Aon Bundle

How Does Aon Navigate the Complex World of Risk and Competition?

In a world grappling with escalating risks and evolving regulations, understanding the Aon SWOT Analysis is crucial. Aon, a global leader in professional services, has consistently adapted and innovated since its inception in 1982. This article dissects the Aon competitive landscape, providing a deep dive into its strategies and rivals.

This exploration will reveal Aon's competitive advantages and disadvantages, examining its position within the insurance industry competition. We'll analyze Aon's market share and compare it with key Aon competitors, offering insights into how Aon maintains its market dominance. Furthermore, the analysis will cover the key challenges facing Aon and its strategies for navigating the competitive insurance market, providing a detailed look at the risk management firms landscape.

Where Does Aon’ Stand in the Current Market?

Aon holds a significant position in the professional services sector, particularly in risk management, retirement, and health solutions. As of early 2025, Aon is recognized as one of the top global insurance brokers. Aon's core operations revolve around providing commercial risk solutions, reinsurance solutions, retirement solutions, and health solutions.

The company serves a diverse clientele, ranging from large corporations to small and medium-sized enterprises across various industries. Aon's value proposition lies in its ability to offer data-driven insights and advanced analytics, moving beyond traditional brokerage services to provide more tailored and proactive advice. This approach helps clients navigate complex risks and make informed decisions.

Aon's extensive geographic presence, operating in over 120 countries, allows it to serve clients with localized expertise and global reach. This widespread presence is crucial for managing risks and providing solutions that meet the specific needs of clients worldwide. Aon's strategic shift towards data-driven solutions and digital transformation has enhanced its ability to offer more customized services, solidifying its market position.

Aon's market share is substantial, especially in reinsurance brokerage, where Aon Reinsurance Solutions is a leading global provider. The company competes directly with other major players in the insurance brokerage and risk management sectors. Understanding Aon's market share is key to assessing its competitive standing and financial performance.

Aon operates in over 120 countries, providing localized expertise and global reach. Its strong presence in North America and Europe is complemented by its expansion in emerging markets across Asia and Latin America. This global footprint allows Aon to serve clients worldwide, adapting to local market conditions.

Aon's financial performance in 2024 was strong, with Q4 2024 earnings per share reaching $3.96, surpassing analyst estimates. The total revenue for the quarter increased by 8% to $3.4 billion. These financial results demonstrate Aon's scale and stability, highlighting its ability to compete effectively in the insurance market.

Aon has strategically emphasized data-driven insights and advanced analytics. This digital transformation enables Aon to offer more tailored and proactive advice. This shift allows Aon to provide more sophisticated risk management and human capital solutions, moving beyond traditional brokerage services.

Aon's competitive advantages include its global reach, comprehensive service offerings, and focus on data-driven solutions. These factors contribute to its strong market position and ability to attract and retain clients. The company's financial health and strategic investments also support its competitive edge.

- Extensive global presence with operations in over 120 countries.

- Strong financial performance, with Q4 2024 revenue growth.

- Strategic focus on data-driven insights and advanced analytics.

- Comprehensive service offerings, including risk, retirement, and health solutions.

For more insight into Aon's performance, consider reading about Owners & Shareholders of Aon. This article provides additional context on the company's financial health and strategic direction.

