Brookshire Grocery Bundle

Can Brookshire Grocery Company Continue Its Southern Grocery Dominance?

Since 1928, Brookshire Grocery Company (BGC) has been a cornerstone of the Southern United States' retail landscape. From a single store in Tyler, Texas, to over 209 locations today, BGC's journey reflects a deep commitment to customer service and community. With the grocery market exceeding $900 billion and growing, understanding BGC's strategic moves is crucial.

This analysis dives into the Brookshire Grocery SWOT Analysis, exploring its expansion plans, financial performance, and competitive landscape within the dynamic retail industry. We'll examine how BGC navigates evolving consumer preferences, including online grocery shopping and sustainability, to maintain its market share in Texas and beyond. Furthermore, we'll explore the impact of inflation, supply chain management, and strategic initiatives on BGC's future prospects, offering insights for investors and industry watchers alike.

How Is Brookshire Grocery Expanding Its Reach?

The company's growth strategy centers on strategic expansion and market penetration, aiming to increase its footprint and customer base. This approach involves both organic growth through new store openings and inorganic growth via acquisitions. The company's focus on providing high-quality products, competitive pricing, and excellent customer service supports its expansion initiatives.

Recent activities highlight the company's commitment to expanding its presence in key markets. These strategic moves are designed to capitalize on market opportunities and adapt to the evolving retail landscape. The company’s expansion strategy is also influenced by retail industry trends, including the growing demand for convenient shopping experiences and a wider array of product offerings.

The company's future prospects are closely tied to its ability to execute these expansion plans effectively. By focusing on strategic growth and adapting to market dynamics, the company aims to strengthen its position in the competitive grocery store chain sector. For more information about the competitive environment, you can read about the Competitors Landscape of Brookshire Grocery.

A key component of the company's expansion strategy involves opening new stores in strategic locations. The planned opening of a second Super 1 Foods store in Ruston, Louisiana, with groundbreaking expected in early 2025, exemplifies this initiative. This new store will showcase the latest generation of Super 1 Foods, emphasizing fresh produce, high-quality meats, and customer service.

The company has actively pursued acquisitions to accelerate its growth and expand its market presence. In October 2024, the company announced the acquisition of four Shoppin' Baskit stores in West and Central Texas. These stores will be converted into Spring Market stores, expanding the company's footprint in Texas. The acquisition of Reasor's in January 2022, which added 17 stores in Oklahoma, was a significant move.

The company is implementing strategic partnerships to diversify its offerings and enhance customer experience. The conversion of Shoppin' Baskit stores in Texas includes a partnership with ACE Hardware in the Ballinger location. This collaboration provides customers with access to ACE Hardware products, expanding the range of goods available. These partnerships are aimed at staying ahead of industry changes and offering a wider array of services.

The company's expansion efforts are primarily focused on accessing new customer bases and solidifying its regional presence. The acquisition of Reasor's significantly expanded its geographical reach and market share in Oklahoma. The new store openings and conversions in Texas are designed to strengthen its position in these key markets. These strategies are aimed at improving the company's overall market share.

The company's expansion strategy includes both organic growth through new store openings and inorganic growth via acquisitions. The new Super 1 Foods store in Ruston, Louisiana, is a key initiative. The acquisition of the Shoppin' Baskit stores and Reasor's demonstrates a commitment to expanding its market presence.

- Opening of a second Super 1 Foods store in Ruston, Louisiana, with groundbreaking in early 2025.

- Acquisition of four Shoppin' Baskit stores in West and Central Texas in October 2024.

- Conversion of Shoppin' Baskit stores into Spring Market stores, expected in early December 2024.

- Partnership with ACE Hardware in the Ballinger location as part of the Shoppin' Baskit conversion.

