Halliburton Bundle

How Did Halliburton Cement Its Place in History?

Dive into the fascinating Halliburton SWOT Analysis and uncover the remarkable story of Halliburton, a company that revolutionized the oil industry. From its inception in 1919, Halliburton's journey is a testament to innovation and resilience. This brief history of Halliburton explores the key milestones that shaped this global energy giant.

The Halliburton company history is a compelling narrative of adaptation and strategic foresight, starting from its early years in Oklahoma. Understanding the Halliburton timeline reveals how a simple idea – cementing oil wells – transformed into a global enterprise. Examining Halliburton's founder and the company's early involvement in the oil industry offers valuable insights into its enduring legacy and impact on the energy sector.

What is the Halliburton Founding Story?

The Halliburton company, a prominent name in the energy sector, traces its roots back to March 10, 1919. This is when Erle P. Halliburton, a former well driller, established the New Method Oil Well Cementing Company. His vision was to revolutionize how oil wells were sealed, addressing critical inefficiencies and safety concerns prevalent in the rapidly expanding oil industry. This marked the beginning of the Halliburton history.

Erle Halliburton's insights into the oil industry's needs led to the development of a pioneering well-cementing method. This innovative approach was designed to seal wellbores effectively, preventing water intrusion and enhancing both oil recovery and well stability. The company's early days were characterized by a commitment to proving the effectiveness of its methods. Halliburton often offered his services on a 'no cement, no pay' basis, showcasing his confidence in his innovative approach.

The early 20th century provided a favorable environment for Halliburton's venture, with rapid industrialization and increasing demand for oil. Oil companies were actively seeking more efficient and safer drilling technologies. The initial business model of the New Method Oil Well Cementing Company revolved around providing this specialized cementing service to oil producers. A key innovation was the 'jet mixer,' which enabled rapid and efficient on-site mixing of cement slurry. This was a major advancement over the manual methods previously used.

Erle P. Halliburton founded the company in 1919, addressing inefficiencies in oil well sealing.

- The initial focus was on providing specialized cementing services to oil producers.

- A significant early innovation was the 'jet mixer,' which improved cement slurry mixing.

- The company's early strategy included offering services on a 'no cement, no pay' basis to demonstrate effectiveness.

- The cultural and economic context of the early 20th century supported the growth of the company.

Halliburton SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Halliburton?

The early growth of the Halliburton company, a key part of the Halliburton history, was marked by the quick adoption of its cementing services across the growing oil fields in the United States. This rapid expansion set the stage for its future as a major player in the oil and gas industry. The company's initial success in Oklahoma quickly led to operations in Texas, Louisiana, and Arkansas, following the oil booms in those areas.

Halliburton expanded rapidly in the mid-1920s, establishing operations in Texas, Louisiana, and Arkansas. This expansion followed the oil booms in these regions, capitalizing on the increasing demand for its services. The company's ability to quickly adapt to new markets was a key factor in its early success.

A significant advancement was the development of specialized equipment, such as cementing trucks. This allowed for more efficient delivery of services directly to well sites. The introduction of well logging services in the 1930s further solidified Halliburton's position as a comprehensive service provider.

Halliburton diversified its service offerings beyond basic cementing. In the 1930s, the company introduced well logging services, expanding its range of services. This diversification helped Halliburton to meet the evolving needs of the oil and gas industry.

Erle P. Halliburton guided the company through its initial growth, fostering a culture of innovation and customer focus. The market reception to Halliburton's services was overwhelmingly positive, as its technologies directly addressed critical operational challenges faced by oil producers. The company's ability to deliver superior, specialized solutions helped it navigate a competitive landscape.

Halliburton PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Halliburton history?

