Nexstar Media Group Bundle

How Did Nexstar Media Group Become a Broadcasting Giant?

From a single station to a media empire, the story of Nexstar Media Group is a compelling tale of strategic growth and adaptation. Founded in 1996 by Perry A. Sook, this Nexstar Media Group SWOT Analysis reveals a company that has consistently reshaped the American media landscape. Discover how Nexstar, starting in Scranton, Pennsylvania, rose to become the largest owner of local television stations in the U.S.

This brief history of Nexstar Media Group explores its pivotal moments, from its initial broadcast endeavors to its current position as a leading media company. The journey of Nexstar, marked by strategic acquisitions and a keen understanding of the evolving media environment, showcases its impressive growth. We'll delve into key milestones, its substantial ownership in television stations, and the challenges it has overcome to become a dominant force in broadcasting.

What is the Nexstar Media Group Founding Story?

The story of Nexstar Media Group, a prominent media company, began on June 17, 1996. It was formally established as Nexstar Broadcasting Group by Perry A. Sook, a key figure in the broadcasting industry. This marked the start of a journey that would see the company grow into a significant player in the local television market.

Sook's vision for Nexstar started with the acquisition of WYOU, a television station located in Scranton, Pennsylvania, from Diversified Communications. This transaction, finalized on September 28, 1996, served as the foundation upon which Sook built his local broadcast television enterprise. This initial move set the stage for the company's future acquisitions and operational strategies.

The initial business model of Nexstar centered on acquiring and operating local television stations. This approach focused on delivering local programming and content to its audiences. A significant early strategic move occurred in 1998 when Nexstar purchased WBRE-TV in Wilkes-Barre, Pennsylvania. This led to an innovative 'shared-services' agreement, demonstrating Nexstar's adaptability and foresight.

Nexstar Media Group was founded in 1996 by Perry A. Sook, starting with the acquisition of WYOU. The company's early strategy focused on acquiring and operating local television stations.

- Nexstar Broadcasting Group was established on June 17, 1996.

- The first acquisition was WYOU in Scranton, Pennsylvania, finalized on September 28, 1996.

- The company initially focused on local programming and content.

- In 1998, Nexstar purchased WBRE-TV, leading to a shared-services agreement.

Nexstar's early growth was supported by ABRY Partners. The company's focus on local content and strategic acquisitions helped it establish a strong presence in various markets. In the early days, Sook designated WYOU as Nexstar's flagship station, even maintaining an office off its newsroom for years. This dedication to local broadcasting and strategic planning were key to the company's initial success.

The purchase of WBRE-TV in 1998 was a pivotal moment. To comply with regulations, WYOU was 'sold' to Mission Broadcasting, but a shared-services agreement was established. This agreement allowed WYOU's sales staff to remain in Scranton while production and news operations moved to WBRE's offices. This innovative approach to operations and regulatory compliance laid the groundwork for future expansion and efficiency. For more information on how the company has grown, read the Marketing Strategy of Nexstar Media Group.

Nexstar Media Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Nexstar Media Group?

The early years of Nexstar Media Group were marked by strategic acquisitions and rapid expansion within the broadcasting industry. This period saw the company grow significantly through the purchase of various television stations. These early moves laid the foundation for its future growth and established it as a key player in the media landscape.

Following its founding,

The company continued its expansion throughout the 2010s, building broadcast and digital teams. In July 2012, Nexstar agreed to purchase eleven stations and Inergize Digital Media from Newport Television. A significant strategic shift occurred in 2005 when Nexstar, under Perry A. Sook, pioneered requesting retransmission fees from pay-TV services for local programming, creating a new revenue stream.

Nexstar began authorizing a quarterly cash dividend policy in 2012, with the first payment made in 2013, signaling financial stability and a commitment to shareholder returns. These financial moves were key to the

The retransmission fee strategy initiated by Nexstar in 2005 has become a substantial revenue source for local broadcasters. This move has had a lasting impact on the industry. The growth of

