Walker & Dunlop Bundle

How Does Walker & Dunlop Stack Up in the CRE Finance Arena?

Founded in 1938, Walker & Dunlop has evolved from a mortgage banking firm into a commercial real estate finance powerhouse. Its journey, marked by strategic growth and client-focused solutions, has positioned it as a key player in the industry. But how does W&D navigate the complexities of today's market?

To truly understand Walker & Dunlop's position, we must dissect its Walker & Dunlop SWOT Analysis and examine its competitive landscape. This includes a thorough W&D market analysis, identifying its key Walker & Dunlop competitors, and evaluating its competitive advantages. We'll explore the impact of commercial real estate finance trends and CRE lending dynamics to offer a comprehensive view of this industry leader and its real estate investment strategies.

Where Does Walker & Dunlop’ Stand in the Current Market?

Walker & Dunlop (W&D) holds a significant market position in the commercial real estate finance industry, particularly in the multifamily sector. The company's core operations involve debt financing, sales brokerage, and investment management across various commercial property types, including multifamily, office, retail, industrial, and hospitality. This diverse service offering allows W&D to cater to a broad customer base, including institutional investors, developers, and individual property owners, solidifying its role as a key player in CRE lending.

As of Q1 2024, W&D demonstrated its strength with a total transaction volume of $7.4 billion, highlighting its substantial involvement in commercial property transactions. The company's strategic expansion and diversification have enhanced its ability to serve clients across different markets. W&D's shift towards becoming a comprehensive capital solutions provider, moving beyond traditional debt financing, has allowed it to capture a larger market share and mitigate risks.

Geographically, W&D maintains a strong national presence across the United States, ensuring broad market coverage. The company's financial performance reflects its substantial operational capacity, with total revenues of $270.8 million reported in Q1 2024. Despite market headwinds, W&D's diversified business model and strong client relationships have helped it navigate challenges, particularly in the multifamily debt market, where it consistently ranks among the top lenders for Fannie Mae and Freddie Mac. For a deeper understanding of W&D's target audience, explore Target Market of Walker & Dunlop.

W&D's strong position in the multifamily debt market, alongside its diversified service offerings, contributes to its competitive advantage. The company's ability to consistently rank among top lenders for Fannie Mae and Freddie Mac is a testament to its market share. W&D's strategic focus on providing comprehensive capital solutions further strengthens its competitive positioning in the commercial real estate finance sector.

In Q1 2024, W&D reported total revenues of $270.8 million, reflecting its substantial operational capacity. While the commercial real estate market faced challenges, W&D's diversified business model helped it navigate these headwinds. The company's financial health is a key indicator of its ability to compete effectively in the market and maintain its strong relationships with clients.

W&D's competitive landscape is shaped by its strong market position and diversified service offerings. The company's focus on multifamily debt, coupled with its comprehensive capital solutions, provides several advantages. These strengths allow W&D to maintain a strong position in a competitive market, providing value to clients and stakeholders.

- Strong presence in the multifamily debt market.

- Diversified service offerings, including debt financing, sales brokerage, and investment management.

- Robust national presence across the United States.

- Consistent ranking among top lenders for Fannie Mae and Freddie Mac.

