Audacy Bundle

Can Audacy Rebound After Bankruptcy?

Audacy, a leading media company, has emerged from Chapter 11 bankruptcy with a significantly reduced debt load, setting the stage for a new chapter. This strategic deleveraging positions Audacy as a scaled, multi-platform audio leader ready to navigate the evolving media landscape. Founded in 1968, the company has a rich history in radio broadcasting and a vision for the future.

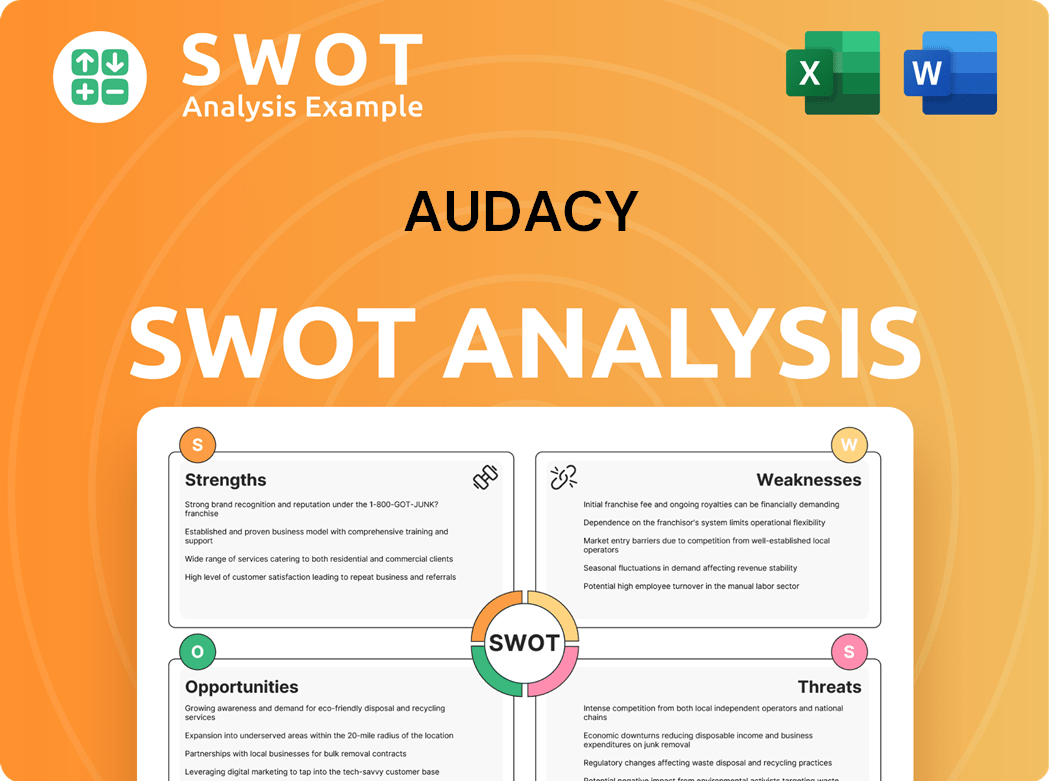

Post-bankruptcy, Audacy is focused on accelerating its digital transformation and achieving long-term growth. The company's Audacy SWOT Analysis reveals key insights into its strengths and weaknesses, guiding its strategic initiatives. By leveraging its foundation in multi-platform audio, digital innovation, and premium content, Audacy aims to capitalize on opportunities within the dynamic digital audio market, focusing on its future prospects.

How Is Audacy Expanding Its Reach?

Audacy's Audacy growth strategy is focused on expanding its multi-platform audio offerings and strengthening its digital presence. The company is actively working to offset declines in broadcast radio advertising revenue by growing its digital revenue streams. This involves significant investment in digital transformation, particularly in podcasting and live audio content.

Audacy's future prospects are closely tied to its ability to execute these expansion initiatives successfully. The company is exploring new frontiers in streaming and interactive audio to stay ahead of the curve. This strategic approach aims to capitalize on the evolving media landscape and maintain its position as a leading media company.

A key element of Audacy's expansion plans is the growth of its digital audio offerings. This includes the development of exclusive digital content and strategic partnerships to broaden its reach. The company is also focused on enhancing its leadership in sports audio, a significant revenue driver.

Audacy is accelerating its digital transformation to boost its digital revenue. This includes the expansion of its podcasting portfolio and exploring new areas in streaming and interactive audio. The company is leveraging its established presence in podcasting and live audio content to drive growth.

