Transcontinental Bundle

How Did Transcontinental Company Become a North American Industrial Powerhouse?

From humble beginnings as a flyer-printing startup in 1976, Transcontinental Company has transformed into a multifaceted industrial leader. This Transcontinental SWOT Analysis reveals the company's strategic evolution. Witness the remarkable journey of a company that has consistently adapted and innovated over nearly five decades.

This article delves into the brief history of Transcontinental Company, exploring its business development and corporate history. We'll examine key milestones in Transcontinental's history, from its early years to its current status as a leading player in flexible packaging, printing, and publishing. Discover how Transcontinental Company navigated challenges and capitalized on opportunities, shaping its legacy in the industry.

What is the Transcontinental Founding Story?

The History of Transcontinental Company began in 1976, marking the start of a significant journey in the printing and media industries. Founded by Rémi Marcoux, along with Claude Dubois and André Kingsley, the company's inception was rooted in a strategic acquisition.

Their initial venture involved purchasing Imprimerie Trans-Continental, a printing company located in Saint-Laurent, a suburb of Montreal. This acquisition set the stage for what would become a diversified and influential entity in the Canadian business landscape. The founders identified a clear market need, focusing on flyer printing to meet the demand for effective advertising distribution.

In its first year, Transcontinental generated revenues of $2.9 million and employed approximately 100 people, demonstrating an immediate impact. The company's early focus on flyer printing and distribution was a strategic move that laid the groundwork for future expansion and diversification.

The company's early years were marked by strategic moves that expanded its reach and diversified its business model. These actions set the stage for its growth and influence in the printing and media sectors.

- In 1978, the company was renamed GTC Transcontinental Group Ltd., coinciding with the establishment of Publi-Home Distributors, a door-to-door flyer distribution division.

- By 1979, Transcontinental entered the publishing industry through the acquisition of the weekly newspaper Les Affaires and SIC magazine (now Les Affaires PLUS), creating a third business sector.

- The same year, the acquisition of Imprimerie Chartier (now Transcontinental Saint-Hyacinthe) enabled further expansion and foreshadowed the company's future in newspaper printing outsourcing.

- The company went public on the Montreal Exchange in 1984, and later on the Toronto Stock Exchange, marking a significant milestone in its growth and access to broader funding.

