Darling Ingredients Bundle

How Does Darling Ingredients Stack Up in the Global Market?

Darling Ingredients, a pioneer in the circular economy, transforms waste into valuable resources, making it a key player in sustainable practices. From its humble beginnings in 1882, the company has grown into a global force, demonstrating remarkable adaptability and innovation. Its focus on renewable fuels and sustainable ingredients positions it at the forefront of a rapidly evolving market.

To truly understand Darling Ingredients' potential, a deep dive into its Darling Ingredients SWOT Analysis is essential. This comprehensive Company Analysis reveals the intricacies of its Competitive Landscape, including its Market Share, key competitors, and Business Strategy. Analyzing Industry Trends and the company's financial performance provides valuable insights into its position and future outlook within the industry.

Where Does Darling Ingredients’ Stand in the Current Market?

As the world's largest publicly traded company specializing in sustainable natural ingredients, Darling Ingredients holds a significant market position. The company's core operations involve processing edible and inedible bio-nutrients to create a wide array of ingredients and specialty solutions.

In 2022, the company processed 16.4 billion pounds of raw materials. Its value proposition lies in its ability to convert waste streams into valuable products for various industries, including food, pet food, and renewable energy, promoting sustainability and resource efficiency.

Darling Ingredients commands an estimated 22% market share in the rendering industry. This strong position is supported by its extensive global footprint and diverse product offerings. The company's focus on sustainable practices and innovative solutions further strengthens its competitive advantage.

Darling Ingredients serves multiple industries, including food manufacturing, agriculture, renewable fuel production, and pet food. Key customer segments include food manufacturers, agricultural companies, renewable fuel producers, and pet food manufacturers. The company's products are essential for various applications, from pharmaceuticals to fertilizers.

With over 270 facilities across 15 countries, Darling Ingredients has a significant global presence. North America accounts for 57.53% of its total revenue. Europe contributes 27.74%, South America 9.22%, and China 4.39%. This diversified geographic footprint helps mitigate risks and capitalize on market opportunities.

For fiscal year 2024, the company reported net sales of $5.7 billion, a decrease from $6.8 billion in 2023. The company experienced a net loss of $26.2 million in Q1 2025, down from a net income of $81.2 million in Q1 2024. Despite these challenges, the core business continues to generate positive cash flow.

Darling Ingredients' expansion into renewable diesel and sustainable aviation fuel (SAF) production through its Diamond Green Diesel (DGD) joint venture with Valero Energy Corporation has diversified its offerings. As of March 29, 2025, the company had $81.5 million in cash and cash equivalents and $1.27 billion available under its revolving credit agreement. The preliminary leverage ratio as of December 28, 2024, was 3.93X, improving to 3.33x by March 29, 2025. The company aims to approach its 2.5x leverage target by year-end 2025 or early 2026. For more details, you can explore the Target Market of Darling Ingredients.

- Focus on sustainable practices and innovative solutions.

- Expansion of renewable fuel production.

- Financial goals to reduce leverage.

- Geographic diversification to mitigate risks.

