Karex Bundle

How did a Malaysian company become the world's largest condom manufacturer?

From its humble beginnings in 1988, Karex Berhad has become a global powerhouse. This Karex SWOT Analysis highlights the company's strategic journey. Discover how this Malaysian company, initially focused on latex products, transformed into a leader in the sexual wellness industry, dominating the global market.

The Karex history is a compelling narrative of innovation and strategic expansion. The Karex company strategically leveraged its expertise in rubber processing to become the world's leading condom manufacturer. Understanding Karex's early years and its evolution from a small family business to a global entity offers valuable insights into successful business strategies and market dominance. Learn about the Karex company timeline and the key milestones that shaped its remarkable journey.

What is the Karex Founding Story?

The story of the Karex history begins in 1988 in Johor, Malaysia. It was founded by brothers Goh Siang and Goh Leng Kian, who brought together their engineering backgrounds to create a business in the latex industry. This venture built upon their family's long-standing experience in rubber production, dating back to the 1920s.

The Karex company initially focused on manufacturing condoms. They faced challenges such as market regulations and competition from established multinational companies. The name 'Karex' itself reflects their commitment to 'caring' and 'excellence'.

The early days of Karex involved leveraging family resources and expertise. Their ability to customize production lines was a key factor in their growth. The company's establishment in Malaysia provided a supportive environment for their entry into the sexual health sector.

Karex started with a focus on condom manufacturing, facing market regulations and competition.

- Initial funding came from the family business, reflecting a bootstrapping approach.

- The company's name, Karex, is derived from 'caring' and 'excellence'.

- In-house expertise in machine fabrication allowed for customized production lines.

- The cultural context of Malaysia provided a foundation in the rubber industry.

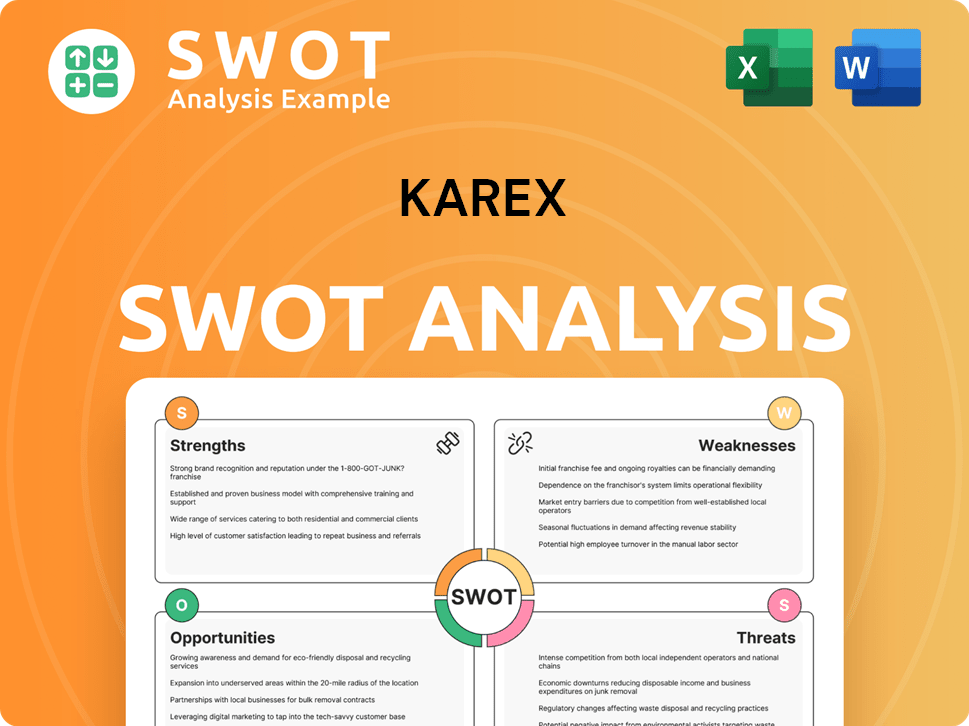

Karex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Karex?

The early growth of the Karex company was characterized by a focus on building manufacturing expertise and expanding its facilities. Initially, the company concentrated on establishing a strong production base in Malaysia. A significant milestone in its expansion was its listing on the Main Market of Bursa Malaysia Securities Berhad in November 2013, which provided a platform for further growth.

