Deckers Outdoor Bundle

Can Deckers Outdoor Company Maintain Its Momentum?

From its origins in 1973, Deckers Outdoor SWOT Analysis has transformed from a niche sandal maker into a global powerhouse, boasting brands like UGG and Hoka. This remarkable journey, marked by strategic acquisitions and product diversification, has fueled impressive financial results, including a significant surge in fiscal year 2024. Explore the intricate strategies that have propelled Deckers' growth and discover what the future holds for this dynamic company.

Deckers Outdoor Company's success story is a compelling case study in effective growth strategy within the competitive footwear industry. The company's ability to adapt and innovate, particularly with brands like UGG and Hoka, has been crucial for its brand performance. This analysis delves into Deckers' expansion plans, market analysis, and sustainable practices, offering insights into the future prospects of this industry leader and the challenges it faces.

How Is Deckers Outdoor Expanding Its Reach?

The growth strategy of Deckers Outdoor Company centers on strategic expansion initiatives, targeting both geographical reach and product diversification. A key driver of recent success has been the Hoka brand, which has shown strong momentum in the performance footwear market. The company is actively pursuing international expansion, particularly for Hoka, to capitalize on the increasing global demand for athletic and performance-oriented footwear.

Deckers aims to access new customer segments and diversify its revenue streams by entering untapped markets and strengthening its presence in existing ones. The company's focus on direct-to-consumer (DTC) channels also signifies a strategic move to enhance customer engagement and capture higher margins directly. This approach is crucial for the long-term growth strategy of the company.

Understanding the future prospects of Deckers Outdoor Company involves analyzing its expansion plans and brand performance, especially for key brands like UGG and Hoka. The company's ability to adapt to changing market dynamics and consumer preferences will be critical for its continued success. For more insight into the company's origins, consider reading a brief history of Deckers Outdoor.

Deckers is focused on expanding its global footprint, particularly for the Hoka brand. This includes entering new markets and strengthening its presence in existing ones. The company aims to increase its international sales and diversify its revenue streams.

While the primary focus is on footwear, Deckers may explore opportunities to diversify its product offerings within its existing brands or through new brand acquisitions. This strategy helps mitigate risks and cater to a broader consumer base. The company's product line includes footwear, apparel, and accessories.

Deckers is investing in its DTC channels to enhance customer engagement and capture higher margins. This includes online stores and potentially expanding its physical retail presence. The DTC strategy allows for better control over the brand experience and direct customer interaction.

The company is heavily investing in its brands, particularly Hoka, which saw net sales increase by 27.5% to $1.81 billion in fiscal year 2024. This includes marketing, product development, and supply chain improvements. The success of brands like UGG and Hoka is crucial for overall financial performance.

Deckers' expansion strategy involves geographical growth, product diversification, and a strong emphasis on DTC channels. These initiatives are designed to drive revenue growth and enhance profitability. The company's focus on brand performance and strategic investments are key to achieving its goals.

- International Market Entry: Expanding into new international markets to increase sales and brand awareness.

- DTC Channel Enhancement: Strengthening online and physical retail presence to improve customer engagement.

- Product Innovation: Developing new products and expanding existing lines to meet evolving consumer demands.

- Strategic Partnerships: Collaborating with retailers and distributors to expand market reach.

