Pinnacle Financial Partners Bundle

How Did Pinnacle Financial Partners Rise to Prominence?

Discover the compelling story of Pinnacle Financial Partners, a financial institution that has redefined banking in the Southeastern United States. From its inception in 2000, this company has prioritized client relationships and personalized financial advice. Learn how a group of Nashville entrepreneurs identified a market gap and built a bank focused on service.

Pinnacle Financial Partners, a significant player among Tennessee banks, began its journey with a clear vision: to offer a superior banking experience. This commitment to client-centric service has fueled its remarkable expansion. Starting operations in October 2000, Pinnacle Financial Partners quickly established itself, now operating in 15 urban markets. For a deeper dive into their strategic approach, consider exploring a Pinnacle Financial Partners SWOT Analysis.

What is the Pinnacle Financial Partners Founding Story?

The story of Pinnacle Financial Partners began on February 20, 2000. A group of twelve Nashville businessmen came together with a shared vision: to establish a locally-owned financial firm. This marked the start of what would become a significant player in the Tennessee banking landscape.

The company officially opened its doors on October 27, 2000, in downtown Nashville. The founding team, including M. Terry Turner, Robert A. McCabe, Jr., and Hugh M. Queener, brought extensive experience from the financial industry. Their goal was to create a bank focused on strong client relationships and local decision-making, setting the stage for the company's future growth and success.

Pinnacle Financial Partners was founded in 2000 by twelve Nashville businessmen with a vision to create a locally-owned financial firm, addressing the need for personalized banking services.

- The company started operations on October 27, 2000, in Nashville.

- Key founders included M. Terry Turner, Robert A. McCabe, Jr., and Hugh M. Queener, bringing experience from First American Corporation.

- The bank aimed to fill the gap left by the consolidation of local financial institutions, focusing on relationship-based banking.

- Pinnacle Financial Partners went public on the NASDAQ in May 2002, trading under the symbol PNFP. Learn more about the Owners & Shareholders of Pinnacle Financial Partners.

The founders of Pinnacle Financial Partners identified an opportunity to provide personalized banking services in the Nashville metropolitan area. They observed that the consolidation of local financial institutions into larger entities had created a need for relationship-focused banking. Their business model centered on offering a comprehensive suite of financial services, including banking, investment, and insurance products, tailored for small to medium-sized businesses and affluent households. They differentiated themselves by providing 'distinctive service, effective advice, and extraordinary convenience.'

Pinnacle's initial strategy was built on local decision-making and a focus on attracting top talent. This approach helped them build a strong client base and foster loyalty. The company's early success set the foundation for its expansion and its role as a significant player among Tennessee banks. The company's commitment to building relationships and anticipating client needs reflects its philosophy as a 'challenger brand' in the financial sector.

The company's financial performance has been noteworthy. For example, in Q1 2024, Pinnacle Financial Partners reported net revenue of $391.1 million, a slight decrease compared to the $394.2 million reported in Q4 2023. Net income for Q1 2024 was $82.2 million, or $1.45 per diluted share. The company's total assets stood at $47.0 billion as of March 31, 2024. These figures highlight the company's steady performance and its ability to navigate the financial landscape.