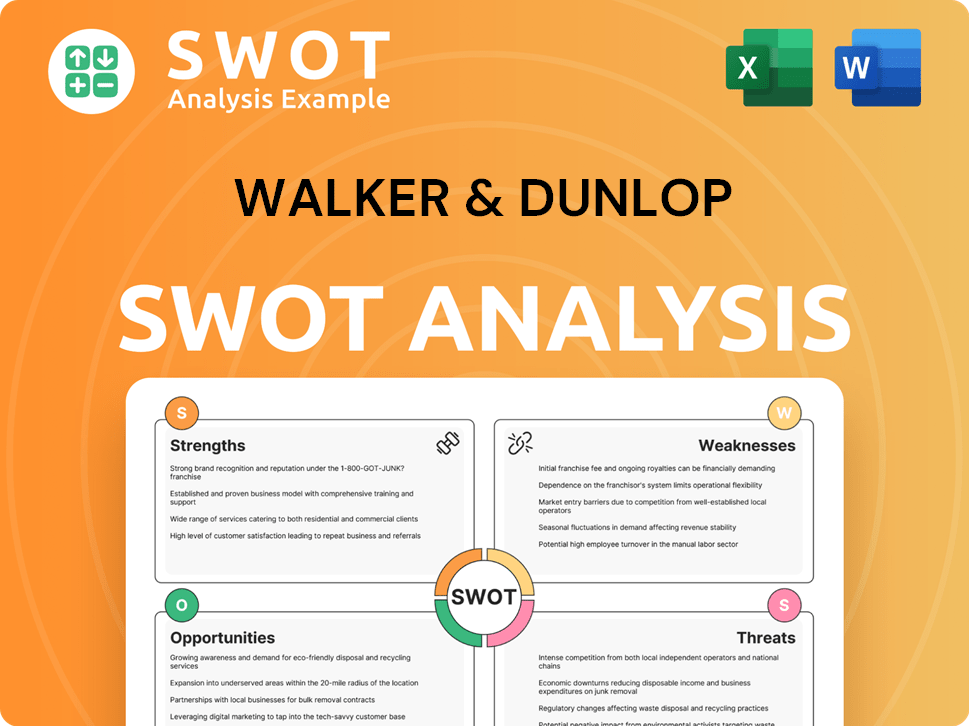

Walker & Dunlop SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Walker & Dunlop?

The Walker & Dunlop competitive landscape is shaped by a variety of players in the commercial real estate finance market. This market is dynamic, influenced by both direct and indirect competitors, as well as evolving trends in the real estate industry. Understanding the competitive environment is crucial for assessing W&D market analysis and its strategic positioning.

Commercial real estate finance is a competitive space, with firms vying for market share through various strategies. These strategies include offering competitive interest rates, providing a wide array of services, and leveraging established client relationships. The competitive dynamics also involve the impact of technology and market consolidation.

Walker & Dunlop competitors include major financial institutions, specialized mortgage banks, and investment sales firms. These entities compete by offering a wide range of CRE lending products and services. The competitive environment is further influenced by the emergence of new players and market consolidation.

Direct competitors of Walker & Dunlop include large financial institutions, specialized mortgage banks, and investment sales firms. These firms directly challenge Walker & Dunlop's market share in commercial real estate finance. The competitive landscape is influenced by the services offered, client networks, and financial capabilities of each player.

Indirect competitors include private equity firms, alternative lenders, and proptech companies. These entities provide alternative financing solutions or streamline real estate transactions. While not direct competitors in all aspects, they can impact market share by offering specialized services or leveraging technology.

Major financial institutions, such as J.P. Morgan Chase, Wells Fargo, and Bank of America, compete by leveraging extensive balance sheets and broad client networks. These banks often handle larger, more complex transactions and offer competitive interest rates. They have the capacity to provide a wide array of CRE lending products.

Specialized mortgage banks and finance companies, including Berkadia and Newmark, are significant rivals. These firms offer comprehensive services, including mortgage banking, investment sales, and loan servicing. They often challenge Walker & Dunlop through deep regional market expertise and established client relationships.

The emergence of proptech companies, which leverage technology to streamline real estate transactions and financing, represents a disruptive force. These new players can impact market share by offering more efficient or specialized services. Technology is changing how the CRE lending market operates.

Mergers and acquisitions among brokerage firms create larger, more formidable competitors with expanded service offerings and market reach. Recent consolidations have reshaped the competitive landscape, intensifying competition for market share. The trend towards consolidation is ongoing.

The competitive landscape is defined by the strategies of key players. Understanding these strategies is crucial for assessing Walker & Dunlop's position and competitive positioning. Key competitors use a variety of approaches, including offering comprehensive services, leveraging financial strength, and focusing on specific market segments.

- J.P. Morgan Chase, Wells Fargo, and Bank of America: These institutions leverage their extensive balance sheets and broad client networks to provide a wide array of commercial real estate lending products. They often handle larger, more complex transactions and offer competitive interest rates.

- Berkadia: Berkadia offers a full suite of services, including mortgage banking, investment sales, and loan servicing. This comprehensive approach allows it to compete directly with Walker & Dunlop across multiple business lines, particularly in the multifamily sector.

