Karex Bundle

Can Karex Maintain Its Dominance in the Global Condom Market?

The global condom industry is a dynamic arena, shaped by shifting consumer demands and continuous innovation. As the world's largest condom manufacturer, Karex Berhad plays a central role in this market. This analysis dives deep into the Karex SWOT Analysis, exploring its competitive positioning and strategic advantages.

Understanding the Karex competitive landscape requires a close examination of its rivals and market dynamics. This includes a comprehensive Karex market analysis to assess its strengths and weaknesses. We will explore who the major Karex competitors are, and evaluate their impact on Karex's market share and overall performance. The study will also touch upon the Karex financials and how the company has adapted to changes in the condom industry and related sectors like the rubber glove market.

Where Does Karex’ Stand in the Current Market?

Karex Berhad's core operations revolve around the manufacturing and distribution of condoms, personal lubricants, and medical devices. The company's value proposition lies in its ability to provide high-quality products at scale, catering to both its own brands and a diverse range of international clients through OEM agreements. This dual approach allows Karex to leverage its manufacturing capabilities and market presence effectively.

The company's strategic focus is on expanding its own branded products, particularly the ONE brand, to capture higher margins and build stronger brand equity. This shift is supported by a robust global distribution network that reaches over 140 countries. Karex's commitment to innovation and quality has solidified its position as a leader in the global condom market.

Karex holds a dominant position in the global condom market, with an estimated 15% market share in 2024. This strong market share makes Karex a key player in the condom industry. The company's competitive advantages include its extensive manufacturing capacity, global distribution network, and diverse product portfolio. Karex has demonstrated resilience and growth, as evidenced by its financial performance in the first half of the financial year 2024.

Karex is the world's largest condom manufacturer, holding approximately 15% of the global market share in 2024. This significant market share underscores its dominance in the condom industry. The company's extensive manufacturing capabilities and global distribution network contribute to its leadership position.

Karex has a strong global presence with manufacturing facilities in Malaysia and Thailand. Its distribution network spans over 140 countries, allowing it to serve a diverse customer base. This extensive reach supports its ability to meet the needs of various markets and customer segments worldwide.

For the first half of the financial year 2024, Karex reported a net profit of RM36.0 million, a substantial increase from RM1.7 million in the previous period. This growth reflects increased sales volume, particularly from its own brand manufacturing segment. This improved financial health demonstrates the company's resilience and strategic focus.

Karex has diversified its product offerings beyond condoms to include personal lubricants and medical devices like catheters. This diversification strategy aims to strengthen its market position and reduce reliance on a single product category. The expansion into related healthcare products supports its growth.

Karex's strategies for market dominance include a focus on own brand manufacturing (OBM) to capture higher margins and build brand equity. The company also leverages its extensive global distribution network to reach diverse customer segments. Furthermore, Karex is expanding its product portfolio to include personal lubricants and medical devices, diversifying its revenue streams.

- Focus on Own Brand Manufacturing (OBM)

