Cintas Bundle

Can Cintas Maintain Its Dominance?

Cintas Corporation, a name synonymous with essential business services, has a rich history dating back to 1929. From its origins in uniform laundry, Cintas has transformed into a multi-billion dollar enterprise, serving over a million businesses. This evolution showcases the power of a well-executed Cintas SWOT Analysis and a forward-thinking approach to business.

This article dives deep into the Cintas growth strategy and explores the Cintas future prospects, providing a comprehensive look at the Cintas company. We'll examine its strategic initiatives, innovation, and financial outlook, offering insights into how Cintas plans to navigate the evolving business landscape and maintain its competitive edge. Understanding the key drivers of Cintas' revenue growth and its expansion plans is crucial for anyone interested in the Cintas business model and the broader Cintas industry analysis.

How Is Cintas Expanding Its Reach?

The Marketing Strategy of Cintas involves a multi-faceted approach to expansion, focusing on both organic growth and strategic acquisitions to broaden its market reach and service offerings. The company actively pursues new geographical markets within North America, particularly in regions experiencing commercial and industrial growth. This expansion is fueled by the increasing demand for outsourced uniform services, facility supplies, and safety solutions across various industries.

Cintas aims to attract new customers by leveraging its established reputation and comprehensive service portfolio. This strategy is supported by continuous enhancements to existing offerings and the introduction of new solutions to meet evolving customer needs. The company's focus on strategic mergers and acquisitions, such as the significant acquisition of G&K Services in 2017, has substantially expanded its market share and operational footprint.

Cintas' growth strategy also includes expanding its fire protection and document management services, which offer opportunities for cross-selling to existing clients and attracting new ones. While specific acquisition details for late 2024 or early 2025 are not available, the company's history suggests that opportunistic acquisitions remain a part of its long-term growth strategy to diversify revenue streams and stay ahead of industry changes.

Cintas is targeting new markets within North America, focusing on areas with robust commercial and industrial activity. This expansion is driven by the increasing demand for its services. The company aims to capture new customers by leveraging its established reputation and comprehensive service portfolio.

Cintas continually enhances its existing offerings and introduces new solutions to meet evolving customer needs. This includes advancements in uniform rental programs, such as incorporating sustainable fabric options. The company is also expanding its first aid and safety product lines.

Cintas has a history of strategic mergers and acquisitions to expand its market share and operational footprint. The acquisition of G&K Services in 2017 is a prime example. While specific acquisitions in late 2024 or early 2025 are not available, the company is expected to continue this strategy.

Cintas focuses on expanding its fire protection and document management services. These expansions offer avenues for cross-selling to existing clients and attracting new ones. This diversification enhances the company's revenue streams.

Cintas' expansion initiatives are driven by several key factors, including increasing demand for outsourced services and a focus on strategic acquisitions. The company's ability to adapt to changing market needs and integrate new technologies is also crucial. These factors contribute to the company's long-term growth prospects.

- Growing demand for uniform rental and facility services.

- Strategic acquisitions to increase market share and service offerings.

- Continuous enhancement of existing services and introduction of new solutions.

- Expansion into new geographical markets with high growth potential.

