UniFirst Bundle

How Does UniFirst Stack Up in the Uniform Rental Arena?

UniFirst, a long-standing name in the uniform and facility services sector, faces a dynamic and competitive environment. Founded in 1936, the company has grown from a small operation to a major player, adapting to changing workplace needs and technological advancements. Understanding the UniFirst SWOT Analysis is crucial for grasping its position in the market.

This analysis delves into the UniFirst competitive landscape, exploring its key UniFirst competitors and assessing its market position. We'll dissect the company's service offerings, evaluate its financial performance, and examine the UniFirst market analysis to provide a comprehensive understanding of its strengths and weaknesses within the UniFirst industry. Furthermore, we'll compare UniFirst to other uniform rental companies to provide actionable insights.

Where Does UniFirst’ Stand in the Current Market?

UniFirst Corporation holds a significant position in the North American uniform and facility services industry, ranking among the largest providers. The company's core operations revolve around supplying a wide range of workplace uniforms, protective clothing, and facility service products. These include items like floor mats, restroom supplies, and cleaning products, catering to diverse customer segments across various industries.

UniFirst's value proposition centers on providing tailored rental, lease, and purchase programs. They focus on high-quality service and building long-term customer relationships. This approach has solidified its market position, offering comprehensive solutions to meet the needs of businesses of all sizes.

UniFirst is a major player in the uniform and facility services sector. They are consistently ranked among the top industry leaders, competing with companies like Cintas and Aramark. Their services are crucial for businesses needing uniforms and facility supplies.

UniFirst offers a wide array of products, including uniforms, protective clothing, and facility services. They provide rental, lease, and purchase options. Their offerings cater to various industries, ensuring businesses have the necessary supplies for their operations.

UniFirst has a strong presence in the United States and Canada, with growing operations in Europe. Their extensive network allows them to serve a broad customer base. This widespread presence is a key factor in their market success.

In fiscal year 2023, UniFirst reported revenues of approximately $2.2 billion. This financial performance underscores their substantial scale within the industry. Their focus on operational efficiency helps them maintain a competitive edge.

UniFirst's competitive advantages include a strong geographic presence and a focus on customer relationships. Their established network and service infrastructure provide a strong position in many localized markets. They consistently prioritize operational efficiency and customer satisfaction.

- Extensive service network across North America and Europe.

- Strong customer retention rates due to quality service.

- Diverse product offerings to meet varied industry needs.

- Strategic focus on operational efficiency.

For more insights into the company's strategic direction, consider reading about the Growth Strategy of UniFirst.