The launch of the Audacy Creator Lab in April 2025 is a significant step in supporting podcast creators and scaling advertising opportunities. This initiative is built on the acquisition of Podcorn in 2021. The platform expands Audacy's creator marketplace to over 20,000 shows and 40,000 creators.

Audacy is extending its leadership in sports audio, operating 40 leading local all-sports stations. It also operates the #1 Sports Podcast Network with over 600 titles. The company is the flagship home of 37 professional teams. It is also the exclusive audio sales partner of Major League Baseball.

Audacy has entered into content distribution partnerships to bring premium audio content to its digital platform. Partnerships with Urban One and Cumulus in 2021, and with Live365 and CBS stations in 2024, are examples of these strategic alliances. These partnerships help to expand Audacy's content offerings.

Audacy's expansion strategies include digital transformation, podcasting growth, and strengthening its sports audio offerings. These initiatives are designed to boost digital revenue and maintain a competitive edge in the radio broadcasting and digital audio markets.

- Focus on digital revenue growth to offset declines in broadcast radio advertising.

- Expansion of the podcasting portfolio and the Audacy Creator Lab to support creators.

- Leveraging leadership in sports audio with a strong network of stations and podcasts.

- Strategic partnerships to expand content distribution and reach.

Audacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Audacy Invest in Innovation?

Audacy is actively using technology and innovation to boost its growth, with a strong focus on digital transformation. This includes integrating advanced technologies like AI to stay competitive in the media landscape. The company's strategy emphasizes multi-platform audio, digital innovation, and premium content to attract and retain audiences.

A key part of Audacy's plan is to leverage artificial intelligence and machine learning to improve how it delivers ads, especially in its podcasts. This approach helps align content with advertising standards and allows for dynamic insertion of relevant ads. This helps Audacy target cross-platform audio campaigns more precisely, which can lead to better results for advertisers.

The company is investing in ad tech and its audio streaming platform. This commitment is evident in its focus on multi-platform audio, digital innovation, and premium content. This includes using AI to analyze conversion data from past campaigns to serve spots with the highest conversion probability. This personalized approach can drive up to twice the conversion rates.

Audacy utilizes AI to enhance contextual advertising in podcasts. This technology transcribes and categorizes podcast content, enabling the dynamic insertion of contextually relevant ads.

The integration of contextual podcast advertising significantly improves the precision of cross-platform audio campaigns. This leads to better returns for advertisers.

Audacy's measurement partner, Claritas, is developing an AI-powered predictive system. This system selects ad creative elements most relevant for target audiences.

This personalized approach can drive up to twice the conversion rates. The use of AI analyzes conversion data from past campaigns to serve spots with the highest conversion probability.

88% of marketers expect AI to have a serious impact on their business by mid-2025. Almost all executives (99%) plan to invest more in AI in 2025.

Audacy's Chief Revenue Officer, Brian Benedik, highlighted that this integration of contextual podcast advertising into their 'Ad Tech stack' significantly enhances the precision targeting of cross-platform audio campaigns.

Audacy's strategic initiatives are designed to capitalize on the evolving media landscape. The company is focused on enhancing its digital audio strategy, which includes its streaming services and podcasting strategy. The adoption of AI and machine learning is a key part of this, helping Audacy improve advertising revenue and gain a competitive edge in the radio broadcasting and media company sectors. For more insights into the company's core values, consider reading Mission, Vision & Core Values of Audacy.

Audacy's innovation in audio involves several key initiatives focused on digital transformation and AI integration to drive growth and enhance its competitive position in the media market.

- Investment in ad tech to improve targeting and efficiency.

- Development of an AI-powered predictive system to optimize ad creative selection.

- Integration of AI to enhance contextual advertising in podcasts.

- Focus on multi-platform audio and digital innovation.

