Yokogawa Electric Corp. Bundle

How Does Yokogawa Electric Corp. Navigate the Industrial Automation Battlefield?

In the fast-paced world of industrial automation, Yokogawa Electric Corp. SWOT Analysis is a global leader, but who are its main rivals, and what strategies does it employ to stay ahead? This detailed market analysis dives deep into Yokogawa's competitive landscape, revealing the key players and the dynamics shaping the industry. Discover how Yokogawa Electric Corp. maintains its industry position in a sector constantly evolving.

This comprehensive industry overview will explore Yokogawa's competitive advantages and challenges, offering a thorough company profile and competitive analysis. We'll examine Yokogawa Electric Corp's financial performance compared to its competitors, providing insights into its market share analysis and global presence. Furthermore, we'll investigate Yokogawa Electric Corp's key strategic partnerships and recent acquisitions, offering a complete picture of its competitive strategy and product portfolio analysis.

Where Does Yokogawa Electric Corp.’ Stand in the Current Market?

Yokogawa Electric Corporation is a significant player in the industrial automation and control sector. The company specializes in providing advanced solutions for various industries, including oil and gas, chemicals, and pharmaceuticals. Its core offerings include distributed control systems (DCS), safety instrumented systems, and field instruments, designed to optimize manufacturing processes and ensure operational safety.

The company's value proposition centers on delivering reliable and innovative solutions that enhance operational efficiency and safety for its customers. Yokogawa's products and services are designed to meet the evolving needs of critical infrastructure and manufacturing processes. This focus allows them to maintain a strong market position and drive growth in a competitive landscape.

For the fiscal year ended March 31, 2025, Yokogawa reported total revenue of JP¥562.4 billion, marking a 4.1% increase from the previous year. The Industrial Automation and Control Business segment was the primary revenue driver. Operating income also increased, reaching JP¥83.5 billion, a 6.0% rise, showcasing the company's financial strength.

Yokogawa is focused on enhancing product competitiveness through investments in existing product lines and strengthening its solution portfolio. The company has a strong global presence, supported by a robust service network. Recent strategic moves and acquisitions are aimed at expanding its market reach and improving its service offerings.

Yokogawa maintains a strong global business foundation, with significant orders in FY2024 coming from the Middle East. The company's global presence is supported by a comprehensive service network, ensuring that it can effectively serve its international clientele. This global reach is a key factor in its competitive strategy.

Yokogawa's financial health is further evidenced by a forecasted annual dividend increase for the third consecutive fiscal year, with a forecast of ¥64 for FY2025. This reflects the company's confidence in its future performance and its commitment to shareholder value. This positive outlook supports its strategic growth initiatives.

The Yokogawa Electric Corp competitive landscape includes major global entities. While specific market share figures are not always available, Yokogawa competitors are recognized as key players in the industrial automation market. The company's ability to innovate and adapt to changing market dynamics is crucial for maintaining its competitive edge. For more insights into their strategic direction, consider reading about the Growth Strategy of Yokogawa Electric Corp.

Yokogawa's strong financial performance and strategic focus position it well within the industrial automation market. The company's commitment to innovation and global presence are key factors in its continued success. The company's ability to adapt to market changes will be crucial for future growth.

- Strong revenue growth in FY2025.

- Increased operating income.

- Focus on enhancing product competitiveness.

- Global business foundation with a supportive service network.

