SPH Bundle

What shaped the legacy of Singapore Press Holdings (SPH)?

From its 1984 inception, Singapore Press Holdings (SPH) has been a pivotal force in Singapore's media evolution. This SPH SWOT Analysis reveals the strategic shifts and pivotal moments that have defined its trajectory. Initially a print giant, SPH's story is one of remarkable adaptation and diversification.

The SPH history reveals how this media company Singapore transformed. Understanding the SPH company's past, including its SPH timeline of Singapore newspapers and strategic moves, is crucial for grasping its current position and future prospects. This exploration provides a comprehensive overview of Singapore Press Holdings.

What is the SPH Founding Story?

The SPH history began on August 4, 1984. This marked the official incorporation of Singapore Press Holdings (SPH) following a strategic merger. The consolidation brought together The Straits Times Press (1978) Limited, Singapore News and Publications Limited, and Times Publishing Berhad.

This pivotal move was driven by the Singaporean government's vision. The aim was to establish a robust and unified media entity. This would better serve the nation's information needs while competing more effectively in the evolving media landscape. The merger's key figures were the leaders of the merging companies. They acted under the strategic guidance of government initiatives designed to streamline the media industry.

The initial issue identified was the fragmented local media market. This fragmentation could lead to inefficiencies and a lack of content and distribution synergy. The original business model centered on publishing a wide array of newspapers and magazines. These publications were designed to provide comprehensive news and information to the Singaporean public. They catered to various linguistic and demographic segments. The first products offered were existing newspapers. These included The Straits Times, Lianhe Zaobao, and Berita Harian, which continued under the new SPH umbrella.

The formation of SPH was a strategic national initiative. It aimed to consolidate media resources and ensure the local press's stability and growth. This move was influenced by Singapore's cultural and economic context in the 1980s. This was a period of rapid development and nation-building. A strong, unified media played a crucial role in disseminating information and fostering national identity.

- The initial funding came from the combined assets and capital of the merging entities.

- The merger aimed to create a more robust financial foundation for the new organization.

- This strategic consolidation laid the groundwork for SPH to become a dominant force in Singapore's media.

- The company later expanded into the property sectors.

The merger was a response to the challenges of a fragmented media market. This consolidation was intended to improve operational efficiency. It also sought to enhance content quality and reach. The early years saw SPH focusing on strengthening its core publishing business. This involved modernizing printing facilities and expanding its editorial capabilities. The company also invested in training and development for its employees. This was to ensure it could meet the evolving demands of the media industry. For more details on the SPH company, consider reading about the Growth Strategy of SPH.

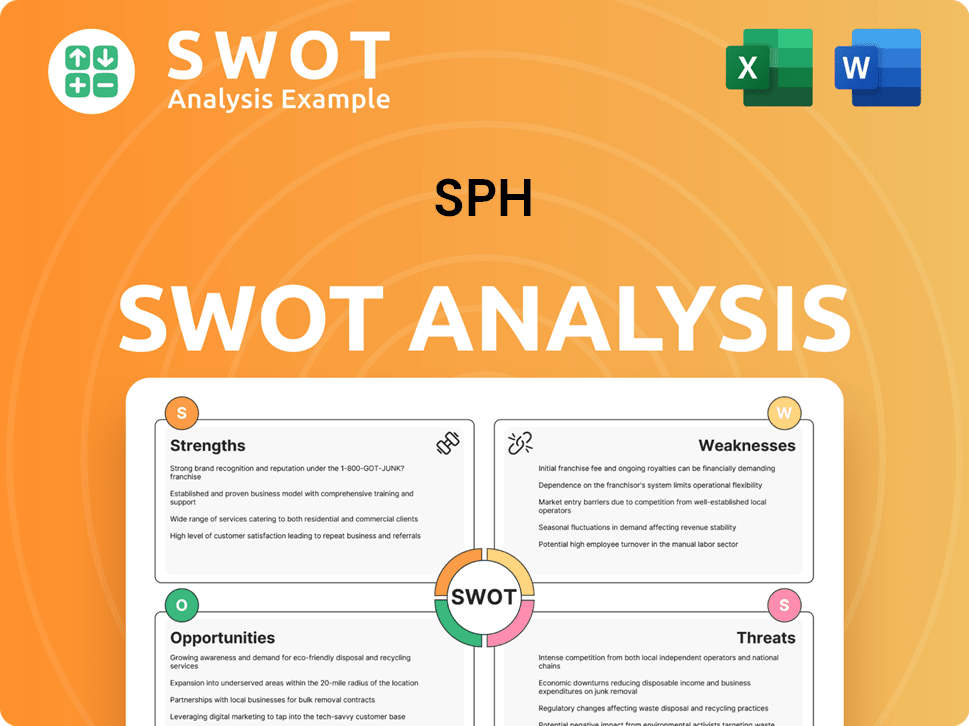

SPH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of SPH?