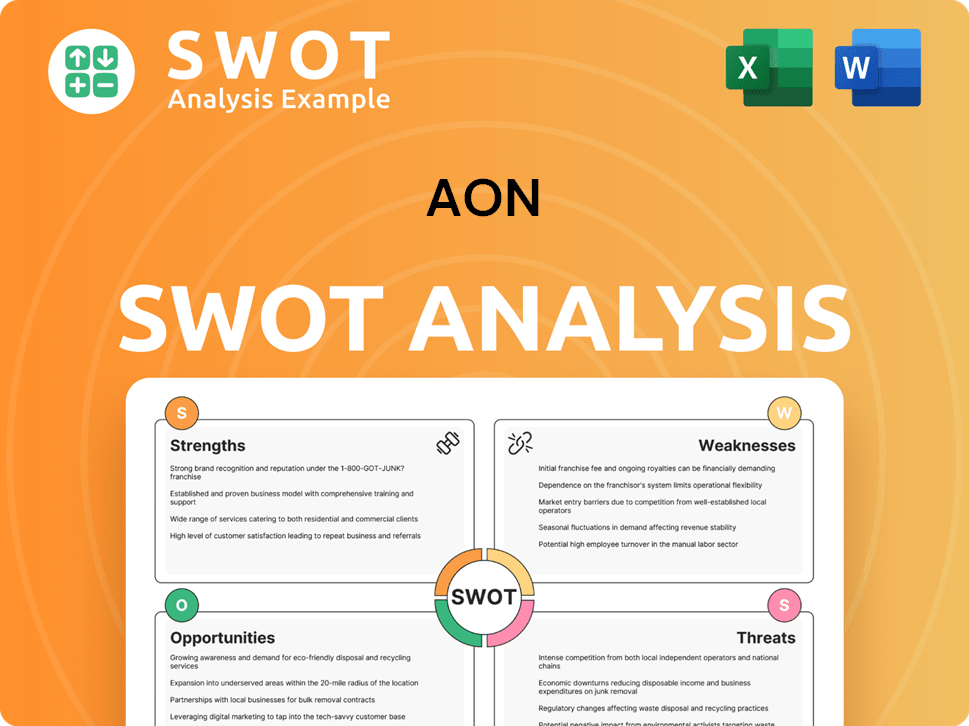

Aon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Aon?

The competitive landscape for Aon is intense, shaped by both direct and indirect competitors. Aon faces challenges from global firms and specialized companies across various sectors, including risk management, insurance brokerage, and human capital consulting. Understanding Aon's competitive environment is crucial for assessing its market position and strategic direction.

Aon's competitive dynamics are influenced by industry trends such as mergers, technological advancements, and the increasing demand for specialized services. The company's ability to adapt and innovate is vital for maintaining its market share. Furthermore, the competitive environment is constantly evolving, requiring continuous analysis and strategic adjustments.

Marsh & McLennan Companies (MMC) is a major direct competitor, offering similar services in risk, strategy, and people. Willis Towers Watson (WTW) provides risk management, insurance brokerage, and human capital consulting. Arthur J. Gallagher & Co. is another significant competitor in insurance brokerage and risk management.

In the reinsurance sector, Aon Reinsurance Solutions competes with Guy Carpenter (part of MMC) and Gallagher Re (part of Arthur J. Gallagher & Co.). These firms compete on expertise, global reach, and client relationships.

Aon faces competition from Mercer (MMC), Willis Towers Watson, and specialized benefits consultants in health and retirement solutions. These firms compete on expertise, technology, and integrated solutions.

InsurTech and AI-driven analytics firms are disrupting the market, offering niche solutions and efficient digital platforms. These emerging players put pressure on established companies to innovate and adapt to new technologies.

Mergers and acquisitions, like Aon's proposed deal with Willis Towers Watson, highlight the industry's drive for consolidation. This trend aims to gain scale and expand capabilities, thus intensifying competitive dynamics.

Aon, Marsh & McLennan, and Willis Towers Watson are the dominant players in the global risk advisory market. The competitive landscape is characterized by ongoing efforts to capture market share through acquisitions and organic growth. For more details, check out Revenue Streams & Business Model of Aon.

Several factors drive competition in this industry, including the breadth of service offerings, global reach, technological innovation, and client relationships. Aon's ability to compete effectively depends on its strategic responses to these factors.

- Global Presence: Extensive networks and international operations are crucial for serving multinational clients.

- Service Diversification: Offering a wide range of services, from risk management to human capital consulting, provides a competitive edge.

- Technological Innovation: Leveraging InsurTech and AI-driven analytics to improve efficiency and offer new solutions.

- Client Relationships: Strong, long-term relationships with clients are essential for retaining business and attracting new clients.

- Mergers and Acquisitions: Strategic acquisitions to expand capabilities and market share.