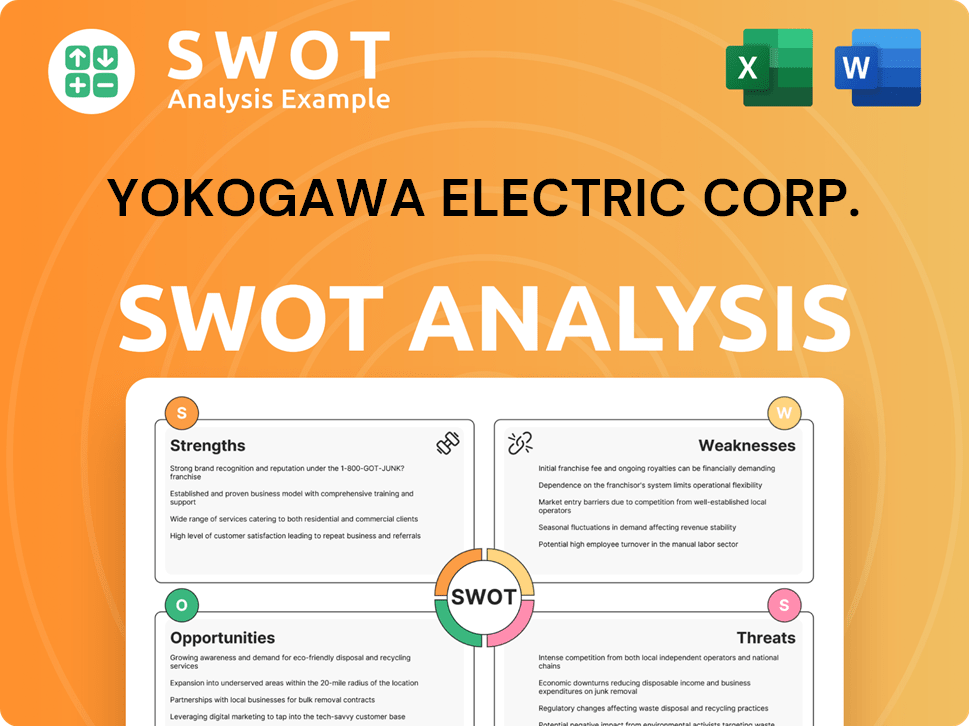

Yokogawa Electric Corp. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Yokogawa Electric Corp.?

The Yokogawa Electric Corp operates in a highly competitive market, with its competitive landscape shaped by both direct and indirect rivals. A thorough market analysis reveals that the company faces significant challenges from established global players. Understanding these dynamics is crucial for assessing Yokogawa Electric Corp's position and future prospects.

The industry overview indicates a dynamic environment where technological advancements and strategic partnerships continuously reshape the competitive arena. This requires constant adaptation and innovation to maintain a strong market presence. To gain deeper insights, you might find the analysis of Revenue Streams & Business Model of Yokogawa Electric Corp. useful.

Yokogawa competitors include major industrial automation giants. These competitors challenge Yokogawa Electric Corp through various means, including pricing strategies and innovation.

Major direct competitors include Siemens AG, Rockwell Automation Inc., ABB Ltd., Mitsubishi Electric Corporation, and Emerson Electric Co. These companies offer a wide array of automation solutions.

Siemens AG provides comprehensive automation solutions, including digitalization, control systems, and IoT technologies. Their Digital Industries platform optimizes production efficiency.

Rockwell Automation is known for its control systems, automation software, and industrial IoT solutions. They are a significant player in the market.

ABB Ltd. offers a wide range of industrial automation products and solutions, including robotics and process automation. They are a key competitor.

Other notable competitors include Honeywell International Inc., Schneider Electric, and Fuji Electric Co., Ltd. These companies have diverse portfolios in industrial control and automation.

These competitors challenge Yokogawa through various means. Yokogawa Electric Corp's competitive strategy is influenced by factors such as aggressive pricing, innovation in AI and IoT, and strong brand recognition. For example, Siemens expanded its Industrial Copilot offering with a new generative AI-powered maintenance solution in March 2025. The industrial robotics market, a component of industrial automation, is highly competitive, with four major players—Fanuc, Yaskawa, ABB, and Kuka—holding a significant global market share.

The competitive landscape is also influenced by emerging players and technological advancements. The impact of mergers and alliances, such as Honeywell's collaboration with Hai Robotics in January 2024 to enhance distribution center efficiency, further intensifies competitive dynamics. Yokogawa Electric Corp faces constant pressure to innovate and adapt to these changing market conditions.

- Market Share Analysis: Analyzing Yokogawa Electric Corp's market share analysis reveals its position relative to competitors.

- Technological Advancements: AI and IoT are driving innovation, with companies investing in AI-powered automation.

