Denali Therapeutics Bundle

Can Denali Therapeutics Revolutionize Neurodegenerative Disease Treatment?

Founded in 2015, Denali Therapeutics has quickly become a prominent Denali Therapeutics SWOT Analysis player in the biotech industry, aiming to conquer neurological disorders. With a market capitalization of $1.82 billion as of April 2025, this Biotech Company is focused on innovative drug development. Their mission is to develop effective medicines for diseases like Alzheimer's Disease and Parkinson's Disease, addressing critical unmet medical needs.

Denali Therapeutics' Growth Strategy hinges on its cutting-edge Transport Vehicle platform, designed to overcome the blood-brain barrier, a major hurdle in treating neurological conditions. The company's Future Prospects are promising, with a robust pipeline targeting diseases like ALS and frontotemporal dementia. Understanding the company's innovative approach and financial planning is crucial for investors and industry watchers alike, making this analysis essential for those seeking insights into the Denali Therapeutics journey.

How Is Denali Therapeutics Expanding Its Reach?

The expansion initiatives of Denali Therapeutics are primarily focused on broadening its therapeutic reach and accelerating product development. A key strategy involves advancing its Enzyme Transport Vehicle (ETV) programs, particularly tividenofusp alfa (DNL310) for Hunter syndrome (MPS II) and DNL126 for Sanfilippo syndrome Type A (MPS IIIA). These programs are central to the company's growth strategy and future prospects.

Denali Therapeutics is also aiming to expand its Transport Vehicle (TV)-enabled portfolio to include enzyme, oligonucleotide, and antibody therapeutics. This expansion is intended to address both rare and common diseases. The company plans to introduce one to two new TV programs into clinical trials annually over the next three years, demonstrating a commitment to sustained growth and innovation in drug development.

These efforts are driven by the need to access new patient populations, diversify revenue streams, and maintain a leadership position in neurodegenerative disease therapeutics. The company's focus on expanding its pipeline and advancing its clinical programs reflects a proactive approach to achieving long-term success and enhancing shareholder value. The current market analysis indicates a strong potential for growth in the neurodegenerative disease market, further supporting Denali's strategic direction.

Denali Therapeutics is prioritizing the advancement of its ETV programs, especially tividenofusp alfa (DNL310) for Hunter syndrome and DNL126 for Sanfilippo syndrome Type A. The company initiated a rolling submission for a Biologics License Application (BLA) for tividenofusp alfa in early 2025. This is a critical step in the drug approval process.

The ongoing global Phase 2/3 COMPASS study for tividenofusp alfa is expected to support global approval. Denali is also working on programs like DNL593 for frontotemporal dementia (FTD) caused by GRN mutations, co-developed with Takeda. These clinical trials updates are crucial for the company's future.

Denali plans to advance one to two additional TV programs into clinical trials each year for the next three years. This includes programs targeting Parkinson's and Alzheimer's diseases, demonstrating a commitment to research and development. The company's pipeline drugs are key to its growth.

Denali is exploring small molecule inhibitors, such as the RIPK1 inhibitor program (SAR443122/DNL758) in collaboration with Sanofi, for peripheral inflammatory diseases. These partnership deals are important for expanding its therapeutic reach. The biotech company is also focused on diversifying its offerings.

Denali Therapeutics' expansion strategies focus on advancing its ETV and TV programs, targeting both rare and common diseases. The company is actively pursuing drug development for neurodegenerative diseases, including Alzheimer's Disease and Parkinson's Disease.

- Advancing ETV Programs: Prioritizing tividenofusp alfa (DNL310) and DNL126.

- Expanding TV-Enabled Portfolio: Including enzyme, oligonucleotide, and antibody therapeutics.

- Clinical Trial Expansion: Advancing one to two new TV programs into clinical trials annually.

- Collaboration: Working with partners like Takeda and Sanofi to broaden its pipeline.