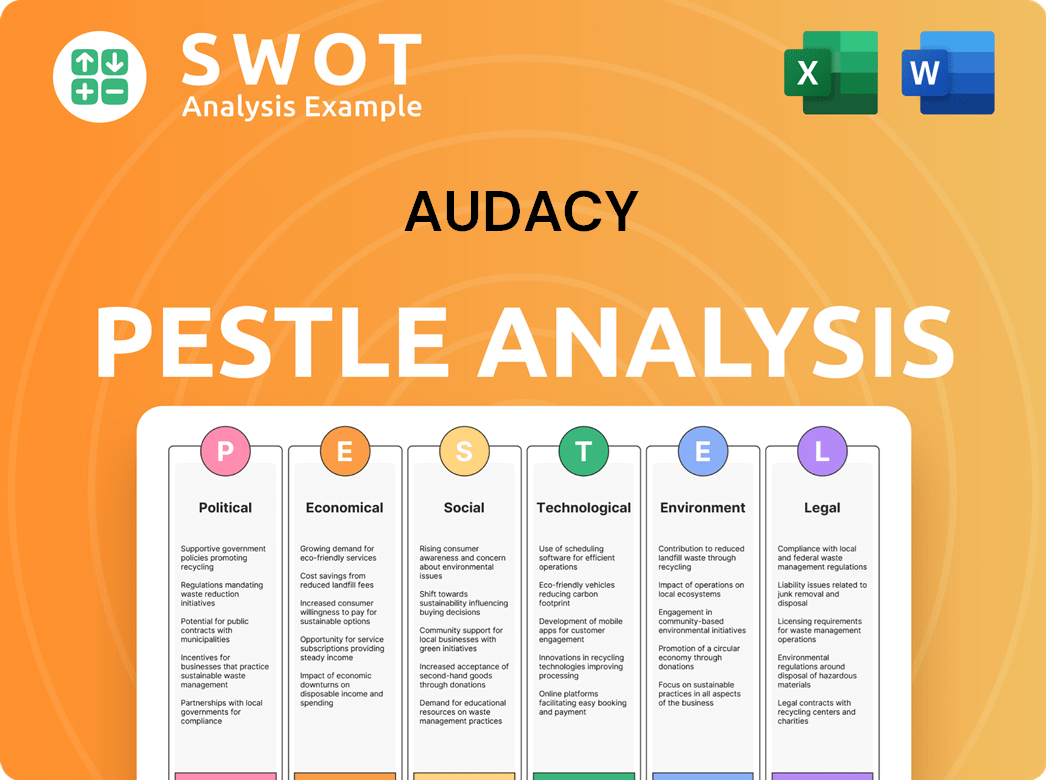

Audacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Audacy’s Growth Forecast?

The financial outlook for the Audacy growth strategy is promising, largely due to its recent emergence from bankruptcy and a significant reduction in debt. This financial restructuring has provided the company with increased flexibility to invest in technology, partnerships, and content creation, which are key elements of its Audacy future prospects.

The company's strategic focus on digital revenue growth is crucial, especially as traditional Radio broadcasting advertising revenue faces declines. Audacy's strategic initiatives include expanding its digital audio offerings and streaming services to offset these declines. The company's ability to adapt and innovate within the media company landscape will be critical for long-term success.

S&P Global Ratings projects Audacy's reported free operating cash flow (FOCF) to be approximately $10 million in 2025. This projection includes a $15 million increase in capital spending, bringing the total to $65 million, to support digital capabilities aimed at driving revenue growth. The company anticipates offsetting the expected 4%-5% annual decline in broadcast radio advertising revenue with a 10% growth in digital revenue. Digital revenue currently accounts for about 23% of Audacy's total revenue.

Audacy reported a strong start to 2024, with January revenue increasing by 1%. This growth was driven by a 1% increase in Radio revenues and a 7% increase in Digital revenues. The first quarter of 2024 showed a 1% increase, and the second quarter is expected to grow in the mid-single digits.

As of May 20, 2025, analyst forecasts project Audacy's revenue to grow from $1413 million in 2024 to $1496 million by 2025. This indicates a positive trajectory for the company's financial performance, supported by its digital audio strategy and overall expansion plans.

The net profit margin is expected to improve from -5% in 2024 to -2% by 2025. This improvement is a result of operational efficiency and strategic initiatives. The projected improvement to 6% by 2032 highlights Audacy's long-term goals and the potential for sustained profitability.

S&P Global Ratings forecasts S&P Global Ratings-adjusted EBITDA margins of 14%-15% over the next two years. This indicates a stable financial performance and the company's ability to manage its operational costs effectively, which is crucial for its success in the competitive landscape.

The future of Audacy company is closely tied to its ability to execute its digital strategy and manage its debt effectively. The company is focused on expanding its digital audio offerings, streaming services, and podcasting strategy to attract a wider audience and increase its advertising revenue.

- Deleveraged Balance Sheet: Reduced funded debt by 80%, from $1.9 billion to $350 million.

- Digital Revenue Growth: Targeting 10% growth in digital revenue to offset declines in radio advertising.

- Revenue Projections: Expected revenue growth from $1413 million in 2024 to $1496 million in 2025.

- Profitability Improvement: Net profit margin expected to improve from -5% in 2024 to -2% by 2025 and 6% by 2032.

For a deeper dive into the marketing strategies driving Audacy's growth, consider reading about the Marketing Strategy of Audacy.