- Strategic Partnerships: Alliances like Honeywell's collaboration with Hai Robotics impact the competitive landscape.

- Product Portfolio: A detailed product portfolio analysis helps understand Yokogawa Electric Corp's offerings.

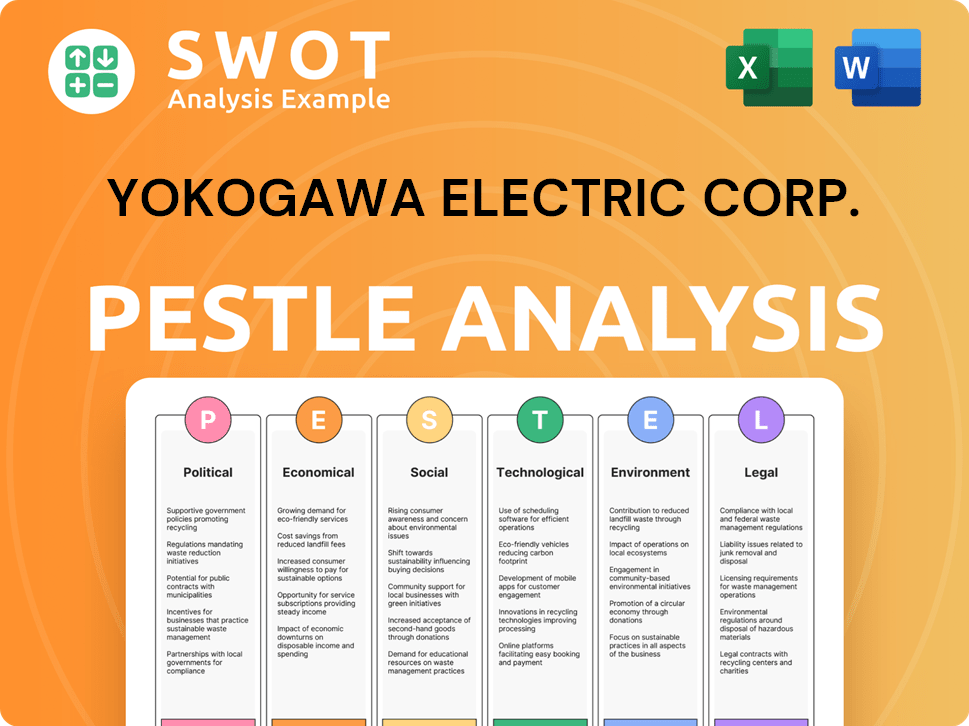

Yokogawa Electric Corp. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Yokogawa Electric Corp. a Competitive Edge Over Its Rivals?

The competitive landscape for Yokogawa Electric Corp. is shaped by its established strengths and strategic initiatives. The company has built a solid reputation for high-quality and reliable products, particularly in crucial sectors like oil and gas, chemicals, and pharmaceuticals. Their focus on digital transformation and integrated solutions further enhances their ability to provide end-to-end services, driving productivity throughout the value chain.

Yokogawa's ability to accomplish complex tasks and offer comprehensive consulting services is a key differentiator. This integrated approach, combined with a commitment to digital transformation, allows them to provide end-to-end solutions that drive productivity throughout the value chain. Their strategic investments in existing product lines and strengthening their solution portfolio enhance their overall competitiveness.

A deep dive into the Growth Strategy of Yokogawa Electric Corp. reveals the company's proactive approach to leveraging external innovation alongside internal R&D. This strategy helps sustain its advantages against imitation and industry shifts. Yokogawa's financial results for FY2024, ending March 31, 2025, indicate a focus on strategic investments, with operating income increasing due to gross profit growth.

Yokogawa's competitive advantages stem from its high-quality products and robust service network. Their established presence in critical industries has fostered strong customer loyalty. The company's focus on digital transformation and integrated solutions further enhances its competitiveness.

Yokogawa is accelerating investments in existing product lines and strengthening its solution portfolio. The company is actively investing in digital technologies and open innovation to meet evolving customer needs. This includes investments in emerging technologies and partnerships to support new business development.