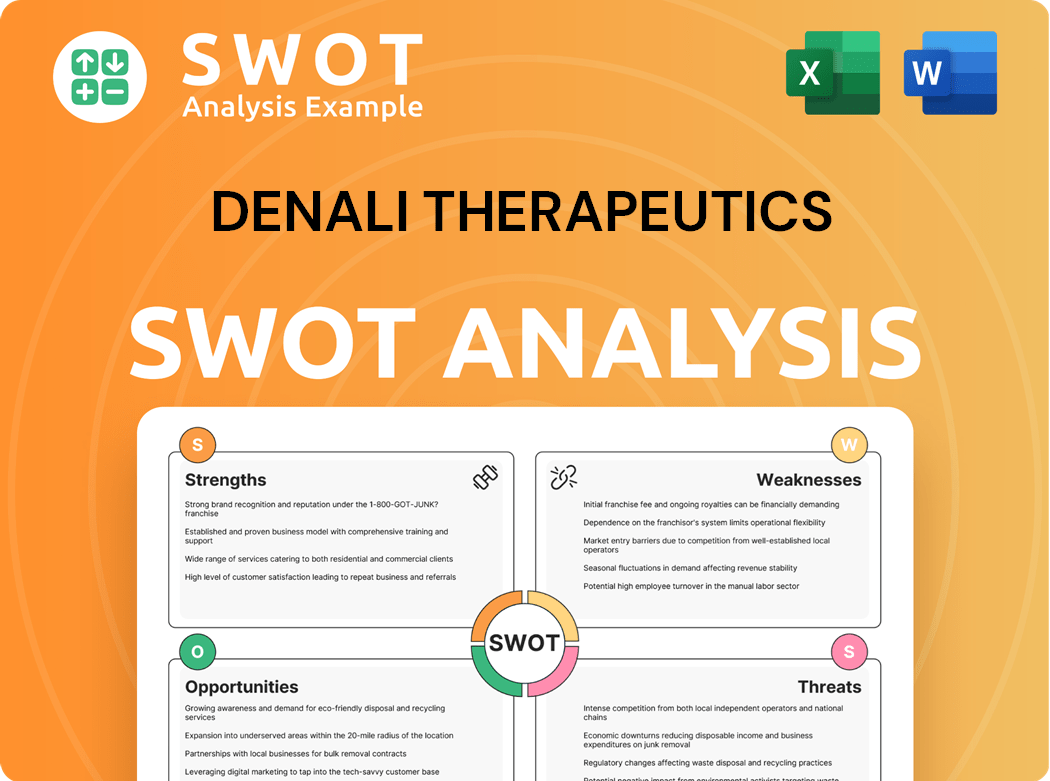

Denali Therapeutics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Denali Therapeutics Invest in Innovation?

The core of Denali Therapeutics' growth strategy hinges on its innovative Transport Vehicle (TV) platform. This technology is designed to enable large therapeutic molecules to cross biological barriers, such as the blood-brain barrier, which is crucial for treating neurodegenerative diseases. This platform allows for broad biodistribution into targeted brain tissues, where treatment is needed.

Denali's approach is centered around addressing significant unmet needs in treating complex neurological conditions. Their focus on diseases like Alzheimer's and Parkinson's reflects a strategic response to the growing global burden of these conditions. The company aims to provide effective treatments by delivering therapies directly to the brain.

The company's commitment to innovation is evident in its substantial R&D investments. In 2024, Denali's R&D expenses were approximately $396.4 million. However, R&D expenses increased to $116.2 million in Q1 2025, up from $107.0 million in Q1 2024, reflecting increased investment in clinical-stage programs and preclinical oligonucleotide TV programs. This sustained investment supports their diverse pipeline.

Denali's innovation strategy involves a multi-faceted approach, focusing on several key areas to drive its growth and future prospects. The company is developing therapies for Alzheimer's disease, Parkinson's disease, ALS, and lysosomal storage disorders. The company emphasizes biomarker-driven development to assess drug activity in the brain and identify patient populations.

- Transport Vehicle (TV) Platform: This proprietary technology is designed to enable large therapeutic molecules to cross the blood-brain barrier.

- Diverse Pipeline: Programs for Alzheimer's disease (e.g., DNL628 targeting tau, DNL921 targeting Abeta), Parkinson's disease (e.g., BIIB122/DNL151 LRRK2 inhibitor with Biogen, DNL422 targeting alpha synuclein), ALS (DNL343 eIF2B activator), and lysosomal storage disorders.

