Denali Therapeutics Bundle

How Does Denali Therapeutics Stack Up in the Biotech Battleground?

The biotech industry is a high-stakes arena, especially when it comes to neurodegenerative diseases. Denali Therapeutics has emerged as a significant player, but who are its main rivals? Understanding the Denali Therapeutics SWOT Analysis is crucial for investors and strategists alike. This article dives deep into Denali's competitive landscape.

Denali Therapeutics' journey, from a South San Francisco startup to a leader in the biotech industry, is a compelling story of innovation in drug development. Examining the company's competitive advantages and strategic partnerships offers valuable insights. This analysis will explore Denali Therapeutics' market share, pipeline drugs, and financial performance, alongside its competitors in the pharmaceutical companies sector. Furthermore, it will help you understand the future outlook of Denali Therapeutics and its potential impact on the biotech industry, including the latest Denali Therapeutics recent news.

Where Does Denali Therapeutics’ Stand in the Current Market?

Denali Therapeutics operates within the biotech industry, specifically focusing on neurodegenerative diseases. Its core mission revolves around developing innovative therapies for conditions like Parkinson's and Alzheimer's. This focus places Denali in a specialized segment of the broader pharmaceutical companies landscape, emphasizing the development of treatments that can effectively penetrate the blood-brain barrier.

The company's value proposition lies in its proprietary Transport Vehicle (TV) technology, designed to enhance drug delivery to the brain. This technology is central to its pipeline of investigational therapies targeting significant unmet medical needs. Denali's strategic focus on novel mechanisms and delivery methods aims to differentiate it within the competitive landscape.

Denali Therapeutics' market position is characterized by its focus on neurodegenerative diseases and its innovative Transport Vehicle (TV) technology. The company's primary focus is on developing treatments for Parkinson's disease, Alzheimer's disease, ALS, and other neurological disorders. Its geographic presence is centered in North America, with research and development based in South San Francisco, California, and clinical trials globally.

Denali Therapeutics' customer segments are primarily patients suffering from neurodegenerative diseases. The company's direct engagement is with healthcare providers and research institutions. This approach allows Denali to focus on the scientific rigor and innovation necessary for drug development. The company's success depends on the progress of its clinical pipeline and its ability to secure strategic partnerships.

As of early 2024, Denali reported approximately $996.9 million in cash, cash equivalents, and marketable securities. This financial standing is crucial for supporting its research and development efforts in an industry known for high R&D costs and lengthy development timelines. This financial stability is key for Denali Therapeutics' future outlook.

Denali's competitive advantages include its proprietary Transport Vehicle (TV) technology and its focus on novel mechanisms and delivery methods. The company holds a strong position in LRRK2 inhibition for Parkinson's disease, with its DNL151 (buntanetap) program showing promising results in clinical trials. For more information, you can explore the Owners & Shareholders of Denali Therapeutics.

Denali Therapeutics focuses on neurodegenerative diseases, with a strong emphasis on treatments for Parkinson's and Alzheimer's. The company's proprietary Transport Vehicle (TV) technology is a key differentiator, enhancing drug delivery to the brain. Denali's financial position, with approximately $996.9 million in cash as of early 2024, supports its R&D efforts.

- Specialized focus on neurodegenerative diseases.

- Proprietary Transport Vehicle (TV) technology.

- Strong financial foundation for ongoing research.

- Promising clinical trial results for Parkinson's disease treatments.

