Veracyte Bundle

How Does Veracyte Stack Up in the Genomic Diagnostics Arena?

Veracyte is revolutionizing disease diagnosis with its genomic tests, offering crucial insights for improved patient outcomes. Founded in 2008, the company has rapidly evolved, focusing on areas like thyroid and lung cancer. This Veracyte SWOT Analysis provides a comprehensive view of the company's strategic position.

Understanding the Veracyte competitive landscape is vital for anyone assessing its potential. This analysis delves into Veracyte competitors, examining their market share and strategies. We'll explore Veracyte market analysis, providing a detailed look at its strengths, weaknesses, and future prospects within the Veracyte industry.

Where Does Veracyte’ Stand in the Current Market?

Veracyte's market position within the genomic diagnostics industry is strong, especially in thyroid, lung, and interstitial lung diseases. The company is a leader in genomic sequencing for thyroid nodule diagnosis, with its Afirma Genomic Sequencing Classifier (GSC) being a widely used solution. Veracyte's focus is on advanced genomic tests designed to reduce the need for invasive procedures and guide treatment decisions, which is a key aspect of its value proposition.

The company's core operations revolve around providing these advanced genomic tests. They serve oncologists, pulmonologists, endocrinologists, and pathologists, offering tools to improve diagnostic accuracy and personalize patient care. Veracyte has strategically shifted to emphasize a comprehensive diagnostic approach, moving beyond single-gene tests to more complex genomic classifiers. This shift highlights a move towards higher-value, more integrated diagnostic solutions.

Veracyte's market analysis reveals a company with consistent revenue growth. For the full year 2023, Veracyte reported total revenue of $370.4 million, a 17% increase compared to 2022. The company's 2024 revenue guidance is in the range of $413 million to $423 million, representing 11% to 14% growth over 2023. This financial health supports ongoing investment in research, development, and commercial expansion. Veracyte's competitive landscape is shaped by its strong position in thyroid cancer diagnostics, alongside its growth efforts in lung and interstitial lung disease markets.

Veracyte holds a leading position in genomic sequencing for thyroid nodule diagnosis. Its Afirma GSC is a widely adopted solution in this area. The company's focus on innovative genomic tests helps it maintain a strong market position.

Veracyte's product portfolio includes Percepta GSC for lung cancer and Envisia Genomic Classifier for interstitial lung diseases. These products address critical diagnostic needs. The company's offerings are designed to reduce unnecessary invasive procedures.

Veracyte has a significant presence in the United States, which is its core market. The company is also expanding its international footprint, particularly in Europe and Asia. This expansion reflects Veracyte's growth strategy.

Veracyte has demonstrated consistent revenue growth, indicating strong financial health. The company's revenue guidance for 2024 shows continued growth. This financial stability supports ongoing investments in research and development.

Veracyte's competitive landscape is defined by its focus on genomic diagnostics and its strategic market positioning. The company's products and services are designed to improve patient outcomes. For more insights, check out the Growth Strategy of Veracyte.

- Strong market position in thyroid cancer diagnostics.

- Expanding presence in lung and interstitial lung disease markets.

- Focus on comprehensive diagnostic solutions.

- Consistent revenue growth and positive financial outlook.

