Wolfspeed Bundle

How Does Wolfspeed Stack Up in the Semiconductor Showdown?

The semiconductor industry is undergoing a seismic shift, and at the heart of this transformation is Wolfspeed, a pioneer in silicon carbide (SiC) and gallium nitride (GaN) technologies. From its origins as Cree, Inc., Wolfspeed has strategically evolved to become a global leader, capitalizing on the explosive growth in electric vehicles, renewable energy, and 5G. This strategic pivot underscores its commitment to wide bandgap semiconductors, which offer superior efficiency and performance.

To truly understand Wolfspeed's position, this analysis provides a deep dive into the Wolfspeed SWOT Analysis and its competitive landscape. We'll dissect the company's main rivals and explore what sets it apart in the dynamic power semiconductors market. This Wolfspeed market analysis will also examine its competitive advantages and growth strategy within the rapidly expanding Silicon carbide market, offering actionable insights for investors and industry professionals alike.

Where Does Wolfspeed’ Stand in the Current Market?

Wolfspeed holds a significant position in the wide bandgap semiconductor industry, specifically within the silicon carbide (SiC) market. Their core operations revolve around the design, development, and manufacturing of SiC materials and power devices. These products are crucial for various applications, including electric vehicles (EVs), renewable energy systems, and industrial power supplies. The company's focus on SiC and gallium nitride (GaN) technologies has solidified its role as a leader in the power semiconductors sector.

The company's value proposition centers on providing high-performance, energy-efficient semiconductor solutions. These solutions enable advancements in several key areas. They include increased EV range, improved charging infrastructure efficiency, and enhanced power conversion in renewable energy systems. Wolfspeed's strategic shift to a pure-play wide bandgap semiconductor company has allowed it to concentrate on these high-growth markets, offering superior products compared to traditional silicon-based semiconductors.

Wolfspeed's market position is reinforced by its strategic investments in manufacturing capacity. The Mohawk Valley Fab, a new 200mm SiC fabrication facility, began production in April 2022. This expansion is vital for meeting the growing demand, particularly from the automotive sector. The company has secured long-term supply agreements, indicating strong customer confidence and demand for its products. This positions Wolfspeed favorably within the competitive landscape.

Wolfspeed is recognized as a leader in the SiC power devices and materials market. While specific market share figures for 2024-2025 are still emerging, the company's consistent performance and strategic focus have solidified its position. Its strong presence in the North American and European EV markets, coupled with its advanced technology, supports its competitive advantage. This is evident in the increasing adoption of SiC content in EVs.

Wolfspeed's product portfolio includes SiC bare and epitaxial wafers, SiC power devices (MOSFETs and diodes), and GaN RF devices. These products cater to diverse customer segments, with a strong emphasis on electric vehicles (EVs), EV charging infrastructure, renewable energy (solar inverters), industrial power supplies, and 5G telecommunications. This wide range of applications highlights the versatility and importance of their technology.

The company's strategic pivot to a pure-play wide bandgap semiconductor leader has been crucial. This allowed for increased investment in SiC and GaN technologies. The construction of the Mohawk Valley Fab is a key investment in expanding manufacturing capacity. This expansion is essential to meet the surging demand from the automotive sector. This strategic approach strengthens its position in high-growth markets.

Wolfspeed's financial health reflects its strategic investments and the increasing adoption of its SiC products. Revenue growth is driven by increased SiC product shipments. The company's focus on high-growth markets like EVs and renewable energy supports its long-term financial prospects. This focus is key to its continued success in the power semiconductors industry.

Wolfspeed's competitive advantages include its advanced SiC technology, strong relationships with leading automotive suppliers, and strategic investments in manufacturing capacity. The company's growth strategy focuses on expanding production, securing long-term supply agreements, and targeting high-growth markets. These strategies have positioned the company well within the silicon carbide market.

- Focus on SiC and GaN technologies.

- Strategic investments in manufacturing capacity.

- Strong relationships with automotive Tier 1 suppliers and OEMs.

- Targeting high-growth markets like EVs and renewable energy.

