BGC Bundle

Can BGC Group's Ambitious Strategy Redefine the Financial Landscape?

Fresh off its acquisition of OTC Global Holdings on April 1, 2025, BGC Group, Inc. (BGC) is poised to dominate the Energy, Commodities, and Shipping (ECS) brokerage sector. This strategic move signifies a pivotal moment in the company's evolution, demanding a close examination of its BGC SWOT Analysis and future trajectory. Founded in 1945, BGC has consistently adapted to market changes, evolving from a fixed-income brokerage to a global financial technology leader.

This report dives deep into BGC's BGC company growth strategy, exploring its BGC future prospects within a dynamic financial services environment. We'll analyze the company's expansion plans, innovation initiatives, and financial outlook, providing a comprehensive BGC market analysis to understand its position in the BGC competitive landscape. Understanding the BGC business development plans is crucial for anyone seeking to understand the potential for future investment opportunities in BGC and the company's ability to navigate the BGC industry trends.

How Is BGC Expanding Its Reach?

The BGC Group is actively pursuing a robust BGC company growth strategy, focusing on expansion through strategic acquisitions, new market entries, and enhancements to its product and service offerings. These initiatives are designed to bolster its market share and diversify revenue streams, particularly in high-growth sectors. The company's approach includes both organic growth and inorganic strategies, aiming to capitalize on emerging opportunities within the financial services industry.

A key element of BGC's strategy involves leveraging its existing strengths in electronic trading and expanding its capabilities in this area. This includes the development and enhancement of platforms like Fenics, which are designed to provide clients with improved pricing and capital efficiency. The company's focus on technology-driven execution is expected to drive higher-margin business and support its long-term growth projections. This strategy is supported by investments in technology and strategic partnerships to enhance its competitive advantages in the market.

BGC's future prospects are significantly influenced by its ability to execute these expansion initiatives effectively. The company's strategic plan for expansion includes a combination of acquisitions and organic growth. This approach aims to position BGC for sustained growth and increased profitability in the competitive financial services landscape. The company's financial performance and future outlook are closely tied to the success of these strategic moves.

BGC Group acquired OTC Global Holdings on April 1, 2025, for $325 million in an all-cash transaction. This acquisition is a significant part of the company's expansion strategy. It is expected to transform BGC's Energy, Commodities, and Shipping (ECS) business.

BGC is expanding its electronic trading capabilities through its Fenics business. The FMX Futures Exchange launched in September 2024. The company aims to convert more voice/hybrid execution into higher-margin, technology-driven execution.

The FMX UST platform saw average daily volume reach a record $60 billion in Q1 2025. This represents a 33% year-over-year increase. FMX FX saw a 105% growth to $14 billion average daily volume.

BGC is focused on expanding its presence in high-growth sectors. The pending acquisition of Sage Energy Partners also aims to bolster BGC's market share. This strategy is part of BGC's broader business development plan.

BGC's expansion initiatives include strategic acquisitions and the enhancement of electronic trading platforms. These efforts are designed to drive growth and increase market share. The company's focus on technology and strategic partnerships is crucial for its competitive advantage.

- Acquisition of OTC Global Holdings for $325 million.

- Launch of the FMX Futures Exchange.

- Significant growth in FMX UST and FMX FX trading volumes.

- Focus on converting voice/hybrid execution to technology-driven execution.

BGC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BGC Invest in Innovation?

The growth strategy of the BGC Group is heavily reliant on its investments in technology and innovation. The company has strategically invested over $1.7 billion in technology since 1998, primarily through its eSpeed platform, to meet the complex needs of its clients and maintain a competitive edge. This approach is crucial for its future prospects, especially in the rapidly evolving financial markets.

A core element of this strategy involves the continuous development and expansion of its electronic trading platforms, with a particular focus on the Fenics business. This commitment is underscored by the launch of the FMX Futures Exchange in September 2024, which aims to bring innovation and efficiency to the U.S. interest rate markets. The company's business development is significantly influenced by its technological advancements.

Furthermore, BGC Group is leveraging digital transformation and automation to enhance operational efficiency. This includes the application of cutting-edge technologies to achieve its growth objectives. For a deeper understanding of the company's target market, consider reading about the Target Market of BGC.

The ongoing development and expansion of electronic trading platforms, particularly the Fenics business, are central to BGC's strategy. This focus is designed to enhance the company's competitive position. BGC's market analysis shows that these platforms are crucial for adapting to market changes.

Launched in September 2024, the FMX Futures Exchange is a key initiative to bring innovation, superior pricing, and improved capital efficiency to the U.S. interest rate markets. This demonstrates BGC's commitment to technological advancement. This exchange is a significant factor in BGC's competitive landscape.