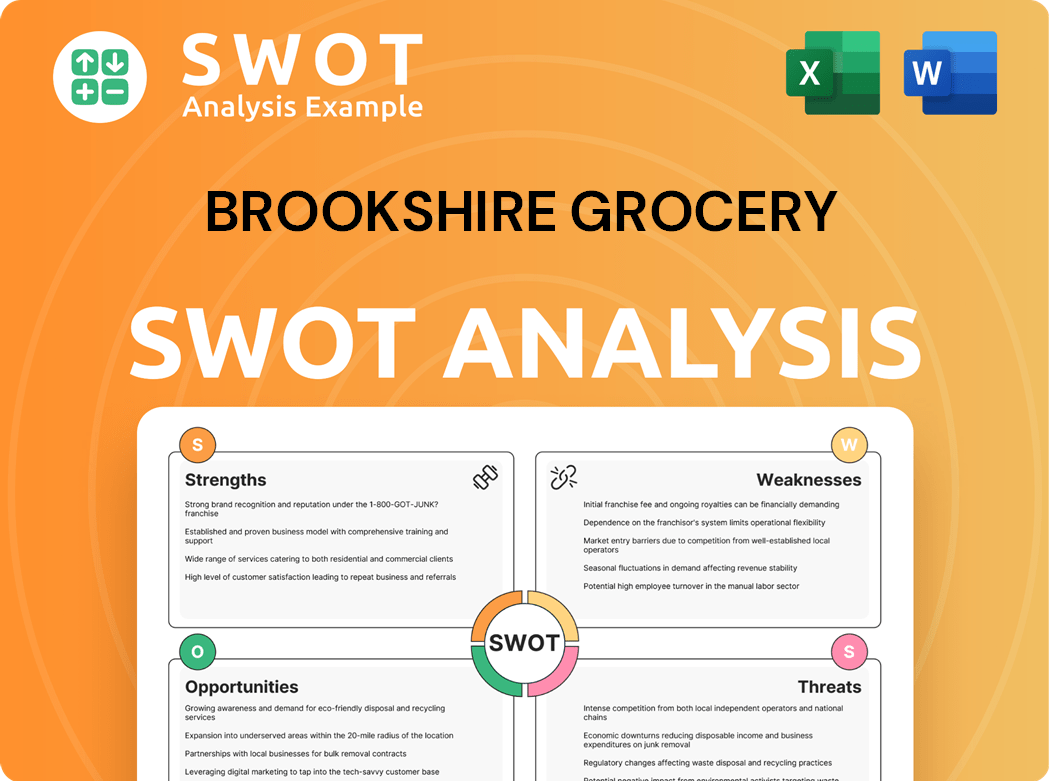

Brookshire Grocery SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Brookshire Grocery Invest in Innovation?

The Brief History of Brookshire Grocery reveals its commitment to innovation and technology to improve operational efficiency and enhance customer experience. This approach is crucial for maintaining a competitive edge in the dynamic retail industry. By adopting cutting-edge solutions, the company aims to meet evolving consumer preferences and market demands.

Technological advancements are central to the company's strategy. These investments are designed to streamline operations, improve customer service, and foster sustainable growth. The focus on innovation reflects a broader trend within the retail sector, where technology plays a key role in driving success.

The company's strategic initiatives leverage technology to adapt to the changing retail landscape. These efforts are designed to enhance its market position and ensure long-term viability. By focusing on innovation, the company aims to create a more efficient and customer-centric business model.

By January 2024, the company completed the implementation of Logile's retail labor planning and workforce management (WFM) solutions across all 209 retail locations and corporate offices. This system helps determine labor needs based on sales volume and store attributes. The 'earned hours program' aims to improve associate experience, operational goals, and customer satisfaction.

The company has adopted NCR point-of-sale solutions, including NCR Emerald, a cloud-native POS system. This system is being rolled out to over 200 locations. The goal is to simplify and standardize store infrastructure. This allows for a greater focus on customer needs and personalized offers.

In August 2024, the company partnered with Local Bounti Corporation to stock its full line of produce products. This included Grab-and-Go Salad Kits, living lettuce, and baby leaf varieties. These products were available in over 180 store locations. This collaboration highlights the commitment to offering fresh, sustainable, and locally grown produce.

The company partners with Mercatus, which launched the 'next generation' of Mercatus Mobile in June 2024. This app and e-commerce platform aims to boost mobile conversions, improve order frequency, and retain online consumers. This investment demonstrates the company's strategic approach to digital transformation.

These technological investments are critical for the company's growth strategy and future prospects. They aim to enhance operational efficiency, improve customer experience, and adapt to retail industry trends. These initiatives are part of a broader effort to maintain a competitive advantage in the market.

- Labor Management: Implementing Logile's WFM solutions to optimize staffing and reduce labor costs.

- Point-of-Sale Systems: Upgrading to NCR Emerald to streamline transactions and improve customer service.

- E-commerce: Utilizing Mercatus Mobile to boost online sales and enhance customer engagement.

- Fresh Produce: Partnering with Local Bounti to offer sustainable and locally sourced produce.

