Nexstar Media Group Bundle

Can Nexstar Media Group Maintain its Dominance in the Evolving Media World?

In a media landscape constantly reshaped by digital innovation, understanding the competitive dynamics of industry leaders like Nexstar Media Group is crucial. This analysis delves into the heart of the broadcast industry, examining Nexstar's strategic positioning and its ability to navigate the challenges of a changing media environment. Founded in 1996, Nexstar has grown significantly, but how does it fare against its rivals?

This exploration of the Nexstar Media Group SWOT Analysis will illuminate its market position, revealing its primary competitors and the competitive advantages that fuel its success. We'll dissect Nexstar Media Group's business strategy, analyzing its financial performance and identifying the key factors shaping its future in the broadcast industry. Discover how Nexstar Media Group's recent acquisitions and its focus on local TV stations and digital media impact its overall competitive landscape.

Where Does Nexstar Media Group’ Stand in the Current Market?

Nexstar Media Group holds a significant market position as the largest owner of local television stations in the United States. Operating approximately 200 owned or operated stations across 116 markets, it reaches around 68% of U.S. television households. This extensive reach allows the company to deliver local news, syndicated programming, and network content to a vast audience.

The company's core operations revolve around traditional broadcast television, with a growing emphasis on digital platforms. Nexstar's primary revenue streams include advertising sales, retransmission fees from cable and satellite providers, and digital media. Its value proposition lies in providing local communities with essential news and entertainment while offering national advertisers and political campaigns a platform to reach a broad audience.

Nexstar has strategically expanded its market position through acquisitions and digital initiatives. A key acquisition was the Tribune Media Company in 2019, which solidified its leadership in local broadcasting and expanded its digital capabilities. This strategic move, along with a focus on digital transformation, has enabled the company to adapt to changing media consumption habits and maintain its competitive edge.

Nexstar is the largest local TV station owner in the U.S., operating 200 stations. This expansive network allows it to reach a substantial portion of the U.S. population. The company's strong presence in local markets gives it a significant advantage in the broadcast industry.

Nexstar generates revenue from advertising, retransmission fees, and digital media. Advertising sales are a major source, with significant contributions from national advertisers and political campaigns. Retransmission fees from cable and satellite providers also provide a stable income stream.

Nexstar is actively investing in digital media to diversify its revenue sources. Digital revenue grew by 10.9% year-over-year in Q1 2024. This growth demonstrates the company's commitment to adapting to changing consumer behavior and expanding its digital footprint.

In Q1 2024, Nexstar reported net revenue of approximately $1.13 billion. The company focuses on reducing leverage and maintaining a strong financial position. This financial stability supports its ability to invest in growth and navigate industry challenges.

Nexstar's strategic positioning is enhanced by its focus on local news and digital expansion. Its strong presence in mid-sized and smaller markets, where local news is highly valued, provides a competitive advantage. The company's digital initiatives are crucial for future growth.

- Acquisitions, like Tribune Media, have strengthened its market position.

- Digital revenue growth indicates successful adaptation to changing media consumption.

- A focus on financial health supports its ability to invest in growth.

- Nexstar's ability to reach a broad audience is detailed in the Target Market of Nexstar Media Group.

Nexstar Media Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nexstar Media Group?

The competitive landscape for Nexstar Media Group is multifaceted, encompassing both direct and indirect rivals across the media spectrum. A thorough media company analysis reveals that Nexstar's position is constantly challenged by the evolving broadcast industry and the rise of digital platforms. Understanding the competitive dynamics is crucial for assessing Nexstar Media Group's market share and future prospects.

Nexstar Media Group's key rivals include traditional broadcasters and digital media outlets. The company faces competition for advertising revenue, audience attention, and the acquisition of premium content, such as sports broadcasting rights. The ability to adapt to changing consumer habits and technological advancements is vital for maintaining a strong market position.

Nexstar's competitive advantages and challenges are shaped by the actions of its rivals. The company's business strategy must consider the impact of mergers and acquisitions, digital content creation, and the ongoing shift in media consumption habits. For a deeper dive into Nexstar's strategic approach, see the Growth Strategy of Nexstar Media Group.

Direct competition primarily comes from other large broadcast station groups. These rivals often compete for the same advertising revenue and viewership in local markets. The scale of operations and the content offerings are key differentiators.

Sinclair operates a significant number of local stations and has invested in national programming and digital ventures. Sinclair's strategy involves expanding its reach through acquisitions and developing content. The company's financial performance and market position are key factors in the competitive landscape.

Gray Television focuses on local news and community engagement, competing directly with Nexstar for local advertising revenue. Gray's emphasis on local content and community involvement is a key part of its strategy. Its financial results and market share are constantly monitored.

Tegna operates a substantial portfolio of network affiliates and has been active in digital content and advertising. Tegna's focus on digital initiatives and audience engagement is a key part of its strategy. The company's financial performance and market position are key factors in the competitive landscape.

Indirect competitors include national news organizations and streaming services. These entities compete for audience attention and advertising dollars by offering on-demand content and diverse entertainment options. The rise of digital media has intensified this competition.