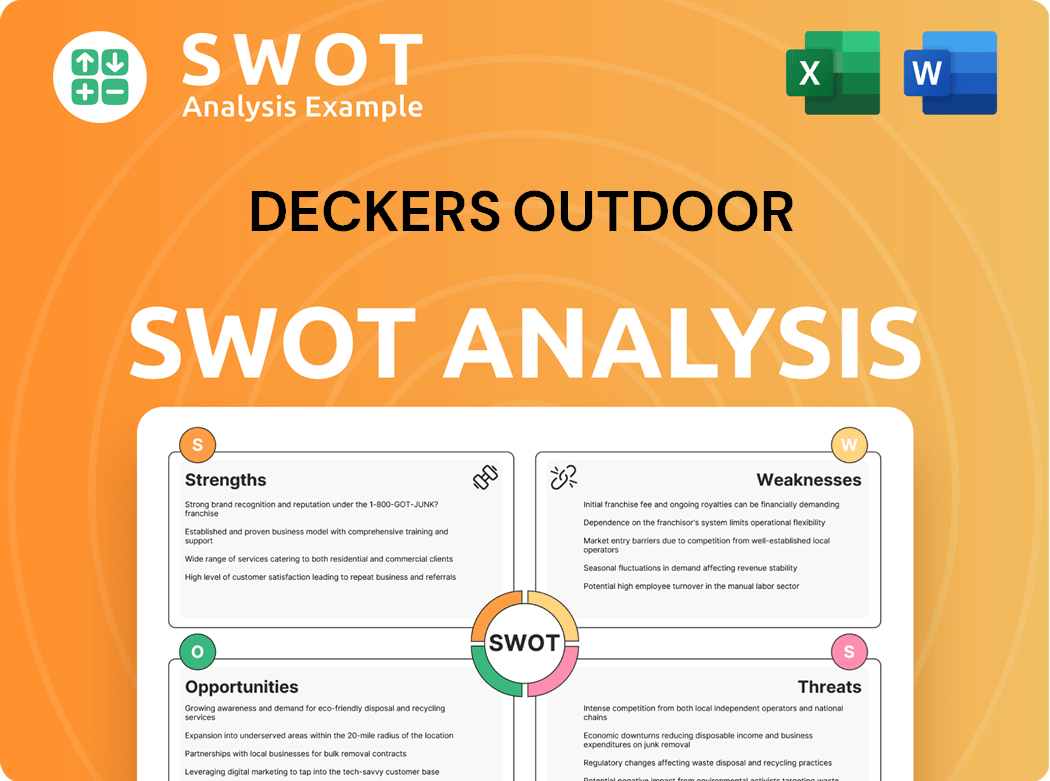

Deckers Outdoor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Deckers Outdoor Invest in Innovation?

The innovation and technology strategy of the company is crucial for its Growth Strategy and future success. While the specifics of research and development investments aren't fully detailed, the company's dedication to product innovation is evident through the ongoing success of its brands. This focus helps maintain market relevance and appeal, driving both short-term gains and long-term sustainability.

The company's approach to digital transformation is supported by its strong direct-to-consumer sales, which saw a significant increase in fiscal year 2024. This highlights a focus on enhancing online platforms and digital customer experiences. The ability to consistently deliver popular and high-performing products across its diverse brand portfolio underscores a commitment to in-house development and collaborations.

The company's success is reflected in the performance of its key brands. For example, the Hoka brand's net sales reached $1.81 billion in fiscal year 2024, demonstrating the impact of continuous innovation in performance footwear. Similarly, the UGG brand, while experiencing a slight decrease in net sales in fiscal year 2024, continues to introduce new styles and materials to maintain its market position. This continuous innovation is key to the company's Future Prospects.

The company consistently introduces new products and materials. This continuous innovation is crucial for maintaining market relevance and appealing to a broad consumer base. The success of brands like Hoka and UGG highlights the effectiveness of this strategy.

The company is focused on enhancing its online platforms and digital customer experiences. This includes a strong emphasis on direct-to-consumer sales, which saw an increase of 18.9% to $1.77 billion in fiscal year 2024. This focus is key to adapting to changing consumer behavior.

The Brand performance of key brands like Hoka and UGG demonstrates the effectiveness of the company's strategies. Hoka's net sales reached $1.81 billion in fiscal year 2024, while UGG continues to introduce new styles. This showcases the ability to drive Growth Strategy.

While specific details on R&D investments were not extensively detailed, the company's commitment to product innovation is evident. The continuous introduction of new products and materials suggests a strong focus on in-house development and potential collaborations. This is a key driver for the company's Future Prospects.

The company adapts to changing consumer preferences and market trends through product innovation and digital enhancements. This includes offering new styles and materials, and improving online customer experiences. This adaptation is crucial for long-term success.

The company's ability to consistently deliver popular and high-performing products across its diverse brand portfolio provides a competitive advantage. This is achieved through in-house development, collaborations, and a focus on cutting-edge designs and materials. This helps in maintaining a strong position in the market.

The company's innovation and technology strategy focuses on product development, digital transformation, and strong Brand performance. This approach is essential for sustained growth and adapting to market changes. The company's ability to innovate and adapt is critical to its success, as discussed in Competitors Landscape of Deckers Outdoor.

- Continuous product innovation and development.

- Enhancing online platforms and digital customer experiences.