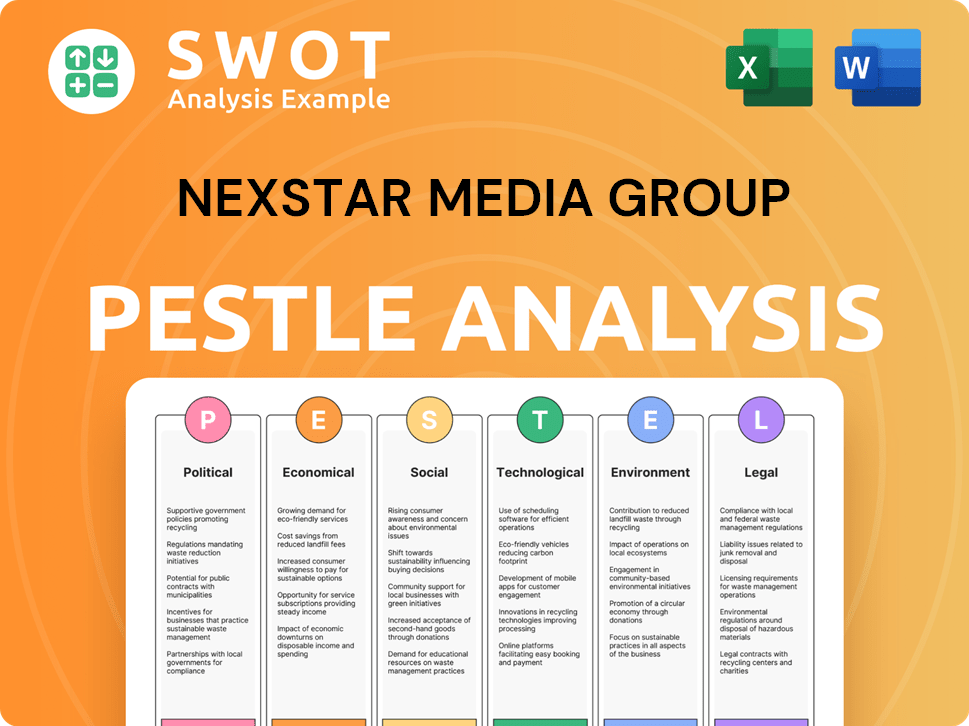

Nexstar Media Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Nexstar Media Group history?

The Nexstar Media Group has a rich history marked by strategic moves and significant growth in the media industry. From its early days, the company has consistently expanded its footprint and diversified its offerings, establishing itself as a major player in broadcasting.

| Year | Milestone |

|---|---|

| 2005 | Pioneered securing retransmission consent fees from pay-TV providers, creating a new revenue stream. |

| 2017 | Completed the acquisition of Media General for $4.6 billion, adding 71 television stations to its portfolio. |

| 2018 | Acquired Tribune Media Company for $6.4 billion, becoming the largest local broadcast television operator in the U.S. |

| 2020 | Launched NewsNation on WGN America, later rebranding it as NewsNation in March 2021. |

| 2021 | Acquired The Hill for $130 million and partnered with SportsGrid Inc. to launch a sports betting streaming channel. |

| 2022 | Acquired a 75% stake in The CW network, aiming for profitability by 2026. |

Innovations at Nexstar have included pioneering new revenue models and expanding content offerings. The company has consistently adapted to the changing media landscape through strategic acquisitions and the launch of new channels and digital platforms.

Nexstar was an early adopter of securing retransmission consent fees, which significantly boosted its revenue. This move set a precedent for other broadcasters and helped to stabilize revenue streams.

The company has grown substantially through acquisitions, including Media General and Tribune Media, expanding its reach. These acquisitions have solidified Nexstar's position as a major media company.

Nexstar launched NewsNation to provide unbiased national news, aiming to capture a broader audience. This expansion into news programming reflects a strategic move to diversify its content offerings.

Acquisitions like The Hill and partnerships with sports betting platforms show Nexstar's focus on digital content. These moves are designed to capitalize on the growing digital media market.

Nexstar's acquisition of a majority stake in The CW network aims to enhance programming and achieve profitability. This move is designed to drive future growth and diversify revenue streams.

Nexstar is advancing technologies like ATSC 3.0 to improve broadcasting capabilities. This technology enhances the quality of the broadcast and expands the capabilities of the television stations.

Despite its successes, Nexstar has faced challenges, including carriage disputes and market fluctuations. The company is actively addressing these issues through strategic initiatives and operational adjustments.

A carriage dispute with Dish Network in December 2020 temporarily removed Nexstar stations from its services. This dispute impacted approximately 63% of TV homes.

The company faces market softness in non-political advertising, impacting revenue. This requires adjustments to financial strategies to maintain profitability.

Expanded sports programming at The CW has led to increased amortization costs, impacting profitability. Net income fell by 41.9% in Q1 2025 compared to Q1 2024.

Nexstar has implemented targeted restructuring actions to reduce operating expenses. These actions include streamlining management and focusing on cost efficiencies.

Nexstar is actively renewing distribution contracts to maintain and grow its revenue streams. This is a key strategy to ensure long-term financial stability.

The media company operates in a competitive market, facing challenges from digital media and changing consumer habits. Nexstar needs to adapt to maintain its position.

Nexstar Media Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Nexstar Media Group?

