NEC Bundle

How Does NEC Navigate the Ever-Changing Tech World?

NEC Corporation, a titan in the global IT and electronics arena, has a rich history dating back to 1899. From its early days connecting the world through telecommunications to its current focus on cutting-edge technologies, NEC has consistently adapted and innovated. Today, with a market capitalization of £25.89 billion as of June 2025, understanding NEC's position in the NEC SWOT Analysis is crucial.

This deep dive into the NEC competitive landscape will explore its key rivals and strategic moves. We'll examine the NEC market analysis to understand its position in the global IT market, including its NEC competitors and how it fares against them in areas like cloud computing and AI. Analyzing NEC's business strategy and NEC industry analysis provides insights into its long-term vision and how it aims to maintain its competitive edge, considering its strengths and weaknesses.

Where Does NEC’ Stand in the Current Market?

NEC Corporation, a key player in the technology sector, focuses on IT and network solutions, serving a global customer base that includes businesses, governments, and communication service providers. The company's core operations encompass system integration, maintenance and support services, outsourcing and cloud services, and system equipment and software. NEC's value proposition lies in providing comprehensive technology solutions, particularly in areas like network infrastructure and IT services, to meet diverse customer needs worldwide.

NEC's financial performance reflects its market position. For the fiscal year ending March 31, 2025, NEC's annual revenue was JPY 3.42 trillion. The company's adjusted operating profit increased to JPY 223.6 billion in Q1 2024, with a forecast of JPY 255 billion for the year ending March 2025. NEC's net income for the fiscal year ending March 31, 2024, was JPY 149.52 billion, increasing to JPY 175.18 billion in 2024, a 17.16% increase. This financial stability and growth are crucial in understanding the Owners & Shareholders of NEC and their strategic direction.

NEC holds a strong market position in the IT and network solutions sector. The company's global presence and diverse product offerings contribute to its competitive standing. NEC's market share analysis reveals its strengths in specific areas, such as wealth management software in Europe and Asia Pacific.

NEC's competitive advantages include a broad product portfolio, global reach, and strong customer relationships. Its disadvantages might involve challenges in rapidly evolving technology markets and intense competition. Understanding these aspects is key to assessing the NEC competitive landscape.

NEC's global presence, with operations in over 160 countries and regions, underscores its significant position in the global IT market. Its diverse offerings and customer base contribute to its competitive standing. The company's ability to adapt to market challenges is crucial.

NEC serves a diverse customer base, including businesses, governments, and communication service providers. Its target markets are global, with a focus on sectors that require advanced IT and network solutions. Understanding these markets is vital for NEC's business strategy.

NEC's strengths include a robust product portfolio, global operations, and strong financial performance. The company's weaknesses may include the need to adapt to rapid technological changes and intense competition. An in-depth NEC industry analysis reveals these nuances.

- Strong market position in IT and network solutions.

- Global presence with operations in over 160 countries.

- Focus on system integration, maintenance, and cloud services.

- Financial performance with revenue of JPY 3.42 trillion for the fiscal year ending March 31, 2025.