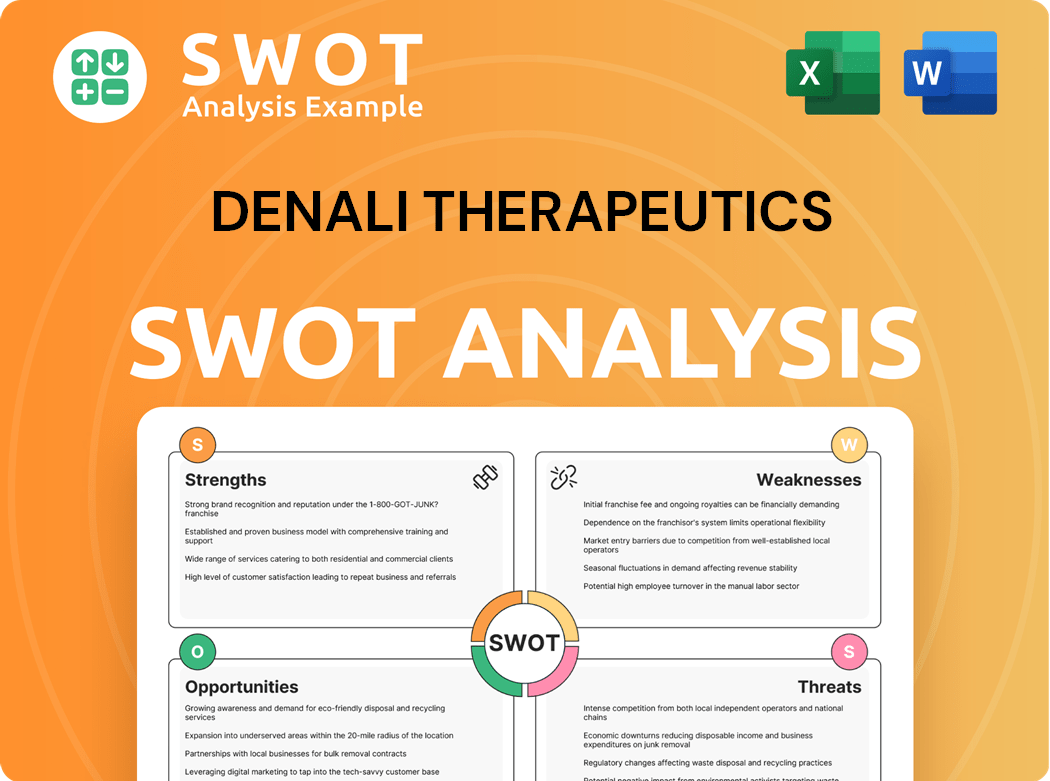

Denali Therapeutics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Denali Therapeutics?

The Denali Therapeutics operates within a fiercely contested arena, primarily focused on neurodegenerative diseases. This landscape is shaped by both established pharmaceutical giants and innovative biotechnology firms, all vying for market share in a field with significant unmet medical needs. Understanding the competitive landscape is crucial for assessing Denali Therapeutics' position and future prospects.

The biotech industry is characterized by high stakes, extensive research and development (R&D) investments, and lengthy timelines for drug development. Success hinges on clinical trial outcomes, regulatory approvals, and the ability to commercialize new therapies effectively. The competitive dynamics are further complicated by strategic collaborations, mergers, and acquisitions, which can rapidly alter the competitive balance.

Denali Therapeutics' competitors include a mix of large pharmaceutical companies and smaller biotech firms. These companies are developing treatments for neurodegenerative diseases, particularly Alzheimer's and Parkinson's diseases. The competitive environment is dynamic, with new entrants and emerging technologies constantly reshaping the landscape. The following sections detail some of the key players and their strategies.

Biogen is a major competitor, particularly in the Alzheimer's disease market. Their success with Leqembi (lecanemab), developed with Eisai, highlights their strong position. In 2023, Leqembi generated approximately $190 million in revenue. Biogen's focus on multiple sclerosis also positions it as a key player in the broader neurodegenerative space.

Roche (Genentech) has a substantial presence in neuroscience and immunology, making it a significant competitor. Roche has a broad portfolio and substantial resources for R&D and commercialization. Their pipeline includes various therapies targeting neurodegenerative diseases.

Eli Lilly is another major player with a robust pipeline in neurodegenerative disorders. They have made significant investments in Alzheimer's disease research. In 2023, Eli Lilly's Alzheimer's drug, Donanemab, showed promising results in clinical trials, potentially positioning it as a future competitor. Eli Lilly's R&D spending in 2023 was approximately $7.8 billion.

Alector is a smaller, innovative biotech company focusing on neurodegenerative conditions. They often target specific pathways or develop novel therapeutic modalities. Alector's focus on immuno-neurology and its strategic partnerships make it a notable competitor.

Acumen Pharmaceuticals is another biotech company focused on Alzheimer's disease. They are developing a therapeutic approach targeting amyloid-beta oligomers. Acumen's pipeline and specific focus make it a direct competitor in the Alzheimer's space.

Indirect competitors include companies developing symptomatic treatments or supportive care for neurodegenerative diseases. Academic institutions and research organizations also contribute to the foundational science. These entities influence the overall market and the development of new therapies.