- Global Distribution Network

- Product Diversification

- Strategic Partnerships and Acquisitions

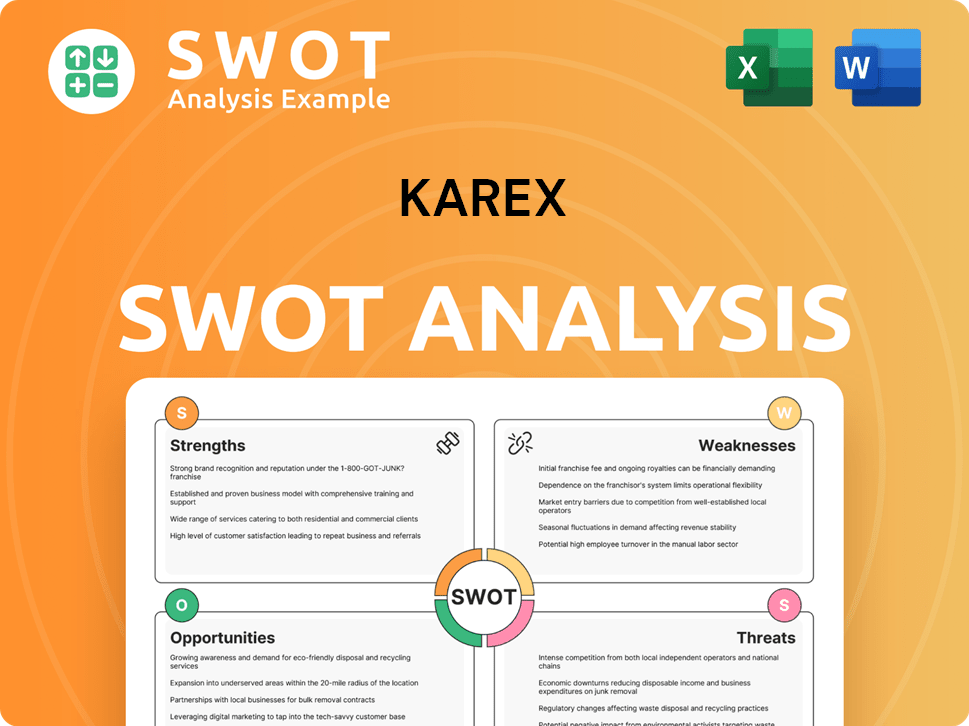

Karex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Karex?

The Karex competitive landscape is shaped by a diverse array of players, from global giants to niche specialists. Understanding these competitors is crucial for evaluating Karex's position and strategic options within the condom industry and related markets.

Karex faces competition across several fronts, including brand recognition, marketing budgets, and distribution networks. The company's ability to navigate this competitive environment significantly impacts its market share and financial performance. Analyzing the strengths and weaknesses of these rivals provides insights into Karex's potential for growth and areas for strategic focus.

The competitive dynamics are constantly evolving, influenced by market trends, technological advancements, and consumer preferences. This necessitates a continuous assessment of the competitive landscape to adapt and maintain a competitive edge.

Karex's primary direct competitors are other condom manufacturers. These companies compete directly for market share, particularly in the global condom market. They often have established brand recognition and distribution networks.

Ansell is a major player in the protective solutions sector, offering a wide range of condoms. They compete with Karex through their strong brand presence and extensive distribution channels. Ansell's financial performance and market strategies are key factors in the competitive landscape.

Durex, owned by Reckitt Benckiser, is a globally recognized condom brand. Durex competes with Karex through aggressive marketing and a premium brand image. They often dominate retail markets and have significant marketing budgets.

Trojan, a brand of Church & Dwight, holds a leading market share in North America. They compete with Karex through their diverse product line and strong consumer loyalty. Trojan's market position and consumer loyalty are crucial in the North American market.

Numerous smaller regional manufacturers also compete with Karex. These companies may focus on specific geographic markets or niche product segments. Their agility and focus can pose a competitive threat.

Emerging players, particularly those focusing on niche segments like organic or ultra-thin condoms, also compete with Karex. These companies often leverage e-commerce and direct-to-consumer models. Their innovative products and distribution strategies are key competitive factors.

Indirect competition comes from other forms of contraception and sexual health products. The Karex market analysis must consider these alternatives. The broader healthcare product market also presents indirect competition.

- Market Share Battles: Intense competition for market share is evident in key regions like Asia and Africa, where both global and local players are active.

- Mergers and Alliances: Potential consolidations in the medical device sector could reshape the competitive landscape, leading to larger competitors.

- E-commerce and D2C: New entrants utilizing e-commerce and direct-to-consumer models are disrupting traditional distribution channels.

- Product Innovation: The introduction of new condom technologies and materials, such as those focused on enhanced sensitivity or sustainability, drives competition.

- Regulatory Environment: Changes in regulations, particularly those related to product safety and labeling, can impact competitive dynamics.

