Haverty Furniture Bundle

Can Haverty Furniture Thrive in Today's Retail Landscape?

Founded in 1885, Haverty Furniture Companies, Inc. has a long history of providing quality home furnishings. As a specialty retailer, Haverty's has built a strong brand, but faces the challenges of the dynamic retail industry. This analysis explores how Haverty's navigates market shifts and consumer preferences to fuel its Haverty Furniture SWOT Analysis and future growth.

The retail industry, significantly impacted by economic factors, demands strategic planning for sustained success. This examination will explore Haverty Furniture's growth strategy, including its expansion plans, innovative approaches, and financial planning. Understanding Haverty Furniture's market share, competitive advantages, and future outlook is crucial for investors and business strategists alike. We will delve into the company's business development initiatives and how it aims to capture growth opportunities in a competitive market.

How Is Haverty Furniture Expanding Its Reach?

The Haverty Furniture Company is actively pursuing expansion initiatives to increase its market share and overall business growth. The company's strategic focus involves a combination of physical store expansion and enhancements to its online presence. These initiatives are designed to reach new customers and strengthen its position within key regions, particularly within its existing distribution footprint.

A key element of Haverty's growth strategy includes opening new stores, with a target of approximately five new locations annually. This strategy often involves selecting former 'big box' retail sites to capitalize on existing infrastructure and visibility. This approach allows for efficient market penetration and supports the company's goal of providing accessible and convenient shopping experiences for its customers.

In 2024, the company successfully opened its first store in Houston, Texas, marking a significant step in its expansion plans. Further expansion within the Houston market is underway, with a second store in Southeast Houston opening in early 2025 and a third store planned for late 2025. Additionally, two more stores are slated for 2026, aiming for a total of six to eight stores to serve the Houston market effectively. The company is also planning a store relocation in Daytona, Florida, scheduled for Q2 2025.

The company is focused on opening new stores, with an average of five new stores per year. Haverty's targets former 'big box' retail sites. Expansion in Houston, Texas, is a key focus, with multiple stores planned.

The website is viewed as an extension of physical stores. Online sales accounted for approximately 3.0% of total sales in 2024. Improving digital channels is a key focus to enhance customer experience and boost sales.

The merchandise strategy emphasizes a wide range of styles. It includes custom upholstery programs and well-known mattress brands. This approach aims to cater to diverse customer preferences and needs.

The company is investing in its supply chain. The goal is to increase inventories of best-selling products. This will provide faster service to customers.

To support these strategic expansion efforts, Haverty's plans capital expenditures of approximately $24.0 million for 2025. These investments will cover new or replacement stores, remodels, and distribution network improvements. This financial commitment underscores the company's dedication to sustained growth and enhanced customer service.

- New store openings and relocations.

- Website and digital channel improvements.

- Supply chain enhancements to improve inventory and customer service.

- Investment in distribution network infrastructure.