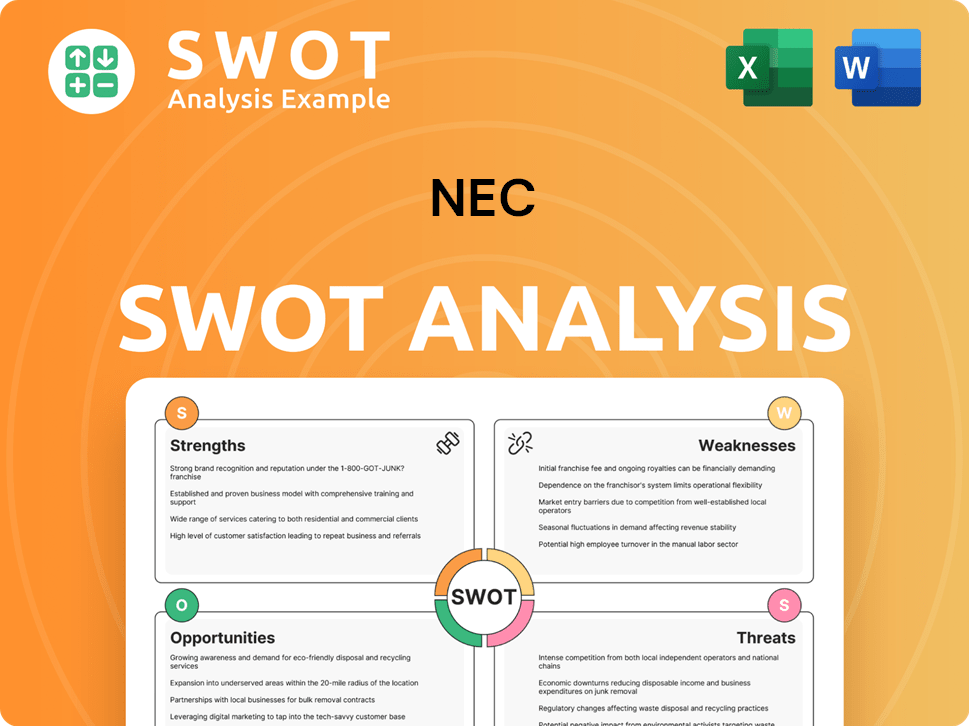

NEC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging NEC?

The NEC competitive landscape is shaped by a diverse array of global technology companies. These rivals compete across various segments, including IT solutions, networking, and communications. The company's business strategy is constantly evolving to navigate this complex market, as highlighted in a recent industry analysis.

NEC's market analysis reveals a dynamic environment where innovation and adaptation are crucial for maintaining a competitive edge. The company faces both direct and indirect competition, requiring strategic responses to stay relevant. Understanding the strengths and weaknesses of rivals is essential for NEC's strategic planning.

NEC's company profile indicates a long-standing presence in the tech industry, positioning it against well-established and emerging players. The company's ability to adapt to market challenges, as explored in Target Market of NEC, is critical for sustained growth.

Several major companies directly challenge NEC. These competitors offer similar products and services, creating a high degree of overlap in their target markets. Understanding their strategies is vital for NEC's competitive positioning.

Fujitsu is a significant global competitor, providing a broad range of IT solutions. It directly competes with NEC in various sectors, including IT infrastructure and services. Fujitsu's market presence and technological advancements pose a continuous challenge.

Hitachi is another major player in IT and network technologies. Its diverse portfolio overlaps with NEC's offerings, creating direct competition in several key areas. Hitachi's scale and resources make it a formidable rival.

IBM is a major competitor, particularly in IT services, software, and hardware. Its extensive resources and market share pose a significant challenge to NEC. IBM's strategic initiatives and technological prowess are key factors.

Cisco is a leading provider of networking solutions, creating direct competition with NEC in networking and communication technologies. Cisco's market position and technological advancements make it a key rival. The networking market is highly competitive.

Besides direct competitors, NEC faces challenges from other significant players. These companies compete in specific segments, influencing the overall competitive landscape. The presence of these rivals necessitates strategic diversification and innovation.

- HP: Hewlett Packard Enterprise competes in the enterprise server market.

- Huawei: Huawei is a major player, particularly in telecommunications and networking.

- Microsoft: Microsoft competes in cloud computing and software solutions.

- Avaya and Mitel: These companies are key rivals in unified communications.

- OVHcloud and Lenovo: These are key competitors in the enterprise server market.