Yokogawa leverages its intellectual property and proprietary technologies, particularly in distributed control systems (DCS) and field instruments. Continuous innovation in these core areas is crucial for maintaining its edge. The company's commitment to open innovation and external partnerships supports its technological advancements.

Yokogawa's financial results for FY2024 (ending March 31, 2025) reflect strategic investments. Operating income has increased due to factors including gross profit growth. The company's financial performance supports its ongoing investments in innovation and market expansion.

Yokogawa's competitive advantages include high-quality products, a robust service network, and a strong installed base. Their focus on digital transformation and integrated solutions allows them to offer end-to-end services. They are also investing in new technologies and partnerships to stay ahead.

- High-quality and reliable products.

- Strong service network and customer loyalty.

- Focus on digital transformation and integrated solutions.

- Strategic investments in existing and new product lines.

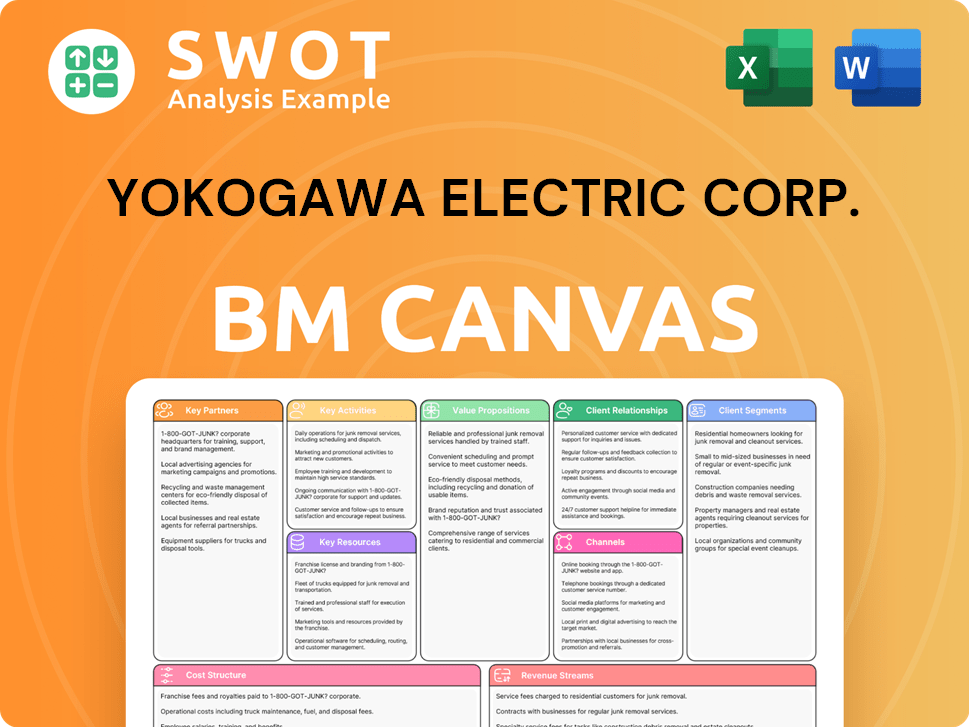

Yokogawa Electric Corp. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Yokogawa Electric Corp.’s Competitive Landscape?

The industrial automation sector is undergoing a significant transformation, driven by technological advancements and evolving market demands. This dynamic environment presents both opportunities and challenges for companies like Yokogawa Electric Corp. A thorough market analysis is crucial to understanding the competitive landscape and formulating effective strategies. The Brief History of Yokogawa Electric Corp. offers valuable background on the company's evolution in this sector.

Yokogawa Electric Corp's position in the industry is influenced by trends such as the integration of Artificial Intelligence (AI) and the Industrial Internet of Things (IIoT). These technologies are reshaping operations across various industries. The company faces risks including cybersecurity threats and the need for skilled labor. The future outlook involves adapting to these changes and capitalizing on emerging opportunities in a rapidly evolving market.

Key trends include the adoption of AI and ML, IIoT, and smart manufacturing. The global factory automation market is expected to reach nearly USD 370 billion by 2034. The industrial automation software market is projected to reach $73.29 billion in 2029.