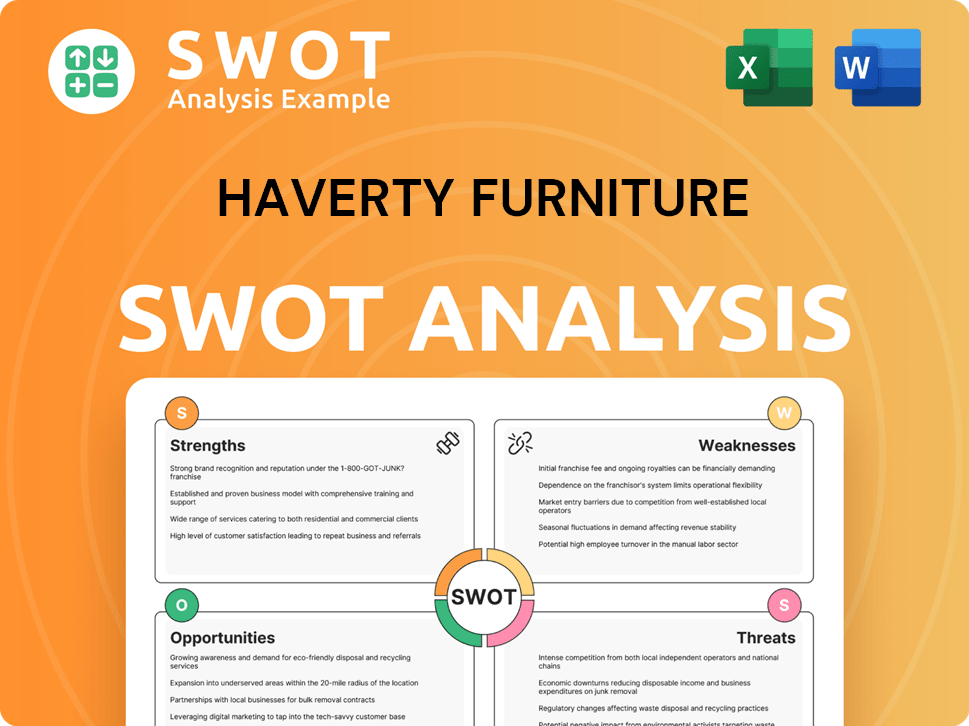

Haverty Furniture SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Haverty Furniture Invest in Innovation?

The Haverty Furniture company focuses on leveraging technology and innovation to drive growth and enhance customer experience. Their digital transformation efforts are evident in their online presence, which acts as an extension of their physical stores. This strategy helps them stay competitive in the retail industry.

The company’s approach includes a strong emphasis on high-touch service and personalized shopping experiences. They are investing in digital channels to boost customer engagement and sales conversion rates. This strategy is part of their broader growth strategy to adapt to changing consumer behaviors and preferences.

The Furniture Company also utilizes tools like a 3-D room planner and upholstery customization on its website. These features enhance the online shopping experience, contributing to a portion of their total sales. This shows their commitment to integrating technology to meet customer needs.

The company's online presence includes tools like a 3-D room planner and upholstery customization. These features contribute to approximately 3.0% of total sales in 2024. This indicates a focus on improving these digital channels to boost customer engagement and sales conversion rates.

Haverty's emphasizes high-touch service and personalized shopping experiences in stores. The free in-home design service saw increased customer engagement. This service contributed to 33.2% of total written sales in the first quarter of 2025, with an average written ticket of $7,422.

The supply chain team is focused on embracing cloud computing and harnessing supply chain intelligence through analytics. This aims to create a 'perfect inventory' across all channels. Investments in information technology are expected to be approximately $2.6 million in 2025.

The online presence of the company is a key component of their strategy. The website's tools and features are designed to enhance the customer experience and drive sales. This online presence is crucial for the company's overall market analysis and future growth.

The free in-home design service plays a significant role in driving sales. This service not only boosts customer engagement but also increases the average transaction value. This personalized approach is a key element of their business development strategy.

The company is investing in information technology to support its digital transformation efforts. These investments are crucial for maintaining a competitive edge in the retail industry. This investment is expected to be approximately $2.6 million in 2025.

Haverty Furniture's approach to innovation and technology is multifaceted, focusing on enhancing both the online and in-store customer experience. This includes leveraging digital tools and providing personalized services. For more insights, check out the Competitors Landscape of Haverty Furniture.

- Digital Channels: Improving the online presence with tools like 3-D room planners and upholstery customization to boost sales.

- Customer Service: Offering high-touch service and personalized shopping experiences, including in-home design services.

- Supply Chain: Utilizing cloud computing and supply chain intelligence for efficient inventory management.

- Financial Commitment: Investing approximately $2.6 million in information technology in 2025 to support these initiatives.