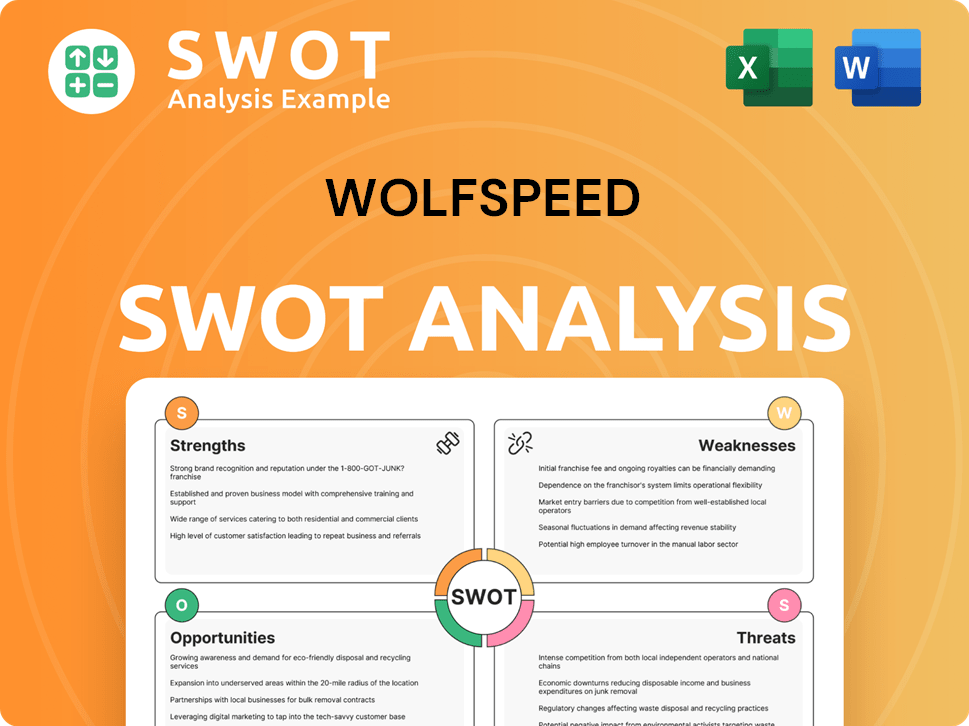

Wolfspeed SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Wolfspeed?

The Wolfspeed competitive landscape is shaped by a dynamic market, where the company faces both established industry leaders and emerging players. The wide bandgap semiconductor market is highly competitive, with significant competition in both silicon carbide (SiC) power devices and gallium nitride (GaN) RF devices. Understanding Wolfspeed's competitors and their strategies is crucial for assessing its market position and future prospects. A detailed Wolfspeed market analysis reveals the key players and the competitive dynamics at play.

The company's success depends on its ability to innovate, secure strategic partnerships, and effectively compete against well-established and emerging rivals. The competitive environment is constantly evolving due to technological advancements, mergers, and acquisitions, as well as shifting customer demands. This chapter will delve into the key competitors, their strategies, and the competitive advantages that define the wide bandgap semiconductor market.

Wolfspeed's main competitors in SiC power devices include STMicroelectronics, Infineon Technologies, and ON Semiconductor. These companies are aggressively expanding their SiC production capabilities and securing design wins, particularly in the automotive sector. STMicroelectronics has a strong vertically integrated SiC supply chain, which allows for greater control over production and quality. Infineon Technologies offers a broad portfolio of power semiconductors, including SiC, and leverages its extensive customer base and R&D capabilities. ON Semiconductor has made significant strides in SiC, focusing on automotive and industrial applications, and has invested in its own SiC boule growth and wafering capabilities.

STMicroelectronics is a major competitor, particularly in the automotive sector. They have been expanding SiC production and securing design wins. Their vertically integrated SiC supply chain provides a competitive advantage.

Infineon offers a broad portfolio of power semiconductors, including SiC. They leverage their extensive customer base and R&D capabilities. Infineon's revenue in fiscal year 2023 was approximately €16.3 billion.

ON Semiconductor has made significant strides in SiC, targeting automotive and industrial applications. They have invested in SiC boule growth and wafering. ON Semiconductor's revenue in 2023 was around $8.2 billion.

Qorvo is a leader in RF solutions, with a strong presence in 5G infrastructure. They offer GaN-based power amplifiers and front-end modules. Qorvo's revenue for fiscal year 2024 was approximately $3.8 billion.

MACOM provides GaN-on-SiC solutions for RF applications, focusing on telecommunications and defense sectors. MACOM's revenue for fiscal year 2023 was around $610 million.

Renesas, a traditional silicon-based manufacturer, offers solutions that can be alternatives in certain applications. Renesas's revenue in fiscal year 2023 was approximately ¥1.4 trillion.

