Veracyte Bundle

How Did Veracyte Revolutionize Cancer Diagnostics?

Veracyte, Inc., a leading genomic diagnostics company, has reshaped the landscape of cancer care. Founded in 2006, this innovative company initially operated under the name Calderome, Inc., before transitioning to Veracyte, Inc. in March 2008. Headquartered in South San Francisco, California, Veracyte's mission has always been to improve patient outcomes through advanced diagnostic solutions.

From its inception, Veracyte SWOT Analysis has focused on leveraging genomic technology and machine learning to provide critical information for diagnosis and treatment decisions. Today, Veracyte's market capitalization of approximately $2.13 billion reflects its impressive journey and strong position in the diagnostics and research industry. This article explores the Veracyte history, its Veracyte company timeline, and its evolution into a global leader in Veracyte diagnostics.

What is the Veracyte Founding Story?

The story of the Veracyte company began with a vision to transform medical diagnostics. Co-founded by Bonnie Anderson and Y. Douglas Dolginow, the company was initially incorporated as Calderome, Inc. on August 15, 2006. The name changed to Veracyte, Inc. in March 2008, marking a pivotal moment in its development.

Bonnie Anderson, a key figure, brought over four decades of experience in regulated diagnostics and life science markets. She served as co-founder, CEO, and Chairman of the Board until June 1, 2021, when she became executive chairwoman. Her leadership was critical in shaping the company's early direction and strategy.

The founders identified a significant issue in medical diagnostics: the prevalence of unnecessary, invasive procedures. This led to the development of molecular diagnostic solutions. These solutions aimed to provide accurate genomic information from outpatient cytology samples, thereby improving diagnostic accuracy. The first product, the Afirma Thyroid FNA Analysis, was designed to clarify uncertain thyroid nodule results, reducing the need for surgeries.

Veracyte secured its initial funding through a Series A round in 2008. This was followed by a $28 million Series B financing in June 2010 from investors like Domain Associates, Kleiner Perkins Caufield & Byers, and Versant Ventures. The company continued to gain financial support.

- A $28 million Series C financing in July 2013 included new investor GE Ventures, alongside existing investors.

- These early funding rounds were essential for the development and commercialization of its genomic tests.

- The company focused on improving diagnostic accuracy at an earlier stage of patient care.

- Veracyte's early focus was on addressing the unmet need for more accurate diagnostic tools.

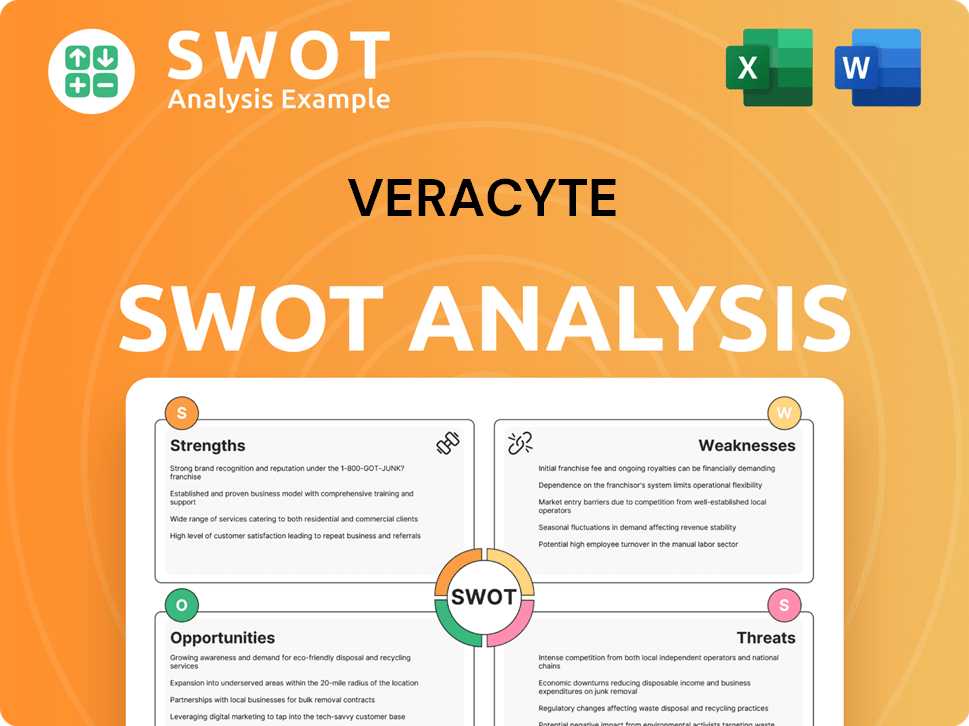

Veracyte SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Veracyte?

