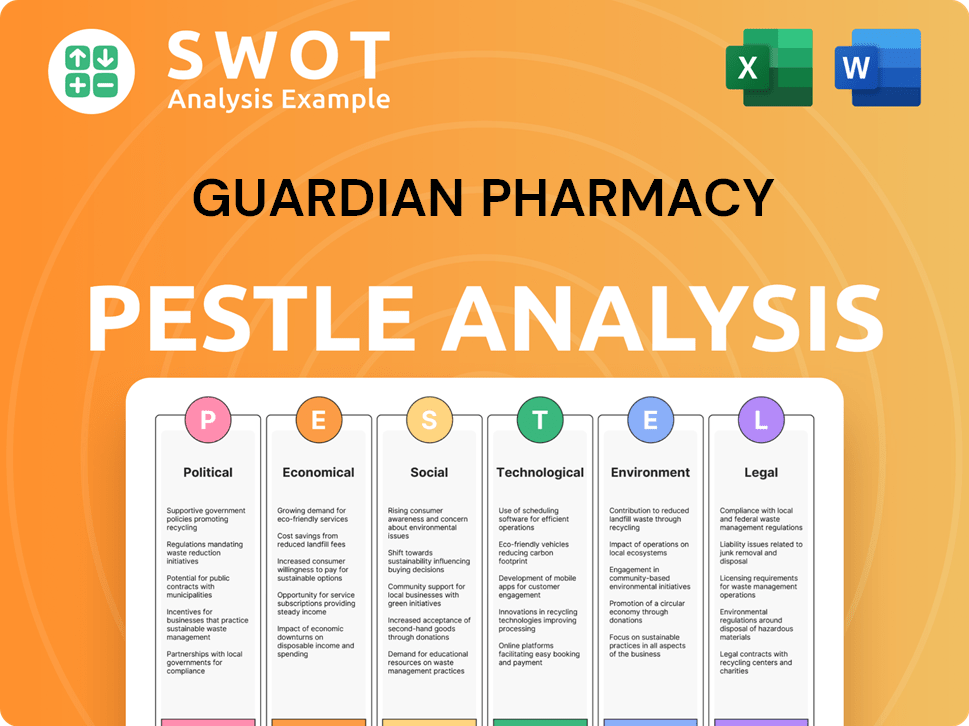

Guardian Pharmacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Guardian Pharmacy history?

The history of Guardian Pharmacy is marked by significant growth in the long-term care pharmacy market. The company has expanded its reach through strategic acquisitions and technological advancements, establishing itself as a key player in the healthcare provider sector.

| Year | Milestone |

|---|---|

| 2024 | Acquired Heartland Pharmacy in April, expanding market share. |

| 2024 | Acquired Freedom Pharmacy in November, further increasing its footprint. |

| 2025 | Serving approximately 189,000 residents across 7,000 long-term care facilities by March 31, 2025. |

Key innovations for Guardian Pharmacy include the development of proprietary technology solutions. These solutions, such as the Guardian Compass platform and GuardianShield products, enhance operational efficiencies for pharmacies and improve clinical outcomes.

Offers real-time operational dashboards and metrics.

Enhances efficiencies for pharmacies.

Provides insights for facilities.

Delivers customer and clinical services benefiting residents and caregivers.

Designed to improve medication adherence.

Reduce care costs and enhance clinical outcomes in long-term care facilities.

Despite its success, Guardian Pharmacy has faced challenges, including the impact of the COVID-19 pandemic. Operating as a public company has introduced additional costs, and the Inflation Reduction Act presents potential future challenges.

The pandemic negatively impacted resident count, decreasing from 132,000 to 123,000 during the nine-month period ended December 31, 2020.

Operational challenges in administering vaccines historically posed profitability headwinds.

Additional costs amounted to over $1 million in 2024.

These costs are expected to increase to $4 million in 2025.

Presents potential challenges impacting operations from 2026 onwards.

The company is focusing on operational efficiency and innovation to address these challenges.