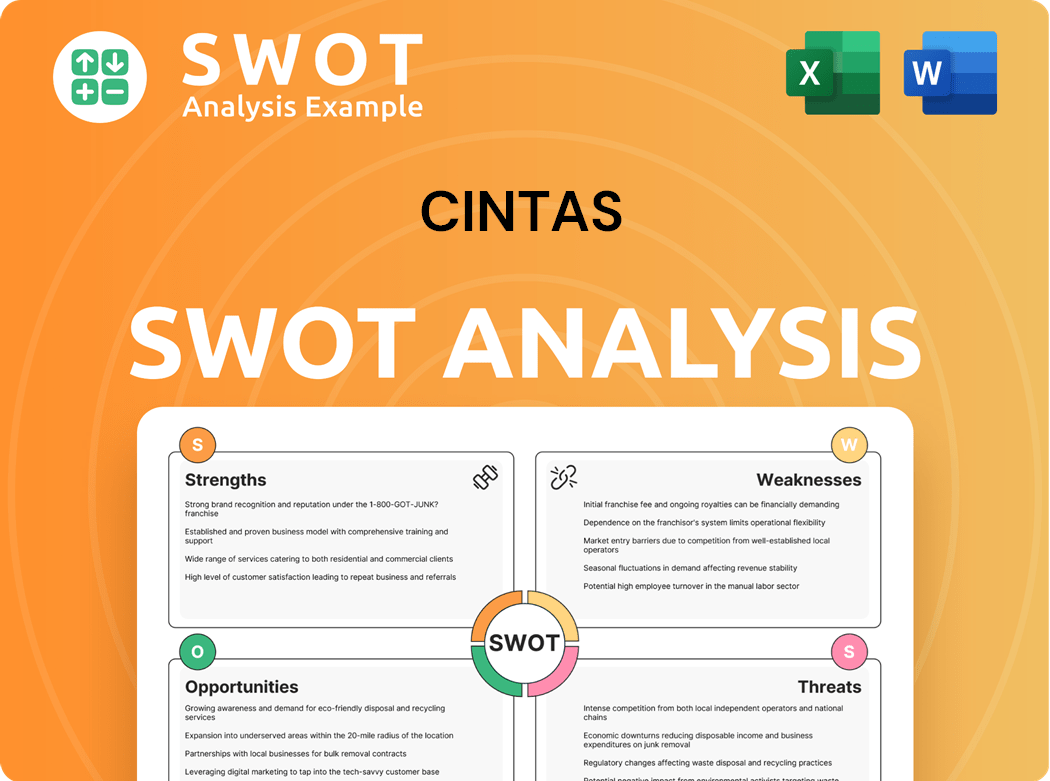

Cintas SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cintas Invest in Innovation?

To sustain its Cintas growth strategy, the company actively integrates innovation and technology. This approach is essential for enhancing service delivery and maintaining a competitive edge in the uniform and facility services sectors. By focusing on technological advancements, the company aims to improve operational efficiency and meet evolving customer demands.

The company's commitment to innovation is evident in its investments in research and development. These efforts are directed towards improving its product offerings, particularly in uniform design and functionality. This includes exploring advanced materials and features tailored for various industries, ensuring uniforms are durable, comfortable, and meet specific industry needs.

Furthermore, the company is undergoing a digital transformation to optimize internal operations and enhance customer experience. This digital focus enables better management of resources and improved service delivery, aligning with its long-term growth objectives.

Automation plays a key role in improving efficiency and reducing operational costs. The company is implementing robotics and advanced sorting systems in its laundries and distribution centers.

The company is exploring data analytics and AI to better understand customer needs. This includes optimizing delivery routes and predicting inventory requirements.

Sustainability is a key focus, with innovations aimed at reducing environmental impact. This includes water-saving technologies and sustainable uniform materials.

Data-driven insights help tailor uniform programs more effectively. This approach allows the company to manage its supply chain with greater precision.

The company is optimizing its fleet for fuel efficiency. This supports its sustainability goals and reduces operational costs.

Continuous investment in these areas demonstrates its commitment to maintaining a competitive edge. This supports its growth objectives through technological advancement.

The company's focus on innovation extends to sustainability initiatives, driven by growing customer demand for eco-friendly solutions. This includes exploring water-saving technologies in its laundries, developing more sustainable uniform materials, and optimizing its fleet for fuel efficiency. While specific details on recent patents or industry awards for technological breakthroughs in late 2024 or early 2025 are not widely publicized, the company's continuous investment in these areas demonstrates its commitment to maintaining a competitive edge and supporting its Cintas future prospects through technological advancement. For a broader view of the competitive environment, consider an analysis of the Competitors Landscape of Cintas.

