Guardian Pharmacy Bundle

How Does Guardian Pharmacy Stack Up in Today's Market?

The long-term care pharmacy sector is undergoing a significant transformation, fueled by an aging population and a rising demand for specialized medication management. Guardian Pharmacy Services has positioned itself as a key player, focusing on comprehensive pharmacy services for long-term care facilities and assisted living communities. Their commitment to enhancing patient care through advanced medication management and innovative technology makes them a noteworthy entity in the industry.

Founded in 2004, Guardian Pharmacy Services has shown consistent growth, expanding its pharmacy network across the United States. This expansion highlights its ability to adapt to the specific needs of its target market within a highly regulated industry. To understand their position, we delve into a detailed Guardian Pharmacy SWOT Analysis, examining their market positioning, key competitors, and the strategic advantages they employ within the dynamic pharmacy industry trends. We will also explore a thorough Guardian Pharmacy Market Analysis to understand their financial performance and how they compare to the retail pharmacy market.

Where Does Guardian Pharmacy’ Stand in the Current Market?

Guardian Pharmacy Services holds a strong position in the long-term care pharmacy sector. Its operations are centered around medication management, including dispensing, packaging, and delivery. They also provide clinical support such as medication reviews and staff education. The company leverages technology, including electronic health record integration, to boost efficiency and patient safety.

The value proposition of Guardian Pharmacy Services lies in its specialized service offerings tailored to the long-term care market. They aim to improve medication adherence and reduce adverse drug events through comprehensive support. Their focus on this niche allows them to provide targeted solutions and maintain strong relationships with healthcare providers. The company's widespread network and technology integrations further enhance its value.

Guardian Pharmacy Services operates across numerous states in the U.S., serving skilled nursing facilities, assisted living facilities, and other specialty care providers. This broad geographic presence allows them to cater to a significant portion of the long-term care market. Their focus has been on refining service delivery to meet the evolving demands of long-term care. The company's financial health and scale are generally strong, supported by the consistent demand for long-term care services. For a deeper dive into their target audience, consider reading about the Target Market of Guardian Pharmacy.

While specific market share figures for 2024-2025 are not publicly disclosed, the company is recognized as one of the largest and most influential providers in the long-term care pharmacy sector. The long-term care pharmacy market is substantial, with billions of dollars in annual revenue. The continued growth in the aging population and the increasing demand for specialized pharmacy services drive this market.

Guardian Pharmacy Services' key offerings include medication dispensing, packaging, and delivery, along with clinical support services. They provide medication regimen reviews, formulary management, and staff education to enhance patient care. The company also uses technology solutions like EHR integration to improve efficiency and patient safety. These services are crucial for long-term care facilities.

Guardian Pharmacy Services has a widespread network across numerous states in the United States. This broad geographic presence allows them to serve a diverse customer base, including skilled nursing and assisted living facilities. The company strategically positions its pharmacies to meet the needs of the long-term care market. They focus on regions where they can establish a dense network and strong healthcare provider relationships.

The financial health of Guardian Pharmacy Services is generally strong, supported by the consistent demand for long-term care services. The company's efficient operational model contributes to its financial stability. While specific financial data is not always public, the long-term care pharmacy market's overall growth indicates a positive outlook. The company’s ability to maintain strong relationships with healthcare providers is a key factor in its financial success.

Guardian Pharmacy Services' strengths include its extensive network, specialized service offerings, and technology integration. They have a strong presence in the long-term care sector, providing comprehensive medication management solutions. Their focus on this niche market allows them to tailor services to meet specific needs.

- Extensive network across multiple states.

- Specialized services tailored to long-term care facilities.

- Integration of technology, including EHR systems.

- Strong relationships with healthcare providers.

