UCP, Inc. Bundle

Can UCP, Inc. Thrive in Today's Real Estate Arena?

The real estate sector is a battlefield of innovation and competition, and UCP, Inc. has staked its claim. Understanding the UCP, Inc. SWOT Analysis is crucial for any investor or strategist. With the global residential real estate market poised to reach trillions, the stakes are higher than ever, making a deep dive into UCP, Inc.'s competitive landscape essential.

This analysis provides a comprehensive UCP, Inc. SWOT analysis to dissect its market position. We'll meticulously examine UCP, Inc.'s key competitors, evaluate its competitive advantages, and perform a thorough UCP Inc. market analysis. Further, we will explore UCP Inc. industry trends, challenges, and opportunities to inform strategic decision-making and assess its potential for future financial performance. This deep dive into UCP Inc. competitive landscape aims to empower you with actionable insights.

Where Does UCP, Inc.’ Stand in the Current Market?

UCP, Inc. operates within the competitive real estate development and construction industry. The company focuses on residential, commercial, and mixed-use projects. The UCP Inc. competitive landscape includes numerous national and regional homebuilders, along with smaller local developers.

The company's primary offerings likely include single-family homes, aligning with the past operations of 'UCP, Inc.' which designed, constructed, and sold single-family homes under the Benchmark Communities brand. This entity also developed and sold lots to third-party homebuilders. Geographically, this former UCP, Inc. was active in California, Washington, North Carolina, South Carolina, and Tennessee. A thorough UCP Inc. market analysis is essential to understand its position.

The broader real estate market shows evolving trends. Positive sentiment is building in commercial real estate in early 2025. The global property market is in a recovery phase, with transaction volumes and values bottoming out in 2024. Investor preferences in 2025 remain focused on the living sector and industrial assets. The UCP Inc. industry is influenced by these wider market dynamics.

The global residential real estate market is projected to grow from $11.67 trillion in 2025 to around $25.82 trillion by 2034. This substantial growth indicates significant opportunities within the UCP Inc. industry. The company's performance will be influenced by its ability to capitalize on this expansion.

In the commercial sector, the industrial segment remains strong, while multifamily and retail continue to perform well. Mixed-use developments are also gaining traction, with a 12% increase in property values in urban cores from 2023 to 2025, outpacing single-use properties by 4%. Understanding these trends is crucial for UCP Inc. business strategy.

To assess UCP Inc. competitors and its position, a detailed analysis is needed. This would involve comparing UCP Inc. vs. competitors comparison, examining their UCP Inc. financial statements competitors, and evaluating UCP Inc. competitive advantages.

- The company's success depends on its ability to navigate market dynamics and compete effectively.

- A UCP Inc. SWOT analysis would help identify strengths, weaknesses, opportunities, and threats.

- Understanding UCP Inc. market share analysis is key to evaluating its performance.

- Exploring UCP Inc. growth strategies and addressing UCP Inc. challenges and opportunities are essential.