- Biomarker-Driven Development: Utilizing biomarkers to assess drug activity in the brain and identify patient populations most likely to benefit.

- Manufacturing Capabilities: Commenced operations at a new Salt Lake City manufacturing facility in Q1 2025 to support drug supply for clinical trials.

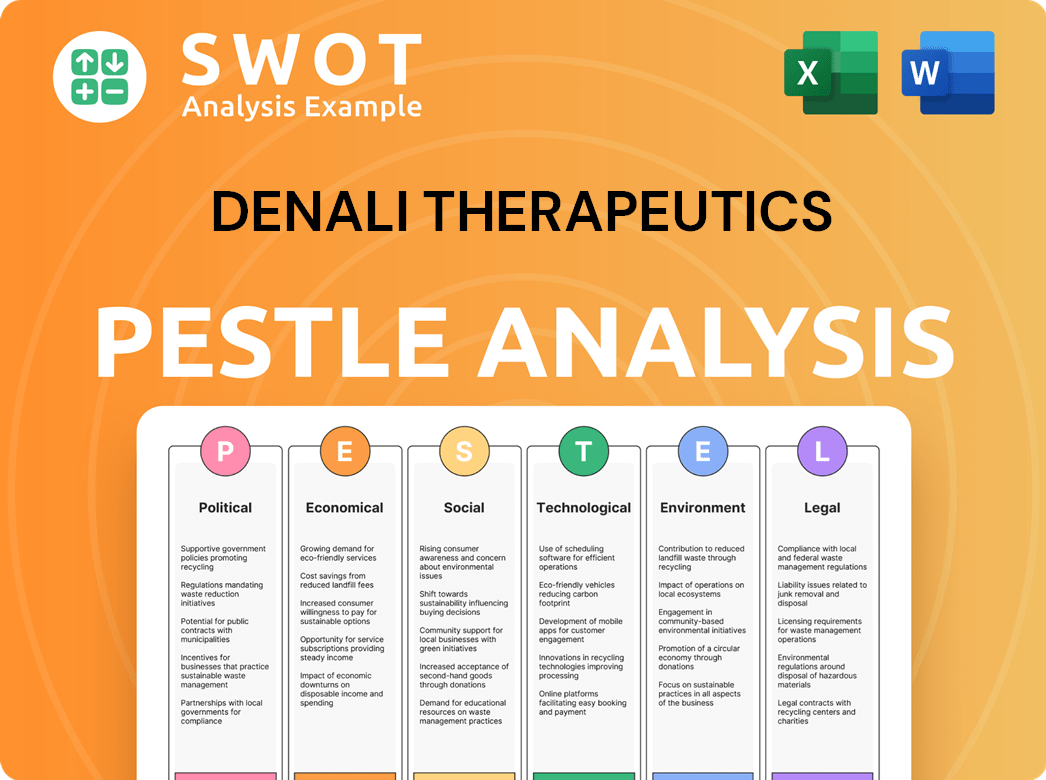

Denali Therapeutics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Denali Therapeutics’s Growth Forecast?

The financial outlook for Denali Therapeutics is shaped by its strategic investments in its drug pipeline and the potential for commercialization, particularly with tividenofusp alfa. The company's financial performance reflects the significant investments in research and development, which are crucial for advancing its clinical-stage programs. The company's financial strategy is focused on sustaining a strong financial position to support its long-term growth objectives.

Denali Therapeutics reported a net loss of $422.8 million for the full year 2024. For the first quarter of 2025, the company reported a net loss of $133.0 million, compared to a net loss of $101.8 million in Q1 2024. This increase in net loss is mainly due to higher R&D expenses. Despite these losses, the company maintains a solid financial foundation.

As of March 31, 2024, Denali Therapeutics had approximately $1.43 billion in cash, cash equivalents, and marketable securities, demonstrating a strong liquidity position. This financial strength is crucial for supporting its ongoing operations and pipeline development. The company's financial strategy includes securing funds through various means, including private investments, to support its operations and growth initiatives. For more details, you can check out Marketing Strategy of Denali Therapeutics.

R&D expenses increased to $116.2 million in Q1 2025, up from $107.0 million in Q1 2024. This increase reflects the company's commitment to advancing its clinical-stage programs and the operation of its new manufacturing facility. These investments are essential for the long-term success of the Biotech Company.