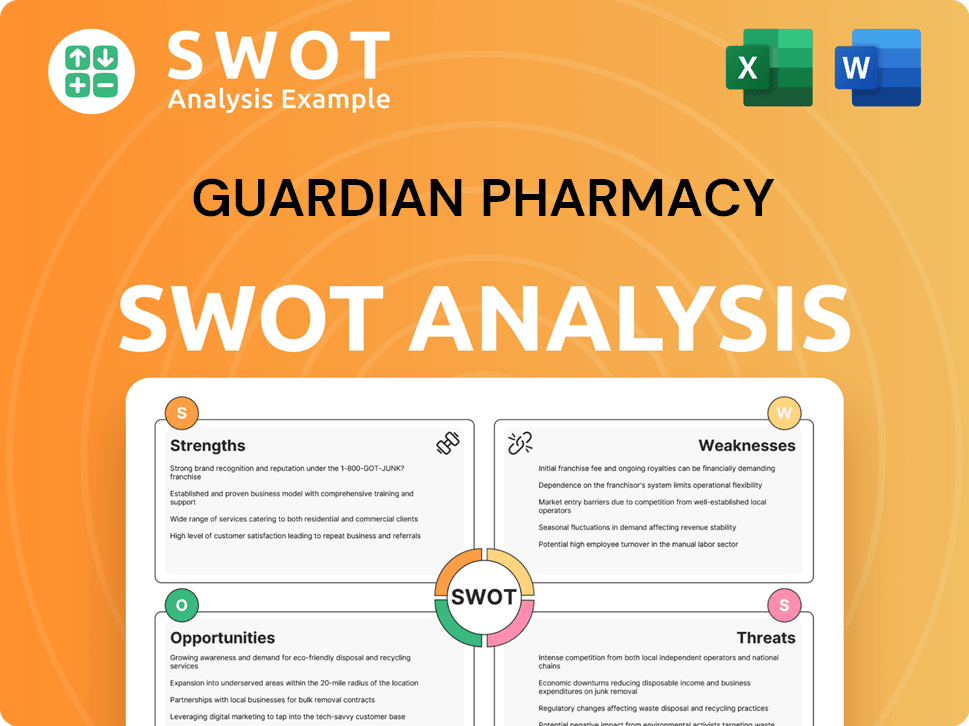

Guardian Pharmacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Guardian Pharmacy?

The competitive landscape for Guardian Pharmacy Services is shaped by both national and regional players specializing in long-term care pharmacies. Understanding the Guardian Pharmacy Competitive Landscape is crucial for assessing its market position and strategic challenges. This analysis involves evaluating direct and indirect competitors, market dynamics, and emerging trends within the Pharmacy Industry Trends.

Key competitors in the long-term care pharmacy sector include major players like Omnicare (a CVS Health company), Remedi SeniorCare, and PharMerica. These entities compete on various fronts, including pricing, service quality, technological capabilities, and clinical support. The Guardian Pharmacy Market Analysis must consider the impact of mergers and acquisitions, such as the CVS Health acquisition of Omnicare, which has reshaped the competitive environment.

Guardian Pharmacy faces competition from several key players in the long-term care pharmacy market. These competitors vary in size, service offerings, and technological capabilities, impacting Guardian's market share and strategic decisions. Understanding these competitors is vital for a thorough Guardian Pharmacy Competitors analysis.

As part of CVS Health, Omnicare benefits from extensive resources, a vast distribution network, and a broad portfolio of healthcare services. This allows Omnicare to compete on scale and integrated offerings, leveraging its parent company's infrastructure. In 2024, CVS Health reported revenues of over $350 billion, demonstrating its significant market presence.

Remedi SeniorCare differentiates itself with its proprietary technology, MyChart, which focuses on medication management and electronic prescribing. This technological innovation allows Remedi to challenge Guardian on efficiency and medication accuracy. The company's focus on technology-driven solutions positions it well in the evolving pharmacy landscape.

PharMerica, a subsidiary of BrightSpring Health Services, is another major competitor with a significant national footprint. It competes on comprehensive service offerings and established relationships within the long-term care industry. BrightSpring Health Services reported revenues of approximately $7.5 billion in 2024, highlighting PharMerica's substantial market presence.

Indirect competitors include traditional retail pharmacies that may offer some long-term care services and hospital-based pharmacies catering to post-acute care patients. These entities typically lack the specialized focus and integrated service model of Guardian and its direct competitors. The Retail Pharmacy Market is also influenced by these indirect competitors.

Competitive dynamics involve battles over client contracts, driven by pricing, service quality, technological capabilities, and clinical support. Mergers and acquisitions, such as CVS Health's acquisition of Omnicare, have reshaped the competitive landscape. Emerging players with technology-driven solutions could also present future challenges.