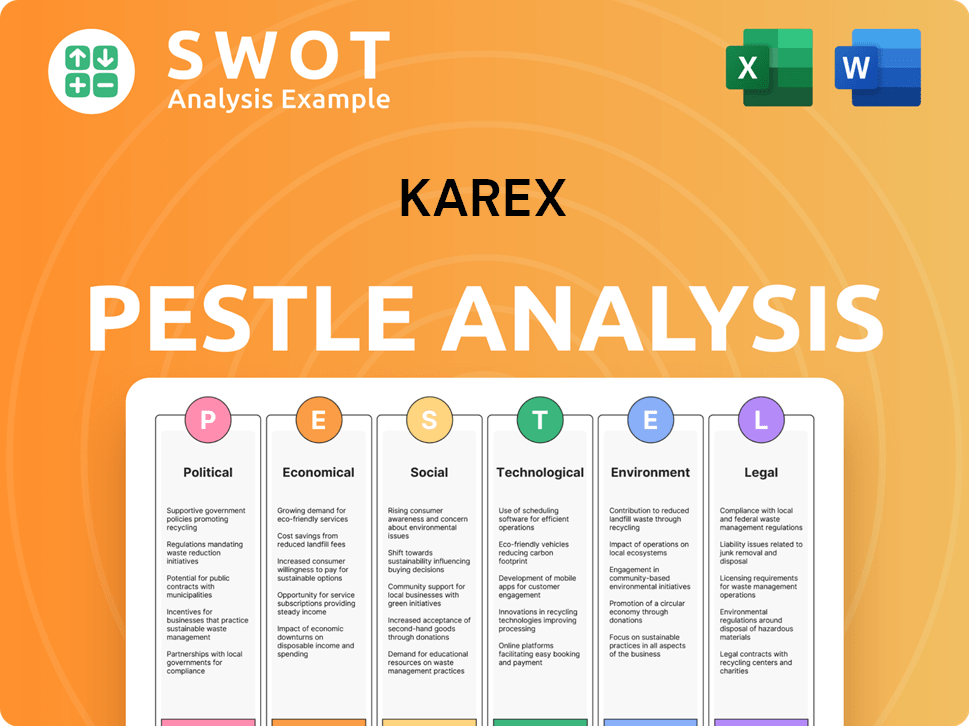

Karex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Karex a Competitive Edge Over Its Rivals?

The competitive landscape of the company is shaped by its significant scale and extensive manufacturing capabilities. As the world's largest condom manufacturer, it benefits from economies of scale, which allow for lower production costs. This cost efficiency is a crucial advantage in the price-sensitive global market. The company's strategic approach combines producing its own brands with serving as an Original Equipment Manufacturer (OEM) for numerous international brands.

The company’s competitive edge is further enhanced by its intellectual property, product innovation, and robust global distribution network. The company consistently innovates and adapts to consumer preferences, including specialized products, which helps maintain its market relevance. The company's global distribution network reaches over 140 countries, ensuring widespread product availability. This extensive reach is particularly crucial for serving diverse markets and fulfilling large-scale orders for public health programs.

The company's evolution from high-volume OEM production to a more balanced approach that emphasizes both manufacturing scale and brand development has created a sustainable competitive position. The company's ability to maintain its market position is also influenced by external factors, including the evolving dynamics of the condom industry and the broader healthcare market. For more information about the company's ownership structure, you can refer to Owners & Shareholders of Karex.

The company's manufacturing facilities are equipped with advanced technology, enabling high-volume production while maintaining stringent quality control standards. It benefits from economies of scale, which lead to lower production costs per unit. This cost advantage is crucial in a competitive global market, where price sensitivity is high.

The company has a dual strategy of producing for its own brands (OBM) and serving as a major Original Equipment Manufacturer (OEM) for numerous international brands. The OEM segment provides a stable revenue base. This strategy allows the company to leverage its manufacturing expertise across a wide range of clients, including governmental and non-governmental organizations.

