Hello Group Bundle

Can Hello Group Rebound?

Hello Group Inc., a key player in China's online social networking scene, has seen its growth strategy evolve amidst shifting market dynamics. Founded in 2011, the company initially thrived with its location-based platform, Momo, before expanding its reach with the acquisition of Tantan. However, recent financial performance reveals a complex picture, prompting a deeper dive into its future.

This analysis examines Hello Group's Hello Group SWOT Analysis, exploring its business model, financial performance, and market share to understand its current position. We'll dissect Hello Group's expansion plans, including its international expansion strategy, and evaluate its long-term growth potential, considering both challenges and opportunities in the competitive landscape. Understanding Hello Group's future prospects requires a comprehensive look at its user acquisition strategies and technological advancements.

How Is Hello Group Expanding Its Reach?

The primary focus of the Hello Group growth strategy centers on international expansion, particularly in response to challenges in its domestic market. This strategic shift aims to leverage opportunities in new markets to drive future revenue and user growth. The company's initiatives are designed to diversify its revenue streams and mitigate the impact of declining user bases in its core apps.

Hello Group's future prospects are significantly tied to the success of its international expansion efforts. The company is targeting both existing and new markets, with a focus on developing and developed regions. This approach is intended to capitalize on the growing demand for social and dating apps globally, while also addressing the evolving needs of its user base.

A comprehensive Hello Group company analysis reveals a strategic pivot towards value-added services and international markets. This shift reflects the company's efforts to adapt to changing market dynamics and maintain its competitive position. The success of these initiatives will be crucial in determining the company's long-term growth potential and investment opportunities.

Hello Group is actively expanding into international markets to fuel future growth. This expansion strategy involves moving beyond existing markets like Turkey, Egypt, and the Persian Gulf, and venturing into developed markets in 2025. The company's CEO has emphasized taking "bolder measures" to drive growth and innovation in these new regions.

In late 2023, Hello Group launched two new apps: Yaahlan, an Arabic-focused audio social game app, and AMAR, a voice-based platform targeting young users in the Middle East and North Africa (MENA) region. Both apps began monetization in late 2024 and are showing stable returns. These launches are a key part of the company's user acquisition strategies.

The company anticipates significant growth in overseas revenue, projecting an increase from RMB 1 billion in 2024 to between RMB 1.7 billion and RMB 2 billion in 2025. This growth is expected to be a major driver of Hello Group's financial performance. The company's focus on international expansion is also expected to impact its market share.

Value-added services, primarily membership fees, have become the largest revenue source, surpassing livestreaming. This shift indicates a change in Hello Group's business model and monetization strategies. The company is focusing on improving profitability over time, even if it is not the primary focus in the short term.

The company is responding to declining user bases and revenue in its core domestic apps, Momo and Tantan. Tantan's monthly active users fell by 2.9 million to 10.8 million in the fourth quarter of 2024, and Momo's paying users dropped to 5.7 million from 7.4 million year-over-year. This has prompted Hello Group to seek new avenues for growth.

- The decline in domestic user numbers has accelerated the company's international expansion plans.

- The shift in monetization strategies, with value-added services leading revenue, is a direct response to these challenges.

- Hello Group's strategic partnerships and technological advancements are crucial for navigating these challenges.

- The company's long-term growth potential depends on its ability to successfully execute its international expansion and adapt its business model.

