United Bank Bundle

How has United Bank Company Shaped the Banking Landscape?

Journey back in time to uncover the United Bank SWOT Analysis and explore the fascinating UBank history. From its humble beginnings in 1839, United Bank Company has witnessed and adapted to over 185 years of economic shifts. Discover how this financial institution transformed from a local bank into a regional powerhouse.

The Brief history UBank is a testament to its enduring commitment to community banking. This article will explore the Bank origins, detailing the early days of UBank operations and the key figures who shaped its trajectory. Understanding the UBank timeline provides valuable insights into its resilience and strategic evolution, making it a compelling case study for any financial analyst or business strategist.

What is the United Bank Founding Story?

The story of the United Bank Company, or UBank, begins in the 19th century, marking a long history of financial service. Understanding the brief history of UBank provides insights into the evolution of a major financial institution and its impact on the communities it serves. The bank's origins are deeply rooted in the need for accessible financial services in a growing region.

The bank's history is a testament to its growth and adaptation. The company has grown from its early days to become a significant player in the financial sector. This expansion reflects the company's commitment to serving its customers and adapting to the changing financial landscape.

The roots of United Bank Company trace back to March 17, 1839, when the Northwestern Bank of Virginia opened in Parkersburg, Virginia (now West Virginia). This marked the beginning of a long-standing tradition of community-focused banking. The initial operations were driven by the need for financial services in the then-rural region, providing a safe place for savings and access to affordable loans for farm families.

- Following the Civil War, the bank was re-established in June 1865 as The Parkersburg National Bank.

- A pivotal moment occurred in 1982 when Parkersburg National began reorganizing as a holding company, leading to the formation of United Bankshares in 1984.

- In 1987, United Bankshares, Inc. became a publicly traded company on the NASDAQ National Market System under the ticker symbol 'UBSI'.

- The initial business model centered on providing commercial and retail banking services, alongside wealth management and trust services, to both individuals and businesses.

The evolution of the bank highlights its adaptation to changing financial landscapes. The transition to a publicly traded entity facilitated further growth and expansion. The commitment to local decision-making and personalized service has been a consistent theme since its inception. For more information on the company's ownership structure, you can explore Owners & Shareholders of United Bank.

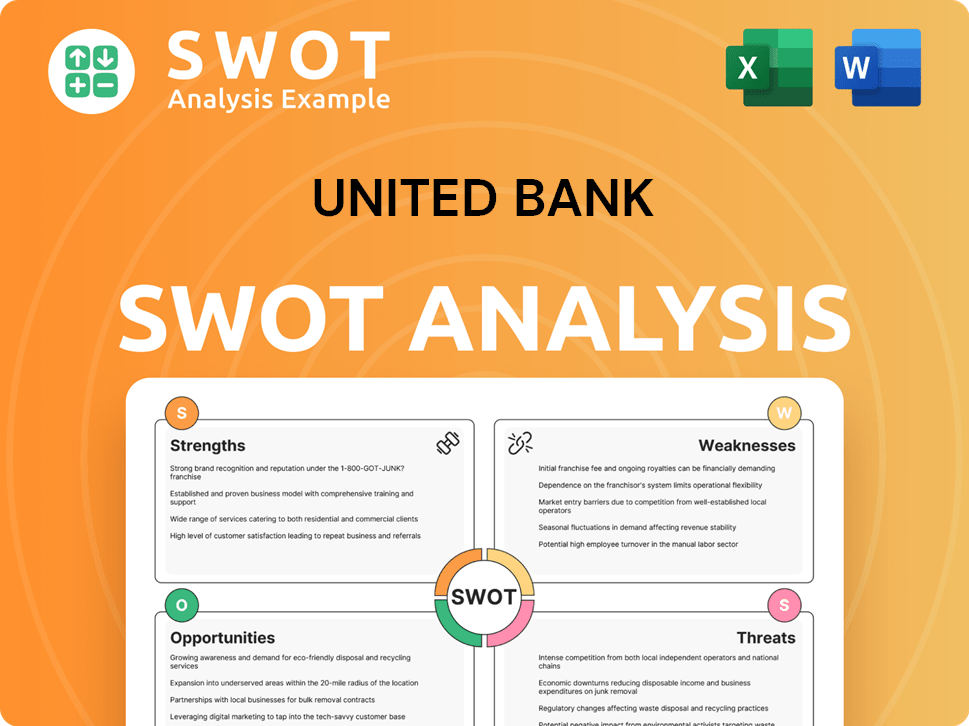

United Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of United Bank?

