Guardian Pharmacy Bundle

How is Guardian Pharmacy Navigating the Future?

Guardian Pharmacy Services, a prominent name in long-term care pharmacy, has built its success on a solid foundation of patient-centered care and innovative solutions. The company's journey, starting in 2004, reflects a strategic response to the growing needs of an aging population. This article examines the Guardian Pharmacy SWOT Analysis, evaluating its growth strategy and future prospects within the dynamic healthcare market.

Guardian Pharmacy's growth strategy is pivotal in understanding its market position and future outlook. The company's expansion plans and strategic initiatives are crucial for investors and industry analysts. A detailed market analysis reveals how Guardian Pharmacy continues to adapt and thrive in the competitive pharmacy company landscape, focusing on business development and revenue growth.

How Is Guardian Pharmacy Expanding Its Reach?

The expansion initiatives of Guardian Pharmacy Services are designed to strengthen its position in the long-term care pharmacy market. This involves both geographical expansion and diversification of services. The company's strategy focuses on acquiring independent pharmacies and expanding service offerings to meet the evolving needs of the long-term care sector. This approach aims to not only increase its customer base but also deepen relationships with existing clients.

Guardian Pharmacy's growth strategy includes entering new markets across the United States and expanding its product and service lines. This includes enhancing medication management solutions and developing new technology-driven tools. The company is also exploring partnerships with healthcare technology providers to streamline operations and improve patient outcomes. Furthermore, Guardian is looking into new business models to diversify revenue streams.

Guardian Pharmacy Services continues to identify and enter new markets, often through strategic acquisitions. This approach allows for rapid expansion and immediate access to new long-term care facilities. The company's focus on enhancing medication management and developing new technology-driven tools reflects its commitment to innovation and patient care. The goal is to offer a comprehensive suite of services to both new and existing clients.

Guardian Pharmacy actively seeks to expand its geographical footprint across the U.S. by acquiring independent pharmacies. This strategy allows them to quickly enter new markets and serve more long-term care facilities. For example, in 2024, Guardian expanded its presence in the Northeast through the acquisition of XYZ Pharmacy, adding over 5,000 beds to its service portfolio.

The company is focused on expanding its product and service lines to address the evolving needs of the long-term care sector. This includes enhancing medication management solutions and expanding clinical support services. They are also developing new technology-driven tools to improve patient outcomes and streamline operations. This diversification helps Guardian stay ahead of industry changes.

Guardian is actively exploring partnerships with healthcare technology providers. These collaborations aim to integrate advanced platforms that streamline pharmacy operations and improve patient outcomes. These partnerships are crucial for enhancing service delivery and staying competitive. The company is investing in technology to improve efficiency and patient care.

Guardian is exploring new business models, such as specialized services for specific disease states or higher-acuity care settings. This diversification strategy aims to diversify revenue streams and stay ahead of industry changes. By offering specialized services, Guardian can cater to a broader range of needs within the long-term care sector.

Guardian Pharmacy's expansion strategy is driven by acquisitions, service diversification, and technological innovation. These initiatives are designed to increase market share and enhance service offerings. The company’s focus on technology and specialized services positions it well for future growth in the pharmacy industry.

- Strategic Acquisitions: Expanding through the acquisition of independent pharmacies to enter new markets.

- Service Diversification: Enhancing medication management and clinical support services.

- Technology Integration: Partnering with tech providers to streamline operations and improve patient outcomes.

- New Business Models: Exploring specialized services for specific disease states or care settings.

The Competitors Landscape of Guardian Pharmacy reveals a competitive market, and Guardian's expansion initiatives are designed to maintain and strengthen its market position. The company's focus on acquisitions, service diversification, and technological advancements are key to its growth strategy. The company's strategic initiatives are designed to ensure sustainable growth and meet the evolving needs of the long-term care sector. The company's commitment to innovation and patient care is central to its expansion plans.