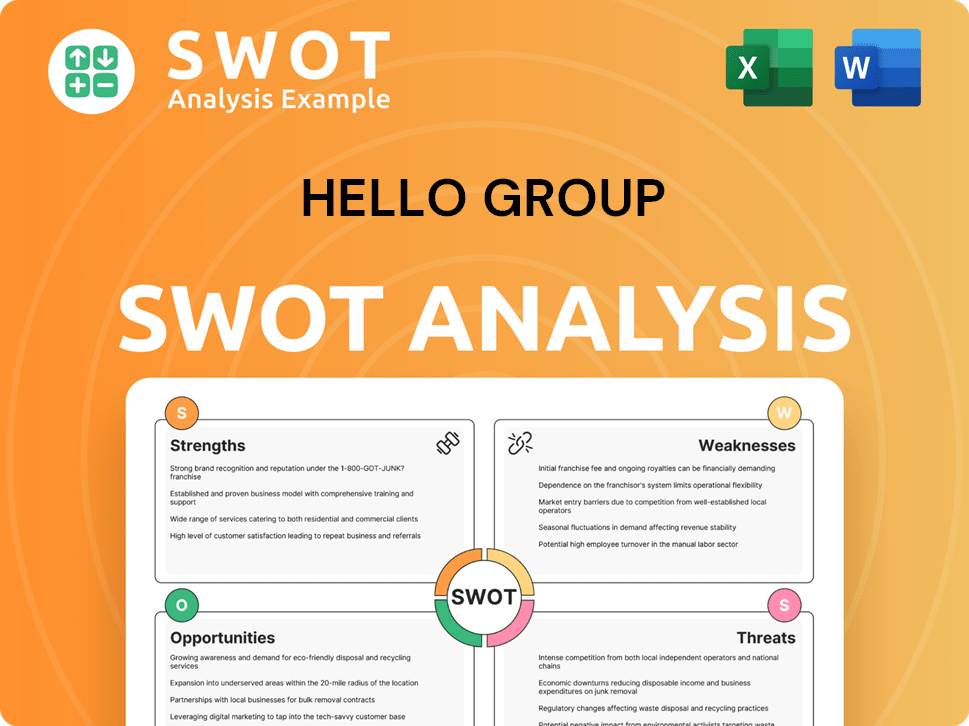

Hello Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hello Group Invest in Innovation?

The company's growth strategy heavily relies on innovation and technology to meet evolving user needs. This approach involves developing new applications and enhancing existing ones to cater to different demographics and niche markets. The goal is to stay competitive and drive revenue through continuous platform improvements.

By focusing on user engagement and strategic cost optimizations, the company aims to boost efficiency and profitability. This data-driven approach is crucial for adapting to the competitive industry dynamics and ensuring sustained growth. The company is actively exploring international expansion and integrating features like live streaming to enhance user experience.

The company's commitment to product-led growth through technological enhancements is evident. This includes refining localization strategies and adding features to existing apps. This strategy has allowed the company to expand its product portfolio beyond its core offerings.

Since 2019, the company has launched apps like Hertz, Soulchill, and Duidui. This expansion beyond Momo and Tantan showcases its ability to serve diverse social and entertainment needs.

Soulchill's revenue increased by 50% from 2023, reaching nearly RMB 1 billion in 2024. This growth surpassed Tantan's earnings, indicating effective strategies.

Improved localization strategies and expansion into new regions are key drivers. Features like live streaming are integrated to enhance user engagement and drive revenue.

The company continuously enhances user engagement and drives revenue growth. Strategic cost optimizations and focused marketing efforts aim to boost efficiency and profitability.

The success of newer apps like Soulchill suggests underlying technological capabilities. This allows the company to adapt and innovate for different market needs.

The company utilizes a data-driven approach to operations. This includes strategic cost optimizations and focused marketing efforts to boost efficiency.

The company leverages technology and innovation for sustained growth. This involves developing new applications and enhancing existing ones, particularly for niche markets.

- The introduction of apps like Hertz, Soulchill, and Duidui has expanded the product portfolio.

- Soulchill's revenue growth, increasing by 50% from 2023, is a key indicator of success.

- Improved localization strategies and live streaming integration are critical for expansion.

- Strategic cost optimizations and focused marketing efforts drive efficiency and profitability.

- The focus on product-led growth through technological enhancements is evident.

To learn more about the company's history and evolution, you can read the Brief History of Hello Group.

