Haverty Furniture Bundle

Can Haverty Furniture Company Thrive in Today's Furniture Market?

The residential furniture industry is a dynamic arena, constantly reshaped by economic shifts and consumer tastes. Haverty Furniture Company, a long-standing player since 1885, faces a complex landscape. This analysis dives into the Haverty Furniture SWOT Analysis, exploring its position amidst evolving trends and fierce competition.

This exploration of the Haverty Furniture Company's competitive landscape will dissect its market position, identifying key furniture competitors and evaluating its strategic advantages. Understanding Haverty Furniture Company's financial performance, including its market share, and how it differentiates itself is crucial for investors and industry watchers. We'll also examine industry trends, challenges, and opportunities shaping its future.

Where Does Haverty Furniture’ Stand in the Current Market?

Haverty Furniture Companies, Inc. focuses on the residential furniture market, targeting middle to upper-middle income households. The company's core operations involve selling furniture through its retail stores, primarily located in the Southern and Midwest regions of the U.S. The company's value proposition centers on offering quality, fashion, value, and service to its customers.

As of December 31, 2024, the company operated 129 stores across 17 states, encompassing approximately 4.5 million retail square feet. Haverty's brand recognition is high within its served markets, associating with quality and service. The company's strategy is to appeal to more affluent customers compared to promotional price-oriented stores.

In 2024, the company's net sales reached $722.9 million, a 16.1% decrease from 2023, with comparable store sales declining by 16.7%. Despite the sales decline, Haverty's maintained a strong gross profit margin of 60.7%, showcasing operational efficiency. The company ended 2024 with $120 million in cash and no funded debt, plus an $80 million revolving credit facility with no outstanding borrowings. Online sales accounted for about 3.0% of total sales in 2024.

Haverty Furniture Company's market position is geared towards middle to upper-middle income households, focusing on well-educated women homeowners in suburban areas. The company's target market appreciates quality, fashion, and service, which allows the company to differentiate itself. This focus allows the company to maintain a strong brand reputation within its markets.

Haverty's financial health is robust, with significant cash reserves and no debt, which provides flexibility for investments. Although net sales decreased in 2024, the company maintained a strong gross profit margin. The company's financial strategy supports its ability to navigate market fluctuations effectively.

The company plans to open an average of five new stores per year, focusing on former 'big box' retail sites, expanding its distribution footprint. Haverty's is also improving its digital channels to enhance customer experience and increase sales conversion rates. These initiatives are designed to drive growth and improve customer engagement.

Analyzing the competitive landscape, Haverty's positions itself against competitors by emphasizing quality and service, rather than solely on price. The company's strategy includes a focus on its target market and maintaining a strong brand image. For more information on the business model, see Revenue Streams & Business Model of Haverty Furniture.

Haverty Furniture Company differentiates itself through its focus on quality, fashion, value, and service, targeting a specific demographic. The company's financial strength allows it to invest strategically, even during economic downturns. The expansion into new markets and enhancement of digital channels are key strategies for growth.

- Targeting middle to upper-middle income households.

- Maintaining a strong gross profit margin.

- Strategic store expansion plans.

- Focus on improving online sales.

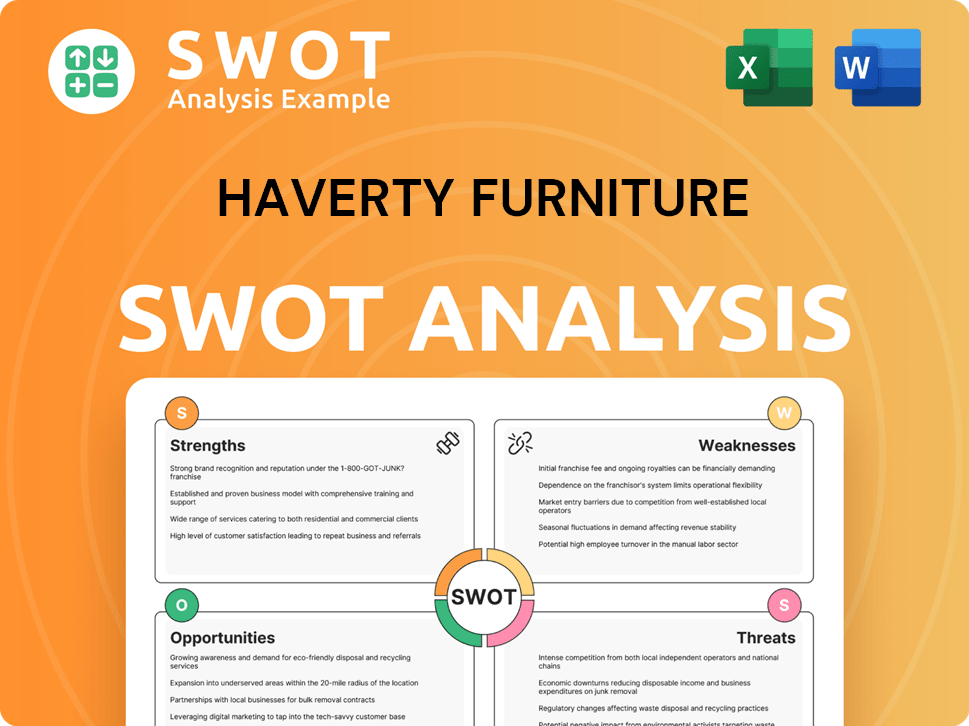

Haverty Furniture SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Haverty Furniture?