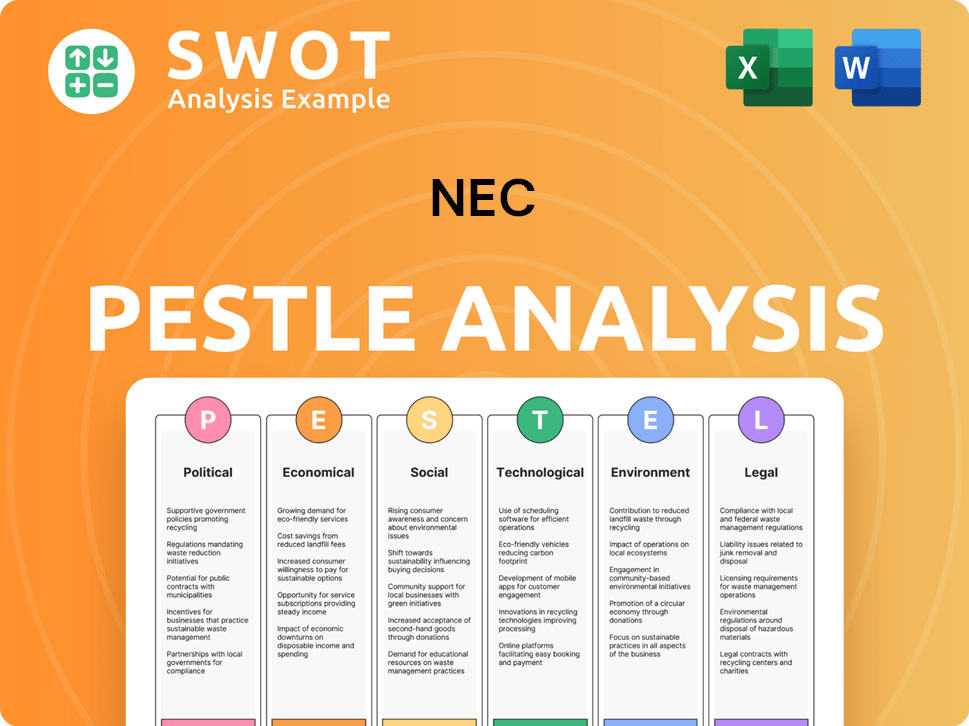

NEC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives NEC a Competitive Edge Over Its Rivals?

The competitive landscape for NEC Corporation is shaped by its technological prowess, global reach, and established customer relationships. NEC's strategic focus on innovation, particularly in biometrics and analytics, positions it as a strong player in the global IT market. The company's ability to consistently deliver top-ranked technologies, such as its face recognition system, gives it a significant competitive edge.

NEC's business strategy emphasizes its deep expertise and extensive presence in over 160 countries, allowing it to effectively serve a diverse customer base. This global footprint, combined with its long-standing partnerships with government agencies and enterprises, provides a solid foundation for growth. Furthermore, NEC’s commitment to continuous innovation and purpose-driven management, guided by 'The NEC Way,' fosters a unique company culture that supports its competitive position.

A comprehensive Brief History of NEC reveals the company's evolution and strategic shifts, highlighting its adaptability in the face of market challenges. NEC's competitive advantages are continuously leveraged in product development, strategic partnerships, and marketing efforts, although the company faces ongoing threats from rapid technological imitation and dynamic industry shifts.

NEC's consistent investment in research and development has resulted in cutting-edge proprietary technologies. Its face recognition technology has been ranked first in speed and accuracy tests by the U.S. National Institute of Standards and Technology (NIST) from 2009 through 2025. This technological leadership is a key differentiator, especially in identity verification and security solutions.

With operations in over 160 countries and regions, NEC has a significant global footprint. This extensive reach allows it to serve a diverse customer base and adapt to local market dynamics effectively. This global presence is particularly advantageous in complex environments like submarine cable systems, where NEC is a global leader.

NEC has established trust and long-standing partnerships, especially with government agencies and enterprises. These relationships, built over decades of supporting critical infrastructure and digital transformation initiatives, provide a significant competitive advantage. The company's customer base includes a wide range of sectors, from telecommunications to public safety.

Guided by 'The NEC Way,' the company culture emphasizes purpose-driven management and continuous innovation. This cultural strength, coupled with its strong track record in supporting stable system migrations and its wealth of experience in public sector businesses, differentiates NEC in the market. This culture fosters a collaborative environment that drives innovation.