The early growth of the company, focused on advanced diagnostics, began with the launch of its first product, the Afirma Thyroid FNA Analysis, in 2011. This test provided clear diagnostic information for thyroid nodules, aiming to reduce unnecessary surgeries. Securing insurance coverage from major payers was crucial for driving product sales, marking a significant step in the company's expansion.

The Afirma Thyroid FNA Analysis, launched in 2011, was a key product. Securing insurance coverage from major payers like Medicare, United Healthcare, Aetna, and Humana was a critical factor in driving sales. This coverage significantly boosted the adoption of the test within the healthcare system.

In October 2013, the company completed its IPO, raising approximately $58.0 million in net proceeds. The IPO involved offering 5,000,000 shares at $13.00 per share, generating a total of $65 million. This influx of capital was pivotal for funding further expansion and research initiatives.

The company expanded its product portfolio by introducing tests like Percepta for lung cancer and Envisia for idiopathic pulmonary fibrosis. By October 2017, it had commercialized three genomic tests, targeting a $2 billion market opportunity. This diversification helped broaden its market reach and revenue streams.

Key acquisitions played a crucial role in the company's growth strategy. The acquisition of Decipher Biosciences in March 2021 significantly enhanced its prostate cancer diagnostics capabilities. In February 2024, the acquisition of C2i Genomics for $100.2 million allowed the company to enter the minimal residual disease (MRD) treatment market, estimated at $20 billion per year. These moves illustrate the company's commitment to innovation and market expansion. For more details on the company's values, you can refer to Mission, Vision & Core Values of Veracyte.

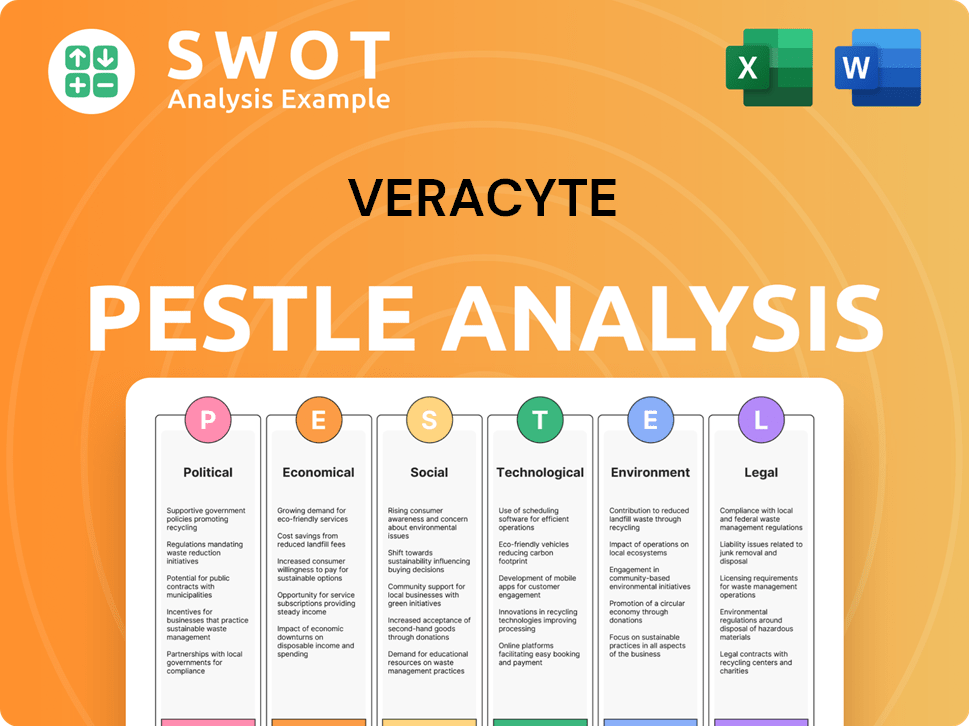

Veracyte PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Veracyte history?

