Organon Bundle

How has Organon shaped the landscape of women's health?

From its humble beginnings in 1923, Organon has evolved into a global healthcare leader. Initially focused on pioneering pharmaceutical solutions, this Organon SWOT Analysis reveals the company's strategic journey. This article explores the fascinating Organon history, charting its course from a Dutch pharmaceutical company to its current status as a champion for women's well-being.

Discover the pivotal moments that defined the Organon company, including its early innovations and strategic shifts. Learn about the company's significant milestones, its contributions to history of medicine, and its response to market changes. Uncover the details of its spin-off from Merck & Co. and how it has positioned itself in the global healthcare market, focusing on women's health needs.

What is the Organon Founding Story?

The Organon story began in 1923, marking the birth of a significant pharmaceutical company. It was originally established as Organon International in Oss, North Brabant, Netherlands. This pivotal moment set the stage for the company's evolution and its impact on the world of medicine.

The founding of Organon was a collaborative effort. Professor Ernst Laqueur, a physiologist and endocrinologist from the University of Amsterdam, joined forces with Saal van Zwanenberg, the owner of a slaughterhouse, Zwanenbergs Slachterijen en Fabrieken. This partnership led to the development of Organon's first product.

In its inaugural year, Organon launched insulin, becoming the first company in Europe to commercialize this life-saving treatment for diabetes. This early success established Organon's commitment to innovation and its role in advancing healthcare.

Organon's early focus was on hormone-based therapies, a strategic move that shaped its future. The company's name, 'Organon,' derived from Aristotle's writings, reflected its dedication to scientific inquiry.

- 1923: Organon is founded in Oss, Netherlands.

- 1923: Organon launches insulin, its first product.

- 1930s: Organon begins manufacturing estrogens, such as estrone (Menformon).

- The company's focus on hormone-based therapies and its commitment to research and development solidified its position in the pharmaceutical industry.

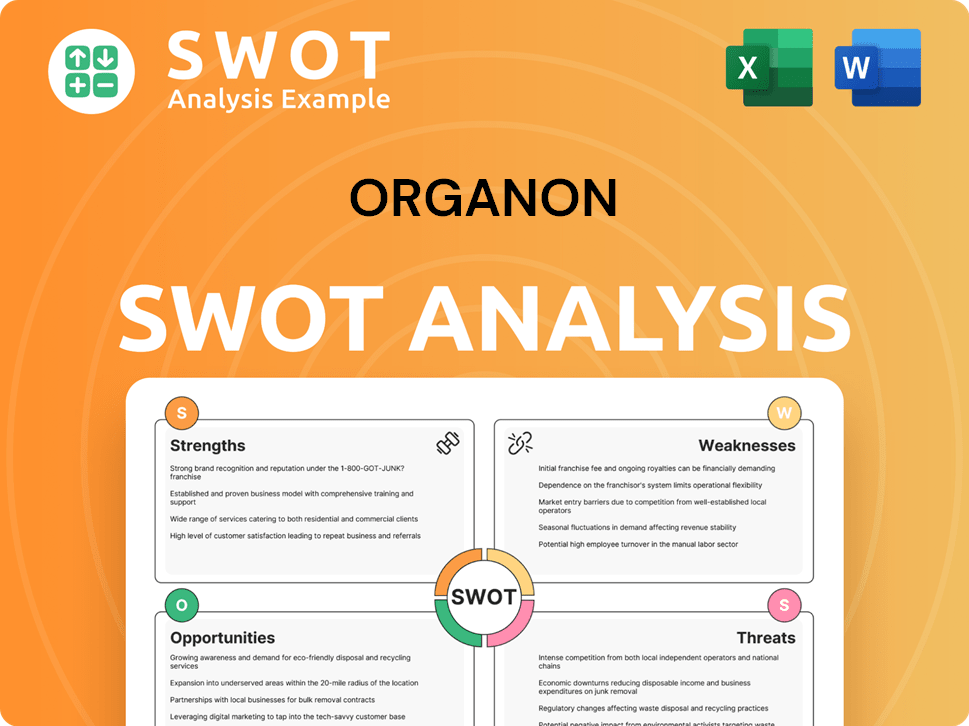

Organon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Organon?

The early years of the Organon company saw significant growth and expansion, marked by strategic product diversification and increased global reach. This pharmaceutical company quickly evolved from its initial focus, broadening its portfolio and establishing a strong presence in the industry. Key milestones shaped its trajectory, including acquisitions and mergers that further solidified its position in the market.

