Econocom Group Bundle

How Does Econocom Group Navigate the Digital Transformation Battlefield?

In the fast-paced world of digital evolution, understanding the Econocom Group SWOT Analysis is crucial for any investor or strategist. Econocom Group SE, a key player in facilitating digital transformation, has a rich history, evolving from an IT equipment financier to a comprehensive digital services provider. This journey highlights its adaptability and strategic foresight in the dynamic IT services market.

To truly grasp Econocom Group's position, this analysis dives deep into its competitive landscape. We'll explore who Econocom's main rivals are, providing a detailed market analysis of their strengths and weaknesses. Understanding the competitive dynamics is essential for evaluating Econocom Group's financial performance comparison and predicting its future outlook within the digital transformation space.

Where Does Econocom Group’ Stand in the Current Market?

Econocom Group SE is a key player in the European digital transformation market, focusing on technology management, sourcing, and managed services. The company offers a range of services, including IT infrastructure financing, digital project implementation, and comprehensive managed services. Its strong presence across Europe, especially in France, Belgium, Spain, Italy, and the UK, serves a diverse clientele of large corporations and public sector entities.

Econocom has evolved from an IT financing company to a holistic digital transformation partner. This strategic shift involves diversifying its offerings to include consulting and project integration alongside traditional financing solutions. This move reflects a broader industry trend towards providing end-to-end digital solutions. The company's focus on recurring revenue streams through managed services further solidifies its financial stability.

In 2023, Econocom demonstrated robust financial performance, with a recurring operational profit (ROC) of €178 million. This financial health underscores its competitive position within the IT services sector. The company's strategic focus on recurring revenue streams through managed services further solidifies its financial stability. Its strong position is particularly evident in the French market, where it maintains a significant footprint and a loyal client base.

Econocom Group's core operations revolve around providing digital transformation services, encompassing IT financing, project implementation, and managed services. These services are tailored to meet the evolving needs of large corporations and public sector clients across Europe. The company's offerings support clients in managing their digital assets and achieving their strategic goals.

Econocom's value proposition lies in its ability to deliver end-to-end digital solutions, combining financial services with consulting and project integration. This approach helps clients navigate the complexities of digital transformation, optimizing their IT investments and improving operational efficiency. The company’s focus on recurring revenue strengthens its financial stability.

Econocom has a significant presence across Europe, with key operations in France, Belgium, Spain, Italy, and the UK. This extensive geographic footprint allows the company to serve a diverse customer base and capitalize on regional market opportunities. The company’s strategic locations support its ability to provide localized services and support.

Econocom reported a strong financial performance in 2023, with a recurring operational profit (ROC) of €178 million. This demonstrates the company's robust scale and financial health compared to many industry averages. The focus on recurring revenue streams through managed services further solidifies its financial stability. For more insights, explore the Growth Strategy of Econocom Group.

Econocom's market position is strengthened by its ability to provide a comprehensive suite of services, from IT financing to managed services. This positions the company well within the competitive landscape of IT services and digital transformation. The company's strategic focus on recurring revenue streams through managed services further solidifies its financial stability.

- Econocom's strong presence in key European markets supports its competitive advantage.

- The company's shift towards end-to-end digital solutions aligns with industry trends.

- Financial performance in 2023, with a ROC of €178 million, highlights its financial health.

- Focus on recurring revenue streams ensures financial stability.