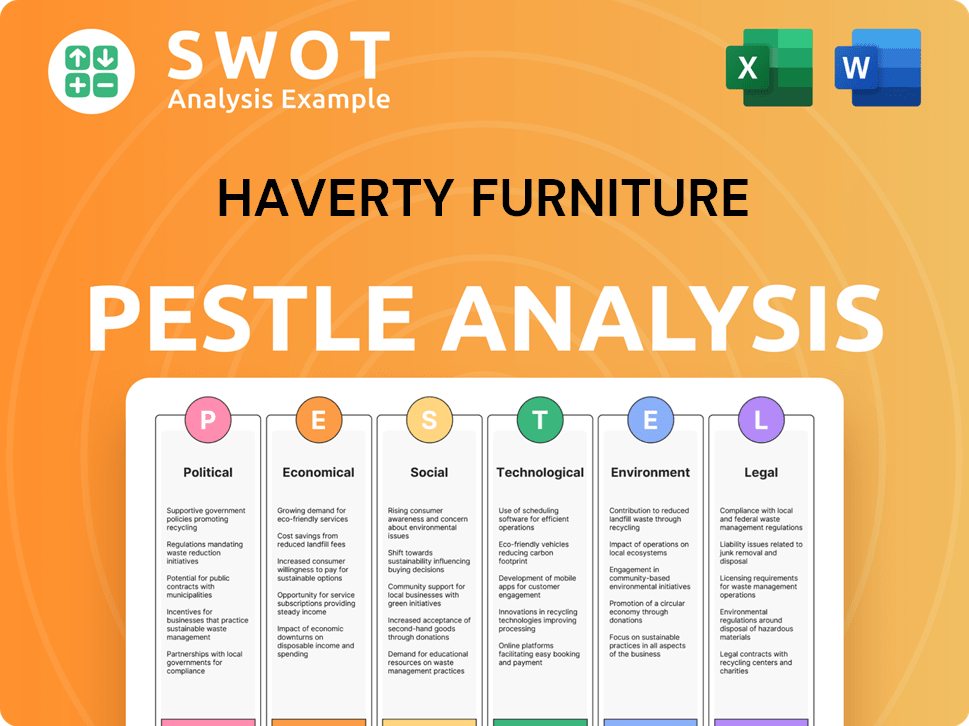

Haverty Furniture PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Haverty Furniture’s Growth Forecast?

The financial outlook for Haverty Furniture, a prominent player in the retail industry, reflects a strategic approach to navigate current market challenges and capitalize on future growth opportunities. The company's financial performance in 2024 and early 2025 provides insights into its resilience and adaptability in a dynamic economic environment. A detailed market analysis reveals how the company is positioning itself for sustained success.

For the full year 2024, Haverty Furniture faced headwinds, with net sales decreasing by 16.1% to $722.9 million, primarily due to the difficult housing market and cautious consumer spending. Despite the sales decline, the company maintained strong gross profit margins, demonstrating effective cost management and product selection strategies. The company's financial performance is a key indicator of its ability to adapt to changing market conditions.

In the first quarter of 2025, Haverty Furniture's consolidated sales decreased by 1.3% to $181.6 million, with comparable store sales declining by 4.8%. However, the gross profit margin improved to 61.2% from 60.3% year-over-year, primarily due to product selection and merchandising mix. This demonstrates the company's ability to maintain profitability even in a challenging sales environment. Understanding the Mission, Vision & Core Values of Haverty Furniture will help to understand the company's strategic initiatives.

Haverty's anticipates gross profit margins for 2025 to range between 60.0% and 60.5%. This projection indicates continued focus on maintaining profitability through strategic product offerings and efficient operations. The company's ability to manage margins is critical for long-term financial health.

Fixed and discretionary selling, general, and administrative (SG&A) expenses for the full year 2025 are projected to be in the $291.0 million to $293.0 million range, an increase due to store growth and inflation. Variable SG&A expenses are anticipated to be in the 18.6% to 19.0% range. Managing these expenses effectively will be crucial for profitability.

The company reported a net income of $20.0 million for 2024, with diluted earnings per common share of $1.19. For Q1 2025, diluted EPS increased to $0.23 from $0.14 in the prior year. These figures highlight the company's earnings performance and its ability to generate profits.