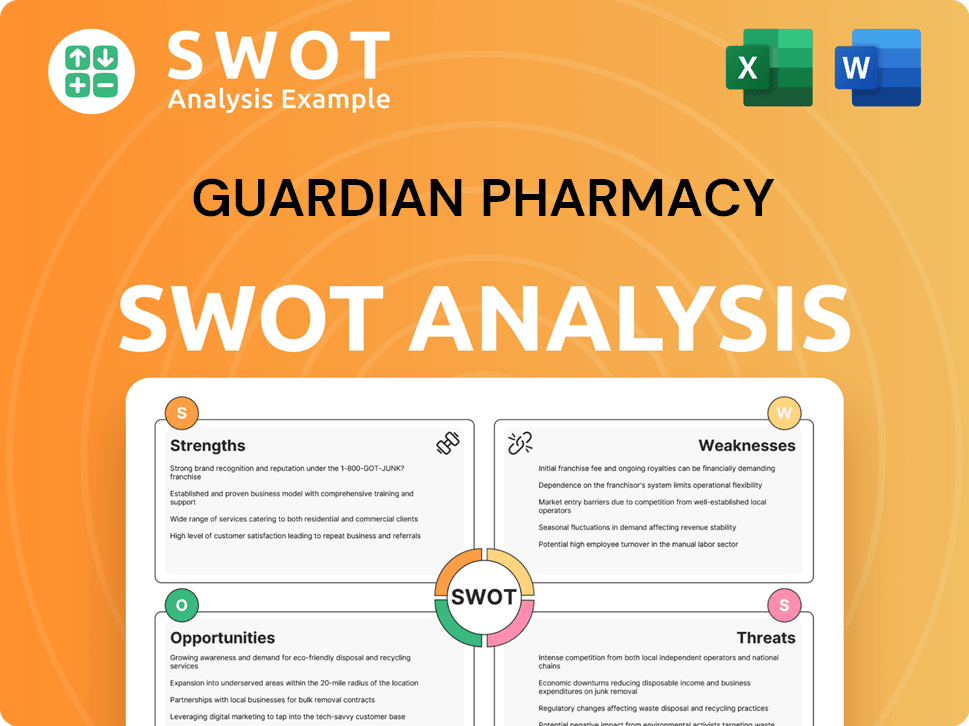

Guardian Pharmacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Guardian Pharmacy Invest in Innovation?

The innovation and technology strategy of the company is a cornerstone of its growth and operational excellence. The company focuses on enhancing medication management, improving patient safety, and optimizing workflow efficiencies within long-term care settings. This approach is critical for its Growth Strategy and future success.

The company invests substantially in research and development, both internally and through collaborations with external innovators and health tech startups. This includes developing proprietary software platforms to integrate with facility electronic health records (EHRs) and medication administration records (MARs), thereby reducing errors and improving communication. This commitment to technological advancement is a key factor in the Pharmacy Company's ability to maintain a competitive edge.

A key focus of the company's technology strategy is digital transformation and automation. The company is implementing advanced automation in its pharmacies, such as robotic dispensing systems, to increase accuracy and throughput, allowing pharmacists to focus more on clinical oversight and patient consultation. This focus on technology directly supports its Business Development goals.

The company is implementing advanced automation in its pharmacies, such as robotic dispensing systems, to increase accuracy and throughput. This allows pharmacists to focus more on clinical oversight and patient consultation. This is a key aspect of the company's Growth Strategy.

The company is exploring the application of cutting-edge technologies like artificial intelligence (AI) for predictive analytics in medication adherence and adverse drug event prevention. This is a forward-thinking approach to improving patient outcomes. This is part of the Future Outlook for the company.

The company is exploring the use of the Internet of Things (IoT) for real-time monitoring of medication storage and delivery. This technology enhances the safety and efficiency of medication management. This supports the overall Market Analysis of the company.

The company's innovation strategy is centered on enhancing medication management within long-term care settings. This targeted approach allows for specialized solutions and improved patient care. This is a key differentiator for the Pharmacy Company.

The company collaborates with external innovators and health tech startups to foster innovation. This approach ensures access to the latest technologies and expertise. This supports the company's Strategic Initiatives.

The company's continuous investment in technology demonstrates its leadership in applying technology to solve complex pharmacy challenges. This ongoing commitment ensures the company remains at the forefront of the industry. This is vital for the company's Revenue Growth.