In the GaN RF device market, Wolfspeed competes with companies like Qorvo and MACOM. Qorvo is a leader in RF solutions and has a strong presence in 5G infrastructure, offering GaN-based power amplifiers and front-end modules. MACOM also provides GaN-on-SiC solutions for RF applications, targeting telecommunications and defense sectors. Indirect competition comes from traditional silicon-based power semiconductor manufacturers like Renesas Electronics and NXP Semiconductors. For a deeper understanding of the company's history, you can read a Brief History of Wolfspeed.

The competitive landscape is shaped by technological innovation, strategic partnerships, and market demand. Mergers and acquisitions further influence the market. Key factors include:

- Market Share: Wolfspeed, STMicroelectronics, Infineon, and ON Semiconductor are vying for market share in the rapidly growing SiC market.

- Strategic Partnerships: Alliances between device manufacturers and automotive OEMs are creating integrated supply chains.

- Technological Advancements: Continuous innovation in wide bandgap materials and device designs is a key differentiator.

- Financial Performance: Companies are investing heavily in R&D and production capacity.

- Geopolitical Factors: Trade policies and regional dynamics can impact the competitive landscape.

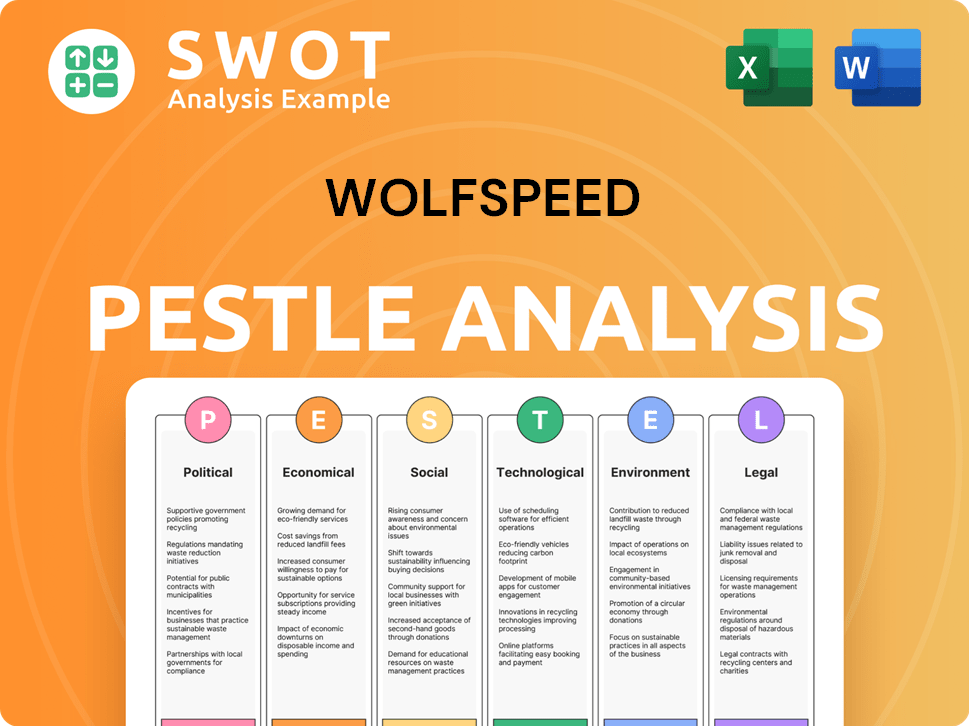

Wolfspeed PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Wolfspeed a Competitive Edge Over Its Rivals?

The competitive landscape for Wolfspeed is defined by its pioneering role in the silicon carbide (SiC) market. Wolfspeed's strategic moves, including significant investments in manufacturing capacity and technology development, have positioned it as a key player in the power semiconductor industry. Understanding Wolfspeed's competitive advantages is crucial for assessing its market position and future growth potential, especially in the rapidly expanding SiC market.

Wolfspeed's competitive edge stems from its deep expertise in SiC materials and devices. Its focus on high-performance and reliable products for demanding applications like electric vehicles and renewable energy systems reinforces its reputation for quality and innovation. The company's long-term supply agreements and partnerships further solidify its market position.

The company's commitment to innovation and strategic partnerships has shaped its competitive landscape. The company's success is closely tied to its ability to maintain its technological lead and expand its manufacturing capabilities to meet growing market demand. For more insights into the company's ownership structure, consider exploring Owners & Shareholders of Wolfspeed.

Wolfspeed's key technologies include its vertically integrated SiC manufacturing process, from crystal growth to device packaging. Its advanced 200mm SiC wafer technology is a key differentiator, enabling higher production volumes and lower costs per chip. The company holds a substantial portfolio of patents related to SiC materials and devices.

