Signet Jewelers Bundle

How Did Signet Jewelers Become a Jewelry Giant?

Journey into the captivating Signet Jewelers SWOT Analysis and discover the remarkable evolution of the world's largest jewelry retailer. From its humble beginnings in 1949 as Ratner Group, Signet Jewelers has transformed the diamond industry. Explore the key moments that shaped this retail history and propelled it to global prominence.

This exploration into the brief history of Signet Jewelers will reveal how strategic acquisitions and a keen understanding of the diamond market fueled its expansion. Learn about the early days of Signet Jewelers, its key milestones, and the diverse portfolio of brands that solidified its position as a leading jewelry retailer. Uncover the factors behind Signet's enduring success and its ongoing influence in the ever-evolving retail landscape.

What is the Signet Jewelers Founding Story?

The story of Signet Jewelers, a prominent jewelry retailer, began in 1949. Founded in the United Kingdom by Leslie Ratner, the company initially operated under the name Ratner Group. The vision was to create a jewelry business that offered accessible and valuable products to a broad customer base.

Leslie Ratner's retail experience and understanding of consumer demand were crucial in establishing the company. The focus was on providing a wide selection of jewelry, particularly diamond pieces, to meet the needs of the post-war consumer market. This strategic approach laid the foundation for what would become a major player in the diamond industry.

The early days of Signet Jewelers, or Ratner Group as it was then known, were marked by a commitment to expanding its retail presence and offering competitive pricing. Initial funding likely came from the founder's capital and early operational revenues. The economic climate of the time, characterized by rising consumer spending, favored the growth of jewelry retail. This environment enabled the company to gradually build its reputation.

Ratner Group's early operations emphasized value and accessibility, catering to the post-war market. The initial business model focused on a diverse selection of jewelry, especially diamond pieces.

- Founded in 1949 by Leslie Ratner in the UK.

- Focused on accessible and valuable jewelry.

- Expanded retail presence with competitive pricing.

- Capitalized on post-war consumer spending.

Over the years, Signet Jewelers, formerly Ratner Group, has undergone significant changes. The company's trajectory has been marked by strategic acquisitions and expansions, transforming it into a global leader in the jewelry market. Further insights into the Signet Jewelers marketing strategies can be found in this article: Marketing Strategy of Signet Jewelers.

The company's growth strategy has involved both organic expansion and strategic acquisitions. This approach has allowed Signet to broaden its portfolio of brands and increase its market share. The company's ability to adapt to changing consumer preferences and market dynamics has been key to its long-term success. As of 2024, Signet operates approximately 2,800 stores.

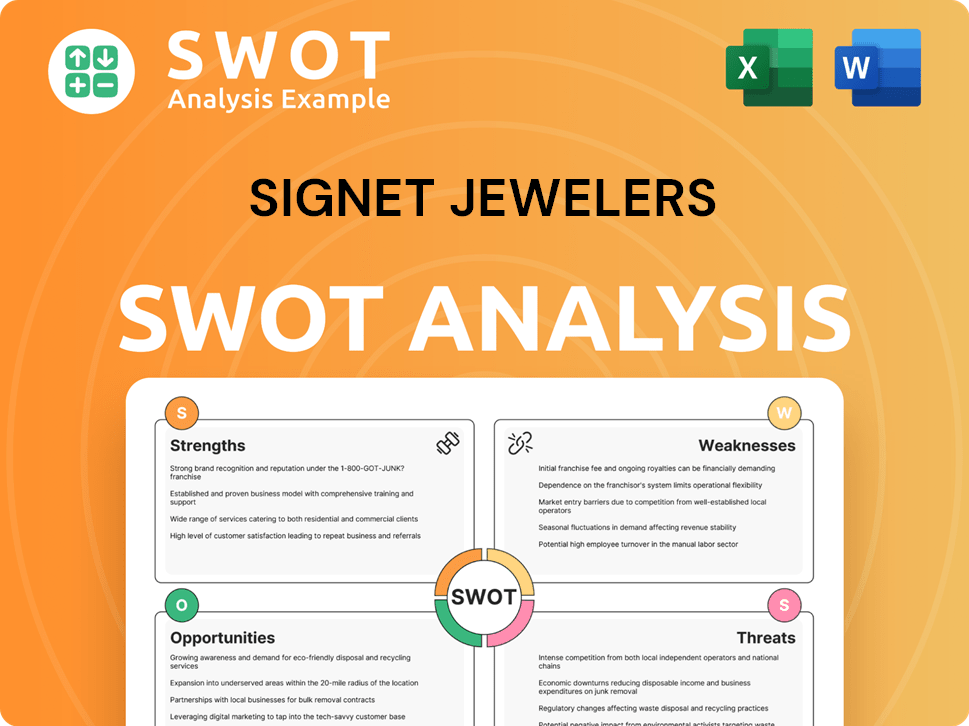

Signet Jewelers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Signet Jewelers?

