Econocom Group Bundle

Can Econocom Group Conquer the Digital Frontier?

Econocom Group, a veteran of the digital age, is undergoing a significant transformation. Founded in 1974, the company has evolved from a pioneer in sustainable IT solutions to a leading provider of Econocom Group SWOT Analysis, IT services, and digital transformation strategies. With a new strategic plan in motion, the company is poised for substantial growth.

This analysis delves into Econocom Group's growth strategy, examining its ambitious 'One Econocom' plan and recent acquisitions like bb-net. We'll explore the company's future prospects, including its expansion plans, innovation in IT services, and the potential for Econocom Group revenue growth. Investors and strategists alike will gain valuable insights into the competitive landscape and the potential investment opportunities within Econocom Group's evolving business model, focusing on its digital transformation strategy.

How Is Econocom Group Expanding Its Reach?

The future growth strategy of the Econocom Group centers around its 'One Econocom' strategic plan. This plan focuses on strengthening its market position through strategic acquisitions, especially in key geographic areas. The company is actively pursuing both acquisitions and organic growth initiatives to expand its business and enhance its service offerings.

The company is focused on expanding its presence in the circular economy and enhancing its sales force. It also aims to develop new growth drivers by improving synergies between its business lines and geographical areas. The company’s strategic plan also includes disposing of non-core or underperforming units to streamline operations.

These initiatives are designed to drive the Econocom Group's Growth Strategy and improve its Econocom Future outlook. The company is adapting to the evolving market needs and technological advancements to ensure sustainable growth and maintain a competitive edge in the IT services and financial services sectors.

A key step in Econocom Group's expansion was acquiring an 80% stake in bb-net, a leading German IT refurbishment company, in January 2025. This strategic move strengthens Econocom Group's position in the circular economy. The acquisition of bb-net, which generated approximately €17 million in revenue in 2024, aligns with the company's strategic objectives.

Econocom Group launched a plan in 2024 to strengthen its sales forces. This initiative involved recruiting over 60 new talents to support future growth. Comprehensive staff training programs were also implemented to improve the skills and capabilities of the existing workforce, ensuring they are well-equipped to meet market demands.

Econocom Group is enhancing synergies between its business lines, solutions, and geographical areas. This approach aims to develop new growth drivers. The launch of 'Gather,' a new European brand targeting the audiovisual, unified communications, and information market, is a prime example of this strategy, designed to unlock additional growth potentials.

As part of its strategic plan, Econocom Group continues to seek the disposal of non-core or underperforming units. This strategic move aims to streamline operations and focus resources on core business areas with higher growth potential. This will help the company to improve its financial performance and focus on its strategic priorities.

Econocom Group's expansion initiatives are multifaceted, encompassing strategic acquisitions, organic growth, and operational streamlining. The acquisition of bb-net and the launch of 'Gather' are key examples of how the company is executing its growth strategy. These initiatives are designed to strengthen the company's market position and drive future revenue growth.

- Acquisition of bb-net to expand in the circular economy.

- Strengthening sales forces with new talent and training programs.

- Enhancing synergies between business lines and geographical areas.

- Launching new brands like 'Gather' to target specific markets.

- Strategic disposals of non-core assets to streamline operations.