- Focusing on the performance and growth of key brands like Hoka and UGG.

- Adapting to changing consumer preferences and market trends.

Deckers Outdoor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Deckers Outdoor’s Growth Forecast?

The financial outlook for Deckers Outdoor Company is robust, supported by consistent growth and strategic investments. The company anticipates continued expansion, driven primarily by the momentum of the Hoka brand. This positive trajectory is built upon a strong foundation of brand performance and effective management across its distribution channels.

For fiscal year 2025, Deckers projects net sales to be between $4.30 billion and $4.40 billion. This represents an estimated increase of approximately 6.7% to 9.2% compared to the fiscal year 2024 net sales of $4.03 billion. The company's financial strategy is designed to capitalize on market opportunities and maintain its growth momentum. The company also projects diluted earnings per share for fiscal year 2025 to be between $18.25 and $18.75.

This optimistic forecast follows a successful fiscal year 2024, where net sales increased by 18.2% to $4.03 billion, and diluted earnings per share rose by 46.7% to $16.29. The gross margin for fiscal year 2024 was 55.6%, and the company anticipates it to be approximately 54.5% for fiscal year 2025. These figures reflect Deckers' ability to generate significant returns and fund future growth initiatives.

In fiscal year 2024, Deckers Outdoor Company achieved net sales of $4.03 billion, marking an impressive 18.2% increase. Diluted earnings per share surged by 46.7% to $16.29, demonstrating strong profitability. The company's financial results underscore its ability to drive growth and enhance shareholder value.

For fiscal year 2025, Deckers anticipates net sales to range between $4.30 billion and $4.40 billion, reflecting a growth of 6.7% to 9.2%. Diluted earnings per share are projected to be between $18.25 and $18.75. These forecasts highlight the company's continued positive outlook and strategic direction.

The gross margin for fiscal year 2024 was 55.6%. Deckers expects a gross margin of approximately 54.5% for fiscal year 2025. This projection indicates the company's focus on maintaining profitability while investing in growth.

The Hoka brand is a primary driver of Deckers' growth strategy, with its continued momentum. Effective management of direct-to-consumer and wholesale channels supports the company's financial ambitions. These factors are crucial for sustaining long-term success.

Deckers Outdoor Company's financial strategy is designed to support its growth strategy and future prospects. The company's strong brand portfolio, including UGG and Hoka, contributes to its consistent financial performance. Effective management of its direct-to-consumer and wholesale channels is also a key factor.

- Focus on brand performance.

- Strategic investments in growth initiatives.

- Efficient management of distribution channels.

- Commitment to sustainable practices.

