Itron Bundle

Who are Itron's main rivals in the smart metering industry?

Itron, a pioneer in utility management, has been transforming how energy and water resources are managed since 1977. From its humble beginnings with a groundbreaking meter-reading service, Itron has evolved into a global leader, offering cutting-edge solutions for utilities and cities worldwide. But in a market this dynamic, who are the key players challenging Itron's dominance?

This exploration will delve into the Itron SWOT Analysis, providing a detailed

Where Does Itron’ Stand in the Current Market?

Itron operates within the utility technology sector, focusing on smart metering and energy management solutions. The company's core operations revolve around providing intelligent technology for energy and water resource management. This includes smart meters, communication networks, software, and various managed services, catering to a global customer base with a strong presence in North America, EMEA, and Asia-Pacific regions.

The value proposition of Itron lies in its ability to deliver comprehensive solutions that enable utilities to optimize resource management. By providing advanced metering infrastructure and data analytics, Itron helps its customers improve operational efficiency, reduce costs, and enhance sustainability. The company's focus on innovation and its commitment to customer service are key drivers of its market position.

As of June 2024, Itron held the largest market share in the US for smart energy meters and smart energy network devices. Itron and Landis+Gyr held 34% and 32% market share, respectively, of the installed base of smart electricity meters in North America. In network endpoints, Itron leads with a 63% market share.

Itron's primary product lines include smart meters for electricity, gas, and water. It also offers communication networks, software, and managed and consulting services. The company's business model is centered on delivering intelligent technology solutions for energy and water resource management, operating primarily in two segments: Electricity and Water.

For the full year ended December 31, 2024, Itron reported revenue of $2.4 billion, a 12% increase from 2023. Gross profit increased by 18% to $839 million. Net income attributable to Itron for 2024 was $239 million. The total backlog reached a record $4.7 billion by the end of 2024.

In Q1 2025, Itron reported revenue of $607 million, a 1% increase year-over-year. The gross margin reached a record 35.8%, driven by a favorable product mix and operational efficiencies. Itron projects full-year 2025 revenue to be between $2.4 billion and $2.5 billion.

Itron's competitive advantages include its strong market position, comprehensive product portfolio, and global customer base. The company's financial health, with a strong net margin of 9.48% and an impressive return on assets (ROA) of 1.72% as of December 2024, further solidifies its position. However, the smart metering industry faces challenges such as technological advancements, regulatory changes, and intense competition.

- Market Leadership: Itron's leading market share in smart meters and network endpoints in North America positions it favorably.

- Financial Strength: Strong revenue growth, gross profit, and net income demonstrate a robust business model.

- Technological Innovation: Continued investment in R&D and the use of AI in energy management are critical for maintaining a competitive edge.

- Competition: The Itron competitive landscape includes Landis+Gyr, Sensus, and other players.

For a deeper look into the company's strategic growth, consider reading about the Growth Strategy of Itron.