The integration of technology, such as electronic prescribing and medication management systems, is a key differentiator. Companies like Remedi SeniorCare, with its MyChart system, are at the forefront of this trend. These advancements streamline operations and improve medication accuracy, impacting the competitive landscape.

Guardian Pharmacy's ability to compete effectively depends on several factors. A strong Guardian Pharmacy SWOT analysis is crucial. Here are some key areas:

- Service Quality: Providing excellent customer service and building strong relationships with long-term care facilities.

- Technological Innovation: Implementing advanced medication management systems and electronic prescribing.

- Pricing Strategy: Offering competitive pricing models to attract and retain clients.

- Clinical Support: Providing comprehensive clinical support services to enhance patient care.

- Market Expansion: Strategic expansion plans to increase market share and reach. For more details, see Marketing Strategy of Guardian Pharmacy.

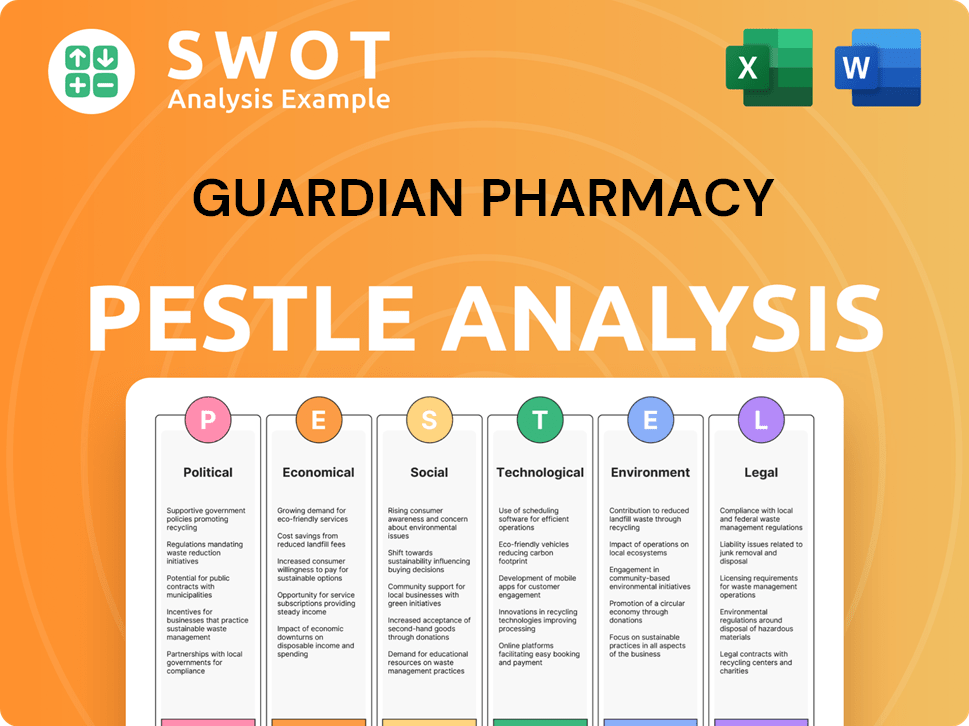

Guardian Pharmacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Guardian Pharmacy a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of Guardian Pharmacy Services is crucial for a thorough Growth Strategy of Guardian Pharmacy analysis. The company has carved a niche for itself, particularly in the long-term care sector. Its strategies and operational models set it apart from competitors in the broader pharmacy industry.

Guardian Pharmacy Services distinguishes itself through a unique blend of local presence and national support. This hybrid model enables strong relationships with facilities, offering personalized service and quick responses. Simultaneously, it benefits from economies of scale in purchasing, technology, and compliance. This approach is central to its competitive edge.

The company's focus on the long-term care sector is another key differentiator. Its service model is designed to meet the complex needs of long-term care facilities. This specialization allows Guardian to provide expert regulatory compliance, medication adherence, and resident safety protocols. Investing in proprietary technology enhances operational efficiency and reduces medication errors, providing tangible benefits to its clients.

Combines local ownership with national resources, fostering strong local relationships and economies of scale. This hybrid approach allows for personalized service and efficient operations.

Tailors its services to the specific needs of long-term care facilities, including medication management and clinical support. This specialization leads to expertise in regulatory compliance and resident safety.