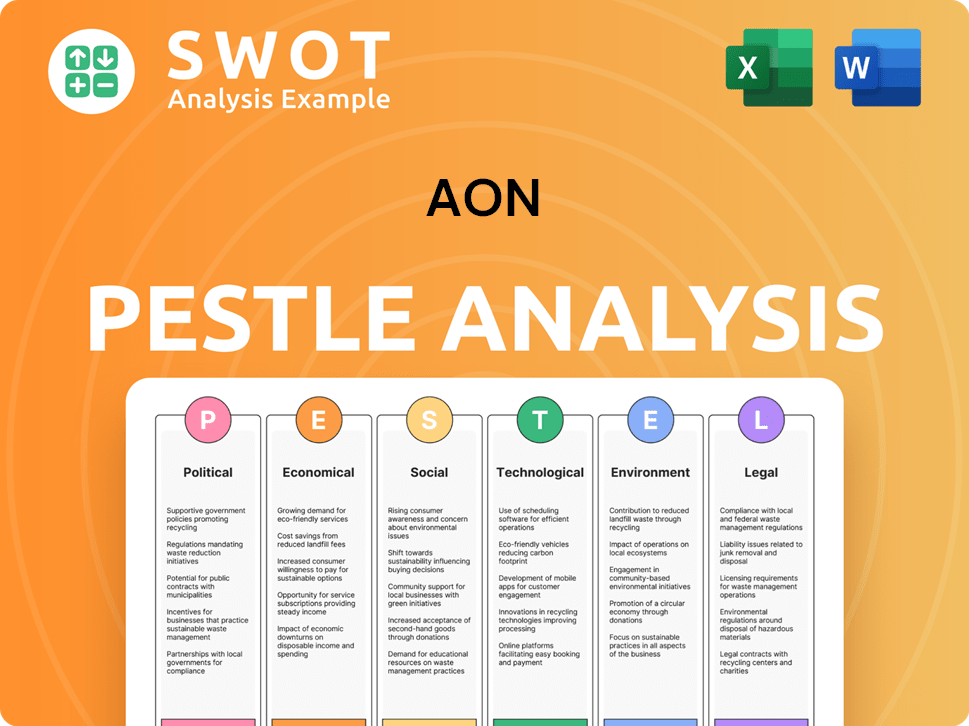

Aon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Aon a Competitive Edge Over Its Rivals?

The competitive advantages of Aon are rooted in its global presence, data analytics, and integrated service model. With operations spanning over 120 countries, Aon has an unparalleled global reach, which is a significant barrier to entry for smaller competitors. Aon's investment in data and analytics, particularly through its Aon Business Services (ABS) platform, provides clients with sophisticated, data-driven solutions, going beyond traditional brokerage services.

Brand equity and client loyalty are crucial advantages, built over decades of delivering complex solutions and maintaining strong client relationships. Aon's reputation for expertise and thought leadership fosters trust and repeat business. The company also benefits from economies of scale, allowing it to invest heavily in technology, talent, and global infrastructure. Its talent pool, comprising highly specialized experts, further enhances its ability to deliver customized solutions.

Aon leverages these advantages in its marketing by highlighting its global network and analytical prowess and in product development by continuously integrating new data insights and technological advancements. These advantages are substantial, but they face threats from rapid technological advancements by InsurTech startups and the potential for imitation by well-resourced competitors. For a deeper understanding of Aon's strategic approach, consider the Growth Strategy of Aon.

Aon's extensive global footprint, with operations in over 120 countries, provides a significant competitive advantage. This broad reach allows Aon to serve multinational corporations effectively. The scale of Aon enables it to invest heavily in technology, talent, and infrastructure, which smaller competitors struggle to match.

Aon's investment in data and analytics, particularly through its Aon Business Services (ABS) platform, provides deep insights into risk, human capital, and market trends. This allows Aon to offer sophisticated, data-driven solutions that go beyond traditional brokerage services. Proprietary technology and intellectual property enable predictive modeling and tailored risk mitigation strategies.