Haverty's maintains a strong financial position with $118.3 million in cash and no debt as of March 31, 2025, and an $80.0 million revolving credit facility with no outstanding borrowings. The company generated $6.2 million in operating cash flow in Q1 2025. This strong financial footing provides flexibility for future investments.

Planned capital expenditures for 2025 are approximately $24.0 million, with $19.6 million allocated for new stores, remodels, and expansions. The company returned $7.2 million to shareholders through dividends and share repurchases in Q1 2025, and paid $20.5 million in quarterly cash dividends in 2024. This demonstrates a commitment to returning value to shareholders.

Haverty's has a long history of dividend payments, consistently paying a cash dividend since 1935. This consistent dividend payment underscores the company's financial stability and commitment to shareholders. The company's history is a testament to its resilience and strategic focus.

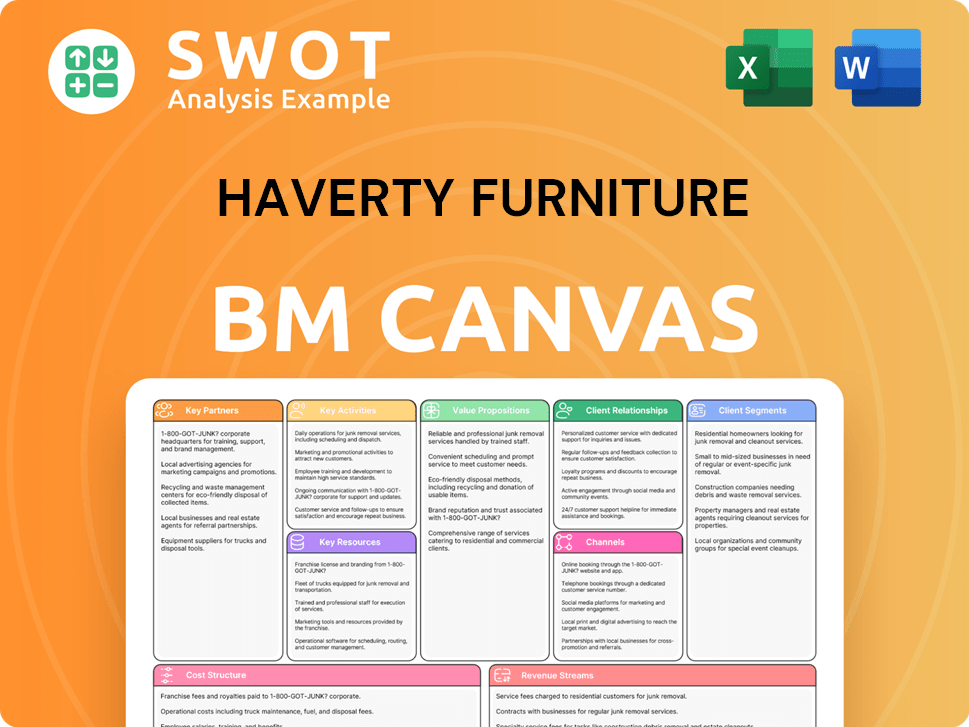

Haverty Furniture Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Haverty Furniture’s Growth?

Several strategic and operational risks could impact the growth of the Haverty Furniture Company. The retail furniture market is highly competitive, with numerous players vying for market share. Economic factors, such as the housing market and consumer confidence, significantly influence sales of furniture and home goods.

Economic uncertainties, particularly in the housing market, present significant challenges. The company's focus on more affluent customers and its competitive advantages, such as custom order capabilities, could help mitigate some of these risks. However, the company must navigate these challenges to maintain its growth trajectory.

Supply chain vulnerabilities and cybersecurity threats are also critical concerns. The company's ability to manage these risks will be essential for continued success. The company is actively working on strategies to address these potential obstacles.

The retail furniture industry is highly competitive, including national, regional, and online retailers. Intense competition, especially during promotional periods, can squeeze profit margins. The company's ability to differentiate itself through customer service and product offerings is crucial.