Karex strategically expanded into new markets through both geographical expansion and product diversification. Manufacturing facilities were established in Malaysia (Pontian, Port Klang, Senai) and Thailand (Hat Yai). Sales and marketing offices were set up in the US and UK. Key acquisitions played a vital role in its expansion.

The acquisition of Pasante, a major independent condom manufacturer in the UK, in 2016 for £6 million was a significant move. In 2015, Karex also acquired Medical-Latex (Dua) Sdn Bhd (MLD) for RM13 million. This acquisition provided access to MLD's distribution network in Singapore, Malaysia, Europe, and Latin America, and secured a five-year exclusive contract to supply condoms to Beiersdorf.

During this period, Karex focused on its in-house Research and Development (R&D) capabilities. This enabled product development, machine re-engineering, and new packaging concepts. The company’s ability to adapt designs and scale up machinery in-house was a pivotal decision that shaped its trajectory. By FY23, Karex saw a significant improvement in its gross profit margin, surpassing 25%, due to the stabilization of logistics and raw material costs, and accelerated automation in its manufacturing processes.

By 1999, the Malaysian company had grown to 60 employees. The IPO in 2013 provided capital for further expansion and market penetration. These early steps were crucial for establishing the company's position as a leading condom manufacturer.

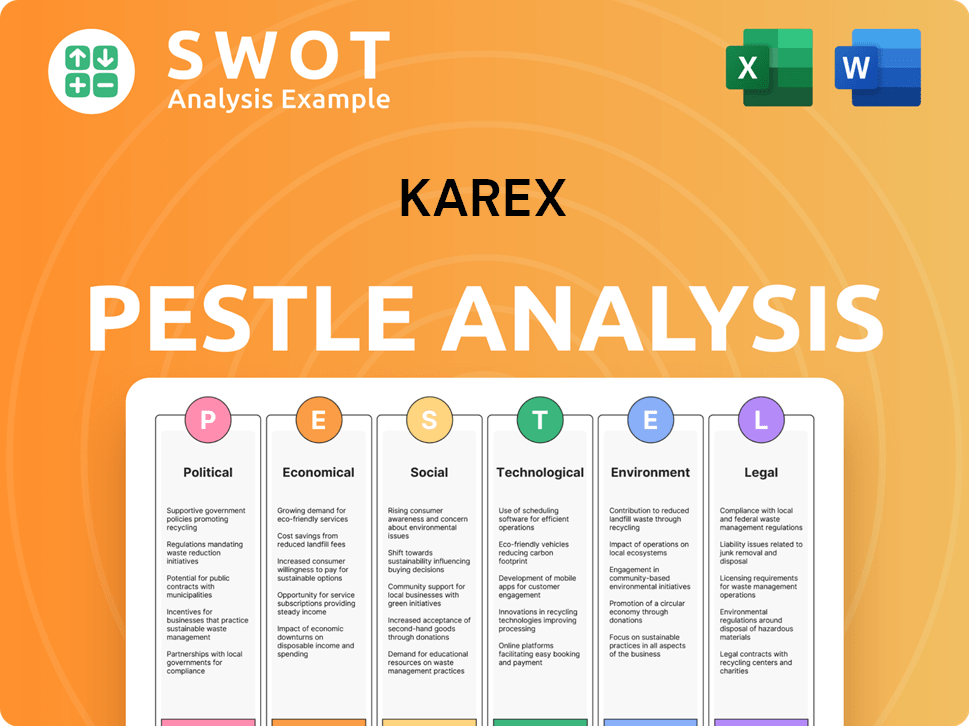

Karex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Karex history?

The Karex history reflects a journey of growth, adaptation, and innovation within the latex products and condom manufacturer industry. The company has navigated significant milestones, from its early years to its current global presence.

| Year | Milestone |

|---|---|

| Early Years | Founded as a Malaysian company focused on latex products. |

| 1980s | Began condom manufacturing, establishing itself as a key player in the industry. |

| 2000s | Expanded its global reach, exporting to over 140 countries and becoming a major condom manufacturer. |

| 2013 | Karex Berhad was listed on the Malaysian stock exchange. |

| 2024 | Obtained CE certification in Europe and FDA approval in the US for its new synthetic condoms. |

Karex has consistently pushed boundaries in innovation. A significant innovation has been the ability to fabricate its own machinery, which allows for rapid adaptation to changing customer preferences and continuous product development.

Karex's ability to manufacture its own machinery allows for swift adjustments to product designs and production methods. This capability is crucial for staying ahead in a competitive market.