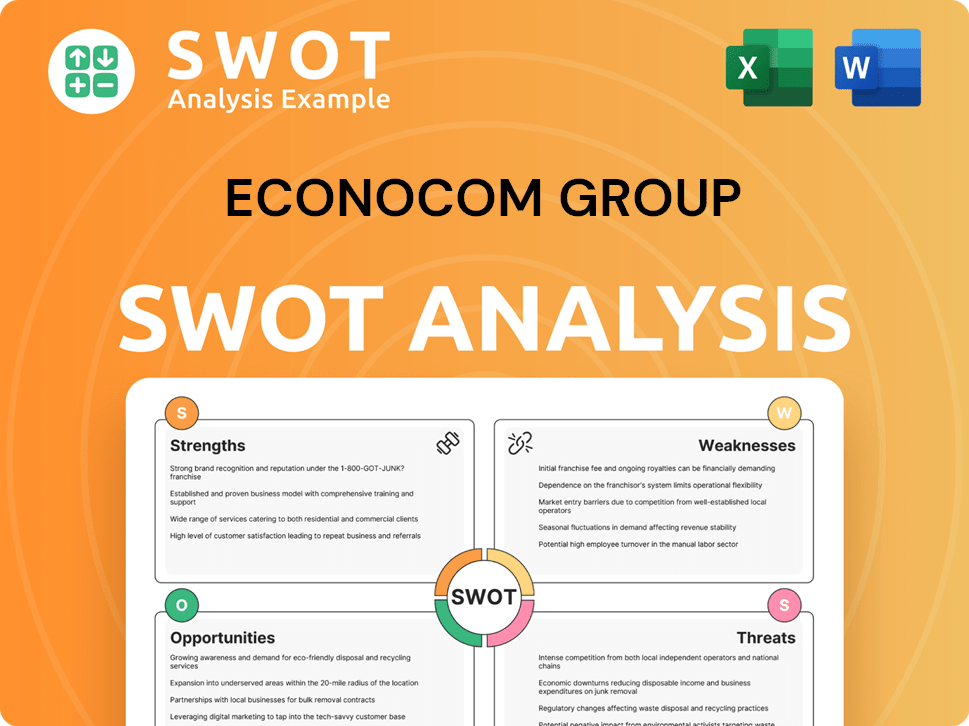

Econocom Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Econocom Group?

The competitive landscape for Econocom Group SE is complex, encompassing a wide array of competitors within the digital transformation and IT services sectors. The company faces both direct and indirect competition, making it crucial to understand the dynamics of its rivals. A thorough market analysis reveals the key players and their strategies, which directly impact Econocom's market share and financial performance.

Econocom's competitors range from large, global IT service providers to specialized financial institutions and smaller, agile firms. The competitive environment is constantly evolving due to mergers, acquisitions, and technological advancements. Understanding these dynamics is essential for assessing Econocom's industry position and potential growth strategies. A detailed examination of the company's rivals provides insights into its competitive advantages and challenges.

The company operates in a dynamic market where technological innovations and evolving customer needs drive competition. The competitive landscape is shaped by the ability to offer comprehensive digital transformation solutions, flexible financing options, and specialized expertise. Analyzing the strategies of Econocom's competitors provides a comprehensive view of the market dynamics and the company's position within it.

Major global IT service providers like Capgemini, Atos, and Accenture are direct competitors. These companies often compete on large-scale digital transformation projects.

Financial institutions and specialized leasing companies, such as Société Générale Equipment Finance and BNP Paribas Leasing Solutions, offer similar financing structures for IT equipment.

Smaller, agile digital native companies and specialized consultancies pose indirect competition. These firms often focus on niche technologies or specific industry verticals.

The competitive landscape is shaped by mergers and acquisitions, which create larger, more formidable rivals. These consolidations impact market share and competitive positioning.

Key competitive factors include pricing, breadth of financial product offerings, and the ability to deliver innovative solutions. Understanding these factors is critical for assessing Econocom's competitive advantages.

Industry trends, such as cloud adoption and digital strategy, influence the competitive dynamics. Companies must adapt to these trends to remain competitive.

The competitive landscape for Econocom Group is multifaceted, with various players vying for market share in the digital transformation and IT services sectors. A detailed Marketing Strategy of Econocom Group provides further insights into the company's positioning. Key competitors include global IT service providers, financial institutions, and specialized consultancies. These rivals challenge Econocom on multiple fronts, from project scope and pricing to technological innovation and customer satisfaction. For example, in 2024, Capgemini reported revenues of approximately €22.5 billion, highlighting the scale of competition Econocom faces. Understanding the strengths and strategies of these competitors is essential for Econocom to maintain its industry position and drive future growth. Analyzing Econocom's market challenges and growth strategy requires a comprehensive understanding of its competitive environment.

Several factors drive competition within the digital transformation and IT services market. These factors impact Econocom's ability to attract and retain customers. Competitive pricing, the breadth of service offerings, and the ability to deliver innovative solutions are critical.