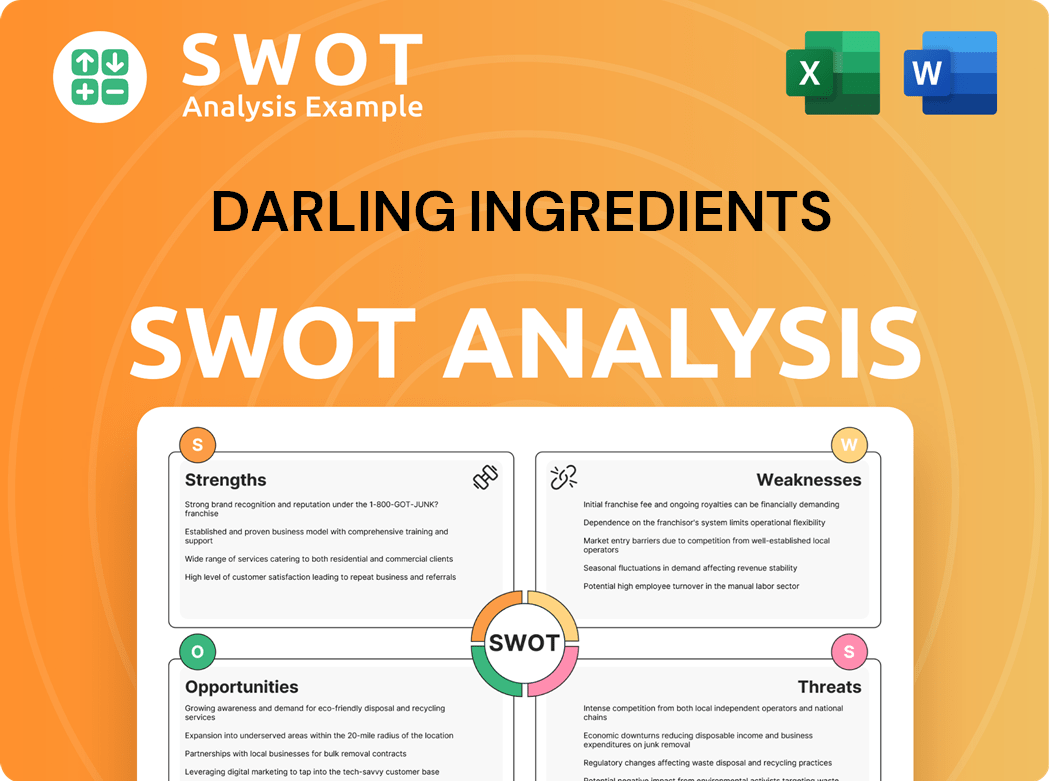

Darling Ingredients SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Darling Ingredients?

The Competitive Landscape for Darling Ingredients is complex, encompassing various direct and indirect competitors across its business segments. The company faces challenges in rendering and ingredient processing, as well as in the renewable fuel market. Understanding these competitors is crucial for a comprehensive Company Analysis.

The competitive environment is dynamic, with established players and emerging technologies shaping the Market Share and Industry Trends. Factors such as operational scale, brand recognition, and distribution networks significantly influence the competitive dynamics. New entrants and technological advancements constantly reshape the competitive landscape.

Darling Ingredients' Business Strategy must consider these factors to maintain and enhance its market position. The company's ability to adapt to these changes will determine its success in the long run. Continuous monitoring and strategic adjustments are essential for navigating the competitive environment.

Key competitors in this market include Tyson Foods, JBS S.A., Smithfield Foods, and Archer Daniels Midland (ADM). These companies have extensive operations and strong market presence. They often compete on a large scale, leveraging their existing infrastructure and distribution networks.

In the renewable fuel market, Darling Ingredients' Diamond Green Diesel (DGD) joint venture with Valero competes with companies like Neste, HollyFrontier, Montana Renewables, and PBF. The renewable diesel market is becoming increasingly crowded. The cost structure and first-mover advantage are important factors.

New players focused on plant-based and synthetic ingredient technologies could disrupt the market. The global plant-based ingredients market was valued at $85.6 billion in 2023. Mergers and alliances within the agricultural and food processing industries also reshape the competitive dynamics.

Tyson Foods is a major meat producer and a significant competitor. They compete by offering animal feed ingredients. They also have operations in renewable energy and biodiesel sectors. This overlap directly challenges Darling Ingredients' core business.

JBS S.A. is another major meat producer that competes with Darling Ingredients. They also offer animal feed ingredients. Their involvement in renewable energy and biodiesel further intensifies the competition.

ADM is a global leader in agricultural processing. They provide a range of animal feed ingredients, biofuels, and renewable chemicals. ADM's diverse portfolio directly competes with Darling Ingredients in multiple areas.

Several factors influence the competitive dynamics within the industry. These include operational scale, brand recognition, distribution networks, and technological advancements. Understanding these factors is vital for Darling Ingredients; competitive analysis report.

- Operational Scale: Larger companies often have cost advantages.

- Brand Recognition: Established brands have a competitive edge.

- Distribution Networks: Extensive networks facilitate market reach.

- Technological Advancements: Innovation can disrupt the market.