The company's intellectual property and product innovation, such as the development of various condom types and personal lubricants, contribute to its competitive edge. Its brand equity, particularly with its ONE brand, has been growing, contributing to higher margins and direct consumer engagement. The company consistently innovates to meet evolving consumer preferences.

The company's robust global distribution network, reaching over 140 countries, is a significant advantage, ensuring widespread availability of its products. This extensive reach is crucial for serving diverse markets and fulfilling large-scale orders for public health programs. This global presence supports its market share and ability to compete effectively.

The company's competitive advantages include its manufacturing scale, dual OEM/OBM strategy, product innovation, and global distribution network. These factors enable the company to maintain a strong position in the condom industry. The company's ability to adapt to market changes and consumer preferences is also a key factor in its success.

- Economies of Scale: The company's large-scale manufacturing leads to lower production costs.

- Dual Business Model: The OEM and OBM strategy ensures a stable revenue base and brand growth.

- Product Innovation: Continuous innovation in product offerings, including specialized products.

- Global Reach: Extensive distribution network in over 140 countries.

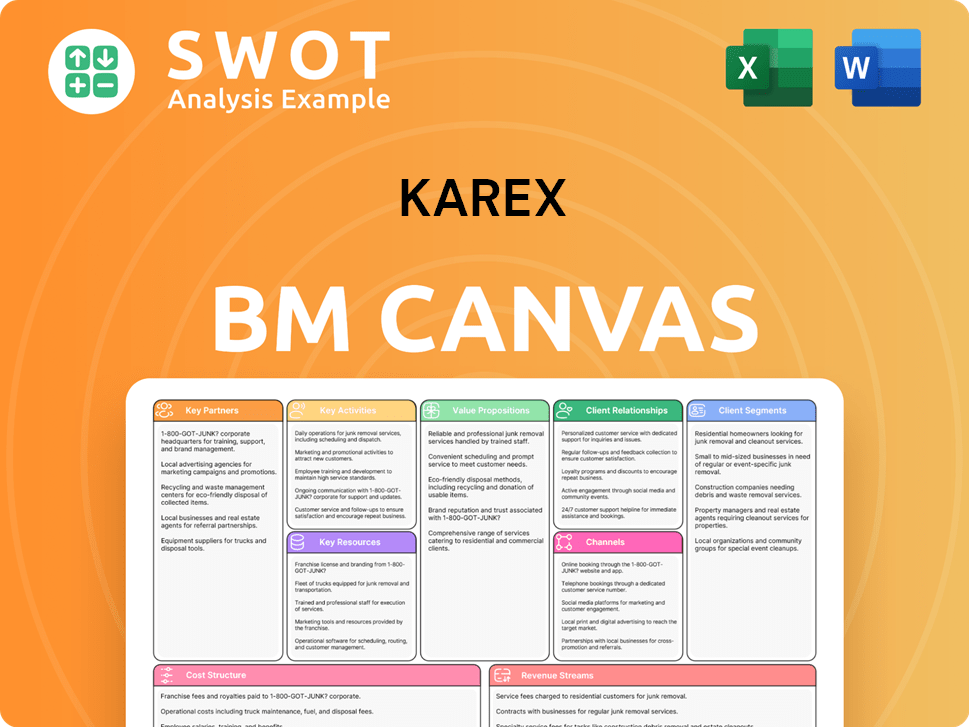

Karex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Karex’s Competitive Landscape?

The Karex competitive landscape is shaped by evolving industry dynamics. Technological advancements, regulatory changes, and shifting consumer preferences are key factors. Additionally, the rise of e-commerce and direct-to-consumer models is transforming distribution and marketing strategies within the condom industry.

The Karex market analysis reveals both challenges and opportunities. Intense competition, potential demand declines, and rising costs pose threats. However, growing markets, product innovation, and strategic partnerships offer significant growth potential. The company's focus on its branded products, such as ONE, aids in capturing higher margins. Read more about the Growth Strategy of Karex.

