Petroplus Holdings AG Bundle

What Led to Petroplus Holdings AG's Demise?

The European oil refining sector is a battlefield of intense competition, and Petroplus Holdings AG once stood as a major player. This Petroplus Holdings AG SWOT Analysis reveals the company's journey, from its rise as an independent refiner to its eventual downfall. Understanding the competitive landscape is crucial for anyone seeking insights into the dynamics of the energy market.

This in-depth company analysis delves into the competitive landscape that shaped Petroplus Holdings AG's fate. Examining its market share, industry rivals, and financial performance offers a critical understanding of the challenges within the refining industry. Exploring Petroplus Holdings AG's competitive advantages and strategic positioning provides valuable lessons for investors and business strategists alike, highlighting the factors that determine success or failure in this complex sector. Analyzing Petroplus Holdings AG's recent performance and comparing it with key competitors sheds light on the critical decisions that impacted its trajectory.

Where Does Petroplus Holdings AG’ Stand in the Current Market?

Before its insolvency, Petroplus Holdings AG held a significant market position as Europe's largest independent oil refiner. The company's core operations revolved around refining crude oil into various petroleum products, including diesel, gasoline, and aviation fuels. These refined products were then distributed across key European markets, catering to a diverse customer base.

The company's value proposition centered on providing refined petroleum products to distributors and end customers. Petroplus aimed to optimize its refining assets and supply chain to maintain a competitive edge. This involved strategic acquisitions and integration of refining capacities to achieve economies of scale and enhance operational efficiencies.

Petroplus's market position was substantial, particularly in the European refining industry. Despite its operational scale, the company faced financial challenges, leading to its insolvency. The Brief History of Petroplus Holdings AG provides further context on the company's journey.

While specific market share figures for Petroplus in its final years are not readily available due to its insolvency, its designation as the largest independent refiner highlights its significant scale. This suggests a substantial portion of the European market for refined products.

Petroplus operated across key European markets, including the United Kingdom, France, Switzerland, Germany, and the Benelux countries. This wide geographic spread allowed the company to serve a significant portion of the European demand for refined products.

The company focused on acquiring and integrating refining capacities to achieve economies of scale. This strategy aimed to enhance operational efficiencies and maintain a competitive edge in the refining industry. This strategy was critical for the company's long-term survival.

The company's financial health deteriorated in the period leading up to its insolvency. This decline was influenced by factors such as fluctuating crude oil prices and narrow refining margins. The company's debt burden also played a significant role.

Several factors impacted Petroplus's market position. These included volatile crude oil prices, refining margins, and the company's debt levels. The competitive landscape also played a crucial role in the company's performance.

- Fluctuating Crude Oil Prices: Impacted profitability and operational costs.

- Narrow Refining Margins: Reduced profitability in the refining process.

- Significant Debt Burdens: Contributed to financial instability.

- Competitive Pressures: From integrated oil companies and other independent refiners.