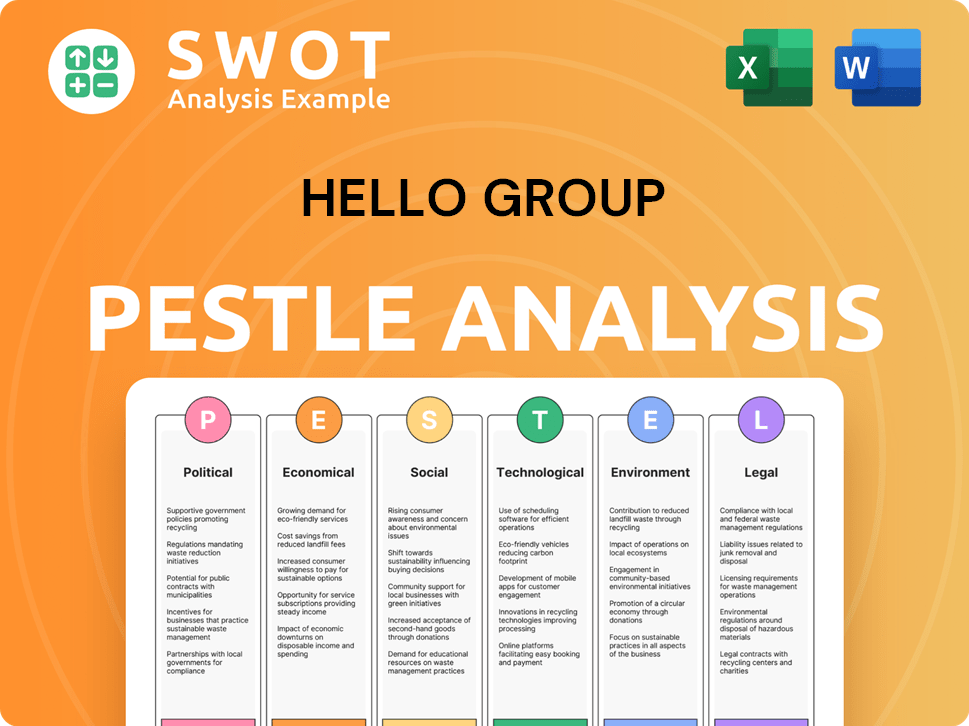

Hello Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hello Group’s Growth Forecast?

The financial outlook for Hello Group in 2025 is marked by a strategic shift towards international markets. This is a key element of the Hello Group growth strategy, as the company aims to offset potential declines in its domestic market. The company's focus on expanding its overseas revenue is central to its future prospects and overall Hello Group company analysis.

For the first quarter of 2025, Hello Group anticipates a decrease in total net revenues, projecting figures between RMB 2.4 billion and RMB 2.5 billion. This represents a year-over-year decrease, but the company is actively working to mitigate these declines. The company's approach to overseas revenue growth is critical for its long-term financial health.

The company's CFO projects that overseas revenue will grow significantly, from RMB 1 billion in 2024 to between RMB 1.7 billion and RMB 2 billion in 2025. This represents a substantial growth of up to 100%, signaling a strong commitment to international expansion. Hello Group's international expansion strategy is a key driver of its financial outlook and future prospects.

Hello Group projects total net revenues between RMB 2.4 billion and RMB 2.5 billion for Q1 2025. This represents a year-over-year decrease of 2.4% to 6.3%. Analysts, however, anticipate a 5.2% decrease in revenue to CNY 2.428 billion for Q1 2025.

The company aims to significantly expand its overseas revenue, projecting growth from RMB 1 billion in 2024 to between RMB 1.7 billion and RMB 2 billion in 2025. This potential growth of up to 100% underscores the importance of international markets.

In Q4 2024, Hello Group reported a revenue of RMB 2.64 billion (US$361.2 million), a 12.2% year-over-year decrease. Net income decreased to RMB 187.2 million (US$25.6 million), down from RMB 452.5 million in Q4 2023, a 59% plunge.

For the full year 2024, total net revenues were RMB 10.56 billion (US$1.45 billion), a 12% decrease from 2023. Non-GAAP net income was RMB 1.23 billion (US$168.9 million), compared to RMB 2.22 billion in 2023.

Hello Group's financial statements analysis reveals a strong cash position, with cash and equivalents totaling RMB 14.73 billion (US$2.02 billion) as of December 31, 2024. The company's commitment to shareholders is evident through a special cash dividend of US$0.30 per ADS, paid on April 30, 2025, reflecting a dividend yield of 4.18%. According to Owners & Shareholders of Hello Group, this signals confidence in the company's financial stability.