NEC's competitive advantages are multifaceted, encompassing technological expertise, global reach, and strong customer relationships. These advantages are continuously leveraged in product development and strategic partnerships. The company's focus on innovation, particularly in biometrics and analytics, positions it well for future growth.

- Technological Innovation: NEC's investment in R&D has led to cutting-edge technologies, such as its top-ranked face recognition system.

- Global Footprint: Operations in over 160 countries allow NEC to serve a diverse customer base and adapt to local market dynamics.

- Strong Partnerships: Long-standing relationships with government agencies and enterprises provide a solid foundation for growth.

- Unique Culture: 'The NEC Way' emphasizes purpose-driven management and continuous innovation.

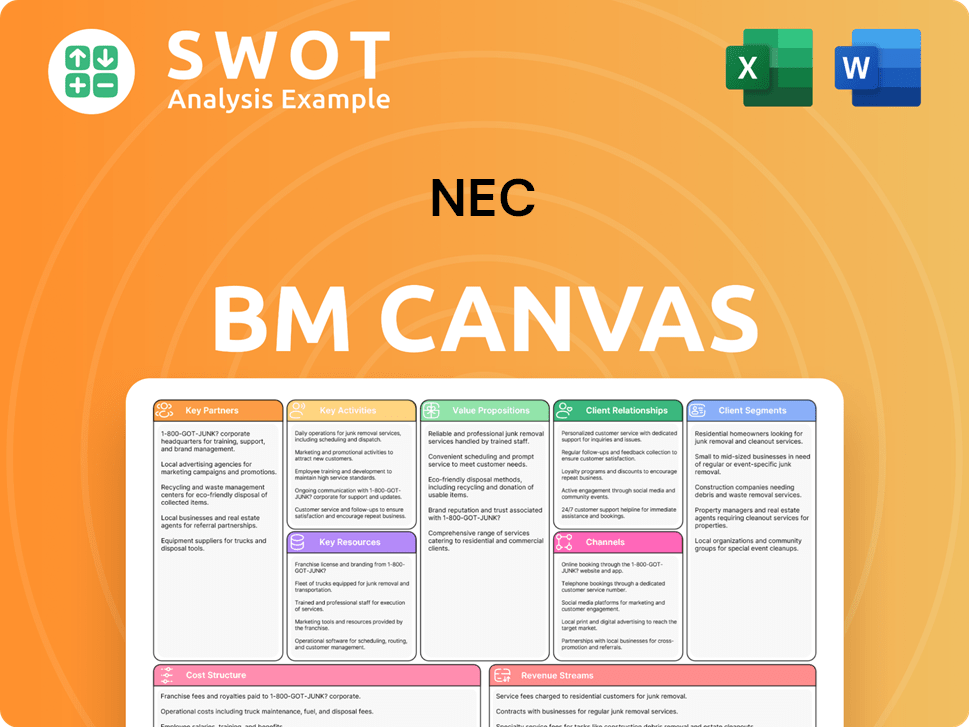

NEC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping NEC’s Competitive Landscape?

The NEC competitive landscape is shaped by significant industry trends, including digital transformation, AI and IoT integration, 5G expansion, and a growing focus on cybersecurity and sustainability. These factors present both challenges and opportunities for the company. A thorough NEC market analysis reveals the need for continuous innovation and adaptation to stay ahead in a rapidly evolving technological environment. The company's NEC business strategy must address both immediate threats and future growth prospects.

The company faces potential disruptions from rapid technological advancements and new market entrants. Intensifying competition in high-growth areas like cloud computing and AI also poses a challenge. Legal issues and inflation's impact further complicate the landscape. However, the increasing global demand for advanced IT and network solutions, the expansion of Open RAN, and the emphasis on sustainability offer significant growth opportunities for NEC Corporation.

Digital transformation, AI and IoT integration, 5G expansion, and a focus on cybersecurity and sustainability are key industry trends. These trends drive the demand for advanced IT and network solutions globally. The growth of Open RAN, anticipated to exceed ¥1.0 trillion by 2025, presents a major opportunity.

