Sallie Mae Bundle

Who's Challenging Sallie Mae in the Student Loan Arena?

The student loan industry is a financial battleground, and Sallie Mae is a key player. Established in 1972, Sallie Mae has transformed from a government-sponsored enterprise to a leading private education loan provider. Understanding the Sallie Mae SWOT Analysis is crucial to grasping its position in this evolving market.

This analysis will delve into the Sallie Mae competitive landscape, examining its Sallie Mae competitors and the broader student loan industry. We'll explore Sallie Mae's market analysis to uncover its competitive advantages and how it navigates the complexities of education finance, including the nuances of private student loans. By understanding Sallie Mae's business model analysis, we can better assess its strategies and future outlook within the ever-changing financial landscape.

Where Does Sallie Mae’ Stand in the Current Market?

Sallie Mae currently holds a significant position within the private student loan market. The company focuses on providing private education loans to students and families. As a leading originator of private student loans, Sallie Mae primarily serves undergraduate and graduate students, along with their families.

The company's geographic presence is primarily within the United States, operating as a national lender. Sallie Mae has strategically shifted its focus, moving away from its original role as a servicer of federal student loans to concentrate almost exclusively on the private loan sector. This specialization allows Sallie Mae to refine its offerings in a competitive niche within the student loan industry.

In addition to private education loans, Sallie Mae also provides savings products and other financial services related to education, diversifying its offerings. The company's financial health indicates a stable and focused operation. For example, Sallie Mae reported a net income of $127 million for the first quarter of 2024, demonstrating its ability to compete effectively. Understanding the Target Market of Sallie Mae is crucial for analyzing its competitive landscape.

While specific market share figures for 2024-2025 are subject to ongoing market analysis, Sallie Mae remains a significant player. The company has historically been a leading originator of private student loans, indicating a strong market position. Analyzing Sallie Mae's market share is key to understanding its competitive landscape.

Sallie Mae's strategic shift to concentrate on private education loans has allowed it to specialize. This focus enables the company to refine its offerings and compete effectively. Sallie Mae’s business model analysis highlights this strategic direction.

Sallie Mae's financial performance reflects a stable operation within its chosen market segment. The company reported a net income of $127 million in Q1 2024. This financial strength underscores its ability to compete effectively in the education finance market.

Beyond private education loans, Sallie Mae offers savings products and other financial services. This diversification strengthens its position within the education finance ecosystem. This strategy helps Sallie Mae to navigate the Sallie Mae competitive landscape.

Sallie Mae's market position is defined by its focus on private student loans and related financial services. The company's financial performance and strategic shifts have strengthened its competitive standing in the student loan industry. Understanding Sallie Mae's competitive strategy is essential for market analysis.

- Leading Originator: Historically a leading originator of private student loans.

- Focused Strategy: Concentrated on private education loans.

- Financial Health: Demonstrated by a net income of $127 million in Q1 2024.

- Diversified Offerings: Provides savings products and other financial services.

