QCR Holdings Bundle

How has QCR Holdings Shaped the Regional Banking Landscape?

Founded in 1993, QCR Holdings, Inc. has charted a remarkable course in the financial sector. From its inception, the company prioritized a community-focused banking model, setting the stage for substantial growth. This approach has allowed QCR Holdings to build a strong presence across multiple states, adapting to the ever-changing financial landscape.

This QCR Holdings SWOT Analysis provides a detailed look into the company's journey, from its early days to its current standing. Discover the QCR Holdings history, key milestones, and strategic decisions that have shaped this influential multi-bank holding company. Explore the QCR Holdings company profile and understand its impact on the industry, its financial performance, and its future outlook.

What is the QCR Holdings Founding Story?

The story of QCR Holdings begins in 1993 in Moline, Illinois. This marked the founding of what would become a significant player in the financial services sector. The initial vision was brought to life by co-founders Michael Bauer and Doug Hultquist, who aimed to establish a community bank in the Quad Cities area.

The first operational subsidiary, Quad City Bank & Trust (QCBT), opened its doors in Bettendorf, Iowa, in 1994. This marked the beginning of QCR Holdings' journey to provide financial services. Key individuals like James 'Jim' Brownson and Ronald 'Ron' Peterson joined the effort, playing crucial roles on the founding board and championing the community banking model.

The founders identified a need for a relationship-focused banking approach, emphasizing local decision-making and tailored solutions. This approach formed the core of the company's initial business model, offering comprehensive commercial and consumer banking services, alongside trust and wealth management, all deeply rooted in the local communities. For more information on their target market, you can read the article: Target Market of QCR Holdings.

QCR Holdings was founded in 1993, with its first bank opening in 1994. The founders aimed to offer relationship-driven banking in the Quad Cities.

- Founding Date: 1993

- First Subsidiary: Quad City Bank & Trust (QCBT) began operations in 1994.

- Core Philosophy: Relationship-driven banking with local decision-making.

- Initial Services: Full-service commercial and consumer banking, trust, and wealth management.

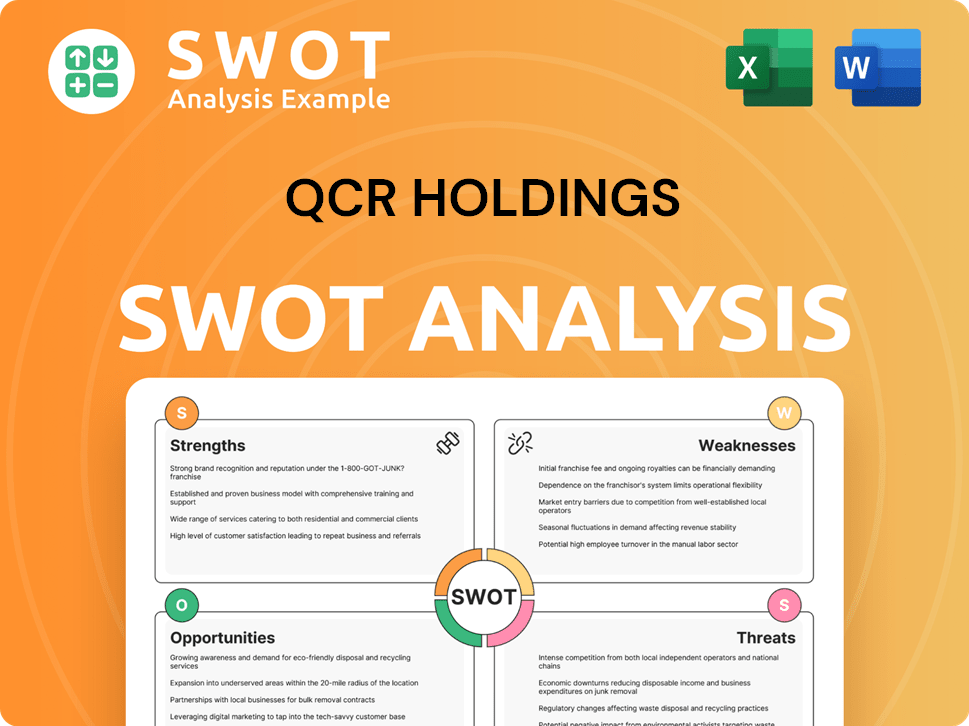

QCR Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of QCR Holdings?

The early growth of QCR Holdings, a key player in the financial services sector, centered on establishing and expanding its presence through subsidiary banks. This QCR Holdings overview highlights how the company strategically grew its footprint. This expansion included entering new markets and integrating acquisitions to broaden its service offerings.