Aon has built strong brand equity and client loyalty through decades of delivering complex solutions and maintaining strong client relationships. Its reputation for expertise and thought leadership in risk management, retirement, and health solutions fosters trust and repeat business. This is a key factor in Aon's competitive advantage.

Aon's integrated service model allows it to offer comprehensive solutions across various risk and human capital needs. This integrated approach enhances its ability to deliver customized solutions. This model is a key differentiator in the competitive landscape.

Aon's competitive advantages include its global presence, data and analytics capabilities, and integrated service model. Its global reach allows it to serve multinational corporations and provide localized expertise, creating a significant barrier to entry for smaller competitors. The company's investment in data and analytics, along with its strong brand equity, further strengthens its position in the insurance industry competition.

- Global Network: Operations in over 120 countries, providing unparalleled global reach.

- Data-Driven Solutions: Proprietary data and analytics capabilities through the Aon Business Services (ABS) platform.

- Client Relationships: Strong brand equity and client loyalty built over decades.

- Integrated Model: Comprehensive solutions across risk and human capital needs.

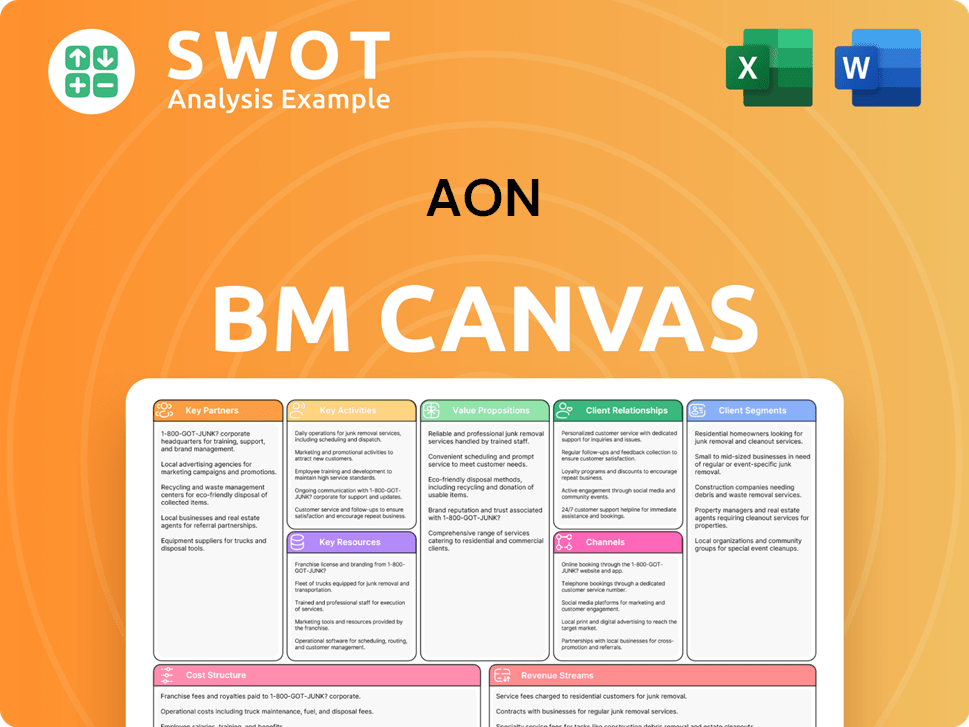

Aon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Aon’s Competitive Landscape?

The professional services sector, particularly within risk, retirement, and health solutions, is experiencing significant shifts. These changes are driven by technological advancements, regulatory adjustments, and evolving consumer preferences. Understanding the Aon competitive landscape requires a grasp of these broader industry dynamics and their specific impact on the company.

Aon's company analysis reveals a landscape shaped by both opportunities and challenges. The increasing complexity of global risks, the rise of InsurTech, and the demand for specialized consulting services are key factors. The firm must navigate these elements strategically to maintain and enhance its market position.