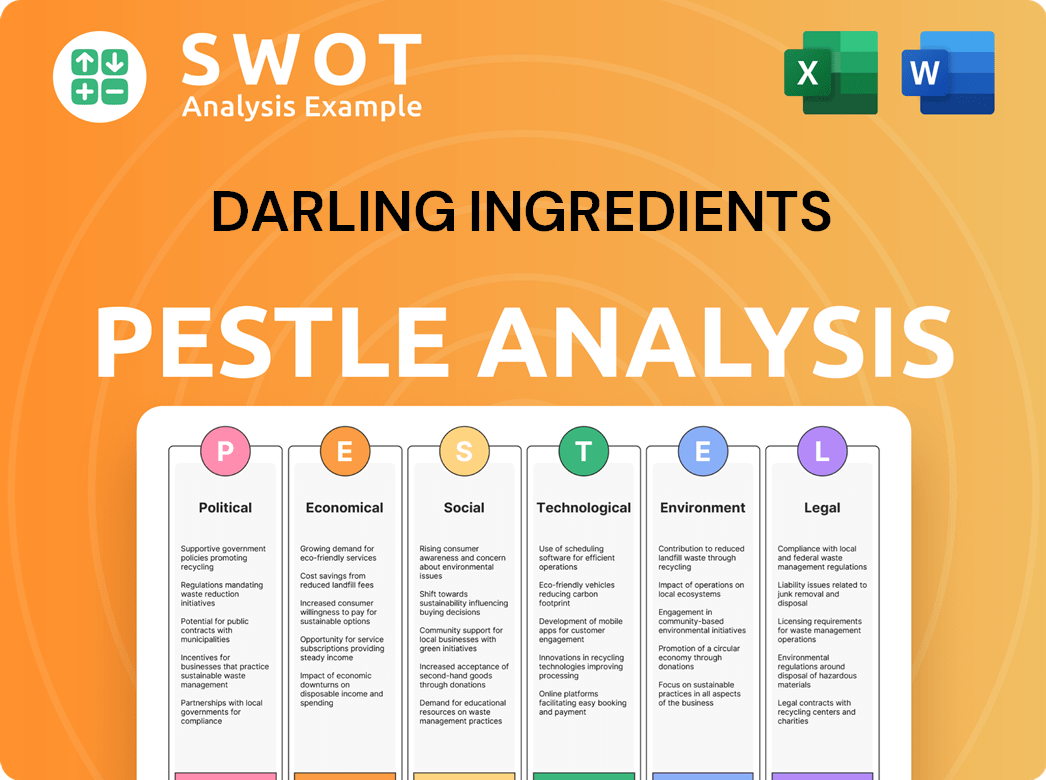

Darling Ingredients PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Darling Ingredients a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape of Darling Ingredients reveals several key strengths. The company's strategic moves, particularly its focus on renewable fuels and sustainable ingredients, have positioned it favorably within the industry. This approach has allowed Darling Ingredients to leverage industry trends and capitalize on market opportunities.

A comprehensive company analysis highlights Darling Ingredients' robust business strategy. The company's ability to adapt to market challenges and maintain a strong market position is crucial. Darling Ingredients' financial performance and recent acquisitions further contribute to its competitive edge.

Darling Ingredients' sustainability initiatives and commitment to a circular economy model also enhance its brand equity. This approach resonates with a growing customer base. The company's focus on operational excellence and debt reduction bolsters its financial resilience.

Darling Ingredients' competitive advantages are rooted in its proprietary technologies and extensive vertical integration. As the world's largest producer of waste fats, the company's ability to channel raw materials directly into its Diamond Green Diesel (DGD) joint venture provides strategic flexibility. This vertical integration is a key element in its business model.

The company's scale is a significant asset, processing approximately 15% of the world's animal agricultural by-products through over 270 facilities globally. This extensive network provides significant economies of scale, contributing to a cost per processing unit that is 15-20% lower than smaller competitors. This scale also ensures a consistent supply of raw materials.

Darling Ingredients benefits from a 'first mover advantage' in renewable diesel and is extending this into SAF production. The company started producing SAF in Q4 2024 and has secured three-year offtake agreements for its initial SAF production at a premium. This early entry allows Darling to capture significant market share.

Darling Ingredients' commitment to sustainability and its circular economy model enhances its brand equity. This approach appeals to a growing customer base prioritizing environmental impact. The transformation of waste materials into valuable ingredients is a core aspect of its strategy.

Darling Ingredients' competitive advantages are multifaceted, encompassing operational scale, vertical integration, and a focus on renewable fuels. The company’s extensive network and proprietary technologies create a strong market position. For more insights into the company's financial structure, consider reading about the Revenue Streams & Business Model of Darling Ingredients.

- Vertical Integration: Darling Ingredients' ability to control the supply chain from raw materials to finished products provides a significant advantage.

- Economies of Scale: The company's large-scale operations result in lower processing costs, enhancing profitability.

- First-Mover Advantage: Early entry into the renewable diesel and SAF markets positions Darling Ingredients for long-term growth.

- Sustainability Focus: The company's commitment to sustainability enhances its brand and attracts environmentally conscious customers.

