Simply Good Foods Bundle

How Did Simply Good Foods Rise to Nutritional Prominence?

Embark on a journey through the Simply Good Foods SWOT Analysis to uncover the story of a company that redefined the snacking landscape. From its inception in 2017, the Simply Good Foods Company (SFD company) has carved a niche in the nutritional foods sector. This exploration delves into the strategic moves that propelled SFD company to its current market position, focusing on its evolution and key milestones.

The Simply Good Foods Company's story began with a strategic merger, uniting Atkins Nutritionals with Conyers Park Acquisition Corp. This pivotal moment set the stage for a company focused on low-carb snacks and better-for-you options. Today, Simply Good Foods, with its Atkins and Quest brands, continues to innovate, driven by the founders' vision to deliver simple goodness to consumers. The company's financial history reflects its commitment to catering to the growing demand for nutritional foods.

What is the Simply Good Foods Founding Story?

The Simply Good Foods Company, often referred to as SFD company, officially launched on July 7, 2017. This marked the culmination of a business combination between Conyers Park Acquisition Corp., a special purpose acquisition company, and NCP-ATK Holdings, Inc., which owned Atkins Nutritionals, Inc.

The founders of Conyers Park, Jim Kilts and Dave West, brought extensive experience from the consumer products industry. They identified a growing market for convenient, better-for-you nutritional snacking options, especially those focused on low-carb snacks and low sugar content. The acquisition of Atkins, a well-known brand in the low-carb space, provided a strong foundation for the new company.

The formation of the Simply Good Foods Company was a strategic move to enter the public market and build a scalable platform.

- Jim Kilts, former CEO of Gillette and Nabisco, and Dave West, former CEO of Big Heart Pet Brands, co-founded Conyers Park.

- Joseph Scalzo, the President and CEO of Atkins, continued to lead the newly formed Simply Good Foods.

- The initial product range included nutrition bars, shakes, snacks, and confectionery items under brands like Atkins and SimplyProtein.

Conyers Park Acquisition Corp. was established in 2016 with the specific aim of facilitating a business combination. This 'Reverse Merger' strategy was designed to provide a pathway to the public market and facilitate future growth. The vision, as articulated by Jim Kilts, was to build upon the Atkins brand and grow the portfolio with brands that offered consumers 'simple goodness.' The company focused on the growing demand for nutritional foods.

Simply Good Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Simply Good Foods?

The early growth and expansion of The Simply Good Foods Company, or SFD company, has been marked by strategic acquisitions and a focus on the snacking market. Founded in July 2017, the company quickly moved to broaden its portfolio. A key move was the acquisition of Quest Nutrition, LLC in November 2019. This focus has helped SFD company establish itself within the nutritional foods sector.

The acquisition of Quest Nutrition was a pivotal moment for the SFD company. This move allowed the company to expand its product offerings to include protein bars, chips, and cookies. This expansion broadened the appeal of the company to health-conscious consumers and fitness enthusiasts, aligning with the growing demand for low-carb snacks.

In Q1 of fiscal year 2025 (ended November 30, 2024), Simply Good Foods reported net sales of $341.3 million, up from $308.7 million the previous year. This growth was significantly driven by the acquisition of Only What You Need, Inc. (OWYN) on June 13, 2024, which contributed $32.3 million to the net sales. In Q2 of fiscal year 2025 (ended March 1, 2025), net sales further increased to $359.7 million, a 15.2% year-over-year rise, with OWYN contributing $33.8 million.

Total retail takeaway for Simply Good Foods increased by approximately 7% in Q2 fiscal year 2025. The Quest and OWYN brands saw strong point-of-sales growth, with about 13% and 52% respectively. However, the Atkins brand experienced a decline, with retail takeaway decreasing by about 10% in Q2 fiscal year 2025. For more insights, check out the Growth Strategy of Simply Good Foods.

Shaun Mara has served as Chief Financial Officer since October 2022, with a prior tenure from 2014 to 2017. The company is structured around an asset-light model, outsourcing manufacturing to reduce costs. This, combined with strategic acquisitions, has helped SFD company expand its market presence and capitalize on the demand for high-protein, low-sugar, and low-carb snacks.