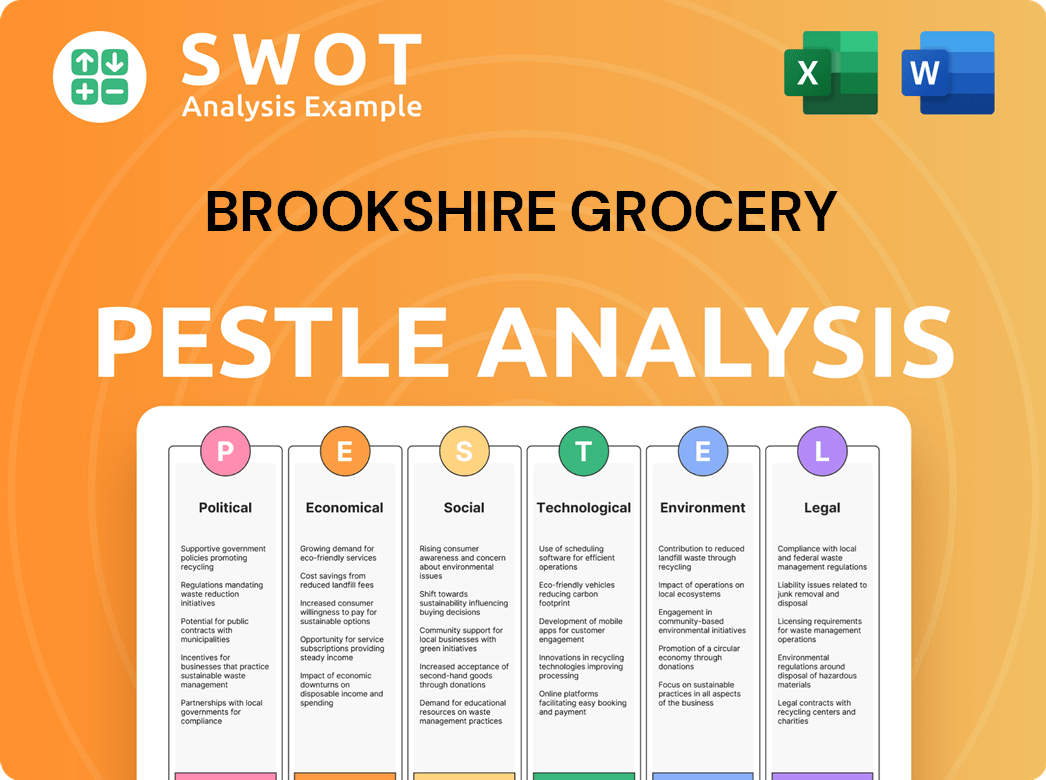

Brookshire Grocery PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Brookshire Grocery’s Growth Forecast?

Understanding the financial outlook for Brookshire Grocery Company (BGC) requires piecing together information from various sources, as the company is privately held. Despite the lack of comprehensive public financial reports, available data and industry analyses offer insights into its financial health and future projections. The Target Market of Brookshire Grocery provides additional context.

As of November 2024, Forbes reported BGC's revenue at approximately $4.4 billion. More recent data from May 2025 indicates an annual revenue of $1.2 billion. These figures provide a snapshot of the company's revenue generation, which is crucial for assessing its overall financial performance and growth trajectory.

The retail grocery market is generally viewed positively, with a projected compounded annual growth rate (CAGR) of roughly 4% over the next five years. This positive industry trend supports BGC's growth potential. Analysts forecast a CAGR of about 5% for BGC over the same period, reflecting the company’s strategic initiatives and expansion plans.

BGC's revenue has shown fluctuations. While Forbes reported $4.4 billion in November 2024, more recent data from May 2025 suggests an annual revenue of $1.2 billion. These variations highlight the need for ongoing monitoring of financial performance.

The retail grocery market is expected to grow at a CAGR of approximately 4% over the next five years. This positive outlook provides a favorable environment for BGC's expansion and strategic initiatives. This is crucial for understanding the company's future prospects.

Strategic acquisitions, such as the purchase of Reasor's, play a key role in BGC's growth strategy. Planned new store openings are also expected to contribute to revenue growth. These moves are part of BGC's strategic initiatives.

While specific profit margins are not publicly disclosed, BGC's consistent expansion and technology investments suggest a healthy financial strategy. This strategy is aimed at long-term growth and market leadership within the competitive landscape.