Rapid technological advancements require continuous innovation and R&D investments. New market entrants and intensifying competition, especially in cloud computing and AI, pose threats. Legal challenges related to contract disputes and inflation also impact the company. The need to reduce low-profit businesses is also a challenge.

Growing global demand for advanced IT and network solutions provides fertile ground for expansion. Strategic partnerships and leveraging expertise in AI and cybersecurity solutions are key. Sustainability initiatives align with NEC's commitment to creating social and environmental value. The company is promoting carbon neutrality initiatives.

Accelerating global growth, transforming domestic businesses, and prioritizing long-term profit maximization are core strategies. The Mid-term Management Plan 2025 focuses on growth businesses like Digital Government/Digital Finance and global 5G. Strengthening corporate governance and executive remuneration systems are also priorities.

NEC's strategy involves accelerating global growth and transforming its domestic businesses. The company aims to improve profitability in core businesses. The Mid-term Management Plan 2025 emphasizes growth in areas like Digital Government and global 5G, while also focusing on improving profitability in base businesses.

- Focus on Digital Government/Digital Finance, global 5G, and core DX businesses.

- Strengthening corporate governance from fiscal 2025.

- Targeting 12,000 DX talents by fiscal year 2026.

- Actively promoting carbon neutrality initiatives.

To understand how NEC is adapting to these challenges and opportunities, consider examining the Growth Strategy of NEC. This provides a deeper insight into the company's specific plans and actions in response to the dynamic NEC competitive landscape.

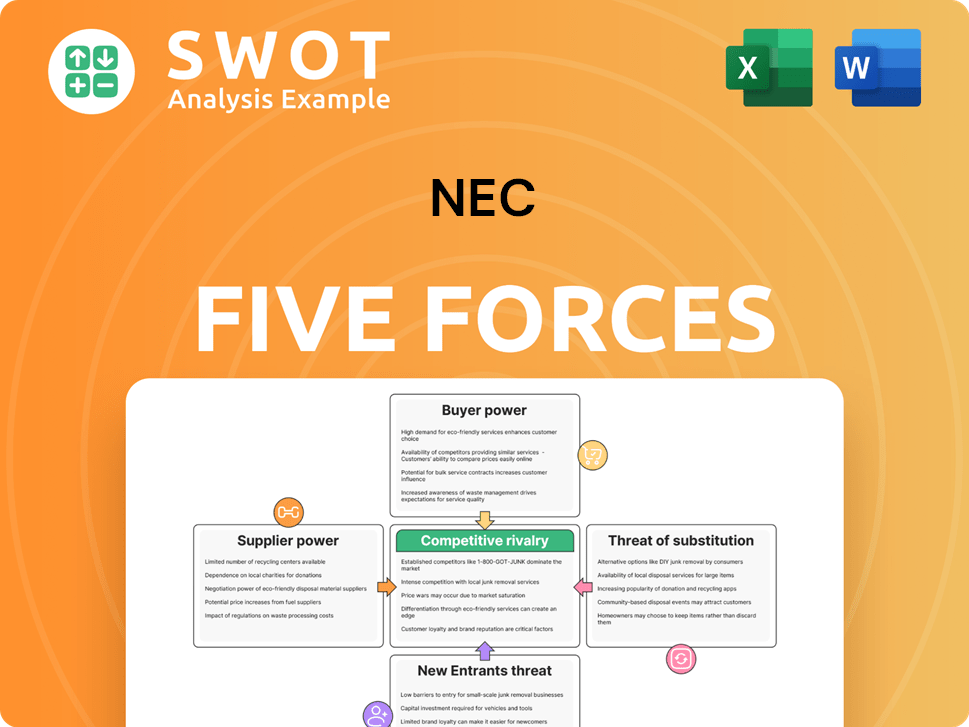

NEC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NEC Company?

- What is Growth Strategy and Future Prospects of NEC Company?

- How Does NEC Company Work?

- What is Sales and Marketing Strategy of NEC Company?

- What is Brief History of NEC Company?

- Who Owns NEC Company?

- What is Customer Demographics and Target Market of NEC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.