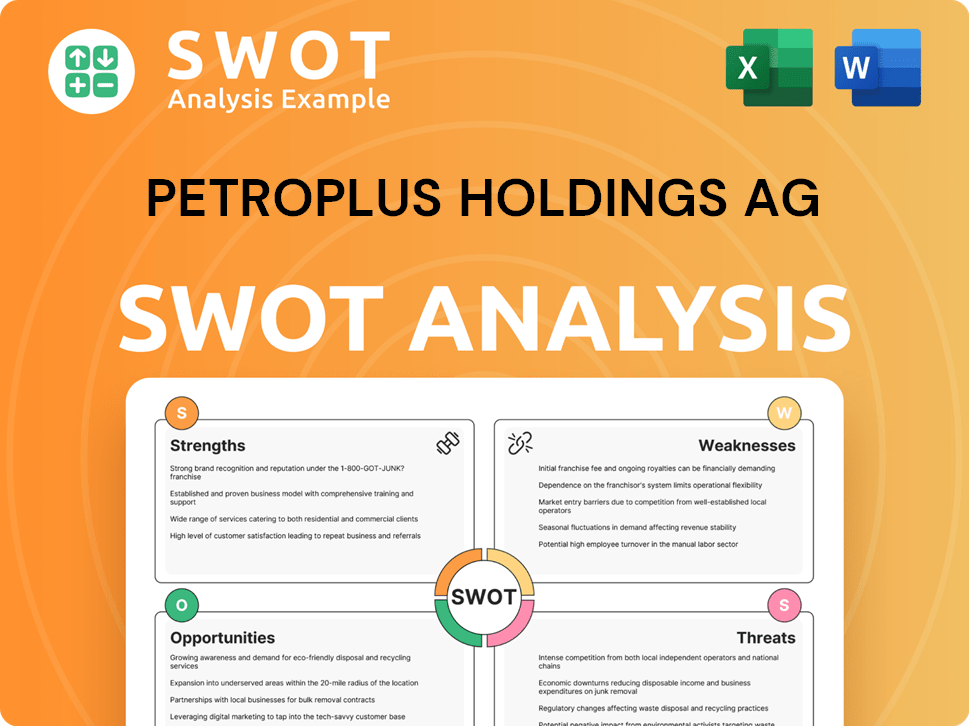

Petroplus Holdings AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Petroplus Holdings AG?

The Petroplus Holdings AG faced a challenging competitive landscape in the European downstream oil sector. A thorough company analysis reveals the significant pressures from both integrated oil majors and independent refiners, influencing its market share and overall financial performance. Understanding the strategies of its industry rivals was crucial for survival and growth.

The dynamics within the refining industry, including Petroplus Holdings AG, were heavily influenced by factors such as crude oil prices, refining margins, and geopolitical events. These elements directly impacted the financial health of the company and its ability to compete. The strategic positioning of Petroplus Holdings AG in this environment required a deep understanding of its competitive advantages and potential vulnerabilities.

The competitive landscape for Petroplus Holdings AG involved a complex interplay of integrated oil majors and independent refiners. These competitors impacted Petroplus Holdings AG's market position. The refining industry faced constant challenges, including fluctuating crude oil prices, changing consumer demands, and environmental regulations, which significantly influenced the future outlook of companies in the sector.

Companies like Shell, BP, ExxonMobil, TotalEnergies, and Eni were significant competitors. These majors possessed vast resources, global reach, and integrated operations. They often had greater financial flexibility to withstand market shocks and invest in technological advancements.

Independent refiners such as Saras S.p.A., Hellenic Petroleum, and various national oil companies presented direct competition. These companies often focused on specific regional markets or niche product lines, leveraging local market knowledge.

The refining industry was subject to fluctuating crude oil prices and refining margins. These factors, along with geopolitical events, directly impacted the financial performance of Petroplus Holdings AG and its ability to compete.

Ongoing mergers and acquisitions within the industry impacted market share and operational capacities. Acquisitions by larger players could intensify competition for independent refiners.

Battles often revolved around optimizing refining margins, securing advantageous crude oil supplies, and efficient distribution networks. These factors were critical in a commodity-driven market.

Petroplus Holdings AG needed a deep understanding of its competitive advantages and potential vulnerabilities. This included a comprehensive SWOT analysis to assess its strengths, weaknesses, opportunities, and threats.

The competitive analysis report for Petroplus Holdings AG would need to consider several strategic implications. These implications would affect the competitor strategies and the company's recent performance.

- Market Share Dynamics: Analyzing how Petroplus Holdings AG's market share compared to integrated oil majors and independent refiners.

- Financial Performance: Evaluating the financial health of Petroplus Holdings AG, including its profitability, revenue, and cost structure, relative to its competitors.

- Operational Efficiency: Assessing the efficiency of Petroplus Holdings AG's refining operations, including throughput, capacity utilization, and maintenance costs, compared to industry benchmarks.

- Supply Chain Management: Examining Petroplus Holdings AG's crude oil sourcing strategies, transportation costs, and relationships with suppliers, in comparison to its rivals.

- Market Challenges: Identifying the market challenges faced by Petroplus Holdings AG, such as fluctuating crude oil prices, changing consumer demand, and environmental regulations.

- Potential Acquisitions: Considering potential acquisitions or divestitures that could impact Petroplus Holdings AG's market position and competitive landscape.

For further insights into the company's market focus, consider reading about the Target Market of Petroplus Holdings AG.