The company's approach to innovation and technology is multifaceted, focusing on efficiency, customer experience, and sustainability. These strategies are crucial for long-term growth and maintaining a strong market position.

- Automation: Implementing robotics and advanced systems in laundries and distribution centers to improve efficiency.

- Data Analytics: Using data to understand customer needs, optimize routes, and predict inventory.

- Sustainable Practices: Developing eco-friendly solutions, including water-saving technologies and sustainable materials.

- Digital Transformation: Optimizing internal operations and enhancing customer experience through digital tools.

- Fleet Optimization: Improving fuel efficiency to reduce environmental impact and operational costs.

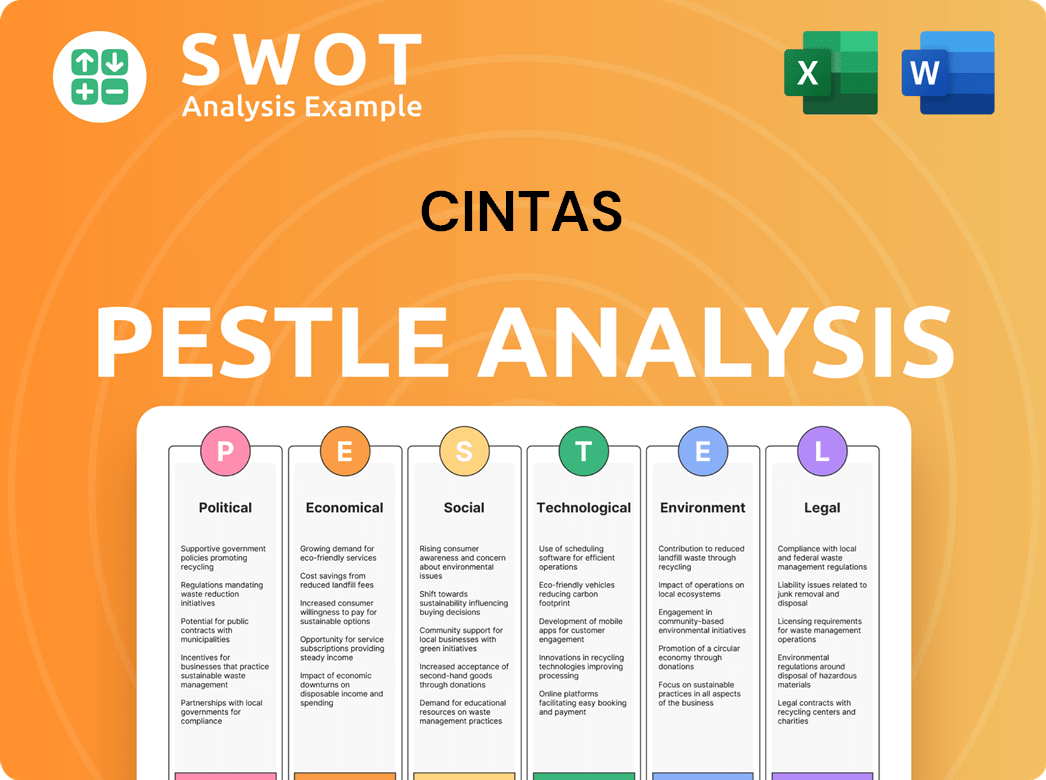

Cintas PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cintas’s Growth Forecast?

The financial outlook for Cintas Corporation is notably positive, reflecting its robust Cintas growth strategy and strong market position. The company has consistently demonstrated its ability to generate substantial revenue and profit growth, supported by the essential nature of its services and effective operational strategies. This consistent performance positions Cintas favorably for sustained expansion and value creation.

For the third quarter of fiscal year 2024, Cintas reported revenues of $2.41 billion, marking a 9.9% increase compared to the same period in the prior year. This growth underscores the effectiveness of the Cintas business model and its ability to capture market share. Additionally, the company's diluted earnings per share from continuing operations for the same period were $3.86, reflecting a 22.2% increase year-over-year. This showcases Cintas's capacity to enhance profitability alongside revenue growth.