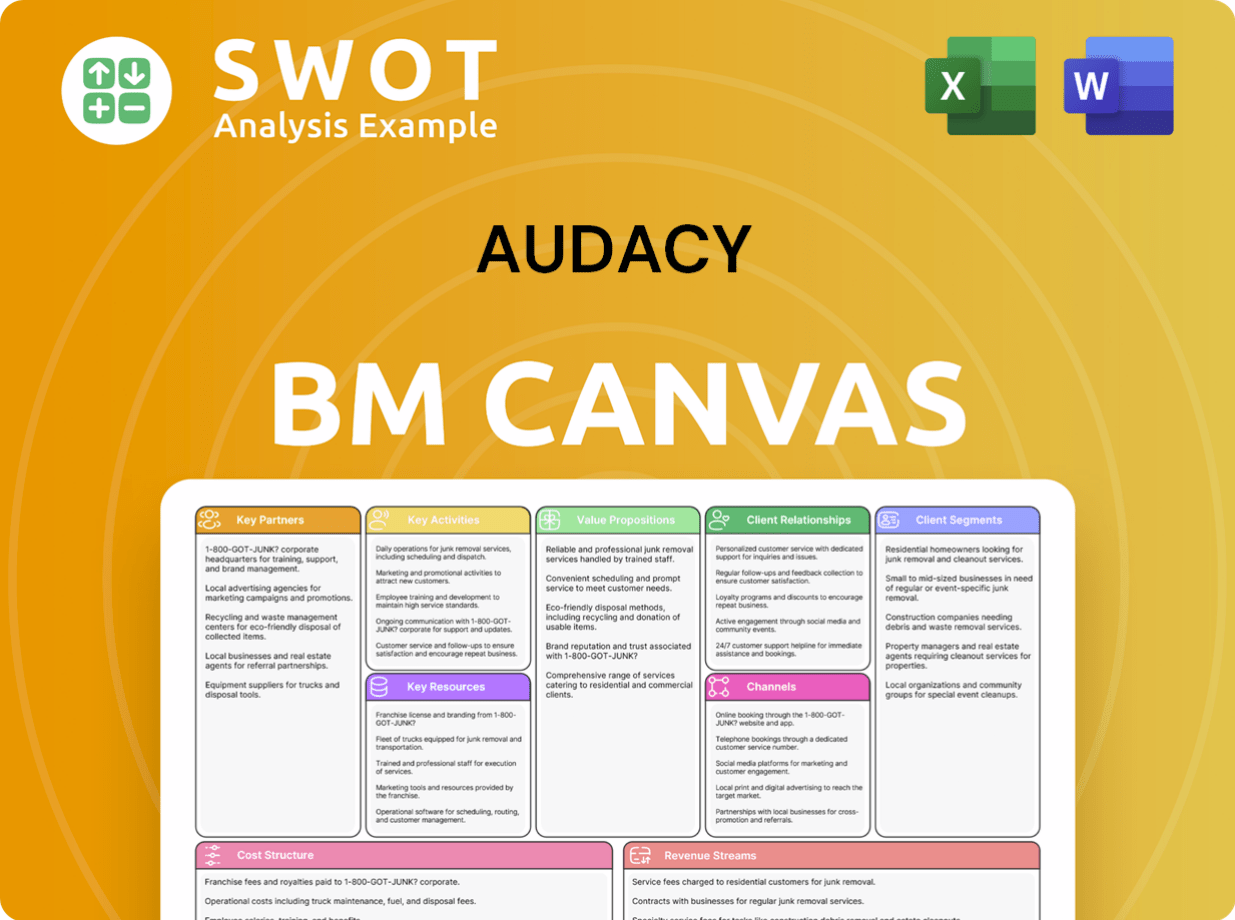

Audacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Audacy’s Growth?

Several risks and obstacles could hinder the Audacy's growth strategy and impact its future prospects. These challenges span from the decline in traditional radio advertising to the need to successfully grow its digital offerings. Understanding these potential pitfalls is crucial for assessing the Audacy company's long-term viability.

The Audacy faces significant headwinds in the media landscape, particularly from the evolving advertising market. The company must navigate a competitive environment and adapt to changing consumer habits. Addressing these challenges will be critical for Audacy's ability to achieve its strategic objectives.

A key risk stems from the continued decline in broadcast radio advertising, which still accounts for a significant portion of Audacy's revenue. S&P Global Ratings expects Audacy's broadcast radio spot revenue to be about 63% of 2019 levels in 2024 and to decline 4%-5% annually. This decline, coupled with the shift towards online advertising, poses a substantial threat to Audacy's advertising revenue.