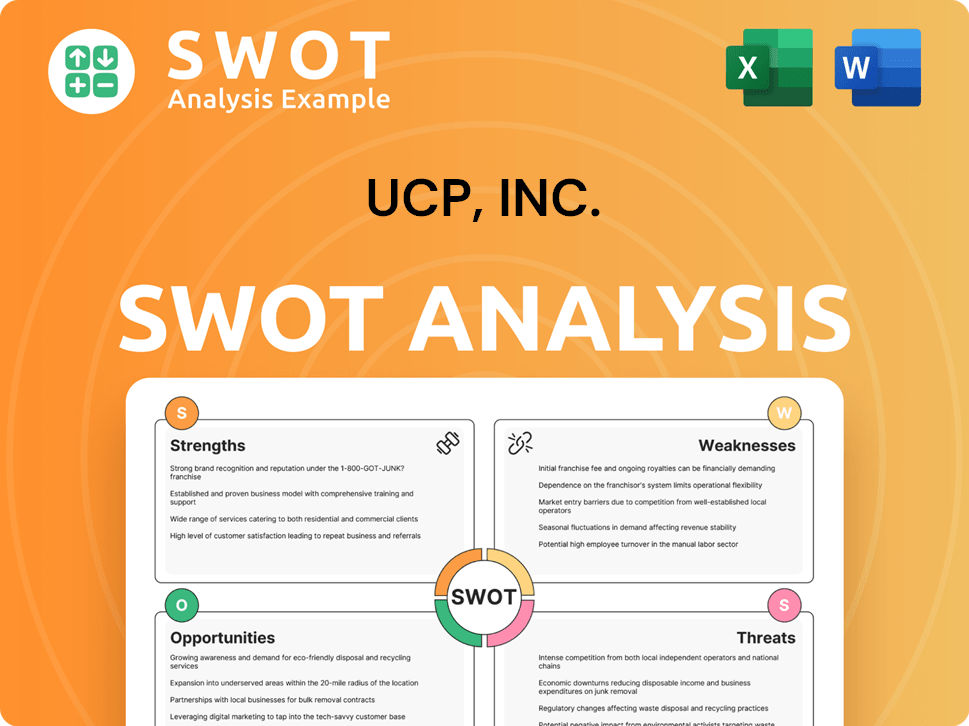

UCP, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging UCP, Inc.?

The Marketing Strategy of UCP, Inc. is significantly influenced by the competitive environment within the real estate development and construction sector. Understanding the UCP Inc. competitive landscape is crucial for assessing its strategic positioning and potential for growth. This analysis involves identifying key players, evaluating their strengths and weaknesses, and understanding the broader industry dynamics.

UCP Inc. competitors span a wide range, from large national homebuilders to regional and local developers. These competitors employ various strategies, including pricing, design innovation, and technological advancements, to gain market share. A thorough UCP Inc. market analysis requires a detailed examination of these competitive strategies and their impact on UCP, Inc.'s performance.

Major national homebuilders like D.R. Horton Inc., Lennar Corporation, and Hovnanian Enterprises, Inc. are key competitors. These companies often have substantial financial resources, enabling them to secure favorable terms for materials and labor.

Significant real estate development companies such as Greystar, Mill Creek Residential, and Trammell Crow Residential also pose competition. These firms often specialize in multifamily developments.

Emerging players and new entrants continuously disrupt the market. The relatively low barriers to entry in certain segments of the real estate business facilitate this ongoing competition.

Mergers and acquisitions significantly shape the competitive landscape. For example, SH Residential Holdings' acquisition of M.D.C. Holdings in April 2024, for $4.9 billion, altered the competitive rankings.

Competitors challenge UCP, Inc. through various means, including pricing strategies, innovative designs, brand recognition, extensive distribution networks, and the adoption of new technologies in construction and property management.

UCP Inc. industry trends, such as the increasing demand for sustainable building practices and smart home technologies, also influence the competitive dynamics. These trends necessitate that companies adapt their UCP Inc. business strategy to stay relevant.

Several factors contribute to the competitive intensity in the real estate development and construction industry. Understanding these factors is crucial for UCP Inc. financial performance and strategic planning.

- Market Share Analysis: Assessing the market share of competitors, including D.R. Horton and Lennar, provides insights into their market dominance.

- SWOT Analysis: Conducting a SWOT analysis helps identify UCP, Inc.'s strengths, weaknesses, opportunities, and threats in relation to its competitors.

- Key Competitors List: A detailed UCP Inc. key competitors list helps in focusing competitive efforts.

- Competitive Advantages: Identifying and leveraging UCP Inc. competitive advantages, such as innovative designs or efficient construction processes, can provide a significant edge.

- Industry Trends: Staying informed about UCP Inc. industry trends, including changes in consumer preferences and technological advancements, is critical.

- Recent Acquisitions: Monitoring UCP Inc. recent acquisitions by competitors helps in understanding the evolving market dynamics.

- Financial Statements: Analyzing competitors' UCP Inc. financial statements competitors provides insights into their financial health and strategies.

- Competitors Comparison: A UCP Inc. vs. competitors comparison helps in benchmarking performance and identifying areas for improvement.

- Growth Strategies: Evaluating UCP Inc. growth strategies in light of competitor actions is essential.

- Challenges and Opportunities: Identifying UCP Inc. challenges and opportunities helps in proactive planning.

