Pinnacle Financial Partners Bundle

How Does Pinnacle Financial Partners Stack Up in Today's Banking Arena?

In the ever-shifting financial services landscape, understanding the competitive dynamics of key players is paramount. Pinnacle Financial Partners, a Southeastern banking powerhouse, has experienced remarkable growth since its inception in 2000. But how does this growth translate into its competitive positioning within the Pinnacle Financial Partners SWOT Analysis?

This analysis delves into the competitive landscape of Pinnacle Financial Partners, exploring its market share, growth strategy, and financial performance. We'll dissect the company's strengths and weaknesses, examining its primary rivals and how it differentiates itself within the banking industry. A comprehensive market analysis of Pinnacle Bank's position will provide valuable insights for investors and strategists alike, helping them understand Pinnacle Financial Partners' long-term viability and potential for continued success.

Where Does Pinnacle Financial Partners’ Stand in the Current Market?

Pinnacle Financial Partners holds a strong position in the financial services sector, offering a comprehensive suite of banking, investment, trust, mortgage, and insurance products. Its primary focus is on serving businesses, individuals, and institutions. The company's operational strategy emphasizes growth through strategic market extensions and talent acquisition, enabling it to gain market share in the competitive landscape.

The company's value proposition centers on delivering a wide array of financial services tailored to meet the diverse needs of its clients. This includes everything from traditional banking services to more specialized offerings like investment management and insurance products. By focusing on a client-centric approach, the company aims to build lasting relationships and provide superior financial solutions.

As of March 31, 2025, the company's total assets reached $54.3 billion, reflecting an 11.0% year-over-year increase. Loans also saw significant growth, increasing by 9.0% year-over-year to $36.1 billion as of March 31, 2025. Noninterest-bearing deposits experienced a substantial annualized increase of 16.5% during the first quarter of 2025, which showcases the company's strong financial health and market position.

Pinnacle Financial Partners is recognized as the No. 1 bank by deposits in the Nashville-Murfreesboro-Franklin MSA as of June 30, 2024. This strong market share highlights its ability to attract and retain customers in a competitive market. The company's focus on customer service and tailored financial solutions contributes to its leading position.

The company strategically operates in urban markets across the Southeastern United States, including Tennessee, North Carolina, South Carolina, Virginia, and Georgia. Recent expansions into new markets such as Atlanta, Jacksonville, Washington, D.C., and Richmond, Virginia, demonstrate its commitment to growth and broader market penetration. The Growth Strategy of Pinnacle Financial Partners focuses on these expansions.

Pinnacle Financial Partners' financial performance remains robust, with Q1 2025 diluted earnings per share (EPS) of $1.77, a 12.7% increase from Q1 2024, and adjusted diluted EPS of $1.90, a 24.2% increase. Net interest income for Q1 2025 was $364.4 million, a 14.6% increase from Q1 2024, with the net interest margin improving to 3.21% from 3.04%.

The company's high associate retention rate of 94% is a significant advantage, contributing to sustained growth. This high retention rate indicates a positive work environment and helps maintain consistency in service and expertise, which is crucial in the competitive banking industry.

Pinnacle Financial Partners' strong market position, strategic geographic expansion, and robust financial performance provide significant competitive advantages. The company's focus on talent acquisition and retention further strengthens its position in the market.

- Leading market share in key areas.

- Consistent financial growth and profitability.

- Strategic expansion into new markets.

- High associate retention rate.