The retail furniture market is intensely competitive, with the Haverty Furniture Company facing a diverse array of competitors. This competitive landscape includes national, regional, and local retailers, as well as online-only players. Understanding the competitive landscape is crucial for Haverty Furniture Company's strategic planning and maintaining its market share.

Furniture industry analysis reveals that Haverty Furniture Company's success depends on its ability to differentiate itself and effectively compete against larger and more established rivals. Factors such as pricing, product innovation, brand appeal, distribution networks, and technological advancements play significant roles in this competition. The dynamics of the furniture market are constantly evolving, requiring Haverty Furniture Company to adapt to stay relevant.

The increasing influence of online retailers and direct-to-consumer brands adds another layer of complexity to the competitive landscape. For example, in 2023, online furniture sales saw a 14.2% increase, capturing 22.5% of the online furniture market. This shift underscores the importance of a strong online presence and e-commerce strategy for Haverty Furniture Company. To learn more about their strategic approach, you can read about the Growth Strategy of Haverty Furniture.

IKEA is a major competitor, known for its affordable, ready-to-assemble furniture and unique in-store experience. It competes on price and a broad product range, often targeting a younger demographic.

Wayfair is a significant online-only retailer that challenges traditional brick-and-mortar stores with a vast selection and competitive pricing. Wayfair represents a key player in the digital transformation of the furniture industry.

Ashley HomeStore is one of the largest furniture retailers, competing through its extensive network of stores and a wide variety of furniture styles. They often offer competitive price points.

La-Z-Boy offers a range of furniture and home goods, competing with Haverty Furniture Company in the mid-range market. Their brand recognition and product specialization are key.

Rooms To Go is another notable competitor, providing a range of furniture and home goods. They compete on price and convenience, often offering package deals.

The rise of direct-to-consumer online furniture brands poses a significant challenge. These brands often focus on specific niches and offer competitive pricing, increasing competition in the online space.

Haverty Furniture Company faces competition across multiple fronts, with competitors employing various strategies to gain market share. These strategies include:

- Pricing: Offering competitive prices and promotional discounts.

- Product Innovation: Introducing new designs, materials, and features.

- Brand Appeal: Building strong brand recognition and customer loyalty.

- Distribution Networks: Expanding store locations and enhancing online presence.

- Technological Advancements: Utilizing e-commerce platforms, virtual reality, and data analytics.

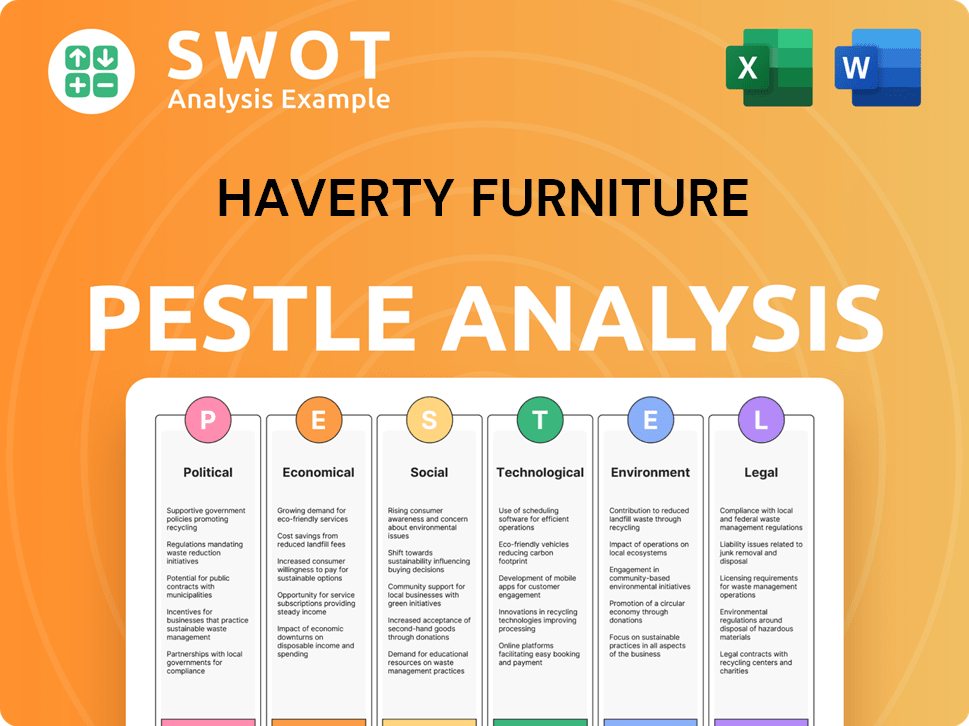

Haverty Furniture PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Haverty Furniture a Competitive Edge Over Its Rivals?