The housing market, operating at a 30-year low, impacts consumer spending on furniture. Factors like affordability issues, high interest rates, and declining consumer confidence affect demand. The company must adapt to these market dynamics.

Tariffs, particularly from China, Canada, and Mexico, pose risks to supply chain costs and pricing strategies. The company's sourcing and pricing strategies need to be flexible. Adjustments to capital expenditures and supply chain strategies are necessary.

Risks associated with foreign sourcing, potential disruptions, and increased shipping costs impact the supply chain. Material sourcing challenges, such as lumber price volatility and international shipping delays, are ongoing. Inventory management optimization is critical.

Cybersecurity threats can harm data, business processes, and the company's reputation. Protecting against cyberattacks is essential for operational integrity. The company must invest in robust cybersecurity measures.

Attracting and retaining key personnel is critical for growth and operational success. A skilled workforce is vital for delivering quality customer service and managing operations. The company must focus on employee retention strategies.

The retail industry is subject to economic cycles. A strong understanding of market trends is essential for strategic planning. Monitoring consumer behavior and market dynamics is critical for adapting to changes.

Strategic initiatives must address competitive pressures and market challenges. Diversifying product offerings and expanding online presence can enhance market share. Adapting to changing consumer preferences is crucial for business development.

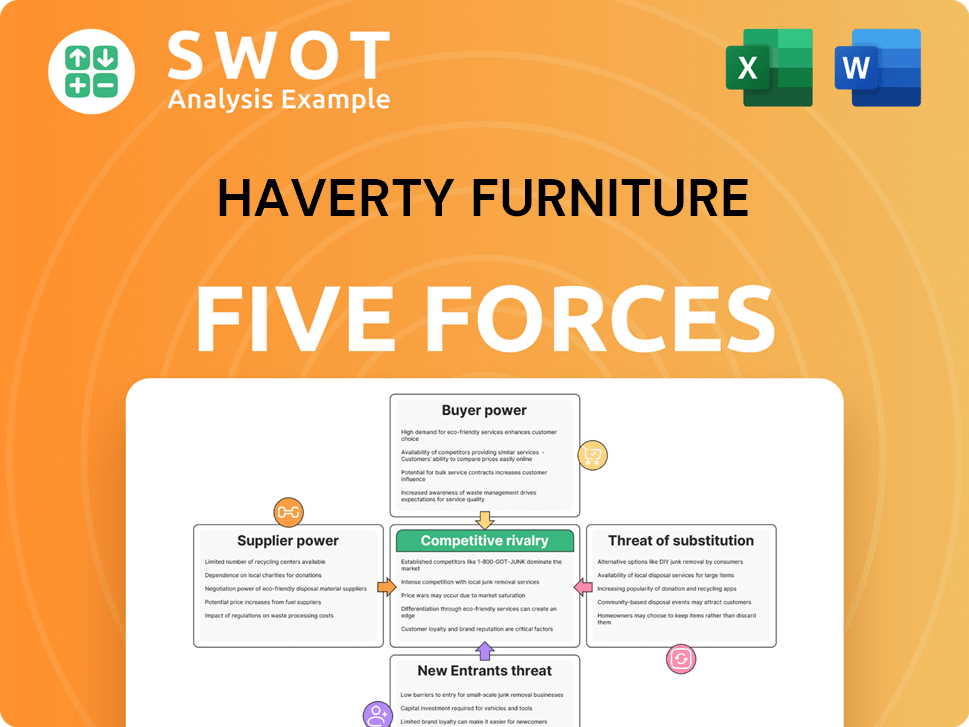

Haverty Furniture Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haverty Furniture Company?

- What is Competitive Landscape of Haverty Furniture Company?

- How Does Haverty Furniture Company Work?

- What is Sales and Marketing Strategy of Haverty Furniture Company?

- What is Brief History of Haverty Furniture Company?

- Who Owns Haverty Furniture Company?

- What is Customer Demographics and Target Market of Haverty Furniture Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.