The FMX UST platform achieved a record average daily volume of $60 billion in Q1 2025, marking a 33% year-over-year increase. This highlights the platform's success and its contribution to BGC's financial performance and future outlook. This growth also reflects positive BGC industry trends.

FMX FX experienced a substantial increase, growing by 105% to $14 billion in average daily volume. This growth underscores the effectiveness of BGC's expansion strategies. It also indicates strong potential for international expansion.

BGC Group is actively leveraging digital transformation and automation to improve operational efficiency. This approach supports the company's growth objectives. This is a key component of BGC's strategic plan for expansion.

The financial services industry is increasingly adopting technologies like AI and IoT. While specific details on BGC's R&D investments in these areas are not extensively detailed, the company's focus on its proprietary Fenics platform demonstrates its commitment to technology-driven services. This also reflects BGC's competitive advantages in the market.

BGC's strategic investments in technology and innovation are pivotal for its growth. The company's commitment to electronic trading platforms, particularly Fenics, and the launch of the FMX Futures Exchange are significant. These initiatives are designed to enhance market share and growth rate.

- $1.7 billion invested in technology since 1998.

- FMX UST platform achieved $60 billion average daily volume in Q1 2025, a 33% year-over-year increase.

- FMX FX grew by 105% to $14 billion average daily volume.

- Focus on digital transformation and automation for operational efficiency.

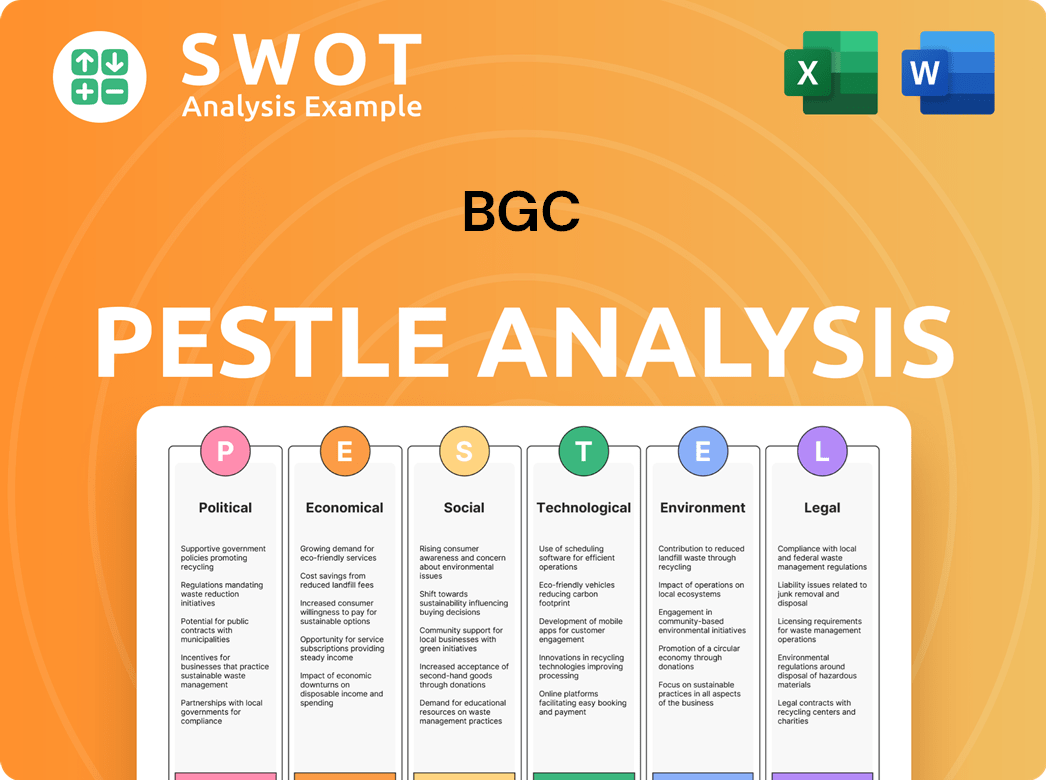

BGC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BGC’s Growth Forecast?

The financial outlook for BGC Group is notably positive, reflecting robust performance and promising growth trajectories. The company's strategic initiatives and adaptability to market dynamics are key drivers of its financial success. Understanding the financial performance and projections is crucial for assessing BGC's potential for future investment and strategic planning. This detailed analysis provides insights into BGC's financial health and future prospects.