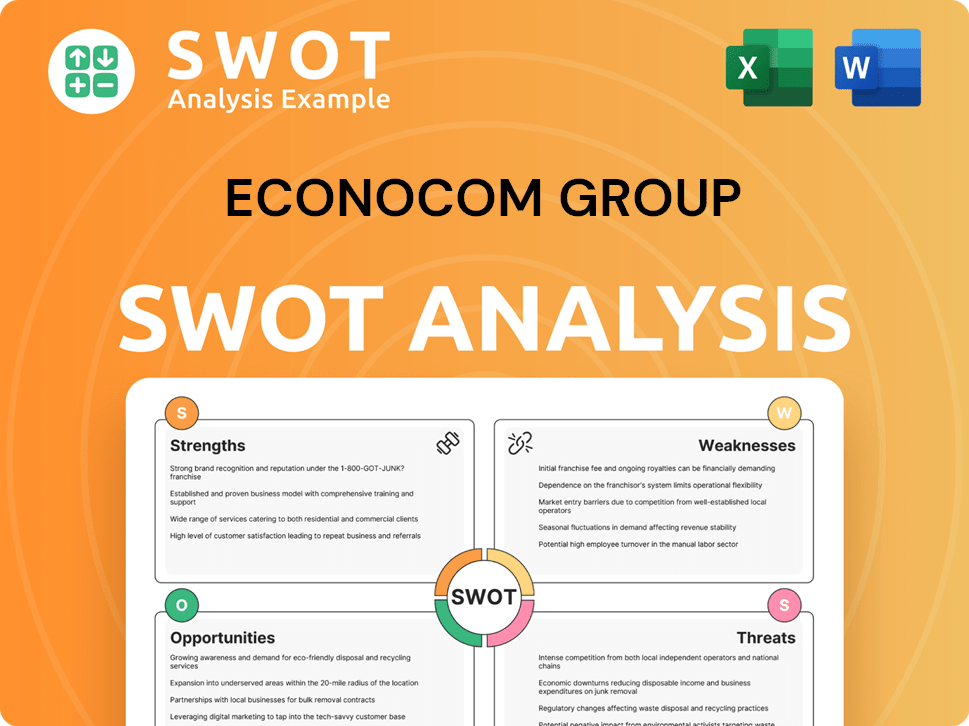

Econocom Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Econocom Group Invest in Innovation?

Econocom Group's growth strategy is heavily reliant on its innovation and technology initiatives, focusing on digital transformation and cutting-edge solutions. The company's approach involves developing and transforming workplaces, infrastructure, audiovisual technology, and digital signage, covering the entire spectrum of digital project execution.

This strategy is underpinned by a commitment to the circular economy and sustainability. Econocom's dedication to refurbishing and reselling IT equipment showcases its long-standing commitment to environmental responsibility, reinforced by its Science Based Targets initiative (SBTi) validation for decarbonization efforts.

Econocom's focus on repairability and extending the lifespan of digital assets, including refurbishing a significant number of devices, directly contributes to its environmental goals and positions it as a leader in sustainable IT. The company's strategic initiatives also include transparency in its CSR commitments to stakeholders.

Econocom's digital transformation strategy centers on providing comprehensive solutions across various sectors. This includes workplace transformation, infrastructure development, and advanced audiovisual technologies. These solutions are designed to meet the evolving needs of businesses.

A core element of Econocom's growth strategy is its dedication to the circular economy. The company refurbishes and resells IT equipment, promoting sustainability. This approach helps reduce e-waste and extends the lifespan of digital assets.

Econocom has set ambitious sustainability targets validated by the SBTi. These targets include reducing greenhouse gas emissions and increasing the use of renewable energy. Econocom aims to ensure all its suppliers have SBTi-validated targets by 2028.

In 2024, Econocom launched 'Impact,' a digital media outlet focused on CSR. This initiative aims to increase transparency and communicate its CSR commitments to stakeholders. This highlights Econocom's focus on non-financial indicators and positive contributions.

Econocom's commitment to CSR has been recognized with the Ecovadis Gold Medal. This places the company in the top 5% of companies worldwide for CSR performance. This recognition highlights Econocom's commitment to sustainable practices.

In 2023, Econocom refurbished 493,000 digital devices. This demonstrates the company's commitment to extending the lifespan of digital assets. This contributes significantly to its environmental goals.

Econocom's innovation and technology strategy is designed to drive sustainable growth by integrating digital solutions, promoting a circular economy, and prioritizing sustainability. The company's focus on IT services and digital transformation is reflected in its strategic initiatives and financial performance. For more insights, consider reading about the Marketing Strategy of Econocom Group.

Econocom's approach to growth is multifaceted, focusing on several key areas:

- Digital Transformation: Providing solutions for workplace transformation, infrastructure, and audiovisual technologies.

- Circular Economy: Refurbishing and reselling IT equipment to reduce e-waste and promote sustainability.

- Sustainability Initiatives: Setting SBTi-validated targets to reduce emissions and increase renewable energy usage.

