WTW Bundle

How has WTW Transformed Over Nearly Two Centuries?

Embark on a fascinating journey through the WTW SWOT Analysis and the remarkable WTW company history, a story of adaptation and innovation. From its origins in 1828 London as a merchant of imported goods, to its current status as a global leader, WTW's evolution is a testament to its enduring vision. Discover how strategic WTW acquisitions and mergers have shaped this influential company.

The Willis Towers Watson history is a compelling narrative of how a small marine insurance brokerage grew into a global powerhouse. The WTW timeline reveals a series of pivotal moments, including the mergers of Towers Perrin and Watson Wyatt, and Willis Group and Towers Watson. Understanding the WTW company evolution provides insights into the company's ability to navigate changing market dynamics and maintain a strong market position, showcasing the company's commitment to its clients.

What is the WTW Founding Story?

The story of WTW, a major player in risk management, insurance brokerage, and advisory services, is a tale of strategic mergers and acquisitions. The roots of the company stretch back to the 19th century, with several independent firms laying the groundwork for what would become a global entity. Understanding the WTW company history is key to appreciating its current scope and influence.

The WTW timeline is a fascinating look at the evolution of these distinct businesses. Each entity brought unique expertise to the table, ultimately shaping the comprehensive services WTW offers today. The journey from these individual firms to the present-day organization is a testament to strategic vision and adaptability.

The origins of WTW can be traced back to 1828, when Henry Willis began his career as a merchant at the Baltic Exchange in London. He started selling imported goods. By 1841, Willis broadened his activities by applying for membership at Lloyd's, where he started brokering insurance for the very commodities he had previously sold. He soon specialized in marine insurance, forming Henry Willis & Company.

- In 1878, Reuben Watson established R. Watson & Sons in the UK, the world's oldest actuarial firm.

- Towers, Perrin, Forster & Crosby was incorporated in Philadelphia, Pennsylvania, in 1934.

- In 1946, Birchard E. Wyatt and seven co-founders established The Wyatt Company in the U.S.

- These separate ventures, each addressing distinct problems or opportunities within the burgeoning fields of insurance, actuarial science, and human resources, would eventually converge to form the modern WTW.

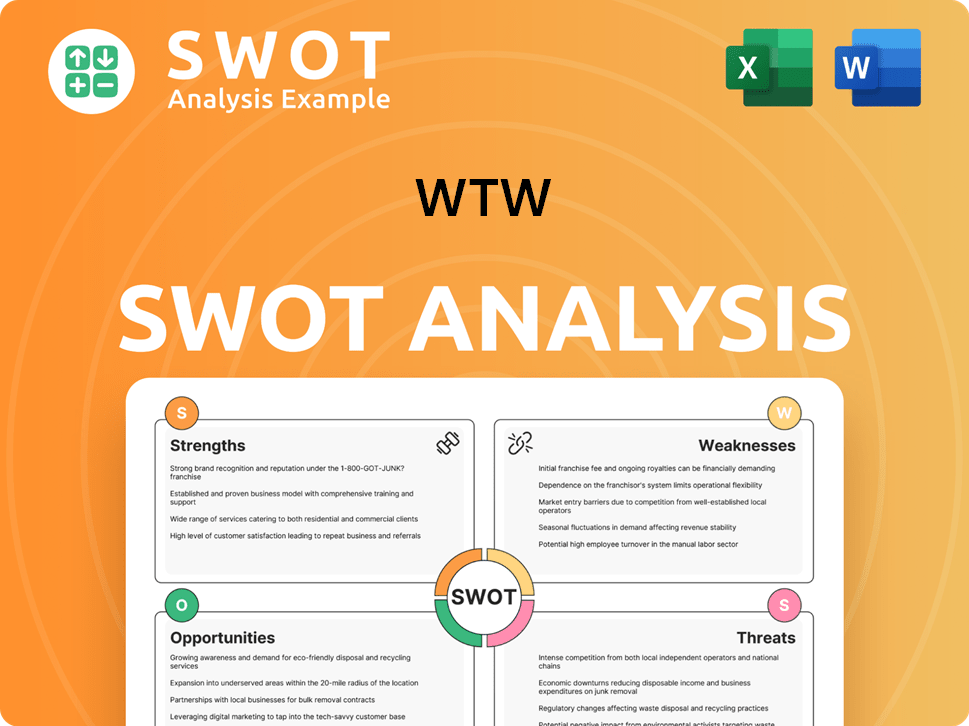

WTW SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of WTW?