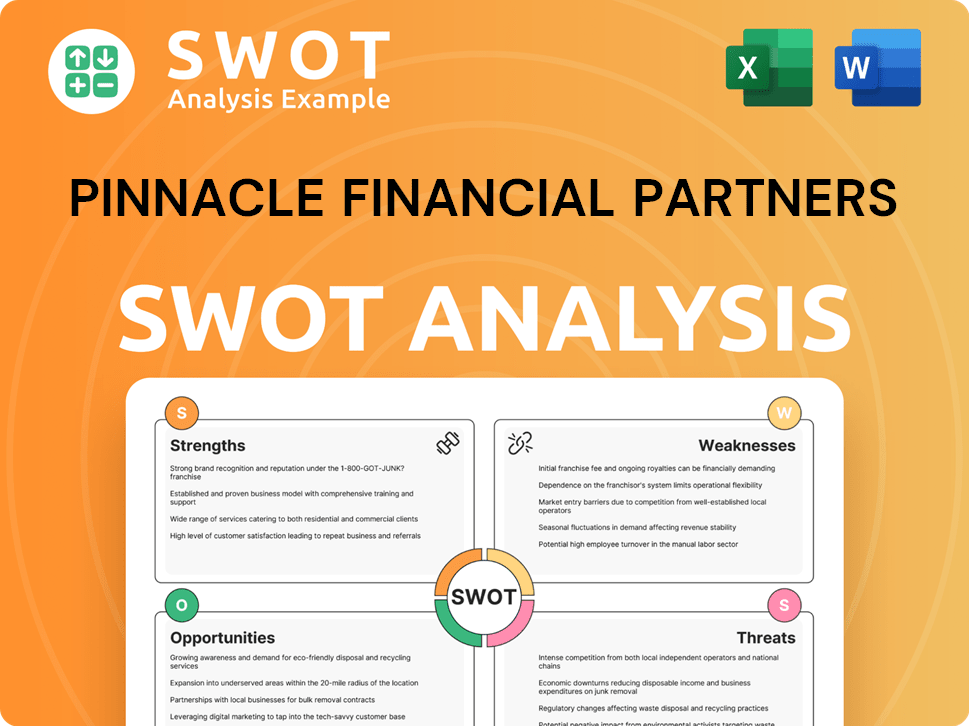

Pinnacle Financial Partners SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Pinnacle Financial Partners?

The Pinnacle Financial Partners operates within a highly competitive financial services sector, facing challenges from a diverse array of institutions. Understanding the competitive landscape is crucial for assessing its market position and strategic direction. This analysis considers various competitors and the dynamics shaping the industry.

The banking industry is constantly evolving, with traditional players and new entrants vying for market share. This environment requires Pinnacle Financial Partners to continually adapt and innovate to maintain its competitive edge. The following sections explore the key competitors and the strategies they employ.

The competitive environment for Pinnacle Financial Partners includes a wide range of institutions, from national and regional banks to smaller community banks and non-bank financial service providers. These entities compete through pricing, product innovation, branding, distribution, and technology. The rise of FinTech companies has also introduced new competitive pressures, reshaping customer expectations and service delivery models.

These institutions often possess significant resources and extensive branch networks. They compete with Pinnacle Bank through a broad range of financial products and services, including loans, deposits, and wealth management. Their scale allows them to offer competitive pricing and invest heavily in technology and marketing.

Specific regional bank competitors include M&T Bank (MTB), Fifth Third Bancorp (FITB), First Citizens BancShares (FCNCA), Huntington Bancshares (HBAN), Regions Financial (RF), KeyCorp (KEY), East West Bancorp (EWBC), First Horizon (FHN), SouthState (SSB), and Webster Financial (WBS). These banks often have a strong regional presence and compete for market share within specific geographic areas.

Smaller community banks and other financial intermediaries, such as Securian Financial, Umpqua Holdings, AmeriServ Financial, and Lakeland Financial, also compete with Pinnacle Financial Partners. These institutions often focus on serving local markets and may offer personalized service and specialized financial products.

Non-bank financial companies can offer competitive advantages due to fewer regulatory requirements. This allows them to provide more attractive rates on loans and deposits. They also leverage technology to offer services traditionally provided by banks, such as mobile payment systems.

FinTech companies are disrupting traditional banking services by reshaping customer expectations around digital convenience and personalization. They often focus on specific niches and use technology to offer innovative financial solutions. This includes mobile banking, online lending, and digital payment platforms.

Mergers and acquisitions within the industry can significantly impact the competitive dynamics. These transactions lead to consolidation and shifts in market share, requiring Pinnacle Financial Partners to adapt its strategies to maintain its position. For instance, in 2024, there were several significant bank mergers that reshaped the competitive landscape.

Pinnacle Financial Partners aims to increase its market share by focusing on sustainable earnings growth and compounded tangible book value. The company's strategic initiatives, as detailed in the Marketing Strategy of Pinnacle Financial Partners, are designed to differentiate it from competitors and enhance its value proposition. This includes a focus on customer service, innovative product offerings, and strategic expansion.