- CSR Transparency: Launching 'Impact' to communicate CSR commitments.

- Ecovadis Gold Medal: Receiving recognition for top CSR performance.

- Refurbishment: Refurbishing a significant number of digital devices annually.

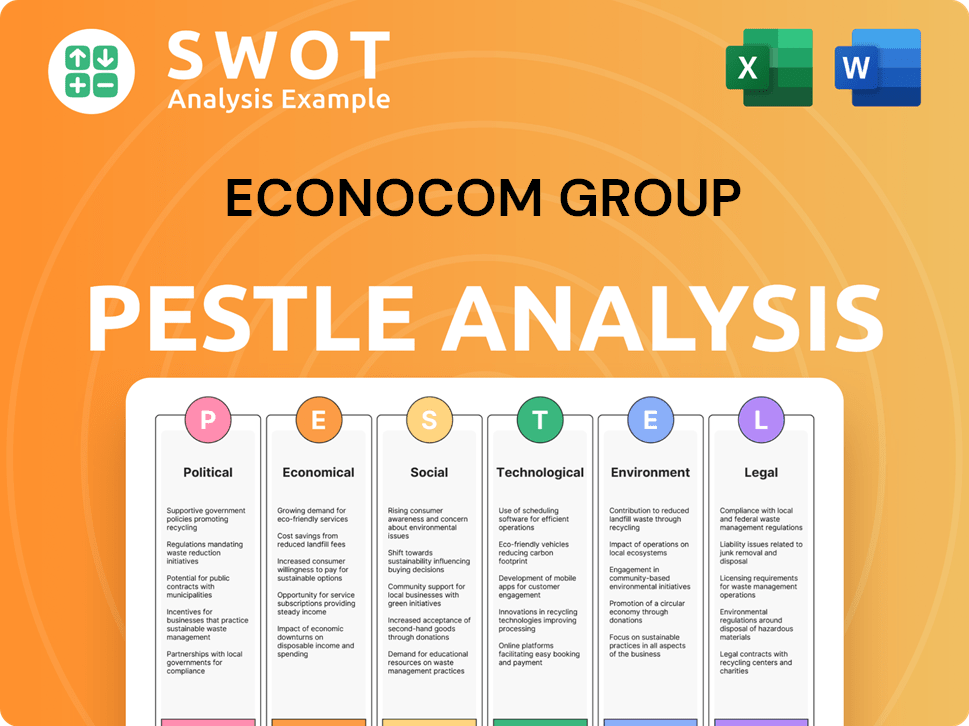

Econocom Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Econocom Group’s Growth Forecast?

The financial outlook for Econocom Group appears positive, with recent performance and strategic initiatives indicating a strong trajectory. In 2024, the company demonstrated solid financial health, reporting increased revenues and a significant reduction in net financial debt. This performance sets a promising foundation for future growth, especially considering the company's focus on Digital Transformation and IT Services.

Econocom Group's strategic focus on profitable growth is evident in its financial results and future projections. The company's commitment to shareholder value is reflected in its proposed dividend payout, which aligns with its strong financial position. Investors and stakeholders can look forward to potential returns as the company continues to execute its growth strategy.

The company's revenue reached €2,744 million in 2024, marking a 3.6% organic increase compared to 2023. The operating margin for 2024 was €110.4 million, with a profitability of 4.0%. Consolidated net profit for 2024 was €37.7 million, which translated to earnings per share of €0.220. The net financial debt was reduced to €96 million by the end of 2024, down from €181 million in 2023, strengthening the company's financial position. For more insights, consider reading about Mission, Vision & Core Values of Econocom Group.

In Q1 2025, the company's revenue reached €663.3 million, showcasing a 4.5% increase on a reported basis, and 3.8% organic growth. This growth was driven by the Technology Management & Financing (TMF) business, which saw a significant revenue increase.

The Technology Management & Financing (TMF) business saw a 16.7% revenue increase to €241.0 million in Q1 2025. The Services division increased by 7.0% to €130.5 million. The Products & Solutions (P&S) revenue declined by 4.7% in Q1 2025 to €291.8 million.