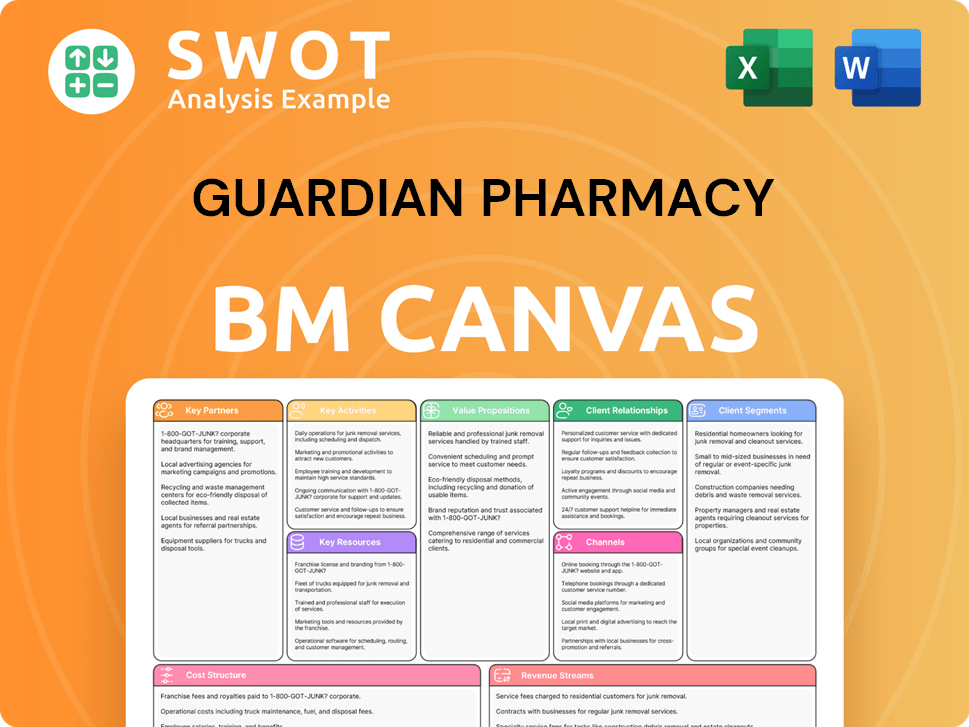

Guardian Pharmacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Guardian Pharmacy?

The Guardian Pharmacy journey began in 2004 in Phoenix, Arizona, and has since expanded significantly. The company has grown from its initial focus on assisted living communities to a nationwide presence. Key milestones include strategic acquisitions, an initial public offering, and consistent revenue growth, reflecting its expansion and adaptation within the long-term care pharmacy market.

| Year | Key Event |

|---|---|

| 2004 | Guardian Pharmacy Services is founded, with its first pharmacy opening in Phoenix, Arizona, focusing on assisted living communities. |

| December 31, 2014 | Serves 52,000 residents. |

| December 31, 2020 | Resident count decreased to 123,000 due to the COVID-19 pandemic. |

| September 16, 2024 | Announces the launch of its initial public offering (IPO) of Class A common stock. |

| September 30, 2024 | Reports revenue of $314.4 million for Q3 2024, a 20% increase year-over-year. |

| November 1, 2024 | Acquires Freedom Pharmacy, expanding into New Jersey. |

| December 31, 2024 | Operates 51 pharmacies, serving approximately 186,000 residents in 7,000 LTCFs across 38 states; reports full-year 2024 revenue of $1.228 billion. |

| March 3, 2025 | Announces preliminary Q4 and full-year 2024 results and provides 2025 financial guidance. |

| March 26, 2025 | Reports fourth quarter and full year 2024 financial results, with Q4 revenue of $338.6 million (up 20% YoY) and full-year 2024 revenue of $1.228 billion (up 17% YoY). |

| March 31, 2025 | Reports Q1 2025 revenue of $329.3 million, a 20% increase year-over-year, and a resident count of 189,000. |

| April 1, 2025 | Closes a small acquisition in Wichita, Kansas, bringing the total number of Guardian pharmacies to 52. |

| May 22, 2025 | Announces pricing of an underwritten public offering of Class A Common Stock. |

| June 2, 2025 | Expands Pacific Northwest footprint with the acquisition of Washington-based Mercury Pharmacy Services. |

For FY2025, the company anticipates revenue in the upper half of its $1.33 billion to $1.35 billion guidance range. Adjusted EBITDA is projected to be between $97 million and $101 million. Analysts forecast an EPS of $0.94, with the expectation of net income turning positive this year.