Wolfspeed has established strong relationships with leading automotive OEMs and Tier 1 suppliers. These partnerships often involve collaborative development, further entrenching Wolfspeed's solutions into next-generation platforms. Long-term supply agreements, some extending into 2029 and beyond, demonstrate the trust in its technology.

Wolfspeed is investing heavily in new fabs, such as the Mohawk Valley Fab, to increase production capacity. These investments position the company to achieve scale advantages as production ramps up. The expansion of manufacturing capacity is crucial to meet the growing demand for SiC devices.

Wolfspeed has built strong brand equity and customer loyalty, particularly within the automotive and industrial sectors. Its focus on high-performance and high-reliability products reinforces its reputation. Long-standing relationships with key customers contribute to its competitive advantage.

Wolfspeed's competitive advantages include its vertically integrated SiC manufacturing, substantial patent portfolio, and strong customer relationships. Its 200mm wafer technology and investments in new fabs provide a cost advantage. The company's deep talent pool in wide bandgap materials science and power electronics engineering is also a critical advantage.

- Vertical Integration: Wolfspeed controls its supply chain from SiC crystal growth to device packaging, ensuring quality and optimizing costs.

- Technological Leadership: A strong patent portfolio and advanced 200mm wafer technology differentiate it from competitors.

- Customer Relationships: Long-term supply agreements with key automotive and industrial customers solidify its market position.

- Manufacturing Capacity: Investments in new fabs, like the Mohawk Valley Fab, are crucial for achieving scale advantages.

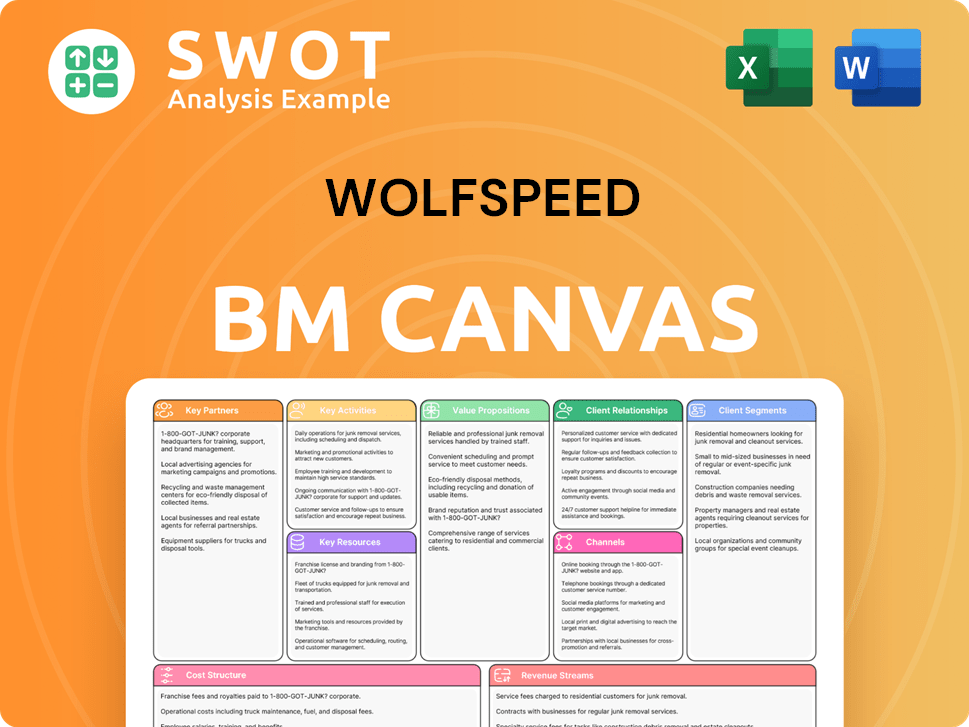

Wolfspeed Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Wolfspeed’s Competitive Landscape?

The wide bandgap semiconductor industry, particularly the Silicon carbide market, is experiencing significant growth, driven by the increasing adoption of electric vehicles (EVs), the expansion of 5G networks, and the rising demand for renewable energy solutions. This creates both opportunities and challenges for companies like Wolfspeed. A thorough Wolfspeed market analysis is crucial to understanding its position in this dynamic environment. This analysis must consider the company's competitive landscape and its strategic responses to industry trends.