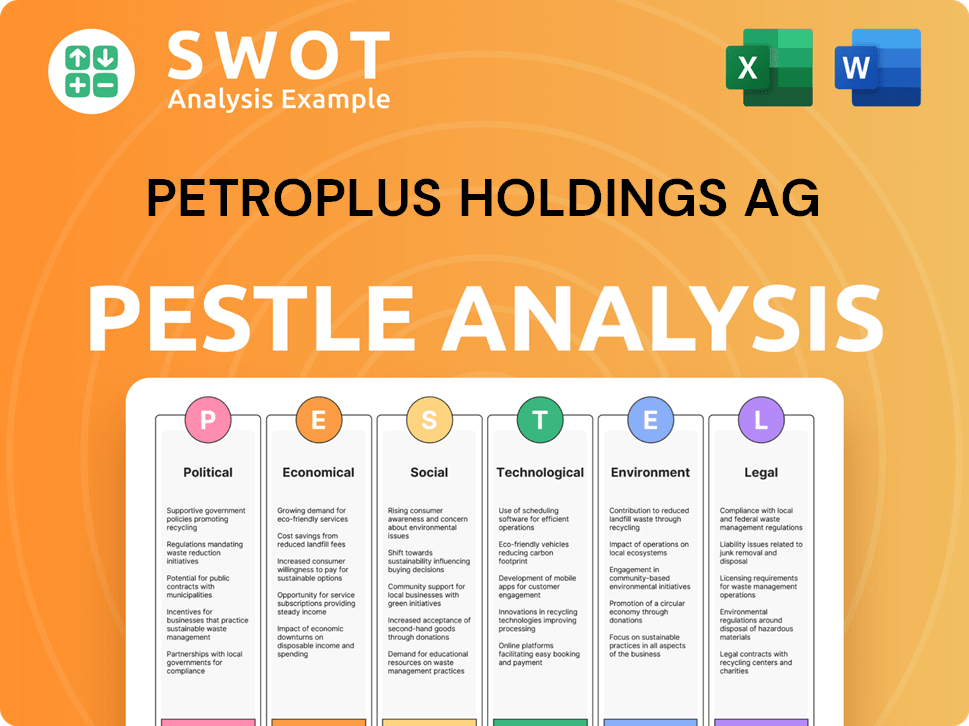

Petroplus Holdings AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Petroplus Holdings AG a Competitive Edge Over Its Rivals?

During its operational period, Petroplus Holdings AG aimed to secure its place as a leading independent oil refiner in Europe by leveraging several competitive advantages. A significant aspect of its strategy involved establishing a strategic network of refining assets across key European locations. This network was designed to optimize logistics, cut down on transportation costs for both crude oil inputs and refined product outputs, and efficiently serve diverse regional markets. By focusing exclusively on refining, the company sought to achieve operational efficiency and specialization, setting itself apart from integrated oil majors that had a wider range of upstream and downstream operations. This approach was critical for maintaining a strong market position.

Another crucial competitive advantage for Petroplus stemmed from its ability to process a wide variety of crude oil types. This flexibility in feedstock processing was especially important in a volatile commodity environment. The company's adaptability allowed it to capitalize on price differentials in the crude market, enhancing its profitability. Furthermore, Petroplus had built strong relationships with distributors and end customers in its core markets, which contributed to a robust sales and distribution network. While specific proprietary technologies weren't a primary differentiator, the company's operational expertise in managing complex refining processes and its ability to achieve economies of scale from its large refining capacity were significant factors. These elements collectively shaped the competitive landscape of Petroplus Holdings AG.

However, Petroplus Holdings AG faced constant challenges. These included fluctuating refining margins, high operational costs, and the capital-intensive nature of the refining business. These factors ultimately threatened the sustainability of its competitive advantages, especially in the face of adverse market conditions. The refining industry is known for its volatility, and external factors such as geopolitical events and shifts in global demand can significantly impact a refiner's financial performance. Understanding these challenges is crucial for a comprehensive Petroplus Holdings AG; competitive analysis report.