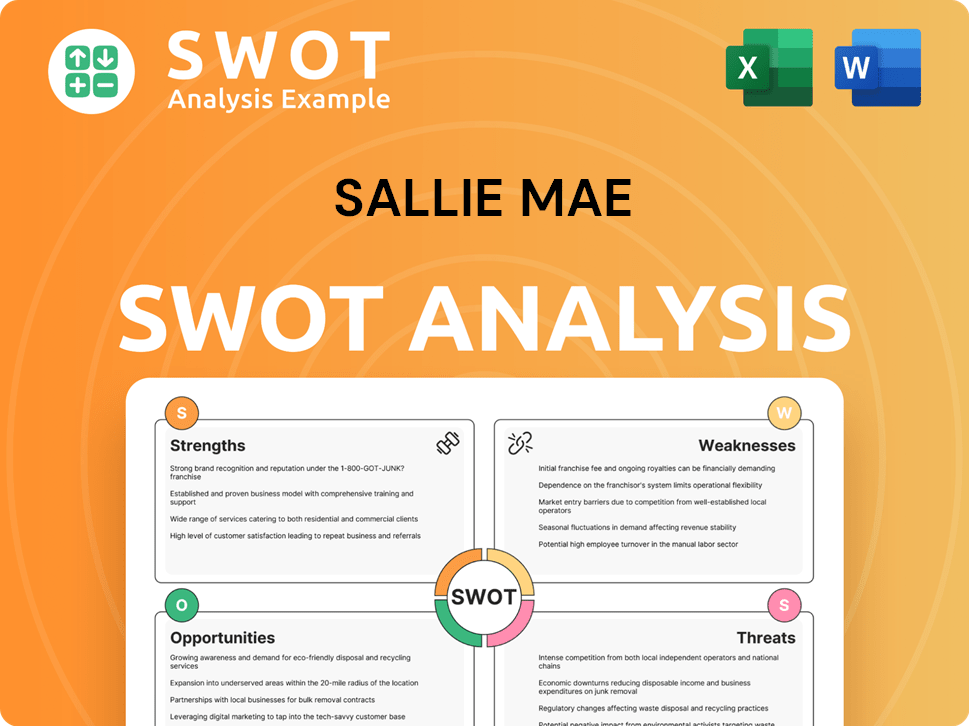

Sallie Mae SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sallie Mae?

The Sallie Mae competitive landscape is shaped by a diverse array of financial institutions and fintech companies vying for market share in the private student loan sector. Understanding the key players and their strategies is crucial for assessing the company's position and future prospects. The student loan industry is dynamic, with competition intensifying as new entrants and established players adapt to changing market conditions and student needs.

Sallie Mae's competitors include both direct and indirect rivals, each employing different approaches to attract borrowers. These competitors leverage various strategies, from brand recognition and extensive product offerings to streamlined application processes and innovative repayment options. A thorough Sallie Mae market analysis involves evaluating these competitors' strengths, weaknesses, and market positioning to understand the competitive dynamics.

Direct competitors primarily focus on offering private student loans. These institutions often have established customer bases and brand recognition. They compete directly with Sallie Mae for student borrowers.

A major player in the financial industry, Wells Fargo offers private student loans as part of its broader financial product portfolio. They leverage their extensive customer base and brand recognition to attract borrowers. In 2023, Wells Fargo's net interest income was approximately $49.8 billion.

Discover Student Loans is known for its no-fee structure and cash rewards programs, which are attractive to many borrowers. They compete by offering competitive interest rates and attractive terms. Discover Financial Services reported net income of $1.1 billion for the fourth quarter of 2023.

Citizens Bank provides private student loans and benefits from its established presence in the banking sector. They offer a range of financial products, including student loans, to their customers. Citizens Financial Group's total revenue for 2023 was approximately $7.4 billion.

Indirect competitors include smaller private lenders, regional banks, and fintech companies. These companies may offer different loan products or target specific niches within the student loan market. They often differentiate themselves through innovative features and customer service.

SoFi started as a student loan refinancing company and has expanded into other financial products. They compete by offering streamlined online application processes and a range of financial services. SoFi's total revenue for Q4 2023 was $615 million.

The Sallie Mae competitive landscape is also influenced by federal student loan programs, which offer an alternative financing option. The availability of federal loans can impact the demand for private loans. Mergers and alliances in the financial services industry can also affect the competitive dynamics by consolidating resources or expanding market reach.

- Federal Student Loans: These loans, while not direct competitors, offer an alternative financing option for many students. The interest rates and terms of federal loans can influence the demand for private loans.

- Fintech Companies: Companies like Earnest are also significant players, often focusing on personalized customer service and innovative repayment options.

- Market Share: Analyzing the market share of each competitor provides insight into their relative strengths and weaknesses. Understanding Sallie Mae's competitors market share is crucial for strategic planning.