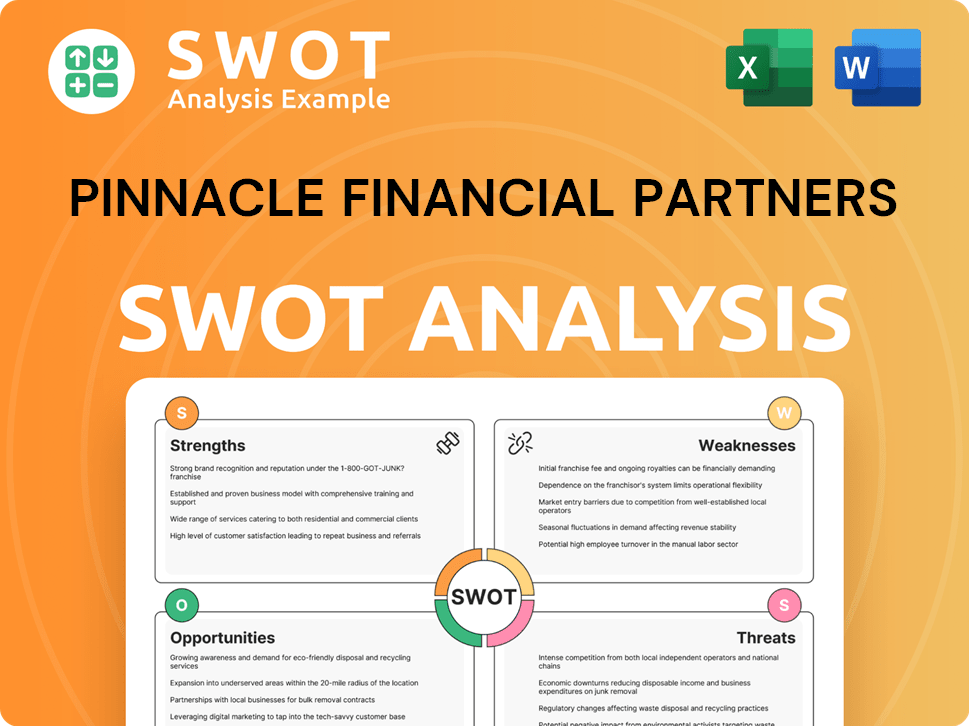

Pinnacle Financial Partners SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Pinnacle Financial Partners?

The early growth of Pinnacle Financial Partners was marked by rapid expansion following its inception in October 2000. The company's strategic approach involved both organic growth and strategic acquisitions. This strategy, combined with a focus on attracting top talent, allowed Pinnacle Financial Partners to establish a strong market presence. The company's history shows a commitment to providing distinctive service.

In May 2002, Pinnacle Financial Partners went public on the NASDAQ, trading under the symbol PNFP. By 2003, the company had successfully raised $20 million in capital through its initial public offering (IPO). This infusion of capital supported the company's early growth initiatives and expansion plans. For more insight into the company's financial performance, consider reading Revenue Streams & Business Model of Pinnacle Financial Partners.

Early developments at Pinnacle Financial Partners included expanding its product and service offerings. These expanded to include a wide range of commercial loans, residential mortgages, and wealth management services. The establishment of Pinnacle Advisory Services, Inc., a registered investment advisor, further broadened the company's service portfolio, providing financial planning services to its clients.

Key acquisitions played a significant role in the early expansion of Pinnacle Financial Partners. The 2012 acquisition of CapitalMark Bank & Trust in Chattanooga, Tennessee, is a prime example. This acquisition broadened its presence in East Tennessee and provided entry into the Chattanooga market. These strategic moves were crucial for expanding its footprint.

A consistent driver of growth for Pinnacle Financial Partners has been its focus on recruiting experienced banking and investment professionals. In late December 2019, the company entered the Atlanta market and built a team of 26 associates. This team included veteran commercial bankers and SBA financial professionals. This strategy has enabled them to compete effectively.