- Pricing: Competitive pricing strategies are essential to win contracts and maintain profitability.

- Service Offerings: The range and quality of services offered, including cloud solutions, digital strategy consulting, and financing options, are crucial.

- Innovation: The ability to offer innovative and cutting-edge solutions can differentiate a company from its rivals.

- Customer Satisfaction: High customer satisfaction ratings and strong client relationships are key to repeat business.

- Geographic Presence: A broad geographic footprint allows companies to serve a wider range of clients.

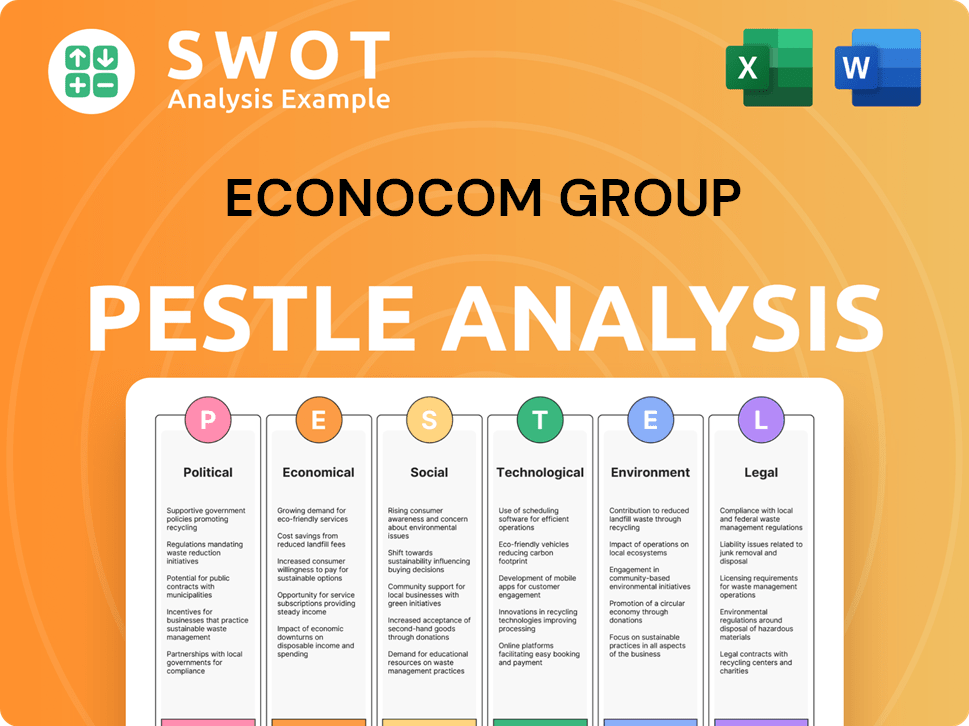

Econocom Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Econocom Group a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Econocom Group involves assessing its unique strengths and how they position the company within the IT services and digital transformation market. Econocom Group's integrated model, combining technology financing with digital services, is a core differentiator. This approach allows it to offer end-to-end solutions, from financing IT infrastructure to its management and renewal, setting it apart from pure-play IT service providers or equipment financiers.

Econocom's deep expertise in technology lifecycle management and financial engineering capabilities provides a significant value proposition, particularly for large organizations looking to optimize their digital investments. The company's strong client relationships, built on trust and a proven track record, contribute to customer loyalty. Furthermore, its extensive network of technology partners allows for flexible and customized digital environments. This comprehensive approach is crucial in a market where digital transformation is a key priority for businesses across various sectors.

While the competitive landscape is dynamic, with new entrants and evolving technologies, Econocom's continuous investment in innovation and its adaptable business model aim to sustain its competitive advantages. A detailed Growth Strategy of Econocom Group can further illuminate the company's approach to navigating these challenges and capitalizing on market opportunities.

Econocom's integrated model combines technology financing with a comprehensive suite of digital services. This allows for end-to-end solutions, from initial financing to deployment, management, and renewal. This approach differentiates Econocom from competitors focused solely on IT services or equipment financing.