The competitive landscape is also influenced by strategic partnerships and collaborations. Denali Therapeutics has formed alliances with companies like Takeda and Sanofi. These collaborations are crucial for funding R&D, expanding clinical trial capabilities, and commercializing products. To learn more about the company's strategic approach, you can read about Growth Strategy of Denali Therapeutics. Mergers and acquisitions within the pharmaceutical and biotechnology sectors also continually reshape the competitive landscape, leading to consolidation and the emergence of new powerhouses. The ability to adapt to these changes is critical for Denali Therapeutics to maintain its position and achieve its goals.

Several factors determine success in the Denali Therapeutics competitors landscape:

- R&D Investment: Significant financial resources are required for drug discovery, clinical trials, and regulatory approvals.

- Clinical Trial Success: Positive clinical trial results are essential for demonstrating efficacy and safety.

- Intellectual Property: Patents and proprietary technologies provide a competitive advantage.

- Commercialization Capabilities: The ability to effectively market and distribute new therapies is crucial.

- Strategic Partnerships: Collaborations can provide access to resources, expertise, and markets.

- Pipeline Diversity: A broad pipeline of drug candidates reduces risk and increases the chances of success.

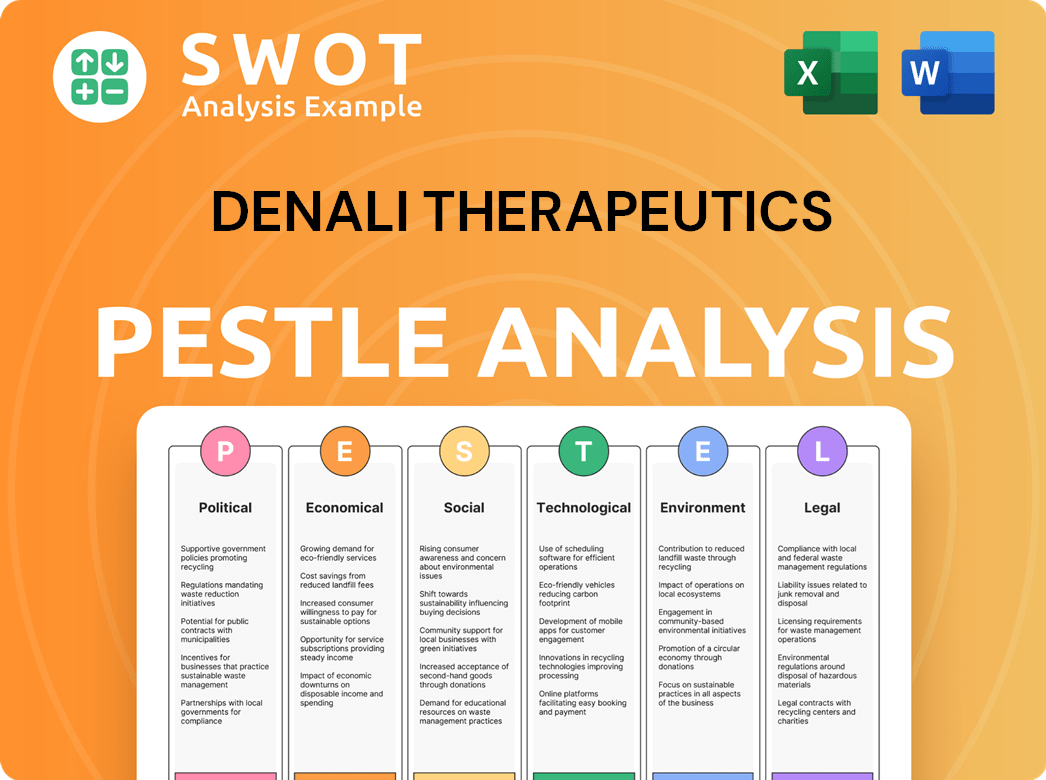

Denali Therapeutics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Denali Therapeutics a Competitive Edge Over Its Rivals?

Understanding the Denali Therapeutics competitive landscape requires a close look at its strengths. The company has carved out a unique position in the biotech industry. Its focus on neurodegenerative diseases and innovative drug delivery methods sets it apart from many pharmaceutical companies.

Denali Therapeutics leverages its proprietary Transport Vehicle (TV) platform, designed to enhance drug delivery across the blood-brain barrier. This technology is a significant competitive advantage. The company's strategic partnerships and robust intellectual property portfolio further solidify its market position. For more insights, consider reading a Brief History of Denali Therapeutics.