The Halliburton company's journey is marked by significant milestones, from its founding to its global expansion and technological advancements. The Halliburton history is a testament to its resilience and adaptability within the dynamic energy sector, showcasing its evolution through various challenges and innovations.

| Year | Milestone |

|---|---|

| 1919 | Erle P. Halliburton founded the company as the New Manufacturing Company in Duncan, Oklahoma. |

| 1920s | Halliburton pioneered cementing services for oil wells, significantly improving well integrity and production efficiency. |

| 1930s | The company expanded its services and operations, establishing a strong presence in the growing oil and gas industry. |

| 1940s | Halliburton revolutionized the industry by introducing hydraulic fracturing, a key technology for increasing oil and gas production. |

| 1960s-1980s | Halliburton expanded globally, diversifying its services and technologies to meet the evolving needs of the energy sector. |

| 1990s-2000s | The company continued to grow through acquisitions and technological advancements, solidifying its position as a leading oilfield services provider. |

| 2010s | Halliburton faced significant challenges, including the Deepwater Horizon disaster, which led to major legal and financial repercussions. |

| 2020s | Halliburton focuses on digital transformation, sustainability, and operational efficiency to adapt to the changing energy landscape. |

Halliburton has consistently been at the forefront of technological innovation in the oil and gas industry. Its advancements in hydraulic fracturing, directional drilling, and logging technologies have significantly enhanced oil and gas production efficiency and safety. These innovations have not only shaped the industry but also established Halliburton as a leader in engineering and technological solutions.

Pioneered in the 1940s, this technique revolutionized oil and gas extraction by increasing production from previously inaccessible formations. This innovation remains a cornerstone of modern oilfield operations.

Halliburton's advancements in directional drilling allowed for more precise well placement and access to difficult-to-reach oil and gas reserves. This technology has improved efficiency and reduced environmental impact.

Halliburton developed advanced logging tools to analyze subsurface formations, providing crucial data for optimizing drilling and production strategies. These technologies enhance the accuracy of resource assessment.

Halliburton's cementing services have been critical in ensuring the integrity of oil and gas wells, preventing leaks and protecting the environment. This has improved safety and operational reliability.

Recent investments in digital technologies and automation have enhanced efficiency and reduced operational risks. This has improved data analysis and decision-making processes.

Halliburton is increasingly focused on developing sustainable solutions, including technologies to reduce emissions and improve environmental performance. This supports the transition to cleaner energy sources.

Halliburton has faced numerous challenges, including market volatility and public scrutiny. The cyclical nature of the oil and gas industry has led to periods of reduced demand and price fluctuations, requiring strategic adaptation. The company has also navigated significant legal and environmental challenges, such as the Deepwater Horizon disaster, which led to substantial financial and reputational impacts.

The oil and gas industry's cyclical nature has caused periods of reduced demand and price volatility, requiring strategic repositioning and cost management. This impacts revenue and profitability.

Competition from other service providers necessitates continuous innovation and strategic adjustments to maintain market share. This requires ongoing investment in research and development.

Major incidents, such as the Deepwater Horizon disaster, have led to significant legal and financial repercussions, impacting the company's reputation. This necessitates enhanced safety protocols and risk management.

The company faces public scrutiny related to environmental incidents and operational practices, requiring a focus on corporate social responsibility and transparency. This impacts stakeholder relations.

Adapting to new technologies and industry trends, such as the shift towards renewable energy, requires ongoing investment and strategic planning. This ensures long-term relevance and sustainability.

Operating in various global locations exposes the company to geopolitical risks, requiring robust risk management and adaptability. This impacts operational stability and financial performance.

For example, in 2024, Halliburton reported revenues of approximately $23 billion, showcasing its continued presence in the market. Furthermore, the company's focus on digital transformation and sustainable solutions reflects its adaptation to current industry demands. To learn more about their approach, consider exploring the Marketing Strategy of Halliburton.

Halliburton Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Halliburton?

The Halliburton company history is marked by significant milestones that have shaped its trajectory in the oil and gas industry and beyond. From its humble beginnings as a cementing company to its current status as a global leader, the company's evolution reflects the dynamic nature of the energy sector and its commitment to innovation.

| Year | Key Event |

|---|---|

| 1919 | Erle P. Halliburton founded the New Method Oil Well Cementing Company in Duncan, Oklahoma. |

| 1920s | Expanded operations across major U.S. oil fields, including Texas and Louisiana. |

| 1930s | Introduced well logging services, diversifying its offerings in the oilfield. |

| 1949 | Pioneered commercial hydraulic fracturing, revolutionizing oil and gas extraction. |

| 1957 | The company was renamed Halliburton Company. |

| 1962 | Acquired Brown & Root, entering the engineering and construction sectors. |

| 1980s | Experienced significant international expansion and growth in global oilfield services. |

| 1998 | Acquired Dresser Industries, further expanding its product and service portfolio. |

| 2010 | Involved in the Deepwater Horizon incident, facing legal and operational challenges. |

| 2014-2016 | Attempted to merge with Baker Hughes, which was terminated due to antitrust concerns. |

| 2020s | Increased focus on digital transformation, automation, and sustainable energy solutions. |

