QCR Holdings Bundle

Can QCR Holdings Continue its Ascent in the Regional Banking Arena?

QCR Holdings, Inc. (NASDAQ: QCRH) has rapidly expanded, but how does it stack up against its rivals? This analysis dives into the QCR Holdings SWOT Analysis, exploring its competitive landscape within the dynamic regional banking sector. We'll dissect QCR Holdings' market position, examining its key competitors and the strategies that fuel its growth.

Understanding the QCR Holdings Competitive Landscape is crucial for investors and strategists alike. This report provides a comprehensive QCR Holdings Market Analysis, identifying QCR Holdings Competitors and assessing their impact. We'll explore QCR Holdings Financial Performance, offering insights into its QCR Holdings Industry Overview and the QCR Holdings Business Strategy driving its success, providing a robust framework for informed decision-making.

Where Does QCR Holdings’ Stand in the Current Market?

QCR Holdings, Inc. holds a strong position in the Midwest regional banking sector. As of March 31, 2025, it operated across Iowa, Missouri, Illinois, and Wisconsin, with 36 branch locations. The company's structure includes subsidiary banks like Quad City Bank & Trust (QCBT), Cedar Rapids Bank & Trust (CRBT), Community State Bank (CSB), and Guaranty Bank (GB), each serving specific communities.

The company offers comprehensive commercial and consumer banking services, along with trust and wealth management. QCR Holdings also engages in niche areas such as Specialty Finance Group and Correspondent Banking. These diverse offerings support the company's financial performance. For insights into how this business model generates revenue, explore the Revenue Streams & Business Model of QCR Holdings.

QCR Holdings' financial health is robust, with a Common Equity Tier 1 (CET1) ratio of 10.26% and a total risk-based capital of 14.16% as of March 2025, exceeding regulatory benchmarks. This strong capital base, coupled with an adjusted return on average assets (ROAA) of 1.35% over the past five years, places QCR Holdings near the top quartile of its peer group.

QCR Holdings maintains a leading position in attractive, growing mid-size metro markets. For instance, QCBT holds the largest deposit market share in the Quad Cities region. The company has shown consistent growth.

As of Q4 2023, QCR Holdings reported $14.9 billion in total assets. The commercial lending portfolio was $8.3 billion, showing a strong focus on business banking. The wealth management segment generated $42.6 million in fee income during 2023.

QCR Holdings' competitive advantages include a strong market position in the Midwest, a multi-bank holding company structure that enables local responsiveness, and a focus on diverse revenue streams. The company's consistent growth, as demonstrated by a 20.3% annualized rate in core deposit growth in Q1 2024, excluding brokered deposits, highlights its ability to attract and retain customers. QCR Holdings' strong capital position and performance metrics, such as ROAA, also contribute to its competitive edge.

- Strong presence in key Midwest markets.

- Diversified financial services offerings.

- Robust financial performance metrics.

- Strategic focus on niche business areas.