The early growth of Signet Jewelers, then known as Ratner Group, was marked by strategic acquisitions and a focus on market penetration. This approach propelled the company's expansion, particularly in the United States. These early moves set the stage for Signet's future as a leading jewelry retailer.

In 1987, the company made a significant move by acquiring Sterling Inc. in the U.S., which included well-known brands like Kay Jewelers and J.B. Robinson Jewelers. This acquisition was a crucial entry into the lucrative U.S. market. The integration of Sterling Inc. significantly boosted the company's revenue and expanded its customer base.

Following the Sterling Inc. acquisition, the company continued to expand its presence in North America. In 1993, Ratner Group officially changed its name to Signet Group plc, reflecting its global strategy. Further expansion in the U.S. market was achieved through organic growth and the establishment of new store locations.

By the early 2000s, Signet had become a major player in the U.S. jewelry retail landscape, leveraging the brand recognition of Kay Jewelers and its other acquired entities. The company focused on enhancing its product offerings and customer service to solidify its market position. Strategic leadership decisions aimed at consolidating market share and optimizing operational efficiencies were key.

The acquisition of Sterling Inc. was a pivotal moment in Signet's history, establishing a strong foothold in the U.S. market. The name change to Signet Group plc in 1993 signaled a shift towards a global strategy. These early strategic moves and acquisitions were crucial for the company's growth and success in the diamond industry.

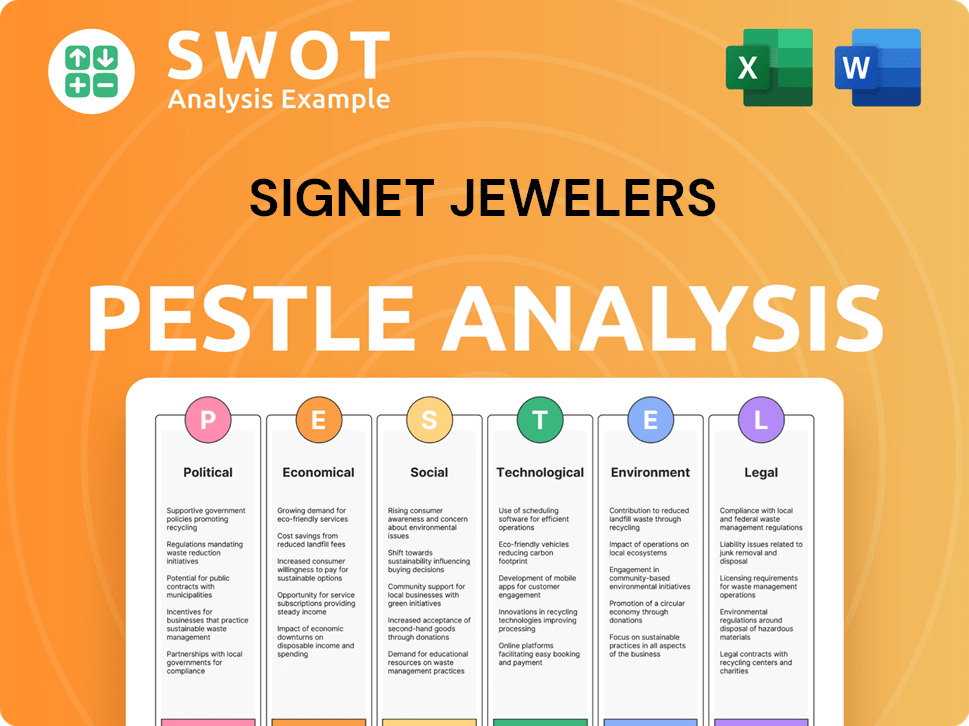

Signet Jewelers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Signet Jewelers history?

The Signet Jewelers has a rich Signet history marked by strategic acquisitions and expansions that have shaped it into a leading jewelry retailer. A key aspect of the Signet company’s evolution involves significant milestones that have propelled its growth within the diamond industry and the broader retail history.

| Year | Milestone |

|---|---|

| 2014 | Acquisition of Zale Corporation, which included Zales and Gordon's Jewelers, significantly expanding Signet's market presence. |

| 2019 | Launched the 'Transformation Plan', focusing on digital capabilities, customer experience, and operational efficiency. |

| 2020 | Accelerated digital transformation and optimized store footprint in response to the COVID-19 pandemic. |

| 2023 | Reported strong financial results, including a focus on personalized jewelry and accessible luxury. |

Signet has consistently embraced innovation to stay ahead in the competitive jewelry market. The company has heavily invested in e-commerce and omnichannel strategies to enhance the customer experience, reporting e-commerce sales of $796.8 million for fiscal year 2024, which represents 19.3% of total sales.