The decline in broadcast radio advertising is a major challenge. Audacy's reliance on this revenue stream makes it vulnerable to market shifts. The company needs to diversify its revenue sources to mitigate this risk.

Audacy's future prospects heavily depend on the success of its digital offerings. Digital revenue is less than one-quarter of that of larger competitors. Intense competition could limit the expected acceleration in digital revenue growth.

Regulatory changes also pose a risk. The FCC's approval of Audacy's restructuring plan has faced scrutiny. Audacy is seeking FCC approval for up to 49.99% foreign ownership, exceeding the standard 25% cap.

Internal resource constraints and leadership changes could present transitional challenges. Job cuts across U.S. radio stations in March 2025 affected 200 to 300 staff members. Leadership changes, including the stepping down of former CEO David Field in January 2025, could also present transitional challenges.

The company's cash flow and leverage could be volatile if broadcast radio advertising declines accelerate or digital revenue growth does not materialize as expected. Macroeconomic conditions also play a crucial role in Audacy's financial performance.

Audacy operates in a highly competitive landscape, facing competition from other media company players. This competition can limit Audacy's market share. Understanding the competitive landscape is vital for strategic planning.

Audacy faces significant challenges in the dynamic media market. The company's ability to adapt to digital trends, address regulatory hurdles, and manage internal resources will be critical. For more insight into Audacy's potential audience, consider exploring the Target Market of Audacy.

Financial performance could be affected by declining advertising revenue and the success of digital initiatives. Operational risks include resource constraints and leadership transitions. Effective risk management is crucial for Audacy's long-term success.

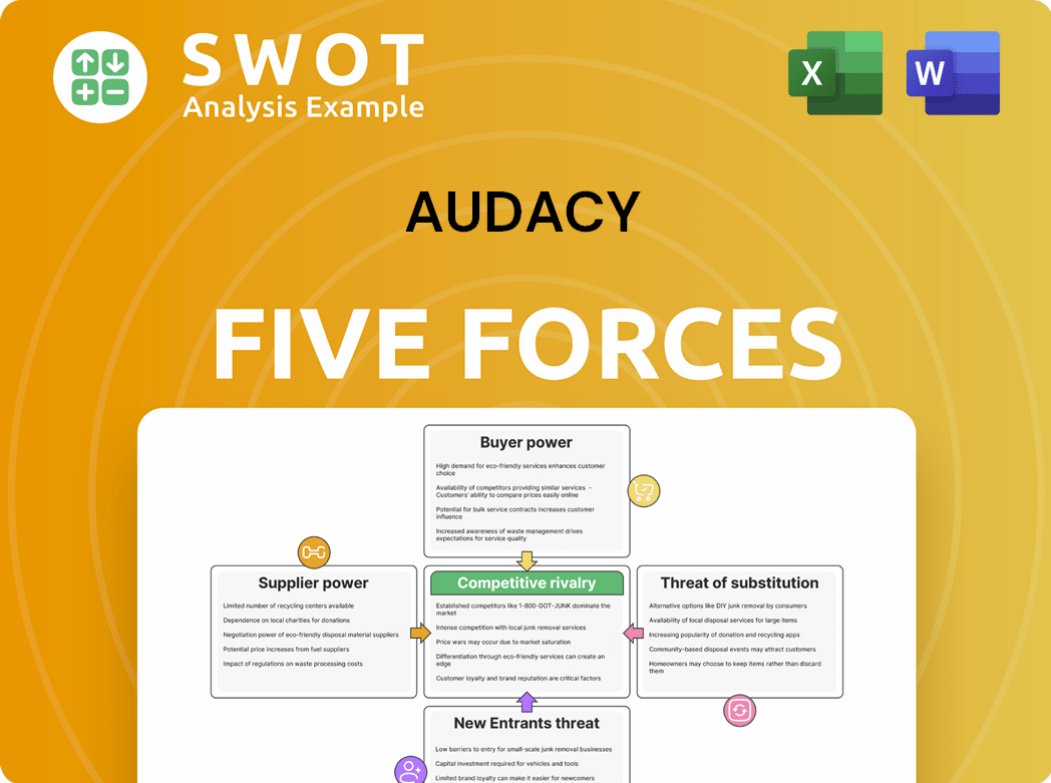

Audacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Audacy Company?

- What is Competitive Landscape of Audacy Company?

- How Does Audacy Company Work?

- What is Sales and Marketing Strategy of Audacy Company?

- What is Brief History of Audacy Company?

- Who Owns Audacy Company?

- What is Customer Demographics and Target Market of Audacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.