Following its initial success with insulin, Organon expanded its offerings to include estrogens in the 1930s. This diversification marked an early step in its evolution as a key player in hormone-based therapies. This expansion set the stage for future innovations and contributions to women's health.

A pivotal move was the acquisition of the Newhouse research site in Scotland in 1948, significantly boosting its research and development capabilities. This strategic investment in research infrastructure enabled Organon to accelerate its innovation pipeline. Subsequently, the company initiated cortisone production in 1953, further expanding its product range.

The introduction of the contraceptive pill in 1962 was a defining moment, propelling Organon onto the global stage. This innovation transformed the company into a major player in the pharmaceutical industry. This product launch significantly impacted Organon's global presence.

In 1969, the company merged with AKU to form AKZO, later known as Akzo Nobel. Organon continued as the human healthcare business unit. In 2004, Organon acquired Diosynth, integrating its supply chain. The 2007 acquisition by Schering-Plough, valued at €11 billion, included Organon BioSciences and Intervet.

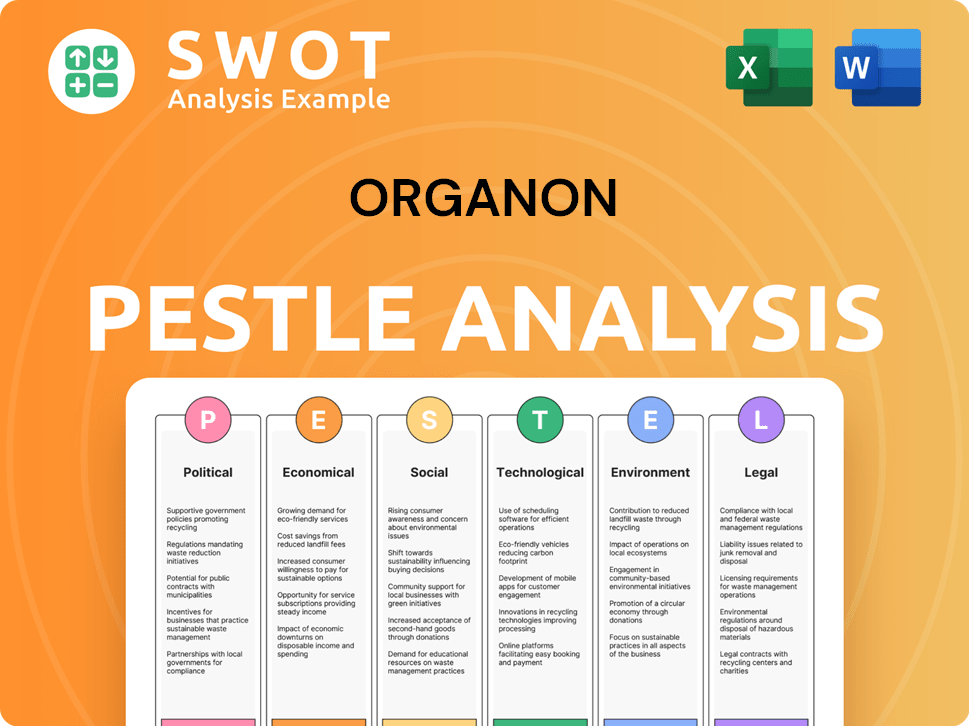

Organon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Organon history?

The Organon company has a rich Organon history, marked by significant milestones in the pharmaceutical industry, particularly in women's health. The Organon company has evolved through various stages, from its early innovations to its current independent status.

| Year | Milestone |

|---|---|

| 1962 | Introduction of one of the first contraceptive pills, establishing Organon as a pioneer in contraception. |

| 1983 | Development of Norcuron, an innovative product in anesthesia. |

| 1994 | Launch of Esmeron, a fast-onset muscle relaxant used in over 125 million patients worldwide. |

| 2007 | Acquisition by Schering-Plough. |

| 2009 | Merger into Merck & Co. |

| 2021 | Spin-off from Merck, becoming an independent company. |

The Organon company has been at the forefront of medical innovation, particularly in women's health. The company's portfolio includes fertility drugs like Puregon and the contraceptive implant Nexplanon.

Organon was a pioneer in the development and introduction of one of the first contraceptive pills in 1962, marking a significant advancement in women's health and reproductive control. This innovation established Organon's early reputation.

Organon developed innovative anesthesia products such as Norcuron (1983) and Esmeron (1994), which became widely used in medical procedures. Esmeron, in particular, has been used in over 125 million patients globally.

The company expanded its offerings to include fertility drugs like Puregon, addressing the needs of individuals and couples seeking assistance with conception. These drugs have helped many people.

