Thryv Bundle

How Did Thryv Transform from Yellow Pages to a SaaS Powerhouse?

From its roots in the legacy Yellow Pages industry, the Thryv SWOT Analysis reveals a compelling narrative of adaptation and innovation. This Thryv company has masterfully navigated the shift from print directories to become a leading provider of software solutions for small businesses. Its evolution offers valuable lessons in strategic transformation and market responsiveness.

Exploring the Thryv Thryv history unveils a fascinating journey of how a business model adapted to the digital age, offering insights into its current standing and future prospects. Understanding the Thryv platform and its evolution is crucial for anyone interested in the small business software landscape, especially considering Thryv small business offerings. This article delves into the Thryv company background, its key milestones, and the Thryv features that have shaped its trajectory, providing a comprehensive overview of its transformation.

What is the Thryv Founding Story?

The story of the Thryv company is one of transformation, evolving from traditional print directories to a cloud-based software provider. The Thryv history is marked by a significant merger and a strategic shift towards digital solutions for small businesses.

Thryv's current form was established in 2017, but its roots trace back to 2013. This transition was driven by the vision of CEO Joe Walsh, who recognized the need for small businesses to embrace digital tools.

The Thryv company emerged from the merger of Dex Media and YP Holdings, both known for their Yellow Pages businesses.

- The official founding year is listed as 2013.

- CEO Joe Walsh, with a background in print directories, saw the shift towards cloud-based operations as an opportunity.

- The initial focus was on guiding small businesses through their digital transformation.

The company began pivoting towards digital solutions, with the development of DexHub in 2015, which later evolved into the Thryv platform. The rebranding to Thryv in 2019 signaled a sharpened focus on its software product. The shift required significant restructuring and securing a proper capital structure. The company went public through a direct listing on NASDAQ in October 2020.

Initial funding came from the directory market, followed by capital raises and debt refinancing. By the time of its public listing, Thryv reported 40,000 SaaS clients. The company's journey reflects a strategic adaptation to the changing needs of small businesses, offering them tools for customer engagement and business management.

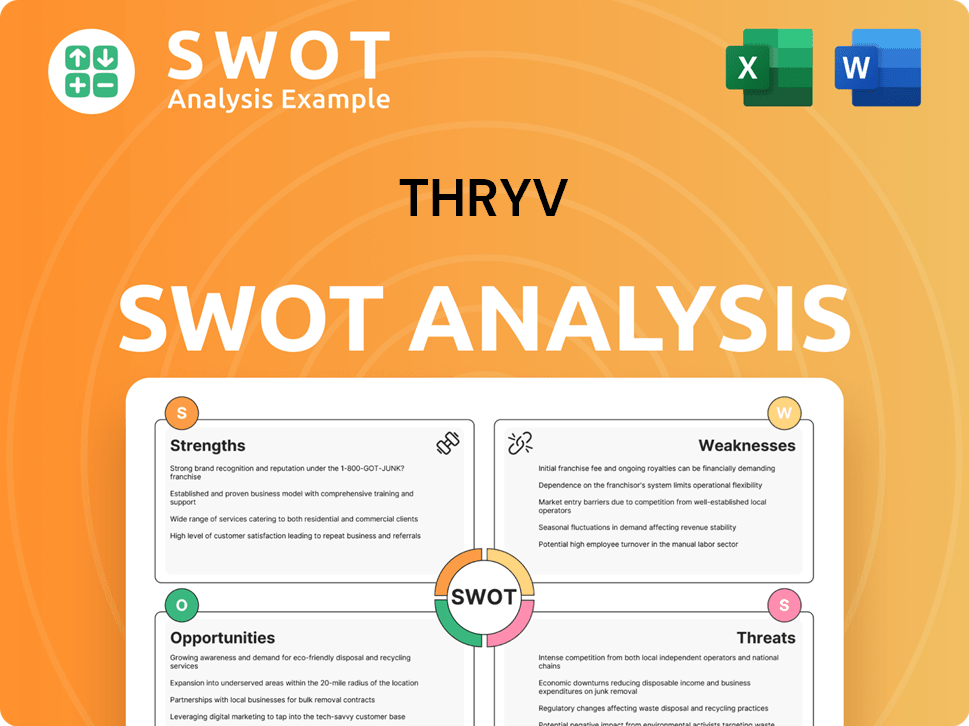

Thryv SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Thryv?

The early growth and expansion of the Thryv company is marked by its transition from print directories to a SaaS-focused model. The company's transformation began after the merger of Dex Media and YP Holdings in 2017. A significant milestone was the rebranding to Thryv on July 15, 2019, highlighting its software product. At that time, the company reported $1.4 billion in revenue.

The evolution of the Thryv platform from a directory-centric model to a comprehensive SaaS platform involved continuous product iterations. Thryv's software now offers various tools for small businesses, including marketing automation, CRM, and payment processing. Key product launches and enhancements include Thryv Command Center, Business Center, Marketing Center, ThryvPay, and Thryv Add-Ons, which offer features like AI-assisted website development and SEO tools.