The early growth and expansion of Singapore Press Holdings (SPH) after its 1984 formation were pivotal in establishing it as a leading media conglomerate in Singapore. This period focused on strengthening its core newspaper business and diversifying into new sectors. The company made strategic moves to broaden its reach and revenue streams, setting the stage for its future development. This SPH company history reveals a dynamic evolution.

Initially, SPH focused on enhancing its core newspaper operations. This involved investments in advanced printing technologies and distribution networks to improve efficiency and expand its reach. Key publications like The Straits Times were refined and expanded. This phase was crucial for solidifying SPH's position in the Singapore newspapers market.

Recognizing the changing media landscape, SPH entered the broadcasting sector. The launch of SPH MediaWorks in 2000, which operated television channels, marked a significant strategic diversification. Although SPH MediaWorks merged with MediaCorp in 2004, this early venture demonstrated SPH's commitment to exploring new media frontiers. This move was part of the SPH timeline.

Simultaneously, SPH began diversifying into property development. This involved leveraging its land assets to develop commercial properties. The development of Paragon, a prime retail mall, began in the early 1990s. This strategic move into real estate significantly shaped its future business. This is a key milestone in SPH history.

The early 2000s saw SPH further expanding its presence in the retail property sector. The company acquired and developed various malls. This period was characterized by a dual strategy of strengthening its core media business and diversifying into property. This approach helped SPH adapt to the fluctuating media industry.

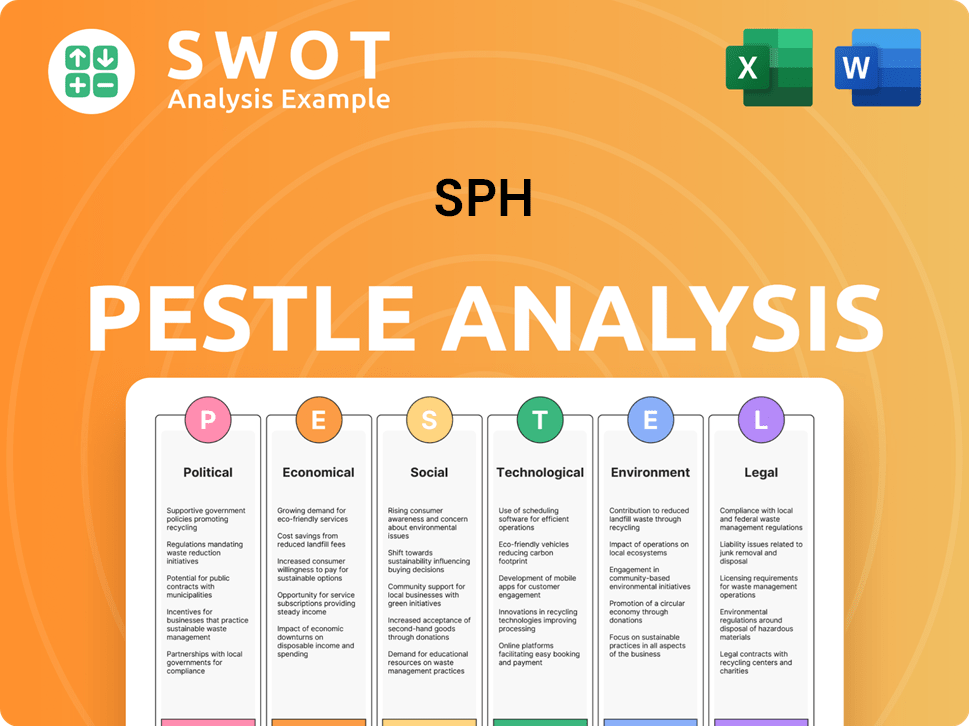

SPH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in SPH history?

The SPH history is marked by significant achievements and strategic shifts. From its beginnings, the SPH company has evolved, adapting to the changing media landscape and expanding its business interests. The SPH timeline showcases a journey of growth, innovation, and resilience in the face of industry challenges.

| Year | Milestone |

|---|---|

| Mid-1990s | The Straits Times launched its website, making it an early adopter of online news platforms. |

| 2021 | The media business was restructured into SPH Media Trust, a not-for-profit entity. |

| 2022 | SPH was delisted from the Singapore Exchange, with its property and non-media assets acquired by Cuscaden Peak Investments Private Limited. |

Singapore Press Holdings consistently embraced technological advancements, particularly in its media arm. A key move was the early adoption of online news platforms.