The company's strong cash position, with $1.43 billion as of March 31, 2024, provides a financial cushion. This financial stability supports the company's ability to fund its Drug Development activities and achieve its Growth Strategy. This helps in managing the risks associated with Denali Therapeutics' Drug Development process.

In February 2024, Denali Therapeutics completed a private investment in public equity (PIPE) financing. The gross proceeds from this financing were $500 million. This financing round is a key aspect of the company's financial strategy to support its operations.

Denali Therapeutics anticipates a 10-15% increase in cash operating expenses for 2025 compared to 2024. This increase is primarily due to preparations for the launch of tividenofusp alfa. These increased expenses are part of the company's plan to support its Future Prospects.

Analyst forecasts for Denali Therapeutics' stock in 2025 predict an average price of $24.56. The potential high is $41.60, and the low is $7.5147, indicating an expected rise of 85.49% from a recent trading price of $13.24. This positive outlook reflects confidence in the company's Future Prospects.

- Denali Therapeutics is focused on Alzheimer's Disease research and treatments.

- The company is actively involved in Denali Therapeutics clinical trials updates.

- The company has various Denali Therapeutics partnership deals.

- Denali Therapeutics is working on Denali Therapeutics Parkinson's disease treatments.

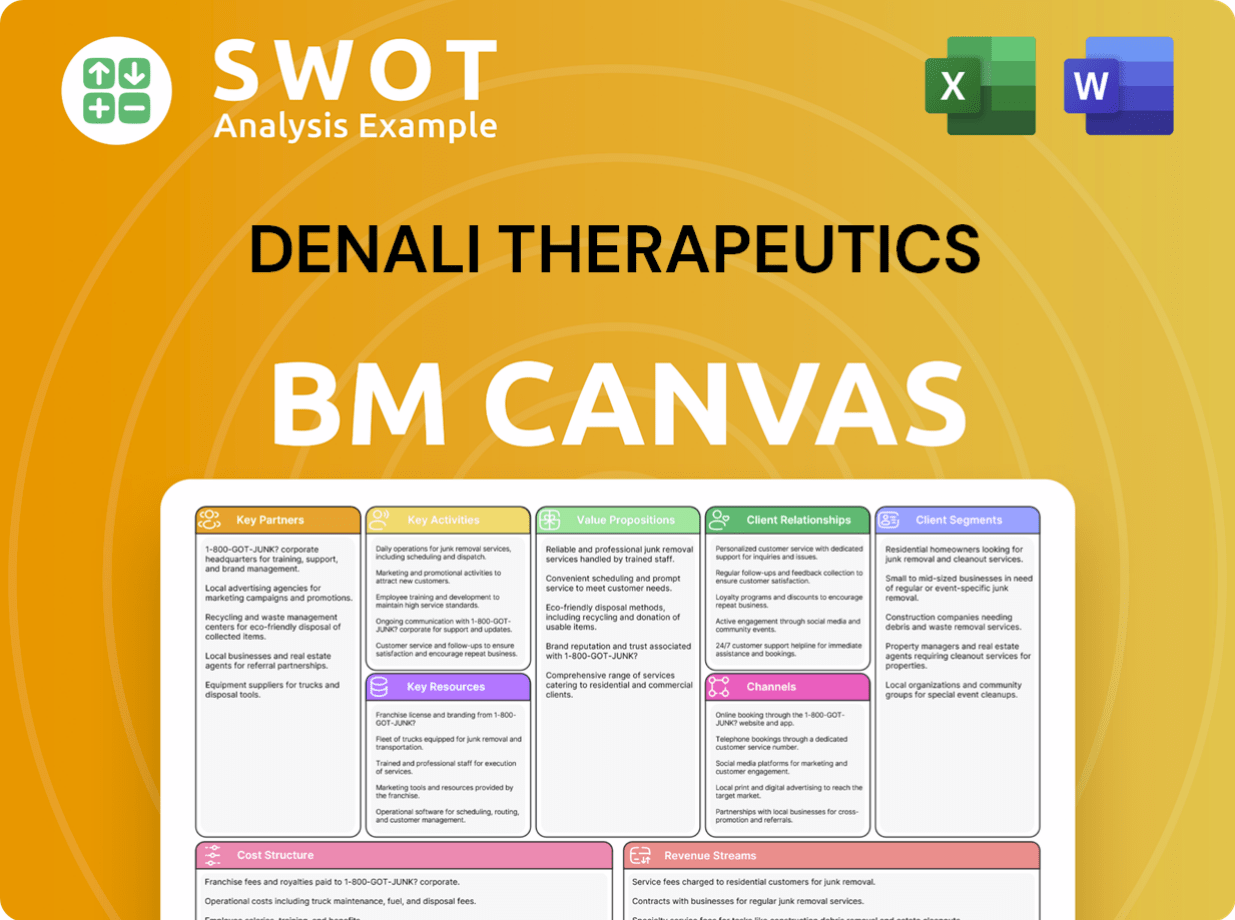

Denali Therapeutics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Denali Therapeutics’s Growth?

The Growth Strategy and future success of Denali Therapeutics, a Biotech Company, are significantly influenced by various risks and obstacles. These challenges span clinical trial outcomes, market competition, regulatory approvals, and financial sustainability. Understanding these potential pitfalls is crucial for assessing Denali Therapeutics' long-term viability and Future Prospects.

The inherent complexities of Drug Development, particularly in neurodegenerative diseases, present substantial hurdles. The company's ability to navigate these challenges will be critical to its Growth Strategy and ability to deliver value to its stakeholders. The Denali Therapeutics pipeline, including potential treatments for Alzheimer's Disease and Parkinson's, faces considerable uncertainties.

The success of Denali Therapeutics hinges on its ability to overcome these challenges and execute its strategic plan effectively. Navigating these challenges is vital for Denali Therapeutics to achieve its Future Prospects and deliver on its promises to patients and investors.