- Competitive Advantages: Companies like Discover Student Loans often highlight their no-fee structure and cash rewards. Examining the Sallie Mae competitive advantages is essential.

- Strategic Analysis: A comprehensive analysis includes assessing Sallie Mae's strengths and weaknesses and evaluating its competitive strategy. For more information on Sallie Mae's marketing strategy, you can read more here: Marketing Strategy of Sallie Mae.

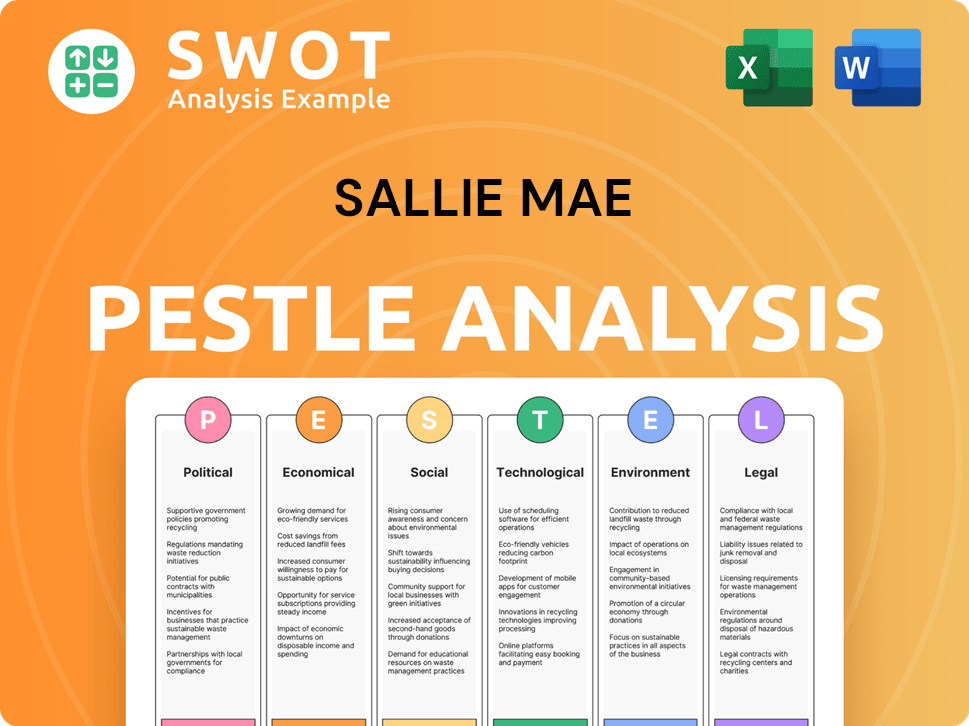

Sallie Mae PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sallie Mae a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Sallie Mae requires a deep dive into its competitive advantages within the student loan industry. Sallie Mae's position in the student loan market is shaped by a combination of factors that set it apart from its competitors. These advantages are crucial for navigating the competitive landscape and maintaining a strong market presence.

Sallie Mae's competitive advantages stem from its brand recognition and specialization in education finance. This focus allows for tailored loan products and services. The company's established relationships with educational institutions also provide a unique distribution network. These elements contribute to Sallie Mae's ability to attract and retain customers in the private student loan market.

The company's long-standing presence in the education finance sector has cultivated a high degree of trust among students and families. This established reputation aids in customer acquisition and retention. Sallie Mae's expertise in the student loan industry enables it to offer a range of private loan options, often with flexible repayment terms and competitive interest rates, which is a key element of its competitive strategy.

Sallie Mae benefits from high brand recognition, built over decades in the education finance sector. This long-standing presence fosters trust among students and families. This trust is a significant advantage in a market where financial decisions are critical.

Unlike diversified financial institutions, Sallie Mae focuses exclusively on education financing. This specialization allows for deep institutional knowledge and tailored financial products. This expertise enables the company to offer customized solutions for various student needs.