- Competitive Positioning: Defining UCP Inc. competitive positioning in the market is key to differentiating itself.

- Market Segmentation: Understanding UCP Inc. market segmentation allows for targeted marketing and development strategies.

- Porter's Five Forces: Applying Porter's Five Forces framework provides a comprehensive view of the competitive environment.

- Business Model Analysis: Analyzing the UCP Inc. business model analysis in comparison to competitors helps in identifying areas for innovation.

- Future Outlook: Assessing the UCP Inc. future outlook in light of competitor strategies and market trends is crucial for long-term success.

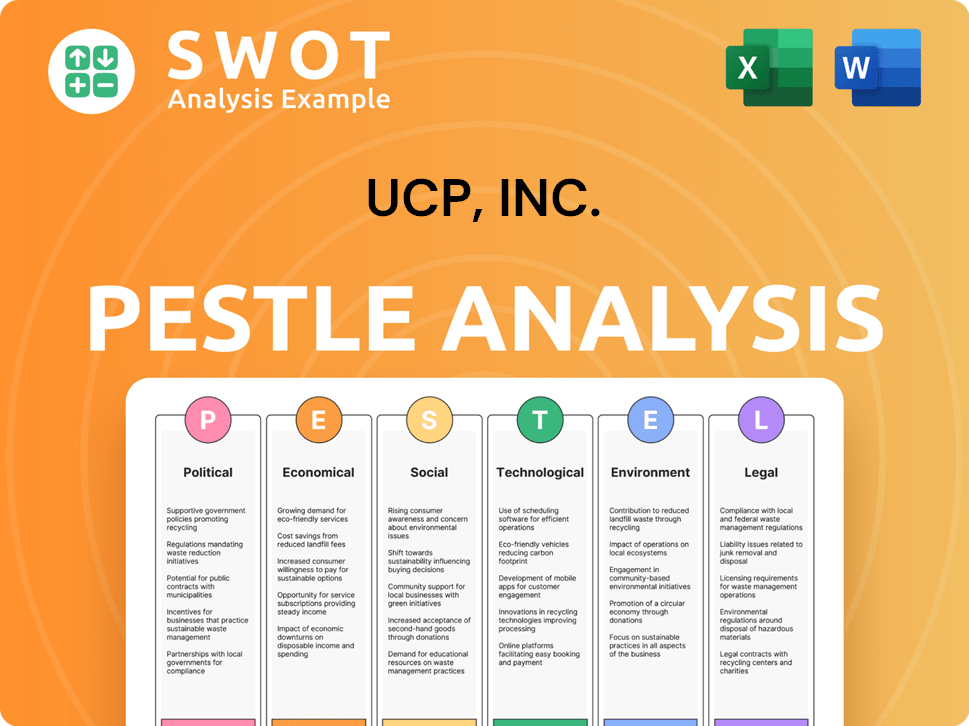

UCP, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives UCP, Inc. a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of UCP, Inc. involves analyzing its approach to the real estate market. The company's focus on community-building and quality construction forms a core differentiator. While specific details on proprietary technologies are not available in public information, the emphasis on community engagement and creating lasting value is a key aspect of its business strategy.

In the real estate sector, UCP, Inc. faces competition from various players. A thorough UCP Inc. market analysis is crucial for understanding its position. The competitive landscape includes companies with strong balance sheets, efficient cost management, and experienced professionals. Maintaining a strong corporate culture and effective risk mitigation are also vital for success.

The real estate market is dynamic and evolving, with industry trends such as sustainable development and smart home technologies gaining prominence. Companies that adapt to changing consumer preferences, like the demand for walkable neighborhoods, can gain a competitive edge. For a deeper dive into the company's growth strategy, consider reading Growth Strategy of UCP, Inc..

UCP, Inc. differentiates itself through community-focused design, creating developments that foster social interaction and a sense of belonging. This approach can lead to increased customer loyalty and positive word-of-mouth referrals. This strategy is particularly relevant in a market where buyers seek more than just a home, but a lifestyle.

The commitment to quality construction is a significant competitive advantage. High-quality builds reduce long-term maintenance costs for residents and enhance the property's value over time. This focus on quality can also lead to a stronger reputation and brand recognition in the UCP Inc. industry.