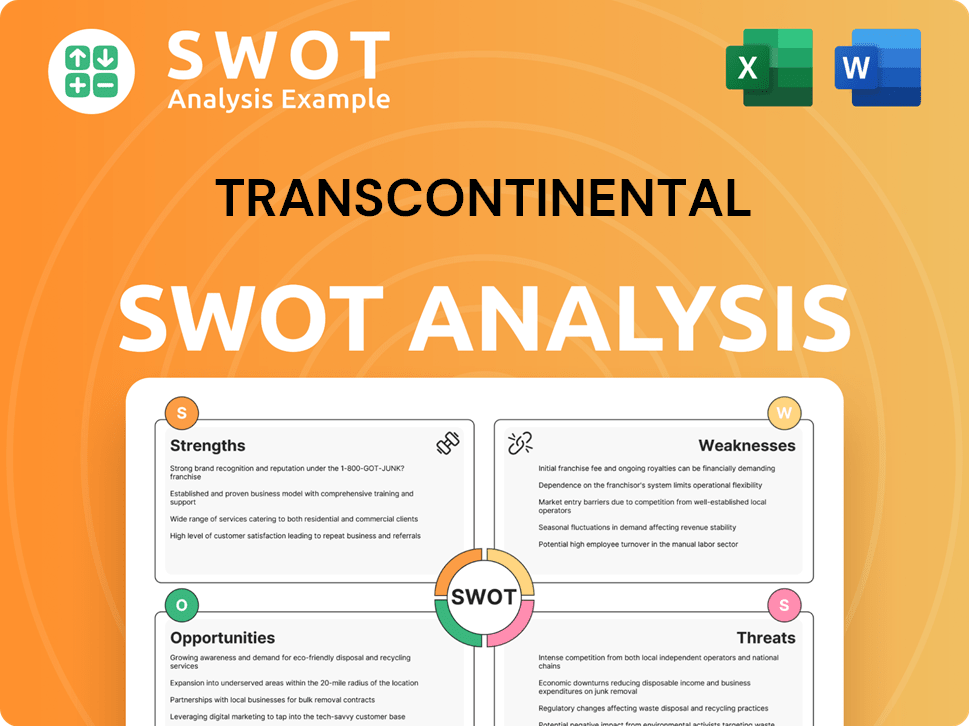

Transcontinental SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Transcontinental?

The early years of the Transcontinental Company saw significant growth and strategic diversification. This History of Transcontinental reflects a period of aggressive expansion, marked by key acquisitions and market entries. The Transcontinental journey began with a focus on integrated services, quickly evolving into a multifaceted business.

In 1978, Transcontinental established Publi-Home Distributors, marking its entry into door-to-door flyer distribution. The following year, the company entered the publishing industry by acquiring Les Affaires and SIC magazine. The purchase of Imprimerie Chartier printing plant further solidified its foundation in the printing sector.

The company's first expansion outside Quebec occurred in 1982 with a flyer printing plant in Brampton, Ontario. This move aimed to reach a broader geographic market. In 1984, Transcontinental Inc. went public, providing access to capital for further expansion and growth.

The 1980s and 1990s were characterized by numerous acquisitions, including community newspapers and commercial printing companies. A significant milestone was the achievement of the billion-dollar revenue mark in 1998. These acquisitions played a crucial role in the company's Business Development.

In 2000, Transcontinental acquired Telemedia's magazine publishing division for $150 million, which included titles like Canadian Living and Elle. Further expansion followed in 2002 with the acquisition of newspapers and printing plants from CanWest Global for $255 million. The Company Timeline shows the company's strategic moves.

The establishment of the Transcontinental Métropolitain printing plant in 2003 was a result of securing a contract to print La Presse. In 2006, the company entered the French-language educational publishing market by acquiring Chenelière Éducation. For more information on the Corporate History of the company, you can read about Owners & Shareholders of Transcontinental.