Econocom benefits from strong, long-standing relationships with its clients, built on trust and a proven track record. These relationships contribute to customer loyalty, positioning Econocom as a strategic partner rather than just a vendor. Tailored solutions further enhance these relationships.

Econocom's extensive network of technology partners provides a significant advantage in offering flexible and customized digital environments. This network enables the company to source a wide range of hardware and software solutions. This ability to offer diverse solutions is a key differentiator.

Econocom's deep expertise in technology lifecycle management provides a significant value proposition. This expertise, coupled with financial engineering capabilities, helps large organizations optimize their digital investments. This focus on lifecycle management is a key competitive advantage.

Econocom's competitive advantages are multifaceted, enabling it to compete effectively in the IT services market. The company's integrated model, customer relationships, and technology partnerships are central to its success. Continuous investment in innovation and an adaptive business model are crucial for long-term sustainability.

- Integrated Technology Financing and Services: Offering both financing and services provides a unique value proposition.

- Strong Customer Relationships: Long-term relationships built on trust and tailored solutions drive loyalty.

- Extensive Technology Partner Network: Enables flexible and customized digital environments.

- Expertise in Technology Lifecycle Management: Helps clients optimize digital investments.

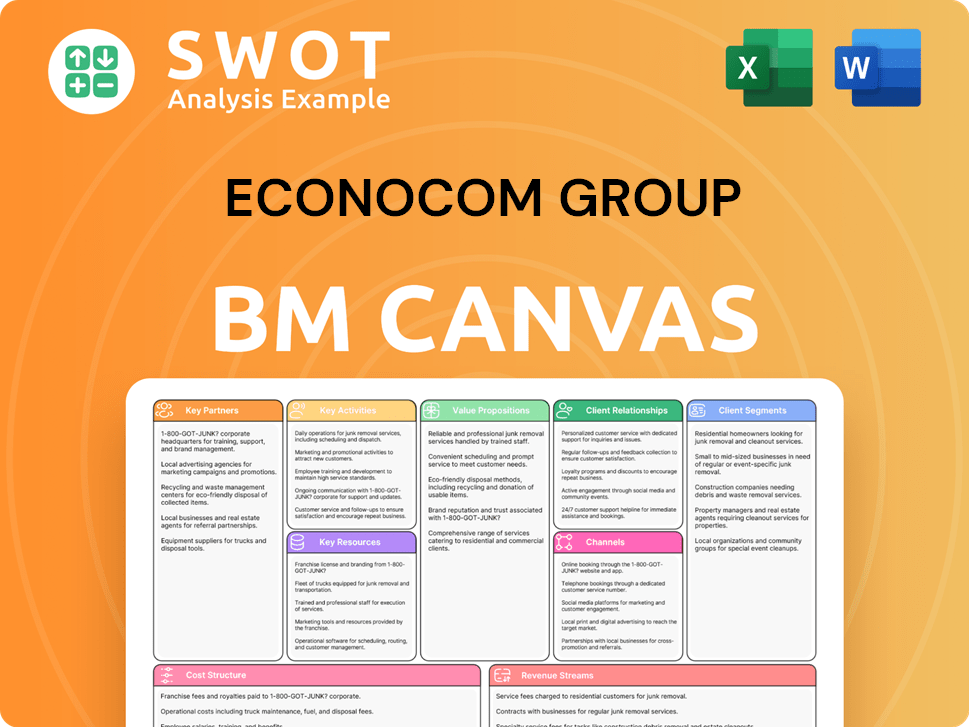

Econocom Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Econocom Group’s Competitive Landscape?

Understanding the competitive landscape of Econocom Group involves analyzing the industry trends, future challenges, and opportunities that shape its market position. The Target Market of Econocom Group is significantly influenced by the dynamic shifts in the digital transformation sector. Econocom's ability to adapt to these changes will determine its future success.

The IT services market, where Econocom operates, is experiencing rapid evolution, with increasing demands for advanced technological solutions. This requires a continuous assessment of the competitive environment to identify potential risks and growth prospects. A detailed market analysis is essential for understanding the dynamics of Econocom's competitive landscape.