The company's approach to drug development, from target identification to clinical trials, aims to bring first-in-class or best-in-class therapies to market. While the competitive landscape is dynamic, Denali Therapeutics' continuous innovation and expansion of its intellectual property are crucial for maintaining its lead. The company's specialized talent pool and strategic collaborations also bolster its competitive edge.

Denali Therapeutics has achieved several key milestones in its drug development journey. These include advancing multiple drug candidates into clinical trials and securing significant funding rounds. The company has also expanded its pipeline through strategic partnerships, enhancing its research and development capabilities. Recent news indicates continued progress in its clinical programs.

Strategic moves have included forging partnerships with major players in the biotech industry. These collaborations provide access to additional resources and expertise. The company has also focused on expanding its intellectual property portfolio. These moves aim to strengthen its position in the biotech industry and accelerate drug development.

Denali Therapeutics' competitive edge stems from its innovative TV platform. This technology allows for more effective delivery of drugs to the brain. The company's focus on neurodegenerative diseases, such as Alzheimer's disease drugs and Parkinson's disease drugs, also gives it a strategic advantage. Its strong intellectual property and strategic partnerships further enhance its position.

While specific 2024 or 2025 financial data might vary, Denali Therapeutics' financial performance is closely tied to its clinical trials progress and partnerships. The company's funding rounds and collaborations with other pharmaceutical companies provide financial stability. Investors often monitor the Denali Therapeutics stock price and Denali Therapeutics market share analysis to assess its financial health. The company's funding rounds are crucial.

Denali Therapeutics possesses several key competitive advantages in the biotech industry. These advantages include its proprietary Transport Vehicle (TV) platform, a strong intellectual property portfolio, and strategic partnerships. The company's focus on neurodegenerative diseases, coupled with its innovative drug delivery methods, positions it well in the market.

- Proprietary Transport Vehicle (TV) platform for enhanced drug delivery.

- Extensive intellectual property portfolio protecting its technology.

- Strategic collaborations with other companies, such as Takeda.

- Highly specialized talent pool with expertise in neuroscience and drug discovery.

