Simply Good Foods Bundle

How Does Simply Good Foods Company Stack Up in the Nutritional Foods Arena?

The Simply Good Foods Company has rapidly become a key player in the health and wellness sector, but who are its main rivals? Founded in 2017, the company focuses on low-carb, high-protein options, catering to health-conscious consumers. With annual revenues soaring, understanding the Simply Good Foods SWOT Analysis and its competitive positioning is crucial for investors and strategists alike.

This detailed market analysis dives deep into the Competitive Landscape of Simply Good Foods Company, examining its strengths, weaknesses, opportunities, and threats. We'll explore Simply Good Foods Company's financial performance, including the impact of acquisitions like OWYN, and assess its strategic moves within the evolving nutritional snacking market. Understanding the competitive advantages of Simply Good Foods is key to evaluating its growth potential and future outlook in this dynamic industry.

Where Does Simply Good Foods’ Stand in the Current Market?

Simply Good Foods Company holds a strong market position within the nutritional snacking industry, primarily due to its well-known brands, Atkins and Quest. The company focuses on high-protein, low-sugar, and low-carb products, aligning with significant consumer trends. Quest, a leading brand in the nutritional snacking category, significantly contributes to the company's revenue, approaching $1 billion in net sales.

The company's product lines include protein bars, ready-to-drink (RTD) shakes, sweet and salty snacks, and confectionery products. It serves a broad customer base across various retail channels, including mass merchandise, grocery, drug stores, club stores, and e-commerce. The recent acquisition of OWYN in June 2024 has expanded its presence in the plant-based protein market. For those interested in the company's marketing approach, you can explore the Marketing Strategy of Simply Good Foods.

Financially, Simply Good Foods shows robust health. The retail takeaway, combining sales from Quest, Atkins, and OWYN, increased by approximately 8% in the first quarter of fiscal year 2025. Quest and OWYN showed strong point-of-sales growth of about 10% and 67%, respectively, in the first quarter of fiscal year 2025. The company reaffirmed its fiscal year 2025 outlook, expecting net sales to increase by 8.5% to 10.5% and Adjusted EBITDA to grow by 4% to 6%.

Simply Good Foods Company's market position is strengthened by its brands, Atkins and Quest. Quest is a leading brand in the nutritional snacking category. The company's focus on high-protein, low-sugar, and low-carb products caters to current consumer preferences.

The company's product lines include protein bars, RTD shakes, sweet and salty snacks, and confectionery products. It serves a broad customer base through various retail channels. Walmart is a significant customer, accounting for approximately 44% of Simply Good Foods' consolidated sales as of Q4 2023.

For the full fiscal year 2024, net sales increased by 7.1% to $1,331.3 million, with Adjusted EBITDA increasing by 9.6% to $269.1 million. In the first quarter of fiscal year 2025, net sales reached $341.3 million, and Adjusted EBITDA was $70.1 million. The company expects net sales to increase by 8.5% to 10.5% in fiscal year 2025.

Simply Good Foods has strategically diversified its offerings, with the acquisition of OWYN in June 2024. This expands its presence in the plant-based protein market. The company is focused on growth and adapting to consumer demands.

Simply Good Foods demonstrates a healthy financial position, with net sales increasing in 2024 and a positive outlook for 2025. The company's strong performance is supported by its leading brands and strategic initiatives.

- Net sales for fiscal year 2024: $1,331.3 million.

- Adjusted EBITDA for fiscal year 2024: $269.1 million.

- Expected net sales growth for fiscal year 2025: 8.5% to 10.5%.

- Cash as of November 30, 2024: $121.8 million.

Simply Good Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Simply Good Foods?

The competitive landscape for Simply Good Foods Company is shaped by its focus on the health and wellness and nutritional snacking sectors. This market is dynamic, with both established and emerging brands vying for market share. A thorough market analysis reveals that the company faces competition from various players, each employing different strategies to gain an edge.

Direct competitors offer similar products, such as protein-rich, low-sugar, and low-carb options. Indirect competition comes from larger food conglomerates that have extensive product portfolios. The company's strategic moves, like the June 2024 acquisition of OWYN, are aimed at strengthening its position in growing market segments. Understanding the competitive advantages of Simply Good Foods is crucial for evaluating its market performance.

The company's ability to adapt and innovate is key to its success in this environment. The Brief History of Simply Good Foods provides context on the company's evolution and its strategic responses to market changes.

Direct competitors include brands offering similar products in terms of nutritional profiles and target markets. These brands often focus on protein-rich, low-sugar, and low-carb options.