Petroplus strategically located its refining assets across key European regions. This network allowed for optimized logistics and reduced transportation costs. The strategic placement facilitated efficient service to diverse regional markets, enhancing its market share.

The ability to process a wide range of crude oil types was a key advantage. This flexibility allowed Petroplus to capitalize on price differentials. It provided a buffer against volatility in the crude oil market, impacting its financial performance.

Petroplus demonstrated operational expertise in managing complex refining processes. The company achieved economies of scale through its large refining capacity. These factors were essential for maintaining a competitive edge in the refining industry.

Strong relationships with distributors and end customers were vital. This network supported a robust sales and distribution system. It ensured efficient market reach and customer service, influencing its market position.

Petroplus faced significant challenges, including fluctuating refining margins and high operational costs. The refining business is capital-intensive, adding to financial risks. These factors could impact the company’s sustainability and future outlook.

- Refining margins are subject to market volatility, impacting profitability.

- High operational costs, including maintenance and labor, put pressure on finances.

- The capital-intensive nature of the business requires significant investment.

- External factors such as geopolitical events and shifts in global demand can impact financial results.

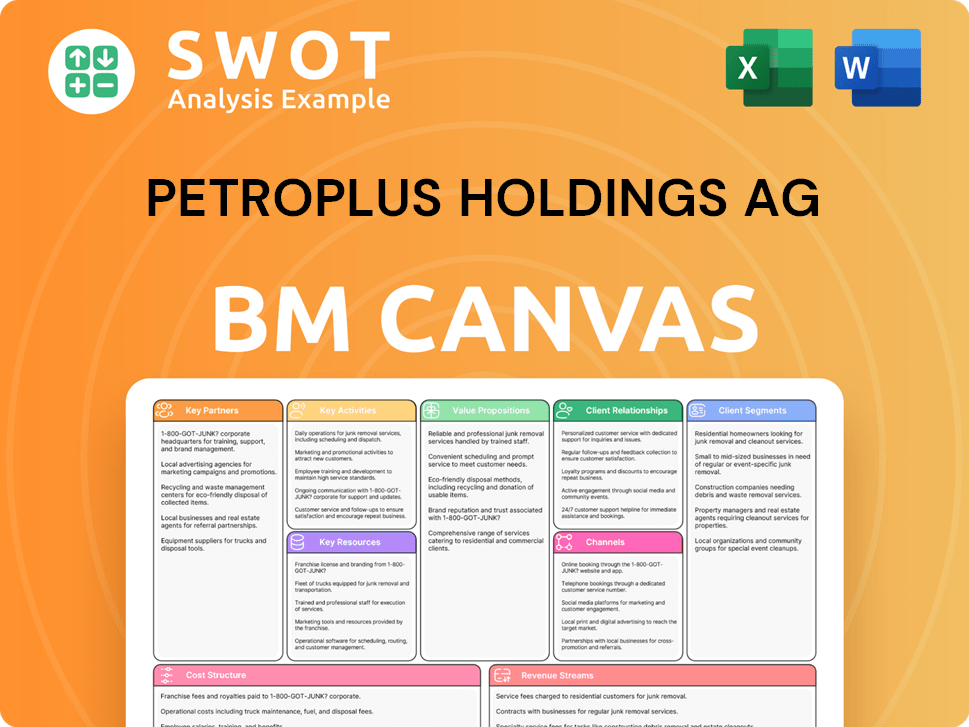

Petroplus Holdings AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Petroplus Holdings AG’s Competitive Landscape?

The European refining industry's competitive landscape, even after the exit of companies like Petroplus Holdings AG, is undergoing significant transformation. This evolution is driven by the energy transition, regulatory pressures, and geopolitical instability. Understanding these trends is crucial for assessing the future outlook and strategic positioning of any remaining or new players in the sector. A thorough Growth Strategy of Petroplus Holdings AG analysis provides insights into the challenges and opportunities within this dynamic environment.

The industry faces risks related to declining demand for traditional fuels and the need for substantial investments in cleaner technologies. However, opportunities exist in specialized products, circular economy initiatives, and strategic collaborations. The ability to adapt, invest in sustainable technologies, and diversify product portfolios will be key to success. The competitive analysis report must address these factors for a comprehensive view of the market.

