Zijin Mining Bundle

How Does Zijin Mining Company Stack Up in the Global Mining Arena?

Zijin Mining Company, a powerhouse in the global mining industry, has rapidly evolved from a local gold producer to a multinational giant. Its impressive growth, fueled by strategic acquisitions and technological advancements, has solidified its position among the world's leading mining companies. This analysis dives deep into the Zijin Mining SWOT Analysis, exploring its competitive landscape.

Understanding the competitive landscape is crucial for investors and stakeholders seeking to navigate the complexities of the mining industry. This comprehensive examination will dissect Zijin Mining Company's market position, scrutinize its key competitors, and evaluate its core competitive advantages. We'll also explore the industry trends, future challenges, and opportunities shaping Zijin Mining Company's strategic direction, providing actionable insights for informed decision-making and a deeper understanding of its financial performance and global operations.

Where Does Zijin Mining’ Stand in the Current Market?

Zijin Mining Company has firmly established itself as a major player in the global mining industry. Its core operations center on the extraction and processing of gold, copper, zinc, and other base metals. The company's value proposition lies in its ability to efficiently manage large-scale mining projects and deliver significant production volumes, making it a key supplier to industrial and investment markets worldwide. Its strategic focus on copper positions it well for the increasing demand driven by the global energy transition.

The company's market position is reinforced by its extensive global footprint, spanning across China, Australia, Africa, and South America. This diversified geographical presence allows Zijin Mining to mitigate risks and capitalize on opportunities in various regions. The company's consistent ranking among the top global gold producers and its rapid ascent in copper production rankings highlight its operational excellence and strategic growth initiatives. For more details on the company's target market, you can refer to this article: Target Market of Zijin Mining.

In 2023, Zijin Mining's mineral gold output reached approximately 67.7 tonnes, and its mineral copper output was around 992,000 tonnes. The company's financial performance reflects its strong market position, with an operating income of approximately RMB 303.1 billion and a net profit attributable to the parent company of RMB 21.1 billion in 2023.

Zijin Mining's primary offerings include gold, copper, and zinc concentrates, as well as refined metals. The company's focus on these key commodities aligns with global demand and industry trends. Its diversified portfolio mitigates risks associated with fluctuations in individual commodity prices, contributing to its financial stability.

Zijin Mining operates across a wide range of countries, including China, Australia, and several African and South American nations. This global presence allows the company to tap into diverse resource bases and access various markets. The company's strategic investments in regions like Serbia and the Democratic Republic of Congo have strengthened its market position.

In 2023, Zijin Mining reported a robust financial performance, with significant operating income and net profit. These figures reflect the company's operational efficiency and effective management of its global mining assets. The strong financial results underscore its ability to generate substantial returns and maintain a competitive edge in the mining industry.

Zijin Mining's growth strategy involves strategic acquisitions and a focus on large-scale, high-grade projects. The company has been actively expanding its copper production capacity to meet the growing demand from the global energy transition. This strategic shift from a domestic gold producer to a globally diversified mining giant underscores its commitment to long-term growth.

Zijin Mining Company's market position is characterized by its significant production volumes, global diversification, and strong financial performance. The company's focus on copper and gold, coupled with its strategic acquisitions, has solidified its standing in the mining industry.

- Top global gold producer and rapidly growing copper producer.

- Extensive global footprint with operations in key mining regions.

- Robust financial performance with strong revenue and profit figures.

- Strategic shift towards copper to capitalize on the energy transition.