Sallie Mae has established relationships with colleges and universities, providing a unique distribution network. These partnerships facilitate referrals and streamline the loan application process. These relationships are a key part of Sallie Mae's competitive strategy.

Sallie Mae invests in digital platforms to streamline application and servicing processes. These technologies enhance the customer experience and operational efficiency. Continuous investment in technology is crucial for maintaining a competitive edge.

Sallie Mae's competitive advantages include brand recognition, specialized expertise, and established relationships within the education sector. These strengths help it compete in the student loan industry. Maintaining these advantages requires ongoing investment and adaptation to market changes.

- Brand Equity: Decades of operation have established trust and recognition.

- Specialization: Focused expertise in education finance allows for tailored products.

- Distribution Network: Relationships with educational institutions provide referrals.

- Technology: Digital platforms streamline operations and improve customer experience.

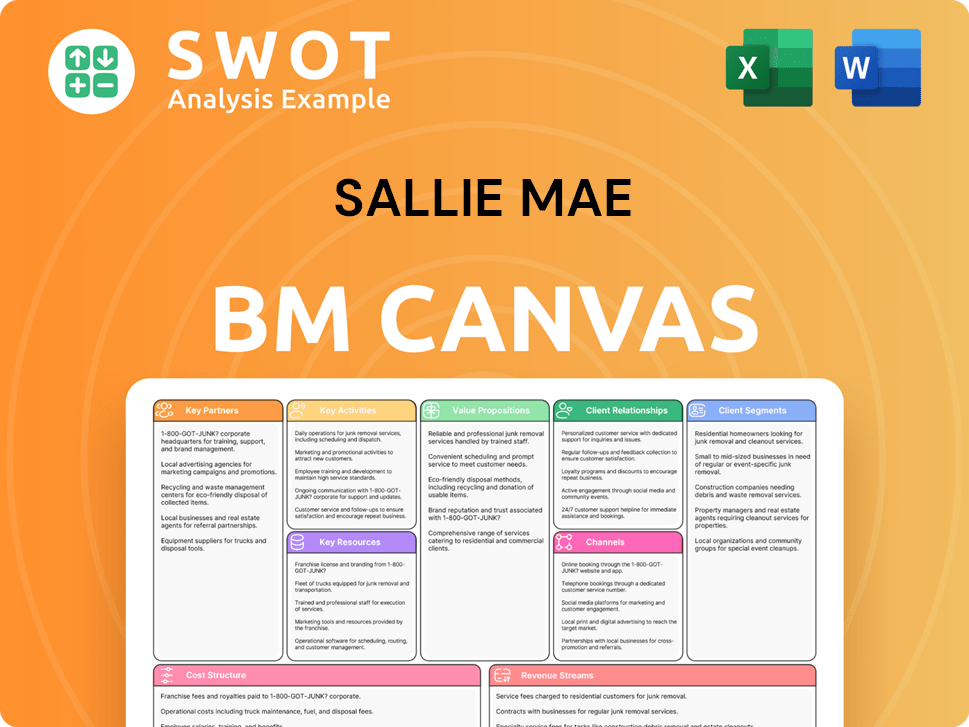

Sallie Mae Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sallie Mae’s Competitive Landscape?

The private student loan industry, where companies like Sallie Mae operate, is subject to shifts driven by regulatory changes, technological advancements, and evolving consumer preferences. Understanding the Sallie Mae competitive landscape requires an analysis of these trends. The industry's future is shaped by how lenders adapt to these factors, impacting their market position and financial performance. For a deeper look at the company's origins, consider reading Brief History of Sallie Mae.

The Sallie Mae market analysis reveals a landscape where success hinges on navigating these dynamics. The company's ability to maintain its position depends on its responsiveness to industry challenges and opportunities. The student loan industry is constantly evolving, requiring strategic agility to thrive.

Regulatory changes are a constant influence, with scrutiny on loan terms and consumer protection. Technological advancements, especially in fintech, provide opportunities for operational efficiency and enhanced customer experiences. Consumer preferences are shifting toward personalized financial advice and flexible repayment options.