Looking ahead, Cintas anticipates continued financial success. The company projects revenue to be between $9.48 billion and $9.53 billion for fiscal year 2024, with diluted earnings per share from continuing operations expected to range from $14.75 to $14.90. These projections highlight the Cintas future prospects and its commitment to sustainable growth. Cintas's financial planning includes strategic investments in expansion, technology, and potential acquisitions, supported by robust cash flow generation.

Cintas's revenue growth is driven by strong demand for its services and effective market strategies. The company's ability to secure and retain customers is a key factor. The consistent increase in revenue demonstrates the effectiveness of its Cintas growth strategy.

Improving profitability is a core focus for Cintas, reflected in its increasing earnings per share. This is achieved through efficient operations and strategic pricing. The company's financial performance indicates a strong ability to manage costs and improve margins.

Cintas invests in expansion initiatives, technology, and acquisitions to support long-term growth. These investments are funded by strong cash flow generation. These strategic moves are crucial for maintaining competitive advantages.

Favorable market conditions and the essential nature of Cintas's services contribute to its success. The company operates in a stable and growing market. This stability supports consistent financial performance and Cintas future prospects.

Strong cash flow generation enables Cintas to fund its growth initiatives and shareholder returns. This financial strength supports strategic decisions. The effective management of cash flow is a key indicator of the company's financial health.

Cintas's financial performance supports its ability to deliver value to shareholders. This is achieved through a combination of revenue growth and improved profitability. The company's focus on shareholder value is evident in its financial strategies.

Cintas's financial success is built on several key factors. The company's strategic initiatives and favorable market conditions are crucial. The company's consistent performance demonstrates its ability to sustain growth and profitability.

- Revenue Growth: The company reported a 9.9% increase in revenue for Q3 FY2024.

- Earnings per Share: Diluted earnings per share increased by 22.2% year-over-year in Q3 FY2024.

- Revenue Forecast: For FY2024, revenue is projected to be between $9.48 billion and $9.53 billion.

- Earnings Forecast: Diluted earnings per share for FY2024 are expected to be between $14.75 and $14.90.

For more information about the company's values and mission, you can read about it here: Mission, Vision & Core Values of Cintas. Cintas continues to demonstrate its commitment to sustainable financial performance and strategic growth, making it a compelling company in its Cintas industry analysis.