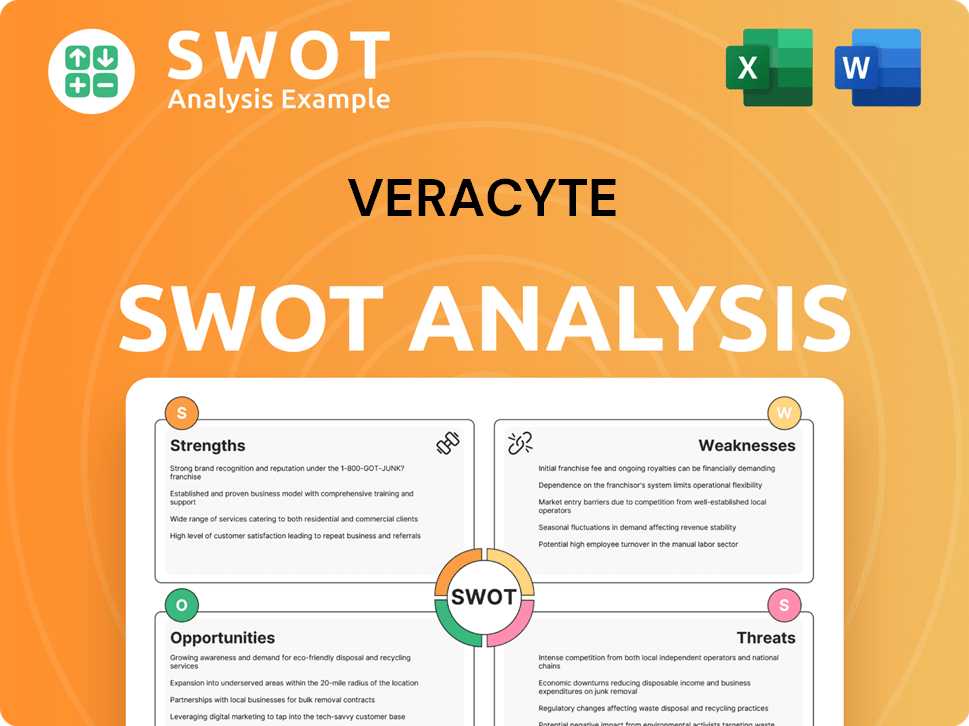

Veracyte SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Veracyte?

The Veracyte competitive landscape is characterized by a dynamic environment with both direct and indirect competitors vying for market share. The company faces challenges from established diagnostic companies and emerging biotech firms. A thorough Veracyte market analysis reveals the complexities of this competitive arena, where success hinges on clinical evidence, test accuracy, and market adoption.

Veracyte competitors often include companies offering molecular diagnostics for similar disease areas, such as thyroid and lung cancer. These companies develop and market tests that aim to provide more definitive information than traditional diagnostic methods. The competitive landscape is also shaped by technological advancements and strategic alliances within the industry.

Indirect competition comes from traditional diagnostic methods, academic institutions, and large hospital systems developing in-house testing capabilities. The competitive landscape is further influenced by technological advancements and strategic moves, such as mergers and acquisitions. Understanding the Veracyte competitive analysis is crucial for investors and stakeholders.

Direct competitors include companies offering molecular diagnostics for similar disease areas, such as thyroid and lung cancer. These firms provide genetic mutation panels and other molecular tests.

Indirect competition comes from traditional diagnostic methods like imaging and pathology. Academic institutions and large hospital systems developing in-house genomic testing capabilities also represent a form of competition.

Key competitors include Guardant Health, which focuses on liquid biopsies, and Foundation Medicine, a Roche company, offering comprehensive genomic profiling for solid tumors. These companies provide tests that can overlap with Veracyte products.

The competitive landscape is shaped by technological advancements, including next-generation sequencing (NGS) and AI-driven diagnostics. New players constantly emerge with innovative platforms.

Mergers and alliances, such as large pharmaceutical companies acquiring diagnostic firms, can alter competitive dynamics. These moves create larger entities with broader market reach and deeper resources.

The 'battles' often revolve around clinical evidence, test accuracy, reimbursement coverage, and market adoption. Companies vie for physician preference and inclusion in clinical guidelines.

The Veracyte industry is highly competitive, with companies continually striving to improve their market position. Factors such as clinical evidence, test accuracy, and reimbursement coverage play crucial roles in determining success. For a deeper dive into how Veracyte approaches its market, consider reading about the Marketing Strategy of Veracyte.

Veracyte faces both advantages and challenges in the competitive landscape. These factors influence Veracyte stock performance analysis and overall financial health.

- Competitive Advantages: Proprietary technology, strong clinical data, and established market presence.

- Challenges: Competition from larger companies, the need for continuous innovation, and securing reimbursement coverage.

- Opportunities: Expansion into new disease areas, strategic partnerships, and technological advancements.

- Threats: Regulatory changes, competitive pressures, and shifts in healthcare policies.