Pinnacle Financial Partners employs several strategies to compete effectively in the financial services market. These strategies are designed to address the challenges posed by its competitors and capitalize on market opportunities.

- Customer Service: Providing exceptional customer service is a key differentiator, fostering customer loyalty and attracting new clients.

- Product Innovation: Developing and offering innovative financial products and services to meet evolving customer needs.

- Strategic Expansion: Expanding its geographic footprint and market presence through organic growth and strategic acquisitions.

- Technology Adoption: Leveraging technology to enhance efficiency, improve customer experience, and offer competitive digital banking solutions.

- Talent Management: Attracting and retaining top talent to drive innovation and deliver superior service.

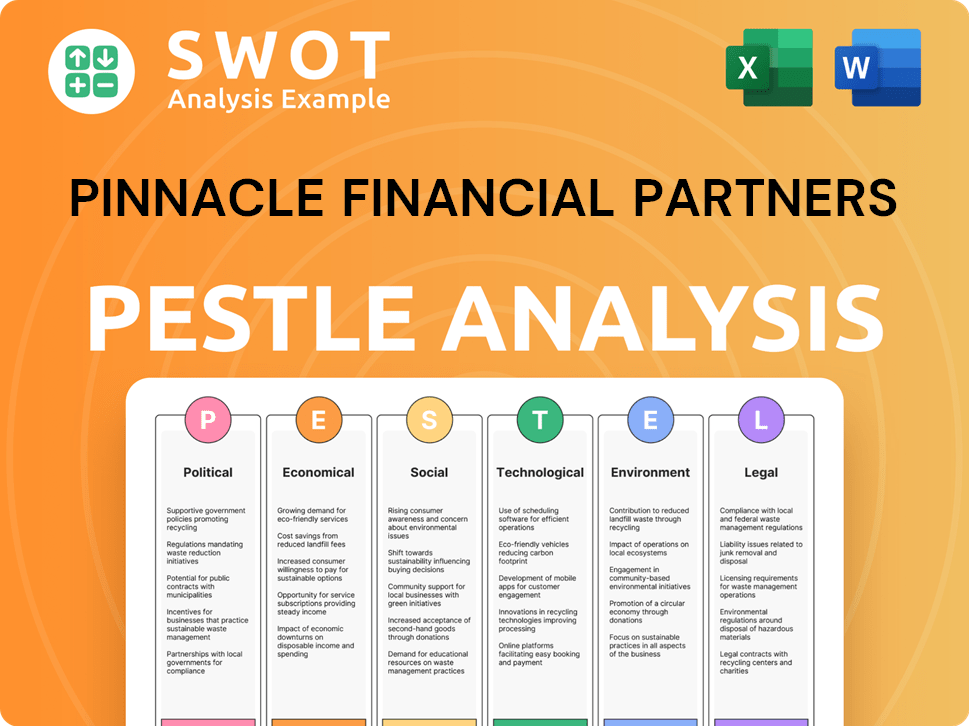

Pinnacle Financial Partners PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Pinnacle Financial Partners a Competitive Edge Over Its Rivals?

Understanding the Pinnacle Financial Partners' competitive landscape involves assessing its key strengths and how it differentiates itself within the financial services sector. The company's success hinges on its ability to attract and retain top talent, fostering a culture that enhances client relationships and fuels growth. This talent-centric model has been a cornerstone of its strategy, allowing it to outperform its peers in key financial metrics.

A deep dive into the Pinnacle Financial Partners' competitive advantages reveals a focus on relationship-based banking and a comprehensive suite of financial products. This approach has enabled the company to build a strong market position. The company's strategic moves, including market extensions and specialized services, highlight its commitment to diversification and sustainable growth, which are critical in the dynamic banking industry.

The Pinnacle Bank's approach to the competitive landscape is unique, particularly in its emphasis on human capital and a client-centric model. This strategy has resulted in significant growth and market share gains, distinguishing it from competitors. For a detailed look at their target audience, you can explore the Target Market of Pinnacle Financial Partners.

Pinnacle Financial Partners maintains a high associate retention rate, approximately 94%, which is exceptional for its size. In 2024, the company recruited 161 revenue-producing associates, a 50% increase from the previous year. This talent-driven approach has led to a loan compound annual growth rate (CAGR) of 15% since 2012, significantly exceeding the 5.1% average of its peers.