The digital transformation industry is experiencing significant growth, driven by cloud computing, AI, and cybersecurity solutions. The global cloud computing market is projected to reach substantial growth in 2024. Regulatory changes, particularly in data privacy and sustainability, are also driving changes in client requirements and operational practices.

Maintaining expertise across a broad spectrum of services is challenging due to the increasing complexity of digital ecosystems. New market entrants specializing in AI or specific cloud services could disrupt traditional business models. Adapting to changing client needs and technological advancements requires continuous investment and innovation.

There is a growing demand for managed cloud services, AI integration, and robust cybersecurity solutions. Emphasis on sustainable IT and circular economy principles aligns with Econocom's financing and asset management capabilities. Recurring revenues and adaptable service offerings are crucial for maintaining a competitive position.

Econocom's strategy focuses on adapting its service offerings to meet the evolving needs of its clients. The company aims to capitalize on the growing demand for digital transformation services and sustainable IT solutions. This strategic approach is essential for navigating the challenges and leveraging the opportunities in the market.

Econocom must continuously invest in new technologies and talent to maintain its competitive edge. The company's ability to adapt its service offerings and focus on recurring revenues will be crucial. Understanding and responding to evolving client needs and regulatory changes are also critical.

- Market Analysis: Continuous monitoring of market trends and competitor activities.

- Technology Investment: Strategic investments in cloud computing, AI, and cybersecurity.

- Sustainability: Integration of ESG principles into service offerings.

- Customer Focus: Prioritizing customer satisfaction and adapting to their changing needs.

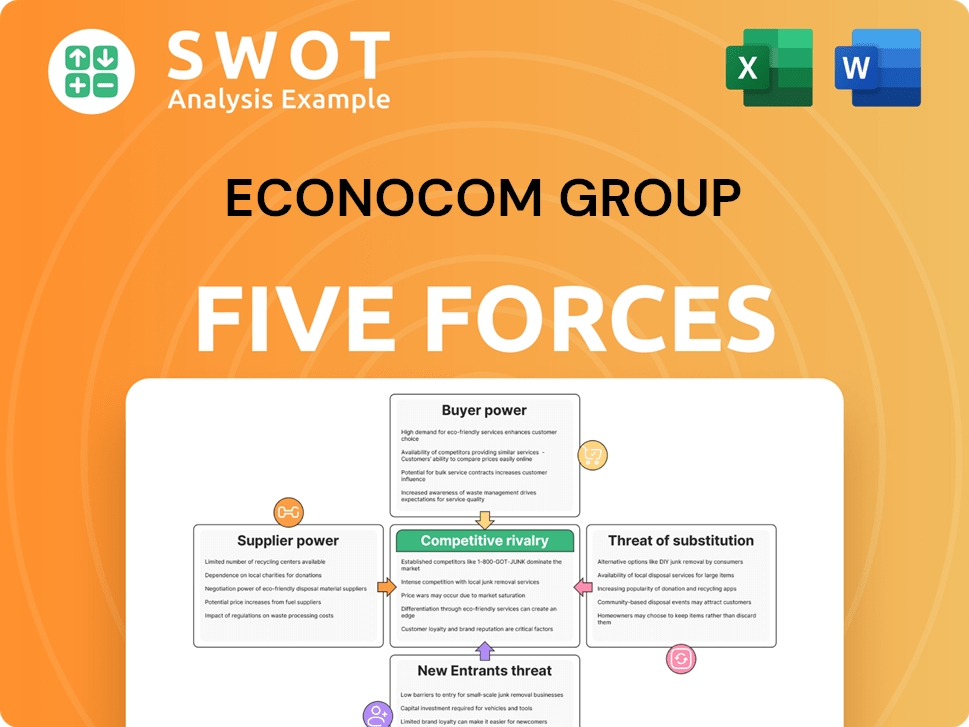

Econocom Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Econocom Group Company?

- What is Growth Strategy and Future Prospects of Econocom Group Company?

- How Does Econocom Group Company Work?

- What is Sales and Marketing Strategy of Econocom Group Company?

- What is Brief History of Econocom Group Company?

- Who Owns Econocom Group Company?

- What is Customer Demographics and Target Market of Econocom Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.