The company has expanded its product range to include condoms with various colors, textures, and properties, catering to diverse consumer preferences. This diversification helps in maintaining market relevance.

Karex has invested in decreasing the thickness of condoms to enhance user experience. This innovation addresses consumer demand for more natural-feeling products.

The introduction of synthetic condoms has opened new market opportunities and distribution channels. This innovation caters to consumers with latex allergies and expands the product portfolio.

Despite its successes, the

Early financial challenges, including those from the Asian Financial Crisis, required strategic financial planning. Adapting to market downturns and volatile commodity prices has also been crucial.

The condom manufacturer industry is highly competitive, with established multinational corporations. Maintaining market share requires continuous innovation and strategic market positioning.

The COVID-19 pandemic caused disruptions to manufacturing and a slowdown in condom demand due to physical distancing. Smaller industry players, particularly in China, faced severe challenges during this period.

Fluctuations in commodity prices impact production costs and profitability. Managing these costs requires efficient supply chain management and strategic pricing strategies.

Rising minimum wages and social compliance costs for foreign labor have prompted the company to accelerate automation in its manufacturing processes. The aim is to reduce reliance on foreign workers.

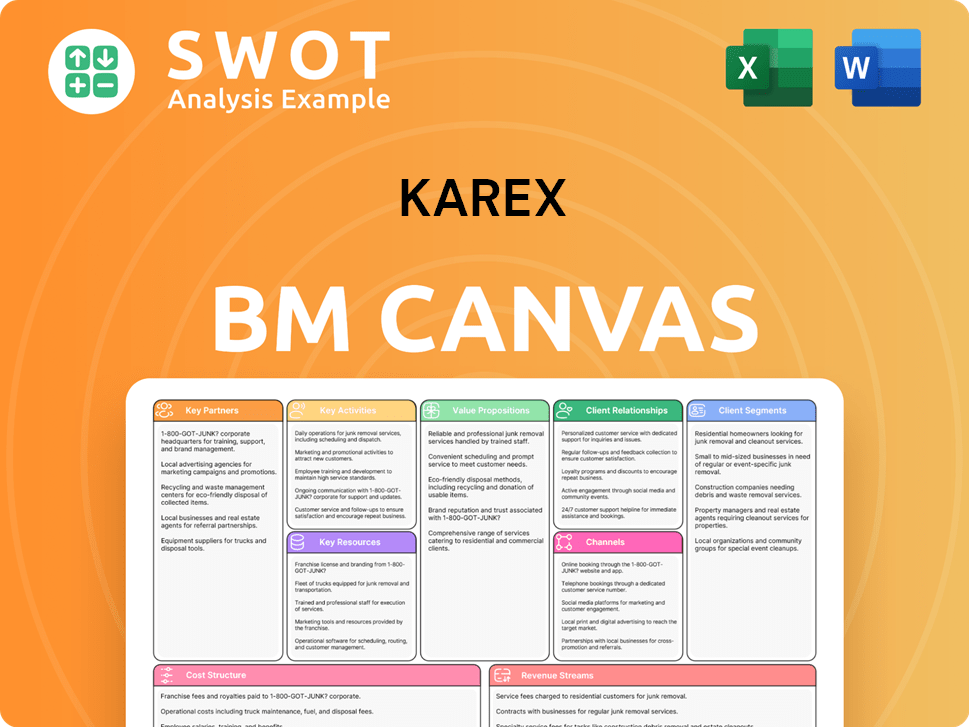

Karex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Karex?

The Karex history is marked by significant milestones, from its humble beginnings as a family business to its current status as a global condom manufacturer. Established in Johor, Malaysia, in 1988, the company has expanded its operations and market presence over the years. A key turning point was the listing on Bursa Malaysia in November 2013. Strategic acquisitions, such as Medical-Latex (Dua) Sdn Bhd and Pasante Healthcare Limited, have broadened its product portfolio and market reach. More recently, Karex has focused on addressing social compliance concerns and expanding into the synthetic condom market, with regulatory approvals and partnerships driving future growth.