Following the launch of Quad City Bank & Trust in 1994, the company saw the commencement of Cedar Rapids Bank & Trust in 2001. This period marked the transformation into a multi-bank holding company, extending its reach across Iowa, including Cedar Valley and Des Moines/Ankeny, and later into Springfield, Missouri. The company's strategic moves reflect its commitment to growth and market penetration.

The initial team expanded organically from approximately a dozen employees in 1994 to around 1,000 employees today. The asset base grew significantly, from $340 million when Todd Gipple joined as CFO to over $9 billion, a 30-fold increase over 25 years. This growth underscores the company's financial performance and strategic vision.

Acquisitions and mergers have been pivotal in QCR Holdings' expansion. The acquisition of Guaranty Federal Bancshares, Inc. in November 2021, enhanced its market share in Springfield, Missouri. This merger was projected to result in approximately 13% EPS accretion in the first full year, demonstrating the impact of these strategic moves on the company's financial outcomes.

Leadership transitions have also shaped QCR Holdings’ growth. Todd A. Gipple, who joined early in the company's history, assumed the role of President and CEO in May 2025, succeeding Larry J. Helling. This change aims to streamline governance and increase agility, positioning the company for future success.

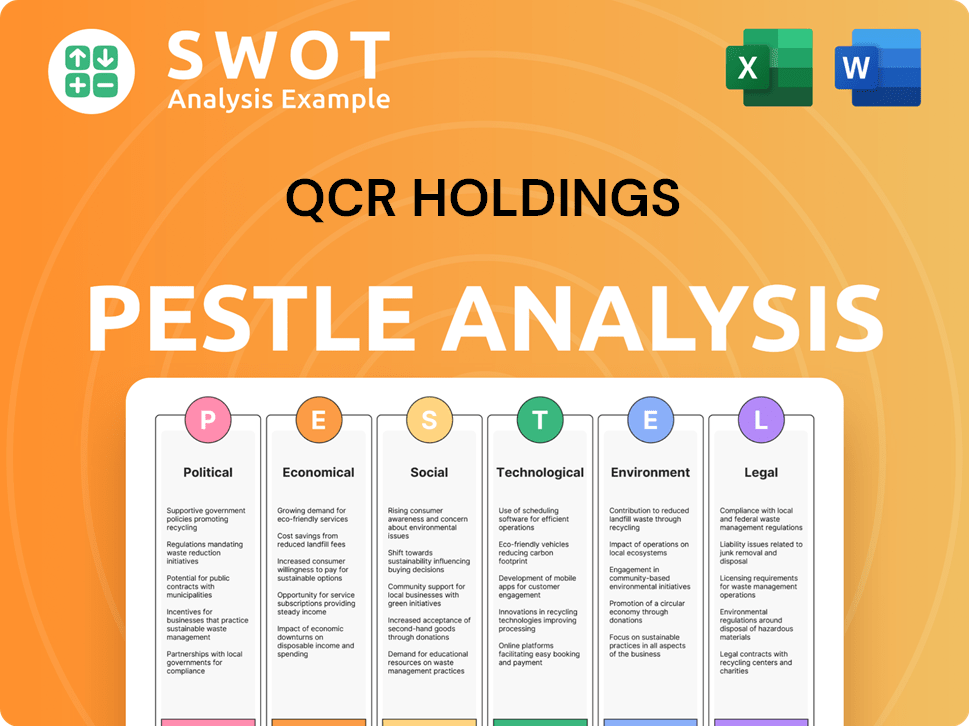

QCR Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in QCR Holdings history?

The QCR Holdings has achieved several significant milestones throughout its QCR Holdings history, marked by consistent growth and strategic initiatives. The QCR Holdings company has demonstrated a strong financial performance over the years, which has solidified its position in the financial services sector. The company's journey reflects a commitment to strategic growth and adaptation within the financial services industry.

| Year | Milestone |

|---|---|

| 2024 | Achieved a record year of net income, reaching $113.9 million for the full year. |

| 2024 | Demonstrated strong financial performance with an adjusted return on average assets (ROAA) of 1.35%. |

| March 2025 | Maintained robust capital ratios, with a Common Equity Tier 1 (CET1) ratio of 10.26% and total risk-based capital at 14.16%. |

QCR Holdings has shown innovation through its focus on its LITECH lending program and wealth management growth. The company continues to adapt and innovate to meet the evolving needs of its customers and the market.

The company has been focused on its LITECH lending program, which is part of its innovative approach to financial services. This program reflects QCR Holdings' commitment to leveraging technology to enhance its services.

Wealth management growth has been a key area of innovation, with an annualized growth of 14% in the first quarter of 2025. This growth indicates the company's success in expanding its wealth management services.