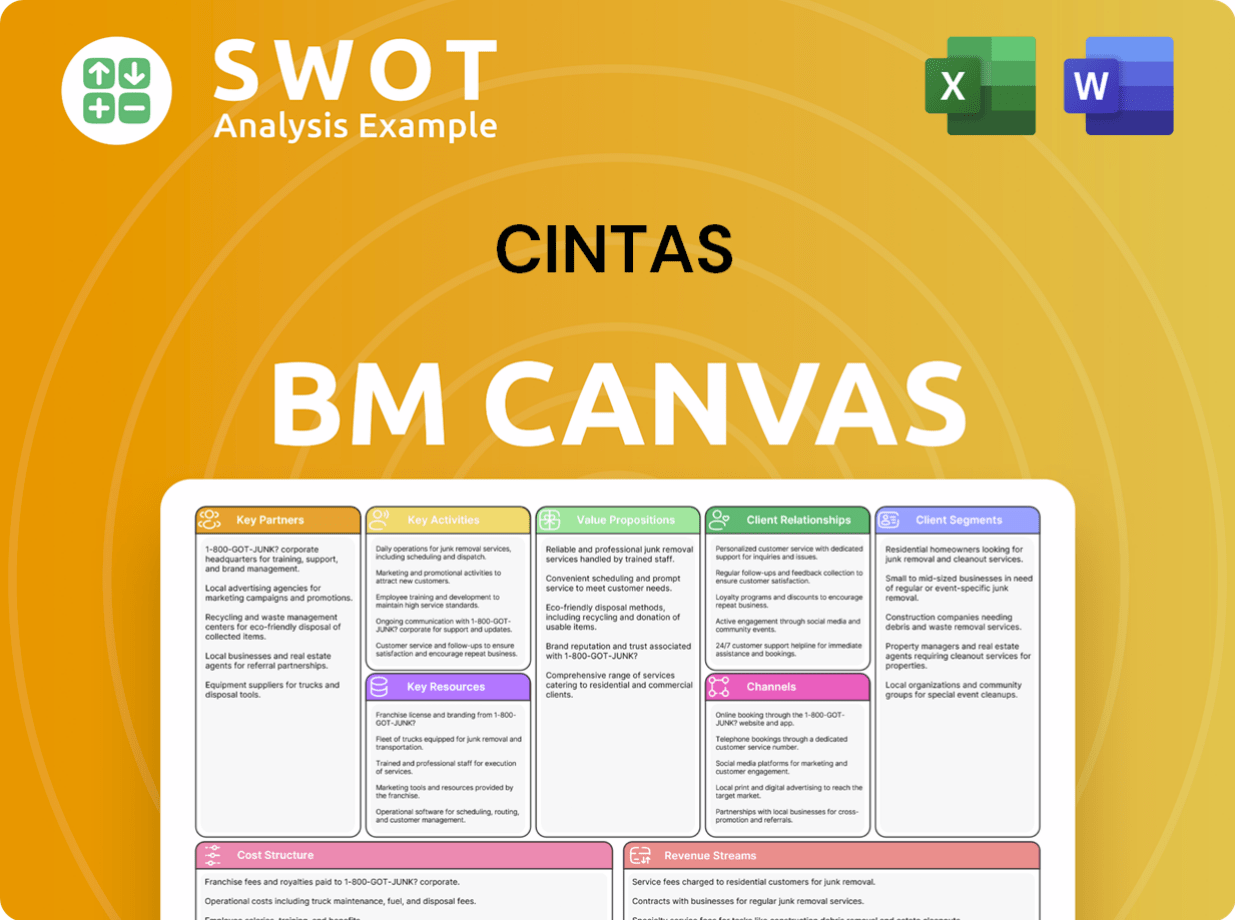

Cintas Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cintas’s Growth?

Several potential risks and obstacles could influence the future of the Cintas company and its Cintas growth strategy. These challenges span market competition, regulatory changes, supply chain vulnerabilities, and technological disruptions. Understanding these potential hurdles is crucial for evaluating Cintas' future prospects.

The competitive landscape presents a constant challenge, with numerous players vying for market share in uniform rental, facility services, and safety solutions. Intense price competition could affect profit margins. Additionally, internal resource constraints, such as the availability of skilled labor, could hinder growth. Addressing these risks is essential for sustained success.

Furthermore, geopolitical events, trade disputes, and technological disruption could pose significant challenges. The rise of on-demand services or highly specialized niche providers could challenge the traditional operational model. The company's ability to adapt and innovate will be key to navigating these complex issues and maintaining its market position.

The uniform rental and facility services markets are highly competitive, with numerous regional and national competitors. Intense price competition can squeeze profit margins. This requires continuous innovation and efficiency improvements to maintain a competitive edge.

Changes in workplace safety regulations, environmental standards, and labor laws could increase compliance costs. Adapting to these changes requires ongoing investment in training, equipment, and operational adjustments. Staying ahead of regulatory changes is crucial.

Disruptions in the supply chain, such as shortages of raw materials or manufacturing delays, can impact the ability to meet customer demand. Diversifying suppliers and maintaining robust inventory management are essential strategies. Geopolitical events can exacerbate these issues.

New technologies and business models, such as on-demand services, could disrupt the traditional service industry. Investing in technology and adapting to new service delivery models is crucial. Staying innovative is key to maintaining market relevance.