UCP, Inc.'s focus on building lasting relationships with residents and stakeholders can foster customer loyalty. This approach is essential in the real estate market, where repeat business and positive referrals are crucial for sustained growth. This strategy can also lead to a more stable financial performance.

The ability to adapt to changing consumer preferences, such as the growing demand for sustainable and smart home features, is a key competitive advantage. Integrating eco-friendly designs and smart technologies can attract environmentally conscious consumers. This adaptability is crucial for long-term success in the UCP Inc. competitive landscape.

UCP, Inc. leverages several competitive advantages to succeed in the real estate market. These advantages include community-focused design, quality construction, and a focus on long-term relationships. The company's ability to adapt to market trends, such as sustainable development, further strengthens its position.

- Community-Focused Design: Creates developments that foster social interaction.

- Quality Construction: Ensures long-term value and reduces maintenance costs.

- Long-Term Relationships: Builds customer loyalty and positive referrals.

- Adaptability: Integrates sustainable and smart home features.

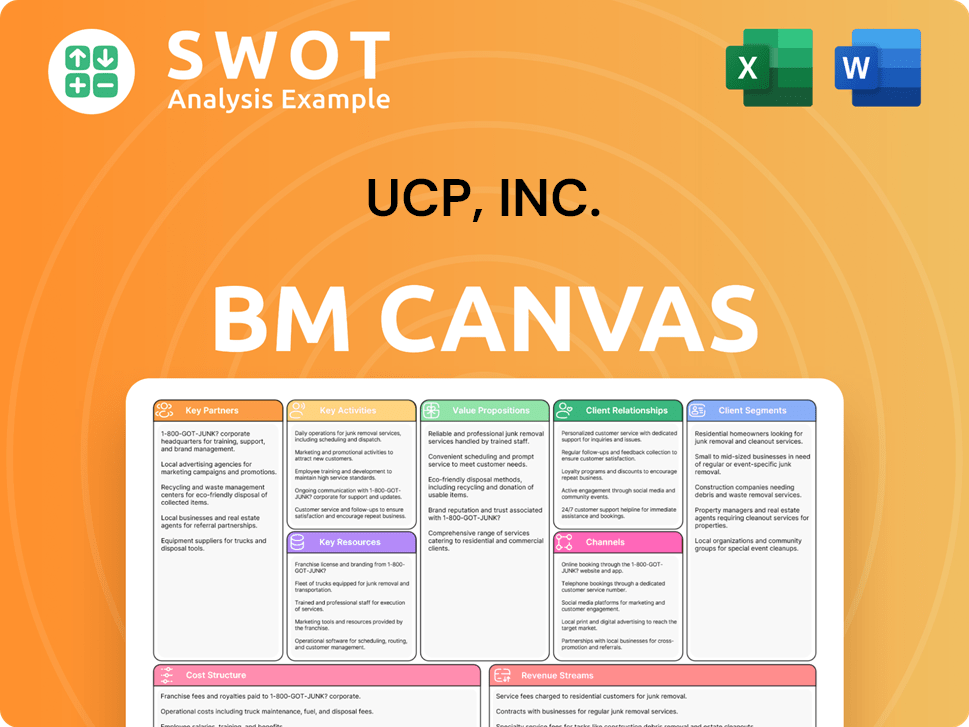

UCP, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping UCP, Inc.’s Competitive Landscape?

The Brief History of UCP, Inc. reveals a company navigating a dynamic real estate development sector. The industry is currently influenced by shifting consumer preferences, technological advancements, and economic uncertainties. Analyzing the competitive landscape of UCP, Inc. requires understanding these trends to assess its strategic positioning and potential for future growth. Understanding UCP Inc.'s market analysis is critical for stakeholders.

The real estate market, valued at approximately $379.7 trillion in 2024, presents both opportunities and challenges. The future outlook for UCP, Inc. depends on its ability to adapt to industry trends, manage risks, and capitalize on emerging opportunities. A thorough understanding of UCP Inc.'s competitive advantages is key to evaluating its long-term financial performance.