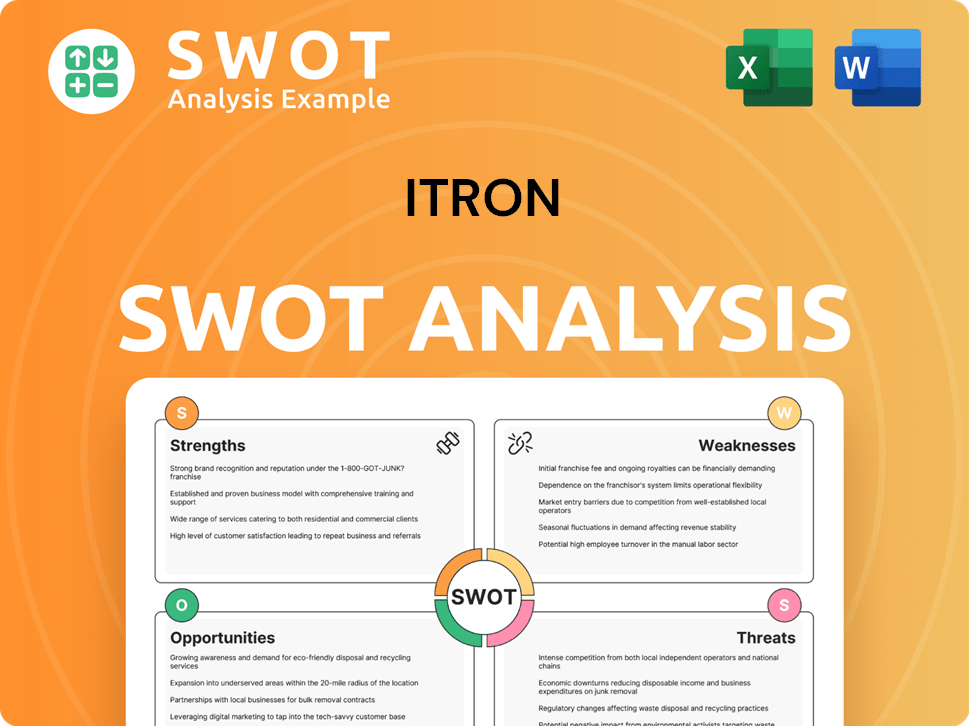

Itron SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Itron?

The Itron competitive landscape is shaped by a diverse array of companies, from specialized firms to large global corporations. These rivals compete across various aspects, including pricing, technology, and distribution. Understanding these competitors is crucial for analyzing Itron's market position and strategic direction.

Itron operates in the smart metering industry, facing both direct and indirect competition. The competitive environment is dynamic, with mergers, acquisitions, and new market entrants continually reshaping the landscape. This analysis provides insights into key players and their impact on Itron's market share and overall performance.

Itron's key competitors include both direct and indirect rivals. These companies challenge Itron through various means, including pricing, innovation, branding, distribution, and technology. The competitive landscape is dynamic, with mergers and alliances reshaping the industry.

Landis+Gyr is a major global provider of integrated energy management solutions, specializing in smart metering and grid management. As of June 2024, Landis+Gyr and Itron hold the largest market shares in North American smart electricity meters, with 32% and 34% respectively.

Siemens AG is a global technology company with a broad portfolio spanning energy, automation, and digitalization. It poses a challenge through its extensive reach and diverse offerings. Siemens competes with Itron in various segments, leveraging its global presence and technological capabilities.

Honeywell International Inc. provides a vast array of technology solutions, including smart metering and building management systems. Honeywell competes with Itron in the broader energy management and smart grid space.

Schneider Electric focuses on energy management and automation solutions. Itron has partnered with Schneider Electric on certain initiatives to digitalize and optimize electricity demand and supply. This partnership highlights the collaborative aspect of the competitive landscape.

Aclara Technologies, now part of Hubbell, is another significant competitor, particularly in network endpoints. Aclara held a 22% market share in North American smart electricity meters. The acquisition by Hubbell has reshaped the competitive dynamics.

Other competitors include Xylem Inc. (formerly Sensus), Badger Meter, Inc., and Mueller Water Products. These companies challenge Itron through various means, including pricing, innovation, branding, distribution, and technology. The competitive landscape is constantly evolving.

The smart metering industry is characterized by dynamic competition, with companies vying for market share through various strategies. Itron's market analysis reveals the importance of innovation, strategic partnerships, and a strong customer base. Understanding the competitive landscape is crucial for Itron's continued success.

- Market Share: Itron and Landis+Gyr are the leaders in North American smart electricity meters.

- Mergers and Acquisitions: The acquisition of Aclara by Hubbell has changed the competitive environment.

- Partnerships: Collaboration with companies like Schneider Electric.

- Technology: Innovation in smart grid and energy management solutions.