Clinical trials are inherently risky, with results often differing from preclinical data. The success of Denali Therapeutics' pipeline depends on positive results that translate to clinical benefits. Adverse events or side effects can halt trials and delay progress.

The market for neurodegenerative disease therapies is highly competitive. Numerous companies are developing treatments, increasing the pressure on Denali Therapeutics. Successfully differentiating its products is essential for market share.

Regulatory changes and approvals are critical for commercialization. Even with Breakthrough Therapy Designation, like with tividenofusp alfa, complex payer negotiations and market access strategies are necessary. The Drug Approval Process is often lengthy and uncertain.

Denali Therapeutics relies on third parties for manufacturing and supply. Supply chain vulnerabilities can disrupt clinical trials and commercial launches. Ensuring a robust and reliable supply chain is crucial.

Denali Therapeutics has reported significant net losses, including $422.8 million for the full year 2024 and $133.0 million for Q1 2025. Managing cash operating expenses, projected to increase by 10-15% in 2025, is essential for sustained growth. Maintaining a strong cash position is critical for funding operations.

Denali Therapeutics employs risk management frameworks, including pipeline diversification. Strategic partnerships are also leveraged to mitigate risks. These strategies aim to reduce the impact of potential setbacks and maintain momentum.

The company's financial health is a key factor in its Future Prospects. In 2024, the company reported a net loss of $422.8 million, and $133.0 million in Q1 2025, highlighting the financial strain of Drug Development. Cash operating expenses are projected to increase by 10-15% in 2025, requiring careful financial management. Brief History of Denali Therapeutics provides further context.

The progress of Denali Therapeutics' pipeline is crucial, with multiple drugs in clinical trials. The success of these trials is uncertain, and positive results are not guaranteed. Delays or failures in clinical trials can significantly impact the company's Growth Strategy and Denali Therapeutics stock price forecast. Updates on Denali Therapeutics clinical trials updates are essential for investors.

Denali Therapeutics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Denali Therapeutics Company?

- What is Competitive Landscape of Denali Therapeutics Company?

- How Does Denali Therapeutics Company Work?

- What is Sales and Marketing Strategy of Denali Therapeutics Company?

- What is Brief History of Denali Therapeutics Company?

- Who Owns Denali Therapeutics Company?

- What is Customer Demographics and Target Market of Denali Therapeutics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.