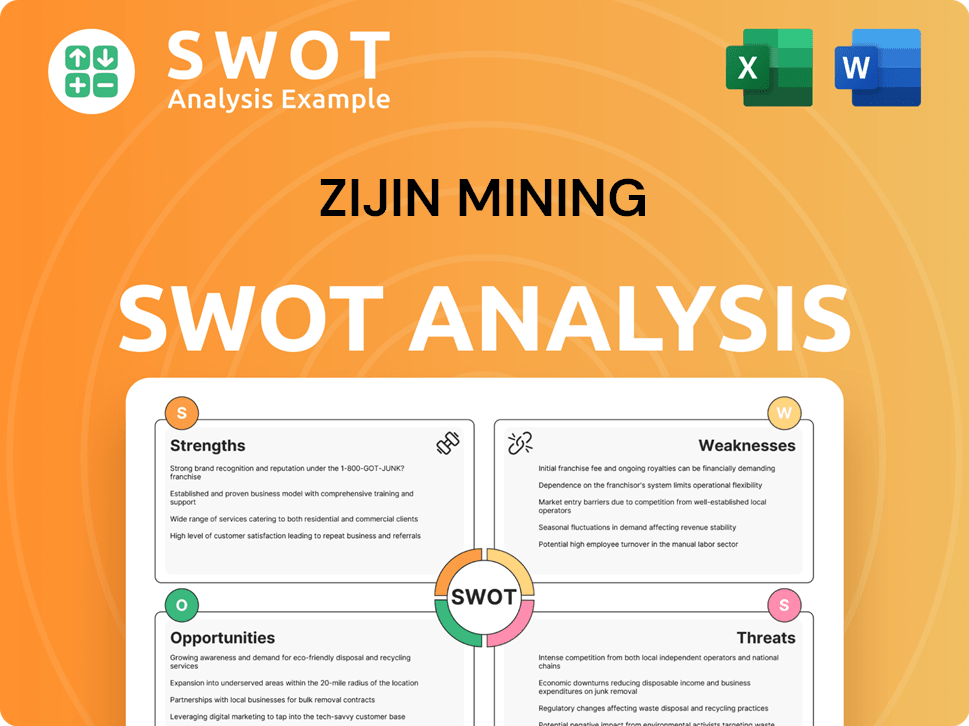

Zijin Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Zijin Mining?

The Zijin Mining Company operates within a dynamic competitive landscape, navigating challenges from both established multinational corporations and specialized regional players. Understanding the mining industry analysis is crucial for assessing its position and potential. The company faces competition across various commodities, including gold, copper, and lithium, each with its own set of key players and market dynamics.

Zijin Mining Company's strategic focus includes expanding its global operations and enhancing its production capacity. This expansion places it in direct competition with major players in the mining sector. Analyzing the competitive landscape involves assessing the strengths, weaknesses, opportunities, and threats (SWOT) of Zijin Mining Company relative to its rivals.

The mining sector is subject to fluctuations in commodity prices, technological advancements, and geopolitical risks. These factors influence the market share and profitability of all mining companies. A detailed examination of Zijin Mining Company's competitive advantages and challenges is essential for a comprehensive mining industry analysis.

In the gold sector, Zijin Mining Company competes directly with major players such as Barrick Gold Corporation, Newmont Corporation, and AngloGold Ashanti. These companies possess extensive global portfolios and significant production capacities.

In the copper market, Zijin Mining Company faces competition from BHP Group, Rio Tinto, Freeport-McMoRan, and Glencore. These companies are dominant forces with vast reserves and integrated operations.

Indirect competition comes from junior mining companies focused on exploration and development. Recycling industries also impact demand for newly mined metals.

High-profile mergers and acquisitions (M&A) significantly alter the competitive landscape. Zijin Mining Company competes fiercely to acquire promising projects, impacting its market share.

Competitors can be segmented by specific metals; for gold, the focus is on primary gold miners, while for copper, it extends to major diversified miners.

Emerging players leveraging advanced data analytics and automation could disrupt traditional competitive dynamics. The capital-intensive nature of mining favors established giants.

Zijin Mining Company's growth strategy involves expanding its portfolio through acquisitions and strategic investments. For example, in 2024, the company continued to focus on increasing its copper production and gold production. The company's recent acquisitions and key projects are critical for its competitive advantages. For further insights, explore the Revenue Streams & Business Model of Zijin Mining.

Several factors influence the competitive landscape for Zijin Mining Company.

- Economies of Scale: Larger companies benefit from lower per-unit costs.