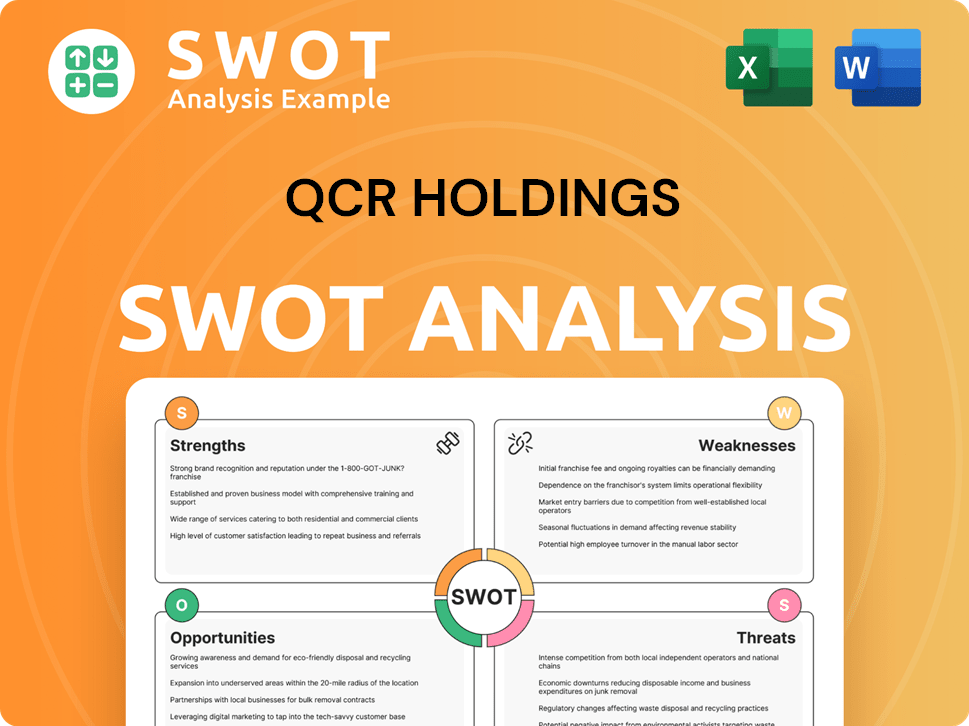

QCR Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging QCR Holdings?

The banking sector is a dynamic environment, and QCR Holdings faces competition from various financial institutions. Understanding the QCR Holdings Competitive Landscape is crucial for investors and stakeholders. This analysis delves into the key competitors and the strategies they employ, providing insights into the challenges and opportunities within the industry. The QCR Holdings Market Analysis highlights the competitive pressures and the company's positioning within this complex environment.

QCR Holdings must navigate a competitive landscape shaped by diverse financial players. These include commercial banks, regional banks, credit unions, and emerging fintech companies. Each type of competitor brings its own strengths and strategies, influencing the overall dynamics of the banking sector. Evaluating the QCR Holdings Competitors helps to understand the competitive threats and opportunities the company faces.

Direct competitors of QCR Holdings include commercial and regional banks. These institutions often compete on scale, offering broader branch networks and a wider range of services. Some examples are 1st Source Corporation, Community Trust Bancorp, Inc., and Enterprise Financial Services Corp.

Indirect competitors include credit unions and fintech companies. These entities often compete on pricing, specialized digital services, and innovative technological solutions. The Kiyo Bank, Ltd., Dime Community Bancshares, Inc., and Bank First Corp. also pose competition.

Financial holding firms like MassMutual, Erie Insurance, and American Family Insurance also compete, although their direct overlap with QCR's core banking services may vary. These firms may offer financial products and services that compete with those offered by QCR Holdings.

Larger banks compete on scale and branch networks, while credit unions and fintech companies focus on competitive pricing and digital services. QCR Holdings' strategy combines local charter autonomy with centralized support to offer personalized service with the capabilities of a larger organization.

Mergers and acquisitions impact the competitive landscape. QCR Holdings has successfully integrated acquisitions, such as the 2021 acquisition of Guaranty Federal Bancshares, Inc. This increased market share and accelerated growth in the Springfield market.

New fintech players continually disrupt traditional banking models. This necessitates ongoing adaptation and innovation from established institutions like QCR Holdings. Digital offerings are increasingly leveraged to enhance profitability and meet customer demands.

Several factors influence the competitive dynamics within the banking sector. These include the scale of operations, the breadth of service offerings, pricing strategies, and technological innovation. For more detailed information on the target market, you can explore the Target Market of QCR Holdings.

- Branch Network and Geographic Reach: Larger banks often have extensive branch networks, providing greater accessibility.

- Service Offerings: The range of financial products and services offered, including loans, deposits, and investment options, is a key differentiator.

- Pricing and Fees: Competitive pricing strategies and transparent fee structures are crucial for attracting and retaining customers.

- Digital Capabilities: The adoption of digital banking platforms, mobile apps, and online services is increasingly important.

- Customer Service: Personalized service and customer satisfaction are vital for building loyalty.