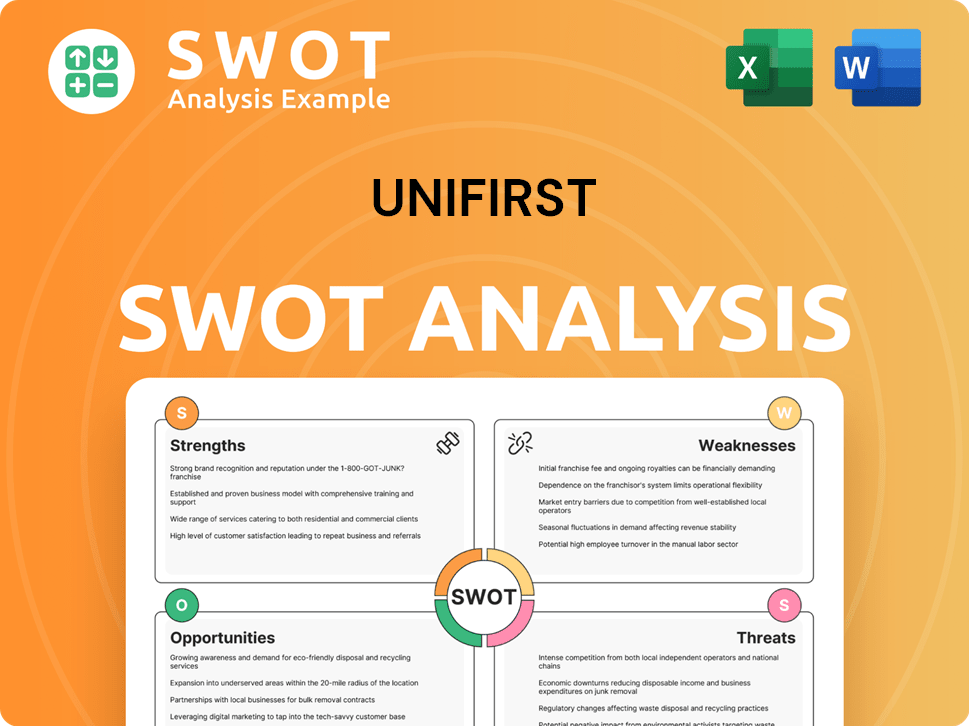

UniFirst SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging UniFirst?

The UniFirst competitive landscape is characterized by a mix of large, established players and smaller regional providers. The uniform and facility services industry is competitive, with companies vying for market share through various strategies. Understanding the competitive dynamics is crucial for assessing UniFirst market analysis and its position within the UniFirst industry.

UniFirst competitors include both direct and indirect rivals. Direct competitors offer similar services, while indirect competitors may provide alternative solutions. The competitive environment is constantly evolving due to mergers, acquisitions, and technological advancements. This makes it essential to continually evaluate the competitive landscape.

UniFirst's primary competitors are Cintas Corporation and Aramark. These companies have a significant presence in the workwear market. They compete on a broad range of services and extensive distribution networks. The strategies employed by these competitors directly impact UniFirst's market position. For instance, Cintas's acquisition of G&K Services in 2017 reshaped the market.

Cintas is often considered the largest player in the uniform and facility services industry. It offers a comprehensive suite of services, including uniform rental, facility services, and safety products. Cintas's scale and brand recognition are significant competitive advantages. In 2024, Cintas reported revenue of approximately $8.8 billion.

Aramark provides uniform services as part of its broader food services and facilities management operations. Its diversified business model allows for cross-selling opportunities. Aramark's extensive client base, particularly in large institutional settings, gives it a competitive edge. Aramark's revenue in 2024 was around $17.3 billion.

Numerous regional and local companies offer uniform and linen services. These companies may provide more personalized service or specialize in niche offerings. They often compete on customer service and specialized products. Their market share varies geographically.

Indirect competition comes from companies providing disposable protective wear or businesses that manage their own uniform and facility service needs. These competitors offer alternative solutions to traditional uniform rental services. The market share held by indirect competitors fluctuates based on economic conditions and industry trends.

Emerging players leverage technology for inventory management and personalized uniform solutions. These companies could disrupt the traditional landscape, although the capital-intensive nature of the industry creates high barriers to entry. The success of these players depends on their ability to innovate and secure funding.

Mergers and acquisitions, such as Cintas's acquisition of G&K Services in 2017, significantly reshape the competitive dynamics. These consolidations concentrate market power among the top players. The industry continues to evolve, with further consolidation expected.

To gain a better understanding of the company, consider reading about the Brief History of UniFirst. Analyzing UniFirst's financial performance compared to competitors, along with UniFirst competitor strengths and weaknesses, offers a comprehensive view of the market. Factors like UniFirst's growth strategy, UniFirst's key business segments, and UniFirst's recent acquisitions also play a crucial role in understanding its competitive position. Furthermore, examining UniFirst's service offerings review, UniFirst customer reviews and ratings, and UniFirst pricing and cost analysis provides valuable insights into its market competitiveness.

Several factors influence the competitive landscape in the uniform and facility services industry. These factors include service offerings, pricing strategies, geographic presence, and customer service. Understanding these elements helps assess the competitive dynamics and UniFirst's position.

- Service Offerings: The breadth and depth of services, including uniform rental, facility services, and safety products.

- Pricing Strategies: Competitive pricing models and value propositions.

- Geographic Presence: The extent of the company's service area and market penetration.

- Customer Service: The quality of customer support and responsiveness.

- Innovation: Adoption of new technologies and service enhancements.

- Sustainability: Environmental initiatives and sustainable practices.