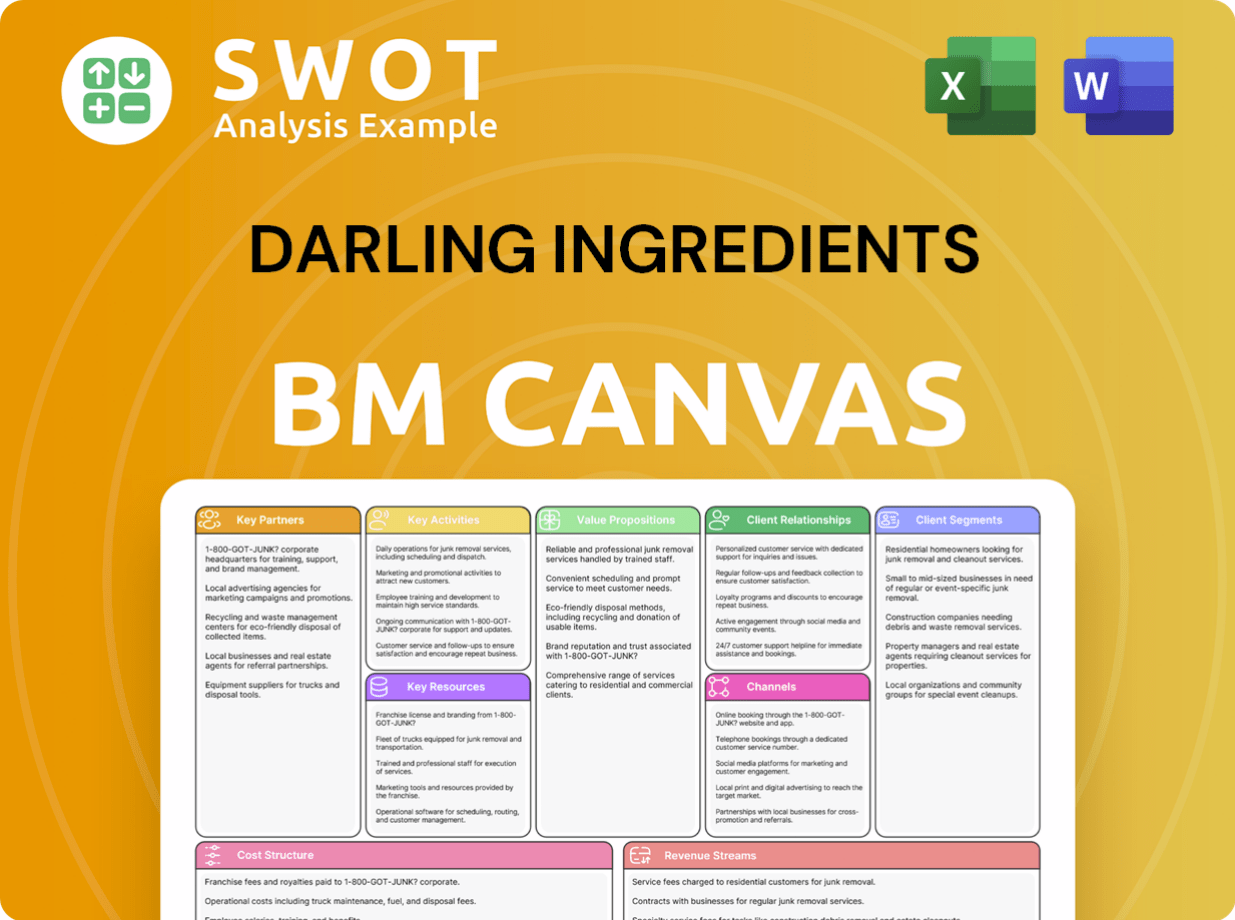

Darling Ingredients Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Darling Ingredients’s Competitive Landscape?

The competitive landscape for Darling Ingredients is significantly influenced by evolving industry trends, regulatory changes, and consumer preferences. A key factor is the growing emphasis on decarbonization, which boosts demand for low-carbon feedstocks and renewable fuels like renewable diesel and sustainable aviation fuel (SAF). This shift presents both opportunities and challenges for the company, particularly in the rapidly changing biofuel sector. Understanding these dynamics is crucial for assessing the company's market position and future prospects.

The company's performance is also affected by commodity price fluctuations and increased competition in the renewable diesel market. While the company has a strong position in feedstock sourcing, it must navigate these challenges to maintain profitability. Furthermore, the company is expanding into renewable natural gas (RNG) production from wastewater, which will be a new source of revenue. The company's ability to adapt to these changes will be critical for its long-term success.

The industry is seeing a strong push towards decarbonization, which increases demand for low-carbon feedstocks and renewable fuels. The anticipated shift from blenders tax credit to a producers tax credit (like the 45Z tax credit) in 2025 is expected to benefit the company. The company's strategic focus on renewable diesel and SAF aligns with these trends, offering substantial growth opportunities.