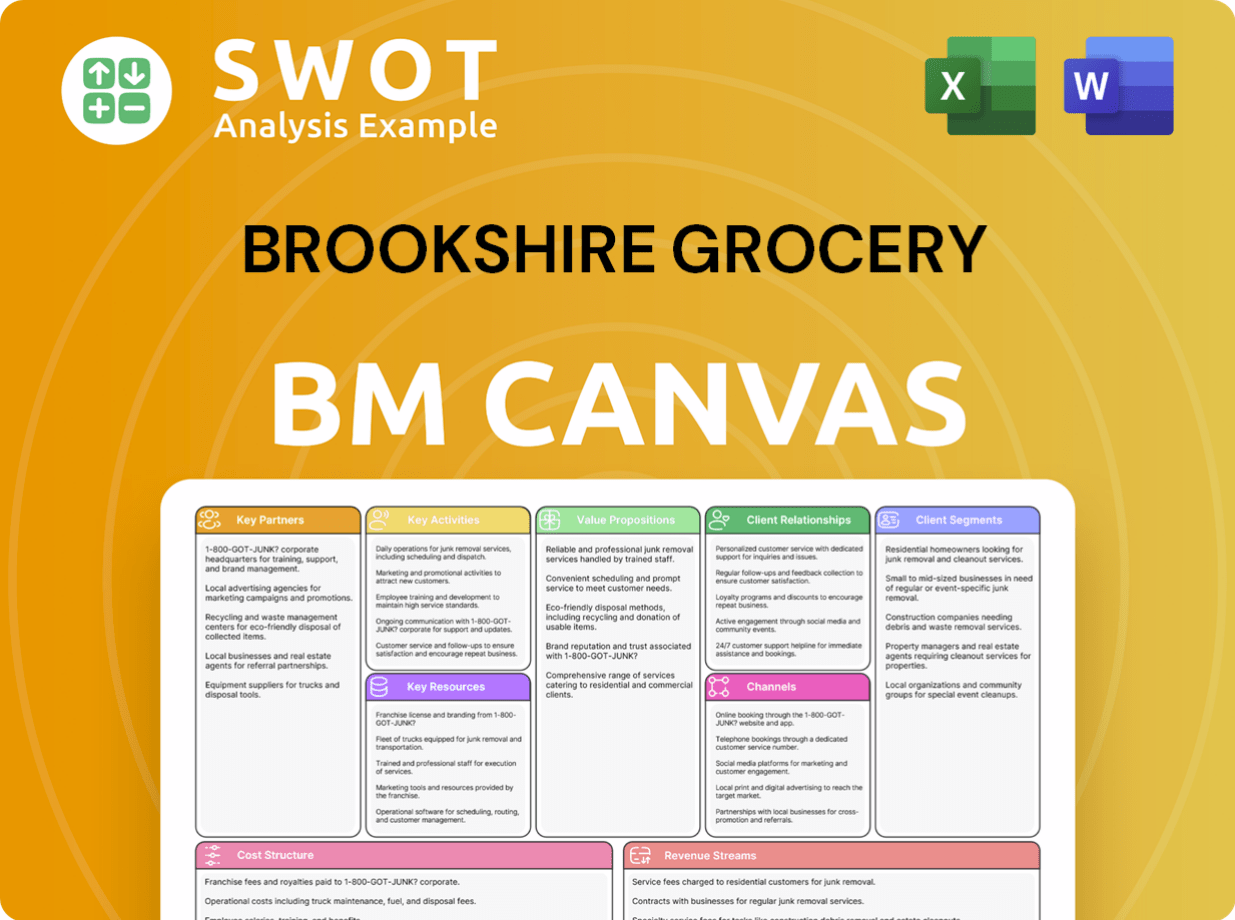

Brookshire Grocery Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Brookshire Grocery’s Growth?

The Brookshire Grocery Company (BGC), like any major player in the grocery store chain sector, faces a variety of risks that could influence its growth trajectory. These challenges range from intense competition within the retail industry to the ever-changing landscape of consumer preferences and economic conditions. Understanding these potential obstacles is crucial for evaluating the company's future prospects and strategic planning.

Market competition is a significant hurdle, as numerous regional and national competitors vie for market share. The grocery sector is known for its slim profit margins, making it vital for BGC to differentiate itself effectively. Moreover, regulatory changes, including those related to food safety, labor laws, and environmental standards, can introduce compliance complexities and increase operational expenses.

Supply chain vulnerabilities also pose an ongoing risk. Disruptions in the supply chain can lead to product shortages, higher logistics costs, and a decline in customer satisfaction. For example, the company experienced temporary store closures in July 2024 due to a global IT issue, illustrating the potential impact of technological disruptions on operations.

The grocery store chain industry is highly competitive, with both national and regional players vying for market share. This necessitates strong differentiation strategies to retain and attract customers. Competitive pressures can impact pricing, marketing, and overall profitability.