Thryv operates in 48 states across the United States and has expanded internationally. The acquisition of Sensis in 2021 was crucial for Thryv's entry into the Australian SMB sector. The company has also expanded its SaaS footprint into New Zealand through the acquisition of Yellow New Zealand and continues to grow in Canada.

Thryv went public through a direct listing on NASDAQ in October 2020, reporting 40,000 SaaS clients at the time. In October 2024, Thryv acquired Infusion Software, Inc. (Keap) for $80.0 million, enhancing its marketing and sales automation offerings. This acquisition significantly boosted Thryv's total SaaS clients.

As of December 31, 2024, the company reported total long-term debt of $777.8 million. In the first quarter of 2025, Thryv's SaaS revenue grew by 50% year-over-year, reaching $111.1 million, and accounted for over 60% of total revenue. By the end of the fourth quarter of 2024, Thryv's total SaaS clients increased 73% year-over-year to 114 thousand. Overall consolidated revenue decreased by 22% year-over-year to $181.4 million in Q1 2025, primarily due to a significant decrease in Marketing Services revenue.

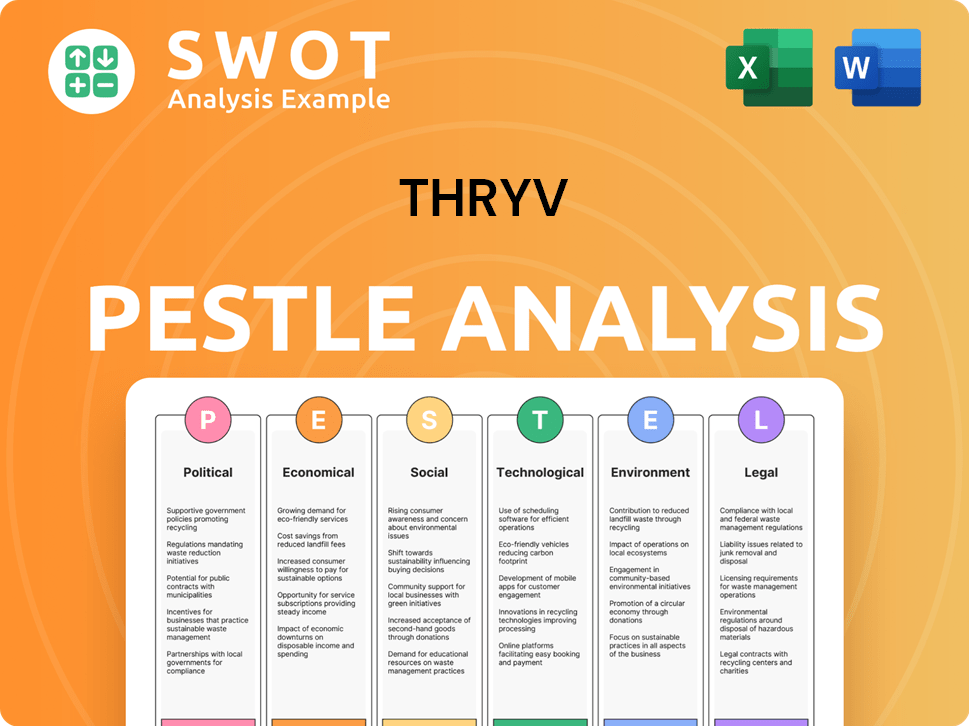

Thryv PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Thryv history?

The Thryv company has experienced a dynamic journey marked by significant milestones as it evolved from a traditional Yellow Pages business to a modern SaaS provider, navigating both successes and challenges in the digital landscape. This evolution has shaped the

| Year | Milestone |

|---|---|

| 2016 | Dex Media, before its merger with YP Holdings, underwent debt restructuring. |

| February 2021 | Partnership with Lendio, offering Paycheck Protection Program loans and small business financing to Thryv subscribers. |

| 2021 | Acquisition of Sensis in Australia, expanding its global SaaS footprint. |

| 2023 | Acquisition of Yellow New Zealand, further expanding its global SaaS presence. |

| October 2024 | Acquisition of Keap, strengthening its product portfolio and expanding its client base. |

| 2028 (Target) | Termination of Marketing Services solutions, focusing entirely on transitioning clients to its SaaS platform. |

The

Centralizes communication, customer relationship management, scheduling, invoicing, payments, and online reputation management.

Provides a centralized hub for managing various business operations and customer interactions.

Offers tools to manage and optimize business listings, online presence, and customer engagement.

Includes AI-assisted website development and SEO tools to improve online visibility and performance.

Integrated payment processing solution for businesses to manage transactions efficiently.

Offers features to manage and execute marketing campaigns, including email marketing and social media management.

Despite these advancements,

The secular decline in the print media industry has led to a decrease in Marketing Services clients and revenue, necessitating a strategic pivot to SaaS.

The shift to a SaaS model requires substantial sales and marketing capital, presenting a significant strategic challenge.

Difficulties in integrating acquisitions can lead to delays in product development and customer service issues.

In 2024, Marketing Services revenue saw a decrease of about 5% due to shifts in customer preferences towards digital solutions. The company reported a consolidated net loss of $74.2 million in 2024.