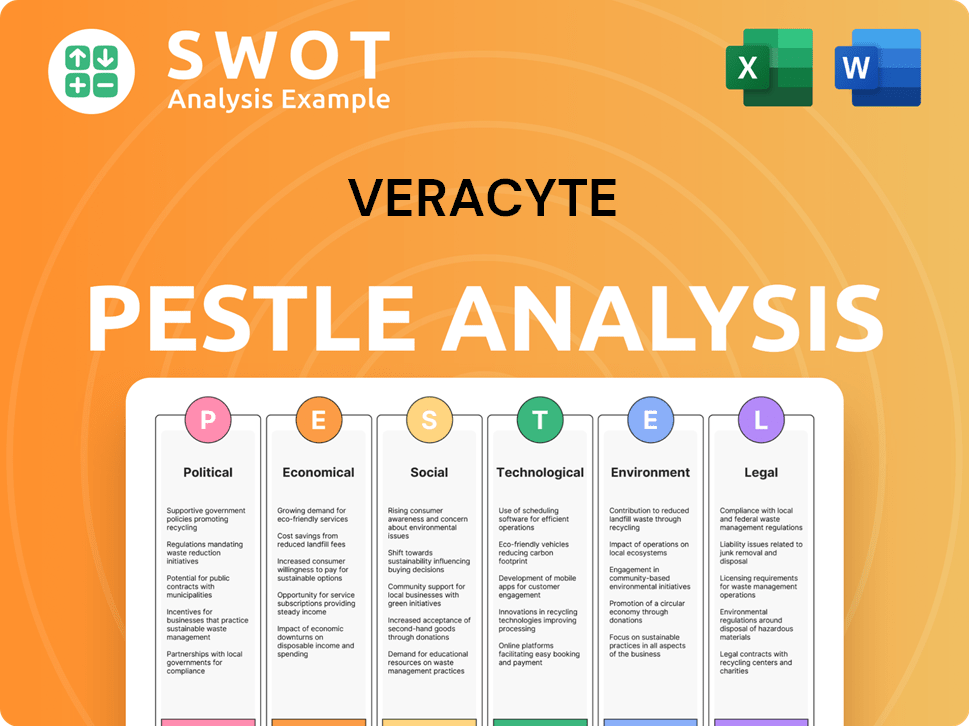

Veracyte PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Veracyte a Competitive Edge Over Its Rivals?

Analyzing the Veracyte competitive landscape reveals a company strategically positioned through proprietary genomic technologies and a strong focus on clinical validation. Key to its success are its diagnostic tests, which have gained significant traction in the market. These tests provide crucial information for physicians, leading to better patient outcomes.

Veracyte's strategic moves include continuous innovation in genomic classifiers and expansion into new disease areas. The company's commitment to research and development, along with its focus on commercial strategy, has helped it build brand equity and customer loyalty. These efforts are designed to maintain and strengthen its market position.

The company's competitive edge is also defined by its intellectual property portfolio, which provides a barrier to entry for competitors. Strong relationships with healthcare providers and a dedicated sales force further contribute to its market leadership. These factors are crucial in the highly competitive diagnostics industry.

Veracyte's core strength lies in its proprietary genomic technologies, particularly its Afirma Genomic Sequencing Classifier (GSC) for thyroid nodule diagnosis. This technology has been clinically validated and widely adopted, significantly improving diagnostic accuracy. These technologies create a substantial barrier to entry for potential Veracyte competitors.

The company's diagnostic tests are supported by extensive clinical evidence and peer-reviewed publications. This validation is crucial for gaining acceptance from healthcare providers and ensuring patient confidence. The strong clinical backing is a key differentiator in the Veracyte market analysis.

Veracyte maintains a robust intellectual property portfolio, including patents on its genomic classifiers and analytical methods. This protection makes it difficult for rivals to replicate its offerings, safeguarding its market position. This IP strategy is essential for long-term competitiveness.

Veracyte has cultivated strong brand equity and customer loyalty among healthcare professionals, including endocrinologists and pulmonologists. This loyalty stems from the proven clinical utility and patient benefits of its tests. This is supported by a dedicated sales force.