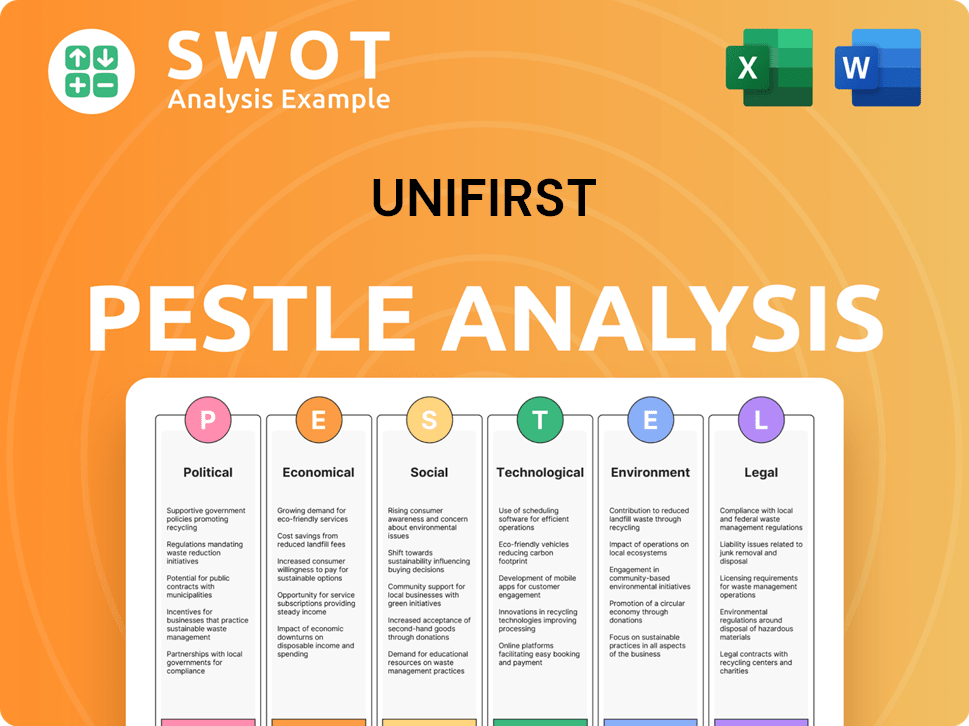

UniFirst PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives UniFirst a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of UniFirst involves recognizing its key strengths that set it apart in the uniform and facility services sector. A deep dive into the UniFirst competitive landscape reveals a company built on a foundation of extensive service networks, operational efficiencies, and a customer-centric approach. This analysis is crucial for anyone looking to understand the dynamics of the UniFirst industry and how it stacks up against its rivals.

The company's competitive advantages are not just about offering services; they are about building lasting relationships and ensuring customer satisfaction. This approach has allowed UniFirst to establish a strong brand reputation over many years. The workwear market is competitive, and UniFirst's strategies are designed to maintain and grow its market position.

UniFirst's success is also reflected in its financial performance compared to competitors. The company's ability to maintain its position in the market is a testament to its strategic focus and operational excellence. This focus is critical in a market where uniform rental companies compete on service quality, cost, and customer relationships. A thorough UniFirst market analysis highlights the company's strategic moves and competitive edge.

UniFirst's broad service network is a significant competitive advantage, providing responsive and consistent service across North America and parts of Europe. This localized presence allows for strong customer relationships and quick response times. The company's ability to offer reliable services across a wide geographic area sets it apart in the UniFirst competitive landscape.

UniFirst benefits from economies of scale through centralized laundry facilities, efficient logistics, and bulk purchasing. These efficiencies help to reduce costs and improve service delivery. The company's robust supply chain ensures consistent product availability, which is essential for maintaining customer satisfaction.

UniFirst prioritizes high-quality service, reliability, and customer satisfaction, building a strong brand reputation. The company's focus on a "family culture" contributes to employee retention and enhanced service quality. UniFirst's commitment to customer satisfaction is a key factor in its market success.