Analysts predict a 19.18% growth in earnings over the next year for Hello Group. EPS is anticipated to rise from $0.73 to $0.87, indicating positive momentum.

The stock currently trades at an attractive P/E ratio of 7.77. This suggests potential undervaluation, making it an interesting prospect for investors.

Profitability remains a secondary priority for overseas expansion in the short term, with the focus primarily on scaling. Bottom-line improvement is expected over time, driven by growth.

The company maintains a strong cash position, with cash and equivalents totaling RMB 14.73 billion (US$2.02 billion) as of December 31, 2024. This provides financial flexibility.

A special cash dividend of US$0.30 per ADS was declared, paid on April 30, 2025, reflecting a dividend yield of 4.18%. This benefits shareholders.

Hello Group's long-term growth potential is tied to its ability to execute its international expansion strategy effectively. This includes navigating the competitive landscape and user acquisition strategies.

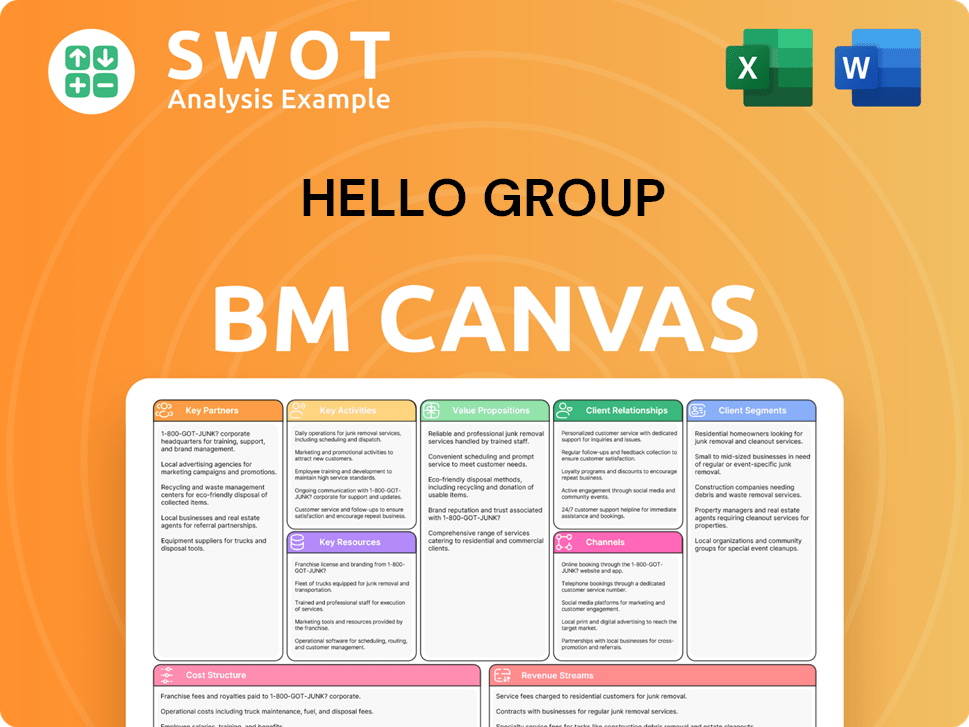

Hello Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hello Group’s Growth?

The growth strategy of Hello Group faces several significant risks and obstacles that could hinder its future prospects. The company's reliance on the Chinese market and its exposure to regulatory changes and macroeconomic pressures present considerable challenges. Understanding these risks is crucial for any Hello Group company analysis.

Intense competition within the social entertainment industry, both domestically and internationally, further complicates Hello Group's path. Declining user numbers on core platforms like Momo and Tantan signal underlying issues. This competitive landscape directly impacts Hello Group's market share and its ability to sustain revenue growth.

The company's strategic focus on international expansion, particularly in the Middle East, also introduces new risks. The potential for increased marketing costs and the inherent instability in the MENA region could affect Hello Group's financial performance and overall business model. For a detailed look at the user base, you can explore the Target Market of Hello Group.

Economic downturns and shifts in consumer spending habits significantly impact Hello Group. These pressures have directly affected domestic business, especially the Momo app. These factors are crucial for assessing Hello Group's challenges and opportunities.