The history of Nexstar Media Group, a prominent media company, is marked by strategic acquisitions and innovations in the broadcasting industry. Founded in 1996 by Perry A. Sook, the company has grown significantly, expanding its reach through various acquisitions and technological advancements. Nexstar's journey reflects its adaptation to the evolving media landscape, from pioneering retransmission consent fees to embracing new technologies like ATSC 3.0. Understanding the Growth Strategy of Nexstar Media Group provides a deeper insight into its evolution.

| Year | Key Event |

|---|---|

| 1996 | Founded as Nexstar Broadcasting Group by Perry A. Sook; acquired WYOU in Scranton, PA. |

| 2003 | Company went public after acquiring Quorum Broadcasting, doubling its station portfolio. |

| 2005 | Nexstar pioneered retransmission consent fees, establishing a new industry revenue stream. |

| 2012 | Began authorizing a quarterly cash dividend policy. |

| 2016 | Announced agreement to acquire Media General for $4.6 billion. |

| 2017 | Completed Media General acquisition; renamed to Nexstar Media Group, Inc. |

| 2018 | Entered definitive agreement to acquire Tribune Media Company for $6.4 billion. |

| 2019 | Completed Tribune Media acquisition, becoming the largest local broadcast television operator in the U.S. |

| 2020 | Launched NewsNation on WGN America; underwent corporate reorganization merging broadcasting and digital subsidiaries. |

| 2021 | WGN America rebrands as NewsNation; acquired political news website The Hill for $130 million. |

| 2022 | Acquired 75% majority stake in The CW Network. |

| 2024 | Achieved record annual revenue of $5.41 billion. |

| January 2025 | Formed a joint venture with EdgeBeam Wireless to deliver wireless data via ATSC 3.0. |

| February 2025 | Completed acquisition of WBNX-TV/TV55 in Cleveland, which will become a CW affiliate in September 2025. |

| May 2025 | Reports Q1 2025 net revenue of $1.23 billion. |

Nexstar anticipates renewing approximately 60% of its distribution contracts in 2025. This is crucial for maintaining its distribution revenue. In Q1 2025, distribution revenue reached a record $762 million. Securing these renewals is a key strategic priority for the company.

Nexstar aims for The CW network to achieve profitability by 2026. This goal is driven by expanded sports programming and strategic cost management. The focus on The CW reflects Nexstar's efforts to diversify its content offerings and revenue streams.

The company is preparing for the 2026 political advertising cycle, which is expected to boost revenue. Q1 2025 saw a significant drop in political ad revenue due to the absence of major elections. Nexstar anticipates a revenue increase from political advertising in the coming years.

Nexstar is actively pursuing deregulation opportunities, such as the potential repeal of the national ownership cap, which could open new avenues for M&A. The company is also investing in advancing ATSC 3.0 technology, viewing it as a key driver for future growth and value creation in delivering wireless data. The focus on ATSC 3.0 reflects Nexstar's forward-thinking approach to technology.

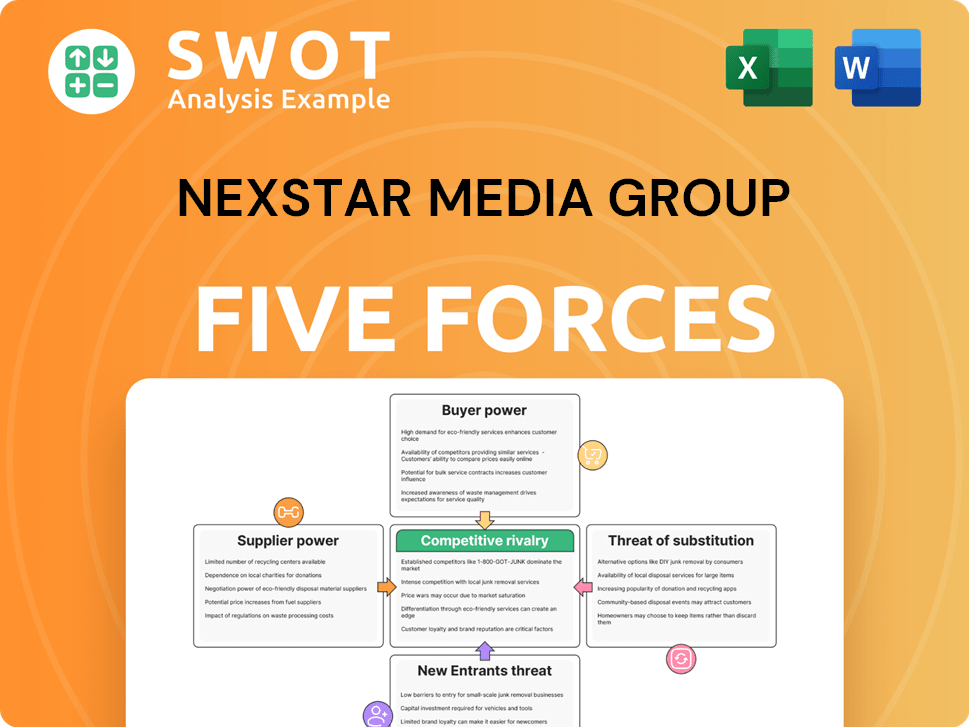

Nexstar Media Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Nexstar Media Group Company?

- What is Growth Strategy and Future Prospects of Nexstar Media Group Company?

- How Does Nexstar Media Group Company Work?

- What is Sales and Marketing Strategy of Nexstar Media Group Company?

- What is Brief History of Nexstar Media Group Company?

- Who Owns Nexstar Media Group Company?

- What is Customer Demographics and Target Market of Nexstar Media Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.