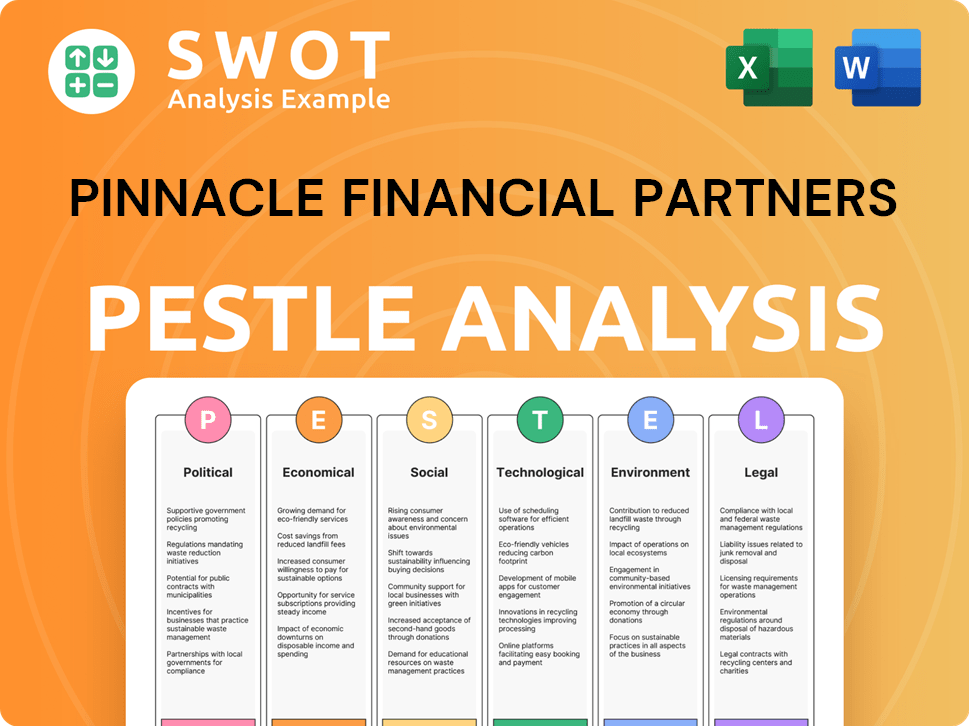

Pinnacle Financial Partners PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Pinnacle Financial Partners history?

Pinnacle Financial Partners, a prominent player among Tennessee banks, has achieved significant milestones since its inception. The Pinnacle Bank history is marked by consistent recognition and strategic growth, solidifying its position in the financial sector. The company has demonstrated a commitment to excellence, as reflected in its numerous accolades and its sustained focus on client service.

| Year | Milestone |

|---|---|

| 2025 | Ranked No. 9 Best Company to Work For in the nation by FORTUNE magazine, marking its ninth consecutive year on the list. |

| 2025 | Received 30 Coalition Greenwich Best Bank awards, the most in the nation, for its service quality in small business and middle market banking. |

| 2024 | American Banker recognized the company as one of America's Best Banks to Work For for the twelfth consecutive year. |

Pinnacle Financial's innovations center on a client-focused model, delivering personalized services and expert advice. They provide a wide range of banking, investment, and insurance products to meet diverse client needs.

The company prioritizes personalized services and effective advice, ensuring clients receive tailored financial solutions. This approach is fundamental to their business strategy and helps them build strong client relationships.

They offer a broad array of sophisticated banking, investment, and insurance products. This comprehensive suite allows them to serve a wide range of financial needs for their clients.

Convenience is a key aspect of their service model, with 24-hour telephone and internet banking available. They also offer debit cards, direct deposit, and courier services for non-cash deposits to businesses.

Pinnacle Financial Partners faces challenges related to market dynamics and competition. While the company has shown resilience, it must navigate economic uncertainties and competitive pressures to sustain its growth. For a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of Pinnacle Financial Partners.

The company must navigate market downturns and economic fluctuations, which can impact financial performance. Economic slowdowns can affect revenue and profitability, requiring strategic adjustments.

Competition from larger regional and super-regional banks poses a continuous challenge. Pinnacle's strategic decisions must consider the competitive environment to maintain its market position.

In Q1 2025, despite strong earnings per share, total revenue fell slightly short of expectations. This highlights the need for continued focus on revenue generation strategies.

Rising wage costs and the potential for economic slowdowns are identified as risks. These factors require careful financial management and strategic planning to mitigate their impact.