Simply Good Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Simply Good Foods history?

The Simply Good Foods Company (SFD company) has achieved several significant milestones since its inception, shaping its trajectory in the nutritional foods sector. These achievements reflect the company's strategic growth and expansion within the low-carb snacks market and broader nutritional foods industry.

| Year | Milestone |

|---|---|

| July 2017 | Strategic business combination of Conyers Park Acquisition Corp. and Atkins Nutritionals, Inc., forming a new entity focused on growth in the nutritional snacking market. |

| November 2019 | Acquisition of Quest Nutrition, LLC, significantly expanding the company's product portfolio and market reach within the protein bar and snack segment. |

| June 13, 2024 | Purchase of Only What You Need, Inc. (OWYN), a plant-based protein brand, entering the growing plant-based diet market. |

| November 30, 2024 | Net debt to Adjusted EBITDA ratio of 0.8x, demonstrating financial resilience. |

Innovation is a core strength for the Simply Good Foods Company, with a focus on launching new products to meet evolving consumer preferences. Quest's Salty Snacks platform has shown remarkable growth, increasing by 45% in the first half of fiscal year 2025, which now represents approximately 35% of total Quest retail sales.

The company regularly introduces new products to keep up with consumer trends. This includes expanding product lines within the Atkins and Quest brands to appeal to a wider audience.

Quest's Salty Snacks platform experienced a 45% increase in the first half of fiscal year 2025. This platform now accounts for roughly 35% of total Quest retail sales, demonstrating strong market acceptance.

The company has secured patents related to food additives and nutrition. A patent was granted on July 11, 2023, for 'Starch-free baked foods and methods of making,' showcasing its commitment to innovation.

Despite its successes, Simply Good Foods has faced several challenges. The nutritional snacking market is highly competitive, with numerous established brands and new entrants, requiring continuous innovation and marketing efforts. Furthermore, the Atkins brand has experienced declines in retail takeaway, falling by approximately 10% in Q2 fiscal year 2025, which presents a challenge for the company to stabilize this segment. For more insights, check out the Marketing Strategy of Simply Good Foods.

The company operates in a highly competitive nutritional snacking market, requiring constant innovation and effective marketing to maintain market share. This includes competition from both established brands and new entrants.

The Atkins brand experienced a decline in retail takeaway, falling by approximately 10% in Q2 fiscal year 2025. This was due to reduced display space and distribution losses at a key club customer, posing a challenge for the brand.

The integration of acquired companies like OWYN presents operational complexities. These include merging logistics and information systems, and retaining employees and customers, which can be resource-intensive.

New tariffs are expected to create a cost headwind of $5 million to $10 million in fiscal year 2025. This will affect 15% to 20% of the company's total cost of goods sold, impacting profitability.

Simply Good Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Simply Good Foods?

The Simply Good Foods Company has a history marked by strategic acquisitions and a focus on the nutritional foods market. The SFD company's journey began in 2017, evolving through key acquisitions like Atkins and Quest Nutrition, and more recently, OWYN, reflecting its commitment to expanding its portfolio of low-carb snacks and nutritional offerings.

| Year | Key Event |

|---|---|

| March 30, 2017 | The Simply Good Foods Company was formed in Delaware. |

| July 7, 2017 | The business combination between Conyers Park Acquisition Corp. and NCP-ATK Holdings, Inc. (Atkins) was completed, officially forming The Simply Good Foods Company. |

| November 2019 | Acquisition of Quest Nutrition, LLC. |

| June 13, 2024 | Acquisition of Only What You Need, Inc. (OWYN), a plant-based protein brand. |

| October 24, 2024 | The company reported Fiscal Fourth Quarter and Full Fiscal Year 2024 Financial Results, with net sales of $375.7 million for Q4 2024, up 17.2% year-over-year. |

| November 30, 2024 | End of Fiscal First Quarter 2025. |

| January 8, 2025 | Simply Good Foods reported Fiscal First Quarter 2025 financial results, with net sales of $341.3 million and reaffirmed fiscal year 2025 outlook. |

| March 1, 2025 | End of Fiscal Second Quarter 2025. |

| April 9, 2025 | Simply Good Foods reported Fiscal Second Quarter 2025 financial results, with net sales of $359.7 million, and reaffirmed fiscal year 2025 outlook. |

| May 15, 2025 | Atkins named a winner in Progressive Grocer's 2025 Editors' Picks Awards. |

| July 3, 2025 | Shaun Mara, CFO, is set to retire, with Christopher J. Bealer expected to succeed him. |