- Technological Capabilities: Advanced technologies improve efficiency and reduce costs.

- Global Supply Chains: Established supply chains ensure reliable access to resources and markets.

- Resource Reserves: Access to vast reserves of copper, gold, and other minerals is crucial.

- Sustainability Initiatives: Environmental, social, and governance (ESG) factors are increasingly important.

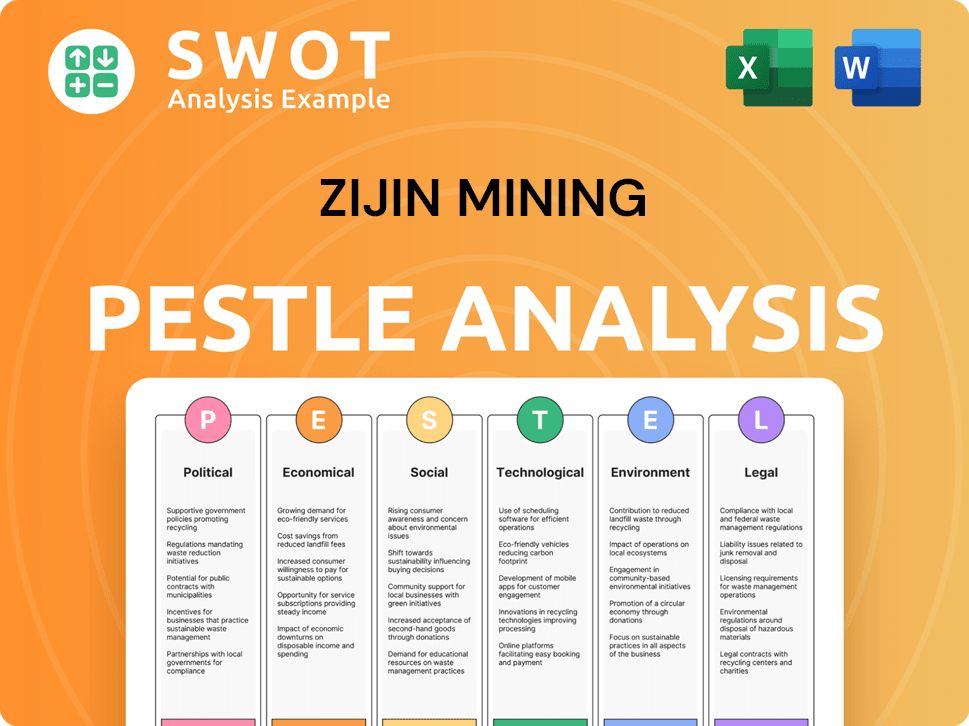

Zijin Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Zijin Mining a Competitive Edge Over Its Rivals?

The Zijin Mining Company carves out its position in the competitive landscape through a combination of strategic advantages. These strengths, including a vast resource base and operational efficiency, have enabled the company to become a significant player in the mining industry. The company's focus on global expansion and technological advancements further solidifies its competitive edge.

Zijin Mining has demonstrated consistent growth, driven by strategic acquisitions and efficient project development. The company's ability to secure and develop high-quality mineral deposits, particularly in gold and copper, is a cornerstone of its success. As the mining industry analysis evolves, the company's adaptability and commitment to sustainable practices are crucial for maintaining its competitive position.

The company's competitive advantages are multifaceted, contributing to its robust financial performance and market standing. Zijin Mining's commitment to cost control and innovation allows it to navigate market fluctuations effectively. This strategic approach is evident in its ability to maintain a strong presence in the global mining sector and enhance shareholder value.

Zijin Mining Company benefits from a substantial and high-quality mineral resource base, particularly in gold and copper. The company consistently invests in exploration and acquisition of world-class deposits. This ensures a sustainable pipeline of production, contributing to lower operating costs compared to some peers.

Zijin Mining leverages advanced mining and metallurgical technologies, including automation and digital solutions, to optimize extraction processes. This operational excellence is evident in its consistently competitive cash costs for both gold and copper. The company's vertically integrated business model enhances efficiency.