The journey of Veracyte, a company focused on advanced genomic diagnostics, is marked by significant milestones that have shaped its trajectory in the healthcare sector. From pioneering diagnostic tests to strategic partnerships and acquisitions, the Veracyte company has consistently pushed boundaries in cancer diagnostics. Understanding the Veracyte history provides insight into its evolution and impact on patient care.

| Year | Milestone |

|---|---|

| 2011 | Launched Afirma Thyroid FNA Analysis, a groundbreaking test using RNA sequencing to differentiate benign from suspicious thyroid nodules. |

| 2015 | Introduced Percepta, a test for lung cancer, expanding its diagnostic offerings. |

| 2016 | Launched Envisia for idiopathic pulmonary fibrosis, further diversifying its product portfolio. |

| 2018 | Decipher Prostate Genomic Classifier received 'Level 1' evidence designation in the NCCN Clinical Practice Guidelines. |

| 2023 | Entered a multi-year agreement with Illumina, Inc. to produce in vitro diagnostic (IVD) variants of its tests. |

| 2024 | Acquired C2i Genomics to enter the minimal residual disease (MRD) market. |

Veracyte has consistently demonstrated innovation in the field of diagnostics. The development of Afirma Thyroid FNA Analysis, using advanced genomic techniques, was a key breakthrough. This innovation significantly reduced the need for invasive surgeries. The company's commitment to innovation is further evident in its strategic partnerships and acquisitions, such as the collaboration with Illumina and the acquisition of C2i Genomics.

This test, launched in 2011, utilizes RNA whole-transcriptome sequencing and machine learning to differentiate between benign and suspicious thyroid nodules. This innovation reduced the need for invasive surgeries, improving patient outcomes and streamlining the diagnostic process.

These tests expanded Veracyte’s diagnostic reach into lung cancer and idiopathic pulmonary fibrosis, respectively. They represent the company's commitment to providing comprehensive diagnostic solutions for various diseases, improving patient care.

The Decipher Prostate Genomic Classifier received a 'Level 1' evidence designation in the NCCN Clinical Practice Guidelines. This recognition highlights its clinical utility and acceptance within the medical community, improving patient outcomes.

The multi-year agreement with Illumina, Inc. is aimed at producing in vitro diagnostic (IVD) variants of its tests. This collaboration is crucial for expanding global access to their tests, which will improve patient care.

This acquisition allowed Veracyte to enter the promising minimal residual disease (MRD) market. This move is a strategic step toward expanding its product portfolio and enhancing its market position.

Veracyte utilizes advanced technologies like RNA whole-transcriptome sequencing and machine learning. These technologies enhance the accuracy and efficiency of its diagnostic tests, improving patient care and outcomes.

Despite these achievements, Veracyte faces several challenges. The adoption of new cancer detection methods can be slow, requiring time for tests to gain widespread acceptance. Regulatory uncertainties and slower growth for certain products, like Afirma, have also presented obstacles. For more context, you can explore the Competitors Landscape of Veracyte.

The scientific and medical community can be skeptical of new cancer detection methods, requiring time for tests to gain popularity and demand. This slow adoption rate can impact revenue growth and market penetration.

Regulatory uncertainties and the slower growth of certain products, such as Afirma compared to Decipher, have presented challenges. These factors can affect the company's financial performance and strategic planning.

The company is evaluating its ownership and operations of its French subsidiary, Veracyte SAS, which includes its immune-oncology biopharma business and contract IVD development. This restructuring could lead to potential divestiture or even bankruptcy proceedings if no buyer is found, impacting its 2025 financial outlook.

Veracyte’s financial performance is crucial for its continued success. The company's strong cash position, with $287.4 million of cash, cash equivalents, and short-term investments at the end of Q1 2025, provides a buffer against these challenges.