Invests in proprietary technology for medication ordering, dispensing, and administration, improving efficiency and reducing errors. These tech-driven efficiencies provide a tangible benefit to clients.

Facilities often prefer working with a local, accessible pharmacy, contributing to customer loyalty. This local presence is a key factor in retaining clients.

Guardian Pharmacy Services' competitive advantages include a decentralized operating model, specialized focus on long-term care, and proprietary technology solutions. These factors contribute to customer loyalty and operational efficiency.

- Decentralized model for personalized service.

- Specialization in long-term care for compliance.

- Technology solutions for efficiency and error reduction.

- Strong local relationships and customer loyalty.

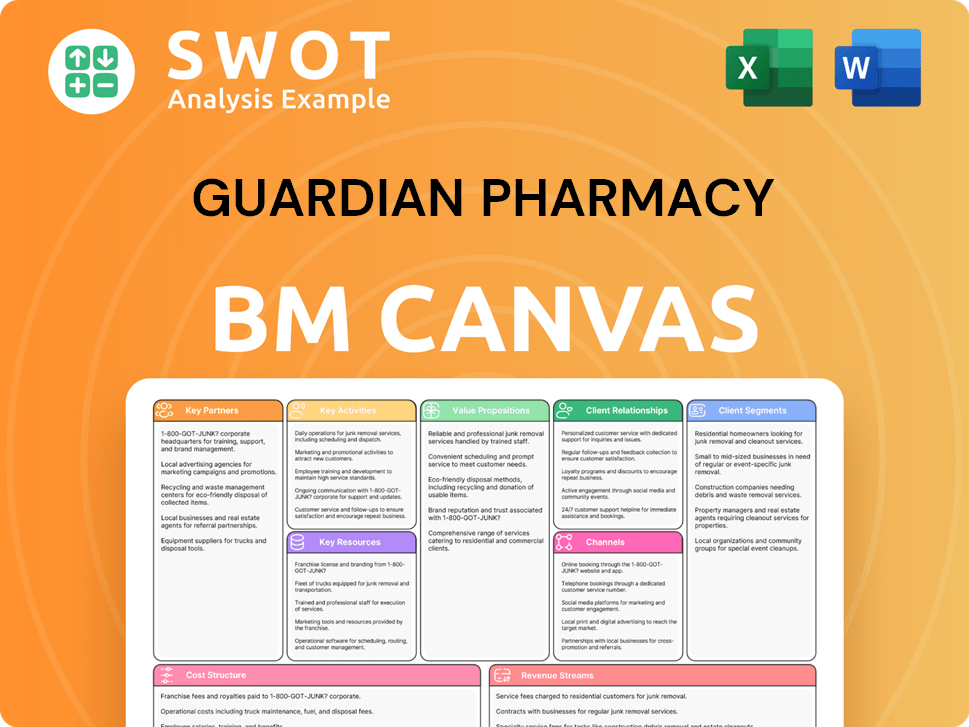

Guardian Pharmacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Guardian Pharmacy’s Competitive Landscape?

Understanding the competitive landscape for long-term care pharmacies, such as the one that provides services, requires a deep dive into industry trends, future challenges, and potential opportunities. This analysis is crucial for stakeholders, including Owners & Shareholders of Guardian Pharmacy, to make informed decisions and strategize for sustained growth. The pharmacy industry is dynamic, with factors like technological advancements, regulatory changes, and evolving consumer preferences shaping its trajectory.

The long-term care pharmacy market is influenced by both internal and external forces. Internal factors include operational efficiency, service quality, and financial performance. External factors encompass market dynamics, regulatory environment, and competitive pressures. A comprehensive understanding of these elements is essential for assessing the competitive position and future outlook of any pharmacy service provider.

Several key trends are reshaping the pharmacy industry, including technological advancements, regulatory changes, and shifts in consumer preferences. Automation, AI, and data analytics are enhancing medication management and patient outcomes. Regulatory changes, such as evolving reimbursement models and stricter compliance requirements, are impacting service providers. There's a growing demand for personalized care and integrated health services.

Opportunities abound for pharmacies to leverage technological advancements and expand their service offerings. Investing in AI-powered tools and advanced analytics can improve efficiency. The aging U.S. population creates a growing market for long-term care services. Strategic partnerships with healthcare systems and technology providers can unlock new growth avenues.