Significant investment in e-commerce platforms and digital marketing to reach a wider audience.

Integration of online and in-store experiences to provide a seamless shopping journey for customers.

Focus on personalized jewelry offerings to cater to individual customer preferences and create unique products.

Use of data analytics to understand customer behavior, optimize marketing efforts, and improve inventory management.

Implementation of responsible sourcing and sustainability practices within the diamond and jewelry supply chain.

Expanding 'Connected Commerce' strategy, integrating online and in-store experiences to meet evolving consumer preferences.

Signet has navigated several challenges, including market downturns and shifts in consumer spending habits. The company has also addressed issues related to responsible sourcing and sustainability within the diamond and jewelry industry.

Economic downturns and changes in consumer spending patterns have required strategic adjustments.

Intense competition from both traditional and online retailers, necessitating innovative marketing and pricing strategies.

The COVID-19 pandemic led to temporary store closures and supply chain disruptions, accelerating digital transformation.

Challenges in ensuring ethical sourcing and sustainable practices within the diamond and jewelry supply chain.

Adapting to evolving consumer preferences, including demand for personalized jewelry and accessible luxury.

Periods of economic instability have impacted consumer spending, requiring strategic adjustments to maintain sales and profitability.

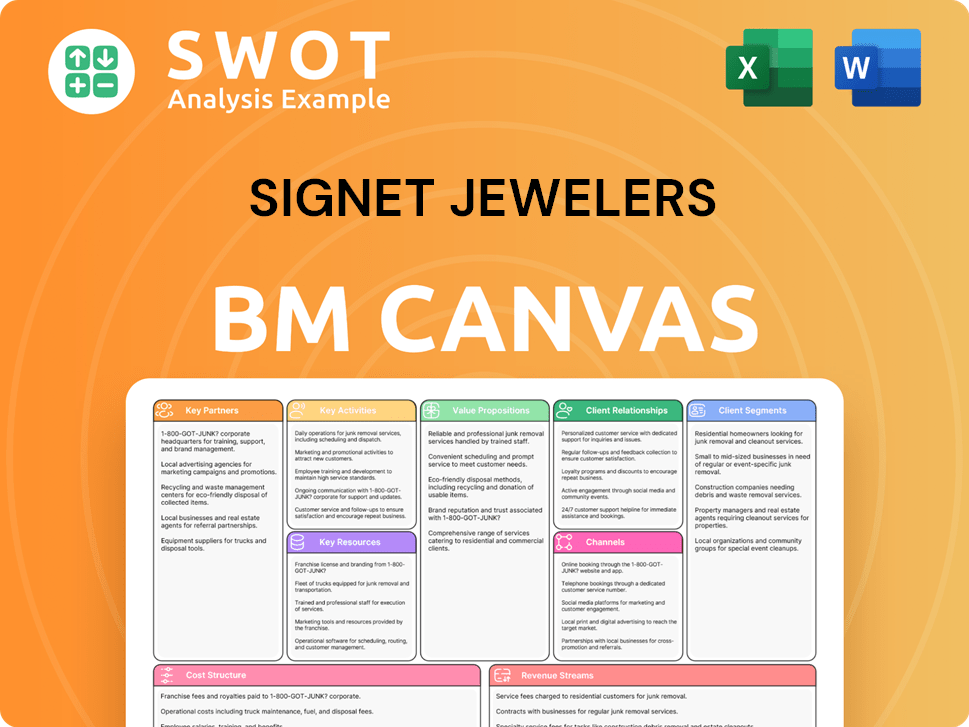

Signet Jewelers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Signet Jewelers?