Technological advancements, including AI and machine learning, are transforming risk assessment and management. Regulatory changes, such as evolving data privacy laws, are increasing compliance demands. Shifting consumer preferences are driving demand for digital and personalized services, impacting insurance industry competition.

The increasing complexity of global risks, including cyber threats and climate change, poses significant challenges. New market entrants, especially InsurTech companies, are disrupting traditional business models. Maintaining a competitive edge requires continuous investment in advanced analytical tools and talent.

Growing demand for specialized consulting in areas like cyber risk and ESG strategies presents opportunities. Expansion into emerging markets, where risk management practices are developing, offers substantial growth potential. Strategic partnerships and acquisitions can bolster capabilities and market reach, impacting Aon market share.

Aon is focusing on innovation through initiatives such as the Aon Client Promise. The company is also investing in data and analytics platforms to provide forward-looking insights. The focus is on a technology-driven, advisory-centric model emphasizing proactive risk mitigation and human capital optimization.

To navigate the competitive landscape, Aon is employing several key strategies. These include enhancing its technological capabilities, expanding its service offerings, and forging strategic partnerships. Aon is also focused on improving client engagement and expanding into new markets. For more information, you can read a Brief History of Aon.

- Innovation: Investment in data and analytics to provide forward-looking insights.

- Client Focus: Initiatives like the Aon Client Promise to enhance client value.

- Market Expansion: Targeting emerging markets with growing risk management needs.

- Strategic Partnerships: Collaborations to bolster capabilities and market reach.

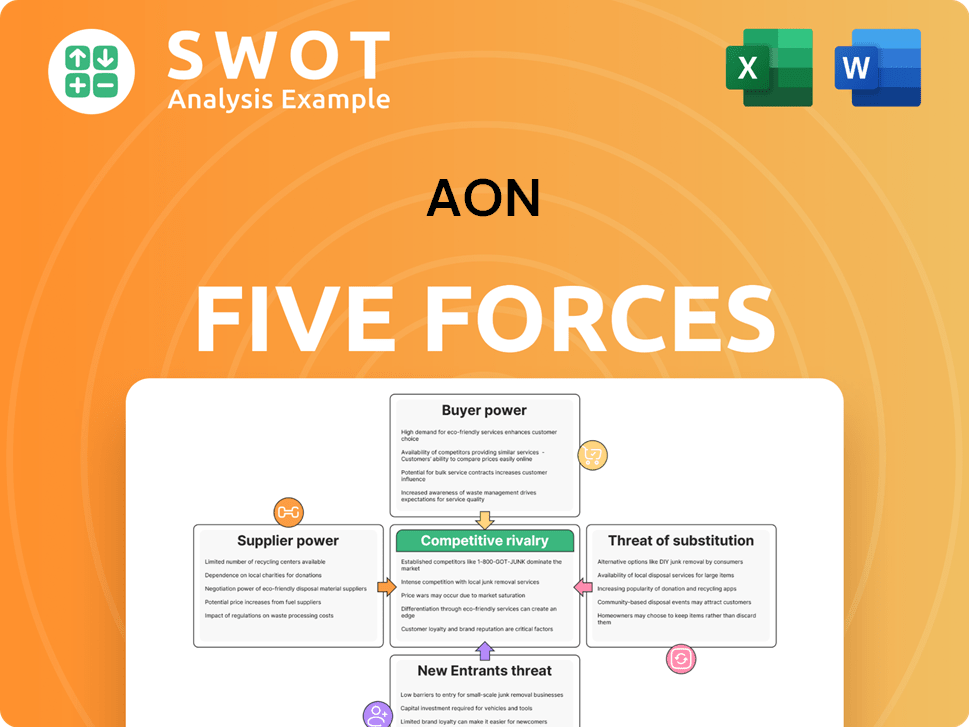

Aon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aon Company?

- What is Growth Strategy and Future Prospects of Aon Company?

- How Does Aon Company Work?

- What is Sales and Marketing Strategy of Aon Company?

- What is Brief History of Aon Company?

- Who Owns Aon Company?

- What is Customer Demographics and Target Market of Aon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.