Veracyte operates in a competitive market with other companies offering diagnostic tests. Competition can affect market share and pricing strategies, impacting financial performance.

Changes in market dynamics, such as shifts in healthcare policies or technological advancements, can impact the demand for Veracyte’s products. Adapting to these changes is crucial for maintaining a competitive edge.

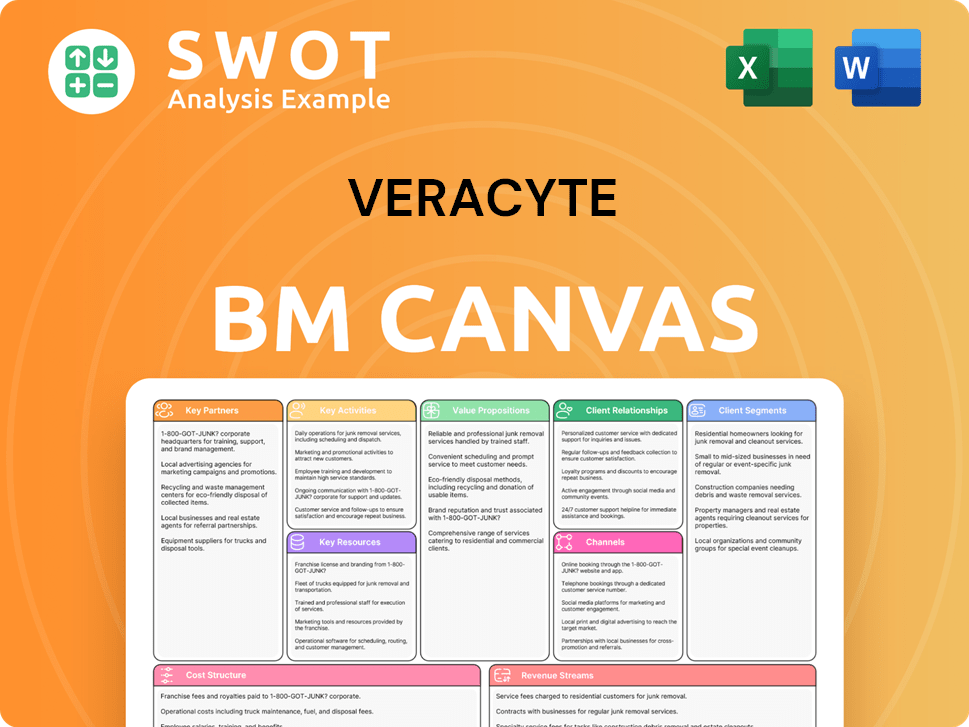

Veracyte Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Veracyte?

The Veracyte company's journey began in August 2006 as Calderome, Inc., evolving into Veracyte, Inc. in March 2008. The company's history is marked by key milestones, including the launch of Afirma Thyroid FNA Analysis in 2011 and its initial public offering (IPO) in October 2013, which raised $65 million. Strategic moves like the acquisition of Decipher Biosciences in March 2021 and C2i Genomics in February 2024 have expanded its portfolio. In November 2023, a multi-year agreement with Illumina for IVD variants of tests was announced. Veracyte's focus on innovation has driven its growth in genomic diagnostics.

| Year | Key Event |

|---|---|

| August 2006 | Incorporated as Calderome, Inc. |

| March 2008 | Changed name to Veracyte, Inc. |

| 2011 | Launched Afirma Thyroid FNA Analysis. |

| July 2013 | Completed $28 million Series C financing. |

| October 2013 | Completed initial public offering (IPO), raising $65 million. |

| March 2016 | Raised a $45 million conventional debt round. |

| December 2019 | Acquired exclusive diagnostics rights to NanoString nCounter platform. |

| January 2020 | Announced biopharmaceutical collaboration with Acerta Pharma (AstraZeneca). |

| March 2021 | Acquired Decipher Biosciences. |

| June 2021 | Co-founder Bonnie Anderson transitioned to Executive Chairwoman; Marc Stapley became CEO. |

| February 2024 | Acquired C2i Genomics for $100.2 million. |

| November 2023 | Entered multi-year agreement with Illumina for IVD variants of tests. |

| Q4 2024 | Reported total revenue of $118.6 million, an increase of 21% year-over-year, and testing revenue of $112.2 million, up 24%. Full-year 2024 total revenue reached $445.8 million, a 23% increase from 2023. |

| Q1 2025 | Reported total revenue of $114.5 million, an 18% increase from Q1 2024, and testing revenue of $107.3 million, up 19%. Net income for Q1 2025 was $7.0 million, a 478% improvement compared to Q1 2024. |