The Signet Jewelers company has a rich history, marked by strategic moves and adaptation within the competitive jewelry retailer landscape. From its origins in the United Kingdom to its current status as a global leader, the company's journey reflects significant acquisitions, rebranding efforts, and a focus on evolving consumer preferences within the diamond industry.

| Year | Key Event |

|---|---|

| 1949 | Founded as Ratner Group in the United Kingdom, marking the beginning of the Signet history. |

| 1987 | Acquired Sterling Inc. in the United States, which included Kay Jewelers, expanding its presence in the North American market. |

| 1993 | Ratner Group officially rebrands to Signet Group plc, signaling a new era for the company. |

| 1995 | Began trading on the New York Stock Exchange, making its presence felt in the financial markets. |

| 2008 | Changes name to Signet Jewelers Limited, reflecting its global ambitions. |

| 2014 | Acquired Zale Corporation, adding Zales and Gordon's Jewelers to its portfolio, further consolidating its market position. |

| 2017 | Acquired R2Net, owner of JamesAllen.com, enhancing its online presence and embracing digital retail. |

| 2021 | Acquired Diamonds Direct, expanding its bridal jewelry offerings and customer base. |

| 2022 | Strengthened its 'Connected Commerce' strategy, integrating physical and digital channels. |

| 2023-2024 | Continues to focus on digital innovation, personalized customer experiences, and responsible sourcing, adapting to current market trends. |

Signet Jewelers is focused on its 'Path to Brilliance' strategy to drive growth and enhance shareholder value. This strategy involves leveraging 'Connected Commerce' capabilities, optimizing the store fleet, and expanding personalized jewelry offerings. The company is also investing in data analytics to better understand customer preferences.

Signet anticipates fiscal year 2025 revenue to be in the range of $6.6 billion to $7.0 billion. This projection reflects the company's confidence in its strategic initiatives and its ability to adapt to market dynamics. The company's financial performance is closely watched by investors and analysts.

The company emphasizes responsible sourcing and sustainability initiatives, aligning with consumer demand for ethical practices. It is also focusing on digital innovation and personalized customer experiences to stay competitive. These efforts are crucial in the evolving retail landscape.

The increasing popularity of lab-grown diamonds and demand for personalized pieces are shaping product development and marketing efforts. Leadership is committed to innovation and adapting to evolving consumer behaviors. Signet aims to maintain its position as the world's largest diamond jewelry retailer.

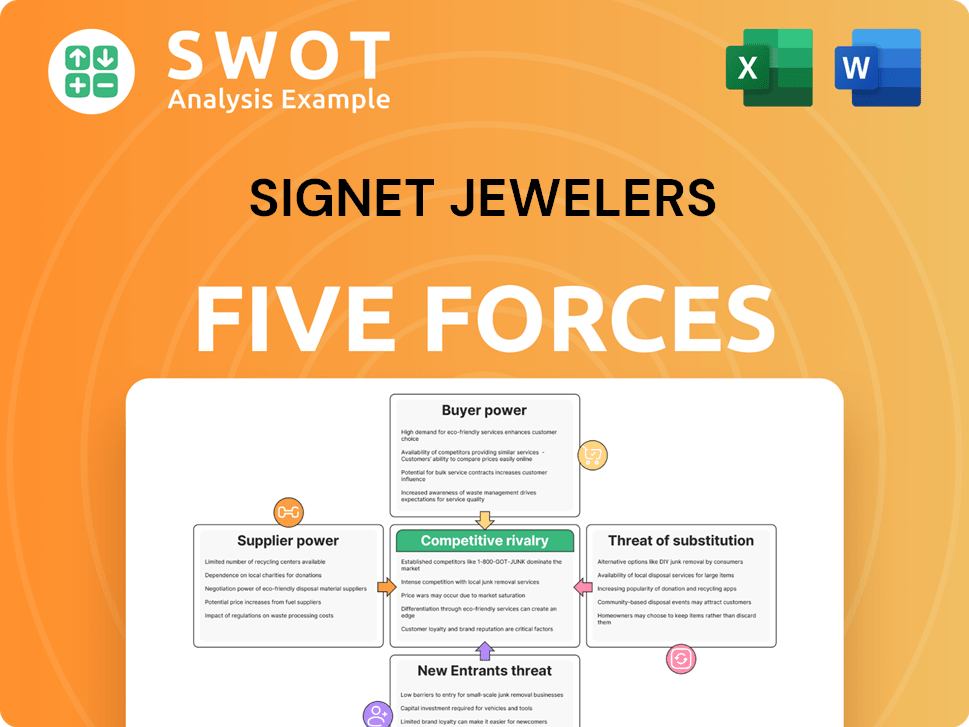

Signet Jewelers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Signet Jewelers Company?

- What is Growth Strategy and Future Prospects of Signet Jewelers Company?

- How Does Signet Jewelers Company Work?

- What is Sales and Marketing Strategy of Signet Jewelers Company?

- What is Brief History of Signet Jewelers Company?

- Who Owns Signet Jewelers Company?

- What is Customer Demographics and Target Market of Signet Jewelers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.