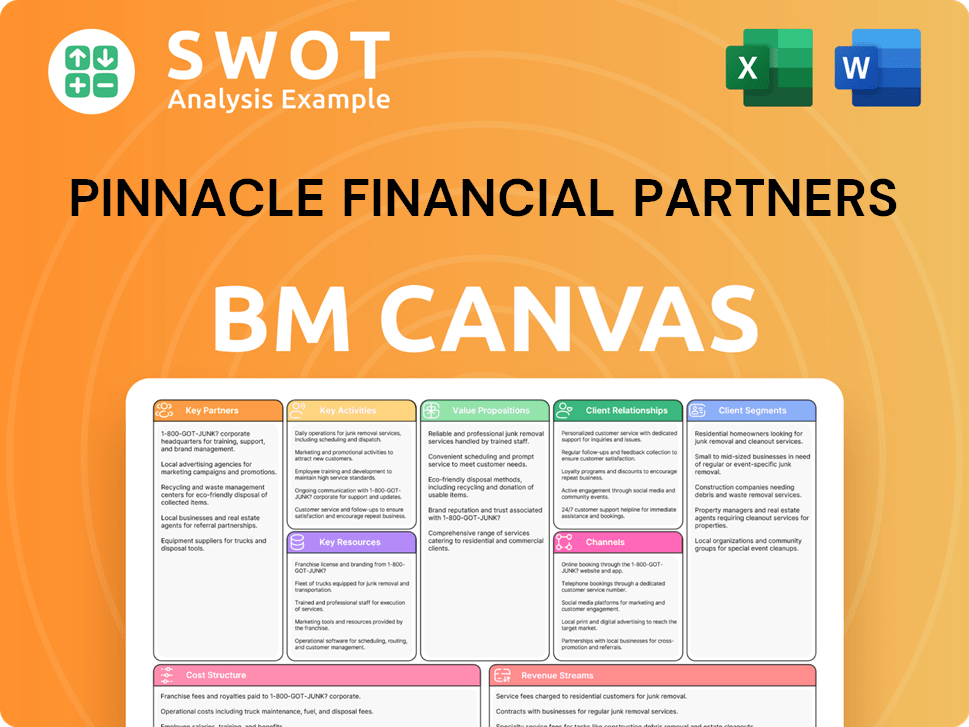

Pinnacle Financial Partners Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Pinnacle Financial Partners?

The story of Pinnacle Financial Partners, a prominent financial institution, began in February 2000 when it was founded by a group of Nashville businessmen. The company, which is one of the leading Tennessee banks, quickly commenced banking operations in October 2000. It then went public in May 2002, raising capital and expanding its reach through strategic acquisitions and market entries. Key milestones include its IPO, headquarters move, and acquisitions, such as the one of BNC Bank, which expanded its footprint across multiple states. In April 2025, the company's financial performance included a diluted EPS of $1.77 and adjusted diluted EPS of $1.90, with total assets reaching $54.3 billion.

| Year | Key Event |

|---|---|

| February 2000 | Pinnacle Financial Partners was founded by twelve Nashville businessmen. |

| October 2000 | Pinnacle National began banking operations in downtown Nashville, TN. |

| May 2002 | The company went public on the NASDAQ with the symbol PNFP. |

| 2003 | Raised $20 million in capital through an IPO. |

| 2010 | Moved into its headquarters, The Pinnacle at Symphony Place, in Downtown Nashville, leasing 65,000 square feet. |

| 2012 | Acquired Chattanooga-based CapitalMark Bank & Trust, expanding into East Tennessee. |

| January 2017 | Announced acquisition of BNC Bank of High Point, North Carolina, expanding operations into North Carolina, South Carolina, and Virginia. |

| June 2017 | Completed the BNC Bank acquisition, a $1.9 billion deal, giving Pinnacle operations in four states. |

| December 2019 | Entered the Atlanta market. |

| October 2020 | Celebrated its 20th anniversary. |

| May 2024 | Pinnacle Financial Partners expands its Ponte Vedra Beach office into a full-service location. |

| April 2025 | Reported Q1 2025 diluted EPS of $1.77 and adjusted diluted EPS of $1.90. Total assets reached $54.3 billion. Expanded into Richmond, VA. |

| April 2, 2025 | Ranked as the No. 9 Best Company to Work For in the nation by FORTUNE magazine and Great Place to Work®. |

| February 27, 2025 | Earned 30 Coalition Greenwich Best Bank awards, more than any other bank in the nation. |

| May 21, 2025 | Jefferies initiated coverage with a Buy recommendation, with an average one-year price target of $115.06/share. |

Pinnacle Financial Partners anticipates loan growth of 8% to 11% for 2025 compared to the end of 2024. The company also aims for 7% to 10% deposit growth in 2025, maintaining a stable net interest margin. Strategic investments in talent and market expansion are expected.