The launch of The Straits Times website in the mid-1990s positioned SPH at the forefront of digital media in Singapore. This early move helped establish a strong online presence and reach a wider audience.

SPH ventured into new content formats, including digital-first publications and multimedia offerings. This allowed the company to engage a younger, digitally native audience effectively.

In 2023, SPH Media reported significant digital growth, with its digital audience for news titles growing by 21% year-on-year. Digital subscriptions for news titles increased by 30%, demonstrating a strong commitment to digital transformation.

SPH faced significant challenges, especially in its traditional media business. Declining print advertising revenue and shifts in readership to digital platforms created considerable pressure. The global disruption of the media industry by tech giants further intensified these challenges.

The decline in print advertising revenue significantly impacted the financial performance of the traditional media business. This decline necessitated strategic adjustments and restructuring.

The rise of digital platforms and social media posed a major challenge to the traditional media model. This required SPH to adapt and innovate to remain competitive.

To address these challenges, SPH undertook a major restructuring in 2021, transferring its media business into a company limited by guarantee, SPH Media Trust. This strategic move aimed to secure the future of quality journalism in Singapore.

SPH's property division achieved significant milestones, including the development and management of large-scale retail and commercial properties. This diversification provided a stable revenue stream.

The delisting of SPH from the Singapore Exchange in 2022 marked a significant strategic pivot. This separation of media and property arms reflects the company's adaptability.

For more details on the current ownership structure, you can refer to the article about Owners & Shareholders of SPH.

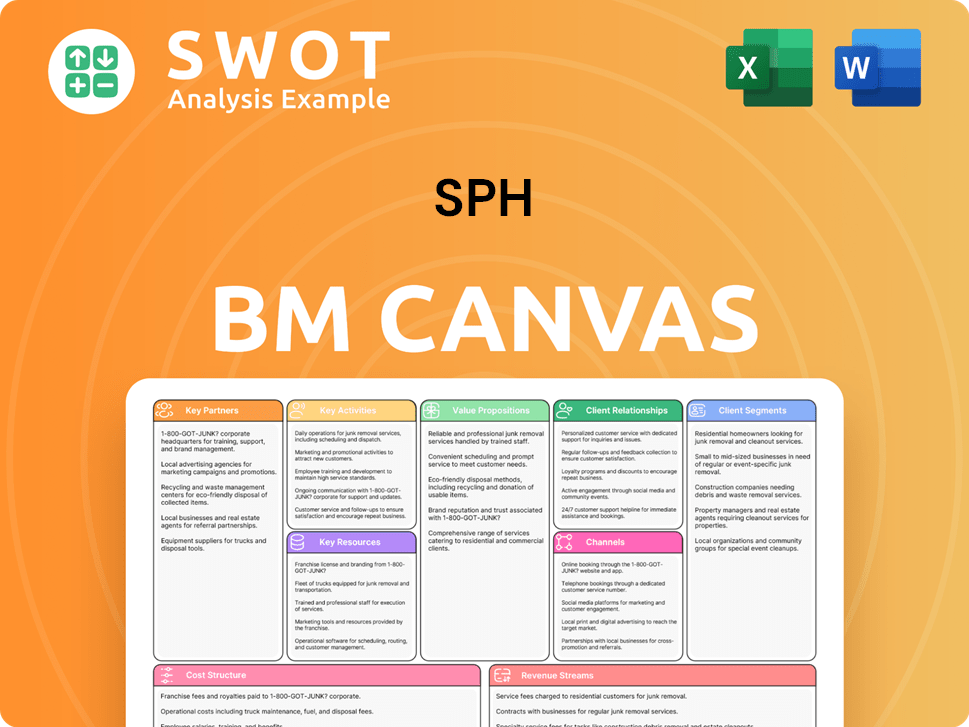

SPH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for SPH?

The SPH company, now primarily known as SPH Media Trust and the property assets under Cuscaden Peak Investments, has a rich history marked by significant transformations. This SPH history reflects its evolution from a media conglomerate to a diversified entity, adapting to the changing media landscape and expanding into the real estate sector. The following timeline highlights key milestones in the SPH timeline and the evolution of the Singapore Press Holdings.