The company's focus on an exceptional work environment attracts high achievers with loyal client followings. New associates brought nearly $3 billion in loan growth and $4.3 billion in deposit growth in 2024. This client-centric model supports long-term growth and strengthens the company's position in the financial services market.

Pinnacle Financial Partners offers a comprehensive range of banking, investment, trust, mortgage, and insurance products. This diversification helps reduce over-reliance on economic cycles and supports a full-service financial relationship for businesses and individuals. Strategic market extensions and growing specialties help diversify growth.

The company's strategic market positioning and focus on specialized services contribute to its competitive edge. These efforts help to diversify its growth, making it less susceptible to economic fluctuations. This approach is key to maintaining a strong industry position.

Pinnacle Financial Partners distinguishes itself through a talent-centric model, high associate retention, and a client-focused approach. These factors contribute to the company's ability to attract and retain top talent, leading to significant loan and deposit growth.

- Exceptional associate retention rate of 94%.

- Recruitment of 161 revenue-producing associates in 2024.

- Loan CAGR of 15% since 2012, significantly above the industry average.

- Focus on a comprehensive suite of financial products and services.

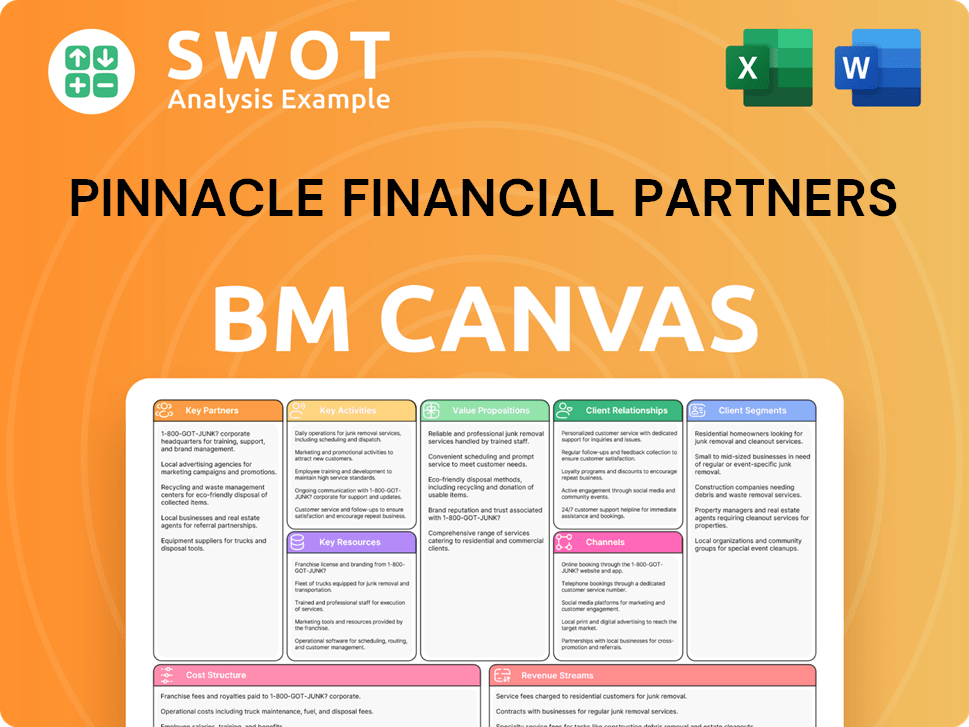

Pinnacle Financial Partners Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Pinnacle Financial Partners’s Competitive Landscape?

The financial services sector is undergoing a significant transformation, driven by technological advancements, evolving consumer preferences, and regulatory changes. In this dynamic environment, understanding the Pinnacle Financial Partners competitive landscape is crucial. The company's strategic position, potential risks, and future prospects are key considerations for investors and stakeholders.

As a player in the banking industry, Pinnacle Financial Partners faces both immediate challenges and long-term opportunities. The company's ability to navigate these complexities will determine its success in a competitive market. This analysis provides a detailed look at the industry trends, future challenges, and opportunities that will shape Pinnacle Financial Partners' trajectory.