Regulatory changes in China, particularly affecting livestreaming services, have reduced a key revenue stream. Livestreaming revenue fell by 16% year-over-year in 2024. This regulatory environment is a key factor in Hello Group's future product development.

The social entertainment industry is intensely competitive, with both domestic and international players vying for market share. Hello Group's competitive landscape analysis reveals challenges in user acquisition strategies. This directly impacts Hello Group's long-term growth potential.

Core apps like Momo and Tantan have experienced user declines, indicating challenges in retaining and attracting users. In Q4 2024, Tantan's MAU fell by 2.9 million, and paying users decreased. These trends are crucial for understanding Hello Group's financial performance.

Expansion into regions like the Middle East introduces risks related to instability and user spending. Entering competitive Western markets could lead to surging marketing costs. These factors affect Hello Group's international expansion strategy.

As a Chinese company listed in the U.S., Hello Group faces potential delisting due to conflicts between U.S. audit laws and Chinese data protection laws. Although a compromise is expected, this poses a risk to investors. This impacts Hello Group's investment opportunities.

Hello Group is shifting its focus to mid-to-long-tail users and expanding its international market presence to counteract domestic declines. The company's strategic partnerships are also a key aspect of this. This strategy is a core part of Hello Group's revenue growth drivers.

Despite the challenges, Hello Group has a strong cash position, with RMB 14.73 billion in cash and equivalents as of December 2024. However, overseas expansion is likely to erode profits in the short term. This impacts Hello Group's financial statements analysis.

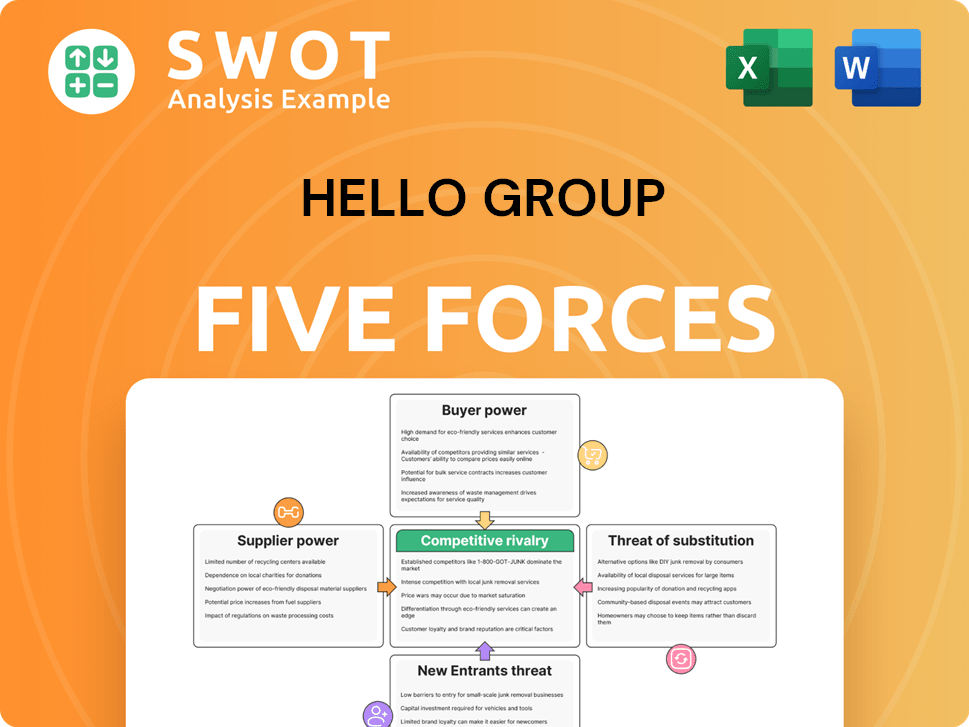

Hello Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hello Group Company?

- What is Competitive Landscape of Hello Group Company?

- How Does Hello Group Company Work?

- What is Sales and Marketing Strategy of Hello Group Company?

- What is Brief History of Hello Group Company?

- Who Owns Hello Group Company?

- What is Customer Demographics and Target Market of Hello Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.