The early growth and expansion of United Bankshares, Inc. have been significant since its establishment in 1984. The company quickly grew, reaching $1 billion in total assets by 1987, a year after becoming publicly traded. A key strategy for UBank history has been strategic acquisitions, with the company completing a substantial number of these to expand its reach and services.

United Bankshares, Inc. has a strong history of growth through acquisitions. Under its current administration, the company has completed a total of 34 acquisitions. One major acquisition was the purchase of Carolina Financial Corporation in 2020, which added $5.0 billion in assets and expanded its presence into North Carolina, South Carolina, and Georgia.

In January 2025, United Bankshares, Inc. expanded its market presence by acquiring Atlanta-based Piedmont Bancorp, Inc. This move further solidified its position in the Atlanta area. These strategic acquisitions have been instrumental in shaping the UBank timeline and its overall growth trajectory.

United Bank operates through a network of community banks spanning multiple states. As of March 31, 2025, United Bank had over 240 locations across eight states, including Virginia, West Virginia, Maryland, Pennsylvania, Ohio, North Carolina, South Carolina, and Georgia, as well as Washington, D.C. This extensive network reflects the company's commitment to serving diverse communities.

Leadership transitions have played a role in the company's evolution. Richard Adams, who led the company through 33 acquisitions, was a key figure. Richard 'Rick' Adams, Jr. became CEO in April 2022, after serving as president since 2014. The company's consistent performance and focus on relationships have allowed it to grow to nearly $32 billion in total assets. Further insights into the competitive landscape can be found in Competitors Landscape of United Bank.

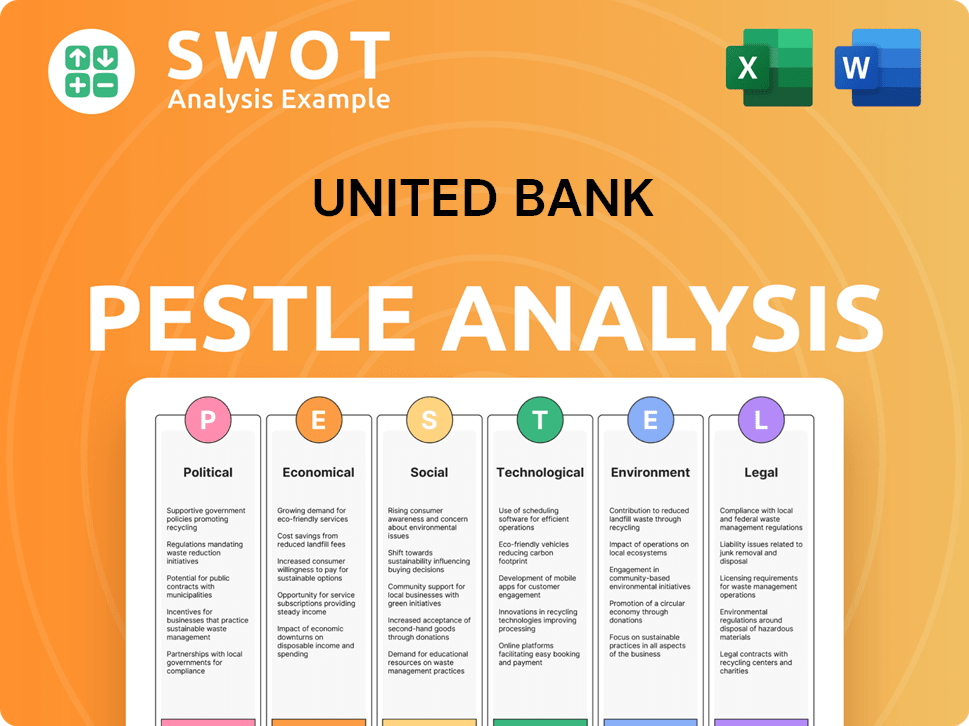

United Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in United Bank history?

The UBank history is marked by significant achievements and a commitment to financial stability. A key aspect of the UBank history is its dedication to shareholders, demonstrated by over 50 consecutive years of dividend increases, a rare accomplishment in the banking sector. Furthermore, the company has consistently shown strong financial performance, including record earnings and loan growth in 2022.

| Year | Milestone |

|---|---|

| 2022 | Achieved record earnings and loan growth. |

| 2021 | Ranked 4th among the 50 largest banking companies in the nation in financial performance. |

| Ongoing | Maintains a history of over 50 consecutive years of dividend increases to shareholders. |

Innovations have been a cornerstone of United Bank Company's strategy, enabling it to offer a comprehensive suite of financial products and services. These innovations include a variety of banking and lending solutions, along with wealth management and mortgage services.