Halliburton is heavily investing in digital technologies like AI and machine learning to enhance operational efficiency. This includes optimizing reservoir performance and automating various processes. The company aims to leverage data analytics to improve decision-making and reduce costs. In Q1 2024, Halliburton reported a 12% increase in digital and software sales, reflecting its commitment to technological advancements.

The company is exploring opportunities in emerging energy sectors, such as carbon capture, utilization, and storage (CCUS), and geothermal energy. This reflects a broader industry shift towards decarbonization and sustainable practices. Halliburton's involvement in these areas is expected to grow, aligning with the global push for cleaner energy sources. The CCUS market is projected to reach $6.4 billion by 2027.

Halliburton continues to invest in research and development to drive innovation in unconventional resource development. This includes improving drilling and completion techniques to enhance production. The company's focus on unconventional resources is crucial for meeting evolving energy demands. In its Q1 2025 earnings call, Halliburton emphasized its commitment to maximizing value for its customers.

Halliburton's robust technological portfolio and global presence position it to maintain a leading role in the oilfield services market. The company aims to maximize value for its customers throughout the lifecycle of the reservoir. This vision ties back to Erle P. Halliburton's original commitment to optimizing oil and gas extraction through innovative solutions. Halliburton operates in over 70 countries worldwide.

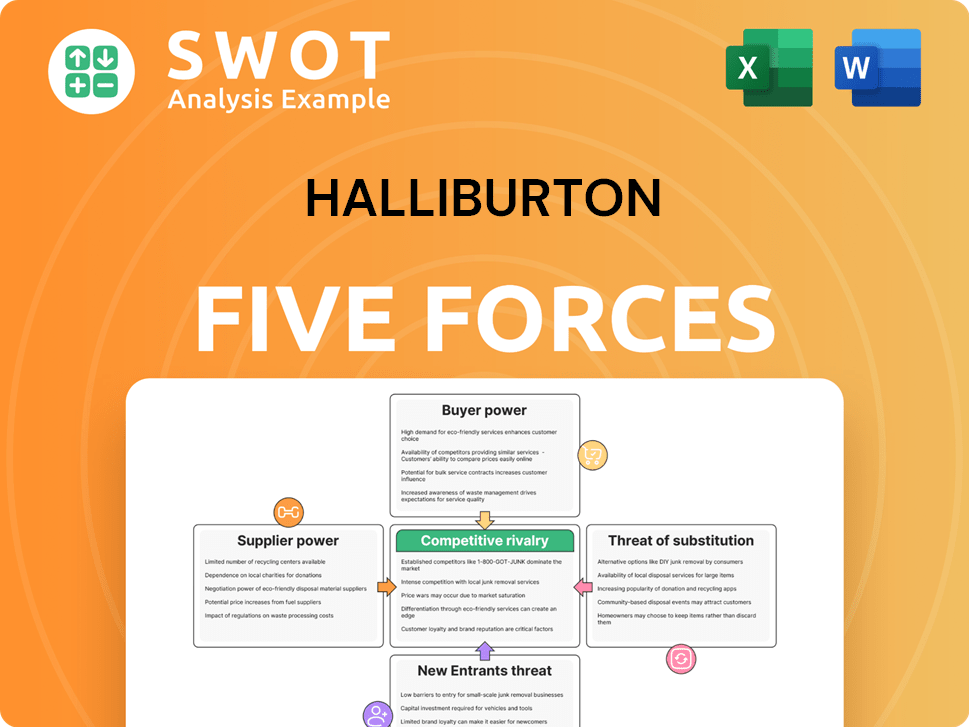

Halliburton Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Halliburton Company?

- What is Growth Strategy and Future Prospects of Halliburton Company?

- How Does Halliburton Company Work?

- What is Sales and Marketing Strategy of Halliburton Company?

- What is Brief History of Halliburton Company?

- Who Owns Halliburton Company?

- What is Customer Demographics and Target Market of Halliburton Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.