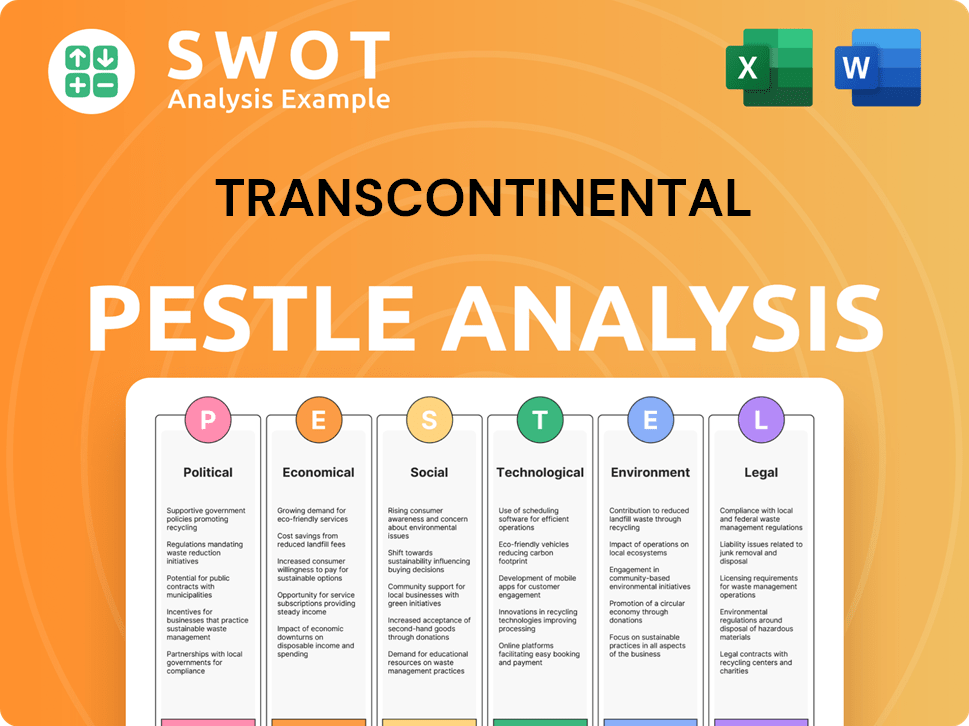

Transcontinental PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Transcontinental history?

The History of Transcontinental Company is characterized by significant milestones, reflecting its evolution and strategic adaptations. These milestones showcase the company's journey through various phases of business development and corporate history, highlighting its resilience and forward-thinking approach.

| Year | Milestone |

|---|---|

| 2018 | Acquisition of Coveris Americas, positioning the company as a leading flexible packaging provider in North America. |

| 2020 | Establishment of a Recycling Group within TC Transcontinental Packaging through the acquisition of assets from Enviroplast. |

| 2020 | Awarded the Mercure award in the 'Innovative Manufacturers – Large Business' category at the Mercuriades awards. |

| 2024 | Sold its industrial packaging operations to Hood Packaging Corporation for US$95 million (approximately C$132 million). |

Innovation has been a cornerstone of the company's strategy, particularly in the realm of sustainable packaging solutions. The company has invested heavily in research and development to promote eco-friendly products and a circular economy.

The company introduced eco-responsible products under the vieVERTe brand, demonstrating its commitment to sustainability. This initiative reflects its focus on providing environmentally friendly packaging options.

The creation of a Recycling Group within the Packaging Sector, including the acquisition of Enviroplast assets, shows a dedication to circular economy principles. This step supports the company's long-term sustainability goals.

The company was the first Canadian-based manufacturer to join the Ellen MacArthur Foundation’s New Plastics Economy Global Commitment. This commitment aims for 100% reusable, recyclable, or compostable plastic packaging by 2025.

The company has received prestigious awards, including the Mercure award in the 'Innovative Manufacturers – Large Business' category. It has also won multiple Gold awards for Sustainability and Packaging Excellence.

The company invests millions annually in research and development within its Packaging Sector. This investment drives innovation in sustainable and circular economy practices.

The company has strategically divested assets to focus on core printing and packaging businesses. This includes the sale of specialty media assets, streamlining the business model.

The company has faced challenges, particularly in adapting to market shifts and competitive pressures. These challenges have led to strategic decisions, including divestitures and operational adjustments.

Market downturns in traditional printing and media sectors prompted strategic shifts. The company responded by refocusing on its core printing and packaging businesses.

Competitive threats in various sectors necessitated strategic realignments. The company adapted by divesting non-core assets and concentrating on growth areas.

Strategic divestitures, such as the sale of industrial packaging operations for US$95 million (approximately C$132 million), helped streamline the portfolio. These moves increased financial flexibility for future acquisitions.

The company continuously optimizes its printing platform, including plant closures to enhance its network. This demonstrates a commitment to efficiency and adaptation.

The company has adapted its business model to remain relevant in dynamic industries. This includes a focus on flexible packaging and sustainable practices.

Strategic divestitures have increased financial flexibility, enabling targeted acquisitions in growth segments. This supports long-term growth and market positioning.