UniFirst continually invests in its service infrastructure and technology to improve operational efficiency and customer experience. Investments in route optimization software and inventory management systems enhance service delivery. This commitment to innovation helps UniFirst maintain its competitive edge.

UniFirst's competitive advantages include its extensive service network, operational efficiencies, and customer-centric approach. These advantages are supported by continuous investments in technology and infrastructure, ensuring consistent service quality and customer satisfaction. Analyzing the UniFirst vs Cintas comparison reveals how these strengths contribute to UniFirst's market position.

- Extensive service network across North America and Europe.

- Economies of scale through centralized operations.

- Strong focus on customer satisfaction and relationship building.

- Continuous investment in technology and infrastructure.

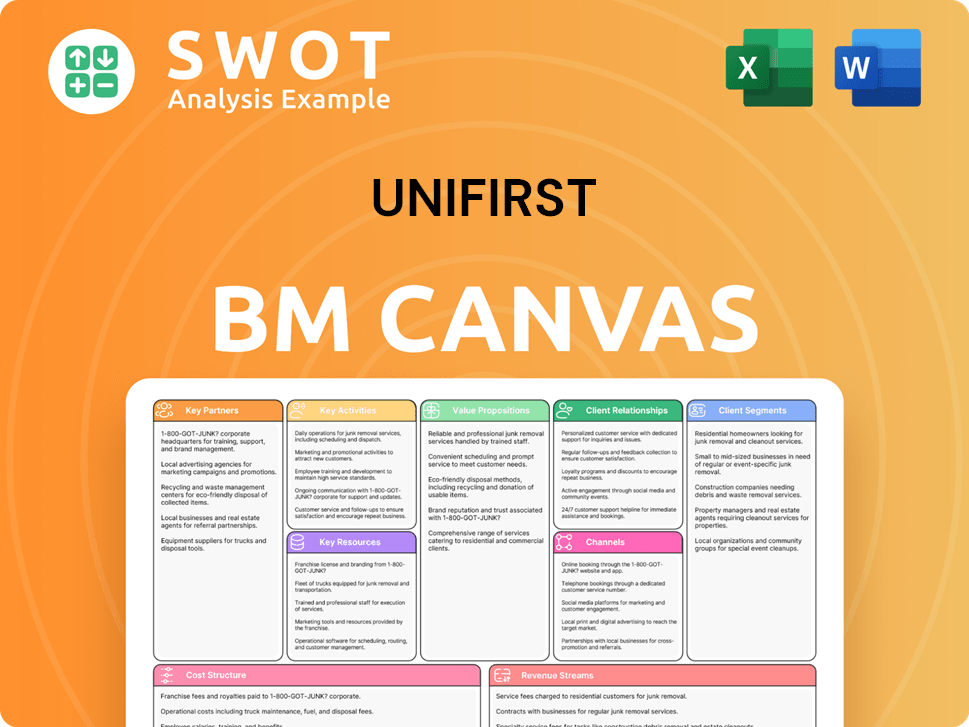

UniFirst Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping UniFirst’s Competitive Landscape?

The uniform and facility services industry, where UniFirst operates, is influenced by several key trends. These include a growing emphasis on sustainability, technological advancements, and evolving workplace safety regulations. Understanding these elements is crucial for a comprehensive UniFirst competitive landscape assessment. The industry is competitive, with major players vying for market share and customer loyalty.

Several factors pose challenges and opportunities for UniFirst. Economic downturns, intense competition, and labor costs are potential hurdles. However, emerging markets, strategic acquisitions, and expanding service offerings present growth opportunities. The post-pandemic focus on hygiene and cleanliness further boosts demand for facility services, potentially strengthening UniFirst's market position.

The uniform and facility services sector is currently seeing increased demand for sustainable practices, prompting companies to adopt eco-friendly laundering processes and offer sustainable uniform options. Technological advancements like RFID tracking and advanced logistics software are improving operational efficiency. Workplace safety regulations are also becoming more stringent, influencing the types of uniforms and services offered.

Potential economic downturns could decrease demand for uniform rental services, impacting revenue. Increased competition from rivals and aggressive pricing strategies pose a threat to market share. Managing labor costs effectively and adapting to evolving workplace safety and environmental regulations are ongoing challenges. The need for continuous investment in technology to remain competitive is also a key factor.