Organon also introduced the contraceptive implant Nexplanon, providing a long-acting, reversible contraceptive option. This innovation offered women a convenient and effective method of birth control.

Despite its innovative contributions, Organon has faced several challenges. The company has also experienced market headwinds, including a forecasted 2.7% revenue decline.

The Organon company has faced challenges related to harmonizing business processes, data, and technology globally after its spin-off from Merck in June 2021. The company also needed to address low segmentation and targeting rates.

The company anticipates top-line sales reductions in its Established Brands segment, projected to decline by over 5% in 2025, and the loss of exclusivity for Atozet in Europe is expected to result in a $200 million revenue headwind for 2025. Organon's first quarter 2025 results showed a 7% year-over-year revenue decline to $1.513 billion.

Organon is navigating a securities fraud lawsuit filed in May 2025, following a significant dividend cut, which triggered a sharp decline in its stock price. The company is implementing cost efficiency measures to drive $200 million in operating savings for 2025.

The Organon company is experiencing a decline in sales of legacy products, such as NuvaRing, which saw a 41% decrease in sales during the first quarter of 2025. This decline impacts overall revenue performance.

The Organon company aims to overcome these challenges through strategic initiatives and a commitment to its core mission. These initiatives include cost-cutting measures and a focus on key therapeutic areas.

A key element of Organon's strategy is its renewed focus on women's health, biosimilars, and established brands, as the company seeks to capitalize on its existing strengths and address unmet needs in the market. You can learn more about the Target Market of Organon.

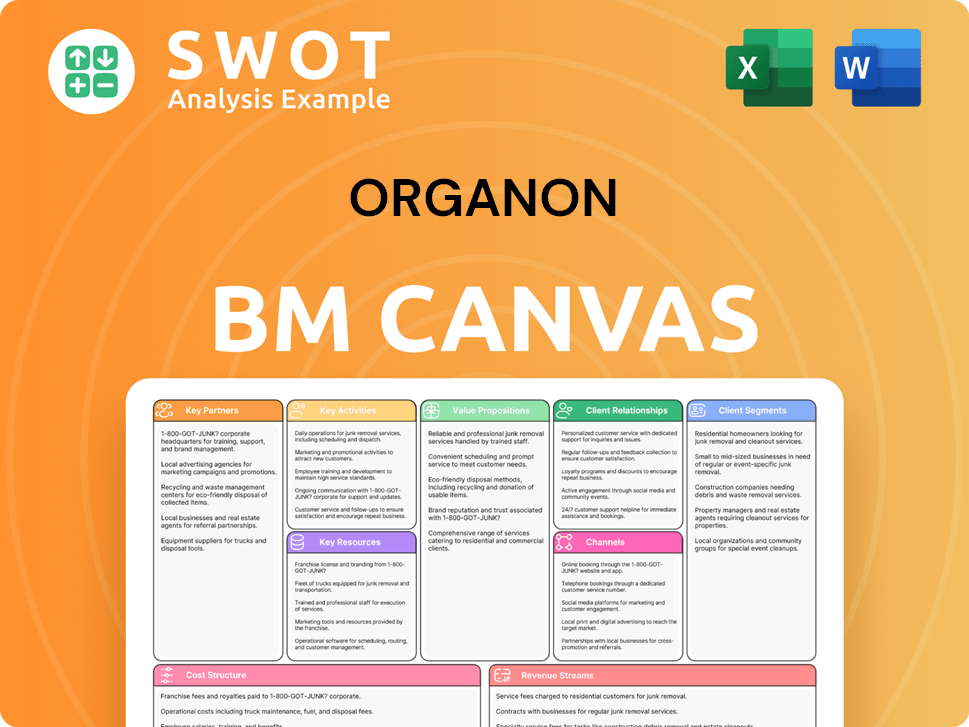

Organon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Organon?