| Year | Key Event |

|---|---|

| 1988 | Karex Berhad is founded as a small family business in Johor, Malaysia. |

| 1999 | The company grows to 60 employees. |

| November 2013 | Karex is successfully listed on the Main Market of Bursa Malaysia Securities Berhad. |

| 2015 | Karex acquires Medical-Latex (Dua) Sdn Bhd (MLD). |

| 2016 | Karex acquires Pasante Healthcare Limited in the UK. |

| 2019 | Karex freezes hiring new migrant workers, aiming for no foreign workers by 2024, to address social compliance concerns. |

| FY2020 | The COVID-19 pandemic significantly impacts operations, leading to temporary suspensions and idle operation expenses. |

| FY2023 | Gross profit margin surpasses 25% due to stabilized logistics, raw material costs, and increased automation. |

| July 2024 | Karex obtains CE certification for its new synthetic condoms, enabling market entry into the European Economic Area. |

| August 2024 | Karex successfully obtains FDA approval for its new synthetic condoms in the US. |

| November 2024 | Karex partners with a major OEM client to launch synthetic condoms in Europe, with North America to follow. |

| End of 2024 | Karex aims to have no foreign workers. |

| End of 2025 | Karex plans to expand synthetic condom production to 16 lines at its Hat Yai plant, boosting total capacity to 400 million pieces annually. |

Analysts predict Karex's revenue to expand by 1.1% in FY25F and 9.5% in FY26F. This growth is expected to be driven by expansion in high-margin products within commercial and Original Brand Manufacturing (OBM) divisions.

The synthetic condom segment, with gross profit margins over 50%, is expected to significantly enhance profitability. Karex is forecast to grow earnings and revenue by 67.6% and 13.6% per annum respectively, with EPS expected to grow by 54.1% per annum.

Karex continues to invest in its in-house machine fabrication capabilities and R&D to differentiate itself and adapt to new industry trends. The company's strategic focus on premium and top-quality products aligns with current market evolution.

The company's future outlook is tied to its founding vision of being a leading provider of sexual wellness products, adapting to changing consumer needs and regulatory environments. Expansion into new markets, such as the synthetic condom segment, is key.

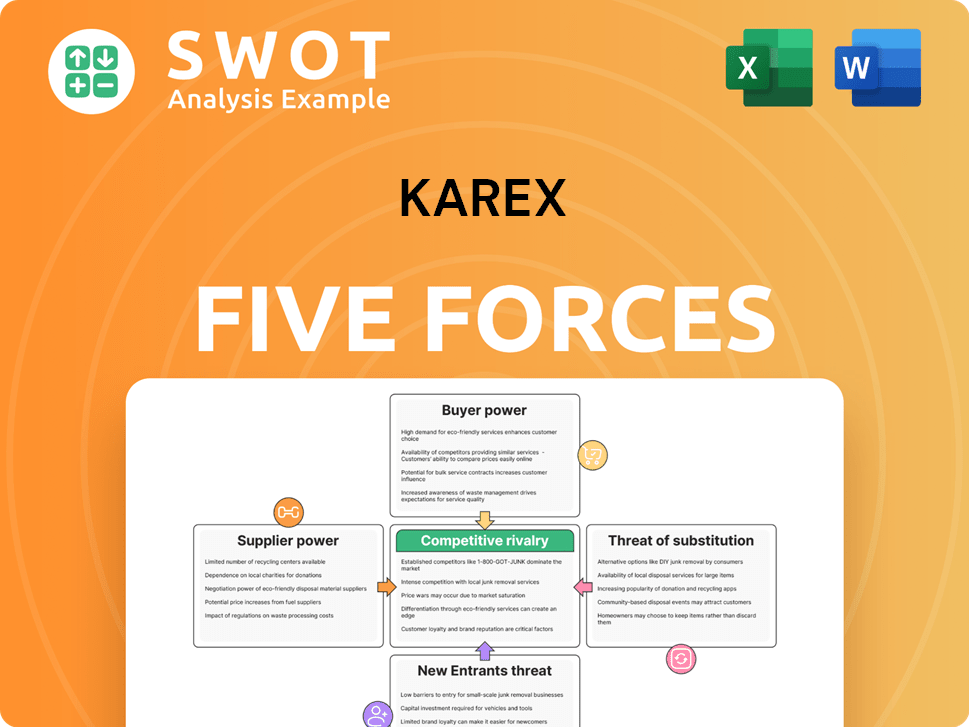

Karex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Karex Company?

- What is Growth Strategy and Future Prospects of Karex Company?

- How Does Karex Company Work?

- What is Sales and Marketing Strategy of Karex Company?

- What is Brief History of Karex Company?

- Who Owns Karex Company?

- What is Customer Demographics and Target Market of Karex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.