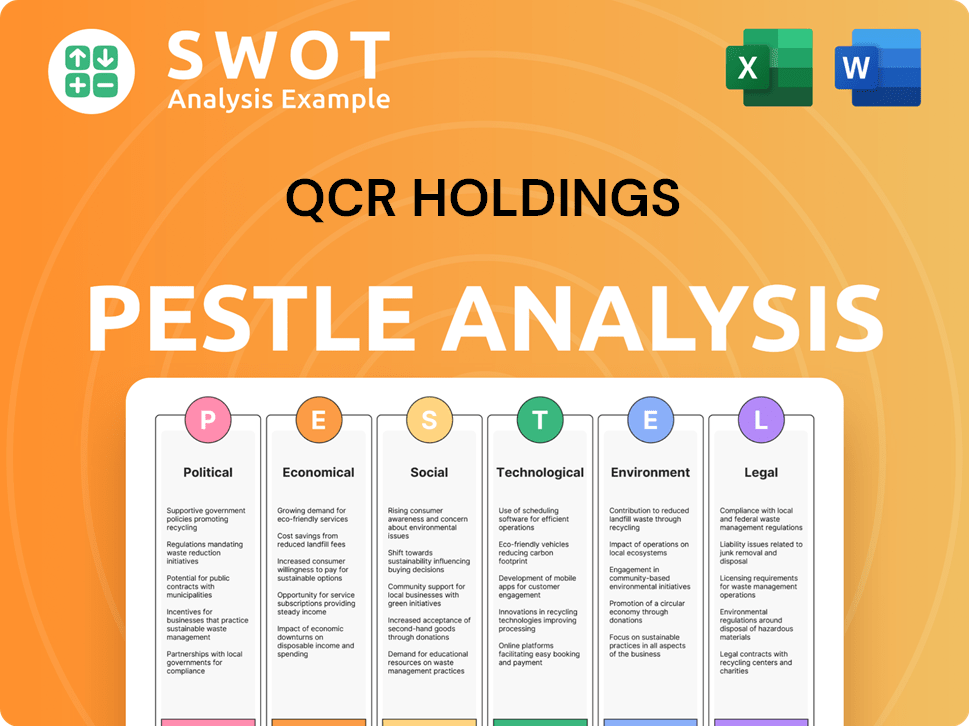

QCR Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives QCR Holdings a Competitive Edge Over Its Rivals?

Understanding the QCR Holdings Competitive Landscape involves assessing its core strengths and differentiators within the regional banking sector. The company's approach combines local autonomy with centralized operational support, creating a flexible and client-focused model. This structure allows for personalized service while leveraging the resources of a larger institution. This unique operating model and its relationship-driven focus are key elements in its business strategy.

A thorough QCR Holdings Market Analysis reveals that the company's success hinges on its ability to build and maintain strong client relationships. This relationship-centric approach, guided by core values like passion and collaboration, fosters customer loyalty. Furthermore, QCR Holdings' focus on high-performing niche business areas, such as its Specialty Finance Group, contributes to its financial performance. This diversification helps to strengthen its competitive edge.

Examining the QCR Holdings Industry Overview shows that the company has several competitive advantages. Its strong capital position and economies of scale provide a solid foundation for expansion and resilience. The company's performance over the last five years, with consistent growth in key financial metrics, showcases its ability to outperform many peers. While some assessments note limitations in market leadership, QCR Holdings' strategic focus on its unique operating model and relationship-driven approach remains a key differentiator.

QCR Holdings' operating model combines local charter autonomy with centralized support. This structure allows subsidiary banks to be agile and responsive to client needs. This approach attracts both top bankers and clients in each market, fostering a competitive advantage.

The company emphasizes building meaningful and lasting relationships with clients. This focus is deeply embedded in its culture, guided by values such as passion and collaboration. This relationship-centric model contributes to strong customer loyalty, a valuable asset in the financial services industry.