Expansion into emerging markets presents a significant growth opportunity, allowing UniFirst to tap into new customer bases. Strategic acquisitions of smaller regional players can expand market presence and service offerings. Expanding service lines to cater to niche industries and specialized protective clothing needs can also drive growth. The increased focus on hygiene and cleanliness post-pandemic sustains demand for facility services.

Technological advancements are significantly impacting the UniFirst industry. RFID technology, for example, helps in tracking garments, optimizing inventory management, and improving customer service. Digital platforms enhance customer interaction and streamline operations. These technologies not only improve efficiency but also provide opportunities for personalized customer experiences. However, staying ahead of the curve requires constant investment.

To remain competitive, UniFirst must continue investing in technology, focusing on sustainability, and strategically expanding into new markets and service lines. A key focus will be on adapting to changing customer needs and industry standards. The company’s ability to navigate these challenges will determine its future growth and market share. For more insight, you can also explore the Revenue Streams & Business Model of UniFirst.

- Market Expansion: Expanding into new geographic regions and customer segments.

- Service Diversification: Offering a broader range of services, including specialized protective clothing and facility services.

- Technological Integration: Implementing advanced technologies to improve efficiency and customer experience.

- Sustainability Initiatives: Adopting eco-friendly practices and offering sustainable uniform options to meet growing demand.

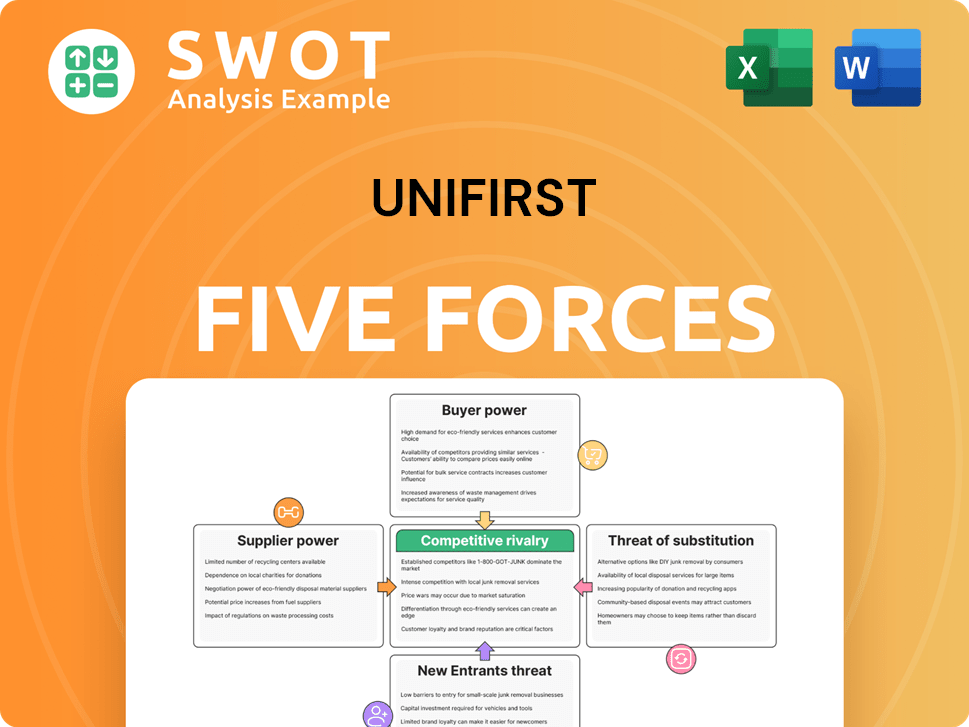

UniFirst Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UniFirst Company?

- What is Growth Strategy and Future Prospects of UniFirst Company?

- How Does UniFirst Company Work?

- What is Sales and Marketing Strategy of UniFirst Company?

- What is Brief History of UniFirst Company?

- Who Owns UniFirst Company?

- What is Customer Demographics and Target Market of UniFirst Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.