These technological advancements contribute directly to growth objectives by improving service quality, reducing operational costs, and enhancing the overall value proposition for long-term care facilities. The company's investment in technology is a strategic move to secure its position in the market. For more insights, consider the Target Market of Guardian Pharmacy.

- Improved Service Quality: Technology enhances accuracy and efficiency, leading to better patient care.

- Reduced Operational Costs: Automation streamlines processes, lowering expenses.

- Enhanced Value Proposition: The company offers superior services, attracting more clients.

- Focus on Patient Safety: Technology helps in preventing medication errors.

- Data-Driven Decisions: AI and predictive analytics provide valuable insights.

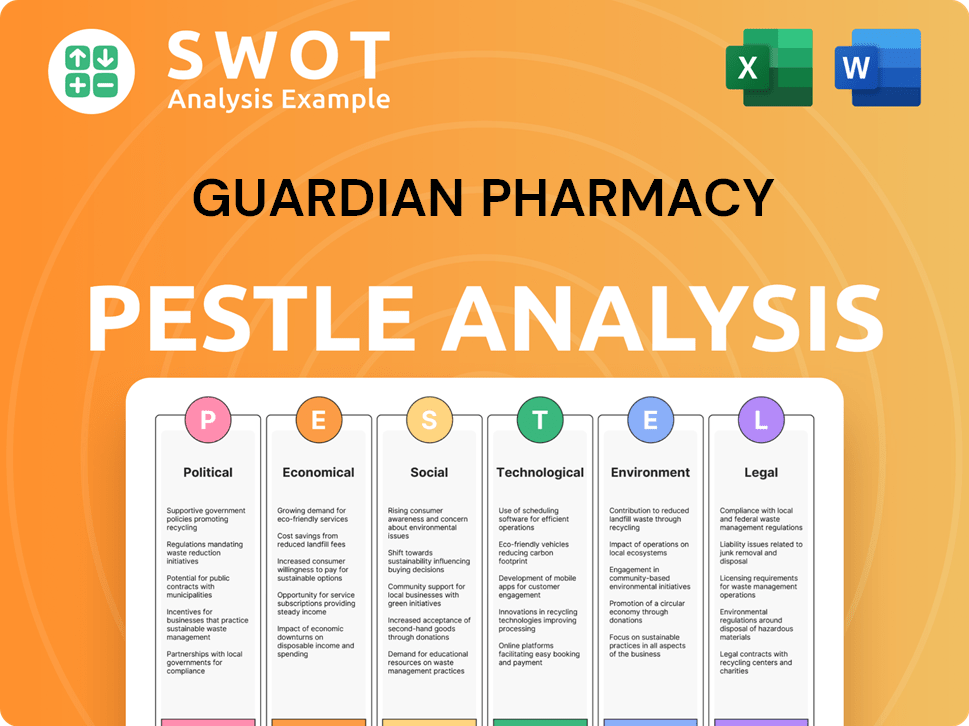

Guardian Pharmacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Guardian Pharmacy’s Growth Forecast?

The financial outlook for Guardian Pharmacy Services is positive, driven by strategic expansion and operational efficiencies. While specific financial details for 2024-2025 aren't publicly available for a privately held company, industry trends and Guardian's consistent growth suggest strong financial performance. The long-term care pharmacy market is expected to grow, fueled by an aging population and increased demand for specialized pharmaceutical services, which benefits Guardian's revenue streams.

Recent market analysis indicates a healthy investment environment in the long-term care sector, with strong valuations for specialized pharmacy services. The company's growth strategy, particularly its focus on acquisitions and service diversification, is expected to boost revenue. Each successful acquisition typically adds a significant number of new beds under Guardian's service, directly impacting its top line. Investment levels are likely to remain high as the company continues to expand its geographical footprint and invest in technological advancements.

Guardian's financial strategy appears focused on reinvesting profits back into the business to fuel further growth, enhance technological capabilities, and maintain its competitive edge. This approach, combined with a strong operational framework, underpins the financial narrative of sustained growth and market leadership in the coming years. For more insights, you can read a Brief History of Guardian Pharmacy.

The long-term care pharmacy market is projected to experience growth. This is driven by an aging population and the increasing demand for specialized pharmaceutical services. This trend positively impacts the financial performance of companies like Guardian Pharmacy.