Econocom Group anticipates growth to exceed the 3.6% achieved in 2024. Analysts forecast earnings and revenue growth of 21.1% and 4.5% per annum, respectively. EPS is expected to grow by 16.7% per annum, demonstrating a positive future outlook.

The Board of Directors plans to propose a shareholder payout of €0.10 per share from the share premium in July 2025. This payout totals €16.7 million, representing 44% of the 2024 net profit, indicating a commitment to shareholder value.

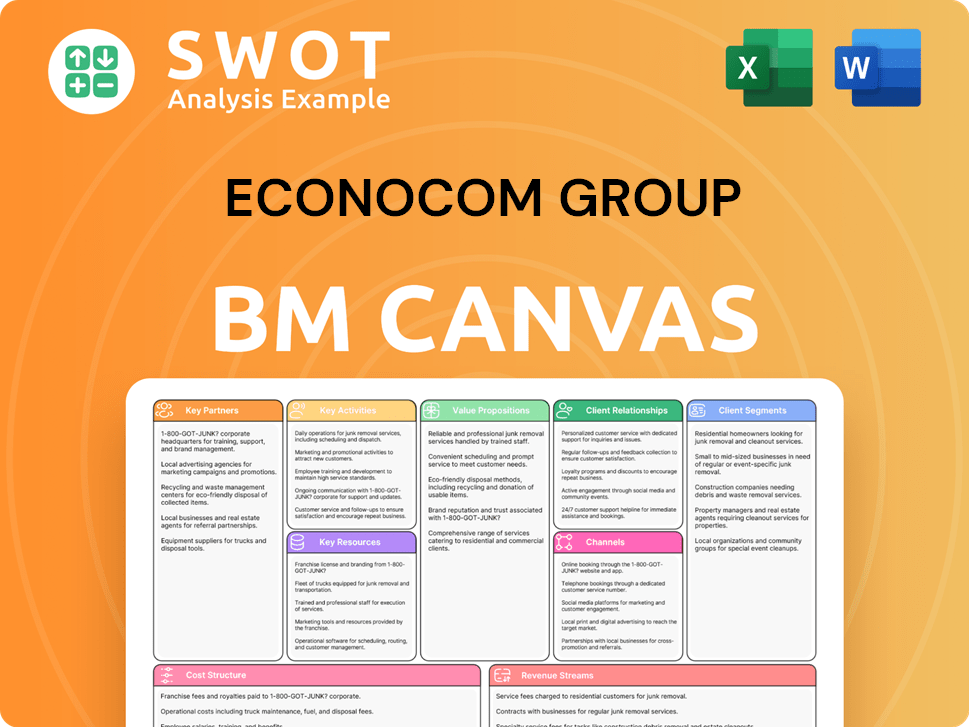

Econocom Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Econocom Group’s Growth?

The Econocom Group's ambitious growth strategy faces several potential risks and obstacles. The competitive nature of the digital services sector and the rapid pace of technological change are significant challenges. Furthermore, the company must navigate economic uncertainties and evolving regulatory landscapes to sustain its Econocom future.

Market competition in the digital services sector is intense, requiring continuous innovation and adaptation. Economic conditions, particularly in Europe, can impact performance, as seen in the Products & Solutions segment, which experienced a 4.7% revenue decline in Q1 2025. The IT distribution market's challenging conditions, specifically in France, also present hurdles.

Ongoing technological disruptions, such as advancements in AI and IoT, demand continuous investment and strategic adjustments. Supply chain vulnerabilities and evolving regulatory requirements, including data privacy and environmental standards, add to the complexity. These factors necessitate proactive risk management and strategic agility for Econocom Group.

The digital services market is highly competitive, requiring constant innovation. The 'Products & Solutions' segment saw a 4.7% revenue decrease in Q1 2025, highlighting market pressures. Difficult conditions in the IT distribution market, especially in France, pose challenges.

Rapid advancements in AI, IoT, and immersive experiences require continuous investment. Staying competitive demands adaptation to new technologies. This constant evolution necessitates strategic foresight and resource allocation.