The financial services industry is rapidly evolving. Technological advancements, especially in AI, are reshaping banking operations. Traditional banks must modernize IT infrastructure to compete with FinTech companies. The shift towards digital banking and personalized services continues to accelerate.

Pinnacle Financial Partners faces several challenges in the coming years. Elevated interest rates through 2025 could impact net interest margins. Economic slowdowns, particularly in the Southeastern United States, and real estate market declines pose risks. Regulatory changes and rising operating costs are also significant concerns.

Despite the challenges, significant opportunities exist for Pinnacle Financial Partners. The company plans to invest in talent acquisition and market expansion. Leveraging data for personalized services and strategic partnerships offer avenues for growth. A strong capital position and low non-performing loans provide a competitive advantage.

The company is focused on organic growth and yield expansion in its earning asset portfolio. Management is actively working on strategies to mitigate interest rate risks. A steeper yield curve is expected to positively impact results in 2025. Experienced bankers in advantaged markets are expected to attract clients.

Pinnacle Financial Partners is focused on several key strategies to drive future growth and manage risks. The company is committed to strategic investments in talent and market expansion, aiming for loan growth of 8% to 11% in 2025. Their investment in Banker's Healthcare Group (BHG) saw a 27.3% increase in income in Q1 2025.

- Strategic Investments: Continued investments in talent and market expansion.

- Organic Growth: Focus on organic growth and yield expansion in the earning asset portfolio.

- Risk Management: Strategies to mitigate interest rate risks, including adjusting rates and hedging.

- Capital Position: Strong capital position and low non-performing loans provide opportunities.

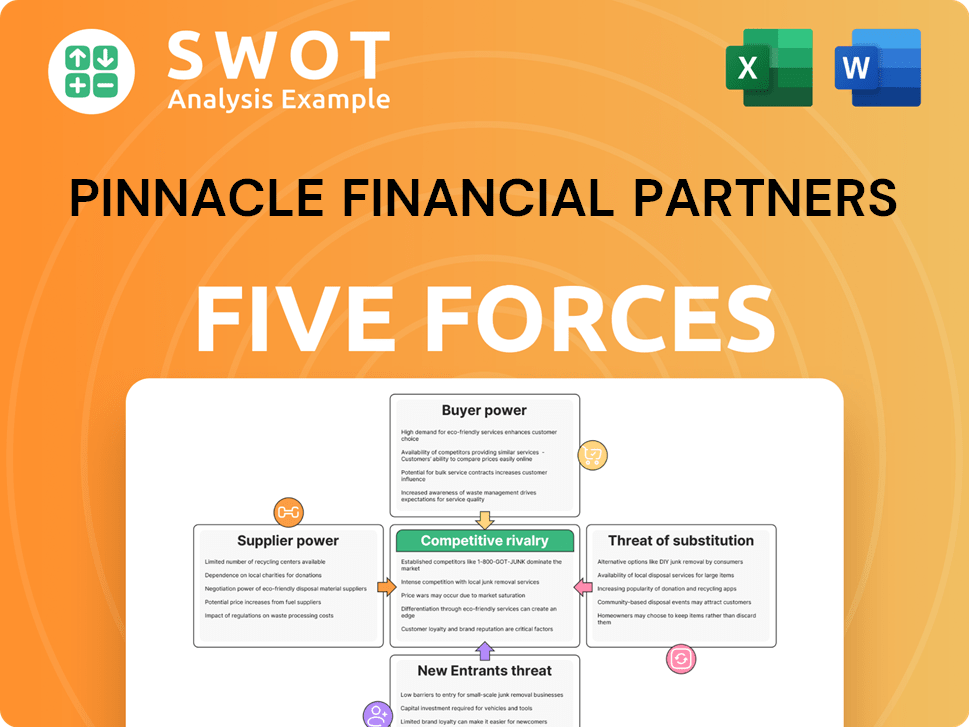

Pinnacle Financial Partners Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pinnacle Financial Partners Company?

- What is Growth Strategy and Future Prospects of Pinnacle Financial Partners Company?

- How Does Pinnacle Financial Partners Company Work?

- What is Sales and Marketing Strategy of Pinnacle Financial Partners Company?

- What is Brief History of Pinnacle Financial Partners Company?

- Who Owns Pinnacle Financial Partners Company?

- What is Customer Demographics and Target Market of Pinnacle Financial Partners Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.