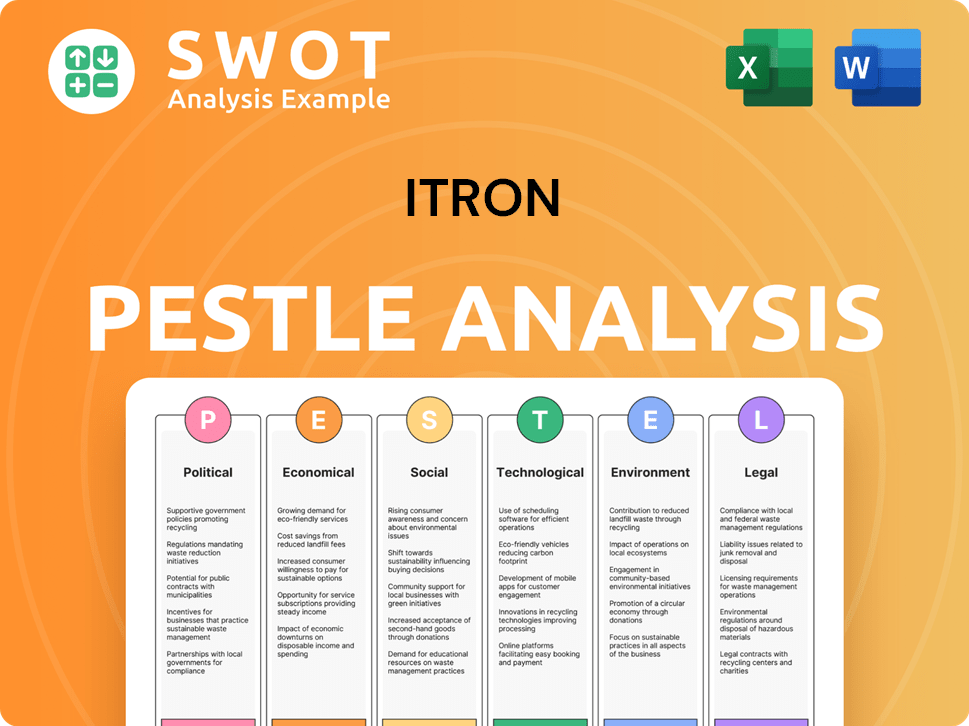

Itron PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Itron a Competitive Edge Over Its Rivals?

Analyzing the Itron competitive landscape reveals a company with several key advantages. Established in 1977, Itron has built a solid reputation within the utility sector. Its long history and global presence, spanning numerous countries, provide a diversified customer base and a strong foundation for future growth. This foundation is critical in the dynamic smart metering industry.

A significant aspect of Itron's strategy involves offering comprehensive, end-to-end solutions. This includes smart meters, communication networks, software, and managed services for electricity, gas, and water management. These integrated solutions allow Itron to provide value across the entire value chain for utilities. The company's focus on 'grid edge intelligence' and its ability to deliver these integrated solutions are key competitive differentiators.

Itron's ability to provide cutting-edge technology at competitive prices has allowed it to secure crucial projects. Strategic alliances and partnerships, such as collaborations with Schneider Electric and GE Vernova, also accelerate product advancement and market entry, leveraging collective expertise to meet customer demands and expand its customer base. For more details on their strategic direction, explore the Growth Strategy of Itron.

Itron's long-standing presence in the utility sector, dating back to 1977, has fostered a strong brand reputation. This established market position is supported by a global footprint, operating in numerous countries. This extensive reach provides a diversified customer base, essential for navigating the Itron competitors.

Itron's strength lies in its ability to offer end-to-end solutions. These include smart meters, communication networks, software, and managed services. This comprehensive approach enables Itron to provide value across the entire value chain for utilities, a key factor in its Itron market analysis.

Itron is recognized for its advanced technology solutions, including smart metering and data analytics. The company's focus on 'grid edge intelligence' and integrated solutions is a significant advantage. Itron's patents cover various technologies related to metering, water leak detection, and AMR/AMI technologies.