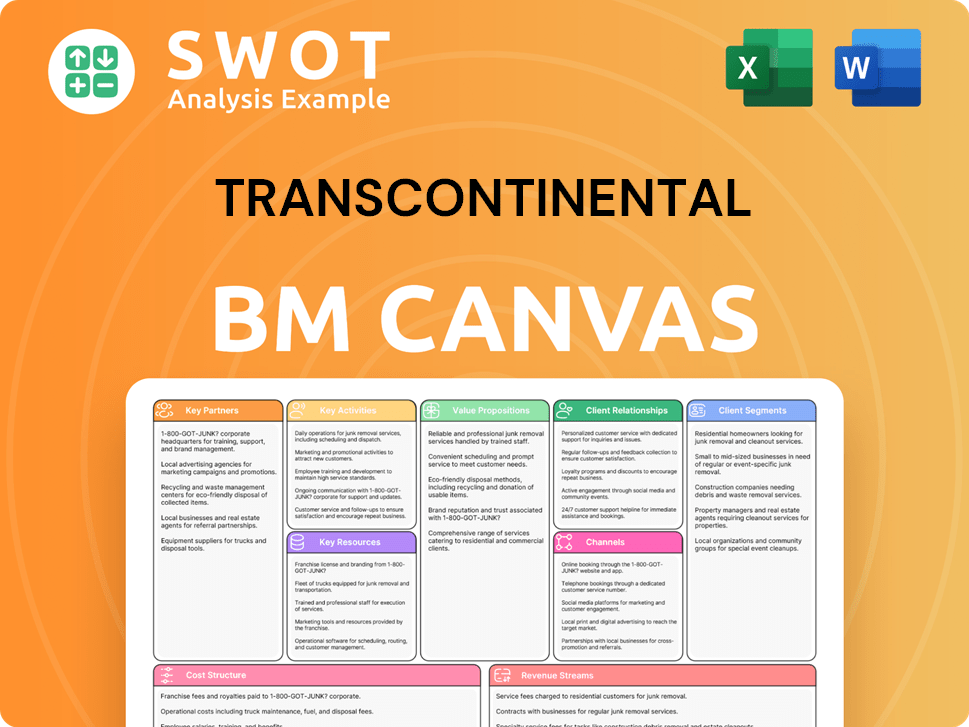

Transcontinental Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Transcontinental?

The History of Transcontinental is marked by significant milestones, from its origins as a flyer-printing business to its current focus on packaging and printing. The company's business development has evolved through strategic acquisitions and a commitment to innovation.

| Year | Key Event |

|---|---|

| 1976 | Rémi Marcoux, Claude Dubois, and André Kingsley founded Transcontinental Inc. as a flyer-printing business in Montreal. |

| 1978 | The company was renamed GTC Transcontinental Group Ltd. and established Publi-Home Distributors, a door-to-door flyer distribution division. |

| 1979 | Transcontinental entered the publishing industry with the acquisition of Les Affaires and SIC magazine, and the purchase of Imprimerie Chartier printing plant. |

| 1984 | The company became publicly traded on the Montreal Exchange, later listing on the Toronto Stock Exchange. |

| 1998 | Transcontinental achieved the billion-dollar revenue mark. |

| 2000 | The company acquired Telemedia's magazine publishing division for $150 million, its largest acquisition at the time. |

| 2006 | Transcontinental acquired Chenelière Éducation, becoming Canada's leading French-language educational resources publisher. |

| 2012 | Rémi Marcoux stepped down as Chair of the Board, succeeded by his daughter Isabelle Marcoux. |

| 2014 | The company entered the packaging sector with the acquisition of Capri Packaging assets. |

| 2018 | Transcontinental completed the acquisition of Coveris Americas, becoming a leader in flexible packaging in North America. |

| 2019 | The company sold the majority of its specialty media assets and event planning activities to Contex Group and Newcom Media to focus on packaging and printing. |

| 2020 | Transcontinental created a Recycling Group within TC Transcontinental Packaging and acquired assets from Enviroplast, aiming for a circular economy for plastics. |

| October 2024 | Transcontinental sold its industrial packaging operations to Hood Packaging Corporation for US$95 million (C$132 million). |

| December 2024 | The company reported revenues of $2.8 billion for the fiscal year ended October 27, 2024. |

| March 2025 | Transcontinental reported revenues of $643.0 million for the first quarter of fiscal 2025, ended January 26, 2025, with adjusted operating earnings before depreciation and amortization increasing by 1.5%. |

| June 2025 | The company announced results for the second quarter of fiscal year 2025, with adjusted net earnings attributable to shareholders increasing by 6.4% from the second quarter of 2024 to $48.2 million. |

Transcontinental is focused on profitable growth within its Packaging Sector through organic sales and acquisitions. The company expects organic growth in adjusted operating earnings before depreciation and amortization for fiscal 2025 compared to fiscal 2024.