QCR Holdings benefits from its high-performing niche business areas, such as its Specialty Finance Group and Correspondent Banking. Expertise in areas like municipal and tax credit financing creates a sustainable business. The Low Income Housing Tax Credit (LIHTC) lending program contributes significantly to capital markets revenue.

As of March 31, 2025, QCR Holdings reported $9.2 billion in assets. The company's strong capital ratios, with a CET1 ratio of 10.26% and total risk-based capital of 14.16% as of March 2025, exceed regulatory benchmarks. This strong capital position provides a buffer against economic shocks.

QCR Holdings' competitive advantages include its unique operating model, relationship-driven approach, and diversified earnings power. The company's focus on niche business areas and strong financial position further enhance its market position. These strengths have allowed the company to consistently outperform many peers.

- Unique Operating Model: Combines local autonomy with centralized support for agility and personalized service.

- Relationship-Driven Approach: Focuses on building lasting client relationships and customized solutions.

- High-Performing Niche Areas: Specialty Finance Group and LIHTC lending contribute to revenue.

- Strong Financial Position: Robust assets and capital ratios provide a solid foundation for growth.

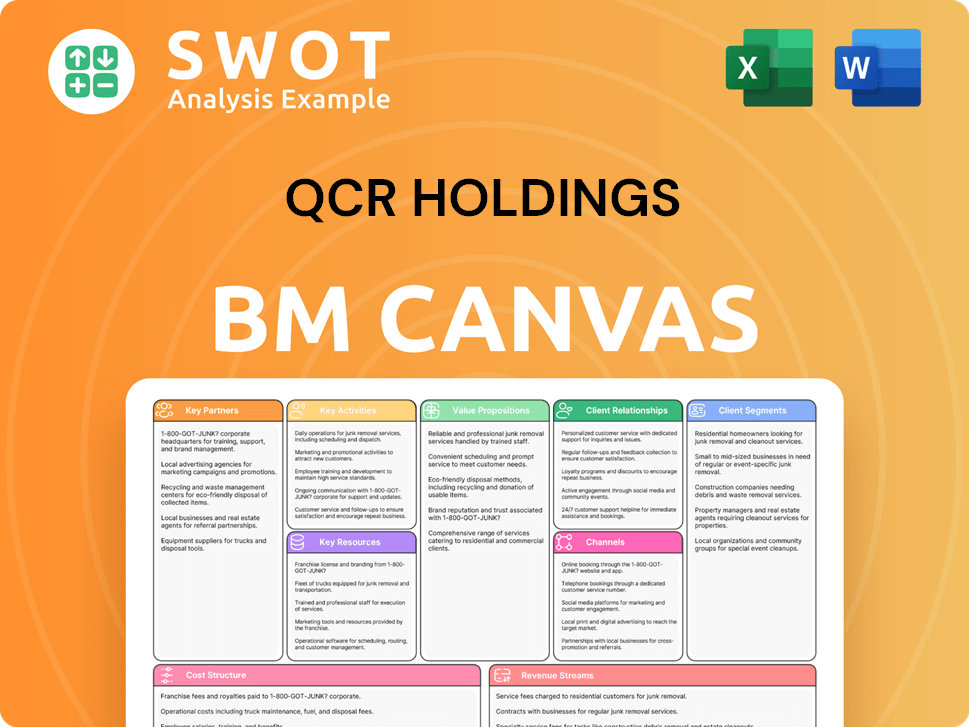

QCR Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping QCR Holdings’s Competitive Landscape?

The financial services industry is currently undergoing significant transformation. Technological advancements, evolving regulations, and changing consumer preferences are reshaping the competitive landscape for companies like QCR Holdings. Understanding these trends is crucial for assessing QCR Holdings' QCR Holdings Competitive Landscape and future prospects.

QCR Holdings Market Analysis reveals that the company faces both challenges and opportunities. The company's performance is directly tied to the Midwestern economy, particularly the agriculture and manufacturing sectors. However, strategic initiatives and a focus on core strengths position QCR Holdings to navigate these complexities and capitalize on emerging trends.