Key branded competitors include CLIF Bar, KIND bars, Special K, Boost, Slimfast, Muscle Milk, ONE bar, Pure Protein, and Think!. These brands compete through product innovation, pricing, and distribution strategies.

Indirect competition comes from larger food conglomerates with broader product portfolios. These companies can leverage extensive distribution networks and marketing budgets.

The acquisition of OWYN in June 2024 positions Simply Good Foods to enter the plant-based protein market. This move allows the company to compete more directly in this growing segment.

The nutritional snacking category is fast-evolving, with ongoing market share shifts. The company's ability to adapt and innovate is crucial for maintaining its position.

In the first quarter of fiscal year 2025, Quest and OWYN showed strong growth, approximately at 10% and 67% respectively, while Atkins retail takeaway was down about 4%. This data highlights the competitive pressures within the brand portfolio.

The competitive landscape is influenced by various factors, including product innovation, pricing strategies, brand awareness, and distribution networks. Understanding these strategies is crucial for evaluating the company's performance and future outlook.

- Product Innovation: Continuously introducing new products and improving existing ones to meet evolving consumer preferences.

- Pricing: Setting competitive prices to attract and retain customers while maintaining profitability.

- Branding: Building and maintaining strong brand awareness and loyalty through effective marketing.

- Distribution: Ensuring products are readily available through various channels, including retail and online platforms.

Simply Good Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Simply Good Foods a Competitive Edge Over Its Rivals?

The Simply Good Foods Company has carved a strong position in the nutritional snacking market, leveraging several key competitive advantages. These strengths are critical in understanding the competitive landscape and the company's potential for growth. The company's success is built on a foundation of strong brands, innovative product development, and a robust distribution network.

A core strength lies in its brand portfolio, which includes well-known names. These brands have high consumer awareness and loyalty, which translates into significant shelf space in retail stores. The company's focus on specific nutritional philosophies, such as low-carb diets, allows it to target distinct consumer segments effectively. This strategic approach is vital in navigating the market analysis of the competitive environment.

Furthermore, the company benefits from a well-established distribution network. Its products are widely available across various retail channels, including mass merchandise, grocery, and e-commerce platforms. The asset-light operating model, which involves outsourcing production, helps keep costs low and contributes to high free cash flow. These advantages have evolved through strategic acquisitions, which further diversify its product offerings and tap into new market segments.

The company's brands, such as Atkins, have high consumer recognition. For example, Atkins had an 83% aided brand awareness in the U.S. in 2019. This strong brand equity provides a competitive edge in the nutritional snacking market. This recognition helps in securing shelf space within retailers' nutrition and wellness aisles.

Simply Good Foods consistently launches new products to meet consumer preferences. The company focuses on high-protein, low-sugar, and low-carb options. The strategic focus on specific nutritional philosophies, such as Atkins for a low-carb lifestyle, allows them to target distinct consumer segments effectively.

The company has a robust distribution network. Its products are available across mass merchandise, grocery, drug, club stores, and e-commerce platforms. Online sales represent a notable percentage of Atkins and Quest sales, enhancing brand loyalty and customer engagement. Walmart accounts for a significant portion of its consolidated sales.

The asset-light operating model, which involves outsourcing production, helps keep costs low. This contributes to high free cash flow, providing financial flexibility. Strategic acquisitions, like OWYN, diversify product offerings and tap into new market segments. These moves enhance the company's position in the market.

The company's competitive advantages are sustained through innovation, effective marketing, and strong distribution partnerships. These factors are crucial for maintaining a leading position in the nutritional snacking market. The company faces threats from imitation and shifts in dietary trends.

- Strong Brand Portfolio: High consumer awareness and loyalty, particularly with brands like Atkins.

- Product Innovation: Consistent launches of new products catering to evolving consumer preferences.

- Robust Distribution Network: Wide product availability across various retail channels, including e-commerce.

- Asset-Light Operating Model: Outsourcing production to keep costs low and maintain financial flexibility.

Simply Good Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Simply Good Foods’s Competitive Landscape?

The nutritional snacking sector is dynamic, significantly influenced by consumer health trends and technological advancements, shaping the Simply Good Foods Company's competitive landscape. This analysis of the Competitive Landscape explores industry trends, future challenges, and opportunities, offering insights into the company's strategic position. Understanding these factors is crucial for evaluating the company's potential for growth and sustainability in a competitive market.

The company faces both opportunities and obstacles. While increasing health consciousness and the rising popularity of low-carb diets, such as the one promoted by Atkins Nutritionals, provide tailwinds, intense competition and economic uncertainties pose significant challenges. The ability to adapt to changing consumer preferences and economic conditions is key for Simply Good Foods Company's success. For a deeper dive into the company's target audience, consider reading about the Target Market of Simply Good Foods.