The SFD company anticipates total net sales to increase by 8.5% to 10.5% in fiscal year 2025. Organic net sales growth is expected to be primarily driven by volume. Adjusted EBITDA is projected to increase by 4% to 6%.

The company forecasts OWYN's net sales to be in the range of $140 million to $150 million for fiscal year 2025. This reflects the integration and growth potential of the recently acquired plant-based protein brand. This is a key factor in the company's growth strategy.

The company will continue to focus on innovation, distribution expansion, and brand awareness. The goal is to increase household penetration for key brands like Quest and OWYN. This strategy aims to capitalize on consumer demand for low-carb snacks and nutritional foods.

The company faces intense competition and potential economic downturns. It also anticipates a decline in gross margins by approximately 200 basis points in fiscal year 2025. Analysts remain bullish, with price targets suggesting potential upside for the Simply Good Foods Company stock.

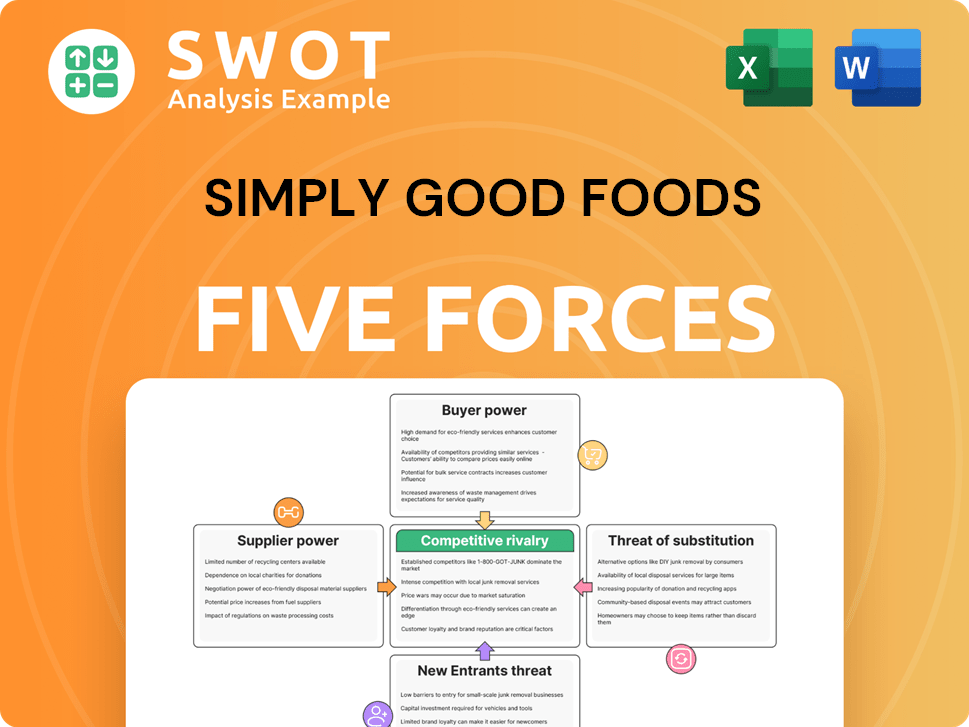

Simply Good Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Simply Good Foods Company?

- What is Growth Strategy and Future Prospects of Simply Good Foods Company?

- How Does Simply Good Foods Company Work?

- What is Sales and Marketing Strategy of Simply Good Foods Company?

- What is Brief History of Simply Good Foods Company?

- Who Owns Simply Good Foods Company?

- What is Customer Demographics and Target Market of Simply Good Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.