A potential challenge is a decline in college enrollment rates or a shift towards alternative education models. Increased competition from fintech companies and other lenders could intensify. Economic downturns and changes in interest rates can impact loan performance and profitability.

Expanding into niche educational programs and exploring partnerships with educational technology platforms present growth prospects. Broadening financial services beyond traditional loans, such as offering savings or investment products, can attract new customers. Digital transformation can improve service delivery and reach a wider audience.

Sallie Mae's strategy likely involves focusing on its core private loan business. It is also crucial to strategically explore new technologies and partnerships. Adapting to the evolving landscape of higher education finance is key to long-term success.

To maintain its position, Sallie Mae must adapt to industry changes and address potential challenges. The company's ability to capitalize on opportunities will determine its future success. This involves navigating regulatory changes, leveraging technology, and responding to consumer preferences.

- Regulatory Compliance: Staying compliant with evolving regulations is crucial.

- Technological Innovation: Embracing fintech to streamline processes and improve customer experience.

- Strategic Partnerships: Forming alliances with educational institutions and technology providers.

- Product Diversification: Expanding financial service offerings beyond traditional loans.

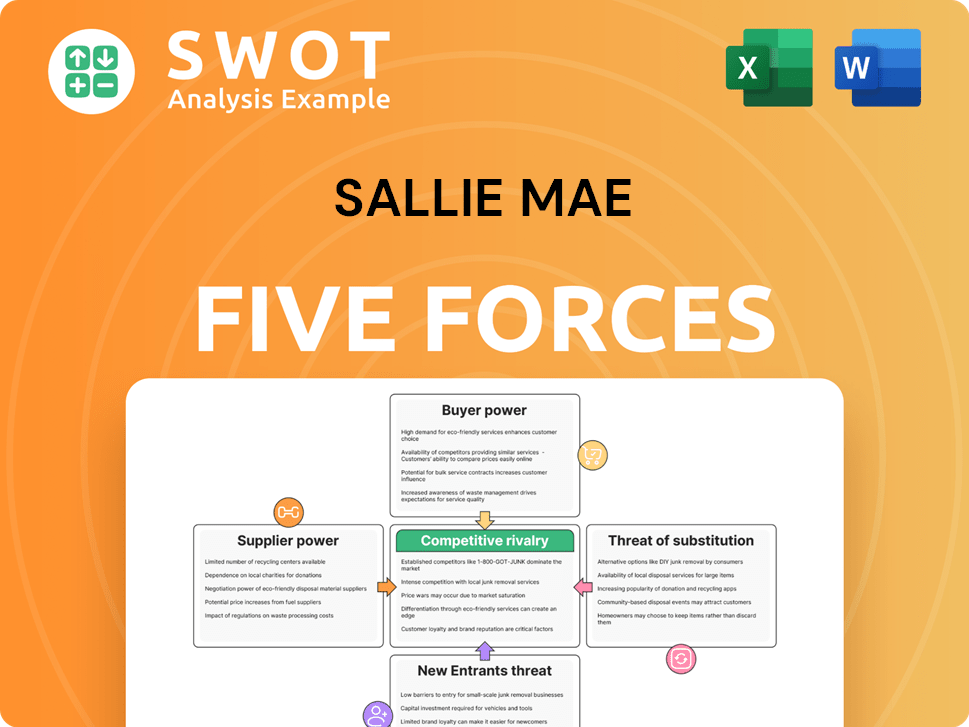

Sallie Mae Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sallie Mae Company?

- What is Growth Strategy and Future Prospects of Sallie Mae Company?

- How Does Sallie Mae Company Work?

- What is Sales and Marketing Strategy of Sallie Mae Company?

- What is Brief History of Sallie Mae Company?

- Who Owns Sallie Mae Company?

- What is Customer Demographics and Target Market of Sallie Mae Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.