The primary industry trend is the growing demand for high-protein, low-sugar, and low-carb snacks. This health-focused shift drives innovation and new product development. E-commerce and digital marketing also play a significant role in reaching consumers. The company leverages these trends to stay competitive and meet consumer needs.

Intense competition from established brands and new entrants poses a significant challenge. Economic downturns can affect consumer spending on premium-priced health products. Regulatory changes and shifts in dietary trends require continuous adaptation. Inflation in input costs could lead to gross margin compression, as anticipated for fiscal year 2025.

The global rise in health consciousness provides a major growth opportunity. Expansion into new markets and product diversification, including the acquisition of OWYN, offer substantial potential. Continued investment in innovation and enhancing distribution networks are crucial for sustained growth. Strategic moves like these support the company's market position.

The company focuses on organic sales growth driven by volume, robust advertising, and ongoing innovation. Strong Quest and OWYN net sales and retail takeaway growth are anticipated for fiscal year 2025. These initiatives are designed to maintain a competitive edge and capitalize on market opportunities.

Simply Good Foods Company has implemented several key strategies to navigate the competitive landscape and capitalize on industry trends. These strategies are designed to drive growth and enhance market share.

- Focus on Organic Sales Growth: Prioritizing volume-driven organic sales growth is a core strategy.

- Robust Advertising and Marketing: Significant investments in advertising and marketing campaigns support brand awareness and product promotion.

- Continuous Innovation: Ongoing product innovation, particularly for brands like Quest, is critical for maintaining a competitive edge.

- Strategic Acquisitions: The acquisition of OWYN, a plant-based protein brand, broadens the product portfolio and consumer base.

- Enhanced Distribution Networks: Improving distribution channels ensures products reach a wider audience and increase availability.

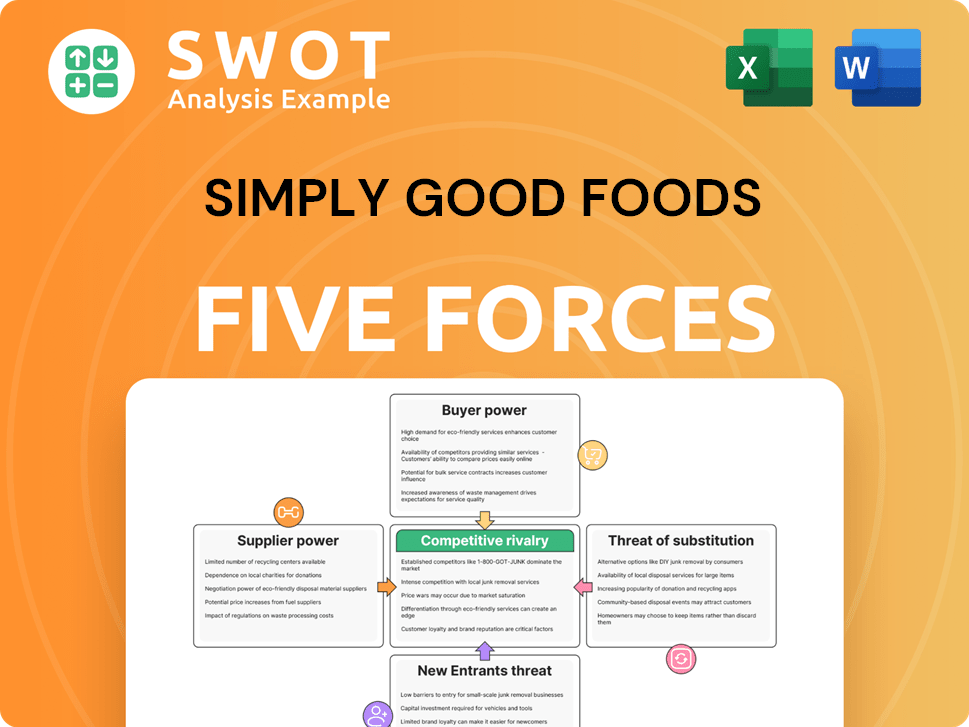

Simply Good Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simply Good Foods Company?

- What is Growth Strategy and Future Prospects of Simply Good Foods Company?

- How Does Simply Good Foods Company Work?

- What is Sales and Marketing Strategy of Simply Good Foods Company?

- What is Brief History of Simply Good Foods Company?

- Who Owns Simply Good Foods Company?

- What is Customer Demographics and Target Market of Simply Good Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.