Guardian's growth strategy includes strategic acquisitions and service diversification. Each successful acquisition adds new beds under Guardian's service. This directly contributes to revenue growth. Investment in technology and geographical expansion are key.

While specific financial details for 2024-2025 are not publicly disclosed, industry trends suggest positive financial performance. The company focuses on reinvesting profits to fuel growth, enhance technology, and maintain a competitive edge. This approach supports sustained growth.

The long-term care sector shows a healthy investment environment. Valuations for specialized pharmacy services remain strong. This indicates confidence in the sector's future growth. These factors support Guardian's financial outlook.

Guardian Pharmacy's financial success is driven by several key factors. These include strategic acquisitions, service diversification, and reinvestment in the business. These elements contribute to sustained growth and market leadership.

- Acquisitions: Adding new beds and expanding service offerings.

- Technology: Investing in technological advancements.

- Market Growth: Benefiting from the growth in the long-term care pharmacy market.

- Strategic Initiatives: Focusing on business development and expansion.

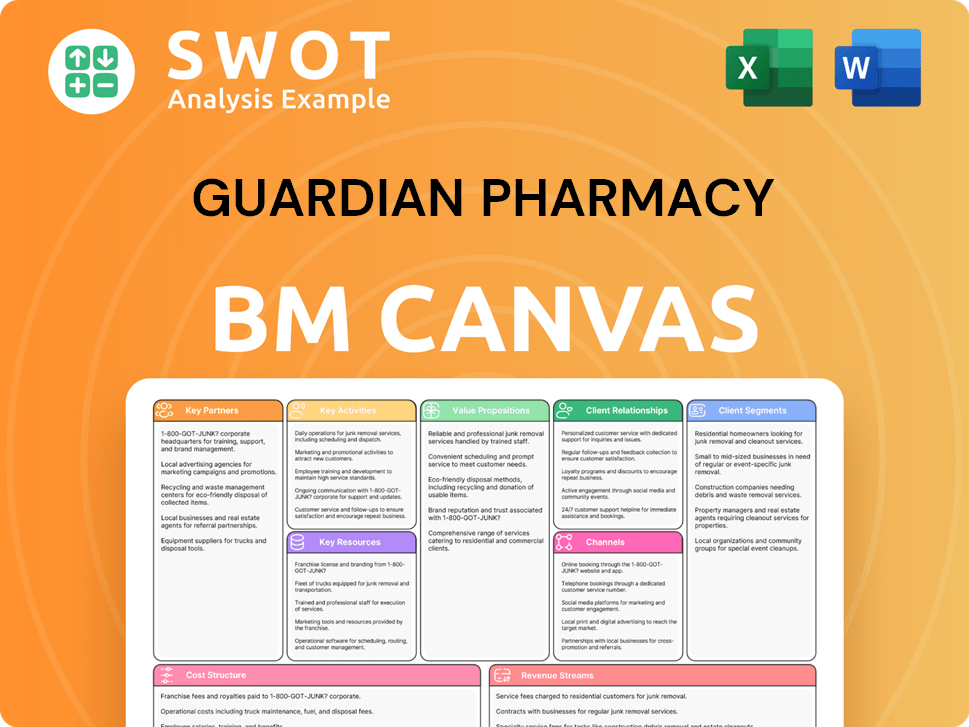

Guardian Pharmacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Guardian Pharmacy’s Growth?

The long-term success of the Guardian Pharmacy hinges not only on its growth strategy but also on its ability to navigate potential risks and obstacles. The healthcare industry, particularly the pharmacy sector, is dynamic and subject to numerous external pressures. Understanding these challenges is crucial for sustained growth and strategic planning.

Several factors could impact Guardian Pharmacy's future, including intense competition, evolving regulations, and supply chain vulnerabilities. The company must proactively address these risks to maintain its market position and achieve its expansion goals. This requires a comprehensive approach that encompasses risk management, strategic diversification, and operational agility.

Market competition presents a significant challenge for Guardian Pharmacy. The pharmacy company operates within a competitive landscape, facing both large national chains and smaller, specialized pharmacies. This competition can lead to pricing pressures and the need for continuous service differentiation to maintain market share. A thorough Mission, Vision & Core Values of Guardian Pharmacy can help to navigate these challenges.