CNN, Fox News, and MSNBC offer pervasive news coverage that can draw away national audiences. These organizations compete with Nexstar for viewers and advertising revenue. Their ability to attract a large audience is a key factor.

The competitive landscape is shaped by various factors, including content acquisition, digital presence, and mergers. Nexstar's ability to navigate these challenges will determine its future success. The company's strategic decisions will be critical.

- Content Acquisition: Securing prime sports broadcasting rights and top syndicated programming is crucial.

- Digital Media: The emergence of digital-first news outlets and localized content creators presents a growing challenge.

- Mergers and Alliances: Potential consolidation among smaller station groups could reshape the competitive dynamics.

- Audience Demographics: Appealing to younger demographics is increasingly important.

- Advertising Revenue: Competition for local advertising spend is intense.

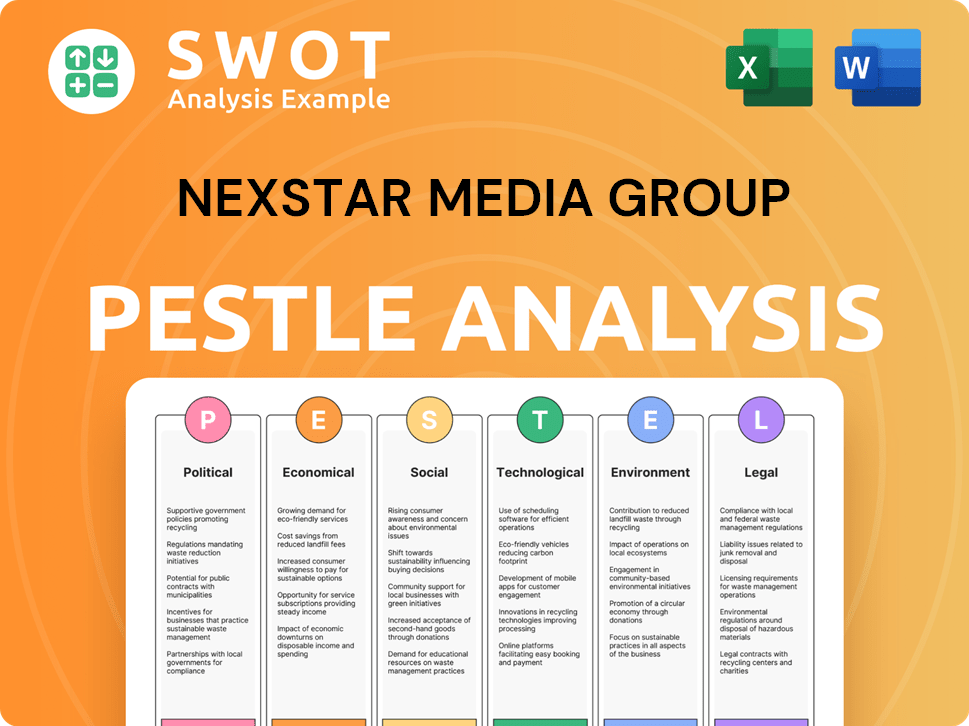

Nexstar Media Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nexstar Media Group a Competitive Edge Over Its Rivals?

The competitive landscape for Nexstar Media Group is shaped by its significant scale and strategic focus. As the largest owner of local television stations in the U.S., Nexstar leverages its extensive reach to negotiate favorable terms and maintain a strong market position. Understanding its competitive advantages is crucial for a comprehensive media company analysis.

Nexstar's commitment to local news and community-focused content further strengthens its brand equity and customer loyalty. This approach, combined with its dual revenue streams from retransmission consent fees and advertising, provides a stable financial foundation. Nexstar's operational efficiency and strategic acquisitions have also contributed to its success in the broadcast industry.

The company's ability to adapt to the changing media market, particularly the shift towards digital consumption, will be key to its future. Nexstar's strategic moves and its capacity to innovate in streaming and personalized content are critical for sustaining its competitive edge. For more insights, you can explore the Growth Strategy of Nexstar Media Group.

Nexstar's extensive network, reaching approximately 68% of U.S. television households, allows for significant economies of scale. This vast distribution network is a major barrier to entry for new media competitors. This scale advantage supports its market share and competitive position.

Nexstar's dedication to local news fosters strong brand loyalty. Investment in local journalism differentiates it from competitors. This strategy is essential for maintaining a strong market position and appealing to local audiences.

Nexstar benefits from retransmission consent fees and advertising revenue. Retransmission consent provides a stable revenue source, contributing to financial performance. This diversified revenue model helps mitigate risks associated with shifts in the media market.

Nexstar's operational efficiency and disciplined approach to acquisitions have allowed it to integrate new stations effectively. This capability generates strong free cash flow. Strategic acquisitions have expanded its reach and market influence.

Nexstar's competitive advantages include its extensive reach, local news focus, and diversified revenue streams. These factors contribute to its strong market position. The company's ability to adapt to digital consumption is crucial for future success.