Veracyte's competitive advantages include proprietary genomic technologies, strong clinical evidence, and a robust intellectual property portfolio. These factors contribute to its market position and differentiate it from competitors. The company's focus on physician education and favorable reimbursement further enhances its market presence.

- Proprietary Genomic Technologies: Afirma GSC, Percepta, and Envisia.

- Extensive Clinical Validation: Numerous peer-reviewed publications.

- Strong Intellectual Property: Patents on genomic classifiers and methods.

- Brand Equity and Customer Loyalty: Trusted by healthcare providers.

- Operational Efficiencies: Economies of scale in CLIA-certified labs.

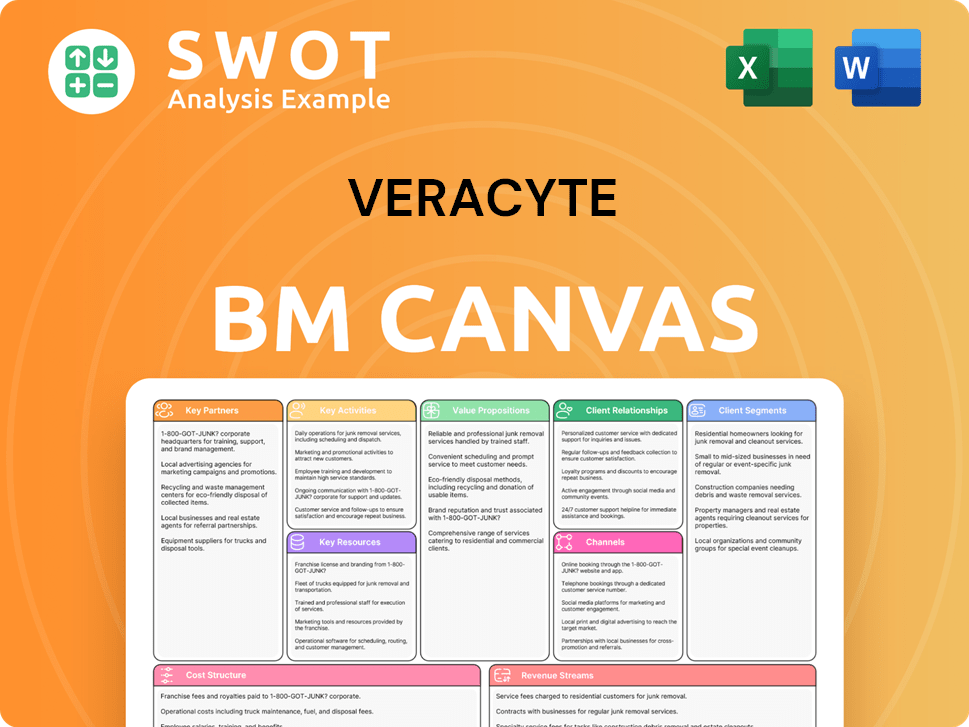

Veracyte Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Veracyte’s Competitive Landscape?

The genomic diagnostics industry is undergoing significant shifts, impacting the Veracyte competitive landscape. Technological advancements in areas like next-generation sequencing (NGS) and bioinformatics are fostering innovation, while regulatory changes and evolving consumer preferences for personalized medicine also play crucial roles. This dynamic environment presents both challenges and opportunities for companies like Veracyte.

Several factors shape the future of Veracyte. These include the rise of multi-cancer early detection (MCED) tests, the integration of artificial intelligence and machine learning, and the emergence of new market entrants. Veracyte must navigate potential threats from changing diagnostic practices and increased regulatory burdens, while also capitalizing on growth opportunities in emerging markets and through product innovation. For a deeper dive into the company's origins, consider reading the Brief History of Veracyte.

Technological advancements, particularly in NGS and bioinformatics, drive innovation, enabling more comprehensive and cost-effective genomic profiling. Regulatory changes and evolving consumer preferences towards personalized medicine also influence the market. The integration of AI and machine learning into diagnostic platforms is reshaping traditional pathways.