The company has strong capabilities in project development and construction, allowing for the rapid and efficient bring-online of new mines. This capability is crucial for quickly capitalizing on market opportunities and expanding production capacity. Efficient project execution is a key driver of growth.

Zijin Mining benefits from strong financial backing and access to capital, enabling it to pursue large-scale projects and strategic acquisitions. Its strong relationships with financial institutions and government bodies in key operating regions also provide a significant advantage. This financial strength supports its growth strategy.

Zijin Mining Company's competitive advantages are multifaceted, contributing to its robust financial performance and market standing. The company's focus on operational efficiency and strategic acquisitions has enabled it to achieve significant growth. For a deeper dive into their strategic approach, consider reading about the Growth Strategy of Zijin Mining.

- Extensive and high-quality mineral resource base, particularly in gold and copper.

- Robust operational efficiency and cost control through advanced technologies.

- Strong financial backing and access to capital for large-scale projects.

- Commitment to sustainable mining practices and environmental stewardship.

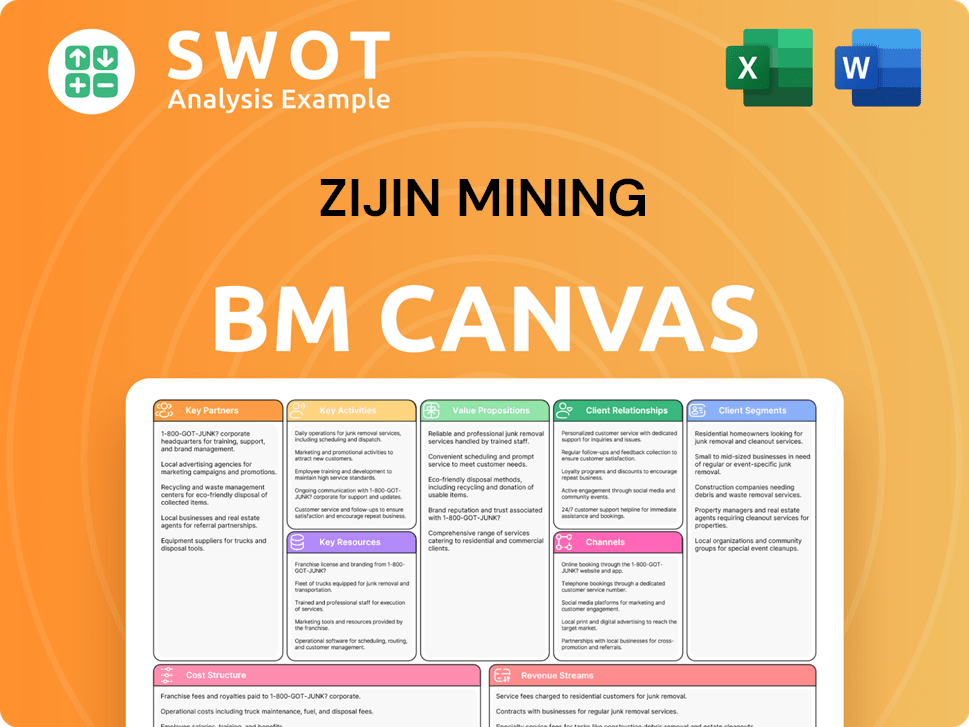

Zijin Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Zijin Mining’s Competitive Landscape?

The global mining industry is experiencing significant shifts that affect the competitive landscape for companies like Zijin Mining Company. Technological advancements, regulatory changes, and global economic dynamics are reshaping the sector. Understanding these trends is crucial for assessing Zijin Mining's market position and future prospects.

Zijin Mining faces both challenges and opportunities. These include adapting to technological changes, navigating environmental regulations, and responding to geopolitical risks. The company's ability to capitalize on the growing demand for critical minerals, such as copper, will be a key factor in its success, as discussed in Owners & Shareholders of Zijin Mining.