The industry faces challenges such as increased regulatory scrutiny, which could lead to higher compliance costs. The shortage of pharmacy professionals and rising labor costs can impact service delivery. Aggressive new competitors leveraging disruptive technologies can challenge market share. Economic downturns could affect funding for long-term care facilities.

To remain competitive, pharmacies should invest in technology, optimize operational efficiency, and foster strong client relationships. Exploring strategic acquisitions or partnerships can expand service portfolios and geographic footprints. Adaptability and innovation are essential for navigating the evolving healthcare landscape.

The competitive landscape for a pharmacy is influenced by various factors, including market share, service offerings, and geographic presence. Key competitors in the long-term care pharmacy market include both national and regional players. Understanding the strengths and weaknesses of these competitors is crucial for developing effective strategies.

- Market Share Analysis: Evaluate the market share of major players in the long-term care pharmacy sector. In 2024, the market is highly fragmented, with no single company holding a dominant position, offering opportunities for growth and consolidation.

- Service Offerings: Analyze the range of services offered by competitors, including medication management, consulting, and specialized programs. Diversification of services can provide a competitive edge.

- Geographic Footprint: Assess the geographic reach of competitors, considering factors like regional concentration and expansion strategies. A strong geographic presence can enhance market penetration.

- Technological Integration: Examine the use of technology by competitors, such as automation, AI, and data analytics, to improve efficiency and patient outcomes. Technological advancements are crucial for competitive advantage.

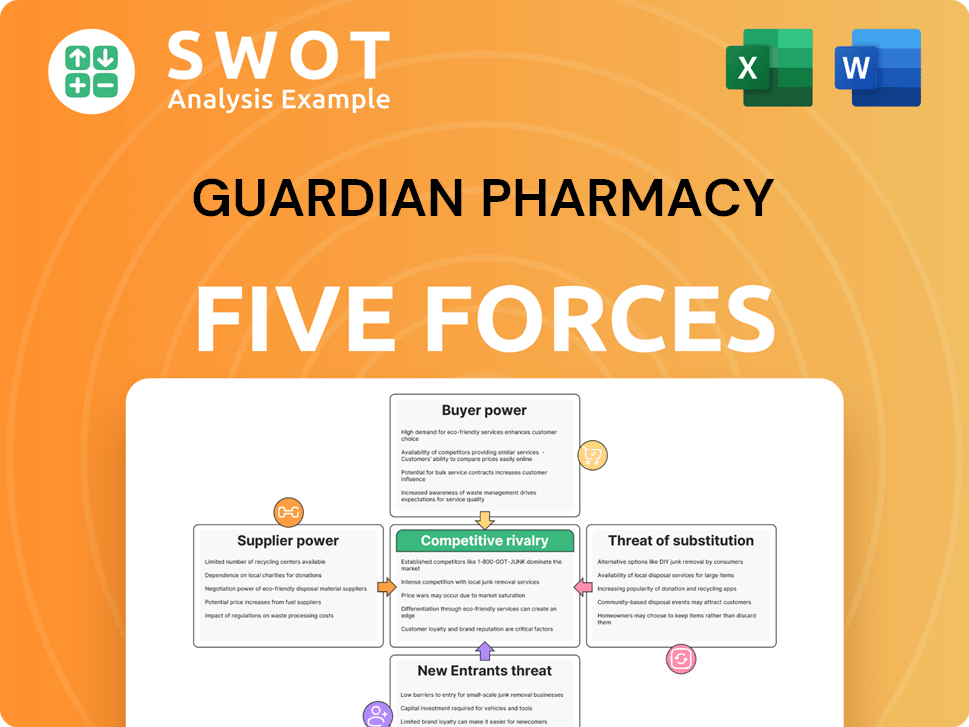

Guardian Pharmacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guardian Pharmacy Company?

- What is Growth Strategy and Future Prospects of Guardian Pharmacy Company?

- How Does Guardian Pharmacy Company Work?

- What is Sales and Marketing Strategy of Guardian Pharmacy Company?

- What is Brief History of Guardian Pharmacy Company?

- Who Owns Guardian Pharmacy Company?

- What is Customer Demographics and Target Market of Guardian Pharmacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.