Offers a full range of banking and lending products to meet diverse customer needs.

Provides treasury management services to assist businesses with their financial operations.

Offers wealth management services to help clients achieve their financial goals.

Provides mortgage services to assist customers with their home financing needs.

Offers both personal and business credit cards to meet varied spending needs.

Leverages technology to provide services and insights comparable to larger banks while maintaining a community focus.

Despite its successes, United Bank Company has faced challenges inherent in the banking industry, including economic downturns and periods of instability. The company's performance in the first quarter of 2025 demonstrates its ability to navigate these challenges, reporting earnings of $84.3 million despite merger-related expenses.

Survived and thrived through various economic cycles, including recessions and depressions, by focusing on the communities it serves.

Navigated significant industry challenges, including major bank failures in 2023.

Reported earnings of $84.3 million in the first quarter of 2025, despite being impacted by $30.0 million in merger-related noninterest expenses.

The net interest margin for the first quarter of 2025 increased to 3.69% from 3.49% in the fourth quarter of 2024, showing resilience.

Asset quality has remained sound, with non-performing loans at 0.29% of loans and leases as of March 31, 2025.

Successfully completed acquisitions, such as the Piedmont Bancorp acquisition, to expand its market presence.

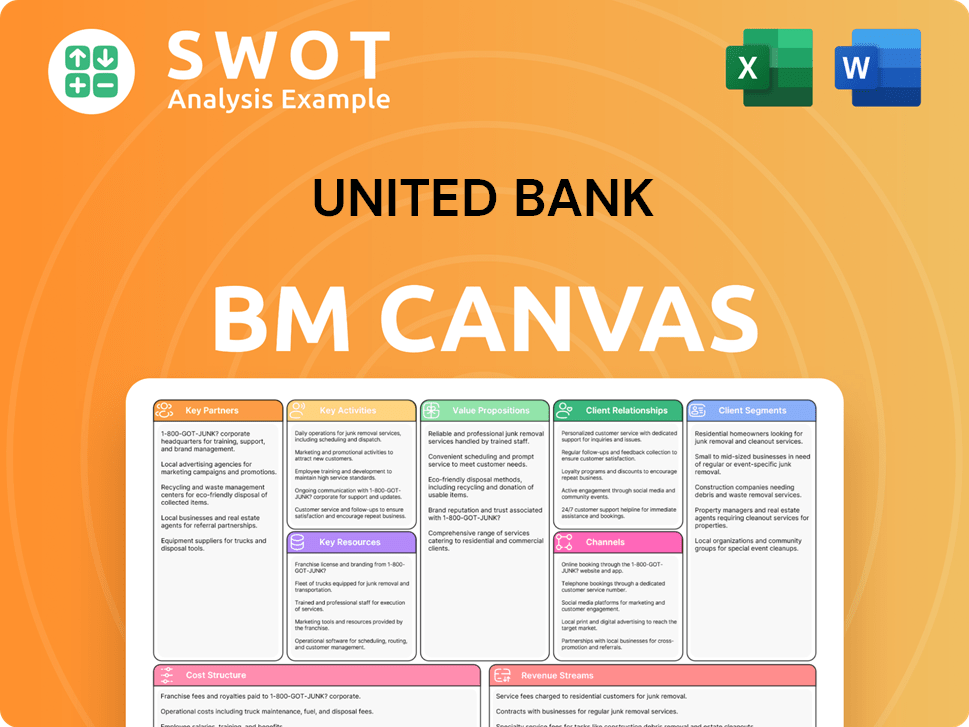

United Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for United Bank?

The Mission, Vision & Core Values of United Bank, now known as United Bank Company, boasts a rich history. It started in Parkersburg, Virginia (now West Virginia), on March 17, 1839, as the Northwestern Bank of Virginia. Over the years, it evolved, navigating significant milestones such as the Civil War and the establishment of a holding company. By 2024, the company celebrated its 185th anniversary and marked its 51st consecutive year of increased dividends, demonstrating its enduring presence in the financial sector.