Supply chain disruptions can impact equipment sourcing and delivery. Though not explicitly detailed, this is an inherent risk. Effective supply chain management is crucial for operational stability.

Changes in data privacy, environmental standards, and international trade regulations pose challenges. Compliance efforts are ongoing and require significant resources. Adapting to these changes is essential for sustained operations.

Economic fluctuations can affect business performance. The company's strong financial position, including a reduction in net financial debt in 2024, provides a buffer. These uncertainties require careful financial planning and adaptability.

The 'One Econocom' strategy focuses on business line and geographical area synergies. The acquisition of bb-net in January 2025 strengthens circular economy presence. CSR and decarbonization efforts enhance reputation and attract clients.

Econocom Group implements the 'One Econocom' strategic plan to enhance synergies across business lines and regions. Diversifying its business model across Products & Solutions, Technology Management & Financing, and Services is key. The acquisition of bb-net in January 2025 strengthens its circular economy presence.

A strong financial position, including a decrease in net financial debt in 2024, provides a buffer against economic uncertainties. This financial health supports investment in innovation and expansion. This financial stability is crucial for navigating potential challenges.

Econocom Group's commitment to CSR and decarbonization, validated by SBTi, enhances its reputation. This commitment attracts environmentally conscious clients and mitigates regulatory risks. These practices support long-term sustainability and stakeholder value.

Understanding market dynamics is crucial for success. The company must adapt to the competitive landscape of IT Services and the challenges of Digital Transformation. For more insights into the target market, explore Target Market of Econocom Group.

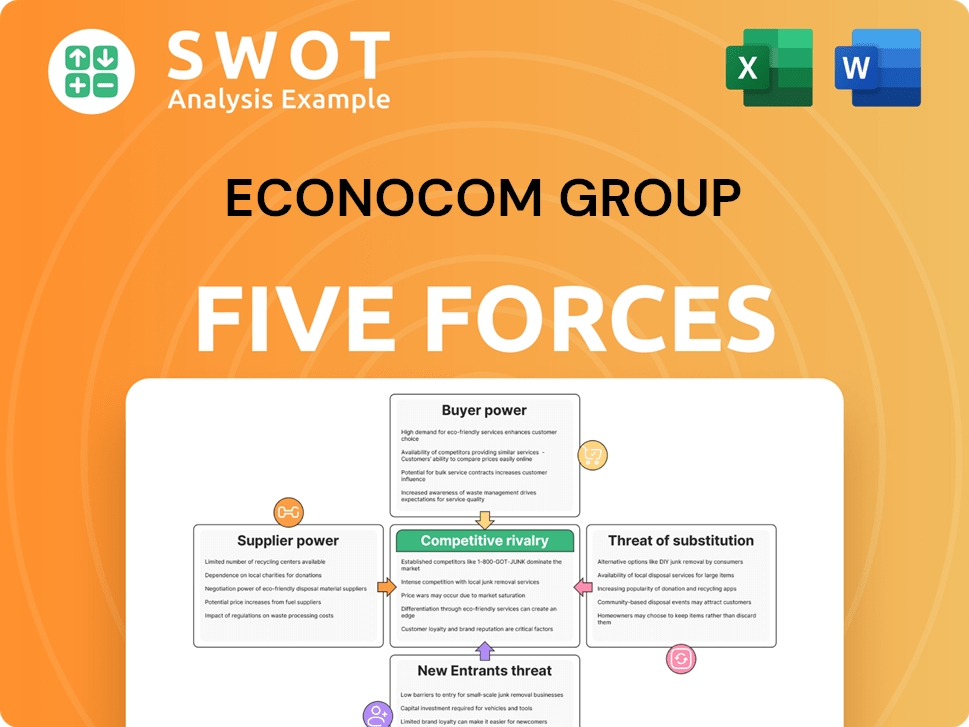

Econocom Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Econocom Group Company?

- What is Competitive Landscape of Econocom Group Company?

- How Does Econocom Group Company Work?

- What is Sales and Marketing Strategy of Econocom Group Company?

- What is Brief History of Econocom Group Company?

- Who Owns Econocom Group Company?

- What is Customer Demographics and Target Market of Econocom Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.