- Largest owner and operator of local TV stations in the U.S.

- Strong brand equity through local news and community focus.

- Dual revenue streams from retransmission consent and advertising.

- Operational efficiency and strategic acquisitions.

Nexstar Media Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nexstar Media Group’s Competitive Landscape?

The broadcast industry is experiencing significant shifts, creating both challenges and opportunities for Nexstar Media Group. The rise of streaming services and cord-cutting directly impacts traditional revenue streams. However, there's also a growing demand for local news and digital content, offering avenues for growth. Understanding the competitive landscape is crucial for Owners & Shareholders of Nexstar Media Group to make informed decisions.

Nexstar must adapt to changing consumer habits and technological advancements to maintain its market position. This involves investing in digital platforms, diversifying content, and exploring new revenue streams. Strategic partnerships and innovative content delivery are vital for long-term success in this evolving media market. The company's performance hinges on its ability to navigate these trends effectively.

The broadcast industry is facing a decline in traditional pay-TV subscribers, impacting retransmission consent revenues. Audiences are increasingly turning to on-demand and personalized content via streaming services. There's a growing demand for local news and information, creating opportunities for local TV stations.

Aggressive competition from digital news providers poses a threat to Nexstar's market share. Audience fragmentation and the need to continually innovate content delivery are ongoing challenges. Regulatory changes, such as potential adjustments to media ownership rules, could impact Nexstar's market position.

Expanding digital advertising solutions, leveraging local reach for targeted campaigns. Growing interest in sports betting could open new revenue streams through partnerships. Digital transformation and streaming capabilities offer a way to reach audiences on their preferred devices.

Focus on a hybrid broadcast-digital model, content diversification, and technological integration. Pursuing strategic partnerships to remain resilient and capitalize on emerging growth areas. Investing in digital platforms and streaming capabilities to reach audiences on their preferred devices.

Nexstar's ability to adapt to digital transformation is crucial for maintaining its competitive edge. The company must leverage its local reach and content to attract and retain audiences. Strategic partnerships and innovative revenue models will be essential for future success.

- Digital Transformation: Investing in digital platforms and streaming capabilities.

- Content Diversification: Expanding content offerings to meet audience preferences.

- Strategic Partnerships: Forming alliances to explore new revenue streams and content opportunities.

- Local Focus: Leveraging local news and content to maintain audience engagement.

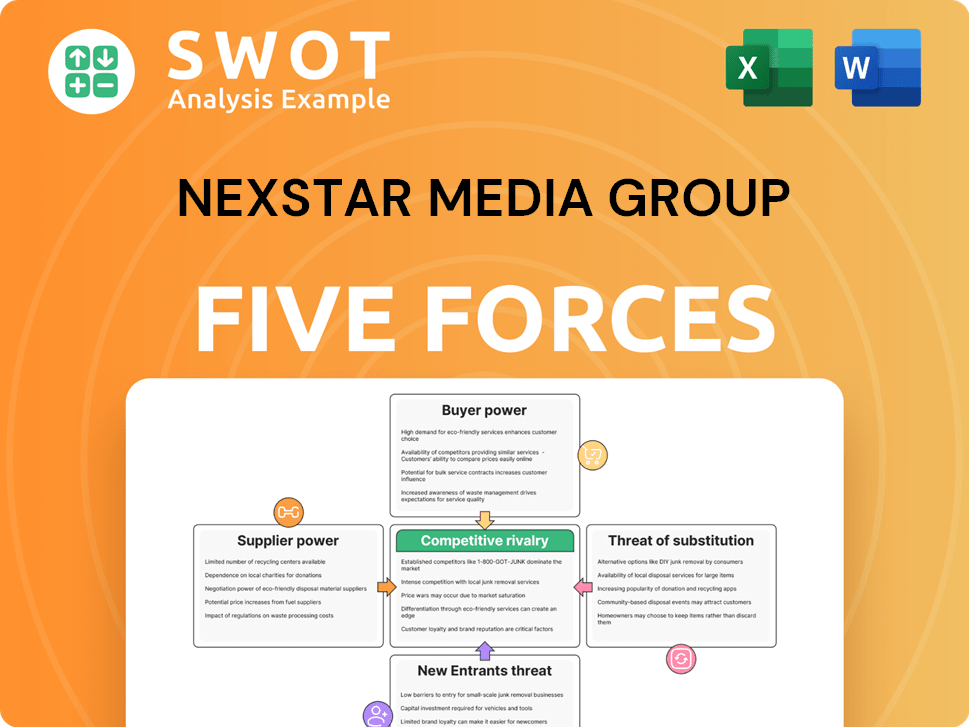

Nexstar Media Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexstar Media Group Company?

- What is Growth Strategy and Future Prospects of Nexstar Media Group Company?

- How Does Nexstar Media Group Company Work?

- What is Sales and Marketing Strategy of Nexstar Media Group Company?

- What is Brief History of Nexstar Media Group Company?

- Who Owns Nexstar Media Group Company?

- What is Customer Demographics and Target Market of Nexstar Media Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.