The average revenue per unit (ARPU) for both Marketing Services and SaaS decreased in the three months ended September 30, 2024. In Q1 2025, Thryv reported a larger-than-expected loss per share, leading to a stock drop.

The company has undergone multiple restructurings, including debt restructuring in 2016 as Dex Media, before its merger with YP Holdings.

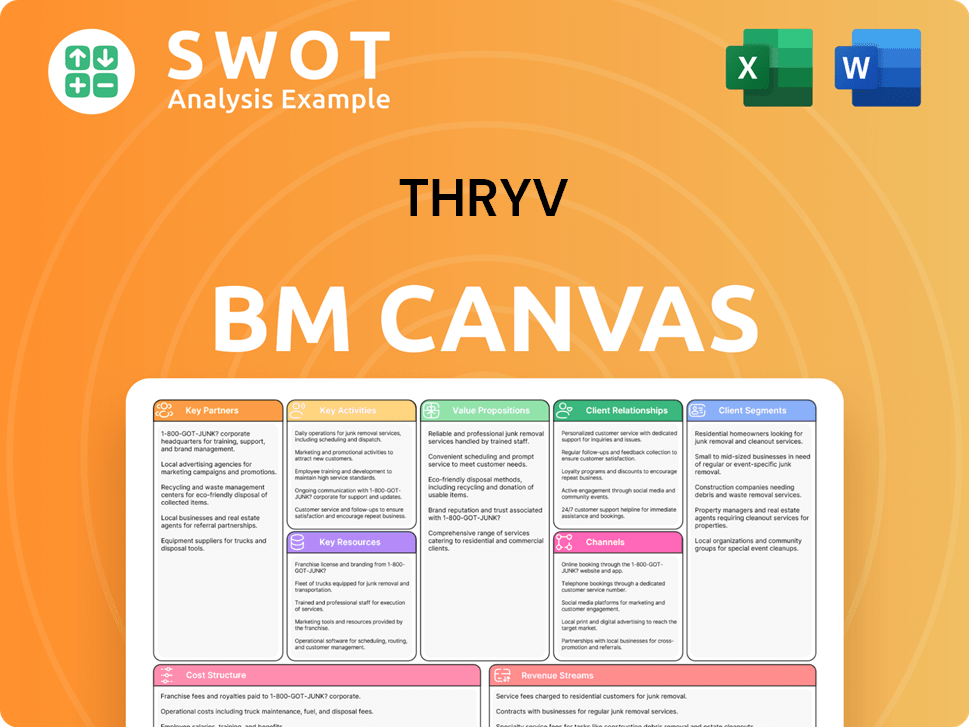

Thryv Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Thryv?

The Thryv company has a history marked by strategic shifts and technological advancements. From its origins as Dex Media to its current focus on SaaS solutions, Thryv has evolved to meet the changing needs of small businesses. The company's journey includes financial restructuring, mergers, and acquisitions, all aimed at enhancing its platform and expanding its market reach.

| Year | Key Event |

|---|---|

| 2012 | Thryv Holdings, Inc. was incorporated. |

| 2013 | The company was founded. |

| 2015 | DexHub, the precursor to Thryv's flagship product, was developed. |

| 2016 | Dex Media completed financial restructuring and emerged from bankruptcy. |

| 2017 | Dex Media and YP Holdings merged, forming the company that would become Thryv. |

| July 15, 2019 | The company rebranded to Thryv, emphasizing its software product. |

| October 2020 | Thryv Holdings, Inc. went public via a direct listing on NASDAQ. |

| February 2021 | A partnership with Lendio was announced to provide financing to Thryv subscribers. |

| March 2021 | Sensis, an Australian digital marketing provider, was acquired. |

| October 31, 2024 | Infusion Software, Inc. (Keap) was acquired for $80.0 million. |

| Q4 2024 | SaaS revenue reached $104.3 million, with total SaaS clients at 114 thousand. |

| Q1 2025 | SaaS revenue increased to $111.1 million, representing over 60% of total revenue. |

Thryv's future is centered on the expansion of its SaaS segment. The company plans to fully transition away from Marketing Services by the end of 2028. This strategic move is expected to result in majority SaaS revenue in 2025 and majority SaaS EBITDA in 2026.

Key initiatives include enhancing the product-led strategy, expanding into new verticals, and deepening customer relationships. Thryv aims to increase average revenue per unit (ARPU) through cross-selling. Acquisitions and international market entries are also part of the growth plan.

Thryv is incorporating AI to improve operational efficiency and customer experience. The integration of Keap is expected to boost the partner channel and create revenue synergies. This focus on technology will continue to shape Thryv's offerings.

Analysts maintain a strong buy consensus for Thryv stock, with a high target of $28, despite recent dips. The company is focused on debt reduction and exploring new capital investment opportunities. As of April 2025, the stock closed at $16.87.

Thryv Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Thryv Company?

- What is Growth Strategy and Future Prospects of Thryv Company?

- How Does Thryv Company Work?

- What is Sales and Marketing Strategy of Thryv Company?

- What is Brief History of Thryv Company?

- Who Owns Thryv Company?

- What is Customer Demographics and Target Market of Thryv Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.