The early growth and expansion of the company's predecessors highlight strategic moves and adaptation to market changes. Henry Willis & Company expanded from marine insurance, with Willis Faber & Co. developing a significant marine portfolio. R. Watson & Sons grew its influence in actuarial services, and The Wyatt Company diversified into healthcare and compensation consulting.

Key moments in the 20th century included Willis's role as the broker for the Titanic in 1912, settling a $1 million hull claim within a month, and later for the moon buggy used in the Apollo program in 1971. In 1976, Willis went public.

In 1995, R. Watson & Sons and The Wyatt Company formed an alliance, leading to Watson Wyatt Worldwide, a global consulting firm. Watson Wyatt went public, listing on the New York Stock Exchange in 2000 and NASDAQ in 2007. These moves reflect the company's strategic growth and its adaptation to the evolving financial landscape.

The 2010 merger of Towers Perrin and Watson Wyatt created Towers Watson, a $4 billion deal, forming the largest employee-benefits consulting firm by revenue globally. This merger combined Towers Perrin's financial services expertise with Watson Wyatt's human capital knowledge, marking a significant consolidation in the industry. For more insights into the company's strategic direction, consider reading about the Growth Strategy of WTW.

The early expansion involved establishing a strong presence in key markets. Watson Wyatt Worldwide, for instance, had operations across the Americas, Europe, and Asia-Pacific. This global footprint helped the company serve a diverse clientele and adapt to different regional market dynamics. The company's history is marked by strategic acquisitions and global expansion.

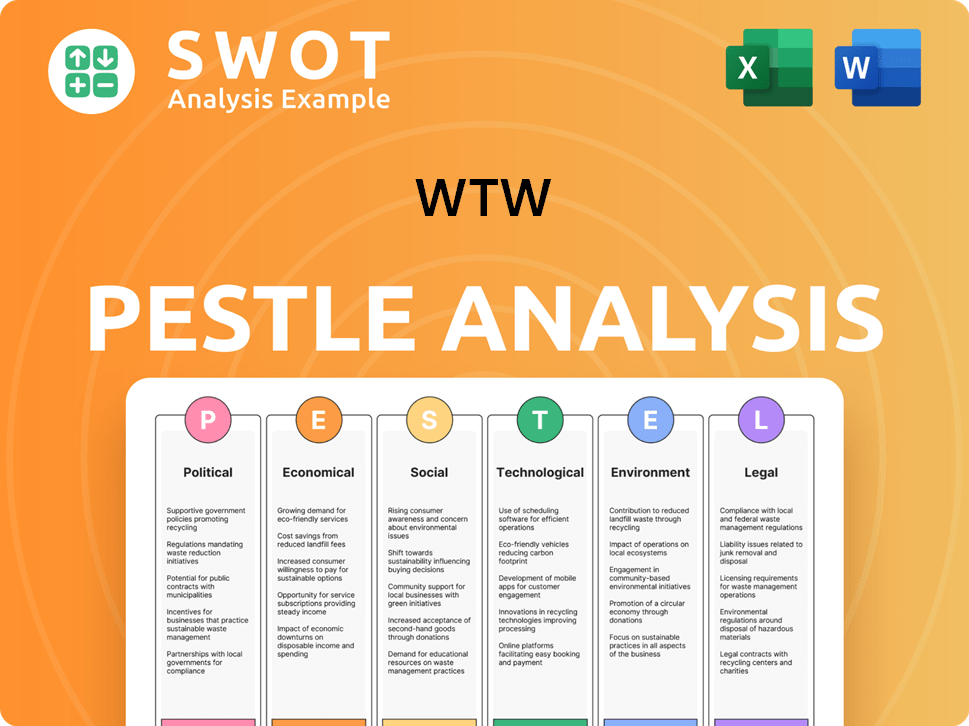

WTW PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in WTW history?