QCR Holdings reported robust core deposit growth of 20% annualized in Q1 2025. This growth highlights the company’s ability to attract and retain deposits.

Wealth management revenue grew by 14% annualized in Q1 2025, demonstrating the effectiveness of the company’s wealth management strategies. This growth shows the positive impact of its innovative approaches.

QCR Holdings has faced challenges, including market downturns and macroeconomic uncertainties. The company addresses these challenges through strategic efficiency and capital management.

QCR Holdings has navigated market downturns, which have impacted its financial performance. These downturns have required the company to adapt its strategies to maintain stability.

Macroeconomic uncertainties have influenced the company's noninterest income, particularly affecting its low-income housing tax credit (LIHTC) lending business. The company has had to adjust to changing economic conditions.

Despite a revenue shortfall in Q1 2025, coming in at $76.88 million compared to an anticipated $94.01 million, the company maintained a strong net income of $26 million. This demonstrates the company’s resilience.

The company focuses on strategic efficiency to address challenges, concentrating on capital, lending, and wealth management. This approach helps QCR Holdings to optimize its operations.

Capital ratios have remained robust, with a Common Equity Tier 1 (CET1) ratio of 10.26% as of March 2025. This strong capital position provides a buffer against economic challenges.

Recent executive transitions and the decision to reduce the board size from 13 to 11 members underscore a commitment to streamlined governance. These changes support agility in navigating modern challenges.

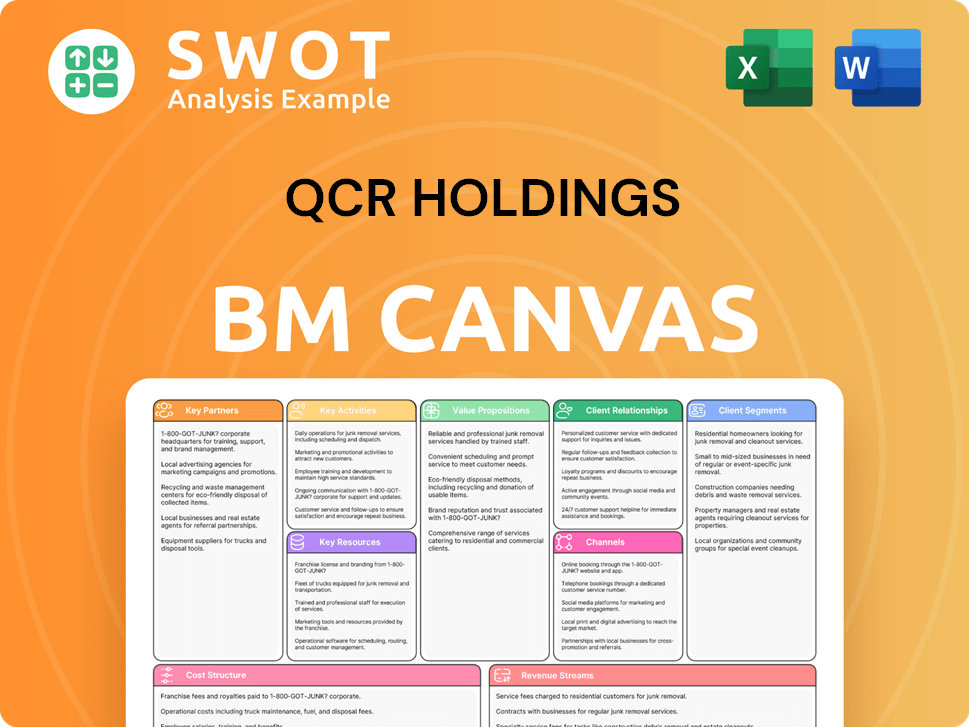

QCR Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for QCR Holdings?

The brief history of QCR Holdings company begins in 1993 when it was founded in Moline, Illinois. Over the years, QCR Holdings has expanded its financial services through strategic acquisitions and organic growth, establishing a strong presence in the Midwest. Significant milestones include the establishment of Quad City Bank & Trust in 1994 and the acquisition of Guaranty Federal Bancshares, Inc. in November 2021, which expanded its footprint in Springfield, Missouri. The company has also navigated leadership transitions and strategic decisions, such as the sale of certain subsidiaries and the retirement of key executives. For a deeper dive into their marketing approach, consider the Marketing Strategy of QCR Holdings.