- Newmark: Newmark's strong presence in investment sales and leasing poses a competitive threat, especially in the brokerage segment. Its deep regional market expertise and established client relationships are key competitive advantages.

- Private Equity Firms and Alternative Lenders: These entities are increasingly active in the commercial real estate debt and equity markets, offering flexible financing solutions that traditional lenders may not provide. They often target specific niches or offer specialized financing structures.

For additional insights into Walker & Dunlop's strategic direction, consider reading about the Growth Strategy of Walker & Dunlop. This article provides a deeper understanding of the company's approach to navigating the competitive landscape.

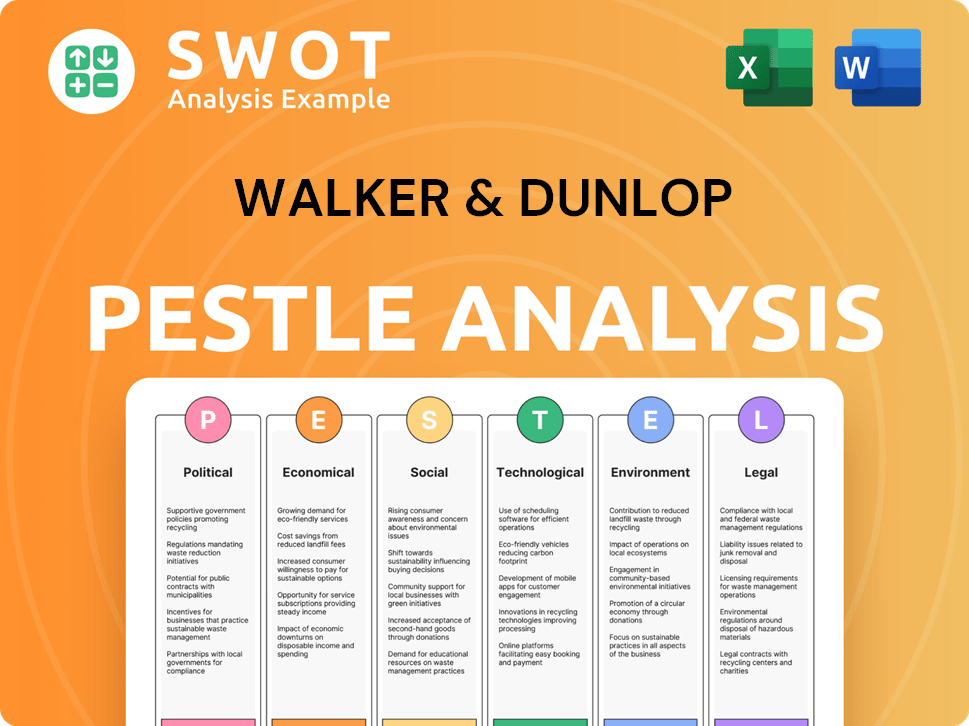

Walker & Dunlop PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Walker & Dunlop a Competitive Edge Over Its Rivals?

Understanding the Walker & Dunlop competitive landscape requires a deep dive into its strengths. The company has carved a significant niche in the commercial real estate finance industry. Its ability to secure and maintain strong relationships, especially with government-sponsored enterprises (GSEs), gives it a distinct edge in the market.

W&D market analysis reveals a company focused on providing comprehensive services. This includes debt financing, investment sales, and investment management. This integrated approach allows them to serve clients throughout the lifecycle of a commercial property. This comprehensive service model sets it apart from more specialized competitors.

The company's strategic investments in technology and data analytics have also enhanced its operational efficiency. Proprietary platforms streamline loan origination, underwriting, and servicing. These advancements contribute to faster execution and more informed decision-making.

Walker & Dunlop maintains robust partnerships with Fannie Mae and Freddie Mac. This provides a consistent flow of agency debt origination. Their expertise and reputation in the multifamily sector build significant client trust and loyalty.

The company offers a full range of services, including debt financing, investment sales, and investment management. This integrated approach allows them to serve clients across the entire commercial property lifecycle. This 'one-stop shop' approach differentiates them from competitors.