Commodity price volatility, particularly in fats and oils, can impact profitability. Increased competition in the renewable diesel market poses a challenge, although the company's feedstock sourcing remains a key differentiator. Navigating policy shifts and managing aggressive new competitors are also significant hurdles. The company reported a net loss in Q1 2025, primarily due to lower finished product pricing and reduced earnings from the DGD joint venture.

Continued expansion into emerging markets for sustainable ingredients and further product innovations present growth avenues. Exploring the conversion of renewable diesel into SAF aligns with the growing demand for low-carbon aviation fuel. The strong performance of the Food Ingredients segment, driven by collagen peptides and new product innovation, offers additional growth potential. The company is also expanding into renewable natural gas (RNG) production from wastewater.

The company expects 2025 to be stronger than 2024, with anticipated improvements in DGD margins as the biofuel environment adjusts and SAF sales increase. The strategy involves continued cash generation, debt reduction, and opportunistic share repurchases. The company focuses on operational excellence and leveraging its integrated supply chain to remain resilient. For a deeper dive, explore the Growth Strategy of Darling Ingredients.

The company faces challenges such as commodity price volatility and increased competition. However, it also benefits from industry trends like decarbonization and the growth of renewable fuels. Strategic initiatives include expanding into SAF production and renewable natural gas, focusing on operational efficiency.

- Focus on renewable diesel and SAF production.

- Expansion into renewable natural gas (RNG).

- Continued focus on operational efficiency and supply chain integration.

- Anticipated improvements in DGD margins.

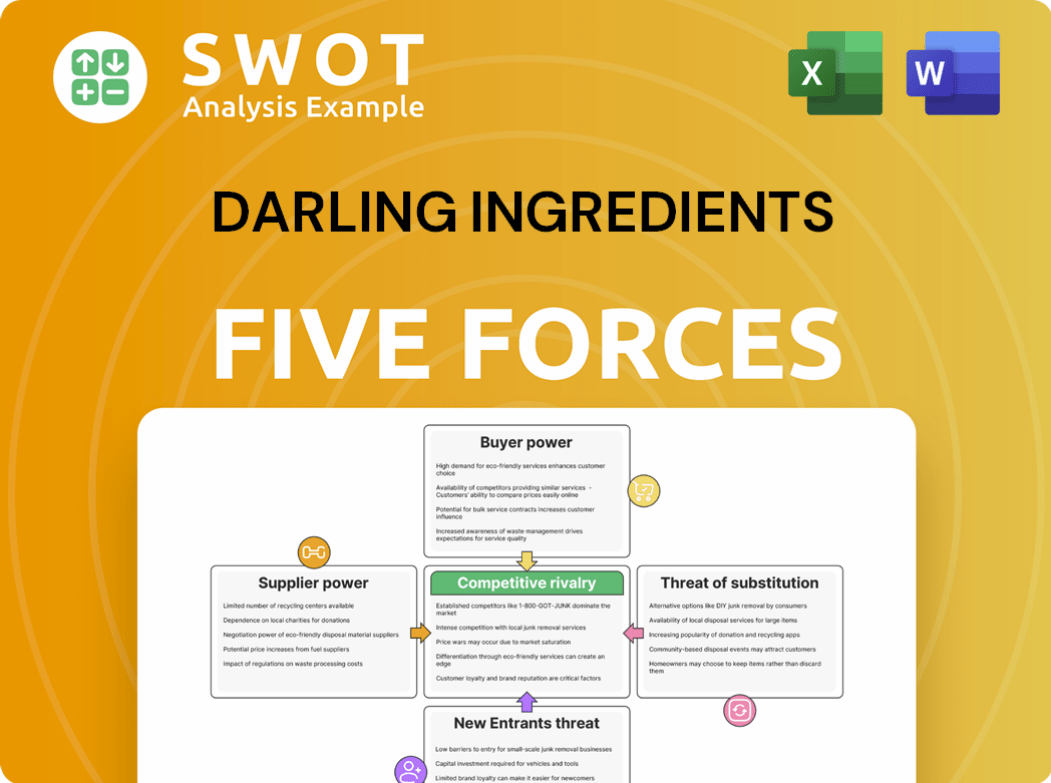

Darling Ingredients Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Darling Ingredients Company?

- What is Growth Strategy and Future Prospects of Darling Ingredients Company?

- How Does Darling Ingredients Company Work?

- What is Sales and Marketing Strategy of Darling Ingredients Company?

- What is Brief History of Darling Ingredients Company?

- Who Owns Darling Ingredients Company?

- What is Customer Demographics and Target Market of Darling Ingredients Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.