The Organon company has a rich history, marked by significant transformations and a strong focus on women's health. From its inception in the Netherlands to its current status as an independent global healthcare company, Organon has consistently adapted and innovated within the pharmaceutical industry. Its journey includes pioneering work in hormone therapy and contraception, alongside strategic acquisitions and mergers that have shaped its global footprint and product portfolio.

| Year | Key Event |

|---|---|

| 1923 | Founded in Oss, Netherlands, as Zwanenberg-Organon, with its first product being insulin. |

| 1930s | Began manufacturing estrogens, including Menformon. |

| 1948 | Acquired the Newhouse research site in Scotland. |

| 1953 | Initiated cortisone production. |

| 1962 | Introduced the contraceptive pill, becoming a major player in global pharmaceuticals. |

| 1969 | Merged with AKU to form AKZO, later Akzo Nobel. |

| 1983 | Introduced Norcuron in anesthesia. |

| 1994 | Launched Esmeron, a fast-onset muscle relaxant. |

| 2004 | Acquired Diosynth, an active pharmaceutical ingredient producer. |

| 2007 | Acquired by Schering-Plough for €11 billion. |

| 2009 | Merged with Merck & Co. (MSD). |

| 2012 | Organon's R&D location transformed into Pivot Park after Merck closed early research facilities. |

| June 2021 | Spun off from Merck & Co. to become an independent global healthcare company focused on women's health, biosimilars, and established brands. |

| 2023 | Reported strong performance in women's health and biosimilars; revenue for full year 2023 was $6.263 billion. Established Organon LLC in Vietnam in August 2023. |

| 2024 | Full year revenue reached $6.4 billion, reflecting 3% growth at constant currency. Nexplanon grew 17% ex-FX to $963 million. |

| Q1 2025 | Reported revenue of $1.513 billion; Women's Health revenue increased 12% ex-FX. |

| Late 2025 | Preparing for a potential U.S. denosumab launch in the Biosimilars segment. |

The company is projecting a full year 2025 revenue between $6.125 billion and $6.325 billion, despite a $200 million foreign currency headwind. The Women's Health franchise, with products like Nexplanon, is a key driver of growth.

Organon is concentrating on its Women's Health franchise, expanding products like Vtama, and exploring business development opportunities. They are actively managing the loss of exclusivity for certain products and addressing generic competition.

Organon aims to achieve a net leverage ratio below 4.0x by the end of 2025. They also anticipate generating over $900 million in free cash flow before one-time costs in 2025.

The company is focused on cost-efficiency measures, aiming for $200 million in operating savings for 2025. This strategy supports their overall financial and operational goals.

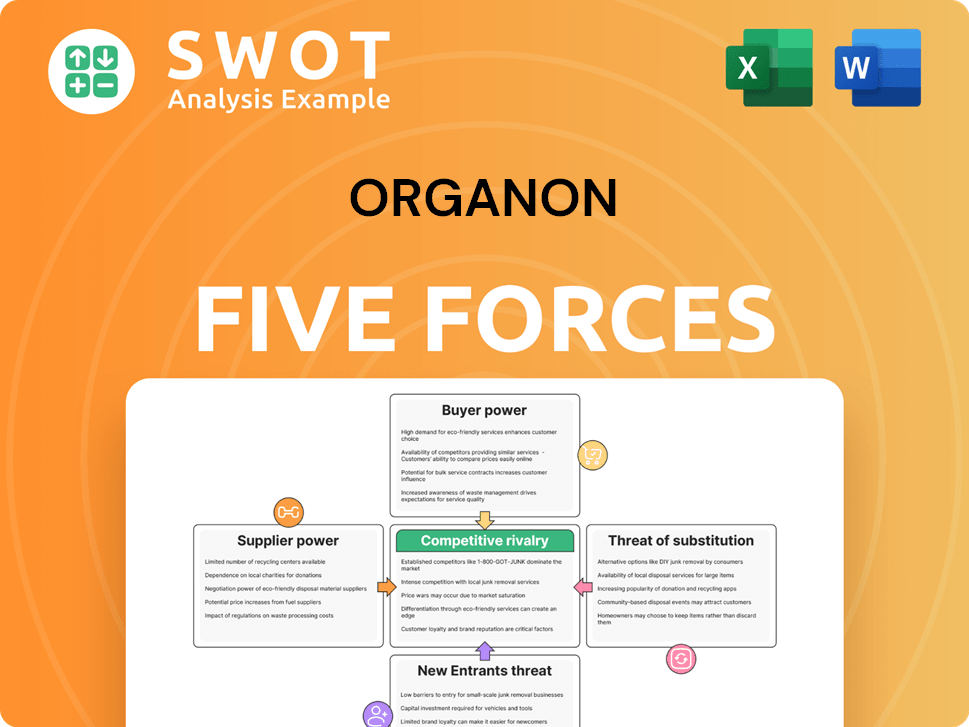

Organon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Organon Company?

- What is Growth Strategy and Future Prospects of Organon Company?

- How Does Organon Company Work?

- What is Sales and Marketing Strategy of Organon Company?

- What is Brief History of Organon Company?

- Who Owns Organon Company?

- What is Customer Demographics and Target Market of Organon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.