Walker & Dunlop has invested in technology and data analytics to boost operational efficiency. Proprietary platforms streamline loan origination, underwriting, and servicing. These tools provide clients with valuable market insights.

The company has built a strong brand over decades, fostering consistent performance and client satisfaction. This serves as a significant competitive barrier. It makes them a preferred partner for many commercial real estate investors and developers.

The competitive advantages of Walker & Dunlop include a strong focus on the multifamily sector. They also have a comprehensive service suite and strategic investments in technology. These factors contribute to their success in the commercial real estate finance market.

- Deep expertise in the multifamily sector, especially in agency lending.

- An integrated service model, including debt financing, investment sales, and investment management.

- Strategic investments in technology and data analytics to enhance operational efficiency.

- Strong brand equity and client loyalty, built over years of consistent performance.

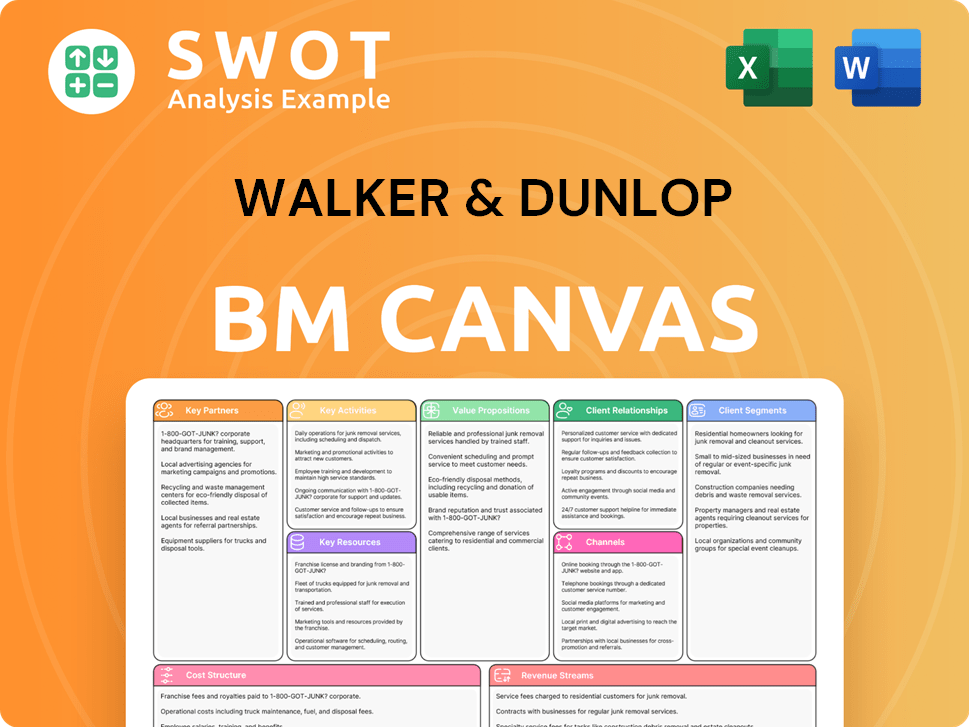

Walker & Dunlop Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Walker & Dunlop’s Competitive Landscape?

The commercial real estate finance industry is currently experiencing significant shifts that affect the competitive landscape of companies like Walker & Dunlop. These changes present both challenges and opportunities, requiring strategic adaptation to maintain and improve market positioning. Understanding these trends is crucial for a comprehensive W&D market analysis and for assessing the company's future outlook.

The industry's trajectory is influenced by technological advancements, evolving regulatory landscapes, and economic fluctuations. These factors impact transaction volumes, property values, and the overall demand for CRE lending services. Examining these elements provides insight into the competitive dynamics and potential growth areas for Walker & Dunlop and its rivals.

Technological advancements, including data analytics and AI, are transforming commercial real estate. Regulatory changes, such as evolving lending standards and ESG considerations, are also key. Economic shifts, particularly interest rate fluctuations, directly impact transaction volumes and property values.

Intense competition from traditional financial institutions and proptech startups is a significant challenge. Declining demand in certain commercial property sectors poses a threat. The need for continuous innovation to meet changing client demands is also critical.