The long-term care pharmacy market is set for continued growth, with the U.S. assisted living facility industry expected to see a CAGR of over 5% from 2023 to 2030. Key trends include technology adoption, personalized medication management, and a focus on staff well-being.

The company remains focused on strategic acquisitions, with an active pipeline. Recent acquisitions, such as Freedom Pharmacy and Mercury Pharmacy Services, demonstrate this commitment. The company plans to launch new pharmacies in cities like Columbus and Oklahoma City.

The increasing use of AI in managed care pharmacy is a significant trend, with 92% of respondents expecting AI to be incorporated into more than 50% of prior authorization reviews. Guardian's focus on technology-enabled services positions it well for future growth.

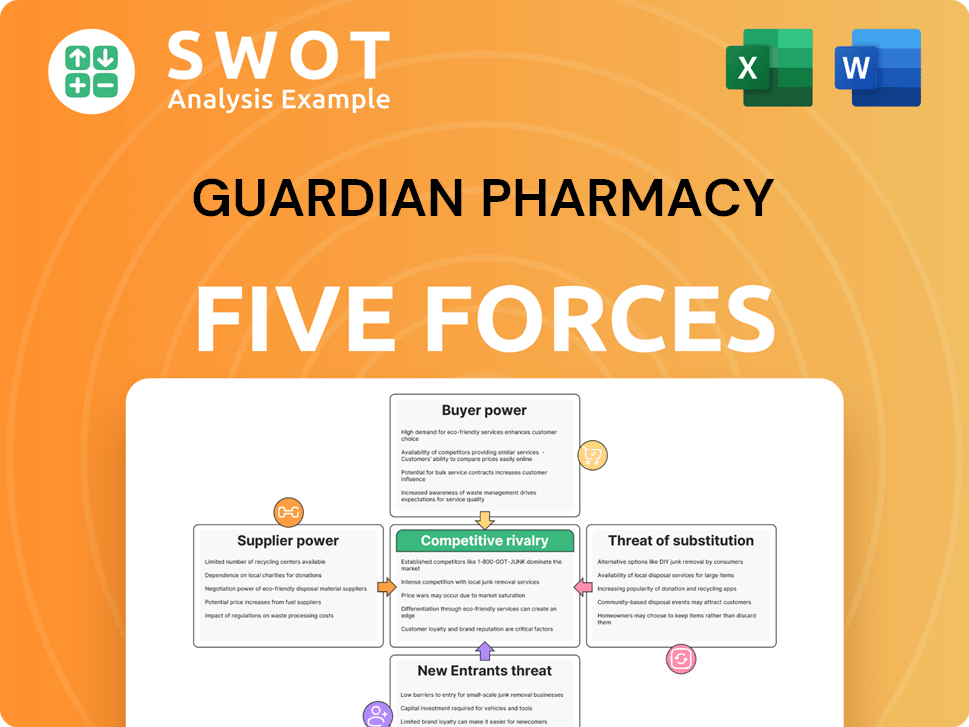

Guardian Pharmacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Guardian Pharmacy Company?

- What is Growth Strategy and Future Prospects of Guardian Pharmacy Company?

- How Does Guardian Pharmacy Company Work?

- What is Sales and Marketing Strategy of Guardian Pharmacy Company?

- What is Brief History of Guardian Pharmacy Company?

- Who Owns Guardian Pharmacy Company?

- What is Customer Demographics and Target Market of Guardian Pharmacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.