Opportunities include integrating AI and IIoT into control systems, expanding in cybersecurity for industrial systems. The shift towards personalized products fuels demand for flexible manufacturing systems. Demand for intelligent automation solutions and predictive maintenance is growing.

Challenges include high initial investment costs for automation, cybersecurity risks, and a shortage of skilled labor. Global economic challenges, geopolitical tensions, and supply chain disruptions also impact the sector. Regulatory changes, like the EU's NIS2 Directive, require enhanced cybersecurity.

Strategies include enhancing competitiveness by investing in existing product lines and strengthening the solution portfolio. The company is focusing on new markets like biotechnology and space. Addressing technology adoption, cybersecurity, and workforce development is crucial.

Yokogawa Electric Corp is focusing on expanding its presence in new markets and enhancing its technology offerings. The company is investing in areas like biotechnology, life sciences, water, the ocean, and space. This strategic shift aims to diversify revenue streams and capitalize on emerging opportunities.

- Open innovation and strategic investments in startups are key.

- Enhancing existing product lines and solutions is a priority.

- Addressing challenges in technology adoption and cybersecurity is crucial.

- The company aims to evolve its competitive position in the transforming industrial automation landscape.

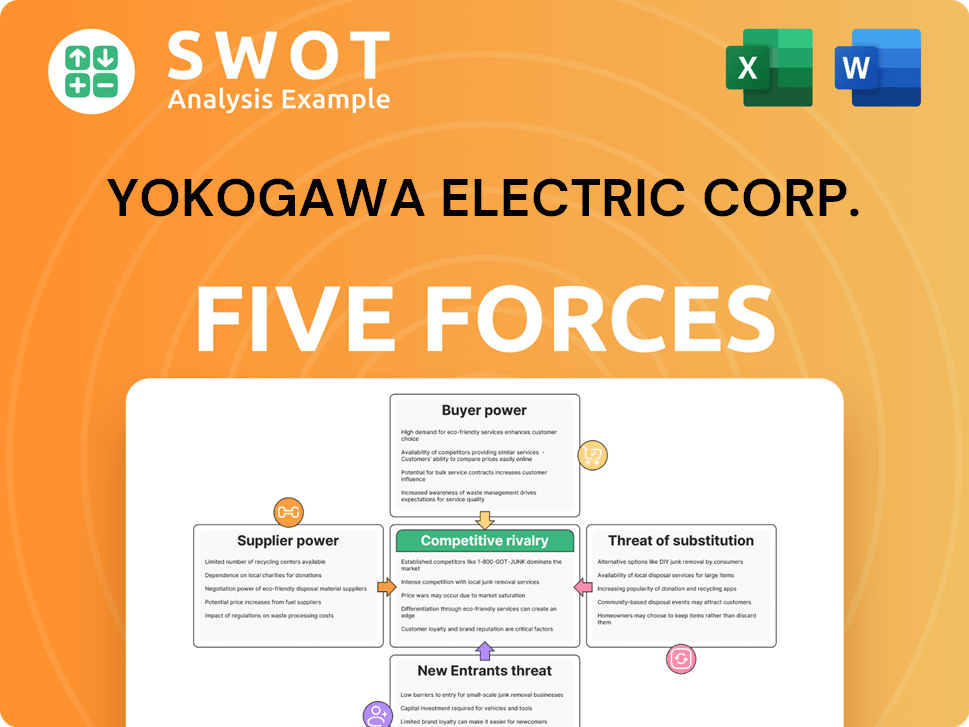

Yokogawa Electric Corp. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Yokogawa Electric Corp. Company?

- What is Growth Strategy and Future Prospects of Yokogawa Electric Corp. Company?

- How Does Yokogawa Electric Corp. Company Work?

- What is Sales and Marketing Strategy of Yokogawa Electric Corp. Company?

- What is Brief History of Yokogawa Electric Corp. Company?

- Who Owns Yokogawa Electric Corp. Company?

- What is Customer Demographics and Target Market of Yokogawa Electric Corp. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.