Automation, AI, and big data analytics are improving efficiency and safety in mining operations. ESG criteria are becoming increasingly important, influencing investment and operational practices. Economic shifts and geopolitical instability impact commodity prices and supply chains.

Stringent environmental regulations necessitate significant investment in sustainable practices. Fluctuations in commodity prices and potential economic slowdowns can impact profitability. Geopolitical risks and resource nationalism pose threats to supply chain security. New market entrants with innovative technologies could disrupt the status quo.

Increased demand for critical minerals, especially copper, due to the energy transition. Expanding copper and gold production and exploring new high-grade deposits in under-explored regions. Strategic partnerships that de-risk large-scale projects and provide access to new technologies or markets.

Zijin Mining's strong copper portfolio and ongoing expansion projects position it well. The company's global footprint in key strategic metals supports resilience. Focus on sustainable and technologically advanced mining practices is crucial.

The mining industry analysis indicates that Zijin Mining must prioritize technological innovation and sustainability. The company needs to manage risks related to commodity price volatility and geopolitical instability. Strategic expansion into critical minerals and partnerships will be vital for future growth.

- Focus on technological advancements to improve efficiency and reduce costs.

- Invest in ESG initiatives to meet regulatory requirements and attract investors.

- Expand copper and gold production to capitalize on market demand.

- Develop strategic partnerships to mitigate risks and access new markets.

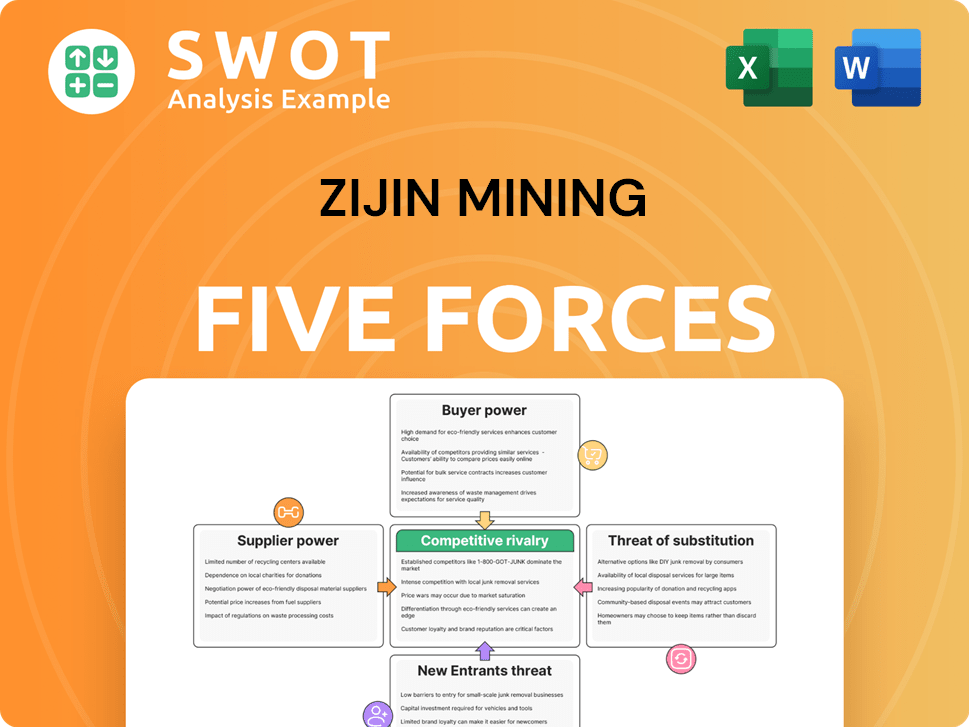

Zijin Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zijin Mining Company?

- What is Growth Strategy and Future Prospects of Zijin Mining Company?

- How Does Zijin Mining Company Work?

- What is Sales and Marketing Strategy of Zijin Mining Company?

- What is Brief History of Zijin Mining Company?

- Who Owns Zijin Mining Company?

- What is Customer Demographics and Target Market of Zijin Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.