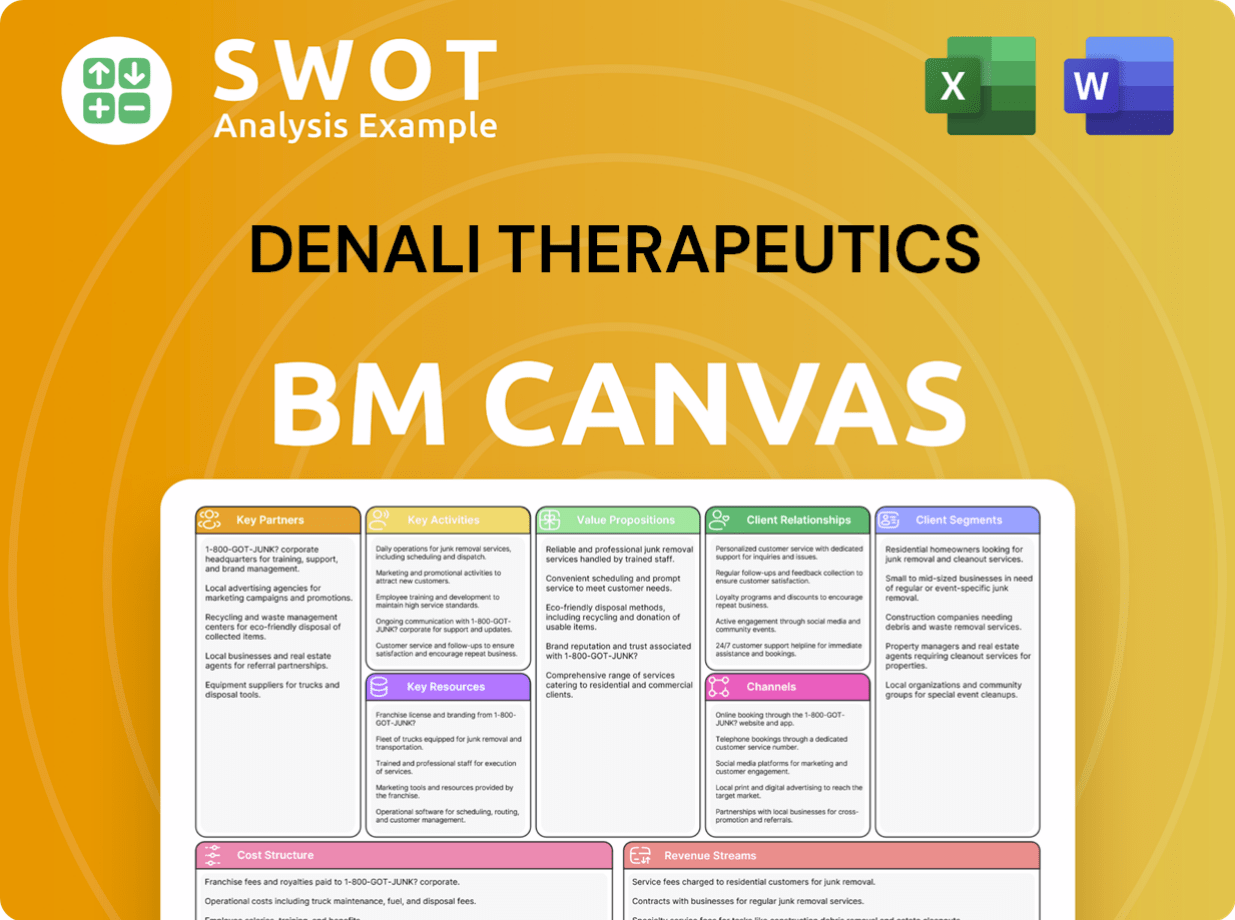

Denali Therapeutics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Denali Therapeutics’s Competitive Landscape?

The biotech industry, specifically the neurodegenerative disease market, is dynamic and competitive. The competitive landscape for companies like Denali Therapeutics is shaped by industry trends, including advancements in drug development and regulatory pathways. Understanding these factors is crucial for evaluating the company's position, potential risks, and future outlook within the context of its competitors.

The Revenue Streams & Business Model of Denali Therapeutics is influenced by its competitive environment, with successes and failures in clinical trials significantly impacting its trajectory. The company must navigate challenges such as high research and development costs and competition from larger pharmaceutical companies. Simultaneously, it can capitalize on opportunities arising from the growing prevalence of neurodegenerative diseases and advances in drug discovery.

Several trends are shaping the neurodegenerative disease market. These include a deeper understanding of disease mechanisms, advancements in biomarker discovery, and the use of precision medicine. Technological advancements in gene sequencing and AI are accelerating drug discovery, while regulatory bodies are expediting reviews for treatments with significant unmet needs.

Significant challenges exist, including high clinical trial failure rates in neurodegenerative diseases, reflecting their complexity. Increased competition from larger pharmaceutical companies, possessing greater financial resources, also poses a threat. The high cost of drug development, with expenses for CNS drugs often being the highest, adds to the financial burden.

The rising global prevalence of neurodegenerative diseases due to aging populations creates a large and expanding market. Advances in understanding disease pathophysiology open new avenues for drug targets. Strategic partnerships and collaborations can de-risk development and accelerate clinical timelines, providing access to broader commercialization capabilities.

Denali's strategy involves continued investment in its proprietary technology, expanding its pipeline, and pursuing strategic alliances. The company aims to remain resilient and capture growth in emerging markets through product innovations. Its competitive position is likely to evolve with the success of its clinical pipeline, especially programs targeting Parkinson's and Alzheimer's diseases.

The neurodegenerative disease market is projected to reach significant valuations. For instance, the global Alzheimer's disease therapeutics market is expected to reach approximately $7.6 billion by 2029. The high cost of drug development, with R&D costs per approved drug ranging from $1 billion to $2 billion, adds to the challenges. The success of Denali's clinical trials, particularly for Parkinson's and Alzheimer's, will be critical.

- Market Growth: The neurodegenerative disease market is experiencing growth due to an aging global population.

- Competitive Landscape: Denali Therapeutics faces competition from established pharmaceutical companies and other biotech firms.

- Strategic Alliances: Partnerships can mitigate risks and accelerate development.

- Pipeline Success: The success of Denali's pipeline, especially in Parkinson's and Alzheimer's, will shape its future.

Denali Therapeutics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Denali Therapeutics Company?

- What is Growth Strategy and Future Prospects of Denali Therapeutics Company?

- How Does Denali Therapeutics Company Work?

- What is Sales and Marketing Strategy of Denali Therapeutics Company?

- What is Brief History of Denali Therapeutics Company?

- Who Owns Denali Therapeutics Company?

- What is Customer Demographics and Target Market of Denali Therapeutics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.