Digital transformation is a major driver in the financial services industry. The rise of AI computing power is also expected to significantly impact the industry. These trends create new opportunities for network innovation and data-driven insights.

QCR Holdings faces intense competition from commercial banks, credit unions, and fintech companies. Regional economic vulnerability, particularly in the Midwest, impacts performance. Halting new lending activities within its m2 Equipment Finance division signals a strategic realignment.

Strategic mergers and acquisitions in underserved markets offer expansion potential. Growing fee income, especially in Capital Markets and Wealth Management, provides diversified revenue. Capital optimization, such as the $350 million securitization initiative in Q2 2025, frees up capital.

QCR Holdings focuses on its relationship-driven model and local market expertise. The company's focus on a strong credit culture provides a solid foundation. Consistent dividend payments for 24 consecutive years, with a low payout ratio of 4% as of Q2 2025, underscores its financial discipline. For more on how the company is positioning itself, see this Marketing Strategy of QCR Holdings.

QCR Holdings aims for 4-6% annualized loan growth for 2025. The company's strategic shifts are measured steps toward fortifying its market position. Clear communication of its renewed vision and strategy will be vital to assure stakeholders.

- Focus on core strengths and relationship-driven model.

- Strategic mergers and acquisitions in underserved markets.

- Capital optimization efforts, including securitization.

- Consistent dividend payments and financial discipline.

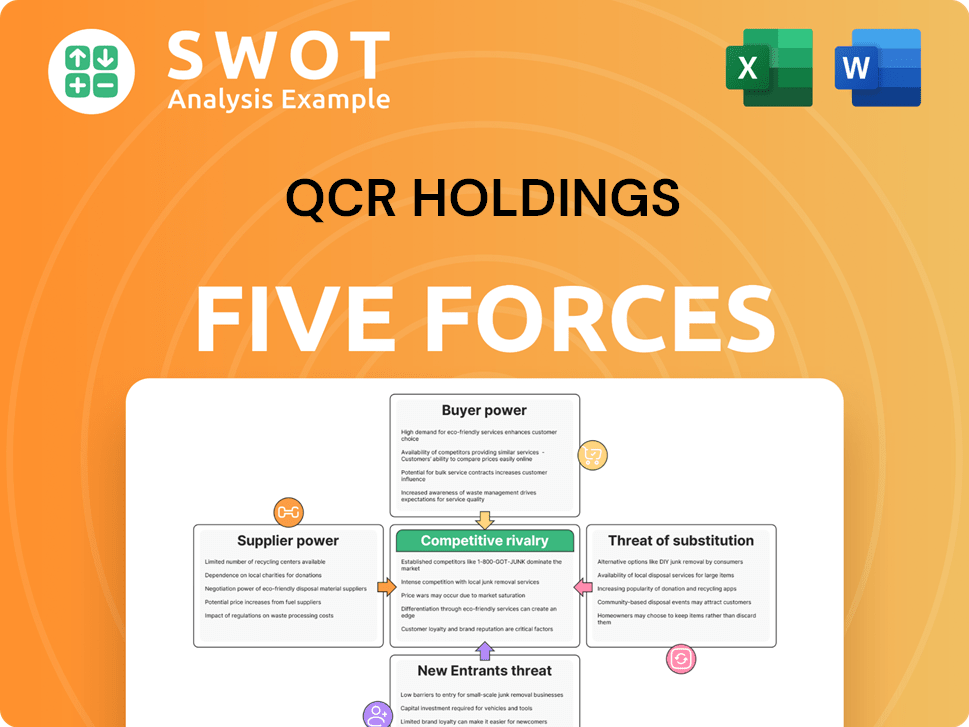

QCR Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QCR Holdings Company?

- What is Growth Strategy and Future Prospects of QCR Holdings Company?

- How Does QCR Holdings Company Work?

- What is Sales and Marketing Strategy of QCR Holdings Company?

- What is Brief History of QCR Holdings Company?

- Who Owns QCR Holdings Company?

- What is Customer Demographics and Target Market of QCR Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.