Strategic alliances, such as collaborations with Schneider Electric and GE Vernova, accelerate product advancement and market entry. These partnerships leverage collective expertise to meet customer demands and expand the customer base. These partnerships are crucial for expanding their energy management solutions.

Itron's focus on innovation and integrated solutions sets it apart in the competitive landscape. The company's strategic shift towards higher-margin software and outcomes segments is evident. Outcomes revenue grew by 14% year-over-year in Q1 2025, showcasing a move toward sustainable, software-driven revenue.

- Comprehensive solutions that include smart meters, communication networks, software, and managed services.

- Strategic alliances and partnerships to accelerate product advancement and market entry.

- Focus on 'grid edge intelligence' and integrated solutions.

- Growing outcomes revenue, reflecting a strategic shift towards software-driven revenue streams.

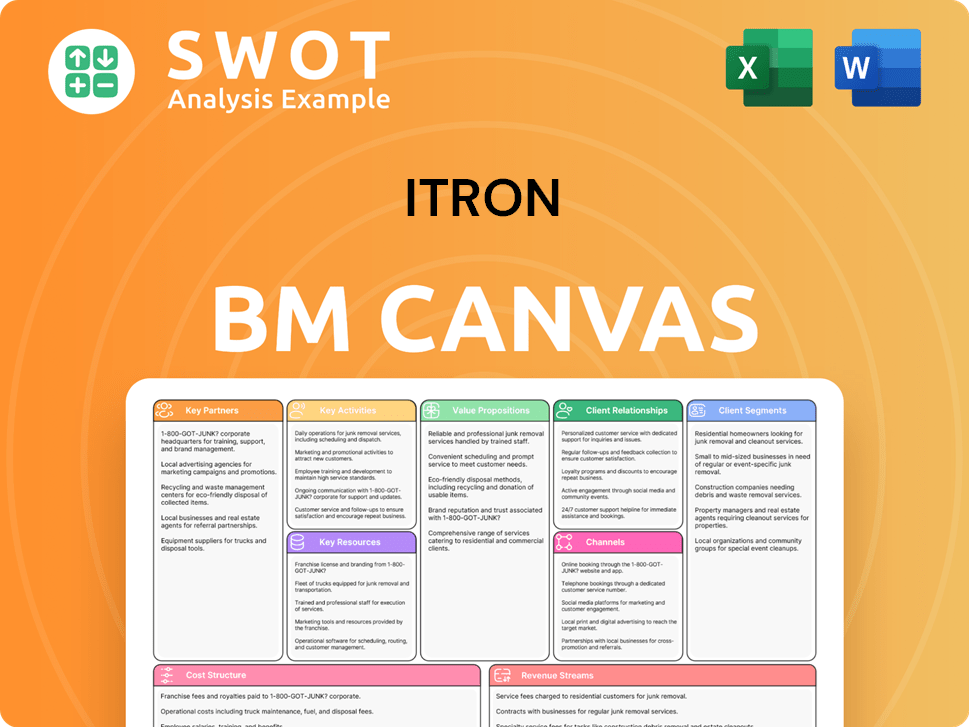

Itron Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Itron’s Competitive Landscape?

The competitive landscape for Itron is heavily influenced by industry trends, including technological advancements, sustainability efforts, and the global shift towards efficient resource use. The smart grid market, where Itron is a key player, is projected to grow significantly. This expansion is driven by increasing electricity demand, urbanization, and the adoption of renewable energy sources.

These trends present both opportunities and challenges for Itron. The company is focused on smart utility solutions and expanding into emerging markets. However, it also faces potential threats from supply chain issues, competitive pressures, and regulatory delays. Cybersecurity risks and broader economic uncertainties could also impact the industry. Itron's ability to maintain its competitive edge will depend on continuous innovation and strategic partnerships.

The smart grid market is expected to nearly double, from $40.12 billion in 2024 to $77.79 billion by 2030, growing at a CAGR of 11.5%. This growth is fueled by rising electricity demand and the integration of renewable energy sources. Technological advancements and the focus on sustainability are also key drivers in the smart metering industry.