Veracyte is focused on expanding its global presence. It aims to increase its market penetration across all indications. The company is developing IVD versions of its Decipher Prostate Genomic Classifier and Percepta Nasal Swab test for international markets to reach a broader patient base.

For 2025, Veracyte anticipates testing revenue in the range of $470 million to $480 million, reflecting 12% to 15% year-over-year growth, or 14% to 16% adjusting for the paused Envisia test. Adjusted EBITDA as a percentage of revenue is projected to be approximately 22.5% in 2025.

Veracyte plans to expand its minimal residual disease (MRD) indications annually starting in 2027. This strategic move aims to provide more comprehensive genomic information for cancer care. This expansion is a key part of the company's long-term strategy.

The completion of the Percepta nasal swab Nightingale study enrollment is expected in Q3 2025. Veracyte is also focused on the development of IVD versions of its tests. These initiatives are designed to enhance the accuracy and availability of their genomic diagnostics.

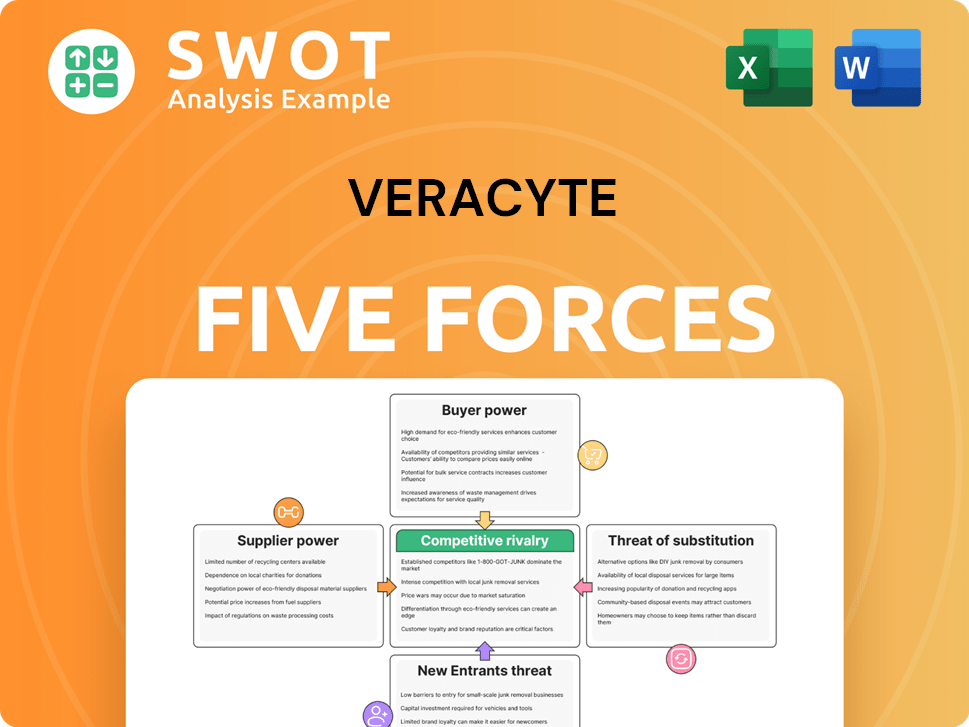

Veracyte Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Veracyte Company?

- What is Growth Strategy and Future Prospects of Veracyte Company?

- How Does Veracyte Company Work?

- What is Sales and Marketing Strategy of Veracyte Company?

- What is Brief History of Veracyte Company?

- Who Owns Veracyte Company?

- What is Customer Demographics and Target Market of Veracyte Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.