Technological advancements are driving innovation in condom design, leading to thinner and stronger products. Regulatory changes, particularly concerning product safety, require continuous adaptation. Consumer preferences are shifting towards sustainable and ethically produced items.

Intense competition from established and new players could pressure pricing and market share. Declining demand in certain regions and the rising cost of raw materials are potential threats. Global supply chain disruptions could also impact profitability.

Growing awareness and acceptance of sexual health products in emerging markets offer substantial growth potential. Product innovations, such as smart condoms, could open up new revenue streams. Strategic partnerships with healthcare organizations could expand reach and product offerings.

Karex is investing in R&D, expanding its OBM segment, and optimizing its global supply chain. The company focuses on its own branded products to capture higher margins and build stronger consumer relationships. These strategies aim to navigate challenges and capitalize on future growth opportunities.

The Karex competitive landscape is influenced by global economic conditions and shifts in consumer behavior. The company's ability to adapt to these changes will be crucial for its success. Understanding the Karex market share analysis 2023 and the strategies of Karex competitors is vital.

- Karex's position in the global condom market depends on innovation and market expansion.

- The company's financial performance is affected by the rubber glove market and raw material costs.

- Karex's strategies for market dominance involve product diversification and geographical expansion.

- Karex's financial performance compared to competitors is an important factor for investors.

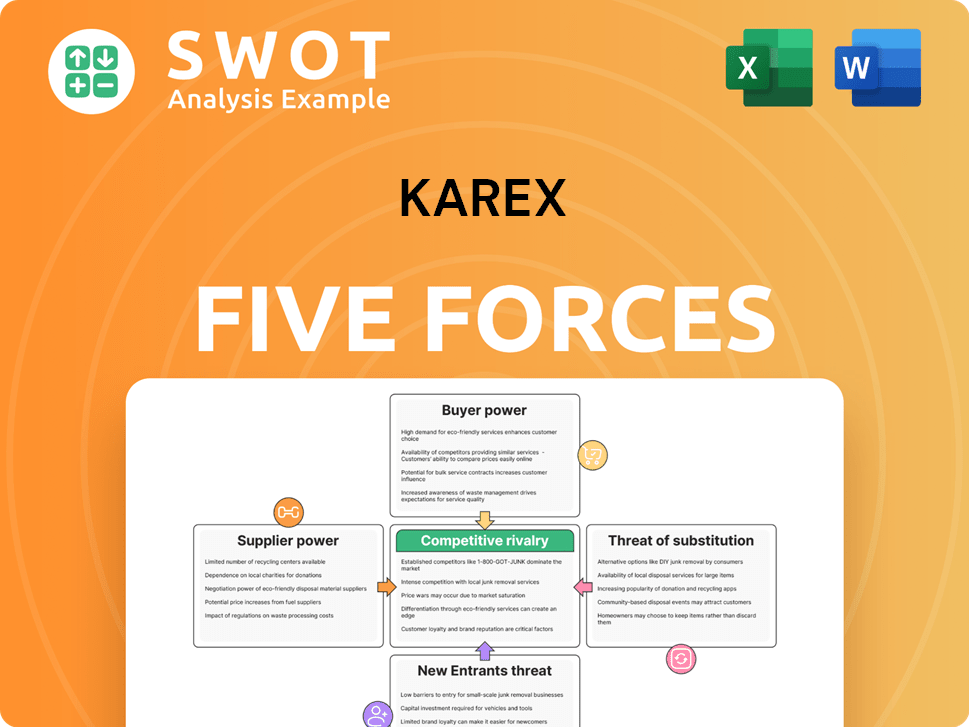

Karex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Karex Company?

- What is Growth Strategy and Future Prospects of Karex Company?

- How Does Karex Company Work?

- What is Sales and Marketing Strategy of Karex Company?

- What is Brief History of Karex Company?

- Who Owns Karex Company?

- What is Customer Demographics and Target Market of Karex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.