The company aims to generate significant cash flows from operating activities to reduce net indebtedness, make strategic investments, and return capital to shareholders. Analyst predictions project revenue to grow from $2813 million in October 2024 to $3319 million by October 2034, representing a compound annual growth rate of approximately 1.7%.

Transcontinental's 2025 Corporate Social Responsibility (CSR) plan outlines ambitious goals across five main themes, aligning with nine of the United Nations Sustainable Development Goals. This includes a commitment to creating a circular economy for plastics.

Leadership emphasizes building a lasting company and passing on the legacy of a solid, responsible corporate citizen, a forward-looking vision that ties back to the entrepreneurial spirit of its founding. The company's focus remains on long-term strategic initiatives.

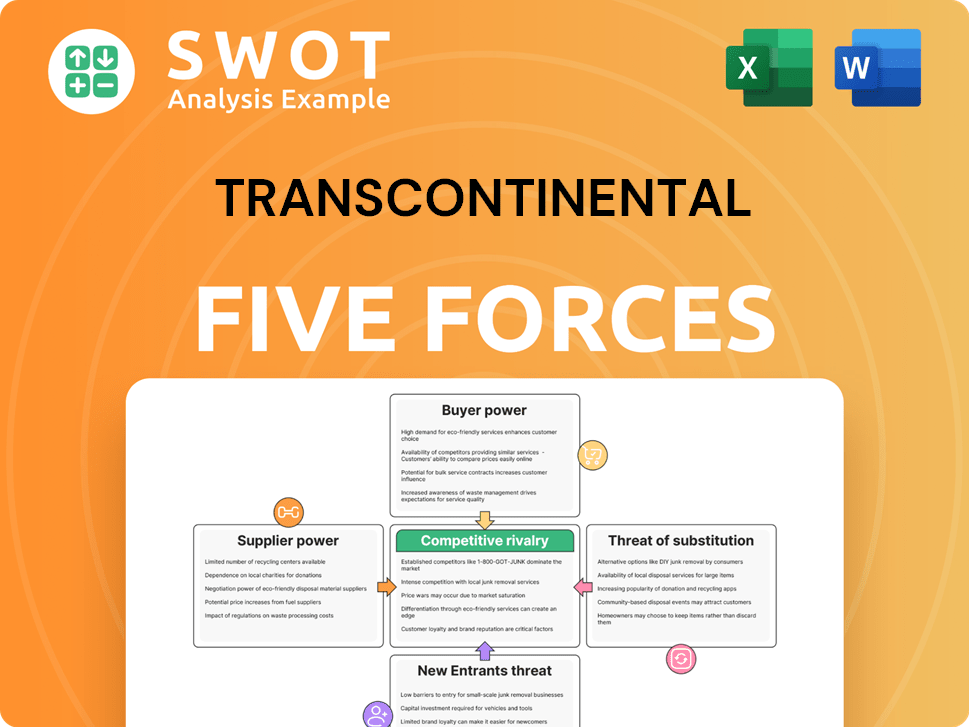

Transcontinental Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Transcontinental Company?

- What is Growth Strategy and Future Prospects of Transcontinental Company?

- How Does Transcontinental Company Work?

- What is Sales and Marketing Strategy of Transcontinental Company?

- What is Brief History of Transcontinental Company?

- Who Owns Transcontinental Company?

- What is Customer Demographics and Target Market of Transcontinental Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.