BGC Group's financial performance showcases a strong foundation for continued expansion. The company's ability to achieve record revenues and significant year-over-year growth across various sectors demonstrates its resilience and effective market strategies. Investors and stakeholders can use this information to make informed decisions about future investment opportunities in BGC. The company's focus on innovation and strategic planning positions it well for sustained growth in the evolving market.

BGC's strategic plan for expansion is supported by its strong financial performance and proactive market strategies. The company's growth is broad-based, with significant contributions from key sectors like Foreign Exchange, Energy, Commodities, Shipping, and Rates. The detailed analysis of BGC's growth strategy reveals a commitment to innovation and market adaptation. For more insights into the company's mission and values, consider reading Mission, Vision & Core Values of BGC.

BGC Group reported record revenue of $664.2 million in Q1 2025, marking a 14.8% year-over-year increase from Q1 2024. This growth was driven by strong performance in Foreign Exchange (+31.0%), Energy, Commodities, and Shipping (+26.6%), and Rates (+14.8%). This demonstrates the company's ability to achieve strong financial results.

Pre-tax Adjusted Earnings for Q1 2025 increased by 18.4% to $160.2 million. Adjusted earnings per share reached $0.29, up 16.0% from the previous year. These figures highlight the company's profitability and efficient operations.

For Q2 2025, BGC has provided revenue guidance of $715 million to $765 million, representing a 30-39% increase from Q2 2024. Excluding the impact of the OTC acquisition, the company expects revenues of $605 million to $645 million, a 10-17% increase. This indicates continued revenue growth.

Pre-tax Adjusted Earnings are projected to be between $156 million and $171 million, up 24-36% year-over-year. This suggests that the company is well-positioned for sustained profitability.

BGC Group's financial health is further supported by its liquidity and strategic financial decisions. The company's strategic plan includes share repurchases and dividend payments, demonstrating confidence in its financial stability.

- Full Year 2024 Revenue: $2.17 billion, an increase of 11.48% compared to the prior year.

- Analyst Forecast: Earnings and revenue to grow by 65.2% and 19% per annum, respectively, over the next three years.

- Liquidity: $1.146 billion as of March 31, 2025, compared to $897.8 million at year-end 2024.

- Share Repurchases: Authorized repurchases of up to $400 million in Company Equity Securities and $50 million in Company Debt Securities.

- Dividends: Pays a quarterly dividend of 2 cents per share.

BGC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BGC’s Growth?

The financial services sector presents several potential risks and obstacles for the company. These challenges include market competition, technological advancements, and regulatory changes. Understanding and mitigating these risks is crucial for the company's sustained growth and success.

Market dynamics and economic conditions also pose significant risks. Fluctuations in interest rates, inflation, and geopolitical events can impact trading volumes and the valuation of financial instruments. The company's ability to navigate these uncertainties is essential for maintaining financial stability and achieving its growth objectives.

Operational risks, such as integrating acquisitions and identifying new market opportunities, add to the complexity. The successful integration of acquisitions like OTC Global Holdings is critical for realizing the anticipated value. Furthermore, the company must adapt to new technologies to stay competitive.

The competitive landscape includes major players like ICAP, TP ICAP, and Tradition. These competitors constantly vie for market share, requiring the company to innovate and maintain a strong market position. The company's ability to differentiate itself is key to its BGC company growth strategy.

Rapid technological changes necessitate continuous investment in technology. The company must stay at the forefront of technological developments to enhance its services and maintain a competitive edge. This includes adopting new platforms and improving trading systems.

The financial industry is heavily regulated, and changes in regulations can impact operations and profitability. Compliance with new rules and adapting to evolving regulatory environments are ongoing challenges. These changes can affect the company's strategic plans.

Operational risks include the challenges of identifying and exploiting new market opportunities. Integrating acquisitions, such as OTC Global Holdings, and managing growth are also critical. Effective risk management is essential to mitigate potential disruptions.

Global economic and market conditions, including geopolitical instability, fluctuating interest rates, and inflation, significantly influence trading volumes and valuations. The company's ability to navigate these uncertainties is crucial for its financial performance. The company must manage these factors effectively to ensure continued growth and stability.

The departure of key personnel, such as the Chairman & CEO, can introduce uncertainty. While analysts may remain optimistic, leadership transitions can impact the company's strategic direction and operational stability. The company needs to ensure a smooth transition to maintain investor confidence.

The company addresses risks through diversification across various financial products and services. This diversification helps to mitigate the impact of market fluctuations. Diversification is a key element of the company's

Effective risk management strategies are essential to mitigate the impact of market risks, such as interest rate and foreign currency exchange rate volatility. The company employs robust risk management practices to protect its financial performance. Proper risk management is crucial for long-term sustainability.

BGC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.