| Year | Key Event |

|---|---|

| 1993 | QCR Holdings, Inc. is founded in Moline, Illinois. |

| 1994 | Quad City Bank & Trust (QCBT) commences operations in Bettendorf, Iowa. |

| 2001 | Cedar Rapids Bank & Trust commences operations in Cedar Rapids, Iowa. |

| 2006 | First Wisconsin Bank & Trust, a Milwaukee subsidiary, commences operations. |

| 2008 | QCR Holdings signs an agreement to sell its Milwaukee subsidiary, First Wisconsin Bank & Trust. |

| 2019 | Doug Hultquist steps down as CEO; Larry J. Helling becomes CEO. |

| August 13, 2019 | QCR Holdings announces an agreement to sell its Rockford subsidiary, Rockford Bank and Trust. |

| November 2021 | QCR Holdings acquires Guaranty Federal Bancshares, Inc., expanding its presence in Springfield, Missouri. |

| December 31, 2024 | QCR Holdings reports record net income of $113.9 million for the full year. |

| January 22, 2025 | QCR Holdings announces fourth-quarter 2024 results and record net income for the full year 2024. |

| February 24, 2025 | QCR Holdings announces CEO retirement and executive transition, with Todd A. Gipple becoming President and CEO. |

| March 31, 2025 | Company reports $9.2 billion in assets, $6.8 billion in loans, and $7.3 billion in deposits. |

| April 22, 2025 | QCR Holdings announces net income of $25.8 million for the first quarter of 2025. |

| May 23, 2025 | QCR Holdings announces annual meeting results and a cash dividend of $0.06 per share, payable on July 3, 2025. |

QCR Holdings anticipates gross loan growth between 8% and 10% for 2025. The company targets net loan growth between 1% and 3%, considering a planned loan securitization. A significant securitization of approximately $350 million is expected to boost its capital position.

The company is focused on its '9-6-5 strategic model' to achieve top-quartile financial performance. This model includes 9% loan growth, 6% growth in fee income, and 5% expense growth. These strategies are designed to drive continued growth and enhance shareholder value.

For the second quarter of 2025, QCR Holdings projects loan growth of 4-6% annualized. The company anticipates a static to slightly improved net interest margin. The company is committed to delivering top-tier financial performance.

QCR Holdings is committed to delivering top-tier financial performance. The company aims for continued growth in earnings per share and substantial growth in tangible book value per share. The relationship-driven approach aims to ensure success.

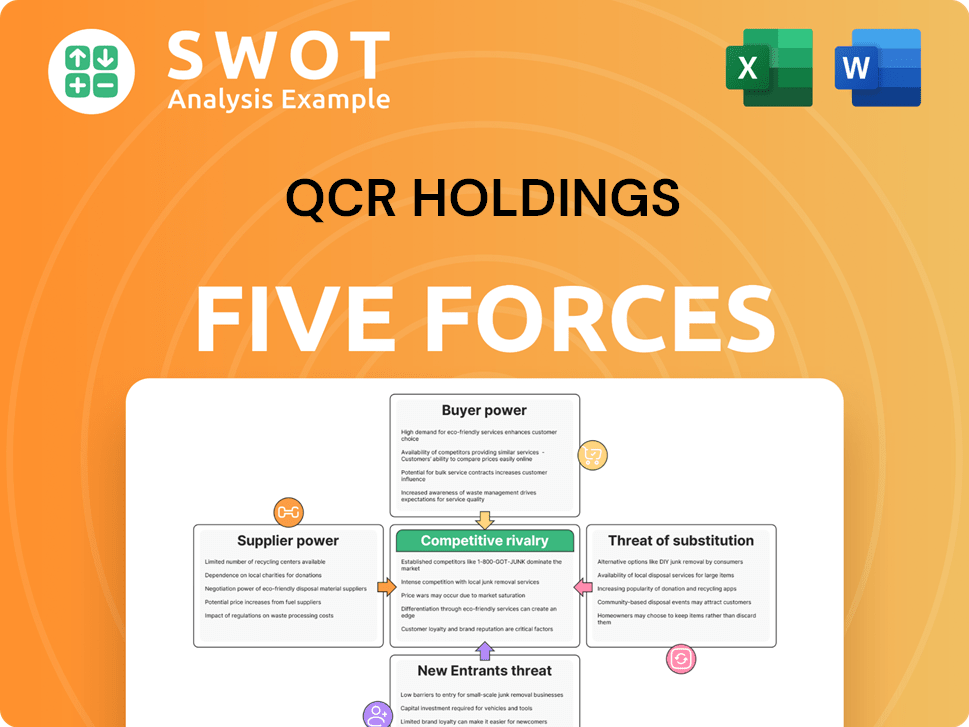

QCR Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of QCR Holdings Company?

- What is Growth Strategy and Future Prospects of QCR Holdings Company?

- How Does QCR Holdings Company Work?

- What is Sales and Marketing Strategy of QCR Holdings Company?

- What is Brief History of QCR Holdings Company?

- Who Owns QCR Holdings Company?

- What is Customer Demographics and Target Market of QCR Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.