The WTW company history is marked by significant milestones, including key mergers and acquisitions that have shaped its global presence. These pivotal moments have solidified its position in the risk management and advisory sectors.

| Year | Milestone |

|---|---|

| 1912 | Willis acted as the broker for the Titanic, successfully settling a US$1 million hull claim. |

| 1971 | Willis brokered the moon buggy used during the American Apollo program's lunar missions. |

| 2010 | Towers Perrin and Watson Wyatt merged to form Towers Watson, becoming the largest employee benefits consulting firm globally by revenue. |

| 2016 | Willis Group and Towers Watson merged, creating Willis Towers Watson. |

| 2025 | Reintroduction of 'Willis' and 'Towers Watson' as trading names for risk and broking, and health, wealth, and career segments, respectively, while maintaining 'WTW' as the company's official name and brand. |

The company has consistently embraced innovation, starting with early adoption of technology. Recent initiatives include the launch of AI-driven monitoring tools and the introduction of new insights for maximizing global business potential.

Among the first actuarial consulting companies to use computers in 1953.

Launched new AI-driven monitoring tools for insurers in March 2025.

Introduced new insights for maximizing global business potential with centralized trade credit programs.

Funded the development of new open-access risk modeling tools launched by the Insurance Development Forum.

Challenges faced by WTW include navigating market downturns and competitive pressures. A significant setback was the failed acquisition by Aon in 2021, along with financial impacts from strategic shifts.

The proposed $30 billion all-share acquisition by Aon was terminated in 2021 due to monopoly concerns.

Reported a net loss of $88 million in 2024, primarily due to impairment charges.

Achieved organic revenue growth of 5% for the full year 2024, reaching $9.93 billion.

The net loss was primarily due to over $1.0 billion in impairment charges related to the sale of its direct-to-consumer insurance distribution business, TRANZACT, a deal completed in January 2025.

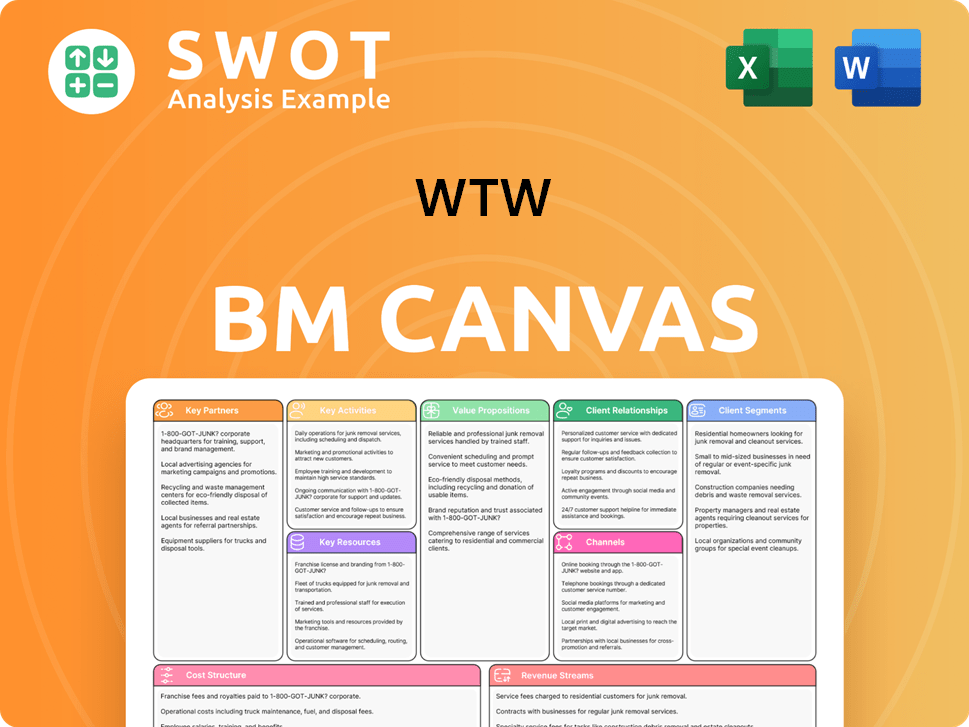

WTW Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for WTW?

The WTW company history is a story of strategic evolution, marked by significant mergers and acquisitions that have shaped its global presence. From its origins in marine insurance and actuarial science to its current status as a leading global advisory, brokerage, and solutions company, WTW's journey reflects the dynamic nature of the financial services industry.