Changes in food safety regulations, labor laws, and environmental standards can pose compliance challenges for BGC. Compliance can lead to increased operational costs and require adjustments to business practices. Staying compliant is essential for avoiding penalties and maintaining consumer trust.

Supply chain vulnerabilities can lead to product shortages and increased logistics costs. Disruptions can negatively impact customer satisfaction and the company's ability to meet demand. The ability to manage and mitigate supply chain risks is crucial for maintaining operational efficiency.

Technological issues, such as the IT issue in July 2024, can cause significant operational disruptions. These disruptions can lead to store closures and impact the ability to serve customers. Investing in robust IT infrastructure and disaster recovery plans is essential.

Economic downturns, inflation, and changes in consumer spending habits can affect BGC's financial performance. Inflation can increase operating costs, while changes in consumer behavior can impact sales. Monitoring economic trends is important for adapting to market conditions.

Attracting and retaining qualified employees is a challenge in the retail industry. Labor shortages and rising labor costs can affect operational efficiency and customer service. Offering competitive wages and benefits is essential for employee retention.

To mitigate these risks, BGC focuses on exceptional customer service, clean stores, and fresh products. Investments in technology, such as the Logile workforce management system, aim to improve operational efficiency. Community involvement and local sourcing also build customer loyalty and differentiate BGC from larger competitors.

BGC competes with both national chains like Walmart and Kroger, as well as regional players. Understanding the competitive landscape is crucial for strategic decision-making. Market share analysis and competitor strategies are important for maintaining a competitive edge.

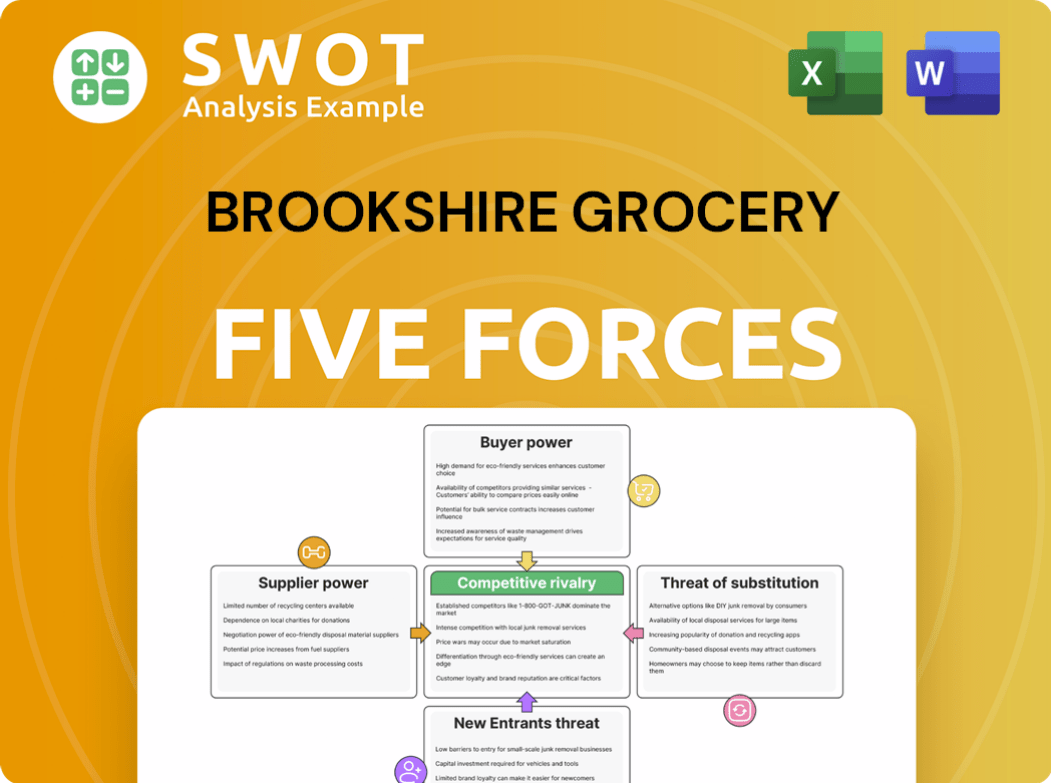

Brookshire Grocery Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brookshire Grocery Company?

- What is Competitive Landscape of Brookshire Grocery Company?

- How Does Brookshire Grocery Company Work?

- What is Sales and Marketing Strategy of Brookshire Grocery Company?

- What is Brief History of Brookshire Grocery Company?

- Who Owns Brookshire Grocery Company?

- What is Customer Demographics and Target Market of Brookshire Grocery Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.