Potential disruptions include the rise of multi-cancer early detection (MCED) tests and increasing competition from new market entrants. Veracyte faces threats from declining demand for specific tests, increased regulatory burdens, and aggressive pricing strategies. Changes in standard diagnostic practices and advancements in imaging could also impact test utilization.

Significant growth opportunities exist in emerging markets, and through product innovations such as expanding the test portfolio to new disease areas. Strategic partnerships with pharmaceutical companies and healthcare systems could unlock substantial value. Continuous innovation, expanding the clinical evidence base, and securing broader reimbursement coverage are key.

Veracyte is deploying strategies focused on continuous innovation, expanding its clinical evidence base, securing broader reimbursement coverage, and exploring international markets. The company's ability to adapt to these trends, capitalize on opportunities, and mitigate challenges will define its future competitive position.

Veracyte's success hinges on its ability to navigate the evolving Veracyte competitive landscape. This involves a multi-faceted approach to innovation, market expansion, and strategic partnerships. Securing broader reimbursement coverage and exploring international markets are also crucial for sustained growth.

- Continuous Innovation: Developing new tests and enhancing existing ones through technological advancements.

- Clinical Evidence: Expanding the clinical evidence base to support test adoption and reimbursement.

- Market Expansion: Exploring emerging markets and expanding the test portfolio to new disease areas.

- Strategic Partnerships: Collaborating with pharmaceutical companies and healthcare systems.

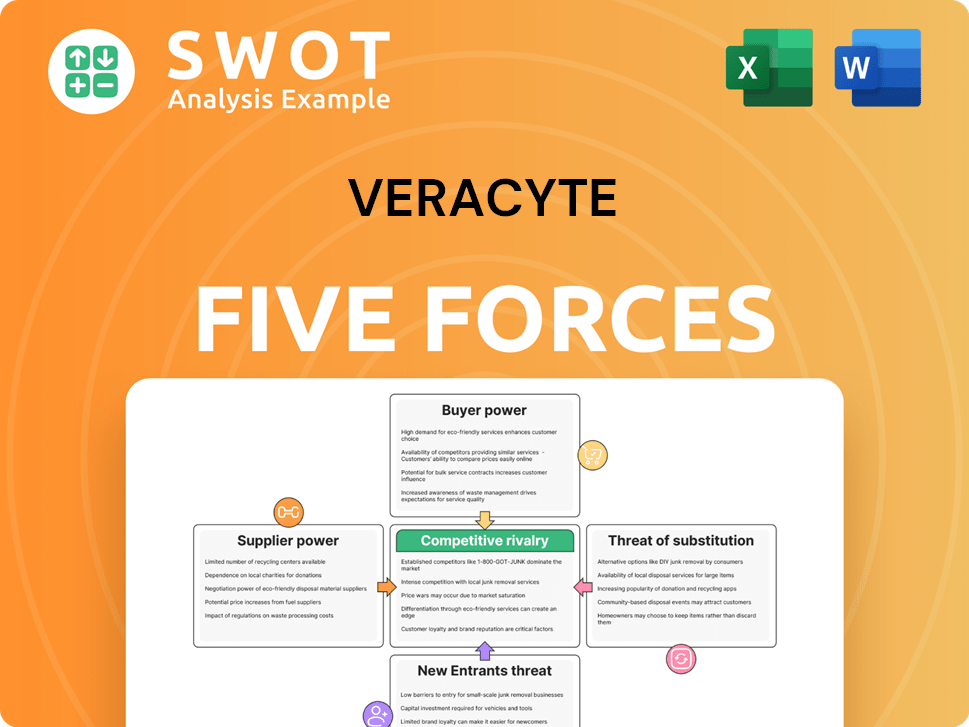

Veracyte Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veracyte Company?

- What is Growth Strategy and Future Prospects of Veracyte Company?

- How Does Veracyte Company Work?

- What is Sales and Marketing Strategy of Veracyte Company?

- What is Brief History of Veracyte Company?

- Who Owns Veracyte Company?

- What is Customer Demographics and Target Market of Veracyte Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.