Emerging markets like affordable housing and specialized properties offer growth potential. Strategic partnerships and targeted acquisitions can enhance market position. Developing financial products tailored to evolving demands is also key.

Leveraging technology for efficiency and market insights is essential. Adapting to regulatory changes, including ESG considerations, is crucial. Focusing on counter-cyclical services can provide revenue stability during downturns.

The Walker & Dunlop competitive landscape is shaped by technology, regulation, and economic factors. Understanding these elements is vital for strategic planning. For example, in early 2024, the commercial real estate market saw a decrease in transaction volume due to higher interest rates, presenting challenges for companies like Walker & Dunlop.

- Technological Advancements: Companies need to leverage data analytics, AI, and blockchain for efficient underwriting and market insights.

- Regulatory Changes: Adapting to evolving lending standards and ESG considerations is crucial.

- Economic Shifts: Interest rate fluctuations and economic slowdowns directly influence transaction volumes.

- Competitive Pressure: Competition comes from traditional financial institutions and proptech startups.

- Market Opportunities: Growth potential exists in affordable housing and specialized properties.

The Walker & Dunlop competitive landscape is influenced by several key factors, including the company's ability to innovate and adapt. This includes how Walker & Dunlop responds to changes in the market and its ability to capitalize on new opportunities. For a more in-depth understanding of the company's background, consider reading Brief History of Walker & Dunlop.

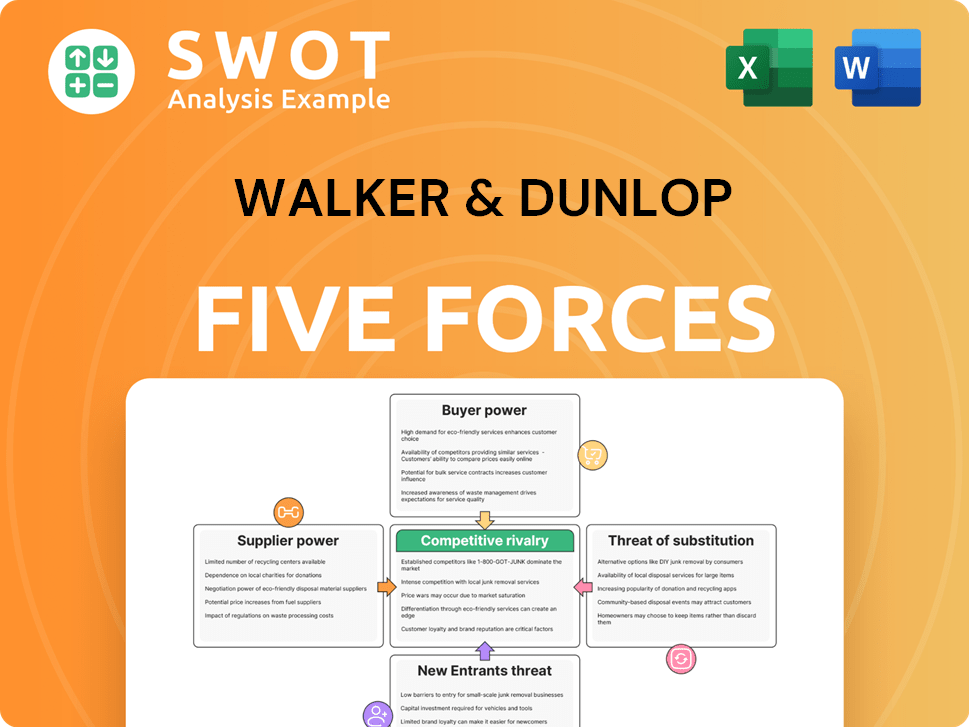

Walker & Dunlop Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Walker & Dunlop Company?

- What is Growth Strategy and Future Prospects of Walker & Dunlop Company?

- How Does Walker & Dunlop Company Work?

- What is Sales and Marketing Strategy of Walker & Dunlop Company?

- What is Brief History of Walker & Dunlop Company?

- Who Owns Walker & Dunlop Company?

- What is Customer Demographics and Target Market of Walker & Dunlop Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.