The company plans to continue recruiting top talent in existing markets and is considering expansion into other large urban markets in the Southeast. Its strong capital position and low non-performing loans create opportunities for acquiring distressed assets or smaller competitors, boosting market share.

Analysts project annual revenue for Pinnacle Financial Partners to be $2.108 billion, an increase of 26.35%, and an annual non-GAAP EPS of $9.03 for 2025. The average one-year price target is $116.50/share, with a range from $105.00 to $135.00, suggesting potential upside.

The company's forward-looking strategy aligns with its founding vision: to be a client-focused financial institution that attracts top talent and provides exceptional service. This approach is key to its continued growth and success in the financial services industry.

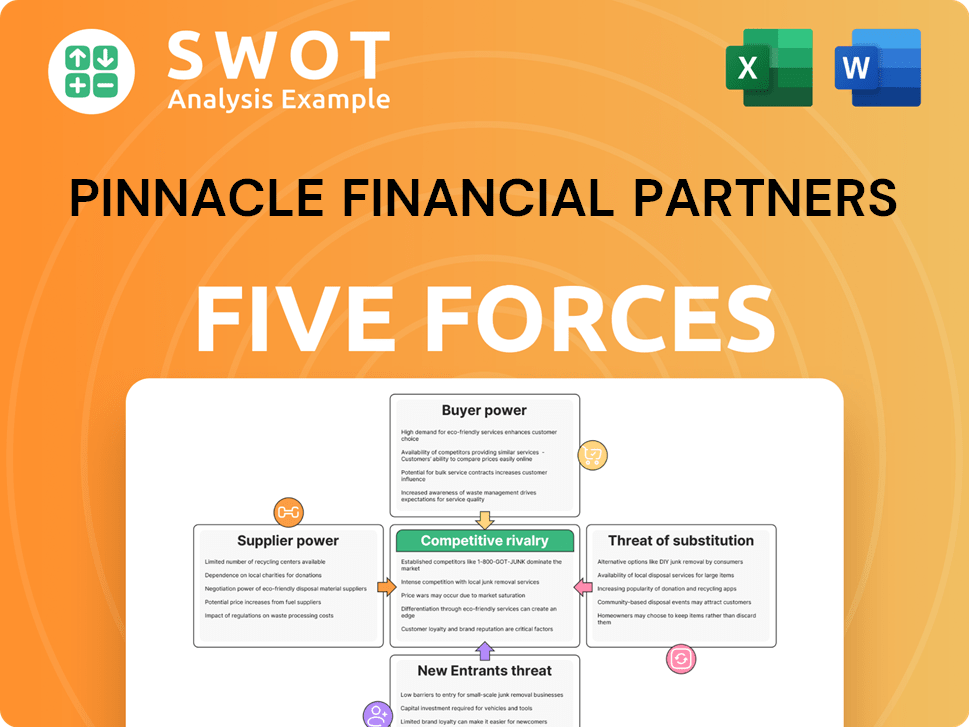

Pinnacle Financial Partners Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Pinnacle Financial Partners Company?

- What is Growth Strategy and Future Prospects of Pinnacle Financial Partners Company?

- How Does Pinnacle Financial Partners Company Work?

- What is Sales and Marketing Strategy of Pinnacle Financial Partners Company?

- What is Brief History of Pinnacle Financial Partners Company?

- Who Owns Pinnacle Financial Partners Company?

- What is Customer Demographics and Target Market of Pinnacle Financial Partners Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.