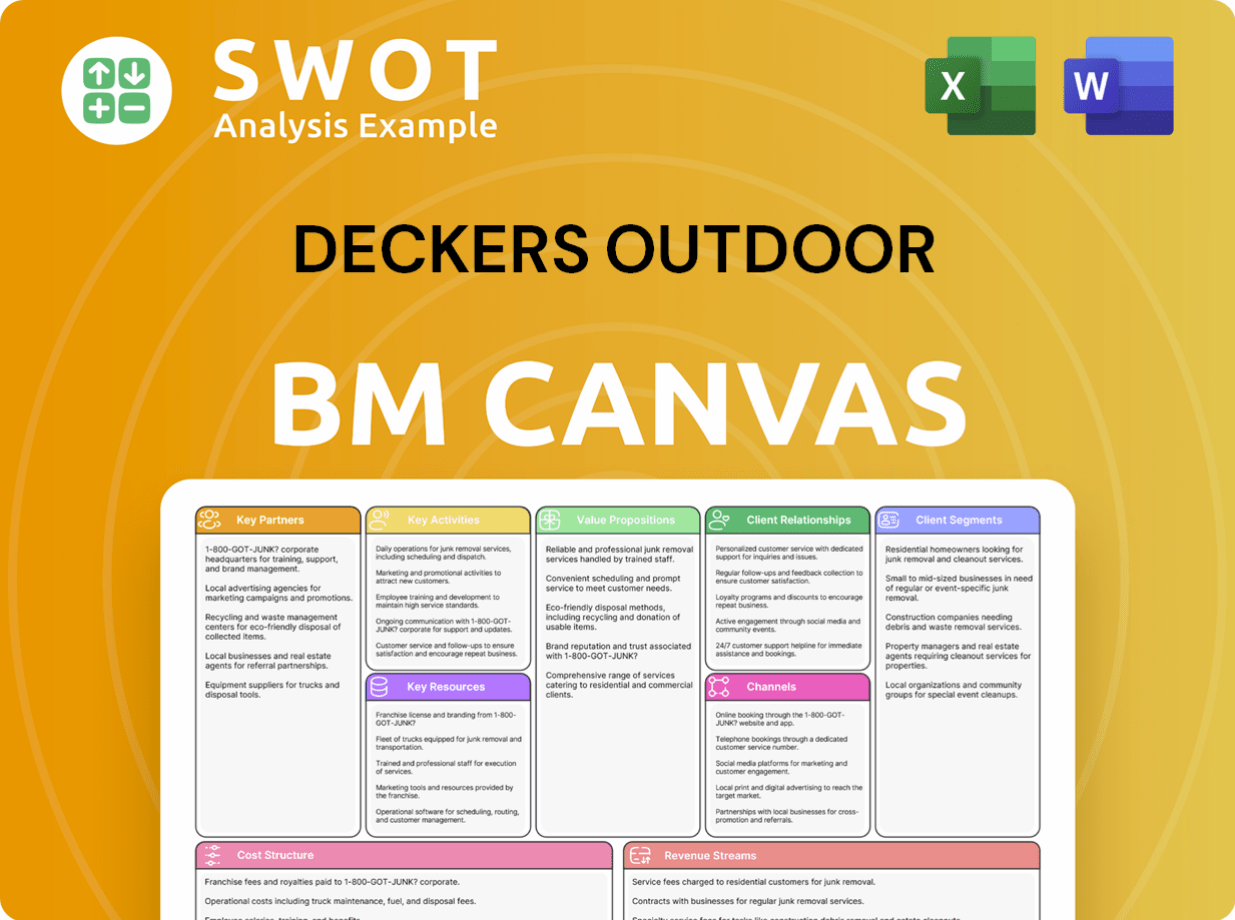

Deckers Outdoor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Deckers Outdoor’s Growth?

The future of Deckers Outdoor Company, and its growth strategy, faces several potential risks and obstacles. These challenges could impact its financial performance and overall market position. Understanding these risks is crucial for assessing the company's long-term prospects in the competitive footwear and apparel industry.

Market competition remains a significant concern for Deckers Outdoor Company. Shifting consumer preferences and fashion trends also pose a continuous risk, requiring the company to constantly innovate and adapt its product offerings. Supply chain vulnerabilities, including disruptions in manufacturing or logistics, could impact product availability and increase costs.

Regulatory changes, particularly concerning international trade and labor practices, could affect operations and profitability. Economic downturns or inflationary pressures could also impact consumer spending on discretionary items like footwear and apparel. The company must navigate these challenges to maintain its growth trajectory.

The footwear and apparel industry is highly competitive, with numerous established and emerging brands vying for market share. This intense competition can pressure pricing and reduce profit margins. The company must differentiate its products and maintain strong brand performance to stay ahead.

Consumer tastes and fashion trends are constantly evolving, necessitating continuous innovation. Deckers must anticipate and adapt to these changes to remain relevant. Failure to do so could lead to declining sales and market share.

Supply chain vulnerabilities, including disruptions in manufacturing or logistics, can impact product availability and increase costs. Global events and economic conditions can exacerbate these risks. Diversifying its manufacturing base can help mitigate these issues.

Economic downturns or inflationary pressures can significantly impact consumer spending. Footwear and apparel are often considered discretionary purchases, making them vulnerable to economic fluctuations. This could lead to decreased sales and profitability.

Changes in international trade policies, tariffs, and labor regulations can affect Deckers' operations and profitability. The company must stay compliant with all relevant laws and regulations. These changes can impact production costs and market access.

While e-commerce offers growth opportunities, it also presents challenges, including increased competition and the need for robust online infrastructure. Deckers must invest in its digital presence and marketing strategies. The impact of e-commerce on Deckers is significant.

To mitigate these risks, Deckers likely employs strategies such as diversifying its manufacturing base and maintaining strong supplier relationships. The company’s strong brand portfolio, including UGG and Hoka, and financial health provide a buffer against some challenges. Continuous vigilance and proactive risk management are essential for sustained growth, as highlighted in the Mission, Vision & Core Values of Deckers Outdoor.