| Year | Key Event |

|---|---|

| 1839 | Northwestern Bank of Virginia opens in Parkersburg, Virginia, marking the bank origins. |

| 1865 | The bank is re-established as The Parkersburg National Bank after the Civil War. |

| 1975 | Richard Adams is named chairman and CEO of Parkersburg National Bank. |

| 1984 | United Bankshares commences full operations, acquiring Parkersburg National and two other banks. |

| 1987 | United Bankshares, Inc. becomes a publicly traded company on NASDAQ. |

| 1988 | Total assets reach $1 billion. |

| 2019 | Celebrates 180th anniversary of the company and 35th anniversary of United Bankshares as a holding company. |

| 2020 | Completes the acquisition of Carolina Financial Corporation, adding $5.0 billion in assets. |

| 2022 | Richard 'Rick' Adams, Jr. becomes CEO. |

| 2024 | Celebrates its 185th anniversary and increases dividend for the 51st consecutive year. |

| 2025 | Completes the acquisition of Atlanta-based Piedmont Bancorp, Inc., increasing consolidated assets to approximately $33 billion. |

| 2025 | Reports record net interest income of $260.1 million and a net interest margin of 3.69% in the First Quarter. |

United Bank Company is focused on strategic growth. The recent acquisition of Piedmont Bancorp, Inc. in Atlanta is expected to provide new growth opportunities. The company aims to maintain its strong financial position, characterized by sound asset quality and robust capital. They continue to focus on organic growth in loans, deposits, and wealth management.

The company has consistently outperformed its peers. Analyst reports in 2024 rated UBSI as 'Outperform' with a price target of $41.00, citing solid results in a challenging environment. In the first quarter of 2025, United Bank Company reported record net interest income of $260.1 million and a net interest margin of 3.69%.

United Bank Company is committed to providing excellent service to its customers, employees, shareholders, and communities. The company's long-term strategic initiatives include driving organic growth in loans, deposits, and wealth management. The leadership is excited about the opportunities in 2025 and beyond, anticipating continued success.

With the acquisition of Piedmont Bancorp, Inc. in Atlanta, United Bank Company has expanded its market presence. The company's consolidated assets have increased to approximately $33 billion. This expansion is expected to enhance the company's ability to serve a broader customer base and capitalize on new market opportunities.

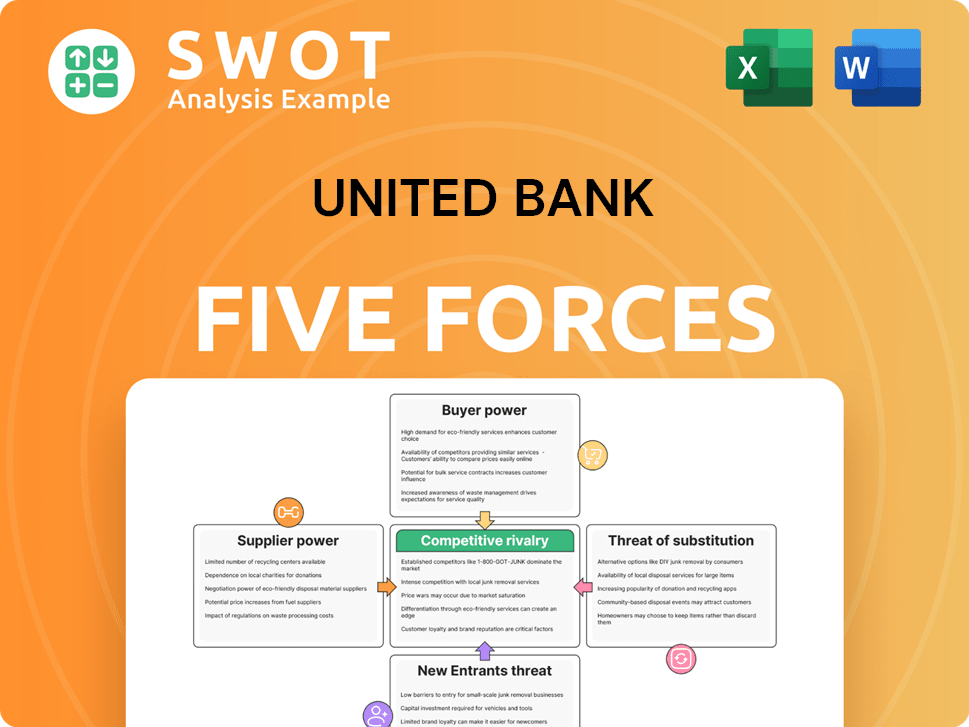

United Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of United Bank Company?

- What is Growth Strategy and Future Prospects of United Bank Company?

- How Does United Bank Company Work?

- What is Sales and Marketing Strategy of United Bank Company?

- What is Brief History of United Bank Company?

- Who Owns United Bank Company?

- What is Customer Demographics and Target Market of United Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.