The real estate industry is seeing a surge in demand for sustainable and smart living solutions. Mixed-use developments are gaining popularity, with property values in urban cores increasing. Technological advancements, such as e-contracts and smart home technology, are also reshaping the industry. UCP Inc. industry must respond to these trends.

Economic uncertainty, geopolitical tensions, and climate risks continue to influence the market. Elevated construction costs and operating expenses pose challenges, particularly in the affordable housing sector. The office sector faces high vacancy rates in some areas. These challenges will impact UCP Inc.'s business strategy.

Opportunities for UCP, Inc. lie in the growing demand for affordable housing. Expanding into emerging markets and innovating in product design to meet consumer preferences for sustainable communities are crucial. Strategic partnerships and a community-focused design approach can differentiate the company. UCP Inc. growth strategies are key.

The global real estate market is expected to see moderate growth in 2025, supported by rising real incomes and potentially lower mortgage rates. However, interest rate fluctuations and construction costs remain key factors. Understanding UCP Inc.'s market share analysis is essential for assessing its competitive positioning.

UCP, Inc. must adapt to industry trends, explore strategic partnerships, and leverage its community-focused design approach. This will help the company navigate challenges and capitalize on opportunities. Key to success is a thorough UCP Inc. SWOT analysis and understanding of its key competitors list.

- Focus on sustainable and smart living solutions.

- Explore mixed-use development opportunities.

- Manage costs and adapt to interest rate fluctuations.

- Consider expanding into emerging markets.

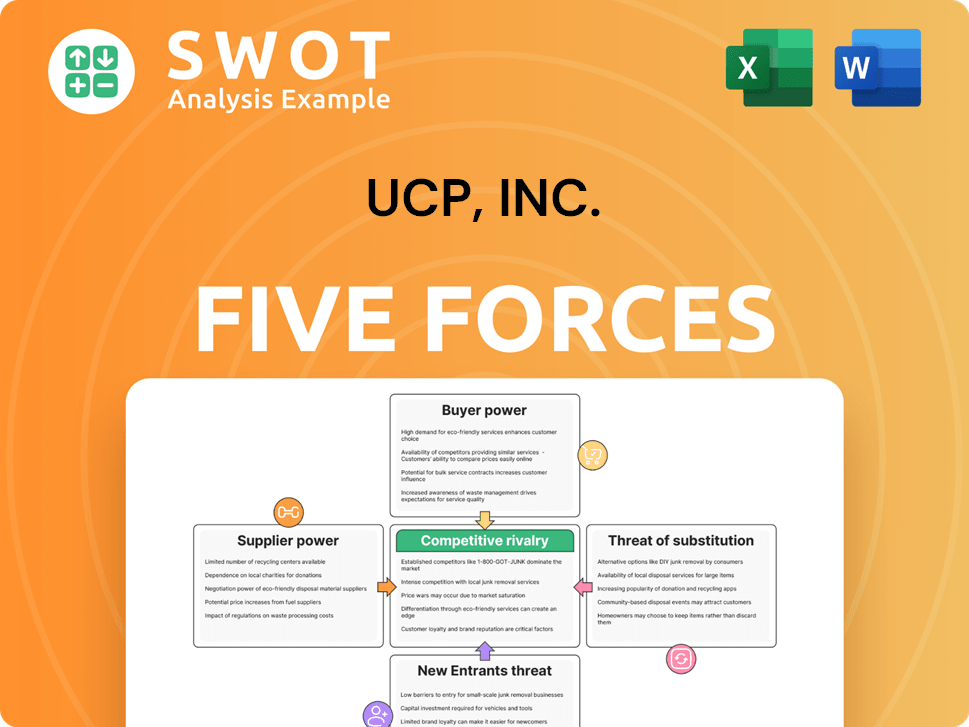

UCP, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UCP, Inc. Company?

- What is Growth Strategy and Future Prospects of UCP, Inc. Company?

- How Does UCP, Inc. Company Work?

- What is Sales and Marketing Strategy of UCP, Inc. Company?

- What is Brief History of UCP, Inc. Company?

- Who Owns UCP, Inc. Company?

- What is Customer Demographics and Target Market of UCP, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.