The success of Deckers depends heavily on the performance of its key brands, UGG and Hoka. Any decline in the popularity or sales of these brands could significantly impact the company's revenue. Maintaining brand relevance and consumer loyalty is crucial for sustained growth. The UGG brand experienced a revenue increase of approximately 15% in the latest quarter, while Hoka saw a revenue increase of around 30%.

The footwear market is subject to rapid changes in consumer preferences and fashion trends. The company must stay ahead of these trends through innovation and effective marketing. The athletic footwear market is projected to reach $120 billion by 2025. This growth presents both opportunities and challenges for Deckers.

Expanding into international markets presents significant opportunities, but also involves risks. Currency fluctuations, differing consumer preferences, and geopolitical instability can impact growth. Deckers must develop effective strategies for international expansion. International sales accounted for approximately 40% of Deckers' total revenue in the last fiscal year.

Efficient supply chain management is crucial for controlling costs and ensuring product availability. Disruptions can lead to increased expenses and delays. Deckers must have robust supply chain strategies in place. The company has been working to diversify its sourcing to mitigate supply chain risks, particularly after the disruptions of 2020 and 2021.

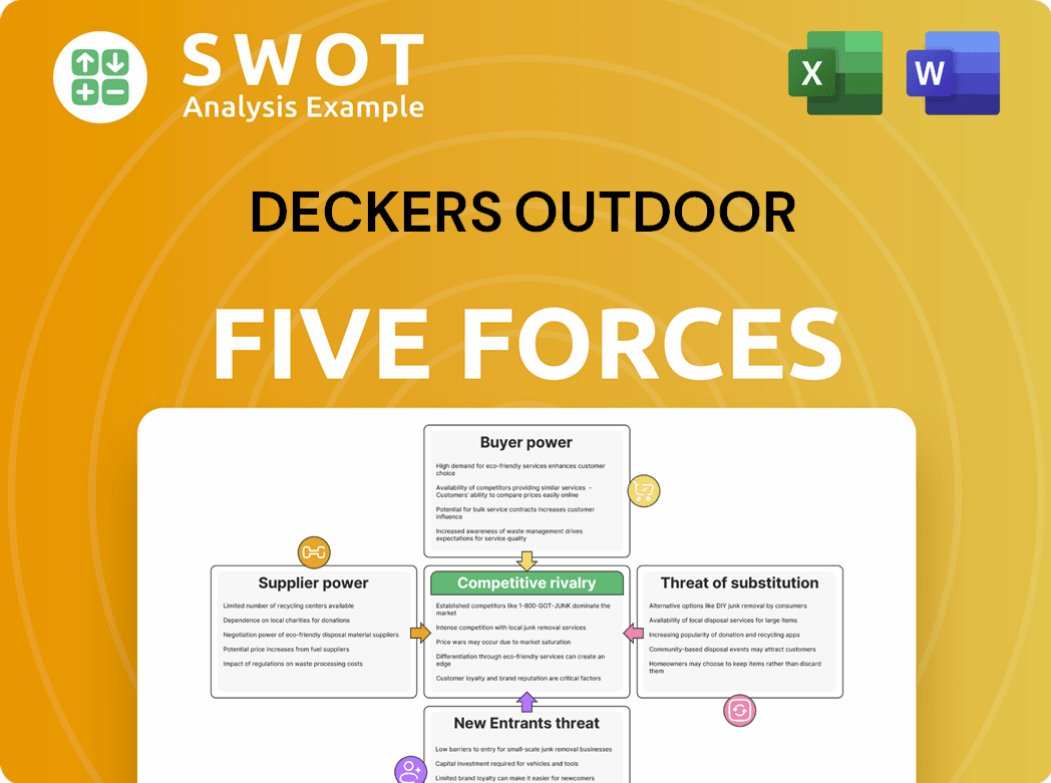

Deckers Outdoor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Deckers Outdoor Company?

- What is Competitive Landscape of Deckers Outdoor Company?

- How Does Deckers Outdoor Company Work?

- What is Sales and Marketing Strategy of Deckers Outdoor Company?

- What is Brief History of Deckers Outdoor Company?

- Who Owns Deckers Outdoor Company?

- What is Customer Demographics and Target Market of Deckers Outdoor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.