| Year | Key Event |

|---|---|

| 1984 | Singapore Press Holdings (SPH) is formed through the merger of three major newspaper companies. |

| 1990s | SPH begins its foray into property development, leveraging existing land assets. |

| 1995 | The Straits Times launches its website, marking SPH's entry into digital news. |

| 2000 | SPH MediaWorks is launched, venturing into broadcast television. |

| 2004 | SPH MediaWorks merges with MediaCorp, consolidating the free-to-air television landscape. |

| 2013 | SPH acquires Orange Valley, expanding its property portfolio into healthcare. |

| 2014 | SPH REIT is listed on the Singapore Exchange, allowing for direct investment in its retail properties. |

| 2017 | SPH expands its property portfolio into purpose-built student accommodation in the UK. |

| 2021 | SPH announces the restructuring of its media business into a not-for-profit entity, SPH Media Trust. |

| 2022 | SPH is delisted from the Singapore Exchange; its non-media assets are acquired by Cuscaden Peak Investments Private Limited. |

| 2023 | SPH Media reports significant digital growth, with a 21% increase in digital audience for news titles and a 30% increase in digital subscriptions for news titles, demonstrating continued digital transformation efforts. |

SPH Media Trust is dedicated to delivering quality journalism in Singapore. Its strategic initiatives include accelerating digital transformation and investing in journalistic talent. The trust is exploring new revenue models beyond traditional advertising, such as subscriptions and philanthropic support. This approach aims to enhance digital capabilities and reach, ensuring relevance in a fragmented media landscape.

In 2023, SPH Media achieved a 21% increase in digital audience for its news titles. Digital subscriptions for news titles also saw a significant rise, increasing by 30%. These figures highlight the success of SPH Media's digital transformation efforts. The focus remains on enhancing digital capabilities and expanding its reach in the digital space.

The property assets under Cuscaden Peak Investments are focused on optimizing the existing portfolio. They are exploring new investment opportunities in sectors like healthcare and education-related real estate. Long-term initiatives include asset enhancement and potential acquisitions to expand geographical reach. The property arm aims to generate stable recurring income.

The future for SPH, in its fragmented form, is a commitment to public service and strategic investment in real estate. SPH Media Trust is prioritizing journalistic integrity and exploring sustainable revenue models. Cuscaden Peak Investments aims to build on the legacy of serving Singapore through value-driven real estate investments. The forward-looking approach is to continue serving Singapore.

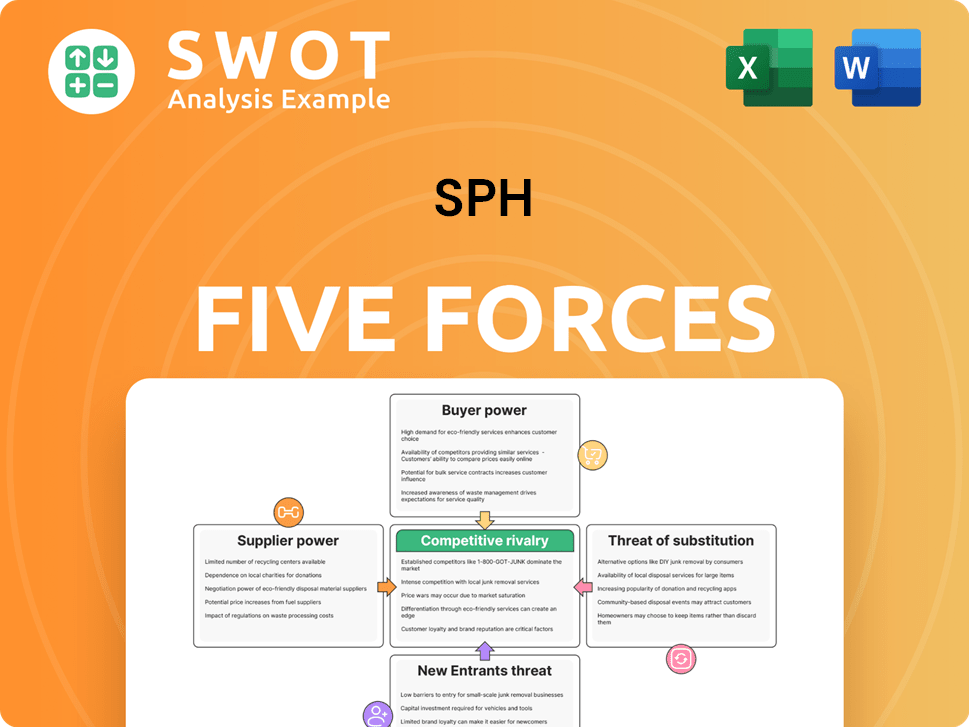

SPH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of SPH Company?

- What is Growth Strategy and Future Prospects of SPH Company?

- How Does SPH Company Work?

- What is Sales and Marketing Strategy of SPH Company?

- What is Brief History of SPH Company?

- Who Owns SPH Company?

- What is Customer Demographics and Target Market of SPH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.