| Year | Key Event |

|---|---|

| 1828 | Henry Willis begins his career in London, later founding Henry Willis & Company, which focused on marine insurance. |

| 1878 | Reuben Watson forms R. Watson & Sons in the UK, the world's oldest actuarial firm. |

| 1934 | Towers, Perrin, Forster & Crosby is established in Philadelphia, specializing in reinsurance and employee benefits. |

| 1946 | The Wyatt Company is founded in the U.S. as an actuarial consulting firm. |

| 1995 | R. Watson & Sons and The Wyatt Company form an alliance, leading to Watson Wyatt Worldwide. |

| 2010 | Towers Perrin and Watson Wyatt merge to form Towers Watson. |

| 2016 | Willis Group and Towers Watson merge to become Willis Towers Watson. |

| January 2022 | Willis Towers Watson rebrands to WTW and changes its NASDAQ ticker symbol to WTW; Carl Hess becomes CEO. |

| December 31, 2024 | WTW reports full-year revenue of $9.93 billion, a 5% increase over the prior year, with a net loss of $88 million due to impairment charges. |

| January 2025 | WTW completes the sale of its TRANZACT business and reintroduces 'Willis' and 'Towers Watson' as trading names. |

| Q1 2025 | WTW reports net income of $239 million, up from $194 million in Q1 2024, despite a 5% revenue decline to $2.2 billion due to the TRANZACT sale. |

WTW enters 2025 with positive momentum after meeting its 2024 financial goals, driven by solid revenue growth and margin expansion. CEO Carl Hess is confident in the new strategy to accelerate performance, enhance efficiency, and optimize the portfolio.

The company plans to repurchase approximately $1.5 billion in shares in 2025, subject to market conditions. WTW is focused on driving growth and margin expansion despite ongoing economic uncertainty, demonstrating a commitment to creating shareholder value.

In May 2025, WTW launched 'FinTech Plus,' a global insurance solution for FinTech leaders. The company is also leveraging Moody's flood data and analytics in its risk modeling suite, showing a continued focus on innovation and specialized solutions.

WTW's strategic initiatives align with broader industry trends that emphasize data-driven insights, risk management, and human capital solutions. The company's evolution reflects its founding vision of providing comprehensive support to institutions and individuals.

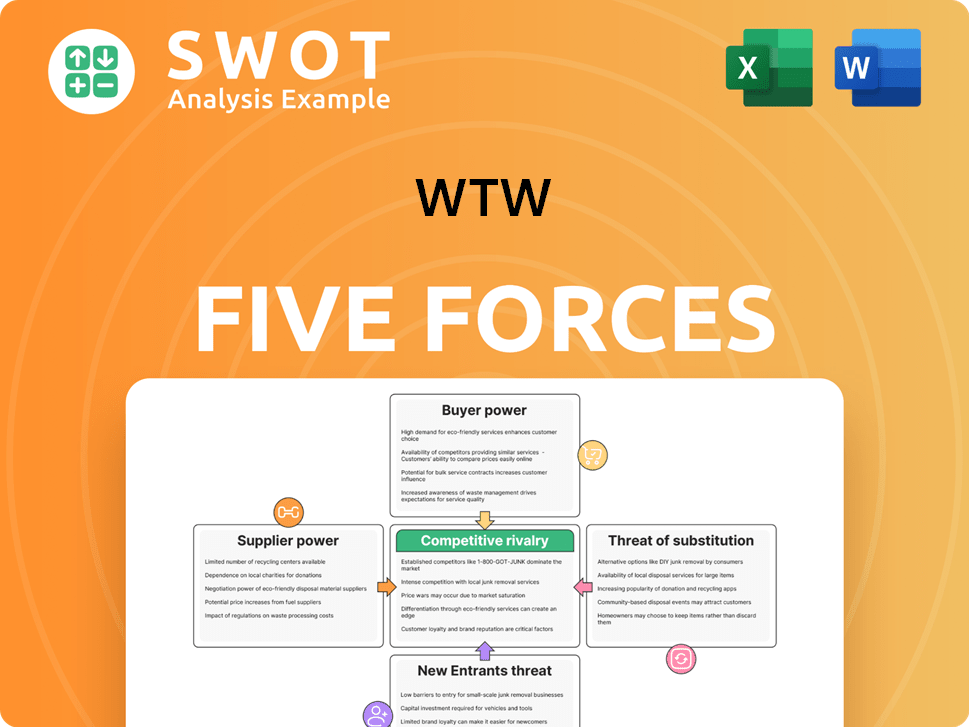

WTW Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of WTW Company?

- What is Growth Strategy and Future Prospects of WTW Company?

- How Does WTW Company Work?

- What is Sales and Marketing Strategy of WTW Company?

- What is Brief History of WTW Company?

- Who Owns WTW Company?

- What is Customer Demographics and Target Market of WTW Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.