The Marketing Strategy of Haverty Furniture focuses on establishing a strong brand reputation and customer-centric approach. This strategy has allowed the company to stand out in the competitive landscape of the furniture industry. Haverty's competitive advantages are rooted in its long-standing brand recognition and dedication to customer satisfaction.

With over a century in the business, Haverty's has cultivated a brand synonymous with quality, fashion, value, and service. This brand equity significantly boosts customer loyalty, encouraging repeat business and positive word-of-mouth referrals. The company's commitment to personalized customer service, especially through its in-home design service, further differentiates it from competitors.

Haverty Furniture Company's success is also driven by its integrated logistics network and disciplined inventory management. These factors contribute to efficient operations and customer satisfaction. By focusing on high-quality, non-promotional merchandise, Haverty's appeals to a more affluent customer segment, solidifying its market position.

Haverty's has built a solid brand reputation over a century, known for quality and service. This reputation fosters customer loyalty, leading to repeat business and positive referrals. The company's focus on customer satisfaction is a key differentiator in the competitive landscape.

The complimentary in-home design service is a significant advantage, increasing customer engagement. This service accounted for 33.2% of total written sales in Q1 2025. The average written ticket was $7,422, demonstrating the value of personalized service.

Haverty's operates an integrated logistics network with distribution and home delivery centers. This network provides greater control over costs and timelines, ensuring timely product delivery. The 'Top Drawer Delivery' service is a key component of this advantage.

The company emphasizes disciplined inventory management, aiming for 'perfect inventory' across all channels. Haverty's focuses on high-quality, non-promotional merchandise. This strategy appeals to a more affluent customer segment, supporting its market position.

Haverty Furniture Company's competitive advantages include a strong brand reputation, personalized customer service, and an efficient logistics network. These factors contribute to customer loyalty and operational efficiency. The company's focus on high-quality products and an omnichannel approach further enhances its market position.

- Strong Brand Equity: Over a century of brand building, synonymous with quality and service.

- Personalized Service: In-home design services and custom order options enhance customer experience.

- Efficient Logistics: Integrated network ensures timely and satisfactory product delivery.

- Inventory Management: Disciplined approach to ensure the right products are available.

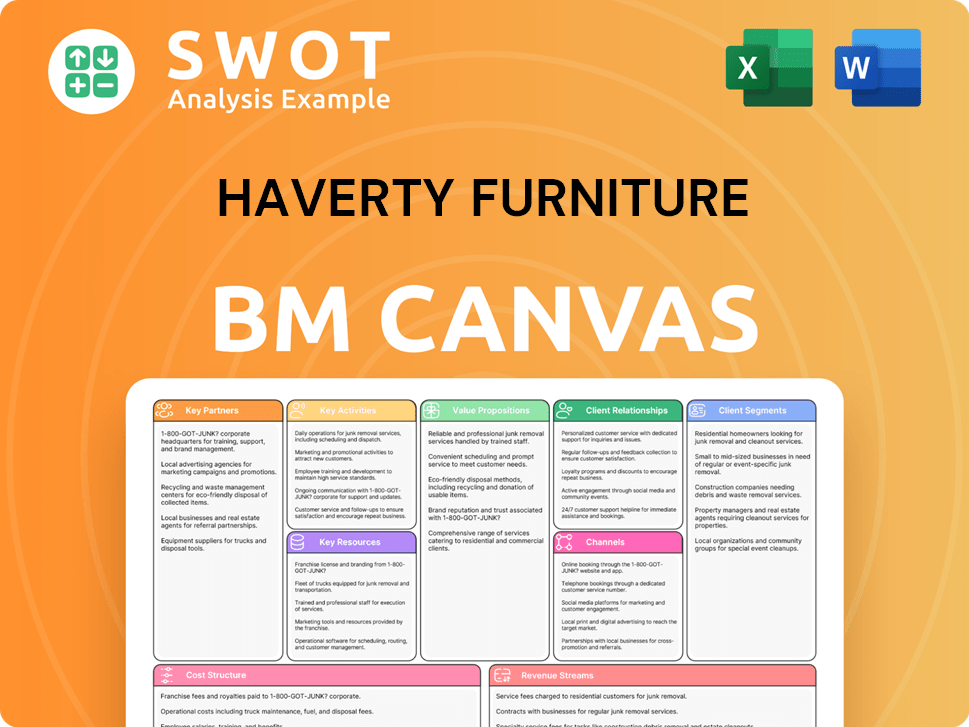

Haverty Furniture Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Haverty Furniture’s Competitive Landscape?