The primary trend is the energy transition, leading to decreased demand for fossil fuels. The rise of electric vehicles and renewable energy sources accelerates this shift. The 'Fit for 55' package by the European Union aims for a 55% reduction in emissions by 2030, heavily influencing the refining industry.

Stringent environmental regulations necessitate costly investments in cleaner technologies. Geopolitical shifts and supply chain disruptions create volatility in crude oil sourcing. The industry must navigate fluctuating commodity prices, as seen in the 2024 and 2025 global energy markets.

Demand remains strong for specialized products like lubricants and petrochemical feedstocks. Circular economy initiatives, such as plastics recycling, offer new avenues. Strategic partnerships and investments in digitalization improve efficiency and reduce operational costs.

Refiners must adapt to evolving trends, invest in sustainable technologies, and diversify their product portfolios. This includes exploring biofuels and sustainable aviation fuels (SAFs). Digitalization and automation are crucial for operational efficiency and cost reduction.

The competitive landscape for Petroplus Holdings AG involves analyzing market share, industry rivals, and financial performance. A SWOT analysis will reveal strengths, weaknesses, opportunities, and threats. Understanding competitor strategies is vital for strategic positioning.

- Market challenges include declining demand for traditional fuels.

- Potential acquisitions and partnerships could enhance market position.

- The future outlook depends on adapting to sustainable technologies.

- Comparison with rivals is essential for understanding competitive advantages.

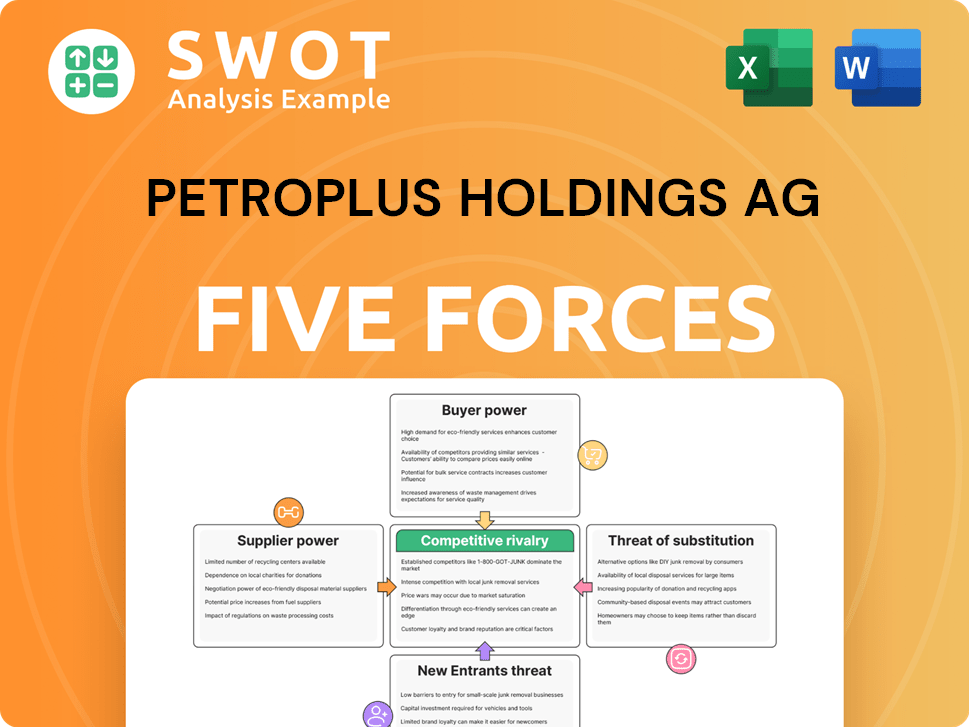

Petroplus Holdings AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petroplus Holdings AG Company?

- What is Growth Strategy and Future Prospects of Petroplus Holdings AG Company?

- How Does Petroplus Holdings AG Company Work?

- What is Sales and Marketing Strategy of Petroplus Holdings AG Company?

- What is Brief History of Petroplus Holdings AG Company?

- Who Owns Petroplus Holdings AG Company?

- What is Customer Demographics and Target Market of Petroplus Holdings AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.