The availability of skilled labor for service routes and plant operations can be a constraint on growth. Investing in employee training and retention programs is essential. Managing labor costs effectively is also important for profitability.

Economic downturns can reduce demand for services, affecting revenue and profitability. Diversifying service offerings and customer base can help mitigate these risks. Maintaining financial flexibility is crucial during economic uncertainty.

The company mitigates risks through diversification of its service offerings, reducing reliance on any single market segment. It employs robust risk management frameworks, including scenario planning, to anticipate and prepare for potential disruptions. Continuous improvement initiatives and strategic adjustments are also key.

Specific examples of major obstacles and how the company overcame them in late 2024 or early 2025 are not widely detailed. The company's long history suggests a proactive approach to risk mitigation, adapting to market shifts and operational challenges through strategic adjustments and continuous improvement initiatives. The company's financial performance reflects its ability to navigate challenges effectively.

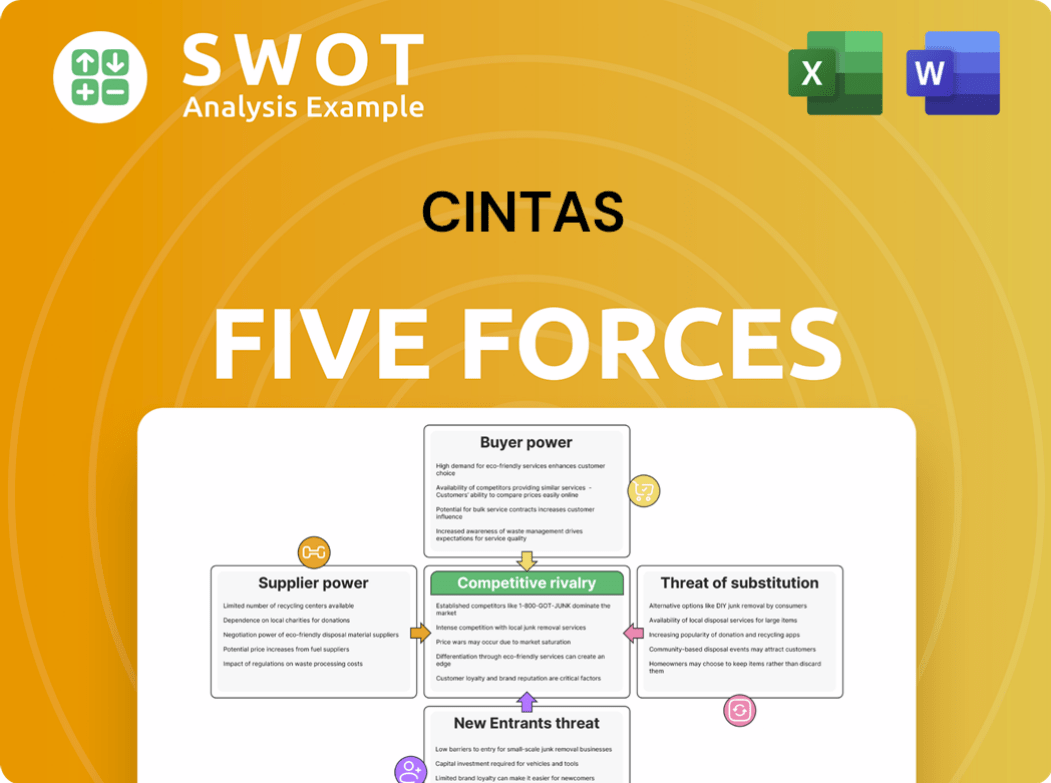

Cintas Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cintas Company?

- What is Competitive Landscape of Cintas Company?

- How Does Cintas Company Work?

- What is Sales and Marketing Strategy of Cintas Company?

- What is Brief History of Cintas Company?

- Who Owns Cintas Company?

- What is Customer Demographics and Target Market of Cintas Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.