Wolfspeed's competitive landscape is shaped by factors such as capital intensity, technological innovation, and supply chain dynamics. The company faces risks including the high costs of scaling production and the potential for price pressures from intensifying competition. However, the company is well-positioned to benefit from the growing demand for SiC devices. A key aspect of this position is its vertical integration, which can provide a competitive advantage in terms of cost control and supply chain resilience. To learn more about its business model, you can explore the Revenue Streams & Business Model of Wolfspeed.

The EV market is a primary driver, with SiC semiconductors essential for efficient powertrains and charging. 5G infrastructure expansion and renewable energy projects also boost demand. Regulatory pressures promoting energy efficiency further accelerate the need for SiC and GaN technologies. These trends are expected to continue fueling growth.

Scaling SiC manufacturing capacity requires significant capital investment and faces potential supply chain bottlenecks. Intensifying competition among Wolfspeed competitors may lead to price pressures. Geopolitical tensions and supply chain disruptions also pose risks. Maintaining technological leadership through R&D is crucial.

The EV market offers substantial growth potential, with SiC demand projected to rise significantly over the next decade. Emerging applications like smart grids and industrial automation also present opportunities. Strategic partnerships and continuous innovation can help capture market share and expand product offerings.

Wolfspeed's strategy involves investing in R&D, forming strategic partnerships, and expanding manufacturing capacity. The company's early mover advantage and vertical integration position it well for long-term growth. The market is expected to mature, but Wolfspeed aims to maintain a significant market share.

Competitive advantages of Wolfspeed include its early entry into the SiC market and its integrated approach, which encompasses materials, devices, and modules. These advantages help to ensure control over the supply chain and product quality. The company's focus on innovation and its strategic partnerships are also crucial.

- Early mover advantage in the SiC market.

- Vertical integration for supply chain control.

- Strong focus on research and development.

- Strategic partnerships with key customers.

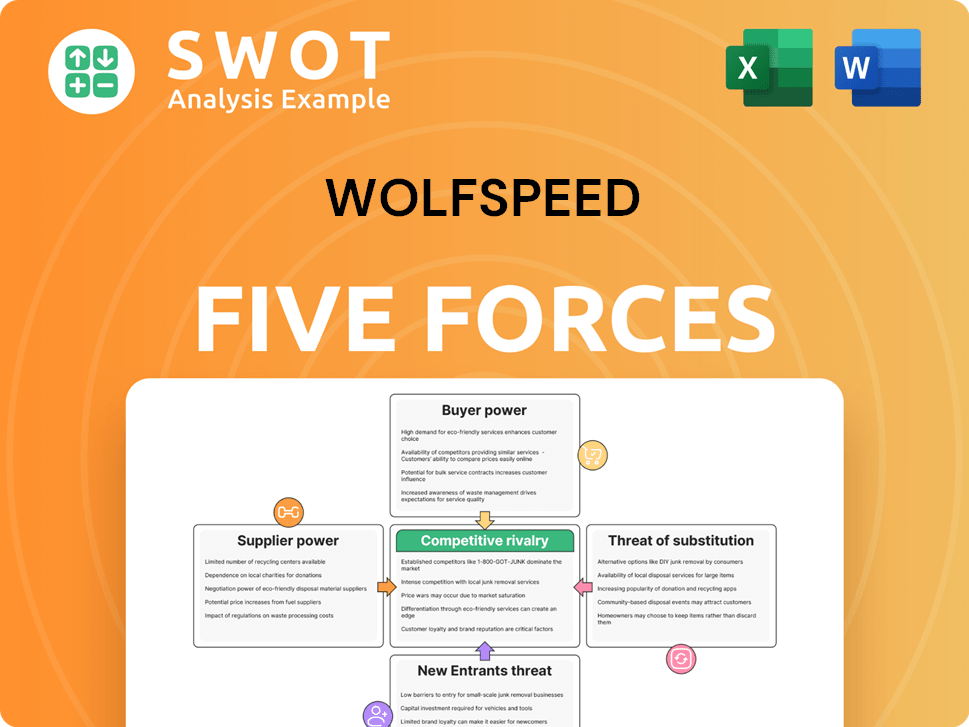

Wolfspeed Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wolfspeed Company?

- What is Growth Strategy and Future Prospects of Wolfspeed Company?

- How Does Wolfspeed Company Work?

- What is Sales and Marketing Strategy of Wolfspeed Company?

- What is Brief History of Wolfspeed Company?

- Who Owns Wolfspeed Company?

- What is Customer Demographics and Target Market of Wolfspeed Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.