The residential furniture industry is currently navigating a landscape shaped by technological advancements, evolving consumer preferences, and macroeconomic shifts. Understanding the competitive landscape is crucial for success. This analysis of the Furniture industry analysis will provide insights into the current market dynamics and future prospects for companies like Haverty Furniture Company.

The Haverty Furniture Company's market position is influenced by both industry-wide trends and company-specific strategies. The industry faces challenges such as economic fluctuations and supply chain disruptions. However, opportunities for growth exist through strategic initiatives and adapting to changing consumer behaviors. For more context, consider reading the Brief History of Haverty Furniture.

E-commerce continues to grow, with online furniture sales increasing. Consumer preferences are shifting towards sustainability. Home improvement and decor trends offer opportunities for market share expansion.

Economic fluctuations, including high mortgage rates, impact consumer spending. Supply chain disruptions, such as increased shipping costs, pose ongoing threats. The competitive nature of the retail furniture market creates pricing pressures.

Expansion of retail footprint by opening new stores. Strategic investments during demand downturns. Product innovations, particularly in custom order capabilities. Strategic partnerships could unlock new growth avenues.

Enhancing customer interactions and new products. High-touch service and better technology. Anticipated capital expenditures of approximately $27.1 million in 2025. Focus on improving profitability.

Online furniture sales increased by 14.2% in 2023. The company experienced a 16.1% revenue decline in 2024. The company plans to open an average of five new stores per year. The company has no funded debt and substantial cash reserves.

- Market share Haverty's is focused on capturing more market share.

- The company is actively working with vendors to mitigate the impact of tariffs.

- Haverty Furniture Company's competitive advantages include a strong financial position.

- Capital expenditures of approximately $27.1 million in 2025 to support expansion.

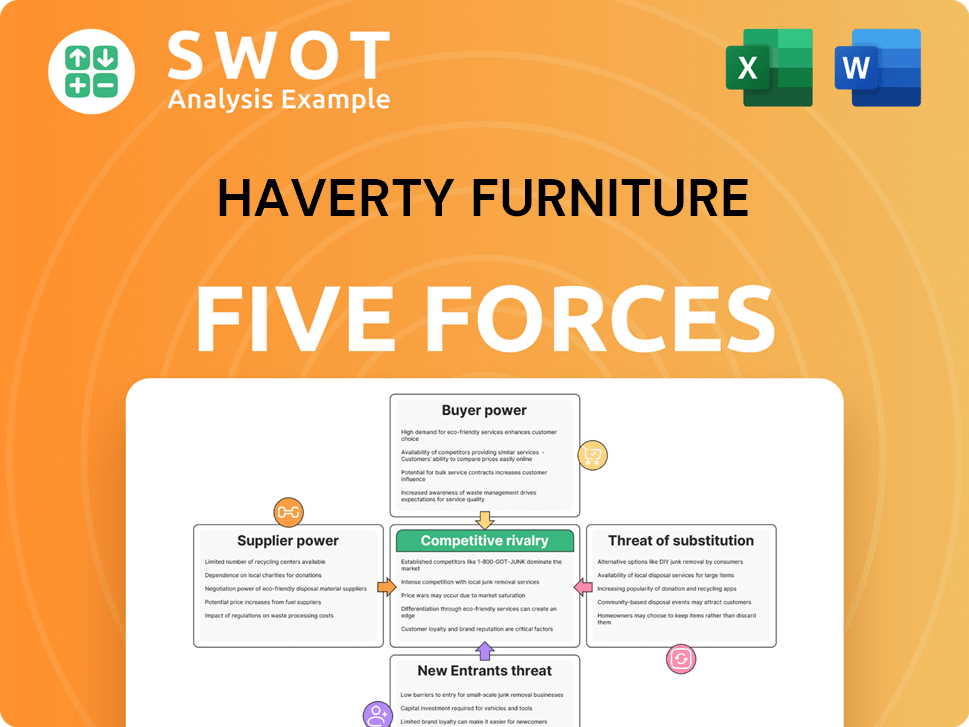

Haverty Furniture Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haverty Furniture Company?

- What is Growth Strategy and Future Prospects of Haverty Furniture Company?

- How Does Haverty Furniture Company Work?

- What is Sales and Marketing Strategy of Haverty Furniture Company?

- What is Brief History of Haverty Furniture Company?

- Who Owns Haverty Furniture Company?

- What is Customer Demographics and Target Market of Haverty Furniture Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.