The healthcare industry is subject to complex and evolving regulations. Changes in reimbursement policies, medication guidelines, or patient privacy laws (such as HIPAA) could necessitate operational adjustments.

Disruptions in the availability of essential medications or medical supplies can impact Guardian's ability to serve its facilities. Global events have highlighted the importance of robust supply chain management.

Competitors developing superior or more cost-effective technology solutions pose a risk. Guardian must continually invest in technology to remain competitive and efficient.

Managing rapid growth can strain resources, including human capital and infrastructure. Attracting and retaining skilled pharmacists and support staff in a competitive labor market is an ongoing challenge.

The market share of independent pharmacies in the United States was approximately 18% in 2023, highlighting the competitive pressure from larger chains and specialized providers. This competitive environment necessitates strategic initiatives to maintain and grow market share.

Changes in Medicare and Medicaid reimbursement rates can significantly impact pharmacy profitability. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to adjust reimbursement models, requiring pharmacies to adapt their strategies to maintain financial viability.

Guardian Pharmacy mitigates risks through diversification of services and geographical reach. The company has implemented robust risk management frameworks to address potential challenges. Continuous monitoring of the regulatory landscape is also crucial.

The decentralized model, with local pharmacies supported by a national network, provides a degree of resilience against localized disruptions. This structure allows for quicker responses to market changes and operational challenges. The company can adapt quickly and efficiently.

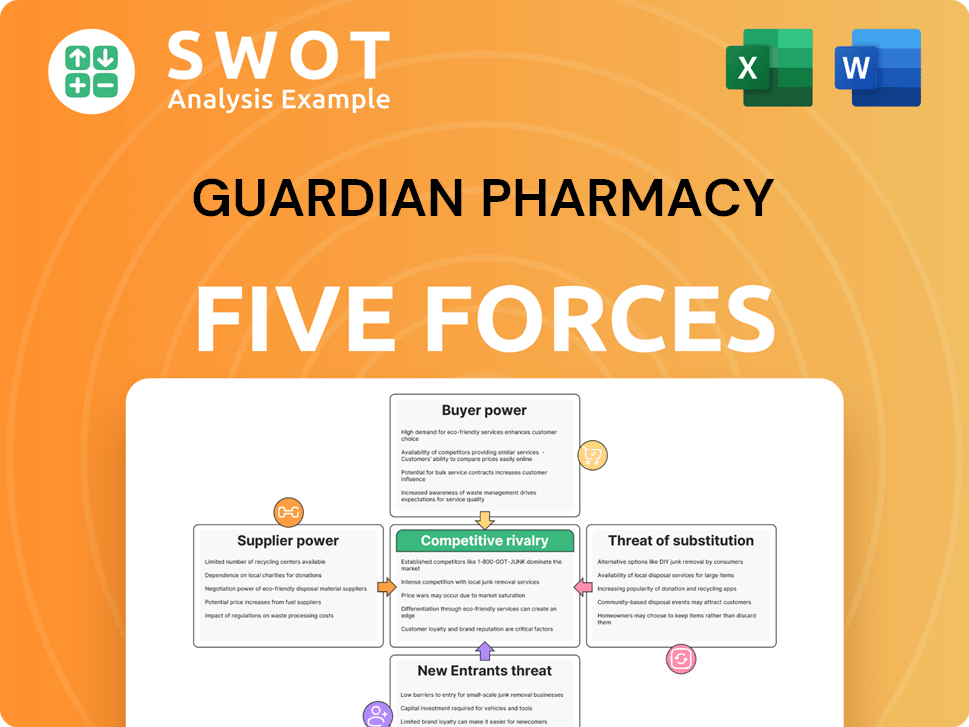

Guardian Pharmacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guardian Pharmacy Company?

- What is Competitive Landscape of Guardian Pharmacy Company?

- How Does Guardian Pharmacy Company Work?

- What is Sales and Marketing Strategy of Guardian Pharmacy Company?

- What is Brief History of Guardian Pharmacy Company?

- Who Owns Guardian Pharmacy Company?

- What is Customer Demographics and Target Market of Guardian Pharmacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.