Challenges include supply chain management, competitive pressures, and regulatory delays in grid projects. Cybersecurity risks and economic uncertainties pose additional threats. The maturing market for first-generation smart meters necessitates a focus on advanced solutions and second-wave rollouts.

Opportunities for Itron include the increasing demand for smart utility solutions, particularly in smart cities and sustainability initiatives. Strategic partnerships and product innovations, such as the Grid Edge Essentials solution, offer significant growth avenues. Itron's record backlog provides a robust foundation for future expansion.

Itron is focusing on higher-margin software and outcomes segments to adapt to changing business models. Partnerships with companies like Xcel Energy and PG&E are key to expanding its market reach. The company's record backlog of $4.7 billion as of Q1 2025, with over $1.8 billion worth of contracts expected to be fulfilled in 2025, supports future growth.

To maintain its competitive position, Itron is focusing on innovation, strategic partnerships, and adapting to the digitized energy landscape. The company aims to leverage its strong backlog and expand into higher-margin segments. This approach is crucial for navigating the evolving demands of the smart metering industry.

- Continuous innovation in smart grid technology.

- Strategic partnerships to expand market reach.

- Focus on higher-margin software and outcomes.

- Addressing cybersecurity risks and economic uncertainties.

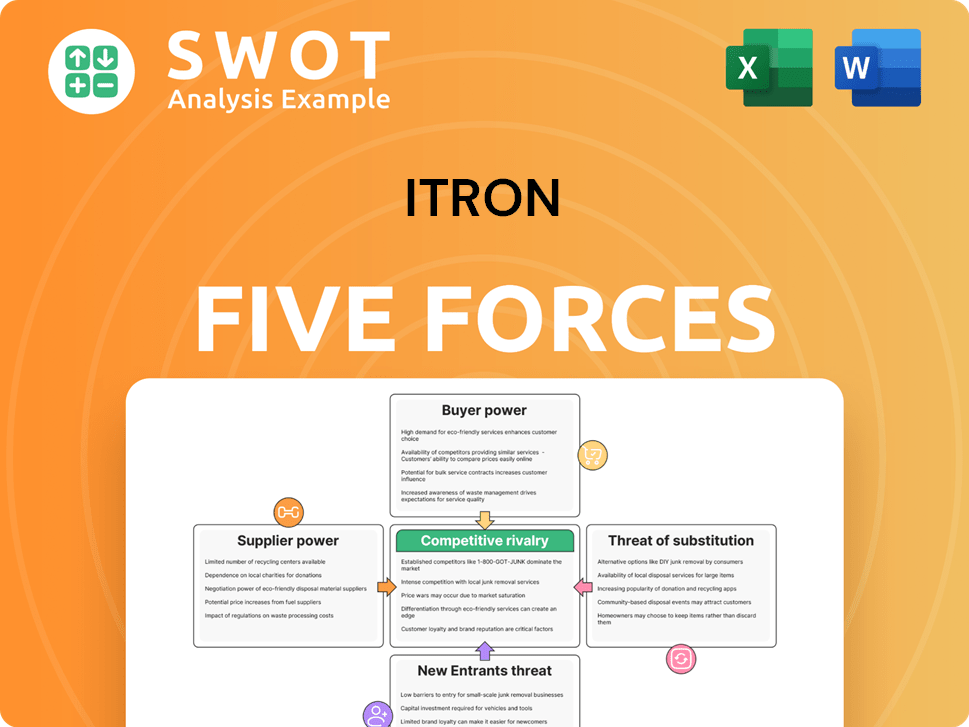

Itron Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Itron Company?

- What is Growth Strategy and Future Prospects of Itron Company?

- How Does Itron Company Work?

- What is Sales and Marketing Strategy of Itron Company?

- What is Brief History of Itron Company?

- Who Owns Itron Company?

- What is Customer Demographics and Target Market of Itron Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.